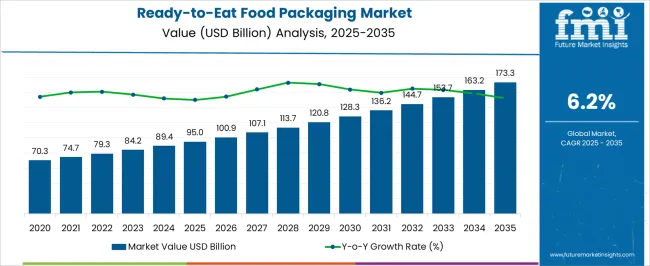

The ready-to-eat (RTE) food packaging market is expected to grow from USD 95.0 billion in 2025 to USD 173.3 billion by 2035, registering a 6.2% CAGR and generating an absolute dollar opportunity of USD 78.3 billion. Growth is supported by rising consumer preference for convenient meal solutions, expanding retail and e-commerce channels, and increasing urban population density. Packaging innovations such as lightweight, tamper-evident, and shelf-stable materials are enhancing product usability and safety, driving adoption across packaged meals, snacks, and ready-to-cook items.

Seasonality and cyclicality detection reveals recurring patterns in demand throughout the year. Peaks are observed during festive periods, school holidays, and major cultural or sporting events, when consumption of RTE products rises sharply. Troughs occur in post-holiday periods or during months of lower discretionary spending. Regional variations affect these cycles, with North America and Europe showing moderate seasonal peaks linked to retail promotions, while Asia Pacific exhibits more pronounced cycles due to cultural festivals, urban lifestyle shifts, and growing e-commerce consumption. Business-to-business demand from foodservice providers also introduces minor cyclicality associated with contract timelines and production schedules.

Despite these fluctuations, overall growth remains upward, with the USD 78.3 billion opportunity reflecting both recurring demand surges and steady baseline adoption across global markets between 2025 and 2035.

| Metric | Value |

|---|---|

| Ready-to-Eat Food Packaging Market Estimated Value in (2025 E) | USD 95.0 billion |

| Ready-to-Eat Food Packaging Market Forecast Value in (2035 F) | USD 173.3 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The ready-to-eat (RTE) food packaging market is primarily influenced by the packaged and convenience food sector, which holds around 48% of the market share. Demand is driven by consumers seeking quick meal solutions that require minimal preparation. Retail chains and supermarkets account for approximately 22%, serving as the main channel for distributing packaged RTE products to a wide audience.

The foodservice segment represents close to 15%, supplying packaged meals to cafes, restaurants, and quick-service outlets for on-the-go consumption. E-commerce platforms contribute roughly 10%, reflecting the rapid growth of online grocery shopping and home delivery services. The remaining 5% comes from specialty health and wellness stores, which focus on functional and ready-to-consume meals designed for convenience, quality, and niche dietary preferences. The RTE food packaging market is evolving with advancements in materials, preservation, and convenience. Multi-layer and vacuum-sealed packaging enhances product freshness and extends shelf life. Microwaveable and ready-to-heat formats are gaining popularity as consumers look for faster, safer options. Biodegradable and recyclable packaging is increasingly adopted to address environmental concerns.

Smart packaging solutions, including QR codes for traceability and product information, are becoming standard. Companies are expanding online sales channels and direct-to-consumer models to reach broader audiences. Rising interest in convenient, high-quality, and safe meal options continues to drive product innovation, packaging improvements, and market adoption.

The ready-to-eat food packaging market is witnessing notable growth, driven by the increasing consumer preference for convenience and on-the-go meal options. Rising urbanization, busy lifestyles, and changing dietary habits have fueled demand for packaging solutions that ensure product freshness, safety, and extended shelf life. Innovations in packaging materials and design are enabling better protection from contamination and environmental factors while maintaining food quality.

Growing awareness around sustainability is also influencing the development of recyclable and eco-friendly packaging alternatives. The market is being shaped by investments in flexible packaging formats, which offer lightweight and space-efficient solutions suited for diverse ready-to-eat products.

Evolving retail channels and rising penetration of e-commerce platforms are further propelling the need for durable, attractive, and tamper-evident packaging As the demand for convenient, healthy food options increases globally, the ready-to-eat food packaging market is positioned for sustained expansion, with manufacturers focusing on enhancing packaging functionality and environmental compliance to meet evolving consumer and regulatory expectations.

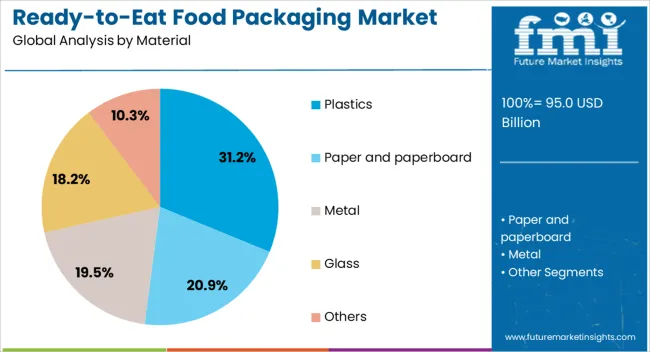

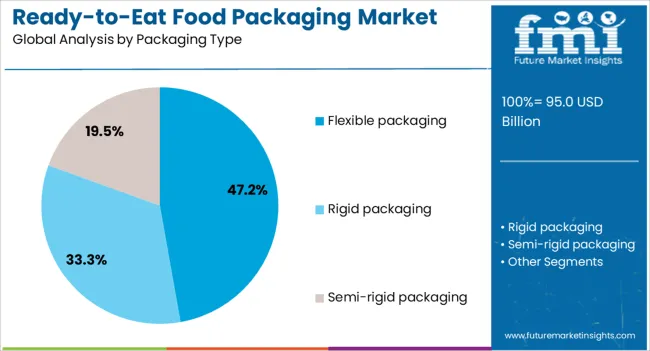

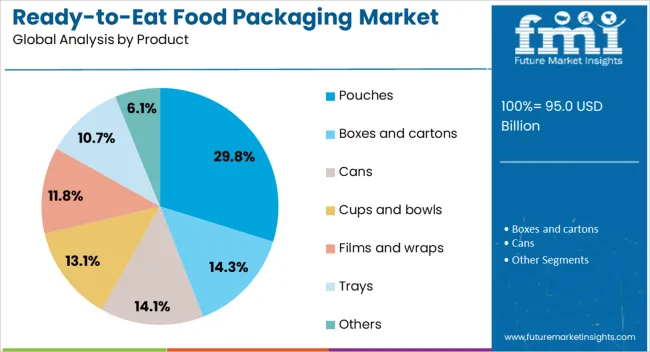

The ready-to-eat food packaging market is segmented by material, packaging type, product, application, and geographic regions. By material, ready-to-eat food packaging market is divided into Plastics, Paper and paperboard, Metal, Glass, and Others. In terms of packaging type, ready-to-eat food packaging market is classified into Flexible packaging, Rigid packaging, and Semi-rigid packaging. Based on product, ready-to-eat food packaging market is segmented into Pouches, Boxes and cartons, Cans, Cups and bowls, Films and wraps, Trays, and Others.

By application, ready-to-eat food packaging market is segmented into Snacks and confectionery, Ready-to-eat meals, Instant noodles and pasta, Meat and seafood, Fruits and vegetables, and Others. Regionally, the ready-to-eat food packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastics material segment is projected to hold 31.2% of the ready-to-eat food packaging market revenue share in 2025, establishing it as a leading packaging material. Its prevalence is supported by the versatility, durability, and cost-effectiveness of plastic materials in preserving food quality and extending shelf life. Plastic packaging offers excellent barrier properties against moisture, oxygen, and contaminants, which are critical for maintaining the freshness and safety of ready-to-eat food products.

Advances in plastic formulation have also facilitated the development of recyclable and bio-based plastics, aligning with sustainability goals. The segment benefits from well-established manufacturing infrastructure and global supply chains, enabling consistent product availability and innovation.

Its compatibility with diverse packaging formats such as films, trays, and containers allows broad application across various food categories. As convenience remains a priority for consumers and regulatory pressure on sustainable packaging grows, the plastics segment is expected to continue its strong market presence through enhanced material innovations and recycling initiatives.

The flexible packaging segment is anticipated to represent 47.2% of the ready-to-eat food packaging market revenue share in 2025, making it the dominant packaging type. This dominance is attributed to flexible packaging’s lightweight, space-saving, and cost-efficient attributes, which support product protection and convenience. Flexible formats such as pouches, bags, and films offer superior sealing capabilities and barrier properties that enhance product freshness and shelf life.

The segment’s adaptability to various food textures and forms makes it highly preferred by manufacturers and consumers alike. Moreover, flexible packaging facilitates easy transportation and reduces material usage compared to rigid alternatives, addressing environmental concerns. Continuous innovation in materials, including the integration of biodegradable and compostable films, is further strengthening its market position.

The segment is also favored for its compatibility with automated filling and packaging lines, which improves manufacturing efficiency. With growing demand for on-the-go foods and sustainability-driven packaging, flexible packaging is expected to sustain its leadership in the ready-to-eat food packaging market.

The pouches product segment is expected to capture 29.8% of the ready-to-eat food packaging market revenue share in 2025, positioning it as a leading packaging format. Pouches are favored for their versatility, ease of use, and ability to maintain product integrity across various ready-to-eat food categories. They provide excellent barrier protection against oxygen, moisture, and contaminants, which helps extend shelf life and preserve flavor and nutritional value.

The lightweight and flexible nature of pouches contributes to reduced transportation costs and lower environmental footprint compared to traditional rigid packaging. Pouches also offer convenience features such as resealable closures and easy-tear notches, aligning with consumer preferences for usability and portion control.

Their adaptability to different shapes and sizes allows manufacturers to differentiate products and appeal to diverse consumer segments. As demand grows for sustainable and functional packaging solutions, the pouch format is expected to continue its strong market growth, supported by material innovations and expanding application scope.

The ready-to-eat food packaging market is expanding due to increasing demand for convenience, extended shelf life, and safe food handling. Global revenue exceeded USD 32 billion in 2024, with a projected CAGR of 7.5% from 2025 to 2030. Asia Pacific leads with 38% share, driven by China, India, and Japan, where packaged convenience foods are widely consumed. North America accounts for 30%, led by the USA, emphasizing pre-packaged meals and on-the-go solutions. Europe contributes 25%, with Germany, France, and UK adoption of efficient and functional packaging. Advanced materials, barrier protection, and portion control support global growth.

Retail, hospitality, and convenience channels represent more than 65% of global ready-to-eat packaging adoption. Retail applications contribute 35%, including supermarkets, hypermarkets, and online grocery delivery platforms offering pre-packaged meals. Hospitality accounts for 20%, including hotels, restaurants, and catering services prioritizing hygienic, single-serve packaging. Convenience stores and vending channels represent 10%, focusing on ready-to-eat snacks and meal kits. Asia Pacific leads with 38% share due to higher consumption of packaged meals in China, India, and Japan. North America contributes 30%, emphasizing meal solutions for working professionals. Europe holds 25%, focusing on functional, efficient, and portion-controlled packaging. Shifting consumption habits and convenience drive market expansion worldwide.

Technological advancements in ready-to-eat packaging include high-barrier films, vacuum sealing, modified atmosphere packaging (MAP), and microwave-safe containers. Barrier films reduce oxygen and moisture, extending product shelf life by 15–20%. MAP and vacuum technologies improve freshness for meat, dairy, and snacks. Microwaveable and oven-safe packaging increases consumer convenience. Asia Pacific emphasizes cost-effective, scalable packaging solutions for retail and e-commerce. Europe invests in recyclable and functional materials to reduce environmental impact. North America integrates tamper-evident and traceable packaging. These innovations improve food safety, maintain product quality, and support broader adoption of ready-to-eat packaging globally.

Ready-to-eat packaging is increasingly applied across frozen, chilled, and ambient products. Frozen foods account for 30% of adoption, including pre-cooked meals, seafood, and vegetables. Chilled products contribute 25%, covering salads, dairy meals, and sandwiches. Ambient foods represent 15%, including cereals, snacks, and meal kits. Asia Pacific leads with 38% share due to rising consumption of packaged meals in China, India, and Japan. Europe contributes 25%, emphasizing chilled and portion-controlled products. North America holds 30%, focusing on frozen and ready-to-eat meal solutions. Expanding product variety and on-the-go consumption patterns continue to drive market growth globally.

The market faces challenges from high material costs, food safety compliance, and packaging regulations. Advanced packaging solutions, including high-barrier films and MAP systems, increase production costs by 12–18%. Regulations in Europe and North America require certifications for food contact, hygiene, and recyclability. Asia Pacific mitigates costs through local material sourcing and high-volume production. Europe focuses on functional packaging with compliance certifications. North America emphasizes automated, tamper-proof solutions for safe product delivery. Despite benefits in efficiency and shelf life, high costs and regulatory requirements remain key barriers to widespread adoption of ready-to-eat food packaging.

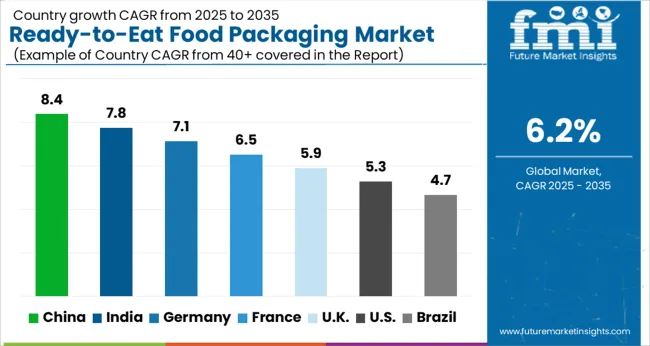

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

In 2025, the ready-to-eat food packaging market is projected to grow at a global CAGR of 6.2% through 2035, fueled by rising consumption of convenient meals, expansion of retail and e-commerce networks, and adoption of modern packaging technologies. China leads at 8.4%, 35% above the global benchmark, supported by BRICS-driven growth in processed food manufacturing, urban retail penetration, and large-scale packaging production. India follows at 7.8%, 25.8% above the global average, reflecting increasing demand in urban centers, growth of quick-service food outlets, and wider adoption of hygienic and functional packaging. Germany records 7.1%, 14.5% above the benchmark, shaped by OECD-backed innovation in packaging materials, automation, and premium meal applications. The United Kingdom posts 5.9%, 4.8% below the global rate, with uptake in convenience food segments, retail-ready meals, and selective packaging solutions. The United States stands at 5.3%, 14.5% below the benchmark, with consistent demand in packaged foods, specialty retail, and niche convenience offerings. BRICS economies drive volume expansion, OECD countries emphasize product quality, efficiency, and technological advancement, while ASEAN nations contribute through growing retail and food production activities.

China ready-to-eat food packaging market is expanding at a CAGR of 8.4%, above the global 6.2%, driven by growth in e-commerce food delivery, convenience retail, and commercial catering. The market in China is growing due to rapid urbanization, rising disposable incomes, and increasingly busy lifestyles that drive demand for convenient meal solutions. Young consumers, office workers, and students prefer RTE products for time efficiency, fueling the need for innovative and sustainable packaging. E-commerce expansion and food delivery platforms further amplify demand for durable, safe, and attractive packaging formats. Additionally, heightened health and hygiene awareness post-pandemic has accelerated the shift toward sealed, tamper-proof, and eco-friendly packaging. Government support for sustainable materials and technological advancements in smart packaging are also boosting market growth in China.

India ready-to-eat food packaging market is growing at 7.8% CAGR, above the global 6.2%, supported by expanding ready meal production, snack foods, and online meal delivery. The market in India is expanding due to changing consumer lifestyles, rising urbanization, and a growing middle-class population seeking convenient meal options. Busy work schedules, increased female workforce participation, and exposure to global food habits are driving demand for packaged RTE meals. The booming e-commerce and food delivery sectors further boost the need for secure, tamper-proof, and portable packaging solutions. Post-pandemic health consciousness has increased preference for hygienic, single-serve packs. Moreover, government initiatives promoting food processing and sustainable packaging materials, alongside innovations in eco-friendly and smart packaging, are accelerating market growth across India’s RTE food segment.

Germany ready-to-eat food packaging market is growing at 7.1% CAGR, above the global 6.2%, driven by demand from retail ready meals, frozen foods, and institutional catering. The market in Germany is growing due to the country’s fast-paced urban lifestyle, rising single-person households, and strong demand for convenient yet high-quality meal solutions. German consumers prioritize health, safety, and sustainability, which drives adoption of eco-friendly, recyclable, and biodegradable packaging for RTE foods. The expanding retail and online grocery sectors, along with meal delivery services, further fuel demand for durable and tamper-proof packaging formats. Additionally, Germany’s strict regulations on food safety and packaging waste encourage innovation in smart and sustainable solutions. These factors collectively position the RTE food packaging market for steady growth in Germany.

United Kingdom ready-to-eat food packaging market is expanding at 5.9% CAGR, slightly below the global 6.2%, supported by growth in convenience foods, frozen meals, and e-commerce meal delivery. The market in the U.K. is growing due to rising consumer preference for convenience, driven by busy work schedules, urban lifestyles, and increasing reliance on quick meal options. Growth of online food delivery platforms and retail-ready packaged meals has boosted demand for secure, tamper-proof, and portable packaging. Post-pandemic, heightened awareness of hygiene and food safety further supports the shift toward sealed and protective formats. Additionally, strong consumer demand for eco-friendly and recyclable packaging aligns with the U.K.’s strict sustainability goals and regulations, encouraging innovation in biodegradable and smart packaging solutions, thereby accelerating market expansion.

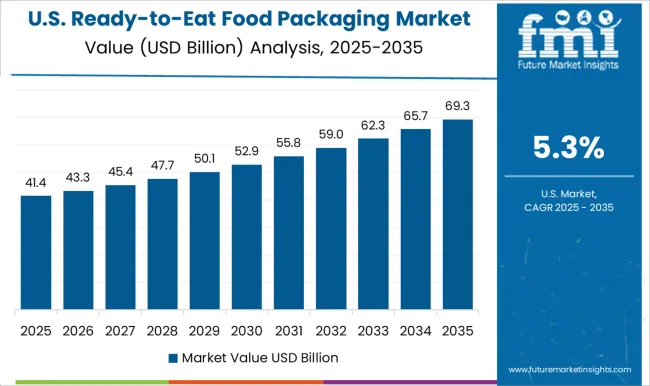

United States ready-to-eat food packaging market is growing at 5.3% CAGR, below the global 6.2%, reflecting steady demand from retail, foodservice, and e-commerce channels. The market in the U.S. is expanding due to busy consumer lifestyles, increasing demand for convenience, and the surge of on-the-go meal solutions. Growth in e-commerce grocery, meal delivery services, and retail-ready packaged foods is driving the need for durable, tamper-evident, and portable packaging. Post-pandemic health and safety concerns have accelerated adoption of sealed and hygienic formats. Moreover, rising consumer preference for eco-friendly, recyclable, and sustainable materials aligns with regulatory pressures to reduce packaging waste. Innovations in smart packaging for freshness, tracking, and interactive features are also fueling growth of the RTE packaging sector in the U.S.

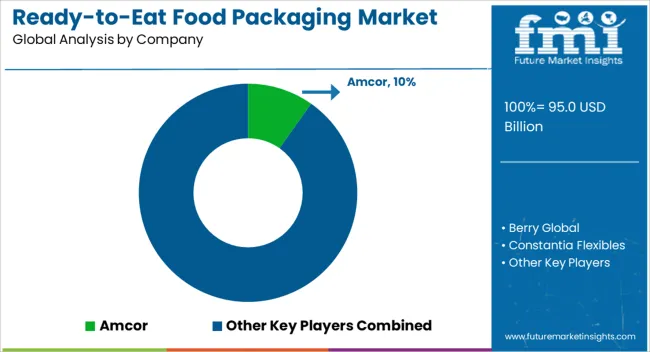

The ready-to-eat food packaging market is highly competitive, driven by the need for barrier performance, product safety, and convenience across retail and food service channels. Market rivalry is shaped by materials, packaging format, sealing integrity, and regulatory compliance. Companies differentiate through innovation in multilayer films, thermoformed trays, laminated pouches, molded fiber, and carton-based solutions that enhance freshness retention and operational efficiency. Key players such as Amcor, Berry Global, Constantia Flexibles, Coveris, Ester Industries, GualaPack, Huhtamaki, Mondi, Novolex, Pactiv Evergreen, PPC Flex, ProAmpac, Sealed Air, Sonoco Products, Tetra Pak, Toppan, Transcontinental, WestRock, and Wipak dominate through global distribution, technical support, and product certifications.

Regional and emerging manufacturers compete with cost-effective, customizable, and eco-friendly solutions tailored to local market needs. Strategies are focused on R&D for advanced barrier materials, sealing technologies, and packaging formats that improve usability, stackability, and shelf life. The market is moderately consolidated, with top companies leveraging innovation, global support, and operational reliability to maintain leadership in ready-to-eat food packaging solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 95.0 billion |

| Material | Plastics, Paper and paperboard, Metal, Glass, and Others |

| Packaging Type | Flexible packaging, Rigid packaging, and Semi-rigid packaging |

| Product | Pouches, Boxes and cartons, Cans, Cups and bowls, Films and wraps, Trays, and Others |

| Application | Snacks and confectionery, Ready-to-eat meals, Instant noodles and pasta, Meat and seafood, Fruits and vegetables, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Berry Global, Constantia Flexibles, Coveris, Ester Industries, GualaPack, Huhtamaki, Mondi, Novolex, Pactiv Evergreen, PPC Flex, ProAmpac, Sealed Air, Sonoco Products, Tetra Pak, Toppan, Transcontinental, WestRock, and Wipak |

| Additional Attributes | Dollar sales by packaging type and end use, demand dynamics across retail, foodservice, and online channels, regional trends in convenience food consumption, innovation in material safety, barrier properties, and sustainability, environmental impact of packaging waste, and emerging use cases in microwaveable, portion-controlled, and functional food packs. |

The global ready-to-eat food packaging market is estimated to be valued at USD 95.0 billion in 2025.

The market size for the ready-to-eat food packaging market is projected to reach USD 173.3 billion by 2035.

The ready-to-eat food packaging market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in ready-to-eat food packaging market are plastics, paper and paperboard, metal, glass and others.

In terms of packaging type, flexible packaging segment to command 47.2% share in the ready-to-eat food packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ready-to-eat Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA