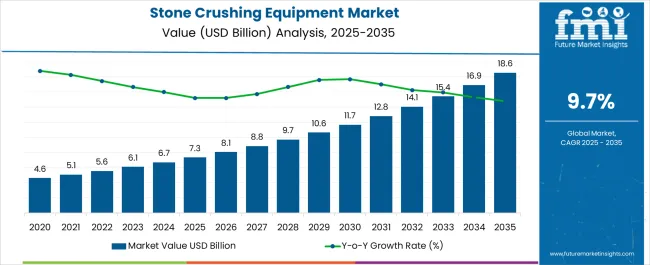

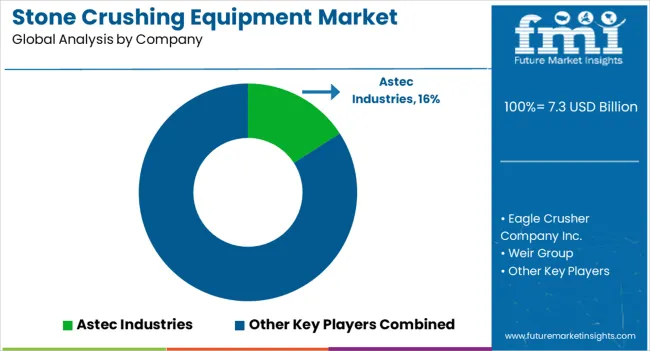

The Stone Crushing Equipment Market is estimated to be valued at USD 7.3 billion in 2025 and is projected to reach USD 18.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Stone Crushing Equipment Market Estimated Value in (2025 E) | USD 7.3 billion |

| Stone Crushing Equipment Market Forecast Value in (2035 F) | USD 18.6 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The stone crushing equipment market is positioned for consistent growth, supported by the rising demand for aggregates across construction, mining, and infrastructure development projects worldwide. Increasing urbanization, expansion of transportation networks, and investments in residential and commercial construction are fueling equipment demand. Growth in mining operations, both metallic and non-metallic, is further accelerating the adoption of advanced crushers that improve efficiency and reduce operational costs.

Technological advancements such as automation, real-time monitoring, and energy-efficient designs are enhancing equipment performance and durability, making them attractive for large-scale operations. Stringent environmental regulations and the need to optimize resource utilization are also shaping industry trends, encouraging manufacturers to focus on designing equipment with reduced emissions and higher productivity.

Emerging economies are witnessing rapid infrastructure expansion, leading to a significant rise in demand for high-capacity crushing machines With supportive government initiatives for road and highway projects and the continuous need for raw materials, the market is expected to maintain steady momentum over the coming years.

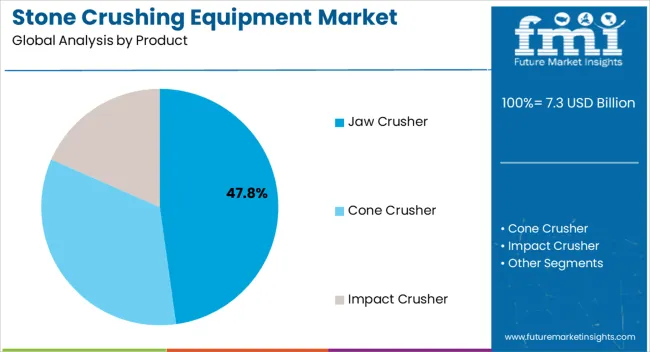

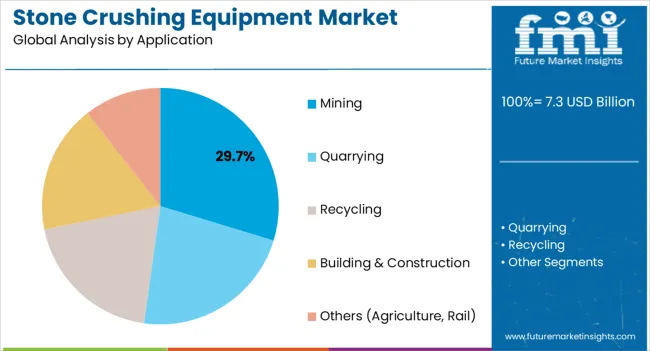

The stone crushing equipment market is segmented by product, application, and geographic regions. By product, stone crushing equipment market is divided into Jaw Crusher, Cone Crusher, and Impact Crusher. In terms of application, stone crushing equipment market is classified into Mining, Quarrying, Recycling, Building & Construction, and Others (Agriculture, Rail). Regionally, the stone crushing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The jaw crusher segment is projected to account for 47.8% of the stone crushing equipment market revenue share in 2025, making it the leading product category. Its dominance is being reinforced by its wide applicability in handling hard and abrasive stones, delivering consistent output across a range of industries. The simple design and cost-effectiveness of jaw crushers make them highly preferred in both small-scale and large-scale projects.

Their ability to provide uniform crushed material with minimal maintenance requirements enhances their appeal in construction and mining applications. The segment is also supported by advances in material engineering, which have improved wear resistance and operational durability. Easy adjustability of output size and compatibility with automated systems are further driving adoption.

Increasing use in road construction, building materials production, and mining operations is solidifying the leadership of jaw crushers Their proven reliability, operational efficiency, and scalability across diverse applications ensure continued dominance within the overall market landscape.

The mining segment is anticipated to hold 29.7% of the stone crushing equipment market revenue share in 2025, positioning it as the leading application area. Growth in this segment is being driven by the rising global demand for minerals, metals, and aggregates required for industrial production and infrastructure development. Stone crushing equipment in mining is essential for primary and secondary crushing, enabling efficient extraction and processing of raw materials.

Increasing investment in large-scale mining projects across regions such as Asia-Pacific, Latin America, and Africa is creating significant opportunities for high-capacity and energy-efficient crushers. The demand for equipment that can handle abrasive and hard materials under extreme operating conditions is boosting adoption of advanced crushing technologies.

Regulatory emphasis on productivity, safety, and sustainability in mining operations is further accelerating the use of modernized crushing equipment As mineral resource exploration expands and demand for processed stone increases, the mining segment is expected to maintain its leadership position, supporting long-term market growth.

Stone crushing equipment is essential for the construction and mining industries due to the requirement for large amounts of aggregate and minerals. These sectors utilize crushed stones for various applications, including concrete production, asphalt paving, and foundation stabilization.

Innovations in stone crushing equipment technology, such as automation, IoT, and advanced sensors, improve operational efficiency and productivity, making it more cost-effective for companies to invest in crushing equipment.

Government initiatives and investments in infrastructure development and construction projects stimulate the market for stone crushing equipment. Policies that promote infrastructure spending and public-private partnerships (PPPs) encourage the use of stone aggregates, benefiting the equipment market.

Mobile crushers are gaining popularity due to their flexibility and mobility. They can be easily transported to different job sites and set up quickly, making them ideal for temporary projects or locations where stationary crushers may not be feasible.

Increasing environmental regulations worldwide require the use of efficient and eco-friendly equipment. Modern stone crushing machines are designed to minimize dust emissions and noise levels, reducing their impact on the environment and nearby communities.

The emphasis on sustainable practices and the circular economy has boosted the demand for recycled aggregates. Stone crushing equipment can process demolition waste and recycled concrete into usable materials, further driving market growth.

There is a growing demand for recycled aggregates derived from demolished concrete and asphalt. Stone crushing equipment capable of processing recycled materials efficiently is in high demand as industries seek sustainable solutions.

There is a trend towards customizable and modular designs in stone crushing equipment. Manufacturers are offering crushers and screens with modular components that can be easily configured to meet specific customer requirements and application needs.

Infrastructure projects such as highways, bridges, and residential buildings continually require crushed stone aggregates, which are essential construction materials. The robust construction and renovation activities across various states further amplify the need for reliable stone crushers to process raw materials efficiently.

The mining sector in the United States contributes significantly to the demand for stone-crushing equipment, as it relies heavily on this machinery to extract and process minerals and ores.

Environmental considerations and regulatory compliance also play a crucial role in shaping the industry, with manufacturers focusing on producing equipment that meets stringent emission standards and operational efficiency requirements.

In the United Kingdom, the demand for stone-crushing equipment is influenced by ongoing construction activities and major infrastructure projects. The government's initiatives to invest in infrastructure development, including roads, railways, and housing, drive the need for aggregates produced by stone crushers.

The United Kingdom's construction industry's reliance on these materials underscores the importance of efficient and reliable crushing equipment to meet demand effectively.

Environmental concerns and sustainable practices are increasingly influencing the industry, with a growing emphasis on using equipment that minimizes environmental impact and meets stringent regulations.

Innovations in technology and equipment design are also shaping the market, with manufacturers focusing on developing more efficient and versatile stone crushers to cater to diverse project requirements.

In India, the demand for stone crushing equipment is driven by factors like the growth in construction and infrastructure projects, urbanization, and the mining sector. Besides, government initiatives such as the "Housing for All" and "Smart Cities" missions propel the demand for construction materials like aggregates, leading to the increased deployment of stone crushers.

The mining industry in India relies heavily on stone crushing equipment for processing various minerals and ores. Stringent regulatory norms pertaining to environmental protection and emission control influence the growth of the industry, prompting manufacturers to innovate and develop advanced stone-crushing machines that are efficient and eco-friendly.

The industry in India is characterized by intense competition among local and international players, driving continuous technological advancements and product development in the stone-crushing equipment sector.

Impact crushers are known for their high throughput and large reduction ratios, enabling operators to process large volumes of material quickly. This efficiency is crucial in meeting the demands of large-scale construction projects and infrastructure developments.

Despite their initial investment cost, impact crushers offer significant long-term cost savings. They require less maintenance compared to other types of crushers and have lower operational costs per ton processed, making them economically viable for continuous use.

Impact crushers are designed to break down medium-hard to hard materials efficiently, reducing them to sizes suitable for further processing or sale. This capability makes them essential in the production of aggregates for construction and infrastructure projects.

Modern impact crushers are designed with advanced technology to minimize dust and noise emissions. This environmental consideration is increasingly important in regulatory compliance and community relations.

Mining operations require the processing of large quantities of ore to extract valuable minerals. Stone crushing equipment is essential for breaking down the extracted material into manageable sizes that can be further processed or sold.

Mining activities often require infrastructure such as roads, railways, and buildings. Stone crushing equipment is crucial for producing aggregates needed for construction materials used in these projects.

As global demand for metals and minerals continues to rise, driven by industrialization and urbanization, mining companies need efficient stone-crushing equipment to meet production targets and extract valuable resources.

Stone-crushing equipment improves the efficiency of mining operations by reducing the size of mined material and facilitating handling and transportation. This leads to cost savings and increased profitability for mining companies.

Key players in the stone crushing equipment industry partner with technology firms and universities to leverage advances in materials science, automation, and digital solutions.

Acquiring smaller companies or startups with innovative technologies or customer access to strengthen product portfolios or enter new product segments.

Ensuring compliance with local and international environmental regulations, including emissions standards and waste management practices. Incorporating sustainable practices into product design and manufacturing processes to appeal to environmentally conscious customers.

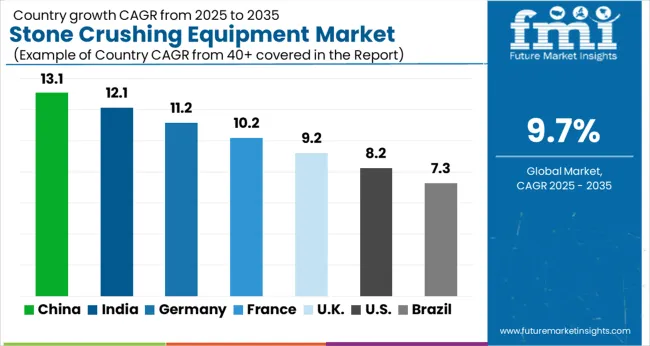

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

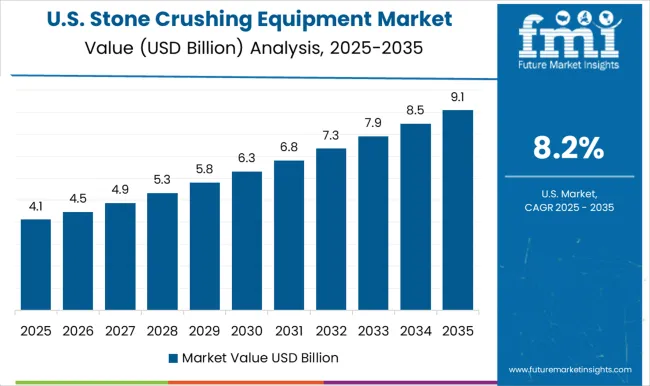

| USA | 8.2% |

| Brazil | 7.3% |

The Stone Crushing Equipment Market is expected to register a CAGR of 9.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 13.1%, followed by India at 12.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.3%, yet still underscores a broadly positive trajectory for the global Stone Crushing Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 11.2%. The USA Stone Crushing Equipment Market is estimated to be valued at USD 2.7 billion in 2025 and is anticipated to reach a valuation of USD 5.9 billion by 2035. Sales are projected to rise at a CAGR of 8.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 388.4 million and USD 219.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.3 Billion |

| Product | Jaw Crusher, Cone Crusher, and Impact Crusher |

| Application | Mining, Quarrying, Recycling, Building & Construction, and Others (Agriculture, Rail) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Astec Industries, Eagle Crusher Company Inc., Weir Group, Metso Corporation, SANDVIK AB, IROCK Crusher, Telsmith Inc., Thyssenkrupp AG, Mormak Equipment Inc., and Komatsu Ltd. |

The global stone crushing equipment market is estimated to be valued at USD 7.3 billion in 2025.

The market size for the stone crushing equipment market is projected to reach USD 18.6 billion by 2035.

The stone crushing equipment market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in stone crushing equipment market are jaw crusher, cone crusher and impact crusher.

In terms of application, mining segment to command 29.7% share in the stone crushing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stone Paper Market Size and Share Forecast Outlook 2025 to 2035

Stone Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Examining Stone Paper Market Share & Industry Trends

Destoner Machine Market Trend Analysis Based on Product Type, End-Use, Automation, and Region 2025 to 2035

Gemstone Market Size and Share Forecast Outlook 2025 to 2035

Gemstone Cosmetic Powder Market Analysis - Trends, Growth & Forecast 2025 to 2035

Kidney Stone Extraction Balloon Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Colored Gemstones Industry

Pancreatic Stone Protein Testing Market Growth - Trends & Forecast 2024 to 2034

Coloured Gemstone Market Analysis - Size, Share, and Forecast 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

Balloon Catheters for Bile Stone Removal Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA