The outbound travel industry in the United Kingdom is expanding steadily due to rising disposable incomes, greater travel accessibility, and a strong cultural inclination toward international experiences. The current scenario reflects robust recovery following pandemic disruptions, supported by increased flight connectivity, flexible booking policies, and evolving traveler preferences toward personalized travel experiences.

Demand is being further stimulated by social media influence, digital engagement, and loyalty-driven programs that enhance traveler retention. The future outlook remains optimistic, driven by consistent economic stability, expanded visa facilitation, and technological adoption in travel management platforms.

Market growth is expected to be reinforced by value-based tourism, growing interest in short-haul destinations, and the increasing popularity of experiential travel The growth rationale is centered on the industry’s ability to deliver tailored travel solutions, enhance booking convenience, and leverage digital innovation to meet diverse traveler expectations, thereby ensuring sustained expansion and strong contribution to the broader tourism economy in the years ahead.

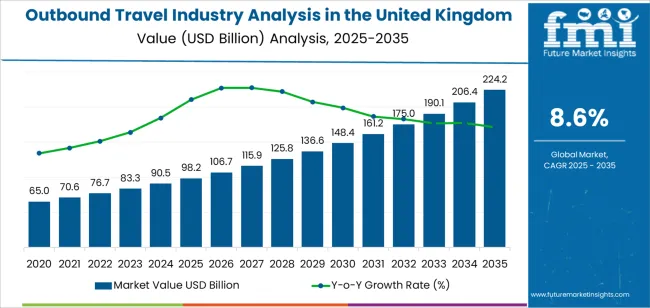

| Metric | Value |

|---|---|

| Outbound Travel Industry Analysis in the United Kingdom Estimated Value in (2025 E) | USD 98.2 billion |

| Outbound Travel Industry Analysis in the United Kingdom Forecast Value in (2035 F) | USD 224.2 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

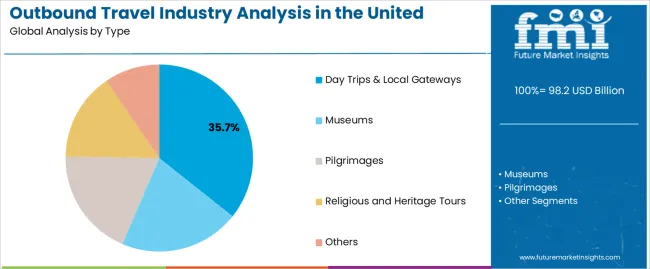

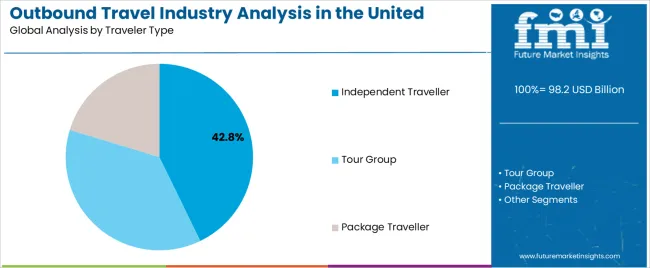

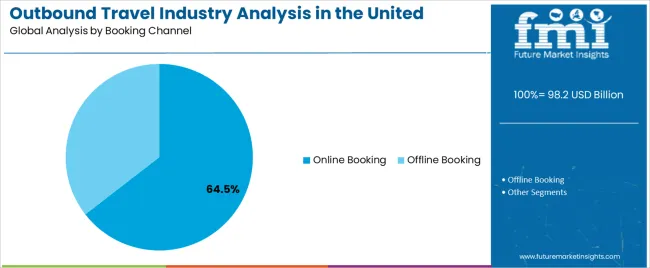

The market is segmented by Type, Traveler Type, Booking Channel, and Age Group and region. By Type, the market is divided into Day Trips & Local Gateways, Museums, Pilgrimages, Religious and Heritage Tours, and Others. In terms of Traveler Type, the market is classified into Independent Traveller, Tour Group, and Package Traveller. Based on Booking Channel, the market is segmented into Online Booking and Offline Booking. By Age Group, the market is divided into 21 to 40 Years, 0 to 20 Years, 41 to 60 Years, and 60 Above. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The day trips and local gateways segment, accounting for 35.70% of the type category, has been leading the market due to its affordability, time efficiency, and adaptability to spontaneous travel behavior. Its prominence is being reinforced by urban professionals and families seeking short-term leisure experiences without extensive planning. Increasing domestic mobility and improved local infrastructure have facilitated access to nearby destinations, strengthening this segment’s appeal.

The rise of flexible work arrangements and weekend travel trends has further contributed to consistent demand. Service providers are focusing on curated local experiences and bundled packages to maximize value perception among travelers.

Enhanced marketing through digital channels and social media visibility has helped drive awareness and conversion rates Going forward, continued emphasis on convenience, cost-effectiveness, and environmental sustainability is expected to sustain this segment’s leadership in the UK outbound travel landscape.

The independent traveller segment, representing 42.80% of the traveler type category, has maintained dominance as modern consumers increasingly prefer autonomy, flexibility, and personalization in their travel experiences. This segment’s growth has been fueled by digital transformation in travel planning and the availability of self-service tools that empower travelers to design customized itineraries.

The shift from traditional group tours toward solo and small-group exploration reflects changing lifestyle priorities, where authenticity and freedom of choice are valued. Cost transparency, combined with access to peer reviews and online resources, has improved decision-making confidence.

Service providers are responding by offering modular travel products and mobile-friendly platforms that align with this trend As technology continues to redefine booking behavior and destination research, the independent traveller segment is expected to sustain its strong position, driving continued innovation in the UK outbound travel ecosystem.

The online booking segment, holding 64.50% of the booking channel category, has emerged as the leading mode of reservation due to widespread digitalization, enhanced user interfaces, and real-time comparison capabilities. Consumers are increasingly adopting online platforms for their convenience, speed, and transparent pricing models.

The segment’s expansion has been accelerated by the growth of mobile applications, digital payment systems, and integrated customer service solutions. Travel aggregators, airlines, and hotel chains are optimizing their digital ecosystems to strengthen user engagement and conversion.

The integration of artificial intelligence, chat-based assistance, and personalized offers is improving the overall booking experience As travel confidence continues to rise, the dominance of online booking channels is expected to deepen, reinforcing their central role in shaping the UK’s outbound travel market by offering seamless connectivity between travelers and service providers.

Work vacations for the Nomadic Workforce

The increase in remote work culture in the United Kingdom has boosted the workcation trend, where professionals mix both working and traveling. Travel companies can target this section by providing co-working spaces, reliable Wi-Fi connectivity, and extended stay packages in attractive destinations. Therefore, these professionals can combine work and tourism.

Luxury Travel Evolution

Luxury travel is moving on from traditional luxury to more authentic experiences throughout the United Kingdom. These include private tours with local guides, access to exclusive cultural events, or bespoke itineraries that uncover hidden gems. To meet this demand, travel companies can provide personalized itineraries that mirror the unique interests and tastes of luxury tourists.

Festival Tourism Takes Flight

Music festivals, food fairs, and cultural fetes have become popular tourist highlights. Hence, British travelers are incorporating these events into their sojourns, thus fueling travel needs for festival-oriented packages and logistics around main occasions. They may also collaborate with festival organizers to offer all-inclusive deals, including ticketing, transport, or lodging services.

Wellness and Spa Retreats

Individuals in the United Kingdom are looking after their health, visiting places with famous Spas, wellness resorts, and natural healing therapies. Yoga, meditation, spa treatments, and healthy food are included in a travel package. The traveler can unwind and rejuvenate while trying to focus on his or her physical as well as mental well-being.

Culinary Experiences

Food tours, cooking classes, and local market visits have gained immense popularity among travelers over the past few years. These include dining experiences like eating at local establishments, learning how to cook from top chefs, and tasting traditional meals and ingredients.

The section offers an analysis of the dominant segments influencing the demand outlook for outbound travel in the United Kingdom. Notably, the day trips and local gateways segment takes the lead with a 44.70% share in 2025. Following this, the online booking channel is estimated to secure a share of 29.60% in 2025.

| Dominant Segment by Type | Day Trips & Local Gateways |

|---|---|

| Share held by the Segment in 2025 | 44.70% |

Day trips and local getaways are likely to take 44.70% of the industry in 2025.

| Dominant Segment by Booking Channel | Online Booking |

|---|---|

| Share held by the Segment in 2025 | 29.60% |

Online booking platforms are likely to have 29.60% of the industry in 2025.

The outbound travel industry in the United Kingdom is a vibrant one, with many established players and new entrants competing against each other. Traditional travel agencies still have a strong presence, especially when it comes to complex itineraries or luxurious holidays.

They use their knowledge and relationships with customers to offer bespoke services and expert advice. Nevertheless, they are expected to embrace the online world and provide competitive rates as well.

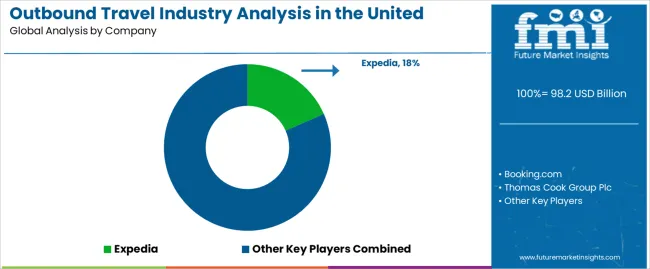

Online travel agents (OTAs), such as Expedia and Booking.com, have emerged as key forces grabbing an increasing percentage of the industry. Their user-friendly portals, combined with a wide range of choices, including flights, hotels, and attractions, make them appealing to budget-conscious travelers who prefer convenience.

Specialized travel companies catering to specific interests like adventure travel, eco-tourism, or cultural immersion trips are gaining traction. These companies cater to a growing segment of travelers seeking unique and authentic experiences. Additionally, travel bloggers and social media influencers are emerging as powerful voices, influencing travel trends and potentially disrupting traditional marketing strategies.

Recent Developments Observed in the United Kingdom Outbound Travel Business

5 Strategies for United Kingdom’s Outbound Travel Companies to Thrive

Embrace Digital Shift

Online portals are becoming increasingly popular among customers making travel bookings. Businesses need websites that are easy to navigate and mobile apps that offer seamless booking experiences at competitive rates. Moreover, AI-powered chatbots for customer support and personalized recommendations can improve the digital experience even more.

Tailor Experiences, Cater to Niches

The introduction of new niche travel segments creates opportunities for companies. Firms can specialize in adventure tours, eco-tourism outings, and cultural immersion trips or target certain demographics, such as families, singles, or digital nomads. Creating unique local experiences with curated itineraries and partnerships with niche providers is likely to cultivate customer loyalty.

Become a Content Hub, Build Trust

Before booking, travelers often look for inspiration and information. This can be achieved by producing engaging online content - blogs, social media posts, travel guides - about destinations, local attractions, and cultural differences. Moreover, making practices involved in sustainable tourism more visible may draw more conscious tourists into the fold.

Offer Flexibility and Value

Flexible travel options reign dominance. Offering customizable itineraries, last-minute deals, and cancellation policies that cater to changing plans can attract a wider audience. Consider incorporating travel insurance and activity bookings within your packages for additional value and convenience.

Prioritize Customer Experience

Building strong customer relationships is key to success. Personalized service goes beyond just booking. Offer pre-departure support, in-destination assistance, and post-trip follow-ups to ensure a seamless travel experience. Leveraging technology like chatbots and live chat support can enhance responsiveness and address customer concerns efficiently. By focusing on building trust and exceeding expectations, companies can cultivate loyal customers who will return for future trips.

The global outbound travel industry analysis in the united kingdom is estimated to be valued at USD 98.2 billion in 2025.

The market size for the outbound travel industry analysis in the united kingdom is projected to reach USD 224.2 billion by 2035.

The outbound travel industry analysis in the united kingdom is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in outbound travel industry analysis in the united kingdom are day trips & local gateways, museums, pilgrimages, religious and heritage tours and others.

In terms of traveler type, independent traveller segment to command 42.8% share in the outbound travel industry analysis in the united kingdom in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outbound Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

Outbound Logistics Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

USA Outbound Travel Market Growth – Trends, Demand & Forecast 2025 to 2035

Japan Outbound Tourism Market Analysis – Growth & Forecast 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

China Outbound Meetings, Incentives, Conferences, Exhibitions (MICE) Tourism to Europe Market Size and Share Forecast Outlook 2025 to 2035

China Outbound MICE Tourism to US Market 2025 to 2035

China Outbound Travel Market Report – Trends, Size & Forecast 2025-2035

Russia Outbound Tourism Market Trends - Growth & Forecast 2025 to 2035

France Outbound Travel Market Analysis – Trends, Growth & Forecast 2025-2035

Germany Outbound Travel Market Report – Size, Trends & Innovations 2025-2035

Hong Kong Outbound Tourism Market Analysis - Growth & Forecast 2025 to 2035

North America Outbound Medical Tourism Services Market – Growth & Forecast 2022-2032

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in GCC Countries Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in France Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in China Market Forecast and Outlook 2025 to 2035

United States Outbound Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA