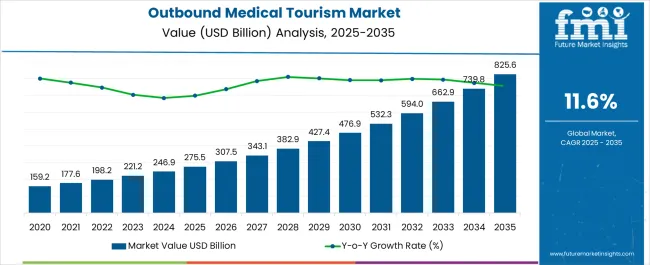

The Outbound Medical Tourism Market is estimated to be valued at USD 275.5 billion in 2025 and is projected to reach USD 825.6 billion by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period.

| Metric | Value |

|---|---|

| Outbound Medical Tourism Market Estimated Value in (2025 E) | USD 275.5 billion |

| Outbound Medical Tourism Market Forecast Value in (2035 F) | USD 825.6 billion |

| Forecast CAGR (2025 to 2035) | 11.6% |

The outbound medical tourism market is experiencing robust expansion fueled by rising healthcare costs in developed economies, increasing awareness of affordable treatment options abroad, and improved connectivity through international travel. Patients are increasingly opting for overseas treatment to access advanced procedures at competitive prices, often combined with shorter waiting times.

Growth is also being supported by improvements in healthcare infrastructure across emerging destinations, accreditation of hospitals to international standards, and enhanced transparency in pricing and care quality. The integration of travel services with medical packages has further simplified the patient journey, making overseas treatment more accessible.

The future outlook remains positive as countries continue to position themselves as hubs for specialized treatments and wellness care, aligning healthcare services with tourism and hospitality to deliver holistic experiences.

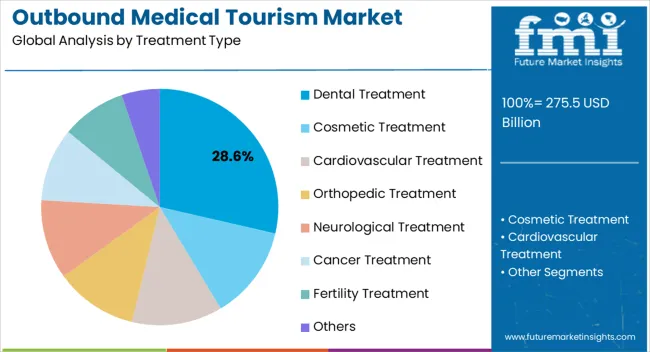

The dental treatment segment is projected to contribute 28.60% of total revenue by 2025 within the treatment type category, positioning it as a significant growth driver. Rising demand for cosmetic dentistry, orthodontic procedures, and restorative treatments has made this category attractive to international patients.

Lower costs compared to developed markets, coupled with availability of advanced dental technologies abroad, are supporting this demand. Additionally, shorter treatment cycles and high success rates are prompting patients to travel overseas specifically for dental care.

The appeal of combining dental procedures with tourism experiences has further reinforced the segment’s prominence in outbound medical tourism.

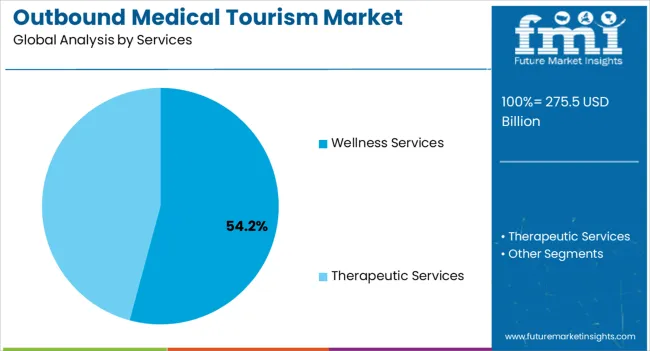

The wellness services segment is expected to account for 54.20% of overall revenue by 2025, making it the dominant services category. Growing consumer focus on preventive healthcare, stress management, and holistic wellbeing has significantly driven this segment.

Wellness retreats that integrate medical screening with spa therapies, yoga, and traditional medicine practices have gained popularity among outbound travelers. Enhanced marketing of wellness destinations and inclusion of these services in medical tourism packages have further expanded reach.

This convergence of healthcare and lifestyle services is positioning wellness services as a cornerstone of outbound medical tourism growth.

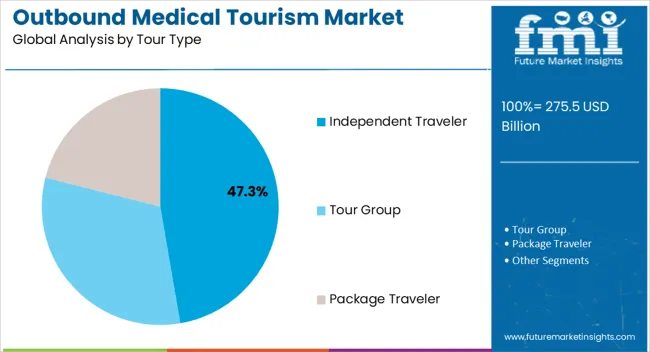

The independent traveler segment is estimated to hold 47.30% of total market share by 2025, making it the leading tour type. This dominance is linked to the growing preference for personalized travel experiences, flexible scheduling, and greater autonomy in healthcare decisions.

Patients are increasingly arranging medical procedures directly with overseas hospitals while managing travel and accommodation independently. Availability of online platforms, transparent pricing, and access to hospital accreditations have empowered travelers to make informed decisions without relying on intermediaries.

This independence not only reduces costs but also enhances trust and confidence, making independent travel the preferred choice in outbound medical tourism.

From 2020 to 2025, the market for outbound medical tourism registered a significant incline, at a CAGR of 10.5%. The outbound medical tourism market is further forecast to grow healthily from 2025 to 2035. People increasingly prefer to avail of outbound medical services amid rising healthcare costs within their home countries. A significant proportion of medical tourists travel to countries such as China and India, as treatment costs are significantly lower compared to both North America and Europe.

The escalating demand for affordable yet superior healthcare services has propelled the medical tourism industry to new heights. This transformation is driven by various factors that have collectively reshaped the healthcare landscape. Notably, the increasing accessibility of information and resources about medical tourism has empowered individuals to make informed choices about their medical needs. Consumers are now more knowledgeable and discerning, actively seeking out the advantages offered by medical tourism.

The growing awareness has led to the emergence of new niche markets. These markets cater to specific medical requirements. They provide targeted solutions. They are designed for individuals seeking specialized treatments and procedures. The convergence of technology and healthcare has transformed the landscape. It has made high-quality medical services more accessible and convenient. Patients worldwide are anticipated to benefit from these advancements.

Given the increased demand for disbursing good quality healthcare at reduced costs, countries globally are revamping existing healthcare infrastructure, incorporating key innovations and technological advancements. Moreover, patients seek overseas medical treatment in lieu of inadequate or limited health insurance coverage.

In addition, outbound medical tourism is also widely dependent on the availability of certain treatments in home countries. Recent years have experienced a major upswing in outbound medical tourism concerned with treatment related to weight loss, cosmetic surgery, dental surgery, cardiovascular treatment, fertility treatment, cancer treatment, and orthopedic treatments. Among these categories, cosmetic surgery, fertility treatments, and dental care are the most sought-after outbound medical tourism drivers.

Medical tourism has evolved beyond medical treatments. It now includes wellness and tourism offerings. Patients can undergo treatments and enjoy a vacation. They can also participate in wellness retreats. This integration provides a holistic experience. Medical tourism encompasses both healthcare and leisure activities.

Several insurance providers offer coverage for medical tourism. Patients now have easier access to it at lower costs. The availability of insurance coverage removes financial barriers. It expands the pool of potential medical tourists. More individuals can now consider medical tourism as a viable option.

The emergence of online medical tourism platforms has significantly simplified the process for patients seeking treatment abroad. These platforms serve as invaluable resources, offering diverse services such as medical consultations, travel arrangements, and insurance options. Patients can now confidently navigate their healthcare journey, armed with comprehensive information and convenient tools provided by these platforms.

Increasing ‘Travel with Purpose’ Frequency to majorly push Outbound Medical Tourism Popularity

The travel and tourism market is prospering, and travelers prefer the ‘travel with purpose’ concept. This concept is prominent among developed regions whereas many untapped regions are emerging as an opportunity for outbound medical tourism.

Factors that have led to the increasing popularity of medical travel include the high cost of health care, long wait times for certain procedures, the ease and affordability of international travel, and improvements in both technology and standards of care in many countries. The avoidance of waiting times is the leading factor for medical tourism from the United Kingdom, whereas, in the United States, the main reason is cheaper prices abroad.

Many surgical procedures performed in medical tourism destinations cost a fraction of the price they do in other countries. For example, in the United States, a liver transplant that may cost USD 300,000, would generally cost about USD 91,000 in Taiwan. A large draw to medical travel is convenience and speed.

Countries that operate public healthcare systems often have long wait times for certain operations, for example, an estimated 782,936 Canadian patients spent an average waiting time of 9.4 weeks on medical waiting lists in 2005. Based on these trends, the market for outbound medical tourism is likely to take a turn for the better in forthcoming years.

The demand for outbound medical tourism is restricted due to factors such as unclear information regarding the treatment centers, safety issues of tourists, and the tours being expensive. The other factors leading to sluggish growth are the expenses involved in the treatments. Nonetheless, the demand is increasing exponentially and reliability is estimated to offer opportunities for growth in the future as well.

The key factor includes economic factors as some of the treatments are expensive and demand tremendous reliability. Broadly, medical issues, financial issues, administrative or practical issues, and hesitation from traveling hinder the outbound medical tourism industry to a significant extent.

Individuals in the United States Embrace Medical Tourism for Affordable Healthcare

The United States outbound medical tourism market is growing significantly. This growth is attributed to the substantial difference in treatment costs between the United States and countries like India and Mexico. A 2014 study published in the International Medical Tourism Journal highlighted this price difference. According to the study, treatment expenses in the United States are 85% higher compared to these countries. For instance, knee replacement procedures in the United States can cost between USD 35,000 and USD 60,000. In contrast, the same procedures are available for less than USD 20,000 in Costa Rica and India, including accommodation and airfare expenses. This significant price contrast is fueling the potential market growth in the United States.

| Country | United States |

|---|---|

| 2025 Value Share in Global Market | 26.1% |

The United States has leading healthcare institutions. Certain countries are renowned for specialized medical facilities and esteemed specialists. Patients choose these destinations for treatment from highly skilled professionals. This enhances their chances of successful outcomes. The government has been actively exploring regulatory changes to facilitate the integration of medical tourism into the domestic healthcare system. These changes aim to evaluate medical tourism as a potential cost-saving measure and streamline processes for medical travelers.

Citizens in the United Kingdom Opt for Medical Tourism to Access Affordable Procedures

The United Kingdom outbound medical tourism market has been experiencing robust growth in recent years. Citizens in this country are increasingly opting to seek medical treatments and procedures abroad, driven by

| Country | United Kingdom |

|---|---|

| Value CAGR (2025 to 2035) | 12.2% |

Individuals from the United Kingdom show a notable increase in interest in wellness tourism. They seek holistic treatments, spa retreats, and wellness programs abroad. The goal is to improve overall well-being and achieve a balance between healthcare and rejuvenation. Citizens opting for medical tourism have witnessed a remarkable surge in demand for cosmetic surgeries. Procedures such as breast augmentation, facelifts, rhinoplasty, dental implants, and smile makeovers are particularly sought after.

Germany's Expertise in Healthcare Draws Global Demand for Outbound Medical Tourism

Germany is renowned for its highly skilled healthcare professionals. The country boasts state-of-the-art medical facilities. Stringent quality standards are upheld in the healthcare sector. As a result, doctors and specialists in this country are sought after worldwide. Patients have confidence in the medical competence available both domestically and abroad.

| Country | Germany |

|---|---|

| 2025 Value Share in Global Market | 6.7% |

Patients in Germany traditionally went to distant countries like Thailand and India for medical treatments. However, a noticeable trend is emerging. Patients now prefer nearby European destinations. Destinations like Hungary, Poland, and the Czech Republic are becoming popular choices. The proximity of these countries and cultural similarities play a significant role. Shorter travel distances make the overall experience more convenient and comfortable for German medical tourists.

Government schemes and High-quality low-cost treatment have positively affected the medical tourism industry in India.

As per Future Market Insights, the India outbound medical tourism market is expected to grow significantly over the forecast period. One of the major factors behind this growth is that the government of India has come up with various schemes and facilities to help in boosting the medical tourism sector in the country.

The Ministry of Tourism has issued key guidelines aimed at making available quality publicity material, training and capacity building for service providers, and participation in international and domestic wellness-related events among others. In addition, it has also extended its Market Development Assistance (MDA) scheme to wellness tourism service providers, including accredited wellness centers.

| Country | India |

|---|---|

| Value CAGR (2025 to 2035) | 12% |

Besides, efforts to streamline the medical visa process by making it easily available under the e-visa section have also proven to be a major boon for Indian outbound medical tourism service providers. Providing visa-on-arrival for tourists from certain countries has also facilitated the growth of medical tourism in the country. Urban cities like Mumbai, Pune, Bangalore, Gurgaon, and Chennai are some of the major hubs for medical tourists visiting India. The availability of the latest and most advanced medical machinery and facilities in these cities also drives the number of visitors every year. The high quality of stay combined with the low cost of travel and treatments also make these hubs a very attractive option for people seeking treatments.

Majority of medical tourists in Italy originate from Arabian and Asian nations

The availability of high-quality healthcare and the ease of access make Italy's healthcare famous amongst medical tourists from developing middle-income countries. The individuals primarily seeking treatment are high-net-worth individuals from these countries. The majority of medical tourists entering Italy are from Arab states and developing Asian nations. This leads to the perfect opportunity to expand the presence of firms in these nations and generate a substantial revenue stream.

The race to attract medical tourists has already started, and the stakes are extremely lucrative. This has led the Italian government to focus on developing a policy framework to initiate the growth of the market and capture the majority market share in the market. The government has already started working on easing the visa policies and making the process hassle-free.

The government plan to open special zones for medical tourism across the country will further help in boosting the sector

The Chinese government has taken a notice of the growing trend of medical tourism that is going around the globe, where its neighboring countries like India, Thailand, and Singapore are succeeding to attract consumers from developed countries. The need to catch up to their contemporaries’ has pushed the government of China to intervene in the sector and make supportive policies to help the sector grow.

| Country | China |

|---|---|

| Value CAGR (2025 to 2035) | 13.3% |

The Hainan province on the southern coast is an island famous for its medical facilities, providing consumers with warm weather, pleasant stay, and excellent quality healthcare. The Hainan Boao Lecheng International Medical Tourism Pilot Zone is one of the most ambitious steps from the government to improve the medical tourism sector in the country. The pilot zone boasts some of the most advanced medical machinery and treatments from across the globe. Some of the facilities are exclusive to the pilot zone, and not available anywhere else in China.

Medical Tourism in Japan is a Rising Trend Revolutionizing Healthcare Choices

The Japan outbound medical tourism market is experiencing robust growth. In Japan, healthcare is universally accessible and provided at no cost to Japanese citizens, expatriates, and foreigners. The country operates under a comprehensive universal healthcare system that extends coverage to all residents, including non-Japanese individuals staying in Japan for over a year.

| Country | Japan |

|---|---|

| 2025 Value Share in Global Market | 4.4% |

With Japan's aging population and high healthcare costs, many individuals are exploring more affordable treatment options abroad. Patients often discover significant cost savings. Countries with competitive healthcare systems are particularly attractive. Medical tourism has become an appealing alternative.

| Segment | 2025 Value Share in Global Market |

|---|---|

| Independent Traveler | 41.6% |

| 45 to 54 Years | 38.9% |

Independent travelers are the prominent tour type category, mainly due to the emergence of technology

Traveling and availing of accommodations has become a hassle-free experience due to the emergence of technology and transparent visa procedures. The government of numerous countries has made it easier for tourists to avail visas for medical reasons on a priority basis. This has led to tourists traveling to these countries independently for medical reasons. This makes independent travelers the major Tour Type category.

Medical treatments can be costly in many countries, particularly for complex procedures. Independent travelers often choose medical tourism to access high-quality healthcare services at more affordable prices. By directly engaging with hospitals or facilitators, they can negotiate prices. They have the potential to save a significant amount compared to receiving the same treatment in their home country.

The age group between 45-54 is most likely to visit other countries for medical treatments

Orthopedic issues are mostly common and start occurring among patients aged between 45-54. This leads to a prominent number of people seeking surgeries for these issues. The UK has some of the best orthopedic surgeons, which leads to people traveling for orthopedic surgeries. This translates to the age group between 45-54 being the major group visiting foreign countries for medical tourism.

As people enter middle age, they tend to become more conscious of their health and well-being. This age group may actively seek out medical treatments and procedures. They seek these treatments to address existing health concerns and prevent future health issues.

People in the 45 to 54 age range are more prone to health issues and chronic conditions. These health issues and conditions often require specialized medical treatments. They choose medical tourism to access high-quality healthcare services. Medical tourism can provide these services at lower costs compared to their home countries. Medical tourism can also be sought for treatments that are not available or are expensive locally.

Wide variety of options and the hassle-free experience of booking make an online booking the preferred channel

Online booking is the most popular booking channel among medical tourists visiting the countries. This is due to the convenience offered by these booking channels. The consumer can choose from a wide variety of options for accommodations ranging from hotels, hostels, and lodges. Booking consultant appointment is also easier through online mode. Medical tourists can reach out to world-class surgeons through online channels of health concierges and book an appointment before their visit.

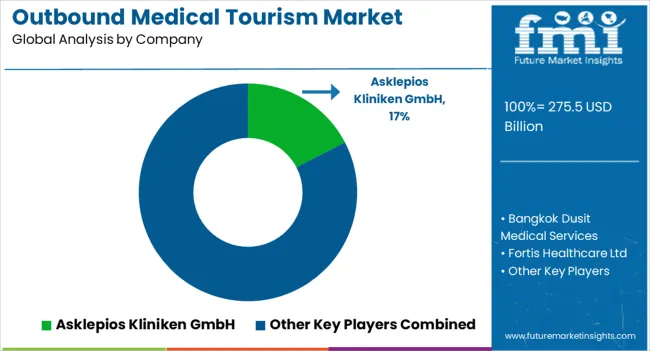

Key firms in the market are looking to provide consumers with customized solutions for their travels. The trend of personalized healthcare will further help the leading firms in keeping a competitive edge. The various key firms are Asklepios Kliniken GmbH, Bangkok Dusit Medical Services, Fortis Healthcare Ltd., Apollo Hospitals, Bumrungrand International Hospitals, Christus Muguerza S.A.P.I De CV, Prince Court Medical Center, Clemenceau Medical Center, Asian Heart Institute, Gleneagles Hospital, and others.

For instance:

Key Market Players

The global outbound medical tourism market is estimated to be valued at USD 275.5 billion in 2025.

The market size for the outbound medical tourism market is projected to reach USD 825.6 billion by 2035.

The outbound medical tourism market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in outbound medical tourism market are dental treatment, cosmetic treatment, cardiovascular treatment, orthopedic treatment, neurological treatment, cancer treatment, fertility treatment and others.

In terms of services, wellness services segment to command 54.2% share in the outbound medical tourism market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

North America Outbound Medical Tourism Services Market – Growth & Forecast 2022-2032

Medical Tourism Market Analysis by Treatment Type, by Age Group, by Tourist Type, by Service Provider, Traveler Type, by Demography, by Booking, and by Region – Forecast for 2025-2035

Competitive Overview of Medical Tourism Companies

UK Medical Tourism Market Trends – Demand, Growth & Forecast 2025-2035

USA Medical Tourism Market Analysis – Size, Share & Forecast 2025-2035

Italy Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

China Medical Tourism Industry Analysis from 2025 to 2035

India Medical Tourism Industry Analysis from 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Outbound Tourism Market Analysis – Growth & Forecast 2025 to 2035

France Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

Turkey Medical Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Russia Outbound Tourism Market Trends - Growth & Forecast 2025 to 2035

Germany Medical Tourism Market Insights – Size, Trends & Forecast 2025-2035

Inbound Medical Tourism Market is segmented by Treatment Type, Service Type, Customer Orientation, Age Group, and Booking Channel from 2025 to 2035

China Outbound MICE Tourism to US Market 2025 to 2035

Hong Kong Outbound Tourism Market Analysis - Growth & Forecast 2025 to 2035

Demand for Medical Tourism in Japan Size and Share Forecast Outlook 2025 to 2035

GCC Medical Tourism Market Trends – Growth & Forecast through 2034

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA