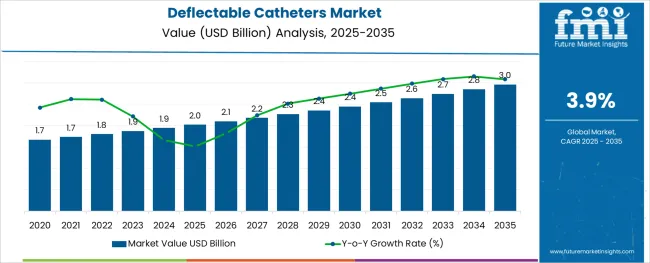

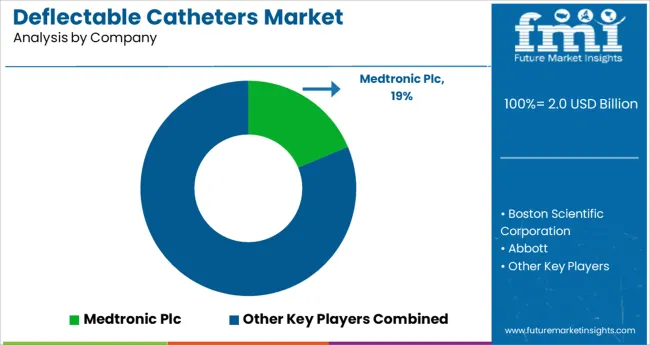

The Deflectable Catheters Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The deflectable catheters market is advancing steadily, fueled by the increasing demand for minimally invasive procedures in cardiology, electrophysiology, and interventional radiology. Clinical advancements in catheter-based therapies are enabling precise navigation within complex anatomical structures, improving procedural success rates and reducing recovery times.

Hospitals and specialty care centers are increasingly adopting these technologies to support advanced cardiovascular interventions and streamline patient management workflows. Surgeons and interventionalists are leveraging deflectable catheters for their steerability, control, and compatibility with imaging systems, thereby expanding their utility across a range of therapeutic areas.

The market is also benefiting from continuous R&D focused on improving torque control, biocompatibility, and access to hard-to-reach lesions. With aging populations and a rising global burden of cardiovascular diseases, the market is expected to witness significant clinical and commercial growth. Technological integration with robotics and enhanced material designs is expected to unlock future opportunities for higher procedural precision and patient safety.

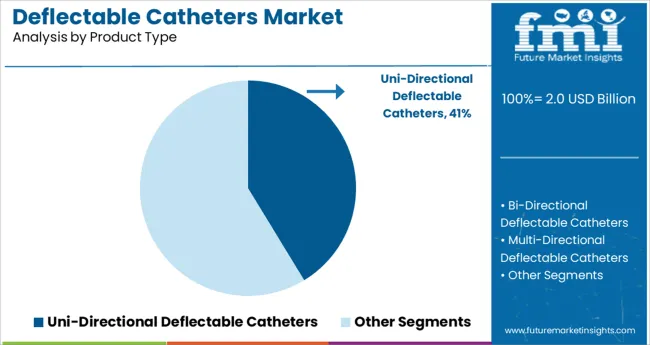

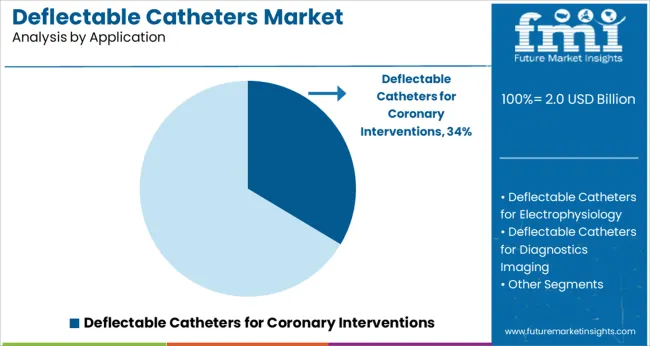

The market is segmented by Product Type, Application, and End User and region. By Product Type, the market is divided into Uni-Directional Deflectable Catheters, Bi-Directional Deflectable Catheters, and Multi-Directional Deflectable Catheters. In terms of Application, the market is classified into Deflectable Catheters for Coronary Interventions, Deflectable Catheters for Electrophysiology, Deflectable Catheters for Diagnostics Imaging, and Deflectable Catheters for Peripheral Interventions.

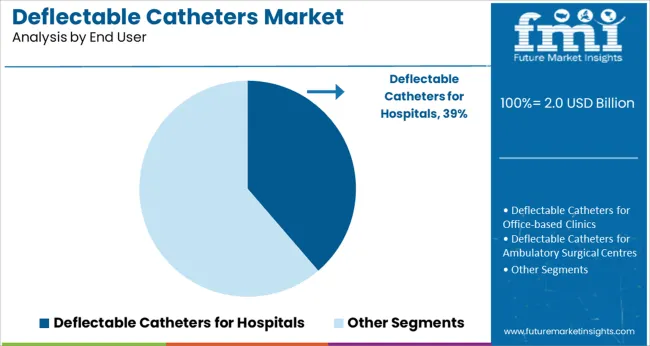

Based on End User, the market is segmented into Deflectable Catheters for Hospitals, Deflectable Catheters for Office-based Clinics, Deflectable Catheters for Ambulatory Surgical Centres, and Deflectable Catheters for Independent Catheterization Labs. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The uni directional deflectable catheters segment is projected to account for 41.3% of the overall product type revenue share in 2025, making it the dominant category. This leadership is driven by the device’s structural simplicity, ease of manufacturing, and reliability in single-axis navigation during routine interventional procedures.

These catheters are widely preferred in applications where linear precision and cost control are prioritized, especially in standardized diagnostic workflows. Their consistent deflection mechanism offers dependable performance, contributing to lower procedural risk and improved physician confidence.

Additionally, uni directional systems are often associated with lower training requirements, accelerating adoption in both established and emerging healthcare settings. Continued use in routine electrophysiology and cardiac interventions, along with broader accessibility, has sustained the segment’s leadership position across global markets.

Deflectable catheters used for coronary interventions are expected to capture 33.6% of the total application-based revenue share in 2025, placing this segment at the forefront of clinical utilization. This growth is being driven by the increasing global incidence of coronary artery disease and the corresponding rise in percutaneous coronary interventions.

The ability of deflectable catheters to precisely navigate tortuous coronary vessels and deliver therapeutic tools to targeted lesions has made them essential in complex procedures. Physicians are increasingly favoring deflectable options for enhanced control during diagnostic angiography, stent delivery, and lesion access.

Hospitals and interventional cardiology centers are integrating these tools into standard coronary procedure kits due to their proven outcomes and procedural efficiency. This sustained clinical demand, reinforced by advancements in catheter tip design and compatibility with robotic-assisted systems, has maintained coronary interventions as a key growth area for deflectable catheter adoption.

The hospital end-user segment is forecast to represent 38.7% of the total revenue share in 2025, establishing it as the primary deployment environment for deflectable catheters. This leadership has been driven by hospitals’ access to high-complexity interventional suites, trained specialists, and comprehensive imaging technologies required for advanced catheter-based procedures.

The volume of cardiac, electrophysiology, and neurovascular interventions performed in hospitals has remained consistently high, reinforcing the need for high-performance deflectable devices. Additionally, hospital procurement practices are aligned with stringent safety and regulatory compliance, which has favored the adoption of clinically validated deflectable catheter systems.

Investments in hybrid operating rooms and integration of robotic navigation platforms have further encouraged usage in tertiary and quaternary care settings. As procedural complexity increases and patient volumes grow, hospitals are expected to remain the largest and most critical setting for the adoption and expansion of deflectable catheter technologies.

| Particulars | Details |

|---|---|

| H1, 2024 | 3.91% |

| H1, 2025 Projected | 3.86% |

| H1, 2025 Outlook | 3.26% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 60 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 65 ↓ |

The comparative analysis and market growth rate of the global deflectable catheters market as studied by Future Market Insights will show a negative BPS growth in the H1-2025 outlook as compared to H1-2025 projected period by 60 BPS, and, a decline in BPS growth is expected in H1-2025 over H1- 2024 duration with 65 Basis Point Share (BPS).

The market is subject to medical device regulations, in accordance with macroeconomic and industrial standards.

The market experienced a decline in the BPS values associated with the inherent device limitations such as its size and limited trackability, and infusion limitations, causing a shift in product preference.

Moreover, a large number of reported occurrences of catheter-associated urinary tract infections (CAUTI) have further restrained patient preference towards the product.

However, with the introduction of steerable catheters, the market is likely to observe a positive growth outlook over the forecasted years. The key developments in the market include the introduction of the cobra catheter for complex surgical interventions.

The world has seen a substantial rise in cardiovascular disorders, and this has spawned major demand for multiple cardiovascular treatments. Consumption of deflectable catheters rose at a CAGR of 3.8% from 2020 to 2024.

The increasing prevalence of peripheral artery diseases, growing geriatric population, increasing preference for minimally invasive surgeries, rapid advancements in catheters, and rising number of cardiovascular surgeries are major factors that guide the sales of deflectable catheter systems.

With cardiovascular diseases becoming one of the prime causes of death across the world, demand for better and more effective treatments has also bolstered amidst this. Government initiatives are focusing on increasing awareness of these cardiovascular disorders and investments to further advance research and development of novel treatment products.

Complications associated with the use of catheters, risk of myocardial infections, and allergic reactions are expected to hinder deflectable catheter sales to a certain extent over the forecast period. However, these drawbacks are being addressed by research and the development of better catheters free from the aforementioned risks.

The deflectable catheters industry is projected to progress steadily at a CAGR of 3.9% from 2025 to 2035.

Increasing Prevalence of Cardiovascular Disorders to Boost Sales of Deflectable Catheters

The world has seen a substantial increase in the incidence of cardiovascular diseases over the past few years which has subsequently influenced the consumption of deflectable catheters. Increasing research and development activity for cardiovascular diseases is propelling demand for innovative products to cover most applications.

Increasing Availability of Microcatheters

Microcatheters have seen a substantial rise in popularity recently and are expected to see rapid development over the forecast period as well. The increasing use of microcatheters is majorly influenced by their key characteristics such as 3D navigation and mirrored workability.

With this widening scope of application, investments in the research & development of microcatheters are expected to see a prominent rise through 2035.

As these advanced microcatheters are developed, their scope of use for deflectable catheters is also expected to increase and subsequently drive market potential.

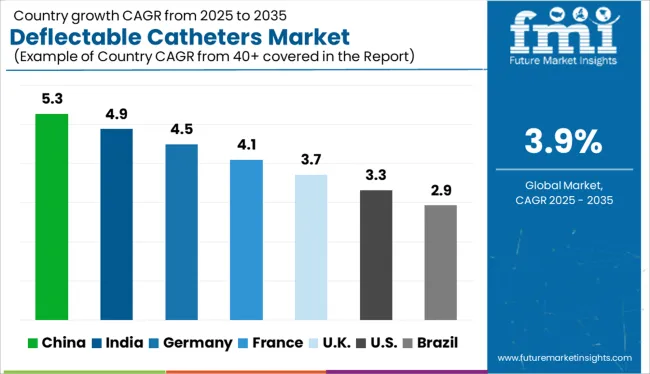

China & India to Emerge as Highly Rewarding Markets in the Asian Region

Deflectable catheter demand analysis for regions such as North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA) has been discussed in this FMI study.

The North American deflectable catheters market is expected to account for the largest market share and is projected to maintain this stance through 2035. The presence of key deflectable catheter manufacturers and well-established healthcare infrastructure are expected to be prime drivers for deflectable catheter shipments in this region.

The Europe deflectable catheter products market is expected to exhibit steady growth in demand over the forecast period. Rising focus on healthcare, increasing medical research and development activities, and a rising geriatric population is anticipated to be major trends in this region.

Deflectable catheter consumption in the regions of South Asia and East Asia is anticipated to see a substantial increase over the forecast period. The increase in demand for deflectable catheters can be attributed to factors such as developing healthcare infrastructure, increasing prevalence of cardiovascular disorders, and increasing healthcare spending potential. China and India are expected to emerge as prime markets in these regions.

Rapidly Developing Healthcare Infrastructure to Provide Lucrative Opportunities for Deflectable Catheter Providers

India has seen a rise in instances of cardiovascular disorders over the past few years, and this is expected to continue through 2035. Increasing sedentary lifestyles, poor eating habits, rising geriatric population, increasing healthcare spending, and rising popularity of minimally invasive cardiovascular procedures are projected to guide deflectable catheter consumption over the forecast period.

Deflectable catheter manufacturers can focus on India to discover untapped potential in this nation and increase their overall sales revenue.

Increasing Incidence of Cardiovascular Ailments to Propel Deflectable Catheter Consumption

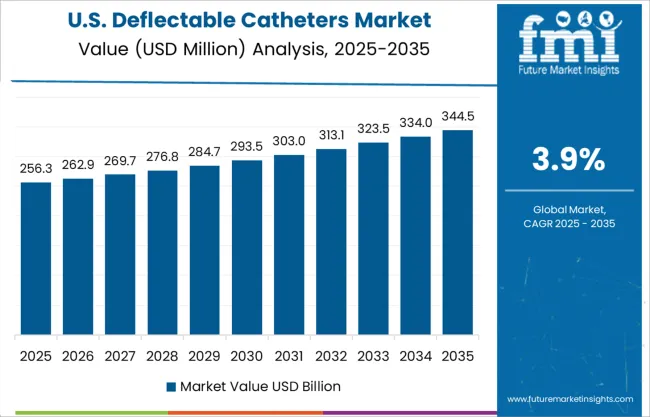

The USA has been battling some major health issues over the past few years that have been massively influencing public health trends in the nation. The nation has seen a substantial increase in the prevalence of obesity which has led to a significant increase in cardiovascular disorders.

Increasing healthcare spending, rising availability of treatment options, and increasing preference for minimally invasive surgeries are some major factors that govern demand for deflectable catheters in the USA

Hospitals Account for Majority of Deflectable Catheter Sales; Demand from Catheterization Labs to Soar Going Forward

Currently, hospitals account for 54.7% of the global deflectable catheter demand and are anticipated to maintain a dominant stance throughout the forecast period, since most cardiovascular treatment procedures require a hospital setting and the presence of medical professionals. However, sales of deflectable catheters are expected to see a rapid increase as demand from independent catheterization labs increases.

In 2025, independent catheterization labs account for 30.7% of the global deflectable catheter market landscape. The number of independent catheterization labs is increasing and is expected to be a prominent trend through 2035.

Office-based clinics and ambulatory surgical centers hold market shares of 2.2% and 12.5%, respectively, in the global deflectable catheters industry.

Deflectable catheter providers are investing in enhancing the deflectable functionality of catheters and stents to optimize cardiovascular procedures.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Units for Volume, million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Turkey, South Africa, and GCC Countries |

| Key Market Segments Covered | Product Type, Application, End User, Region |

| Key Companies Profiled | Medtronic Plc.; Merit Medical Systems; Biosense Webster Inc.; Teleflex Incorporated; Boston Scientific Corporation; Biomerics LLC; OSYPKA AG; Abbot; Japan Lifeline Co.; CathRx Ltd.; Biotronik SE & Co. KG. |

The global deflectable catheters market is estimated to be valued at USD 2.0 billion in 2025.

It is projected to reach USD 3.0 billion by 2035.

The market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types are uni-directional deflectable catheters, bi-directional deflectable catheters and multi-directional deflectable catheters.

deflectable catheters for coronary interventions segment is expected to dominate with a 33.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stroke Catheters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Airway Catheters Market Analysis - Growth & Industry Insights 2025 to 2035

Rectal Catheters Market

Balloon Catheters for Bile Stone Removal Market Size and Share Forecast Outlook 2025 to 2035

Balloon Catheters Analysis by Product Type by Indication and by End User through 2035

Echogenic Catheters Market

Esophageal Catheters Market Size and Share Forecast Outlook 2025 to 2035

Angiographic Catheters Market Growth - Trends & Forecast 2025 to 2035

Brachytherapy catheters Market

Wedge Pressure Catheters Market

Vascular Access Catheters Market - Growth & Forecast 2025 to 2035

Peripheral Micro Catheters Market Trends – Industry Forecast 2024-2034

Umbilical Vessel Catheters Market

Sonohysterography Catheters Market Trends and Forecast 2025 to 2035

Self-Intermittent Catheters Market

Serration Balloon Catheters Market

Neurovascular Access Catheters Market

Nephrology Stents and Catheters Market

Ready to Use Intermittent Catheters Market Size and Share Forecast Outlook 2025 to 2035

Demand for Vascular Access Catheters in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA