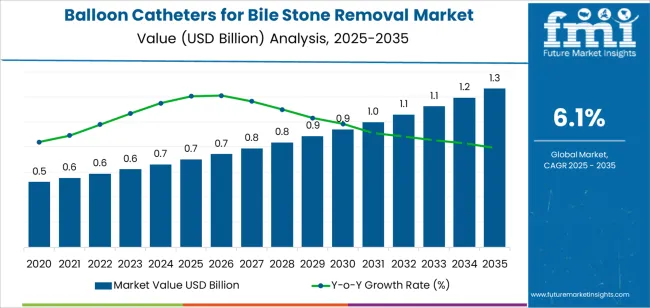

The global balloon catheters for bile stone removal market is valued at USD 0.7 billion in 2025. It is slated to reach USD 1.2 billion by 2035, recording an absolute increase of USD 0.5 billion over the forecast period. This translates into a total growth of 80.8%, with the market forecast to expand at a compound annual growth rate of 6.1% between 2025 and 2035. The market size is expected to grow by nearly 1.8 times during the same period, supported by increasing prevalence of gallstone disease, growing adoption of minimally invasive endoscopic procedures, and rising focus on advanced bile duct intervention technologies across diverse hospital settings and gastroenterology practices.

Between 2025 and 2030, the market is projected to expand from USD 0.7 billion to USD 0.9 billion, resulting in a value increase of USD 0.2 billion, which represents 42.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing incidence of biliary disorders and cholelithiasis, rising adoption of endoscopic retrograde cholangiopancreatography procedures, and growing demand for single-use sterile catheter systems in therapeutic endoscopy applications. Hospitals and endoscopy centers are expanding their interventional gastroenterology capabilities to address the growing demand for bile stone extraction procedures that ensure patient safety and minimize procedural complications.

From 2030 to 2035, the market is forecast to grow from USD 0.9 billion to USD 1.2 billion, adding another USD 0.3 billion, which constitutes 57.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of outpatient endoscopy procedures and ambulatory surgical centers, the development of advanced balloon catheter designs with improved stone extraction efficiency, and the growth of specialized applications for complex biliary interventions and post-surgical bile duct management. The growing adoption of advanced endoscopic techniques and precision medical device technologies will drive demand for balloon catheters with enhanced functionality and procedural performance features.

Between 2020 and 2025, the market experienced steady growth, driven by increasing awareness of minimally invasive treatment options and growing recognition of endoscopic procedures as preferred interventions for managing biliary obstructions and gallstone complications. The market developed as gastroenterologists and endoscopy specialists recognized the clinical advantages of balloon catheter technology to facilitate stone extraction, improve bile duct clearance, and support patient recovery while minimizing surgical intervention requirements. Technological advancement in catheter design and balloon inflation mechanisms began focusing the importance of maintaining procedural safety and extraction efficiency in challenging biliary anatomy environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 0.7 billion |

| Forecast Value in (2035F) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

Market expansion is being supported by the increasing global incidence of gallstone disease and biliary disorders driven by aging populations and dietary lifestyle factors, alongside the corresponding need for minimally invasive intervention technologies that can improve procedural outcomes, reduce patient recovery times, and maintain clinical effectiveness across various endoscopic bile duct procedures and therapeutic interventions. Modern gastroenterology departments and endoscopy centers are increasingly focused on implementing balloon catheter solutions that can facilitate stone extraction, enhance bile duct clearance, and provide consistent performance in complex biliary anatomies.

The growing focus on outpatient procedures and reduced hospital stays is driving demand for balloon catheters that can enable efficient endoscopic interventions, support same-day discharge protocols, and ensure comprehensive patient safety. Clinical practitioners' preference for single-use medical devices that combine procedural reliability with infection prevention and quality assurance is creating opportunities for advanced balloon catheter implementations. The rising influence of minimally invasive surgery adoption and therapeutic endoscopy advancement is also contributing to increased utilization of balloon catheters that can provide superior stone extraction capabilities without compromising procedural safety or clinical outcomes.

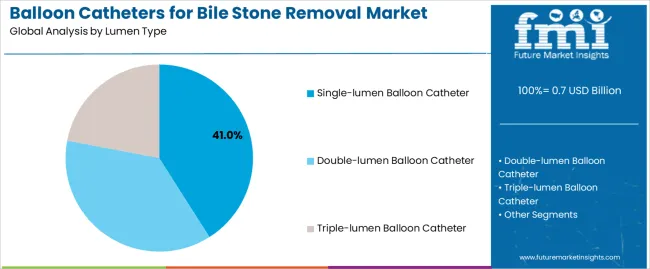

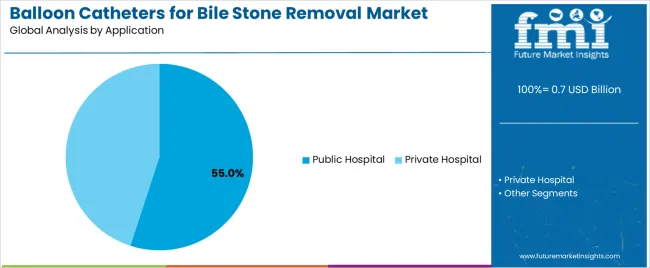

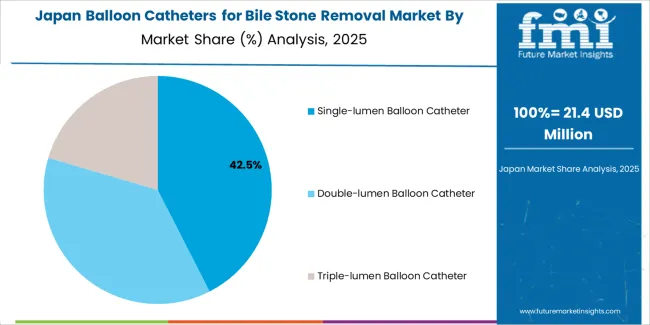

The market is segmented by lumen type, application, and region. By lumen type, the market is divided into single-lumen balloon catheter, double-lumen balloon catheter, and triple-lumen balloon catheter. Based on application, the market is categorized into public hospital and private hospital. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The single-lumen balloon catheter segment is projected to maintain its leading position in the market with 41.0% market share in 2025, reaffirming its role as the preferred device configuration for standard endoscopic bile stone extraction procedures. Gastroenterologists and endoscopy specialists utilize single-lumen balloon catheters for their procedural simplicity, cost-effectiveness, and proven effectiveness in removing bile duct stones while maintaining adequate visualization and working channel access. Single-lumen catheter technology's proven clinical performance and ease of use directly address the procedural requirements for routine bile stone extraction and bile duct clearance across diverse patient populations and stone characteristics.

This device segment forms the foundation of standard endoscopic stone removal procedures, as it represents the catheter configuration with the greatest adoption rate and established safety record across multiple endoscopy applications and clinical settings. Healthcare facility investments in endoscopic intervention capabilities continue to strengthen adoption among gastroenterology departments and ambulatory endoscopy centers. With clinical protocols focusing procedural efficiency and patient safety, single-lumen balloon catheters align with both treatment objectives and economic considerations, making them the central component of comprehensive bile stone management strategies.

The public hospital application segment is projected to represent the 55.0% market share of balloon catheters for bile stone removal demand in 2025, highlighting its role as the primary setting for endoscopic biliary interventions across emergency presentations, scheduled procedures, and complex case management. Public hospitals utilize balloon catheters for bile stone removal due to their comprehensive gastroenterology departments, high patient volumes, and ability to manage diverse biliary complications while supporting emergency care capabilities and teaching hospital functions. Positioned as essential medical devices for hospital endoscopy units, balloon catheters offer both clinical effectiveness and procedural versatility.

The segment is supported by continuous expansion in public healthcare infrastructure and the growing availability of trained endoscopists that enable wider access to therapeutic endoscopy procedures with improved clinical outcomes and reduced surgical intervention rates. Public hospitals are investing in comprehensive endoscopy programs to support increasingly complex biliary disease management and population health requirements. As healthcare access expands and endoscopic intervention adoption increases, the public hospital application will continue to dominate the market while supporting advanced procedural capabilities and clinical training initiatives.

The balloon catheters for bile stone removal market is advancing due to increasing prevalence of gallstone disease driven by aging demographics and growing adoption of minimally invasive endoscopic procedures that require specialized medical device technologies providing enhanced clinical outcomes and patient safety benefits across diverse therapeutic endoscopy and biliary intervention applications. The market faces challenges, including procedural complexity and specialist training requirements, competition from alternative stone extraction devices and surgical interventions, and reimbursement constraints related to procedure coding and healthcare payment limitations. Innovation in catheter design technologies and advanced balloon materials continues to influence product development and market expansion patterns.

The growing adoption of endoscopic retrograde cholangiopancreatography as the preferred intervention for bile duct stone management is driving demand for specialized balloon catheters that address procedural requirements including stone extraction efficiency, bile duct clearance verification, and minimal tissue trauma during stone removal. Hospital endoscopy units require reliable catheter systems that deliver consistent performance across varied stone sizes while maintaining procedural safety and reducing complication rates. Gastroenterology specialists are increasingly recognizing the clinical advantages of balloon catheter integration for biliary stone management and treatment optimization, creating opportunities for advanced catheter designs specifically developed for complex biliary interventions.

Modern medical device manufacturers are incorporating advanced polymer materials and innovative catheter designs to enhance procedural performance, improve stone capture efficiency, and support comprehensive clinical objectives through optimized balloon compliance and controlled inflation characteristics. Leading companies are developing radiopaque marker systems, implementing tapered balloon configurations, and advancing catheter shaft technologies that improve device trackability and procedural control. These technologies improve clinical outcomes while enabling procedural flexibility, including varied stone extraction techniques, balloon dilation capabilities, and enhanced endoscopic visualization. Advanced design integration also allows clinicians to support comprehensive treatment objectives and procedural optimization beyond traditional catheter limitations.

The expansion of infection prevention protocols and patient safety initiatives is driving adoption of single-use balloon catheters with sterile packaging and quality assurance systems that eliminate reprocessing concerns and ensure consistent device performance. These disposable medical devices address healthcare facility requirements for infection control compliance, reduce cross-contamination risks, and provide standardized product specifications that support predictable procedural outcomes. Manufacturers are investing in cost-effective production capabilities and quality management systems to serve growing demand for single-use endoscopy devices while supporting innovation in catheter functionality and clinical performance.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| United States | 5.8% |

| United Kingdom | 5.2% |

| Japan | 4.6% |

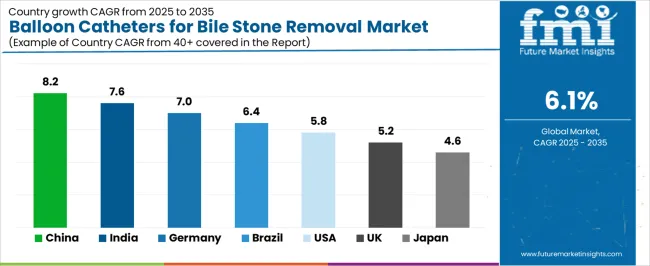

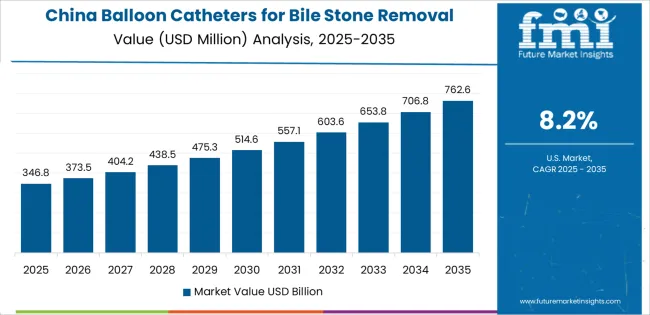

The market is experiencing solid growth globally, with China leading at an 8.2% CAGR through 2035, driven by expanding endoscopy infrastructure, growing prevalence of biliary disorders, and increasing adoption of minimally invasive therapeutic procedures. India follows at 7.6%, supported by rising gallstone disease incidence, expanding gastroenterology departments, and growing healthcare access in tier-2 and tier-3 cities. Germany shows growth at 7.0%, focusing advanced endoscopy techniques, clinical excellence in gastroenterology, and established therapeutic endoscopy training programs. Brazil demonstrates 6.4% growth, supported by expanding healthcare infrastructure, increasing endoscopy procedure volumes, and growing medical device market development. The United States records 5.8%, focusing on outpatient endoscopy expansion, ambulatory surgical center growth, and advanced biliary intervention techniques. The United Kingdom exhibits 5.2% growth, focusing National Health Service endoscopy programs and gastroenterology service expansion. Japan shows 4.6% growth, focusing clinical quality standards and advanced endoscopic device adoption.

The report covers an in-depth analysis of 40 countries, top-performing countries are highlighted below.

Revenue from balloon catheters for bile stone removal in China is projected to exhibit exceptional growth with a CAGR of 8.2% through 2035, driven by expanding endoscopy infrastructure and rapidly growing gastroenterology departments supported by government healthcare initiatives and hospital modernization programs. The country's massive healthcare sector expansion and increasing investment in minimally invasive procedure capabilities are creating substantial demand for therapeutic endoscopy devices. Major medical device manufacturers and international suppliers are establishing comprehensive distribution and clinical support capabilities to serve both urban tertiary hospitals and expanding regional medical centers.

Revenue from balloon catheters for bile stone removal in India is expanding at a CAGR of 7.6%, supported by increasing prevalence of gallstone disease, expanding gastroenterology services, and growing adoption of therapeutic endoscopy procedures driven by healthcare infrastructure investments and medical education advancement. The country's substantial patient population and expanding hospital networks are driving demand for bile stone removal technologies throughout diverse clinical settings. Leading medical device companies and local distributors are establishing comprehensive supply chains and clinical training programs to address growing procedural demand.

Revenue from balloon catheters for bile stone removal in Germany is expanding at a CAGR of 7.0%, supported by the country's leadership in gastroenterology, advanced endoscopy infrastructure, and focus on clinical quality standards for therapeutic endoscopy procedures. Germany's medical excellence and established training programs are driving demand for high-quality medical devices throughout gastroenterology departments. Leading university hospitals and endoscopy centers are investing in advanced therapeutic techniques and device technologies.

Revenue from balloon catheters for bile stone removal in Brazil is growing at a CAGR of 6.4%, driven by expanding healthcare infrastructure, growing endoscopy procedure volumes, and increasing adoption of minimally invasive biliary interventions across public and private hospital networks. Brazil's developing healthcare sector and population health needs are supporting investment in therapeutic endoscopy capabilities. Medical device distributors and healthcare facilities are establishing endoscopy service capabilities for biliary disease management.

Revenue from balloon catheters for bile stone removal in the United States is expanding at a CAGR of 5.8%, supported by expansion of ambulatory surgical centers, growing outpatient endoscopy procedures, and established gastroenterology specialty networks providing comprehensive biliary intervention services. The nation's mature healthcare infrastructure and procedure volume migration to outpatient settings are driving demand for efficient single-use medical devices. Ambulatory care facilities and hospital endoscopy departments are investing in quality devices and procedural efficiency optimization.

Revenue from balloon catheters for bile stone removal in the United Kingdom is expanding at a CAGR of 5.2%, supported by National Health Service endoscopy programs, gastroenterology service expansion, and ongoing efforts to reduce endoscopy procedure waiting times through capacity enhancement initiatives. The country's integrated healthcare system and clinical guideline adherence are driving demand for standardized medical devices. Hospital trusts and endoscopy units are implementing quality improvement programs for biliary intervention procedures.

Revenue from balloon catheters for bile stone removal in Japan is expanding at a CAGR of 4.6%, supported by the country's focus on clinical quality, advanced endoscopy technology adoption, and comprehensive gastroenterology training programs ensuring high procedural standards. Japan's medical sophistication and attention to device quality are driving demand for premium balloon catheter products. Leading academic medical centers and community hospitals are investing in advanced therapeutic endoscopy capabilities.

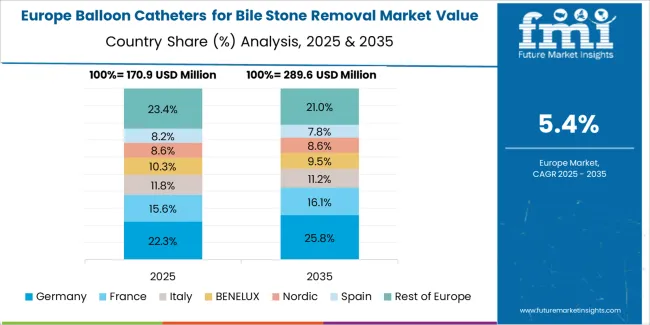

The balloon catheters for bile stone removal market in Europe is projected to grow from USD 245.7 million in 2025 to USD 434.6 million by 2035, registering a CAGR of 5.9% over the forecast period. Germany is expected to maintain leadership with a 26.5% market share in 2025, moderating to 26.2% by 2035, supported by advanced gastroenterology infrastructure, clinical excellence in therapeutic endoscopy, and comprehensive training programs.

France follows with 19.8% in 2025, projected at 20.1% by 2035, driven by established endoscopy networks, academic medical centers, and national digestive health programs. The United Kingdom holds 17.6% in 2025, declining slightly to 17.3% by 2035 due to healthcare budget constraints and procedure volume management. Italy commands 13.4% in 2025, rising to 13.6% by 2035, while Spain accounts for 10.2% in 2025, reaching 10.5% by 2035 aided by gastroenterology service expansion and endoscopy infrastructure development. The Netherlands maintains 6.8% in 2025, up to 7.0% by 2035 due to advanced endoscopy facilities and clinical quality initiatives. The Rest of Europe region, including Nordic countries, Central and Eastern Europe, and other markets, is anticipated to hold 5.7% in 2025 and 5.3% by 2035, reflecting gradual adoption in emerging gastroenterology markets and endoscopy service development programs.

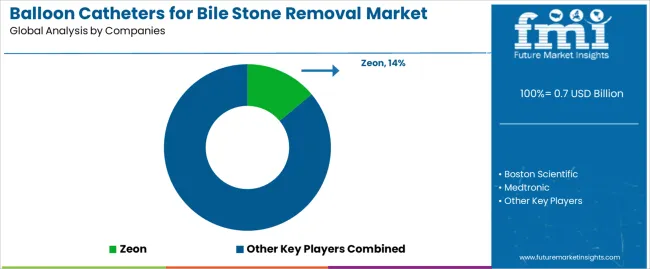

The market is characterized by competition among established medical device manufacturers, specialized endoscopy equipment companies, and regional catheter suppliers. Companies are investing in advanced balloon material development, catheter design innovation, clinical evidence generation, and application-specific product portfolios to deliver safe, effective, and user-friendly balloon catheter solutions. Innovation in radiopaque marker systems, balloon compliance characteristics, and catheter shaft flexibility is central to strengthening market position and competitive advantage.

Zeon leads the market with comprehensive balloon catheter solutions with a focus on clinical performance, device reliability, and established presence in therapeutic endoscopy applications across diverse gastroenterology settings. Boston Scientific provides innovative endoscopy devices with focus on procedural efficiency and advanced catheter technologies for complex biliary interventions. Medtronic offers versatile medical device portfolios with focus on gastroenterology and therapeutic endoscopy solutions. Cook Medical delivers specialized endoscopy products with comprehensive catheter offerings for biliary procedures. CONMED provides endoscopic intervention devices with focus on procedural performance and clinical support. Micro-Tech Endoscopy specializes in therapeutic endoscopy technologies with focus on emerging markets and cost-effective device solutions.

Medorah Medical focuses on specialized catheter technologies for challenging biliary anatomy. Penlon offers medical device solutions with established product lines for endoscopy applications. Edwards Lifesciences provides advanced medical technologies with expertise in catheter-based interventions. B. Braun delivers comprehensive medical device portfolios including endoscopy and intervention products for healthcare facilities worldwide.

Balloon catheters for bile stone removal represent a specialized medical device segment within therapeutic endoscopy and gastroenterology applications, projected to grow from USD 0.7 billion in 2025 to USD 1.2 billion by 2035 at a 6.1% CAGR. These single-use intervention devices serve as essential tools in endoscopic procedures for bile duct stone extraction, bile duct clearance verification, and biliary obstruction management where procedural safety, stone removal efficiency, and patient comfort are required. Market expansion is driven by increasing gallstone disease prevalence, growing minimally invasive procedure adoption, advancing endoscopy infrastructure, and rising focus on outpatient therapeutic interventions across diverse hospital and ambulatory care settings.

How Healthcare Regulators Could Strengthen Device Standards and Patient Safety?

How Healthcare Associations Could Advance Clinical Standards and Training Development?

How Medical Device Manufacturers Could Drive Innovation and Clinical Excellence?

How Healthcare Facilities Could Optimize Clinical Outcomes and Procedural Efficiency?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 0.7 billion |

| Lumen Type | Single-lumen Balloon Catheter, Double-lumen Balloon Catheter, Triple-lumen Balloon Catheter |

| Application | Public Hospital, Private Hospital |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | Zeon, Boston Scientific, Medtronic, Cook Medical, CONMED, Micro-Tech Endoscopy |

| Additional Attributes | Dollar sales by lumen type and application category, regional demand trends, competitive landscape, technological advancements in catheter design, material innovation, clinical evidence development, and procedural technique optimization |

The global balloon catheters for bile stone removal market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the balloon catheters for bile stone removal market is projected to reach USD 1.3 billion by 2035.

The balloon catheters for bile stone removal market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in balloon catheters for bile stone removal market are single-lumen balloon catheter, double-lumen balloon catheter and triple-lumen balloon catheter.

In terms of application, public hospital segment to command 55.0% share in the balloon catheters for bile stone removal market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Balloon Catheters Analysis by Product Type by Indication and by End User through 2035

Cryoballoon Ablation System Market – Trends & Forecast 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Micro Balloon Catheter Market Growth – Trends & Forecast 2025 to 2035

Cutting Balloons Market Insights – Growth, Demand & Forecast 2025 to 2035

Occlusion Balloon Catheter Market Size and Share Forecast Outlook 2025 to 2035

Serration Balloon Catheters Market

Stent Graft Balloon Catheter Market Insights - Growth & Forecast 2025 to 2035

Intra-Aortic Balloon Pump (IABP) Market Size and Share Forecast Outlook 2025 to 2035

Intra-gastric Balloons Market Size and Share Forecast Outlook 2025 to 2035

Radiofrequency Balloon Catheter Market Size and Share Forecast Outlook 2025 to 2035

Pulmonary Dilation Balloon Market

Kidney Stone Extraction Balloon Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Stroke Catheters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Airway Catheters Market Analysis - Growth & Industry Insights 2025 to 2035

Rectal Catheters Market

Echogenic Catheters Market

Esophageal Catheters Market Size and Share Forecast Outlook 2025 to 2035

Deflectable Catheters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA