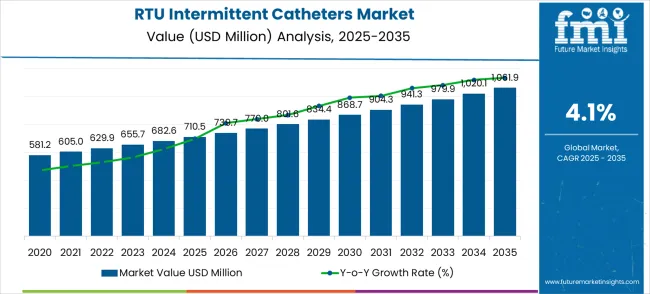

The ready-to-use intermittent catheters market is projected to grow from USD 710.5 million in 2025 to USD 1,061.9 million by 2035, representing a CAGR of 4.1%. Analysis of the first half-decade from 2025 to 2030 indicates steady expansion, with market value increasing from USD 710.5 million to USD 834.4 million. This phase reflects moderate growth driven by gradual adoption in healthcare facilities, increasing awareness of urinary tract infection prevention, and improvements in catheter design that enhance patient compliance. The weighted growth during this period shows early stabilization of demand as hospitals and clinics integrate ready-to-use solutions into standard care protocols.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 710.5 million |

| Market Forecast Value (2035) | USD 1,061.9 million |

| Forecast CAGR (2025–2035) | 4.1% |

The second half-decade, spanning 2030 to 2035, demonstrates an accelerated growth trajectory with market value rising from USD 868.7 million in 2030 to USD 1,061.9 million in 2035. This period benefits from expanded usage across home healthcare settings, regulatory approvals easing market entry, and technological enhancements that improve safety and convenience. Weighted growth analysis emphasizes a more pronounced contribution from mature markets while emerging regions increasingly adopt these devices, reflecting the shift from early adoption to broader acceptance.

Half-decade weighted growth for the ready-to-use intermittent catheters market indicates a consistent upward trend with measurable acceleration in the latter half of the forecast period. The first half-decade lays the foundation for adoption, while the second half consolidates market penetration and revenue gains. By evaluating growth in these two distinct periods, stakeholders can anticipate investment timing, supply chain planning, and regional deployment strategies for optimal returns, ensuring that market expansion is balanced and sustainable across both early and mature phases.

Market expansion is being supported by the increasing prevalence of urological disorders across global populations and the corresponding need for safe, convenient catheterization solutions that reduce infection risks and improve patient compliance. Modern healthcare delivery requires efficient urological care products that provide superior safety profiles while supporting patient independence and quality of life. The excellent infection prevention characteristics and user-friendly design of ready-to-use intermittent catheters make them essential components in contemporary urological care where patient safety and clinical outcomes are paramount.

The growing emphasis on healthcare-associated infection prevention and patient-centered care is driving demand for advanced catheter technologies from certified manufacturers with proven track records of clinical safety and product reliability. Healthcare providers are increasingly investing in ready-to-use catheter systems that offer reduced infection risks and improved patient experiences over conventional catheterization methods. Clinical guidelines and infection control standards are establishing safety benchmarks that favor sterile, pre-lubricated catheter solutions with demonstrated clinical efficacy and patient acceptance.

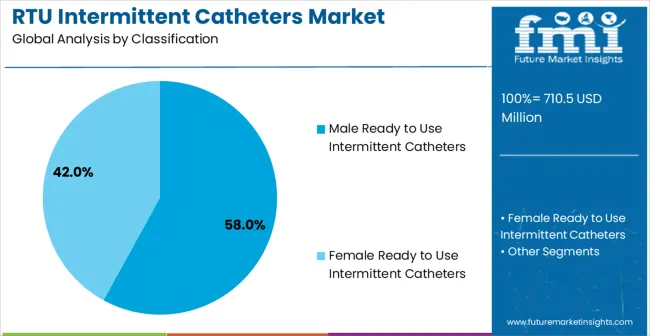

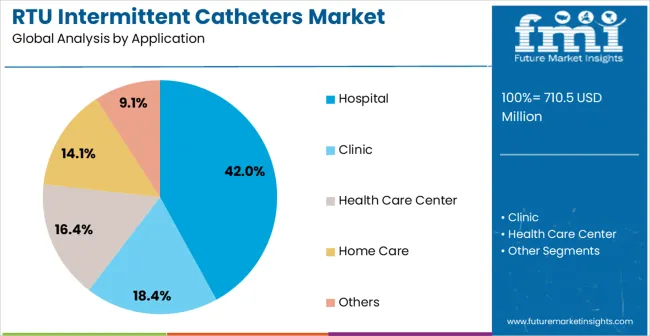

The market is segmented by catheter type, application, and region. By patient-specific design, the market is divided into male ready to use intermittent catheters and female ready to use intermittent catheters. Based on application, the market is categorized into hospital, clinic, health care center, home care, and other healthcare settings. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Male ready-to-use intermittent catheters are projected to capture 58% of the market in 2025, making them the leading catheter type. This dominance is driven by the higher prevalence of urological conditions in male populations and anatomical requirements for longer, ergonomically designed catheters. Male catheters feature optimized length, diameter, and handling, supporting both hospital and home care use. Advanced hydrophilic coatings, sterile packaging, and ergonomic design enhance patient comfort, reduce infection risk, and improve compliance. Long-term catheterization needs of spinal cord injury and neurogenic bladder patients particularly drive demand. The aging male population with conditions such as benign prostatic hyperplasia further supports growth. Integration of user-friendly packaging and high-quality materials reduces caregiver burden and enables independent catheterization, accelerating adoption. The combination of clinical safety, patient comfort, and operational efficiency ensures male catheters maintain a dominant market position in 2025.

Hospital applications are expected to represent 42% of ready-to-use intermittent catheter demand in 2025, reflecting the primary clinical setting for acute urological care. Hospitals require sterile, reliable catheters for post-surgical care, spinal cord injury management, and acute neurogenic bladder treatment. Standardized procurement processes and clinical protocols prioritize infection control, patient safety, and operational efficiency. Catheters designed for hospital use meet sterility requirements, accommodate diverse patient types, and integrate seamlessly into clinical workflows. The focus on reducing healthcare-associated infections and improving clinical outcomes supports consistent demand. Major healthcare systems across North America, Europe, and Asia-Pacific drive adoption, investing in evidence-based urological care products. Increased surgical volumes, trauma care, and value-based healthcare initiatives further reinforce growth. Catheter technologies demonstrating safety, reliability, and patient satisfaction remain essential for hospitals seeking optimal outcomes in bladder management.

The ready to use intermittent catheters market is advancing steadily due to increasing aging population demographics and growing recognition of infection prevention importance in urological care. However, the market faces challenges including higher product costs compared to reusable alternatives, reimbursement limitations in some healthcare systems, and varying clinical protocol adoption across different regions. Clinical evidence development and reimbursement advocacy programs continue to influence market access and healthcare provider adoption patterns.

The growing implementation of hydrophilic coatings and antimicrobial surface treatments is enabling enhanced patient comfort and reduced infection risks in ready-to-use catheter applications. Advanced coating technologies provide improved lubrication, reduced friction, and antimicrobial properties while maintaining product sterility and shelf stability. These technologies are particularly important for patients requiring frequent catheterization and those at high risk for urinary tract infections.

Modern catheter manufacturers are incorporating patient-centered design approaches and home care optimization features that improve independence and quality of life for individuals requiring long-term intermittent catheterization. Integration of ergonomic designs, discrete packaging, and comprehensive patient education materials enables successful home-based catheter programs and reduced healthcare utilization. Advanced manufacturing techniques and quality control systems also support development of specialized catheters for pediatric, geriatric, and mobility-impaired patient populations.

| Country | CAGR (2025–2035) |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| United States | 3.9% |

| United Kingdom | 3.5% |

| Japan | 3.1% |

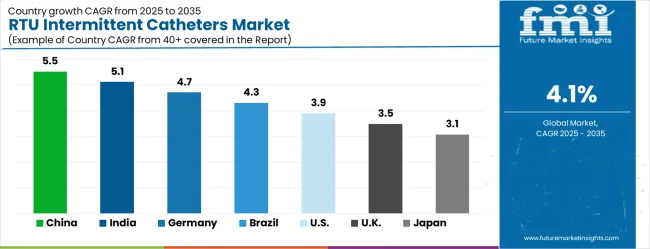

The ready to use intermittent catheters market is growing rapidly, with China leading at a 5.5% CAGR through 2035, driven by expanding healthcare infrastructure, growing awareness of urological care standards, and increasing prevalence of spinal cord injuries and diabetes-related complications. India follows at 5.1%, supported by rising healthcare access and growing recognition of infection prevention importance in urological procedures. Germany records strong growth at 4.7%, emphasizing clinical excellence, patient safety standards, and advanced healthcare delivery capabilities. Brazil grows steadily at 4.3%, integrating modern catheter technologies into expanding healthcare systems and home care programs. The United States shows moderate growth at 3.9%, focusing on clinical outcome optimization and infection prevention initiatives. The United Kingdom maintains steady expansion at 3.5%, supported by NHS protocols and patient safety programs. Japan demonstrates stable growth at 3.1%, emphasizing technological innovation and aging population care solutions.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from ready-to-use intermittent catheters in China is projected to grow at a CAGR of 5.5% through 2035. This growth is driven by rapid expansion of healthcare infrastructure, rising awareness of modern urological care standards, and increasing prevalence of chronic conditions such as diabetes and spinal cord injuries. Hospitals and specialized care facilities are integrating advanced catheter systems to ensure improved patient outcomes and adherence to international safety protocols. The market benefits from large-scale adoption of infection prevention measures and sterile, ready-to-use products that minimize hospital-acquired complications. With government-backed modernization programs supporting quality healthcare delivery, demand for high-performance catheters is expected to remain strong, particularly in urban medical centers implementing standardized urological care procedures.

India’s ready-to-use intermittent catheters market is expected to expand at a CAGR of 5.1%, supported by growing healthcare access across urban and rural areas and increasing investment in modern medical technologies. Rising awareness of infection prevention and patient safety drives hospitals and outpatient facilities to adopt advanced catheter systems capable of supporting diverse patient populations. Infrastructure expansion and clinical improvement programs are fostering demand for devices that combine sterility, ease of use, and clinical reliability. The market also benefits from increasing government initiatives aimed at upgrading hospital equipment and standardizing patient care protocols. As private and public healthcare sectors continue investing in evidence-based technologies, the demand for ready-to-use intermittent catheters is expected to sustain strong growth across major healthcare regions.

Germany is projected to grow at a CAGR of 4.7%, supported by strong emphasis on clinical excellence, patient safety, and stringent healthcare quality standards. Hospitals and specialized urological care centers increasingly adopt advanced catheter systems that comply with rigorous sterility requirements and infection prevention protocols. Market growth is reinforced by structured clinical programs focusing on outcome optimization and the adoption of evidence-based devices that reduce complication risks. Investments in healthcare technology emphasize high-performance catheter solutions that demonstrate measurable benefits in safety and efficiency. As German healthcare facilities implement clinical excellence initiatives, adoption of ready-to-use intermittent catheters is expected to expand steadily, supporting optimized patient care while maintaining regulatory compliance across acute care, rehabilitation, and outpatient settings.

Brazil’s ready-to-use intermittent catheters market is projected to grow at a CAGR of 4.3%, driven by the expansion and modernization of healthcare systems across public and private sectors. Hospitals, clinics, and outpatient facilities are increasingly adopting advanced catheter technologies to improve patient care, clinical outcomes, and adherence to evolving safety standards. The market benefits from national programs that support modernization of medical infrastructure and investment in evidence-based technologies. Demand is further fueled by the increasing prevalence of chronic urological conditions and heightened awareness of infection prevention. As healthcare facilities across major regions continue integrating advanced catheter systems into clinical workflows, Brazil is expected to maintain steady market growth, with adoption concentrated in hospitals, rehabilitation centers, and specialized urological clinics.

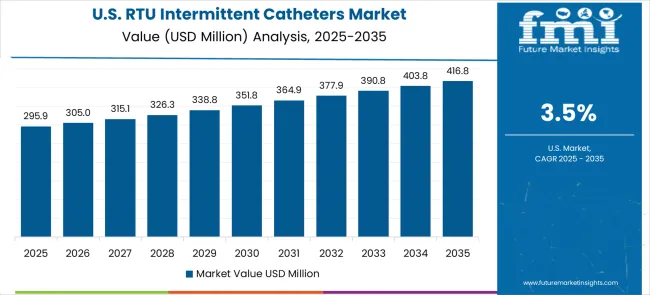

The U.S. market is expected to expand at a CAGR of 3.9%, supported by clinical outcome optimization initiatives, infection prevention programs, and standardized healthcare protocols. Hospitals, long-term care facilities, and outpatient centers are increasingly adopting evidence-based catheter systems that demonstrate reduced infection risks, improved patient comfort, and measurable clinical effectiveness. The market is reinforced by strong reimbursement frameworks and established procurement processes favoring high-quality sterile devices. Growth is further fueled by value-based healthcare initiatives emphasizing patient safety, clinical performance, and cost reduction. As the adoption of advanced urological care solutions becomes integral to hospital quality metrics, ready-to-use intermittent catheters are projected to maintain stable demand, particularly across acute care, rehabilitation, and chronic care management settings.

The U.K. market is projected to grow at a CAGR of 3.5%, driven by patient safety programs, NHS protocols, and evidence-based medicine practices emphasizing infection prevention. Hospitals and outpatient facilities are adopting standardized catheter systems that provide consistent performance, meet clinical guidelines, and support staff efficiency. Regulatory oversight and quality improvement initiatives ensure that catheter adoption aligns with safety and operational metrics. Demand is further reinforced by growing focus on patient-centered care, reducing hospital-acquired infections, and improving treatment outcomes. As NHS hospitals and private healthcare providers continue to prioritize reliability and clinical effectiveness, ready-to-use intermittent catheters are expected to see sustained uptake, particularly for acute urological care, post-surgical recovery, and chronic bladder management.

Japan’s market is expected to grow at a CAGR of 3.1%, driven by advanced technological innovation and comprehensive care programs for the aging population. Hospitals and eldercare facilities are increasingly adopting precision-engineered, patient-friendly catheter systems that enhance comfort, reduce infection risks, and optimize clinical outcomes. Market growth is supported by Japan’s strong focus on high-quality medical device manufacturing and ongoing innovation in hydrophilic coatings, packaging, and catheter design. As elderly care programs expand and chronic urological conditions become more prevalent, demand for advanced ready-to-use catheters continues to rise. Adoption is particularly concentrated in hospitals, home healthcare services, and rehabilitation centers, where improved device performance and patient independence are critical for long-term care strategies.

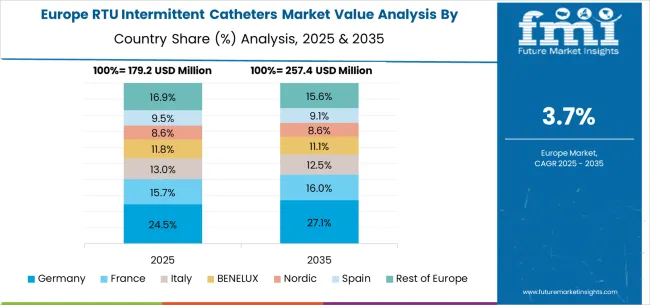

The ready to use intermittent catheters market in Europe is projected to grow from USD 191.8 million in 2025 to USD 286.6 million by 2035, registering a CAGR of 4.1% over the forecast period. Germany is expected to maintain its leadership with a 29.2% share in 2025, supported by its comprehensive healthcare system and advanced medical technology adoption. The United Kingdom follows with 18.6% market share, driven by NHS protocols and patient safety initiatives. France holds 15.7% of the European market, benefiting from healthcare modernization and clinical care improvement programs. Italy and Spain collectively represent 22.0% of regional demand, with growing focus on urological care and aging population support. The Rest of Europe region accounts for 14.5% of the market, supported by healthcare development in Eastern European countries and Nordic healthcare systems.

The ready to use intermittent catheters market is defined by competition among established medical device manufacturers, specialized urological product companies, and regional healthcare suppliers. Companies are investing in advanced coating technologies, clinical evidence development, regulatory compliance programs, and patient education initiatives to deliver safe, effective, and user-friendly catheter solutions. Strategic partnerships, clinical research, and geographic expansion are central to strengthening product portfolios and market presence.

Coloplast, operating globally, offers comprehensive intermittent catheter solutions with focus on infection prevention, patient comfort, and clinical evidence support. B. Braun provides advanced catheter systems with emphasis on safety technology and healthcare professional education. Hollister, specialized urological care provider, delivers comprehensive catheter technologies with focus on patient independence and quality of life. Convatec offers advanced catheter solutions with proven clinical performance and global support services.

Wellspect HealthCare provides specialized intermittent catheter systems with emphasis on patient-centered design and clinical research. Becton Dickinson delivers medical device solutions with focus on safety and clinical effectiveness. Teleflex offers comprehensive catheter technologies with advanced materials and manufacturing quality. Safe N Simple provides specialized catheter systems with focus on home care applications.

Clinisupplies and Dynarex offer specialized catheter products, regional distribution capabilities, and clinical support across healthcare and home care markets.

The ready to use intermittent catheters market underpins urological care advancement, infection prevention, patient independence, and healthcare quality improvement. With patient safety mandates, clinical outcome requirements, and demand for infection prevention solutions, the sector must balance cost effectiveness, clinical performance, and patient accessibility. Coordinated contributions from governments, healthcare systems, manufacturers, clinical organizations, and investors will accelerate the transition toward evidence-based, patient-centered, and clinically optimized catheter technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 710.5 million |

| Classification Type | Male Ready to Use Intermittent Catheters, Female Ready to Use Intermittent Catheters |

| Application | Hospital, Clinic, Health Care Center, Home Care, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Coloplast, B. Braun, Hollister, Convatec, Wellspect HealthCare, Becton Dickinson, Teleflex, Safe N Simple, Clinisupplies, Dynarex |

| Additional Attributes | Dollar sales by catheter type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established medical device manufacturers and specialized suppliers, buyer preferences for male versus female catheter specifications, integration with advanced coating technologies and infection prevention systems, innovations in hydrophilic coatings and ergonomic design for enhanced patient comfort and safety, and adoption of comprehensive patient education and home care support programs for improved clinical outcomes and patient independence. |

The global ready to use intermittent catheters market is estimated to be valued at USD 710.5 million in 2025.

The market size for the ready to use intermittent catheters market is projected to reach USD 1,061.9 million by 2035.

The ready to use intermittent catheters market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in ready to use intermittent catheters market are male ready to use intermittent catheters and female ready to use intermittent catheters.

In terms of application, hospital segment to command 42.0% share in the ready to use intermittent catheters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ready-to-Use Therapeutic Food Market Trends and Forecast 2025 to 2035

Ready-To-Use Supplementary Food Market Analysis Hospital & Clinics, Charities, NGOs, And Others Through 2035

Ready-to-eat Canned Tuna Market Size and Share Forecast Outlook 2025 to 2035

Ready to Drink (RTD) Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-Eat Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready To Eat Seafood Snacks Market Size and Share Forecast Outlook 2025 to 2035

Ready to Drink Coffee Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ready-to-Finish Bakery Products Market Analysis - Size, Share and Forecast 2025 to 2035

Ready to Drink Shakes Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-eat Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ready-to-Drink Beauty Beverage Market Analysis by Ingredients, Flavor, Form and Distribution Channel Through 2035

Ready-to-Serve Cocktails Market Trends - Innovation & Demand 2025 to 2035

Ready To Drink (RTD) Tea Market Trends - Functional & Refreshing Beverage Growth 2025 to 2035

Ready-to-eat Cups Market Analysis by Product Type, Nature, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast through 2035

Ready To Drink Cocktails Market Growth – Size, Trends & Forecast 2025-2035

Ready-to-Drink Beverage Market Analysis – Size, Share & Forecast 2024-2034

Museums Tourism Market Trends – Growth, Demand & Forecast 2025 to 2035

Ectoin-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuse Block Market Size and Share Forecast Outlook 2025 to 2035

Refuse Compactor Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA