The Europe Bakery Ingredients market is set to grow from an estimated USD 10,174.1 million in 2025 to USD 28,372.1 million by 2035, with a compound annual growth rate (CAGR) of 10.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 10,174.1 million |

| Projected Europe Value (2035F) | USD 28,372.1 million |

| Value-based CAGR (2025 to 2035) | 10.8% |

Steadily, the market for bakery ingredients in Europe is growing as changes in consumer preferences and trends dictate the current pattern of the world. Healthy European consumers prefer items that will give them good health benefits and match their expectations regarding taste while giving them satisfaction regarding nutritional benefits as well.

Ingredients such as whole-grain flour, low-sugar sweeteners, and plant-based emulsifiers have seen a surge in popularity as consumers embrace healthier, more sustainable eating habits. More still, the demands of a hurried lifestyle make readymade baked products the easier option.

Their demand thus provides a platform with a requirement to have good ingredients that would produce bakery products in the best form, flavour, and shelf-life for consumers. For this purpose, the main division of the bakery market is such as flour & grains; sweeteners, fats & oils, leavening agents and emulsifiers & stabilizers, and a few others that serve customers' various tastes.

Flours & grains remain the most dominant, especially with the increasing demand for whole grain products, ancient grains, and gluten-free flour options. The shift away from traditional sugars toward natural, low-calorie sweeteners like stevia and monk fruit reflects the rising health concerns regarding obesity and diabetes.

Fats & oils also change, and with the growth of the vegan movement, more people are adopting plant-based options. Small regional players continue to innovate in niche markets, such as local preference markets, such as French artisanal products or German rye-based items.

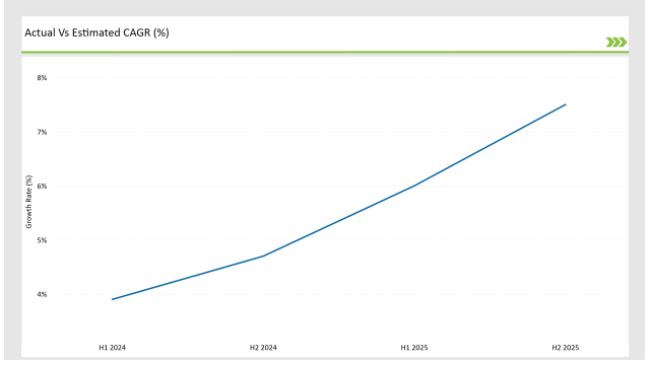

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Bakery Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2023 to 2033) | 3.9% |

| H2 (2023 to 2033) | 4.7% |

| H1 (2024 to 2034) | 6.0% |

| H2 (2024 to 2034) | 7.5% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Bakery Ingredients market, the sector is predicted to grow at a CAGR of 3.9% during the first half of 2023, with an increase to 4.7% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 6.0% in H1 but is expected to rise to 7.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Product Launch - Puratos introduced a new range of gluten-free, high-protein bakery ingredients designed to support the increasing demand for protein-rich, gluten-free options. These ingredients are targeted at both the retail and foodservice sectors, where demand for health-focused baked goods continues to rise. |

| March-2024 | Acquisition - Kerry Group acquired Cargill’s European bakery ingredients division , significantly enhancing its capabilities in key product areas such as leavening agents , emulsifiers , and natural sweeteners . This acquisition is a strategic move to expand Kerry’s portfolio in the European market and strengthen its position as a leading supplier of functional ingredients . |

| February-2024 | Partnership - Archer Daniels Midland (ADM) formed a strategic partnership with Bakery Europe Ltd. to supply advanced plant-based emulsifiers to European commercial bakeries. The collaboration focuses on developing new formulations to meet the growing demand for vegan and dairy-free bakery products. |

Expansion of Gluten-Free Bakery Ingredients: New Flours, Binders, and More in Gluten-Free Baking

With growing gluten sensitivities and increasing adherence to gluten-free diets, the gluten-free segment has become one of the fastest-growing sectors in the European bakery market. The bakery companies have been on the lookout for new ways to emulate the taste and texture of gluten-based traditional baked goods. The options are drawn from a variety of gluten-free flours and alternative grains, such as quinoa, spelled, and rice flour.

The challenge will come in finding the right combination of taste and mouthfeel of the product, which consumers demand more from-bread, cakes, and pastries. Puratos addresses this challenge through the launch of a series of special bread improvers that support the texture and rise of gluten-free products.

Increasing demand for low-carb, high-protein, or fibre-rich baked goods is increasing the boundaries to innovation in an industry where newer ingredients are invented to improve both the nutritional aspects and sensory performance of these types of products.

Plant-based bakery ingredients rise: embracing sustainability and nutrition alternatives in modern baking

The plant-based movement has gained a lot of momentum in Europe and is reshaping the bakery ingredients market. With the increasing demand for plant-based diets, bakery companies are now looking for alternatives to animal-derived ingredients such as dairy and eggs.

The easy availability of plant-based emulsifiers, vegan butter substitutes, and egg replacers has made it easier for bakers to create vegan-friendly products without compromising on taste or texture. Plant-based ingredients are also now being marketed based on health benefits since they are low in cholesterol and saturated fats compared to their animal-derived counterparts.

Companies such as Cargill and ADM have developed several plant-based fats and emulsifiers that can perform exactly like their dairy-based counterparts. This enables bakers to bake vegan cakes, breads, and pastries that meet growing consumer demand.

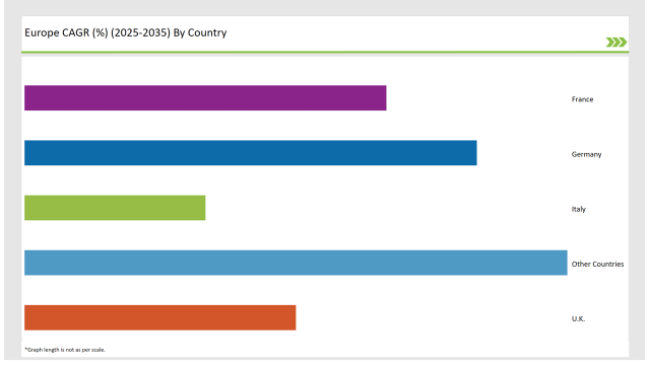

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 25% |

| Italy | 10% |

| UK | 15% |

| France | 20% |

| Other Countries | 30% |

Germany is an important market of bakery ingredients among the largest across Europe. That is due in part to the deep-rooted history of baking across the country with an increased call for healthier functional bakery products.

The German baked goods industry pursues innovation, and now puts its focus into its production to create healthier sustainable bakery products, while nowadays consumers of the products are incessantly demanding whole grain bread, gluten-free products, and plant-based products.

This change in consumer demand was the reason for the creation of new, innovative ingredients which are fibre-enriched flours and plant-based emulsifiers, used to meet these demands for healthy consumption. Germany's bread-making traditions, especially those involving rye bread and sourdough, have also fostered innovation of traditional recipes using healthier ingredients.

France is the land of bread and pastry culture. Bakery market growth in France has been largely fuelled by demand for clean label, premium, and artisan products. In French markets today, buying organic or clean additive-free is the favourite choice of many people.

These consumers focus on the high quality of the raw materials and look for products that do not have any added artificial agents or preservatives. Such a trend boosts demand for whole-grain flour, organic ingredients, and natural sweeteners.

In addition to the demand for clean labels, this is in addition to the most special interests of this rise with vegan and plant-based options. There are certain specifications at which the French market is very fussy regarding artisan bread. Consumers vote for traditional production methods that project the quality of ingredients used.

The bakers in France respond to these trends by adopting healthier ingredients such as low-sugar sweeteners and plant-based fats to craft products fitting modern dietary preferences. On top of that, massive demand for gluten-free and low-carb options in France has emerged because people are intolerant to gluten, and their trend getting popular every day with the help of a low-carb diet like keto.

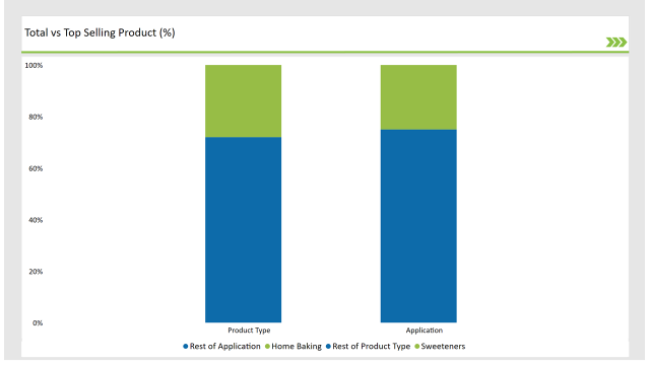

% share of Individual Categories Product Type and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Sweeteners) | 28% |

| Remaining segments | 72% |

The sweeteners segment in the European bakery market has been experiencing a remarkable metamorphosis. The more traditional sugars have been substituted with the more natural, low-calorie variants, which are people`s primary choice amid the beating obesity, diabetes, and other health issues.

Among the intuitive solutions to sugar, stevia, monk fruit, and erythritol have ascended to the top of the users` avatars, simulating the energy without the caloric burden. The number of requests for sugar-free and low-sugar bakery goods has exponentially increased as a result of the greater part of shoppers looking for healthier options.

The consequent effect of this course is that bakery companies are preparing products with low sugar content, changing traditional sugars with these healthier sweetener alternatives. Besides, the advent of clean-label products has triggered interest in natural sweeteners that lack artificial additives such as made with no preservatives.

| Main Segment | Market Share (%) |

|---|---|

| Application (Home Baking) | 25% |

| Remaining segments | 75% |

The home baking section of the European bakery ingredient market has grown a lot due to the increase in consumer interest in this activity as a hobby, especially after people started to notice the COVID-19 pandemic. This development caused an increase in the requirement for high-quality, simple, and creative ingredients for home baking.

The main products in this segment include specialty flours, gluten-free options, natural sweeteners, and instant mixes that help bakers do their work easily. The public is becoming more and more interested in foods without added preservatives, and therefore, they are more inclined towards products that are organic and natural rather than synthetic.

Particularly, the impact of social media and baking shows - as a strong inspiration for people to bake at home - has become crucial to this phenomenon. People also started going on a plant-based diet that contains more vegetables, and therefore, an increased demand for vegan products such as egg replacers and dairy alternatives.

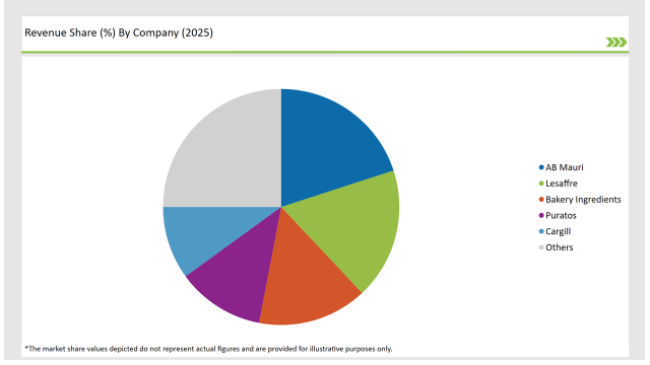

2025 Market share of Europe Bakery Ingredients manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| AB Mauri | 20% |

| Lesaffre | 18% |

| Bakery Ingredients | 15% |

| Puratos | 12% |

| Cargill | 10% |

| Others | 25% |

Note: The above chart is indicative in nature

The European bakery ingredients market is noticed for a very fierce rival struggling and a very big market concentration. The companies that run the market most are the Tier 1 firms that have the main reason for their very large product portfolios and their worldwide presence.

The top companies belong to this group, like ADM, Kerry Group, Puratos, and Cargill, who through their dominant market shares are utilizing their powerful research and development capacity to develop new and innovative products. These firms regularly introduce new trends to the sector, thus, their mass production capabilities and robust distribution networks have been responding to the various target needs of the European bakery sector.

Tier 2 companies over the years have been identified as such as Lesaffre and Bakery Europe Ltd. They are finding that this is a business model that they can persistently derive profits from, specializing in the segments of the market that they choose.

Furthermore, the Tier 3 companies which in most cases are small and local are also vital to these. The companies only sometimes have the same big research and development capabilities as the bigger ones, but they are still significant suppliers for the local markets. They contribute to the addressing of the needs on a more localized level and provide service to the consumers as they want and in the material that they require.

As per Product Type, the industry has been categorized into Flours, Sweeteners, Leavening Agents, Fats and Oils, and Others.

As per Application, the industry has been categorized into Commercial Baking, Home Baking, and Industrial Baking.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Bakery Ingredients market is projected to grow at a CAGR of 10.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 28,372.1 million.

Key factors driving the European bakery ingredients market include the rising demand for convenience foods and the growing trend of health-conscious eating, leading to increased interest in specialty and functional ingredients. Additionally, innovation in product formulations and the expansion of the artisan baking sector further contribute to market growth.

Germany, France, and UK are the key countries with high consumption rates in the European Bakery Ingredients market.

Leading manufacturers include AB Mauri, Lesaffre, Bakery Ingredients, Puratos, and Cargill known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA