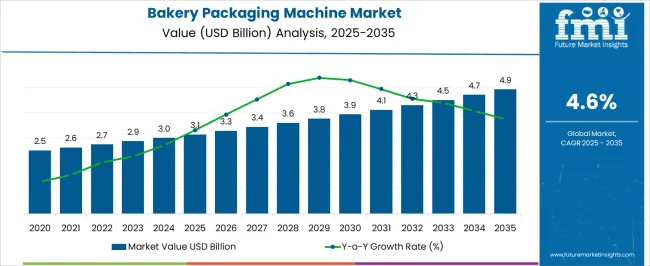

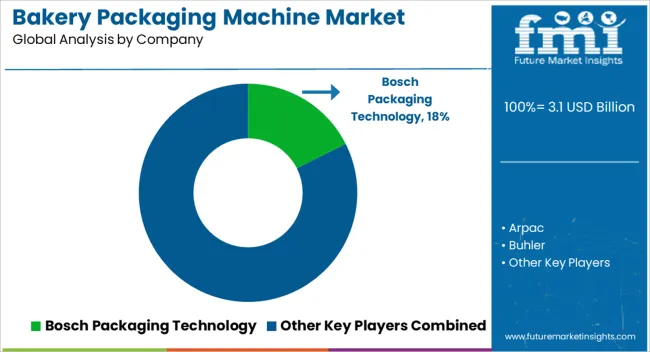

The bakery packaging machine market is projected at USD 3.1 billion in 2025 and anticipated to reach USD 4.9 billion by 2035, expanding at a CAGR of 4.6%, creating an absolute dollar opportunity of USD 1.8 billion during the forecast period. Growth in this market is closely tied to the rising global consumption of baked goods such as bread, cakes, pastries, and cookies, driven by urbanization, lifestyle changes, and convenience-oriented eating habits.

With bakeries focusing on extending shelf life, ensuring product safety, and enhancing visual appeal, advanced packaging solutions such as flow wrapping machines, vacuum sealing, and modified atmosphere packaging are gaining traction. Automation in the packaging process is expected to reduce labor costs and improve consistency, making it a preferred investment for both large-scale bakeries and SMEs.

The rise of e-commerce food delivery platforms is creating demand for innovative packaging that maintains product integrity during transit. In parallel, sustainability pressures are pushing machine manufacturers to develop systems that can handle biodegradable, recyclable, or lightweight materials without compromising efficiency. Growing regulatory emphasis on food safety and hygiene also influences adoption trends, particularly in regions like Europe and North America. Meanwhile, emerging markets in the Asia-Pacific region are showcasing rapid adoption due to expanding bakery chains and modern retail formats. The cumulative result is a market environment where innovation, automation, and sustainability converge to shape purchasing decisions, while the sizeable absolute dollar opportunity of USD 1.8 billion highlights significant room for new entrants and technology upgrades across the industry.

| Metric | Value |

|---|---|

| Bakery Packaging Machine Market Estimated Value in (2025 E) | USD 3.1 billion |

| Bakery Packaging Machine Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The bakery packaging machine market derives its demand from five primary parent segments, each holding a distinct percentage share of the ecosystem. The bread and loaf packaging segment commands the largest share at 32%, driven by high-volume consumption of packaged bread globally, where automated wrapping and sealing machines ensure freshness and extended shelf life.

The cakes and pastries segment follows with 25%, supported by growing consumer demand for premium, decorated, and portion-sized bakery items that require specialized packaging formats to maintain product integrity and visual appeal. The biscuits and cookies segment holds a 20% share, benefitting from the rising popularity of snack foods and convenience packs, where flow-wrapping and flexible packaging machines are heavily deployed.

The frozen bakery products segment contributes 13%, as demand for frozen breads, dough, and ready-to-bake items increases across retail and foodservice channels, requiring advanced packaging solutions compatible with cold chain logistics. Finally, the retail-ready and specialty bakery packaging segment accounts for 10%, catering to artisanal, organic, and on-the-go products, where eco-friendly and innovative packaging formats are emphasized.

Bread, cakes, and biscuits contribute 77% of overall demand, underscoring that core bakery categories drive the largest consumption of packaging machinery, while the frozen and specialty segments are expanding rapidly with new retail trends, sustainable packaging initiatives, and rising urban convenience lifestyles expected to accelerate future adoption.

The bakery packaging machine market is witnessing robust momentum, fueled by rising demand for packaged bakery products across both developed and emerging economies. Expansion is being driven by the need for enhanced shelf life, improved product presentation, and compliance with stringent food safety regulations. Manufacturers are investing in technological advancements to deliver higher throughput, precision, and versatility, enabling compatibility with diverse packaging formats.

Automation is gaining prominence as producers seek to reduce labor dependency, improve efficiency, and ensure consistent quality. Global supply chain developments, along with the growth of retail and e-commerce bakery channels, are prompting investments in flexible and scalable packaging solutions.

Energy efficiency, reduced material wastage, and smart controls are emerging as key differentiators in purchasing decisions. Over the forecast period, the market is anticipated to sustain growth through modernization of production facilities, rising disposable incomes fueling bakery consumption, and strategic adoption of automation to meet increasing consumer expectations for quality and convenience.

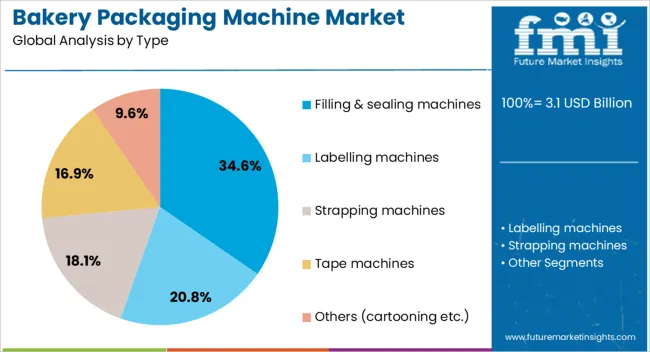

The bakery packaging machine market is segmented by type, automation grade, output capacity, application, distribution channel, and geographic regions. By type, bakery packaging machine market is divided into Filling & sealing machines, Labelling machines, Strapping machines, Tape machines, and Others (cartooning etc.).

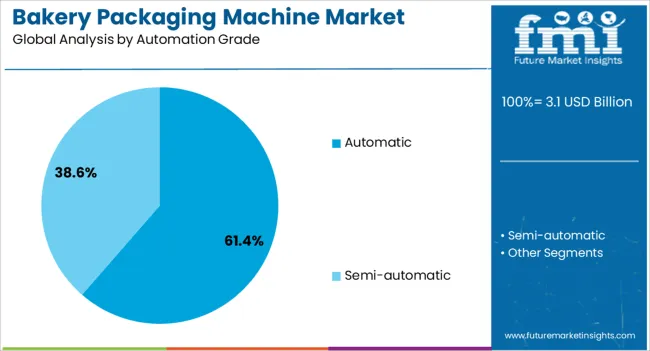

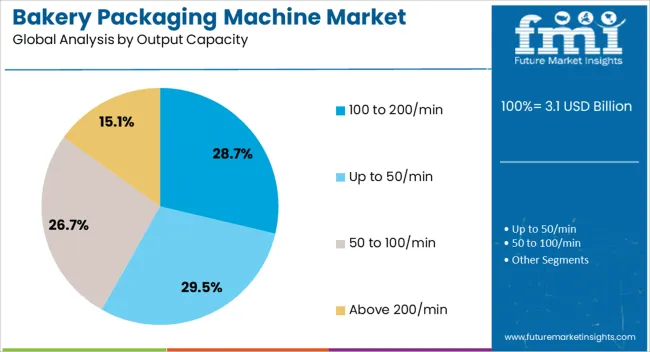

In terms of automation grade, the bakery packaging machine market is classified into Automatic and Semi-automatic. Based on output capacity, the bakery packaging machine market is segmented into 100 to 200/min, up to 50/min, 50 to 100/min, and above 200/min. By application, the bakery packaging machine market is segmented into Bread, Cakes, Cookies, Pastry, Bagels, and Others (croissants, etc.).

By distribution channel, the bakery packaging machine market is segmented into Direct sales and Indirect sales. Regionally, the bakery packaging machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The filling & sealing machines segment, with a 34.6% share in the type category, has maintained its lead due to its essential role in ensuring product integrity, extending shelf life, and supporting diverse packaging styles. These machines are preferred for their precision in portion control and adaptability to different bakery products, from bread and pastries to biscuits and cakes.

Demand has been reinforced by technological upgrades that enable faster changeovers, reduced downtime, and integration with automated handling systems. Food safety compliance, achieved through hygienic design and minimal human contact, has strengthened its adoption across both large-scale industrial bakeries and medium-sized producers.

Global expansion of packaged bakery goods, coupled with the need for efficient sealing to preserve freshness during extended distribution cycles, has cemented its market position. Over time, further adoption is expected as cost efficiencies and operational flexibility align with the sector’s evolving production demands.

The automatic segment, holding 61.4% of the automation grade category, dominates the market as bakeries increasingly prioritize high-speed, consistent, and low-labor packaging operations. Automatic systems provide greater throughput, accuracy, and operational reliability compared to semi-automatic or manual alternatives. Their integration into production lines reduces human error, enhances food safety, and enables scalability to meet seasonal or promotional demand spikes.

Technological advancements, such as servo-driven mechanisms and programmable logic controllers (PLCs), have enhanced performance, reduced maintenance requirements, and optimized energy consumption. In markets where labor costs are high, automation has become a cost-effective solution, further boosting adoption.

Additionally, the ability of automatic systems to accommodate varied packaging sizes and designs without compromising speed makes them an attractive investment. As the bakery sector faces growing pressures for efficiency and product consistency, the dominance of this segment is expected to remain strong.

The 100 to 200/min segment, representing 28.7% of the output capacity category, has emerged as a preferred choice for medium-to-large-scale bakery operations seeking a balance between high productivity and manageable investment costs. This capacity range offers flexibility to meet diverse production demands while maintaining operational efficiency and product quality.

Machines within this range are capable of handling various packaging formats and materials, enabling manufacturers to adapt to changing market trends and product innovations. Their throughput level is well-suited for both domestic distribution and moderate export operations, supporting the needs of bakeries aiming to expand market reach without overextending production resources.

Reliability, coupled with reduced downtime for maintenance, has made this range appealing for producers focused on consistent supply. With the bakery industry’s continued growth and product diversification, demand for equipment in this capacity bracket is projected to remain stable, supported by its balance of speed, cost-effectiveness, and adaptability.

The bakery packaging machine market is being driven by rising packaged food demand, foodservice expansion, product differentiation needs, and distribution growth. Evolving retail formats and consumer expectations continue to shape adoption worldwide.

The bakery packaging machine market is heavily influenced by the increasing global demand for packaged bakery products. Growing consumer preference for ready-to-eat, hygienically packed bread, cakes, cookies, and pastries is boosting the requirement for efficient packaging machinery. Supermarkets, hypermarkets, and convenience stores prefer long shelf-life products that retain freshness, appearance, and safety during transportation and storage. This shift is compelling bakery producers to invest in advanced machines that can handle high-speed, consistent, and quality packaging. Furthermore, the rise of private-label bakery goods and expansion of retail channels worldwide are amplifying packaging volumes, encouraging manufacturers to deploy machines that can meet rising consumer expectations for both efficiency and product appeal.

The strong expansion of cafes, restaurants, hotels, and quick-service chains is significantly driving bakery packaging machine adoption. Packaged bakery items such as croissants, muffins, and doughnuts are increasingly offered as part of on-the-go menus, requiring reliable and flexible packaging solutions. Foodservice operators are demanding compact machines capable of handling smaller batch sizes, custom packaging designs, and multipack options for takeaway customers. Moreover, rising home delivery and online food ordering have created additional requirements for packaging that ensures product integrity during transit. These factors are pushing bakery manufacturers and foodservice providers to invest in packaging machines that enhance convenience, preserve freshness, and align with shifting consumer consumption habits.

Packaging machines are being adopted not just for efficiency, but to enable unique branding elements such as creative designs, resealable formats, and transparent packs that highlight product appeal. Premium bakery products in particular rely on high-quality packaging that communicates freshness, exclusivity, and indulgence. The rise of seasonal offerings, personalized bakery items, and gifting-oriented packaging has encouraged bakeries to adopt machines with capabilities for flexibility and customization. As consumer choices expand, manufacturers are placing greater emphasis on machines that can handle diverse shapes, sizes, and materials to stand out on retail shelves and appeal to evolving preferences.

The global expansion of organized retail chains and e-commerce platforms has transformed how bakery products are sold and packaged. Efficient packaging machines are essential to meet retailer requirements for shelf-ready, attractive, and tamper-proof bakery packs. Large-scale distribution demands consistency, durability, and cost-effective packaging, while small specialty bakeries focus on differentiation and niche formats. Online platforms also require packaging that ensures safe last-mile delivery without compromising product quality. As distribution channels diversify, manufacturers of bakery packaging machines are tailoring solutions to balance speed, affordability, and presentation. This shift highlights the critical role of distribution networks and retail trends in shaping the adoption and evolution of packaging equipment globally.

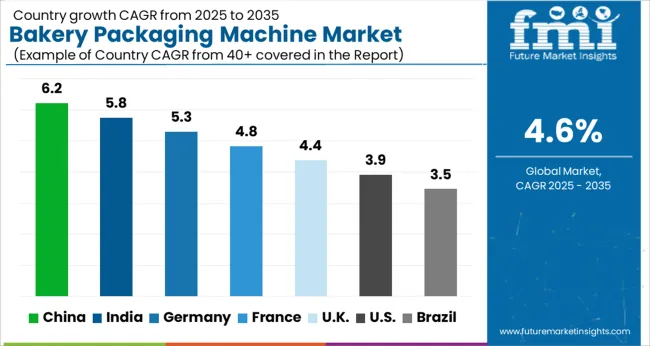

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

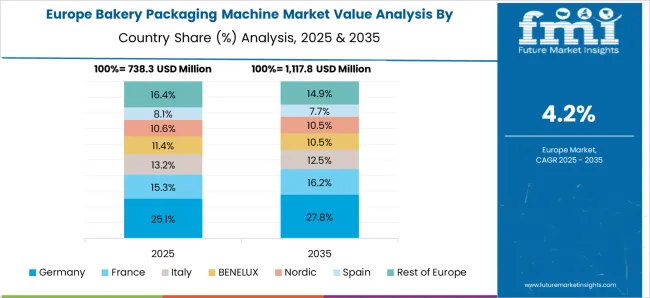

The global bakery packaging machine market is projected to grow at a CAGR of 4.6% from 2025 to 2035. China leads with 6.2%, followed by India at 5.8%, Germany at 5.3%, the UK at 4.4%, and the USA at 3.9%. Growth is supported by increasing demand for packaged bakery products across both developed and emerging markets. China and India are experiencing robust expansion fueled by a rising middle class, evolving consumption habits, and growing investments in modern food processing infrastructure. In contrast, Germany, the UK, and the USA are focusing on advanced, high-speed, and customizable packaging machinery to support premium, artisanal, and export-oriented bakery products. The adoption of automation, flexible packaging formats, and enhanced retail distribution networks further accelerates market opportunities. The analysis includes over 40+ countries, with the leading markets detailed below.

The bakery packaging machine market in China is projected to grow at a CAGR of 6.2% from 2025 to 2035, driven by rising consumption of packaged bakery products and strong investments in the food processing industry. China’s expanding middle class, growing bakery retail chains, and a preference for hygienically packed products are creating robust demand for automated, high-speed packaging machinery. Domestic manufacturers are scaling up production capacity and adopting advanced technologies to meet bulk demand while maintaining quality and efficiency. International players are also partnering with local firms to expand market access. E-commerce platforms and modern retail outlets further accelerate growth by boosting packaged bakery product distribution.

The bakery packaging machine market in India is projected to grow at a CAGR of 5.8% from 2025 to 2035, supported by rising bakery consumption, growth of quick-service restaurants, and expansion of organized retail. India’s younger demographic is fueling demand for packaged cakes, biscuits, and breads, creating opportunities for packaging machinery that delivers speed, durability, and cost-effectiveness. Local manufacturers are focusing on flexible packaging formats and machines suitable for small to mid-sized bakeries, while global companies target industrial-scale production lines. The rise of supermarkets, food delivery platforms, and export-oriented bakeries further strengthens market prospects. Government incentives for food processing infrastructure also support widespread adoption.

The bakery packaging machine market in Germany is anticipated to grow at a CAGR of 5.3% from 2025 to 2035, driven by demand for high-quality packaging solutions in artisanal and industrial bakeries. Germany’s strong bakery culture, emphasis on product freshness, and premium segment growth create opportunities for advanced, sustainable, and customizable packaging equipment. Local manufacturers are known for engineering excellence, offering machines with precision, durability, and energy efficiency. Export-oriented bakeries further demand machines capable of meeting international packaging standards. With the growing importance of automation and customization, manufacturers are focusing on integrated solutions for efficiency and flexibility. Distribution through modern retail and specialty bakery stores strengthens demand.

The bakery packaging machine market in the UK is forecast to grow at a CAGR of 4.4% from 2025 to 2035, fueled by changing consumer lifestyles and a growing preference for convenience foods. Bakeries, supermarkets, and online food delivery platforms are driving demand for efficient, compact, and versatile packaging machinery. Manufacturers are focusing on multipurpose machines capable of handling various packaging formats, including flexible pouches, cartons, and wraps, to meet diverse bakery product requirements. Rising consumer interest in premium baked goods, along with increasing exports of bakery products, supports investments in advanced packaging lines. Market players are also strengthening after-sales services and technical support to ensure machine reliability and minimize downtime.

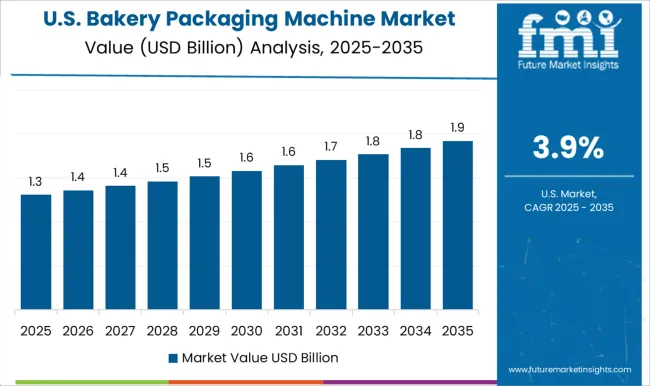

The bakery packaging machine market in the USA is projected to grow at a CAGR of 3.9% from 2025 to 2035, influenced by rising demand for ready-to-eat bakery items and large-scale production requirements. Industrial bakeries, quick-service restaurants, and foodservice chains rely heavily on automated machines to ensure consistent quality, higher throughput, and compliance with food safety regulations. Manufacturers are focusing on customization, offering modular systems suitable for varied packaging needs, from snack-size packs to bulk cartons. Growth in private-label bakery products within retail chains further drives demand for efficient, cost-effective packaging solutions. Evolving consumer preferences toward freshness and convenience continue to reinforce investments in bakery packaging machinery.

Competition in the bakery packaging machine market is driven by efficiency, flexibility, and the ability to meet diverse bakery product formats such as breads, cakes, biscuits, and pastries. Bosch Packaging Technology and Syntegon Technology lead the market with advanced, automated packaging lines emphasizing precision, hygiene, and scalability for industrial bakeries. Buhler and Rademaker specialize in integrated bakery production and packaging solutions, offering customized systems tailored for both artisanal and high-volume production. Ishida and Multivac compete with advanced weighing, sealing, and modified atmosphere packaging systems that preserve freshness and extend product shelf life. Viking Masek and PAC Machinery provide versatile packaging machines for mid-scale bakeries, focusing on affordability, speed, and multipurpose applications.

Other players, including Arpac, Filpack, Hopak Machinery, Joiepack Industrial, Rianta, SOMIC Packaging, Middleby, and Rademaker, differentiate through niche offerings such as flow wrapping, vertical form-fill-seal, cartoning, and tray sealing. Their strategies emphasize modularity, compact design, and user-friendly interfaces to serve bakeries of varying sizes. Many players highlight after-sales service, quick maintenance support, and operator training as key differentiators. Strategies across the industry emphasize modular and flexible systems capable of handling multiple packaging formats, ensuring compliance with food safety standards, and reducing operational downtime.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Type | Filling & sealing machines, Labelling machines, Strapping machines, Tape machines, and Others (cartooning etc.) |

| Automation Grade | Automatic and Semi-automatic |

| Output Capacity | 100 to 200/min, Up to 50/min, 50 to 100/min, and Above 200/min |

| Application | Bread, Cakes, Cookies, Pastry, Bagels, and Others (croissants etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Packaging Technology, Arpac, Buhler, Filpack, Hopak Machinery, Ishida, Joiepack Industrial, Multivac, PAC Machinery, Rademaker, Rianta, SOMIC Packaging, Syntegon Technology, Middleby, and Viking Masek |

| Additional Attributes | Dollar sales, share, regional demand patterns, competitive positioning, pricing benchmarks, regulatory compliance, automation trends, material compatibility, buyer preferences, and growth opportunities in emerging markets. |

The global bakery packaging machine market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the bakery packaging machine market is projected to reach USD 4.9 billion by 2035.

The bakery packaging machine market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in bakery packaging machine market are filling & sealing machines, labelling machines, strapping machines, tape machines and others (cartooning etc.).

In terms of automation grade, automatic segment to command 61.4% share in the bakery packaging machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Competitive Breakdown of Bakery Mixes Suppliers

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Improvers Market

Bakery Conditioner Market

Bakery Flexible Packaging Market

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United States Bakery Ingredients Market Outlook – Demand, Size & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Bakery Ingredient Market Trends – Growth, Demand & Forecast 2025–2035

Europe Bakery Mixes Market Report – Growth, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA