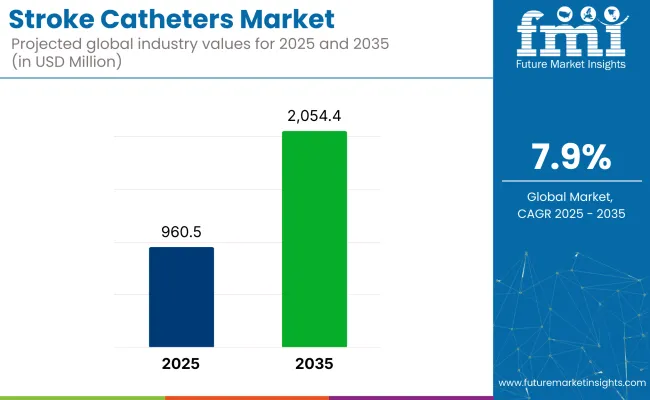

The stroke catheters market is expected to record USD 960.5 million valuation in 2025 and a valuation of USD 2,054.4 million by 2035, registering a CAGR of 7.9% during the forecast period. This growth is being driven by the increasing need for minimally invasive procedures and advanced technologies that enhance the efficacy of stroke interventions. The industry is expected to grow due to rising stroke-related conditions, the demand for improved diagnostic solutions, and the rising focus on reducing healthcare costs through more efficient treatments.

In a statement made by Wayne Allen, CEO of Perfuze, on March 12, 2025, during the PULSE 2.0 event, it was noted: “The Zipline catheters represent an innovative technology that I believe will simplify stroke intervention, reduce costs, and accelerate reperfusion.

In my initial experience, they have enabled rapid clot access and aspiration, even in complex anatomy.” This highlights how Zipline catheters are expected to revolutionize stroke interventions, offering rapid clot removal in challenging cases. The adoption of Zipline catheters is anticipated to significantly contribute to industrial growth, especially for complex interventions.

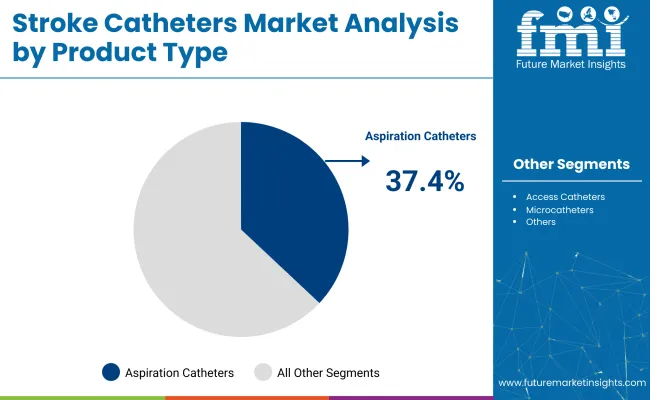

The aspiration catheters segment is expected to dominate in 2025, holding an estimated 37.4% share. This segment’s growth is being driven by the increasing preference for non-invasive solutions and the demand for efficiency in stroke management.

Asia, particularly India, is expected to emerge as a key growth region due to increasing healthcare infrastructure, a rising stroke rate, and growing awareness around stroke interventions. Technological advancements and investments in stroke therapy innovation are expected to further propel the industry through 2035.

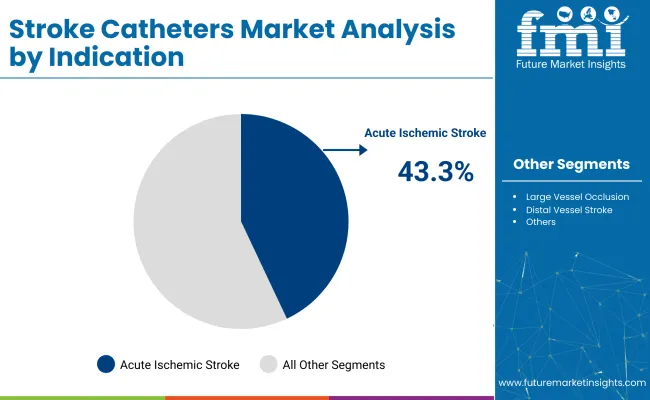

The stroke catheters market is experiencing significant growth, driven by innovations in aspiration catheters, acute ischemic stroke indications, and an increasing demand for stroke care in comprehensive stroke centers. Rising awareness about stroke care and advancements in catheter technologies are contributing to the growing adoption of these medical devices globally.

Aspiration catheters are projected to capture a 37.4% market share in the stroke catheters segment by 2025.

Acute ischemic stroke is projected to dominate the stroke catheter industry by indication, with a 43.3% market share in 2025.

Comprehensive stroke centers are expected to lead the stroke catheter industry by end-user, holding a 43.8% market share by 2025.

The stroke catheters market is being driven by the increasing prevalence of stroke and advancements in catheter technology. However, challenges such as high treatment costs and the need for specialized training are limiting industry growth.

The increasing prevalence of stroke is driving industry growth

The rising incidence of stroke globally is significantly contributing to the demand for stroke catheters. Stroke is a leading cause of death and disability worldwide, with millions of new cases reported annually.

This growing burden is prompting healthcare systems to adopt advanced medical technologies, including stroke catheters, to improve patient outcomes. Stroke catheters are essential in procedures like thrombectomy, where timely intervention is crucial. As the number of stroke cases continues to rise, the adoption of stroke catheters is expected to increase, driving industry growth.

Advancements in catheter technology are enhancing treatment efficacy

Technological innovations in catheter design and materials are enhancing the efficacy of stroke treatments. Modern stroke catheters are being developed with features that improve navigation through cerebral vessels, reduce procedural complications, and facilitate the removal of thrombus with greater precision.

These advancements are enabling more effective and safer interventions for patients experiencing acute ischemic strokes. The continuous improvement in catheter technology is contributing to better clinical outcomes and is expected to bolster the adoption of stroke catheters in medical practices.

The stroke catheters market is expected to grow steadily through 2035, driven by increasing stroke incidences and advancements in catheter technologies. Emerging industries like China and India are experiencing rapid growth, while mature industries like the USA and Germany are focusing on technological innovations and improving patient care.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

| Germany | 6.9% |

| China | 8.7% |

| Japan | 5.3% |

| India | 9.5% |

The United States stroke catheters industry is expected to grow at a CAGR of 6.1% through 2035.

The Germany stroke catheters market is projected to grow at a CAGR of 6.9% through 2035. Growth is supported by Germany’s emphasis on technological innovation and high standards in patient care.

The China stroke catheters market is expected to grow at a CAGR of 8.2% through 2035. Expansion is driven by rapid healthcare modernization and the growing demand for advanced medical solutions.

The Japan stroke catheters market is projected to grow at a CAGR of 4.2% through 2035. Growth is being supported by an aging population and the rising demand for stroke intervention solutions.

The India stroke catheters market is expected to grow at a CAGR of 9.5% through 2035.

The stroke catheters market is driven by leading players, key innovators, and emerging companies. The industry is dominated by Medtronic plc, Stryker Corporation, Penumbra, Inc., and Johnson & Johnson MedTech (Cerenovus), which offer advanced thrombectomy catheters and neurovascular products. Devices such as aspiration systems and stent retrievers are provided by these companies, improving outcomes in stroke interventions.

Specialized imaging solutions for interventional applications are offered by Canon Medical Systems, Fujifilm Holdings Corporation, and NeuroLogica Corporation. Innovative technologies addressing specific industry needs are being developed by emerging players like Imperative Care, Inc., CurveBeam AI, and Koning Health.

Recent Industry News in the Stroke Catheters Market:

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 960.5 million |

| Projected Market Size (2035) | USD 2,054.4 million |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Product Types Analyzed (Segment 1) | Access Catheters, Aspiration Catheters, Microcatheters, Balloon Guide Catheters, Combination Catheters |

| Indications Analyzed (Segment 2) | Large Vessel Occlusion, Acute Ischemic Stroke, Distal Vessel Stroke (DVO), Intracranial Atherosclerosis Disease (ICAD) |

| End Users Analyzed (Segment 3) | Comprehensive Stroke Centers, Primary Stroke Centers (PSCs), Tertiary Care Hospitals, Neurointervention Suites |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Johnson & Johnson MedTech, Terumo Neuro, Medtronic, Imperative Care, Inc., Route 92 Medical, Penumbra, Inc., Stryker, NeuroSafe Medical Co., Ltd. |

| Additional Attributes | Dollar sales, share by product type and indication, growing demand for aspiration and microcatheters in ischemic stroke treatment, regional adoption trends in stroke intervention suites, technological advancements in combination catheters |

The industry is segmented into access catheters, aspiration catheters, microcatheters, balloon guide catheters, and combination catheters.

The industry covers large vessel occlusion, acute ischemic stroke, distal vessel stroke (DVO), and intracranial atherosclerosis disease (ICAD).

The industry is categorized into comprehensive stroke centers, primary stroke centers (PSCs), tertiary care hospitals, and neurointervention suites.

The industry spans North America, Western Europe, East Asia, and South Asia.

It is expected to reach USD 2,054.4 million by 2035.

The industry is projected to be USD 960.5 million in 2025.

The industry is expected to grow at a CAGR of 7.9% from 2025 to 2035.

Aspiration catheters are projected to hold a 37.4% share in 2025.

India is expected to be the fastest-growing country with a 9.5% growth rate.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stroke Assistive Devices Market

VR Stroke Rehabilitation Market Insights – Growth & Trends 2023-2033

Ischemic Stroke Aspiration Systems Market - Trends & Forecast 2025 to 2035

Cryptogenic Stroke Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hemorrhagic stroke Treatment Market Size and Share Forecast Outlook 2025 to 2035

Ischemic Cerebral Stroke Prevention Therapeutics Market

Airway Catheters Market Analysis - Growth & Industry Insights 2025 to 2035

Rectal Catheters Market

Balloon Catheters for Bile Stone Removal Market Size and Share Forecast Outlook 2025 to 2035

Balloon Catheters Analysis by Product Type by Indication and by End User through 2035

Echogenic Catheters Market

Esophageal Catheters Market Size and Share Forecast Outlook 2025 to 2035

Deflectable Catheters Market Size and Share Forecast Outlook 2025 to 2035

Angiographic Catheters Market Growth - Trends & Forecast 2025 to 2035

Brachytherapy catheters Market

Wedge Pressure Catheters Market

Vascular Access Catheters Market - Growth & Forecast 2025 to 2035

Peripheral Micro Catheters Market Trends – Industry Forecast 2024-2034

Umbilical Vessel Catheters Market

Sonohysterography Catheters Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA