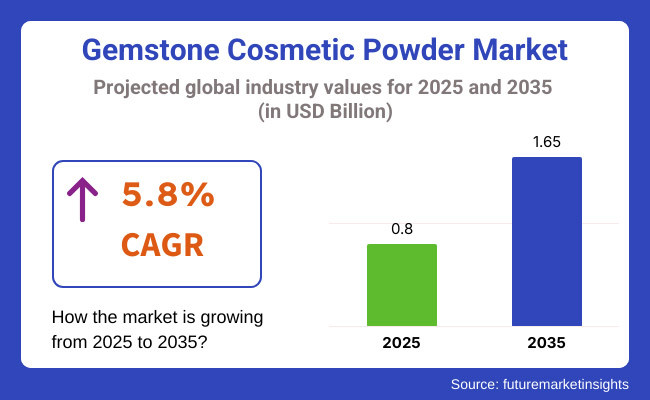

The gemstone cosmetic powder market is set for significant growth between 2025 and 2035, fuelled by the rising demand for luxury beauty products, mineral-based skincare, and holistic wellness formulations. The market is projected to expand from USD 0.8 billion in 2025 to USD 1.65 billion by 2035, reflecting a CAGR of 5.8% over the forecast period.

The adding preference for natural, mineral-rich beauty products and the growing influence of indispensable mending practices similar as demitasse- invested skincare and energy-grounded cosmetics are driving demand. Consumers are seeking high-performance, chemical-free, and skin-nutritional phrasings, leading to the rise of amethyst, rose quartz, tourmaline, and plum-invested ornamental maquillages.

The expansion of clean beauty, vegan phrasings, and sustainable cosmetics is further propelling invention in the market. Luxury and decoration beauty brands are investing in rock-invested maquillages to enhance gleam, anti-aging benefits, and skin revivification. Also, social media influencers and heartiness lawyers are promoting rock-grounded cosmetics, making them more mainstream.

North America is one of the leading markets for rock ornamental maquillages, driven by the rising fashion ability of clean beauty, organic skincare, and high-performance mineral makeup. The USA and Canada are witnessing strong demand for atrocity-free and eco-friendly phrasings, particularly in luxury and prestige beauty parts.

Consumers in North America are drawn to multifunctional beauty products that offer both skincare and ornamental benefits. Brands are launching rock-invested setting maquillages, highlighters, and face maquillages amended with natural minerals and radiance-boosting chargers.

Retail expansion through Sephora, Ulta Beauty, and online direct-to-consumer ( DTC) channels is adding availability to decoration rock maquillages. Also, celebrity signatures and influencer collaborations are shaping copping geste, with numerous brands using crystal clear mending and energy-grounded beauty trends to appeal to heartiness-conscious buyers.

Europe is anticipated to witness steady growth, with consumers prioritizing sustainability, ethical sourcing, and holistic skincare benefits. Countries like Germany, France, and the UK are leading the shift toward organic, mineral-rich, and eco-conscious ornamental phrasings.

European regulations favor clean-marker beauty products, pushing brands to develop rock maquillages free from parabens, sulfates, and artificial complements. The decoration skincare and makeup assiduity incorporate rock excerpts for their cheering, anti-aging, and skin-balancing parcels, driving invention in the member.

The rising demand for luxury and artisanal beauty brands is also expanding market openings, particularly in exchange and niche beauty stores. Also, hookups with gym and heartiness centres are driving the relinquishment of rock - invested beauty rituals.

Asia- Pacific is anticipated to be the swift-growing region, driven by K- beauty and J- -J-beauty inventions, rising disposable income, and artistic preferences for holistic skincare. Countries similar as South Korea, Japan, China, and India are embracing rock-invested maquillages for their cheering, oil painting- control, and skin-enhancing parcels.

The demand for traditional beauty rituals invested with natural rocks like wanton, plum, and ruby is rising, particularly in China and South Korea, where ancient beauty doctrines emphasize energy-balancing constituents. Also, K- K-beauty brands are incorporating rock maquillages into BB creams, bumper compacts, and translucent maquillages to produce glowing, indefectible complexions.

E-commerce platforms like Tmall, Shopee, and Lazada are making rock ornamental maquillages extensively accessible, while beauty tech inventions are similar as AI-driven skin analysis and substantiated product recommendations are driving digital engagement in the market.

Challenge

One of the biggest challenges in the rock Gemstone Cosmetic Powder market is high product costs associated with sourcing, processing, and incorporating genuine rocks into beauty phrasings. Icing authenticity, chastity, and ethical mining practices adds to the complexity of manufacturing, making these products more precious than conventional maquillages.

Also, fake rock maquillages and misleading marketing claims are growing enterprises in the beauty assiduity. Consumers are demanding vindicated component sourcing and transparent phrasings, pushing brands to gain instruments and third- party lab testing.

To address this, companies must educate consumers about the benefits of authentic rock cosmetics, invest in traceable force chains, and highlight sustainability sweats to separate from mass- market carbons.

Opportunity

The crossroad of beauty and heartiness presents a significant growth occasion for rock ornamental maquillages. With the adding fashionability of demitasse mending, energy-grounded skincare, and aware beauty rituals, brands can tap into spiritual and heartiness-conscious consumers by situating rock maquillages as both beauty enhancers and mood-boosting tools.

individualized beauty results similar as customized rock blends grounded on skin type, wheel signs, or emotional well- being are gaining traction, offering brands a chance to produce exclusive, existential product lines.

Also, advancements in nanotechnology and skincare-invested makeup are enabling brands to enhance the bioavailability of rock excerpts, perfecting their efficacy in ornamental phrasings. Collaborations with dermatologists, energy healers, and holistic beauty influencers will further validate the benefits of rock - invested cosmetics, driving consumer trust and market expansion

| Country | United States |

|---|---|

| Population (Million) | USD 345.4 Million |

| Estimated Per Capita Spending (USD) | 22.80 |

| Country | China |

|---|---|

| Population (Million) | USD 1,419.3 Million |

| Estimated Per Capita Spending (USD) | 18.50 |

| Country | South Korea |

|---|---|

| Population (Million) | USD 51.6 Million |

| Estimated Per Capita Spending (USD) | 21.70 |

| Country | France |

|---|---|

| Population (Million) | USD 65.6 Million |

| Estimated Per Capita Spending (USD) | 20.90 |

| Country | Japan |

|---|---|

| Population (Million) | USD 123.3 Million |

| Estimated Per Capita Spending (USD) | 19.80 |

The USA rock Gemstone Cosmetic Powder Market is driven by luxury skincare and clean beauty trends. Consumers prefer high-end brands incorporating crushed diamonds, plums, and other rocks for enhanced radiance and anti-aging benefits.

Major ornamental players like Estée Lauder and La Mer dominate, offering mineral-grounded phrasings with luminous homestretches. Dermatologist-recommended rock maquillages, known for their skin-mending and cheering parcels, are gaining traction in decoration skincare routines.

China’s market thrives on a growing preference for rock-invested beauty products, particularly in wanton and plum maquillages. Traditional Chinese drug influences consumer choices, promoting rock cosmetics for their detoxifying and complexion-enhancing parcels.

Social media and influencer marketing on platforms like We Chat and Douyin drive demand for both domestic and transnational luxury brands. The rising clean beauty movement pushes brands to incorporate natural, finely-mulled rock excerpts in face maquillages, setting maquillages, and highlighters.

South Korea’s market leads in K- beauty inventions, incorporating rock maquillages in skincare and makeup mongrels. Amethyst, ruby, and tourmaline maquillages are popular for their skin-amping and revitalizing parcels.

Original brands like Sulwhasoo and Clio concentrate on multifunctional products, similar as foundation maquillages invested with rock excerpts for a radiant, glass-skin effect. Rising demand for dermatologist-backed phrasings boosts decoration and organic rock cosmetics.

France’s rock thrives on luxury beauty and artisanal phrasings. Leading brands like Chanel and Guerlain influence rare rock infusions to enhance their greasepaint products’ refulgence and life. French consumers seek high-quality, skin-friendly options, favouring finely- mulled, natural phrasings free from synthetic complements. The clean beauty trend continues to push the relinquishment of crushed plum and diamond maquillages in luxury face maquillages and setting products.

Japan’s market benefits from its focus on natural beauty and skincare-invest cosmetics. Pearl greasepaint, extensively used in traditional Japanese beauty, dominates the member, offering anti-aging and cheering benefits.

The demand for ultra-lightweight, permeable maquillages invested with precious minerals continues to grow. Japanese beauty brands like Shiseido and Kosé incorporate rock excerpts into compact maquillages and setting maquillages, appealing to both skincare-conscious and luxury beauty consumers.

The market for beauty gemstone powder is expanding with increasing demand for premium beauty products, skin advantages, and organic mineral makeup. A global online survey conducted among 250 end-consumers in important regions is the primary market and purchasing trend driver.

Skin-positive attributes influence demand, and 72% of consumers would rather use products containing gemstones like tourmaline, amethyst, and pearl powder for their age-resistance and glow benefits. Consumers in North America (65%) and Europe (60%) are most likely to use these ingredients in face powders and highlighters.

Prestige and luxury dominate the market, as 58% of the sample mentioned gemstone-enriched cosmetics as luxury beauty items. Prestige brands with jade, ruby, and sapphire powder are gaining popularity in Asia, particularly China and Japan, through traditional beauty orientations.

Natural and clean beauty trends dominate the buying behavior wherein 64% of the buyers choose talc-free, mineral-based and cruelty-free products. The trend is highly dominant in Europe (67%) and North America (62%), wherein buying becomes ingredient and sustainability-driven.

Multi-tasking appeal is attractive to the buyer since 48% of the sample seek gemstone powders with make-up and skin-care benefits such as oil-absorbing, hydrating and brightening functions. Gemstone-botanical hybrid products are becoming popular.

Influencer and e-commerce-driven purchase experience 53% of customers purchasing gemstone makeup powders online from beauty retailer websites, brand stores, and luxury online shopping websites. Social media and influencers are influential, especially in Asia (55%) and North America (50%).

As the consumers become increasingly inclined towards luxury, natural, and beauty-enhancing beauty goods, players in the gemstone cosmetic powder market can gain through clean beauty trends, high-end branding, and multi-function product development in keeping up with changing needs

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Growth in gemstone-infused skincare and makeup, featuring diamond, amethyst, tourmaline, and pearl powders. Increased demand for luxury, mineral-based formulations. |

| Sustainability & Circular Economy | Shift towards ethically sourced and cruelty-free gemstone powders. Growth in biodegradable and refillable packaging. |

| Connectivity & Smart Features | AI-driven beauty apps recommended gemstone powders based on skin concerns (e.g., glow, anti-aging, hydration). Rise of AR-powered virtual try-ons for gemstone-infused makeup. |

| Market Expansion & Consumer Adoption | Increased demand for luxury, natural, and holistic beauty solutions. Rise of K-beauty and Ayurvedic-inspired gemstone skincare. Direct-to-consumer (DTC) gemstone beauty brands gained traction. |

| Regulatory & Compliance Standards | Stricter regulations on gemstone authenticity and purity claims. Increased demand for dermatologist-tested and hypoallergenic certification. |

| Customization & Personalization | Rise of bespoke gemstone-infused skincare with AI-assisted ingredient matching. Luxury brands introduced custom gemstone beauty kits. |

| Influencer & Social Media Marketing | Beauty influencers and luxury skincare bloggers popularized gemstone powders on TikTok, Instagram, and YouTube. Celebrities launched crystal-infused beauty collections. |

| Consumer Trends & Behavior | Consumers prioritized luxury, holistic wellness, and multifunctional skincare. Demand for natural, non-toxic, and spiritual beauty solutions increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered skincare analysis customizes gemstone powders based on skin needs. Lab-grown gemstone powders replace mined alternatives for sustainability. Bioactive gemstone technology enhances collagen production and skin health. |

| Sustainability & Circular Economy | Zero-waste, lab-grown gemstone powders dominate the industry. Blockchain-backed traceability ensures responsible sourcing and authenticity. AI-optimized ingredient extraction minimizes waste. |

| Connectivity & Smart Features | Smart skincare devices analyze real-time skin conditions and dispense gemstone-infused powders accordingly. Metaverse-based luxury beauty consultations allow digital skin profiling for personalized gemstone treatments. |

| Market Expansion & Consumer Adoption | AI-driven gemstone skincare ecosystems personalize formulations based on genetic and lifestyle factors. 3D-printed gemstone-infused beauty powders create custom blends on demand. Subscription-based luxury gemstone skincare gains popularity. |

| Regulatory & Compliance Standards | AI-powered compliance tracking ensures purity, ethical sourcing, and environmental safety. Standardized global certification for gemstone-infused cosmetics ensures transparency and quality. |

| Customization & Personalization | Real-time adaptive gemstone skincare tailors formulations based on weather, pollution, and skin hydration levels. Blockchain-based ingredient authentication ensures premium quality. |

| Influencer & Social Media Marketing | AI-generated virtual beauty influencers promote personalized gemstone beauty solutions. Augmented reality (AR)-powered gemstone selection tools let consumers visualize skincare benefits before purchase. |

| Consumer Trends & Behavior | Biohacking-inspired gemstone skincare integrates skin energy balancing with AI-driven diagnostics. Smart, adaptive gemstone-infused beauty products adjust benefits in real-time for personalized skincare. |

The USA rock Gemstone Cosmetic Powder market is witnessing strong growth, driven by adding consumer demand for luxury beauty products, rising relinquishment of natural and mineral- grounded cosmetics, and the expansion of heartiness- driven skincare trends. Major players include La Prairie, Chantecaille, and Tatcha.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

The UK rock Gemstone Cosmetic Powder market is expanding due to adding demand for clean beauty phrasings, rising consumer preference for holistic skincare, and the influence of decoration gym and heartiness brands. Leading brands include Charlotte Tilbury, Hourglass, and Rodial.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.0% |

Germany’s rock Gemstone Cosmetic Powder market is growing, with consumers favoring dermatologist- tested, mineral-rich, andanti-inflammatory beauty products. crucial players include Dr. Hauschka, Weleda, and Babor.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.1% |

India’s rock Gemstone Cosmetic Powder market is witnessing rapid-fire growth, fueled by adding consumer interest in Ayurveda- invested luxury cosmetics, rising disposable inflows, and expanding original and transnational brand presence. Major brands include Forest rudiments, Biotique, and Kama Ayurveda.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

China’s rock is expanding significantly, driven by adding disposable inflows, rising demand for high- tech and luxury beauty results, and the strong influence of K- beauty and J- beauty trends. crucial players include Chando, Pechoin, and L’Oréal Paris.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

Consumers decreasingly seek high-end beauty results that incorporate rare and natural constituents, boosting the demand for rock-invested ornamental maquillages. These maquillages, amended with finely mulled rocks like amethyst, ruby, and sapphire, are favored for their luminous finish and implicit skincare benefits. Luxury beauty brands influence rock maquillages to appeal to consumers looking for both aesthetic and skincare-enhancing parcels.

The objectification of rocks in cosmetics is linked to skincare benefits, including enhanced radiance, oil painting immersion, and soothing goods. Consumers prefer products invested with crushed plums, tourmaline, and wanton for their contended detoxifying, anti-aging, and cheering parcels. Clean beauty lawyers decreasingly favor rock ornamental maquillages as a volition to synthetic constituents.

The objectification of rocks in cosmetics is linked to skincare benefits, including enhanced radiance, oil painting immersion, and soothing goods. Consumers prefer products invested with crushed plums, tourmaline, and wanton for their contended detoxifying, anti-aging, and cheering parcels. Clean beauty lawyers decreasingly favour rock ornamental maquillages as a volition to synthetic constituents.

Online beauty retailers and niche brands are necessary in driving the fashionability of rock ornamental maquillages. Social media influencers and beauty bloggers punctuate the radiance- boosting the goods of these products, and adding consumer mindfulness. Direct-to-consumer deals and ultra expensive packaging also contribute to the growing appeal of rock-invested cosmetics in luxury and heartiness markets..

The Gemstone Cosmetic Powder market is gaining instigation as consumers seek luxury, natural skincare results invested with minerals and crystal clear energy. These maquillages, made from crushed rocks like amethyst, ruby, tourmaline, and plum, are decreasingly used in high- end skincare and makeup phrasings for their supposed radiance-boosting and skin- revitalizing parcels. The market is driven by clean beauty trends, rising demand for decoration cosmetics, and influencer marketing in the heartiness space.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| L’Oréal Group (Lancôme, YSL Beauty) | 18-22% |

| Estée Lauder Companies (La Mer, Bobbi Brown, MAC) | 14-18% |

| Shiseido (Clé de Peau Beauté, NARS) | 10-14% |

| LVMH (Dior, Givenchy Beauty, Guerlain) | 8-12% |

| KOSÉ Corporation (DECORTÉ, Albion) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| L’Oréal Group | Leads in luxury and scientific skincare, integrating ruby and amethyst powders in anti-aging and illuminating products. |

| Estée Lauder Companies | Expands La Mer and Bobbi Brown’s gemstone-infused formulas, emphasizing skin hydration and luminosity. |

| Shiseido | Focuses on Clé de Peau Beauté’s pearl-based skincare, leveraging advanced Japanese beauty technology. |

| LVMH | Promotes Dior’s mineral-rich powders and Guerlain’s luxury highlighters, blending skincare and makeup benefits. |

| KOSÉ Corporation | Strengthens DECORTÉ’s presence in gemstone cosmetics, with tourmaline and rose quartz-infused beauty products. |

Strategic Outlook of Key Companies

L’Oréal Group (18-22%)

Investing in luxury skincare- meets- makeup inventions, enhancing its radiance- boosting product lines with high-performance rock excerpts. Expanding-commerce and personalization tools for demitasse- invested beauty trends.

Estée Lauder Companies (14-18%)

Strengthening La Mer’s decoration positioning, integrating rock excerpts into luxury skincare rituals. Expanding clean beauty and customized skincare results.

Shiseido (10-14%)

staking on Asian beauty traditions by investing plum, wanton, and tourmaline maquillages into high- end skincare and foundations. Enhancing luxury brand reach in Western markets.

LVMH (8-12%)

Innovating in high-end beauty with Dior and Guerlain, fastening on gem-invested setting maquillages, highlighters, and finishing mists. Strengthening digital and influencer collaborations.

KOSÉ Corporation (6-10%)

Driving DECORTÉ’s and Albion’s expansion in demitasse-invested skincare, emphasizing anti-aging and skin- cheering parcels. Targeting decoration consumers in Asia-Pacific and North America.

Other Key Players (30-40% Combined)

Diamond Powder, Pearl Powder, Amethyst Powder, Ruby Powder, Tourmaline Powder, and Others.

Skincare, Haircare, Makeup, and Personal Care.

Supermarkets/Hypermarkets, Specialty Stores, Pharmacies/Drug Stores, Online, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Gemstone Cosmetic Powder industry is projected to witness a CAGR of 5.8% between 2025 and 2035.

The Gemstone Cosmetic Powder industry stood at USD 0.8 billion in 2024.

The Gemstone Cosmetic Powder industry is anticipated to reach USD 1.6 billion by 2035 end.

Amethyst and tourmaline-based powders are set to record the highest CAGR of 7.5%, driven by increasing demand for luxury and holistic skincare.

The key players operating in the Gemstone Cosmetic Powder industry include L’Oréal, Estée Lauder, Shiseido, Glo Skin Beauty, Gemology Cosmetics, and La Prairie.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by type, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by application, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by nature, 2019 to 2034

Table 8: Global Market Volume (Tons) Forecast by nature, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 10: Global Market Volume (Tons) Forecast by sales channel, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by type, 2019 to 2034

Table 14: North America Market Volume (Tons) Forecast by type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by application, 2019 to 2034

Table 16: North America Market Volume (Tons) Forecast by application, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by nature, 2019 to 2034

Table 18: North America Market Volume (Tons) Forecast by nature, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 20: North America Market Volume (Tons) Forecast by sales channel, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by type, 2019 to 2034

Table 24: Latin America Market Volume (Tons) Forecast by type, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by application, 2019 to 2034

Table 26: Latin America Market Volume (Tons) Forecast by application, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by nature, 2019 to 2034

Table 28: Latin America Market Volume (Tons) Forecast by nature, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 30: Latin America Market Volume (Tons) Forecast by sales channel, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by type, 2019 to 2034

Table 34: Western Europe Market Volume (Tons) Forecast by type, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by application, 2019 to 2034

Table 36: Western Europe Market Volume (Tons) Forecast by application, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by nature, 2019 to 2034

Table 38: Western Europe Market Volume (Tons) Forecast by nature, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 40: Western Europe Market Volume (Tons) Forecast by sales channel, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by type, 2019 to 2034

Table 44: Eastern Europe Market Volume (Tons) Forecast by type, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by application, 2019 to 2034

Table 46: Eastern Europe Market Volume (Tons) Forecast by application, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by nature, 2019 to 2034

Table 48: Eastern Europe Market Volume (Tons) Forecast by nature, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 50: Eastern Europe Market Volume (Tons) Forecast by sales channel, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by type, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by type, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by application, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by application, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by nature, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by nature, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by sales channel, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by type, 2019 to 2034

Table 64: East Asia Market Volume (Tons) Forecast by type, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by application, 2019 to 2034

Table 66: East Asia Market Volume (Tons) Forecast by application, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by nature, 2019 to 2034

Table 68: East Asia Market Volume (Tons) Forecast by nature, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 70: East Asia Market Volume (Tons) Forecast by sales channel, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by type, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Tons) Forecast by type, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by application, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Tons) Forecast by application, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by nature, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Tons) Forecast by nature, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Tons) Forecast by sales channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by nature, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by type, 2019 to 2034

Figure 11: Global Market Volume (Tons) Analysis by type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by application, 2019 to 2034

Figure 15: Global Market Volume (Tons) Analysis by application, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by application, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by application, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by nature, 2019 to 2034

Figure 19: Global Market Volume (Tons) Analysis by nature, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by nature, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by nature, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 23: Global Market Volume (Tons) Analysis by sales channel, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 26: Global Market Attractiveness by type, 2024 to 2034

Figure 27: Global Market Attractiveness by application, 2024 to 2034

Figure 28: Global Market Attractiveness by nature, 2024 to 2034

Figure 29: Global Market Attractiveness by sales channel, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by type, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by application, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by nature, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by type, 2019 to 2034

Figure 41: North America Market Volume (Tons) Analysis by type, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by type, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by type, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by application, 2019 to 2034

Figure 45: North America Market Volume (Tons) Analysis by application, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by application, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by application, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by nature, 2019 to 2034

Figure 49: North America Market Volume (Tons) Analysis by nature, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by nature, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by nature, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 53: North America Market Volume (Tons) Analysis by sales channel, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 56: North America Market Attractiveness by type, 2024 to 2034

Figure 57: North America Market Attractiveness by application, 2024 to 2034

Figure 58: North America Market Attractiveness by nature, 2024 to 2034

Figure 59: North America Market Attractiveness by sales channel, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by application, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by nature, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by type, 2019 to 2034

Figure 71: Latin America Market Volume (Tons) Analysis by type, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by type, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by application, 2019 to 2034

Figure 75: Latin America Market Volume (Tons) Analysis by application, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by application, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by application, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by nature, 2019 to 2034

Figure 79: Latin America Market Volume (Tons) Analysis by nature, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by nature, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by nature, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 83: Latin America Market Volume (Tons) Analysis by sales channel, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 86: Latin America Market Attractiveness by type, 2024 to 2034

Figure 87: Latin America Market Attractiveness by application, 2024 to 2034

Figure 88: Latin America Market Attractiveness by nature, 2024 to 2034

Figure 89: Latin America Market Attractiveness by sales channel, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by type, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by application, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by nature, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by type, 2019 to 2034

Figure 101: Western Europe Market Volume (Tons) Analysis by type, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by type, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by type, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by application, 2019 to 2034

Figure 105: Western Europe Market Volume (Tons) Analysis by application, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by application, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by application, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by nature, 2019 to 2034

Figure 109: Western Europe Market Volume (Tons) Analysis by nature, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by nature, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by nature, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 113: Western Europe Market Volume (Tons) Analysis by sales channel, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by type, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by application, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by nature, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by sales channel, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by type, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by application, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by nature, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by type, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Tons) Analysis by type, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by type, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by type, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by application, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Tons) Analysis by application, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by application, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by application, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by nature, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Tons) Analysis by nature, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by nature, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by nature, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Tons) Analysis by sales channel, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by type, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by application, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by nature, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by sales channel, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by type, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by application, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by nature, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by type, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by type, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by type, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by type, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by application, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by application, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by application, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by application, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by nature, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by nature, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by nature, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by nature, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by sales channel, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by type, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by application, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by nature, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by sales channel, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by type, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by application, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by nature, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by type, 2019 to 2034

Figure 191: East Asia Market Volume (Tons) Analysis by type, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by type, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by type, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by application, 2019 to 2034

Figure 195: East Asia Market Volume (Tons) Analysis by application, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by application, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by application, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by nature, 2019 to 2034

Figure 199: East Asia Market Volume (Tons) Analysis by nature, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by nature, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by nature, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 203: East Asia Market Volume (Tons) Analysis by sales channel, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 206: East Asia Market Attractiveness by type, 2024 to 2034

Figure 207: East Asia Market Attractiveness by application, 2024 to 2034

Figure 208: East Asia Market Attractiveness by nature, 2024 to 2034

Figure 209: East Asia Market Attractiveness by sales channel, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by type, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by application, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by nature, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by type, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by type, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by type, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by type, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by application, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by application, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by application, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by application, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by nature, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by nature, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by nature, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by nature, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by sales channel, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by type, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by application, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by nature, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by sales channel, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Gemstone Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA