The Stone Paper Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Stone Paper Market Estimated Value in (2025 E) | USD 4.3 billion |

| Stone Paper Market Forecast Value in (2035 F) | USD 7.5 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The stone paper market is gaining strong traction globally, driven by its sustainable profile, superior durability, and alignment with eco-friendly initiatives across industries. Rising concerns about deforestation and plastic waste have accelerated the adoption of stone paper, which is manufactured primarily from calcium carbonate and requires no water, bleach, or wood pulp during production. Increasing regulatory emphasis on reducing environmental impact in packaging, publishing, and stationery sectors is reinforcing demand for this alternative material.

Stone paper offers tear resistance, water resistance, and recyclability, which are becoming key attributes for manufacturers seeking to meet consumer and industry expectations. Advances in production technologies are enhancing scalability and lowering production costs, further broadening accessibility across global markets.

Growing investments in circular economy practices and the shift of major industries toward sustainable raw materials are expected to create long-term growth opportunities With governments, businesses, and consumers prioritizing eco-friendly solutions, the stone paper market is poised for sustained expansion as it continues to establish itself as a viable replacement for traditional pulp-based and synthetic papers.

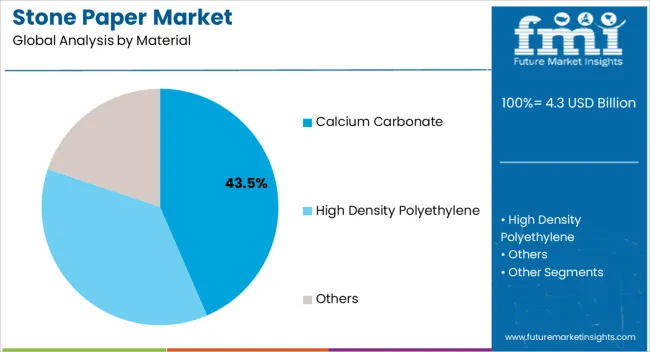

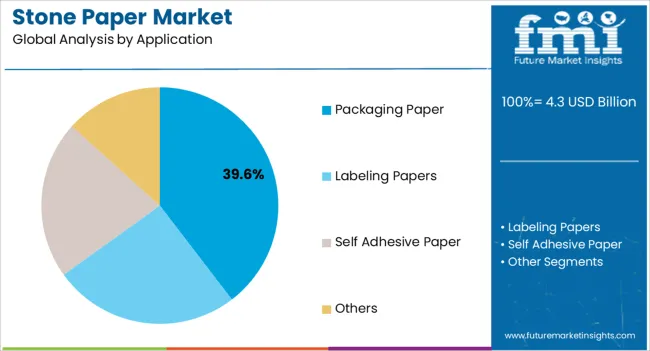

The stone paper market is segmented by material, application, and geographic regions. By material, stone paper market is divided into Calcium Carbonate, High Density Polyethylene, and Others. In terms of application, stone paper market is classified into Packaging Paper, Labeling Papers, Self Adhesive Paper, and Others. Regionally, the stone paper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The calcium carbonate segment is projected to represent 43.5% of the stone paper market revenue share in 2025, making it the leading material category. This leadership is attributed to the abundant availability, cost-effectiveness, and favorable physical properties of calcium carbonate, which allow the production of durable and high-quality stone paper. The mineral’s ability to provide a smooth surface finish and high opacity has made it a preferred choice for applications requiring enhanced printability and aesthetics.

Its role in ensuring mechanical strength, water resistance, and recyclability has reinforced its position in sustainable material development. The relatively low energy and resource consumption during processing further add to its environmental benefits, aligning with global sustainability goals.

The segment’s dominance is also being supported by ongoing research and development aimed at optimizing processing methods to increase yield and reduce costs As demand for eco-friendly paper alternatives continues to accelerate across packaging, publishing, and commercial printing, the reliance on calcium carbonate as the primary raw material is expected to remain central to the growth trajectory of the stone paper industry.

The packaging paper segment is anticipated to hold 39.6% of the stone paper market revenue share in 2025, establishing it as the dominant application category. This leadership is being driven by the rising need for sustainable packaging solutions across consumer goods, food and beverage, and e-commerce industries. The inherent properties of stone paper, including tear resistance, waterproofing, and recyclability, make it a strong alternative to traditional pulp-based paper and certain plastic packaging formats.

Regulatory mandates focused on reducing single-use plastics and promoting sustainable packaging practices are further accelerating adoption in this segment. Brands and manufacturers are increasingly leveraging stone paper packaging to enhance product differentiation while meeting sustainability commitments.

The material’s ability to maintain print quality and durability under diverse conditions also makes it highly suitable for labels, bags, and specialty packaging applications With consumer preferences shifting toward environmentally responsible products, the packaging paper application is expected to remain the largest contributor to revenue growth in the stone paper market, reinforcing its long-term strategic importance.

A key trend in the stone paper market is the emerging usages for stone paper in the market due to environmental concerns. The material is not only recyclable but also water resistant and tear resistant, making the paper highly durable.

As global awareness of deforestation and environmental sustainability rises, industries ranging from packaging to printing are increasingly opting for the paper.

The production process, which eliminates the need for water and harsh chemicals, significantly reduces environmental impact. Consumer preference for sustainable products and government regulations promoting green practices further drive the trend.

The stone paper market is also witnessing technological advancements, improving the quality and variety of stone paper products. The stone paper sector is poised for substantial growth, aligning with the broader movement towards sustainability and environmental responsibility in manufacturing and consumer goods.

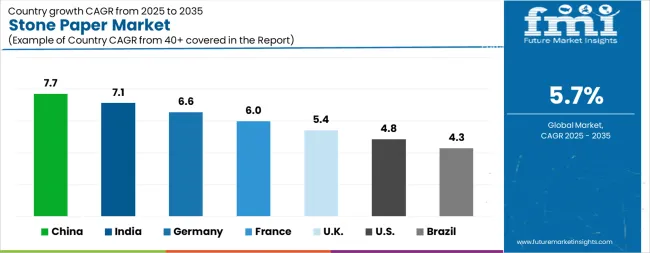

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The Stone Paper Market is expected to register a CAGR of 5.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.7%, followed by India at 7.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.3%, yet still underscores a broadly positive trajectory for the global Stone Paper Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.6%. The USA Stone Paper Market is estimated to be valued at USD 1.5 billion in 2025 and is anticipated to reach a valuation of USD 2.5 billion by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 221.5 million and USD 129.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Material | Calcium Carbonate, High Density Polyethylene, and Others |

| Application | Packaging Paper, Labeling Papers, Self Adhesive Paper, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

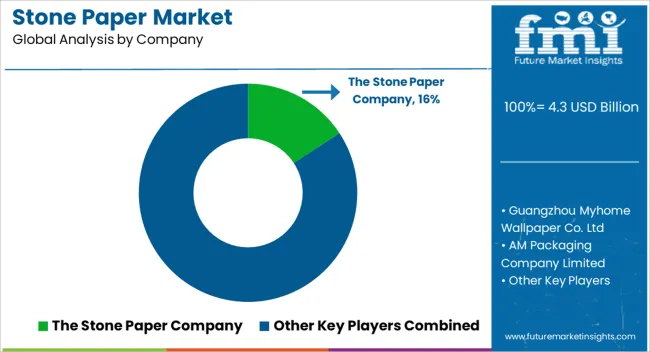

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Stone Paper Company, Guangzhou Myhome Wallpaper Co. Ltd, AM Packaging Company Limited, Shenzhen Stone Paper Enterprise, Kapstone, Taiwan Longmeng Composite Materials Co., Ltd., STP STONE PAPER GmbH, Stone Paper, TBM Co., Ltd, Pishgaman Sanat Sabz Co., Sphera International, and Anydesignsrl |

The global stone paper market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the stone paper market is projected to reach USD 7.5 billion by 2035.

The stone paper market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in stone paper market are calcium carbonate, high density polyethylene and others.

In terms of application, packaging paper segment to command 39.6% share in the stone paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Stone Paper Market Share & Industry Trends

Stone Crushing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stone Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Destoner Machine Market Trend Analysis Based on Product Type, End-Use, Automation, and Region 2025 to 2035

Gemstone Market Size and Share Forecast Outlook 2025 to 2035

Gemstone Cosmetic Powder Market Analysis - Trends, Growth & Forecast 2025 to 2035

Kidney Stone Extraction Balloon Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Colored Gemstones Industry

Pancreatic Stone Protein Testing Market Growth - Trends & Forecast 2024 to 2034

Coloured Gemstone Market Analysis - Size, Share, and Forecast 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

Balloon Catheters for Bile Stone Removal Market Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA