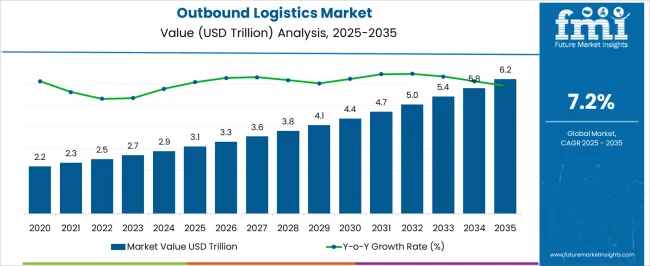

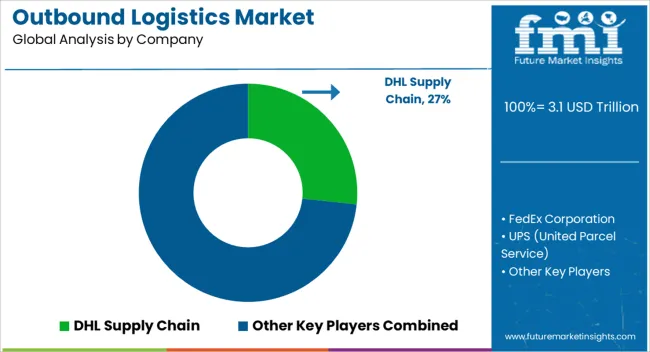

The outbound logistics market is expected to grow from USD 3.1 trillion in 2025 to USD 6.2 trillion by 2035, registering a 7.2% CAGR and generating an absolute dollar opportunity of USD 3.1 trillion. Growth is driven by increasing global trade, e-commerce expansion, and rising demand for efficient transportation and delivery solutions. Advances in warehouse automation, route optimization software, and real-time tracking systems support adoption by logistics providers, freight forwarders, and retailers, enabling cost reduction and faster delivery times across multiple regions.

Rolling CAGR analysis highlights variations in year-over-year growth momentum over the forecast period. From 2025 to 2028, rolling CAGR remains slightly below the long-term average, reflecting steady adoption in mature regions such as North America and Europe, where logistics networks are already well established and growth is driven mainly by efficiency upgrades. Between 2029 and 2032, rolling CAGR accelerates above the average, as Asia Pacific, Latin America, and the Middle East expand trade, industrial output, and e-commerce penetration, driving higher demand for outbound logistics services.

From 2033 to 2035, rolling CAGR moderates as early-adopting regions reach higher network utilization, with incremental revenue increasingly derived from technology upgrades, fleet modernization, and process optimization. Overall, the USD 3.1 trillion opportunity demonstrates a consistent expansion trajectory, with rolling CAGR reflecting early steady growth, mid-period acceleration, and late-stage stabilization across the global outbound logistics market between 2025 and 2035.

| Metric | Value |

|---|---|

| Outbound Logistics Market Estimated Value in (2025 E) | USD 3.1 trillion |

| Outbound Logistics Market Forecast Value in (2035 F) | USD 6.2 trillion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The outbound logistics market is primarily driven by the e-commerce and retail sector, which accounts for around 43% of the market share, as businesses increasingly rely on efficient warehousing, order fulfillment, and last-mile delivery services. The manufacturing sector contributes about 27%, deploying outbound logistics solutions to distribute finished goods across domestic and international markets. The food and beverage industry represents close to 15%, using temperature-controlled transportation and specialized packaging to ensure product quality and safety.

The automotive and spare parts segment accounts for roughly 10%, managing timely delivery of components and finished vehicles. The remaining 5% comes from pharmaceuticals, healthcare, and electronics, which require high-precision, traceable, and reliable logistics solutions for critical goods. The market is evolving with innovations in digital tracking, automation, and sustainable delivery solutions. IoT-enabled sensors and GPS systems provide real-time visibility and route optimization for improved efficiency. Automated sorting, robotics, and warehouse management systems are reducing manual handling and delivery errors. Electric and low-emission vehicles are gaining adoption for last-mile delivery to reduce environmental impact.

Manufacturers and third-party logistics providers are focusing on integrated platforms to streamline operations and enhance supply chain transparency. Growing e-commerce penetration, global trade expansion, and demand for faster, reliable deliveries continue to drive market growth worldwide.

The outbound logistics market is experiencing steady growth due to the increasing complexity of global supply chains, rising e-commerce volumes, and a renewed focus on delivery speed and accuracy. Businesses are investing in streamlined outbound operations to ensure efficient movement of finished goods from manufacturing units to end consumers.

Technological advancements in route optimization, fleet management, and inventory visibility are improving operational performance across distribution networks. Additionally, demand for integrated logistics solutions is driving partnerships between logistics service providers and large enterprises to reduce transit time and cost.

The growing importance of customer experience and last mile delivery excellence is also accelerating investments in advanced outbound logistics infrastructure. The future outlook remains strong as industries prioritize resilience, responsiveness, and scalability in their outbound logistics strategies to support omnichannel operations and dynamic market demand.

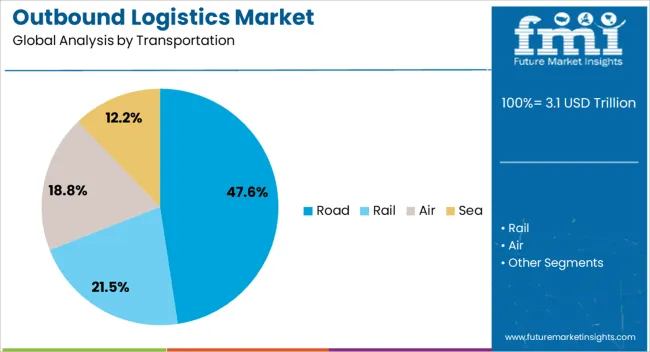

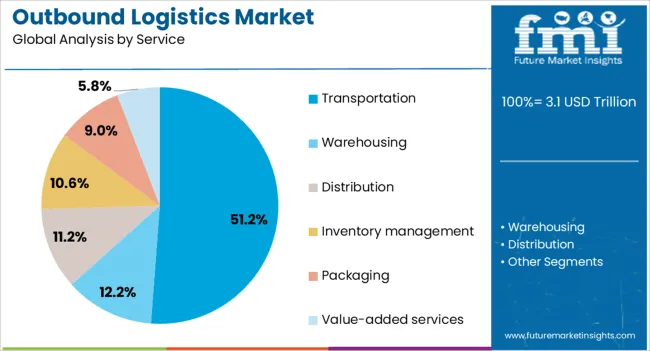

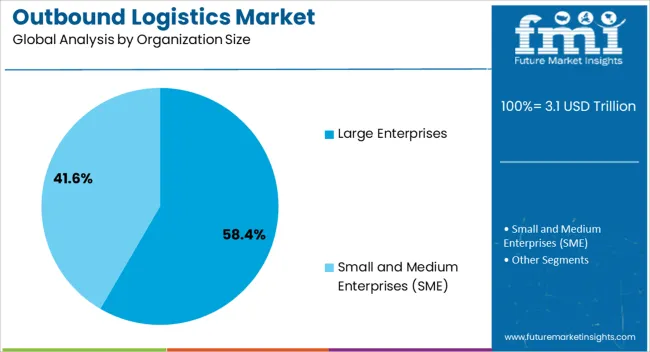

The outbound logistics market is segmented by transportation, service, organization size, industry vertical, and geographic regions. By transportation, outbound logistics market is divided into Road, Rail, Air, and Sea. In terms of service, outbound logistics market is classified into Transportation, Warehousing, Distribution, Inventory management, Packaging, and Value-added services. Based on organization size, outbound logistics market is segmented into Large Enterprises and Small and Medium Enterprises (SME). By industry vertical, outbound logistics market is segmented into Retail, Manufacturing, Healthcare and pharmaceuticals, Automotive, Consumer goods, Food and beverage, Technology and electronics, Aerospace and defense, and Others. Regionally, the outbound logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The road transportation segment is projected to hold 47.60% of the market by 2025, positioning it as the leading mode within the transportation category. This preference is due to its flexibility, accessibility, and cost efficiency across both urban and rural routes.

Road transport supports diverse cargo sizes and facilitates door to door delivery, making it essential for retail, automotive, and FMCG industries. Ongoing investments in highway infrastructure, fleet modernization, and real time tracking systems are further enhancing service quality.

Additionally, its ability to adapt to varying delivery schedules and geographic coverage makes road transport a reliable and scalable choice, especially for last mile operations. These factors have contributed to its continued dominance in outbound logistics.

The transportation segment under the service category accounts for 51.20% of total market revenue in 2025, emerging as the most prominent service type. Its leadership stems from the critical need for efficient product movement across supply chains, particularly in fast moving and time sensitive industries.

Businesses rely heavily on outsourced or in house transportation solutions to manage inventory turnover and meet customer delivery expectations. Enhanced tracking capabilities, compliance with safety regulations, and investment in environmentally responsible transport methods are strengthening its value proposition.

As demand for just in time delivery and streamlined logistics rises, the transportation service segment continues to lead in driving outbound logistics performance.

The large enterprises segment is expected to represent 58.40% of market revenue by 2025 under the organization size category, making it the dominant contributor. This is attributed to their extensive distribution requirements, high shipment volumes, and capacity to invest in sophisticated logistics infrastructure.

Large enterprises often manage expansive outbound networks across multiple regions, requiring integrated systems for coordination, tracking, and delivery optimization. Their focus on cost control, service level enhancement, and strategic partnerships with logistics providers further supports their leadership in this segment.

As these organizations scale operations and expand their product lines, outbound logistics remains a vital component of their overall supply chain strategy, ensuring continued dominance by large enterprises.

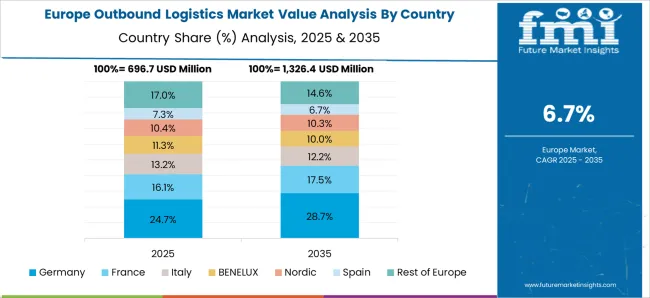

The outbound logistics market is expanding due to rising e-commerce activity, globalization of supply chains, and demand for faster delivery. Asia Pacific leads with USD 85 billion in 2024, driven by China (USD 40 billion), India (USD 25 billion), and Japan (USD 20 billion). Europe accounts for USD 70 billion, with Germany (USD 25 billion), France (USD 20 billion), and UK (USD 25 billion). North America holds USD 65 billion, primarily the USA, while Latin America and Middle East & Africa together represent USD 25 billion. Key services include transportation (50%), warehousing (30%), and last-mile delivery (20%).

Growth is fueled by the expansion of e-commerce, increasing international trade, and demand for faster supply chain operations. Transportation accounts for 50% of expenditures, warehousing 30%, and last-mile delivery 20%. Asia Pacific leads at USD 85 billion, Europe USD 70 billion, and North America USD 65 billion. Over 2 billion packages were shipped globally in 2024, with China handling 1 billion shipments. Investment in cold chain logistics is growing by USD 4–5 billion annually to support pharmaceuticals and perishable goods. Automation and digital tracking technologies reduce delivery delays by 15–20% and improve operational efficiency.

Key trends include warehouse automation, AI-enabled route optimization, and IoT-based tracking. Approximately 30% of warehouses deploy automated picking and sorting systems, increasing throughput by 25–30%. AI-driven route optimization is used in 40% of last-mile delivery fleets, reducing fuel consumption by 10–15%. IoT sensors and GPS integration in 50% of freight vehicles improve shipment visibility and reduce loss or damage rates by 20%. Autonomous delivery vehicles and drones are being trialed in select urban areas, representing 5–10% of new deployment projects. Asia Pacific and Europe are leading regions for advanced logistics technology adoption.

Significant opportunities exist in e-commerce fulfillment, industrial goods distribution, and temperature-sensitive supply chains. Transportation accounts for 50% of adoption, warehousing 30%, and last-mile delivery 20%. Asia Pacific is projected to reach USD 105 billion by 2027, Europe USD 85 billion, and North America USD 78 billion. Expanding online retail in China, India, and Southeast Asia drives demand for high-capacity logistics solutions. Growth in pharmaceuticals, perishable foods, and temperature-sensitive chemicals boosts demand for cold chain solutions worth over USD 12 billion annually. Partnerships with third-party logistics providers improve efficiency and reduce operational costs by USD 2–4 billion globally.

High transportation costs, regulatory hurdles, and labor shortages limit growth. Freight and delivery expenses range from USD 500–2,000 per ton depending on distance and mode. Cross-border shipments require compliance with customs regulations, adding USD 200–500 per shipment in paperwork and delays. Labor shortages in warehousing and delivery increase operational costs by 10–15%. Fuel price volatility affects 40% of logistics providers, adding USD 3–5 million annually to large fleets. Infrastructure constraints in emerging markets can delay delivery by 2–5 days. Environmental regulations and emission compliance further increase costs for vehicle fleets and warehousing operations.

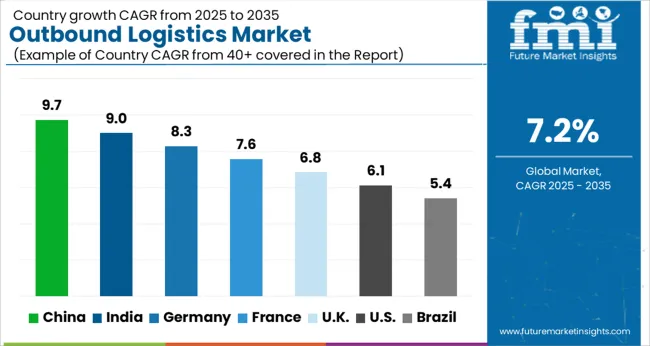

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The outbound logistics market is projected to grow at a global CAGR of 7.2% through 2035, driven by e-commerce expansion, supply chain optimization, and demand for efficient freight management solutions. China leads at 9.7%, a 1.35× multiple over the global benchmark, supported by BRICS-driven industrial output, logistics infrastructure expansion, and growing export volumes. India follows at 9.0%, a 1.25× multiple of the global rate, reflecting rising manufacturing output, warehouse modernization, and freight optimization initiatives. Germany records 8.3%, a 1.15× multiple of the benchmark, shaped by OECD-backed innovation in supply chain technology, automated logistics, and high-efficiency freight operations. The United Kingdom posts 6.8%, slightly below the global average at 0.94×, with adoption concentrated in e-commerce fulfillment, warehousing, and commercial transport. The United States stands at 6.1%, 0.85× the benchmark, with steady uptake in freight management, industrial logistics, and last-mile delivery solutions. BRICS economies drive most of the market volume, OECD countries emphasize technology-driven efficiency and precision, while ASEAN nations contribute through expanding industrial and trade logistics networks.

The outbound logistics market in China is projected to grow at a CAGR of 9.7%, supported by rapid expansion of e-commerce, rising industrial exports, and adoption of automated and digital logistics solutions. Leading providers such as SF Express, JD Logistics, and Cainiao focus on optimizing warehouse operations, last-mile delivery, and fleet management. Technological developments emphasize real-time shipment tracking, predictive routing, and energy-efficient transportation. Growth is particularly evident in sectors such as e-commerce, industrial manufacturing, and retail distribution networks, where timely delivery and operational efficiency are critical. The market benefits from strong government initiatives promoting digital logistics infrastructure and smart supply chain integration, enabling faster adoption of advanced technologies.

India’s outbound logistics market is expected to grow at a CAGR of 9.0%, driven by increasing industrial production, expanding e-commerce penetration, and upgrades to road, rail, and port infrastructure. Providers such as Blue Dart, Delhivery, and Gati leverage warehouse automation, real-time shipment tracking, and fleet optimization solutions to improve efficiency and reduce operational costs. The market is witnessing strong adoption across industrial goods, retail, and e-commerce sectors. Technological enhancements focus on route optimization, predictive analytics, and integration with supply chain management systems. Government initiatives supporting digital logistics platforms and smart transportation networks further boost growth, enabling faster, more reliable deliveries across urban and semi-urban areas.

Germany’s outbound logistics market is projected to grow at a CAGR of 8.3%, influenced by high-value industrial exports, automotive distribution, and increasing adoption of advanced logistics technology. Providers including DHL, DB Schenker, and Kuehne + Nagel focus on warehouse automation, fleet optimization, and digital shipment tracking to meet efficiency and sustainability requirements. The market is driven by demand from automotive manufacturing, industrial production, and e-commerce fulfillment, where reliability and timely delivery are key. Technological developments emphasize energy-efficient transportation, automated sorting, and real-time monitoring. Regulatory frameworks supporting digital logistics and industrial compliance further contribute to the growth of efficient and traceable supply chains.

The outbound logistics market in the United Kingdom is expected to grow at a CAGR of 6.8%, driven by e-commerce growth, industrial distribution, and technological integration in supply chains. Providers emphasize warehouse automation, fleet management, and advanced shipment tracking systems. Adoption is concentrated in e-commerce, retail, and industrial sectors, where demand for timely and cost-effective deliveries is high. Technological developments focus on predictive routing, operational efficiency, and integration with enterprise supply chain solutions. Government support for digital logistics platforms and sustainable transportation initiatives further accelerates growth. Increased consumer demand for rapid delivery services and industrial compliance with distribution standards contributes to steady expansion across urban and regional markets.

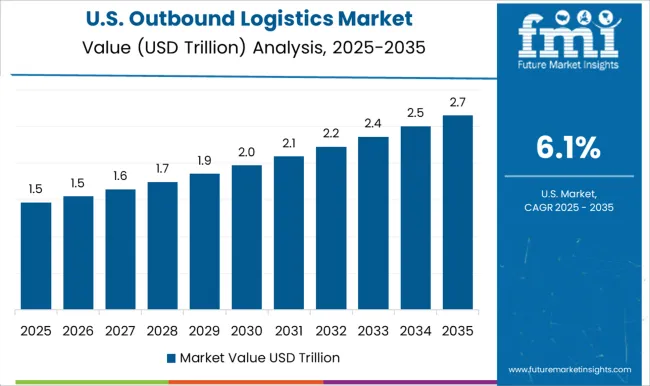

The outbound logistics market in the United States is projected to grow at a CAGR of 6.1%, supported by industrial distribution, retail fulfillment, and e-commerce expansion. Major providers such as FedEx, UPS, and XPO Logistics focus on real-time tracking, automated sorting, and optimized route planning to meet efficiency and reliability targets. Adoption is concentrated in industrial goods, retail, and e-commerce sectors, where rapid delivery is critical. Technological improvements emphasize operational efficiency, cost reduction, and predictive logistics management. Growth is further boosted by government initiatives promoting infrastructure modernization and smart logistics solutions. The market is witnessing increasing integration of AI-driven routing and warehouse automation to improve service levels and reduce operational bottlenecks.

Competition in the outbound logistics market is being shaped by delivery speed, supply chain visibility, and network reliability for e-commerce, retail, and industrial sectors. Market positions are being reinforced through advanced transportation management systems, real-time tracking solutions, and global distribution networks that ensure timely, secure, and cost-efficient shipments. DHL Supply Chain and FedEx Corporation are being represented with end-to-end logistics solutions engineered for large-scale distribution, temperature-controlled handling, and high-volume fulfillment. UPS (United Parcel Service) and XPO Logistics are being promoted with systems structured for route optimization, automated sorting, and flexible last-mile delivery. C.H. Robinson and DB Schenker are being applied with supply chain solutions optimized for multi-modal transport, customs clearance, and real-time shipment monitoring. Kuehne + Nagel and DSV Panalpina are being showcased with integrated logistics services designed for global reach, freight consolidation, and operational efficiency. Nippon Express, Ryder System, and Maersk (A.P. Moller-Maersk) are being advanced with specialized services tailored for international shipping, inventory management, and high-value cargo handling. Strategies in the market are being centered on automation, digitalization, and sustainability to improve operational efficiency and service reliability. Research and development are being allocated to enhance route planning algorithms, warehouse automation, shipment tracking technologies, and fuel-efficient transport solutions. Product brochures are being structured with service offerings, transit times, coverage areas, transport modes, and value-added services. Features such as real-time tracking, flexible delivery options, integrated reporting, and customized logistics solutions are being emphasized to guide procurement and operational planning. Each brochure is being arranged to present service performance, compliance certifications, and client support systems. Information is being provided in a clear, evaluation-ready format to assist supply chain managers, procurement teams, and logistics partners in selecting outbound logistics solutions that meet performance, reliability, and operational efficiency requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Trillion |

| Transportation | Road, Rail, Air, and Sea |

| Service | Transportation, Warehousing, Distribution, Inventory management, Packaging, and Value-added services |

| Organization Size | Large Enterprises and Small and Medium Enterprises (SME) |

| Industry Vertical | Retail, Manufacturing, Healthcare and pharmaceuticals, Automotive, Consumer goods, Food and beverage, Technology and electronics, Aerospace and defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain, FedEx Corporation, UPS (United Parcel Service), XPO Logistics, C.H. Robinson, DB Schenker, Kuehne + Nagel, DSV Panalpina, Nippon Express, Ryder System, and Maersk (A.P. Moller-Maersk) |

| Additional Attributes | Dollar sales by service type and end use, demand dynamics across e-commerce, retail, and manufacturing, regional trends in transportation and distribution infrastructure, innovation in route optimization, automation, and real-time tracking, environmental impact of fuel use and emissions, and emerging use cases in cold chain, last-mile delivery, and smart logistics solutions. |

The global outbound logistics market is estimated to be valued at USD 3.1 trillion in 2025.

The market size for the outbound logistics market is projected to reach USD 6.2 trillion by 2035.

The outbound logistics market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in outbound logistics market are road, rail, air and sea.

In terms of service, transportation segment to command 51.2% share in the outbound logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Outbound Travel Industry Analysis in the United Kingdom Forecast and Outlook 2025 to 2035

Outbound Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

USA Outbound Travel Market Growth – Trends, Demand & Forecast 2025 to 2035

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

China Outbound Meetings, Incentives, Conferences, Exhibitions (MICE) Tourism to Europe Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA