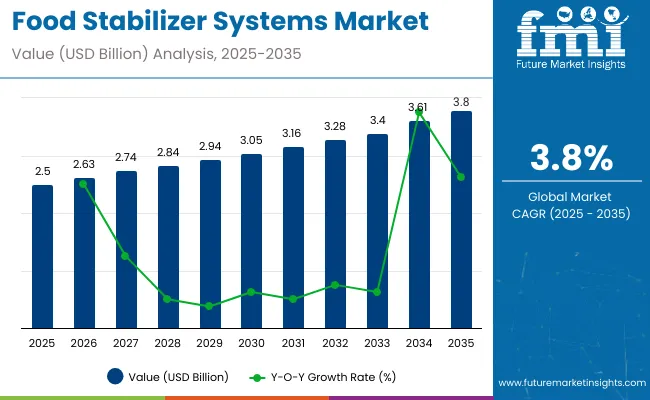

The global food stabilizer systems market is projected to grow from USD 2.5 billion in 2025 to USD 3.8 billion by 2035, advancing at a CAGR of 3.8%. This growth is being driven by increasing demand for processed foods, the surge in clean-label product preferences, and the functional benefits stabilizers offer in enhancing texture, shelf life, and sensory appeal across dairy, bakery, and beverage categories.

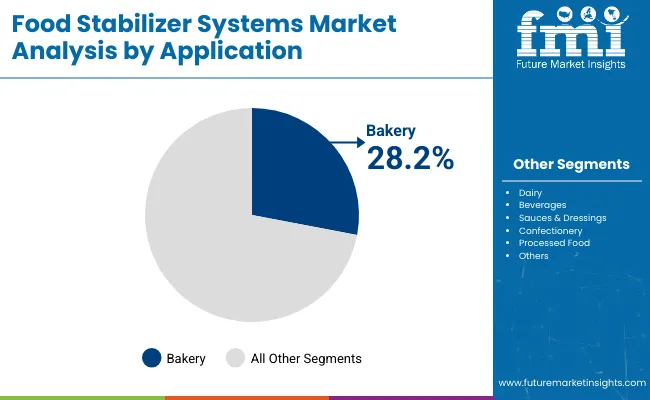

In 2025, the bakery segment is projected to lead with a 28.2% revenue share, while North America will continue dominating with over 33.7% of global sales. Food stabilizers are essential in maintaining homogeneity, supporting emulsification, and ensuring physio-chemical balance in multi-ingredient formulations. The market is transitioning from synthetic to natural and plant-derived stabilizers, catering to rising consumer health awareness and regulatory shifts towards safer, sustainable additives.

A key trend driving innovation is the integration of plant-based ingredients. In 2023, As per cargill’s press release Cargill introduced a line of pea starch-based stabilizers under its SimPure portfolio. These are tailored for meat alternatives, soups, and snacks, helping manufacturers optimize water retention and product structure without compromising on label claims or clean-label requirements.

This launch aligns with the growing plant-based movement and supports formulation challenges in processed food design. Meanwhile, As mentioned in ScienceDirect press release, recent scientific studies have validated the use of nanocellulose-including cellulose nanocrystals (CNCs) and nanofibrils (CNFs)-as sustainable stabilizers in Pickering emulsions.

These emulsions are gaining interest due to their high stability and applicability in fat replacement, food packaging, and delivery systems. Research published in Advances in Colloid and Interface Science confirms the viability of nanocellulose in clean-label, high-performance food products, reinforcing the direction toward eco-friendly innovations in food stabilization.

The industry is also benefiting from digital tools supporting product development. In 2021, Tate & Lyle launched Stabilizer University, an online course designed to assist food scientists with stabilizer formulation challenges, though newer resources and AI-enabled tools have since taken the lead.

As global consumption of ready-to-eat, allergen-free, and texture-rich food items expands, leading companies are doubling down on R&D, regional customization, and cleaner labeling strategies. The shift towards natural multifunctional blends, combined with technological advances in plant-based and nanomaterial science, is expected to shape the future of the food stabilizer systems industry well into 2035

Companies operating in the food stabilizer ecosystem are implementing smart technologies such as real-time sensors, data analytics, and intelligent packaging to ensure consistency, freshness, and compliance. These technologies complement the functionality of stabilizers by enhancing environmental control, tracking, and shelf-life management across the supply chain.

Keep-it Technologies (Keep-it Indicator Label)

Keep-it Technologies provides the Keep-it Indicator Label, a time-temperature sensitive label that reflects actual product shelf life based on cumulative temperature exposure. This dynamic freshness indicator is used on packaged food products to complement stabilizer effectiveness by providing real-time information on product viability.

Wiliot (Wiliot IoT Pixel Tags)

Wiliot produces IoT Pixel Tags, small, battery-free sensors that collect data on temperature, humidity, and motion. These tags are applied to food packaging to monitor freshness and support stabilizer performance by providing insights into environmental conditions throughout distribution.

Apeel Sciences (Apeel Edible Coating)

Apeel Sciences manufactures the Apeel Edible Coating, a plant-based barrier applied to fresh fruits and vegetables. The coating acts as a natural stabilizer by slowing oxidation and water loss. It is paired with data insights to determine ideal application rates and optimize shelf life without synthetic additives.

RipeLocker (RipeLocker Storage Vessel)

RipeLocker offers the RipeLocker Storage Vessel, a low-pressure, controlled-atmosphere container that regulates oxygen and carbon dioxide levels. This system works in tandem with stabilizers to extend the freshness of produce and florals during storage and transport, particularly in high-value perishable goods.

Strella Biotechnology (Strella Gas Biosensor)

Strella Biotechnology develops the Strella Gas Biosensor, which measures ethylene and other ripening-related gases in real-time. The sensor data helps supply chain managers optimize storage timing and stabilizer usage to better control the ripening process of fruits such as apples, pears, and bananas.

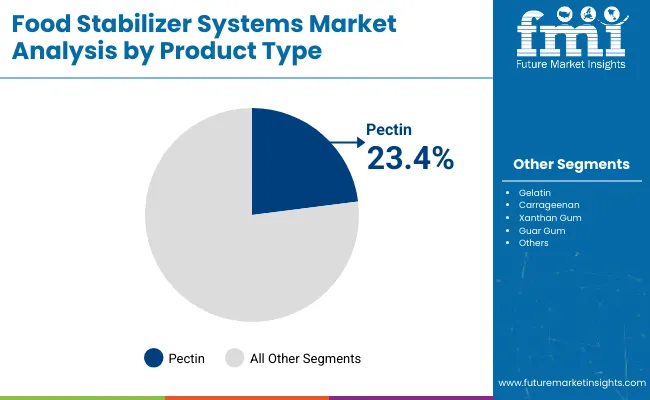

The global food stabilizer systems market will see the bakery segment lead with a 28.2% share in 2025, followed by pectin at 23.4%. Growth is driven by rising demand for RTE bakery items, functional dairy products, and plant-based alternatives. Clean-label trends and formulation innovations are shaping investment in emulsifiers and hydrocolloids.

The bakery segment is projected to lead the food stabilizer systems market in 2025 with a 28.2% market share, driven by the continued rise in consumption of frozen, convenience, and ready-to-eat (RTE) bakery products. Stabilizers in bakery applications are essential for improving moisture retention, enhancing crumb structure, and extending shelf life in items such as pastries, croissants, muffins, and cakes.

The use of emulsifiers like mono- and diglycerides and hydrocolloids such as guar gum and xanthan gum is growing, particularly to maintain product consistency under varying temperature and humidity conditions. With rising raw material prices-especially for fats, sugars, and flours-bakeries are increasingly relying on customized stabilizer blends that offer formulation flexibility and cost-effectiveness.

Emerging clean-label trends are influencing the reformulation of traditional bakery stabilizers, encouraging the adoption of plant-based and allergen-free solutions. Manufacturers are responding with new launches that cater to both large-scale production and artisanal baking needs, helping ensure uniform dispersion of ingredients, smoother textures, and improved mouthfeel. As bakery continues to grow globally, especially in urban centers and retail chains, stabilizer system demand will remain robust and essential.

In the food stabilizer systems market, pectin is expected to be the leading product type in 2025, accounting for an estimated 23.4% market share. Its natural origin, clean-label appeal, and gelling ability make it the stabilizer of choice in fruit-based beverages, yogurts, and sugar-reduced products. As consumer demand shifts toward transparency and plant-based ingredients, pectin's application is expanding in both traditional and innovative formulations.

Other product types such as gelatin, carrageenan, xanthan gum, and guar gum continue to play critical roles across various food categories. Gelatin remains prominent in confectionery and dairy desserts but faces substitution in vegan offerings. Carrageenan is widely used in dairy beverages and processed cheese, although its acceptance varies by region.

Xanthan gum and guar gum are essential in sauces, baked goods, and gluten-free products for their thickening and stabilizing properties. The “Others” category, including locust bean gum and gellan gum, is gaining ground through hybrid blends that meet specialized textural needs in plant-based and allergen-free foods. Together, these alternatives support diverse formulation strategies across a broadening range of applications.

The food stabilizer systems market is shaped by clean-label trends, rising functional food demand, and product customization. While high raw material costs and regulatory hurdles remain key challenges, opportunities lie in R&D innovation, e-learning platforms, and tailored solutions. Companies offering natural ingredients and technical support are gaining traction across bakery, dairy, and plant-based segments.

Clean-label and Natural Ingredient Preferences Drive Market Expansion

Consumer preferences are shifting toward clean-label formulations. Products with recognizable, plant-derived ingredients are increasingly favored. As a result, stabilizers like guar gum, agar, pectin, and locust bean gum are being widely adopted. Several multinational food brands have started reformulating their products.

Artificial additives are being removed from ingredient lists. Regulatory bodies in the EU and North America are also encouraging the use of natural stabilizers. Nestlé and Unilever, for example, have made commitments to clean-label transitions. This trend has increased the use of natural hydrocolloids across bakery, dairy, and beverage categories. Market expansion is being driven by both regulatory compliance and consumer expectations related to ingredient transparency.

High Production Costs and Regulatory Compliance Act as Constraints

Manufacturers face high costs in stabilizer system formulation. Extensive trials are required to meet performance and safety standards. Ingredients such as xanthan gum, gelatin, and emulsifiers have witnessed volatile pricing. These price fluctuations affect budget-sensitive markets. Additionally, food safety regulations vary by country.

Harmonization across regions is lacking, making global expansion complex. For instance, Europe’s EFSA and the USA FDA require separate validation procedures. This increases R&D and compliance timelines. Smaller companies struggle to meet these demands. Cost pressures are expected to limit smaller players unless efficiencies in sourcing and production are achieved. Thus, regulation and raw material pricing act as growth barriers.

Growing Demand for Functional Foods Spurs Innovation

Functional food consumption is increasing rapidly. These foods require stabilizers to maintain texture and flavor while delivering nutritional benefits. New stabilizer blends are being developed for low-fat, high-protein, and sugar-free products. Consumers seek items that offer gut health, immunity, and heart benefits.

As a result, stabilizer systems are being customized for use in protein drinks, high-fiber bars, and plant-based milks. For example, pectin is used in fiber-enriched yogurts to maintain creaminess. Innovation is being driven by nutritional science. This enables food producers to retain product appeal while enhancing functionality. Manufacturers that offer tailored stabilizers aligned with health claims are seeing growing demand globally.

Product Customization and Online Education Support Adoption

Personalized stabilizer solutions are helping manufacturers meet formulation challenges. Food brands are seeking technical support for new product launches. Stabilizer vendors are responding with online tools and education platforms. In April 2021, Tate & Lyle launched Stabilizer University, an e-learning platform for food scientists.

The platform provides training on stabilizer performance in dairy, dressings, and beverages. Such initiatives are helping clients shorten development cycles. Tailored support is also being provided through virtual labs and regional technical centers. This investment in knowledge-sharing is accelerating the adoption of stabilizers across multiple food applications. Manufacturers are increasingly choosing suppliers that offer both products and formulation support.

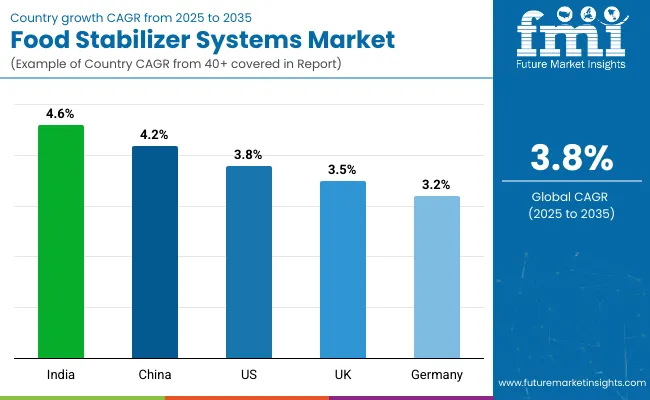

The food stabilizer systems market study highlights growth trends across the United States, United Kingdom, China, India, and Germany. Companies operating in these regions are prioritizing clean-label formulations, texture-enhancing natural additives, and cost-effective stabilizer blends. The table below presents the projected CAGR for each of these leading countries during the forecast period.

The CAGR for the USA food stabilizer systems market is estimated at 3.8% from 2025 to 2035. The country remains a dominant force due to its expansive processed food sector and preference for natural, label-friendly stabilizers. Rising dairy and bakery product consumption supports widespread use of emulsifiers and hydrocolloids to maintain food texture and shelf life.

Clean-label initiatives from major food brands are increasing adoption of plant-based stabilizer blends. Regulatory frameworks promote safe, non-artificial ingredients, encouraging innovation. Foodservice chains and snack manufacturers continue to integrate stabilizers into sauces, dips, and frozen goods. Texture enhancement and allergen-free positioning remain critical.

Ongoing R&D investments by leading firms ensure custom stabilizer formulations for niche dietary preferences. The rise of functional dairy and prebiotic-rich drinks further supports market expansion. With high consumer awareness and advanced manufacturing capabilities, the USA is expected to sustain strong growth in stabilizer system deployment over the forecast period.

The CAGR for the UK for food stabilizer systems market is projected at 3.5% from 2025 to 2035. Consumer expectations around clean labels and food transparency are pushing British food producers to adopt advanced stabilizer systems. Growing demand for sauces, gravies, and bakery products with improved mouthfeel and viscosity is expanding the market.

Stabilizers such as pectin, agar, and carrageenan are gaining traction in response to natural additive trends. Urban consumers increasingly seek ready-to-eat meals and snacks, raising formulation needs for shelf-stable and visually appealing products. Customized blends tailored to specific processing requirements are in high demand.

Food tech startups and legacy brands are innovating with low-fat, gluten-free, and plant-based product lines that rely on stabilizer functionality. With the UK food industry embracing sustainable and allergen-free ingredients, stabilizer suppliers are focusing on compliant and eco-friendly solutions. The emphasis on product premiumization will further stimulate demand for functional stabilizer technologies in coming years.

The CAGR for food stabilizer systems market in China is expected at 4.2% from 2025 to 2035. China’s growing middle class and increasing urbanization are driving significant changes in eating habits, boosting demand for processed foods. Global and domestic companies are expanding stabilizer manufacturing and R&D facilities within the country to meet localization needs.

Functional food and beverage development is expanding rapidly, requiring stabilizers for texture, viscosity, and shelf stability. Products such as flavored milk, desserts, sauces, and plant-based items are being reformulated to meet evolving preferences. Local innovation centers are focused on creating clean-label stabilizers to comply with both domestic regulations and export standards.

The surge in e-commerce food sales is also pushing manufacturers to develop stabilizers suitable for extended storage and delivery resilience. Government incentives to improve food safety and labeling transparency are accelerating reformulation efforts. China’s strategic focus on food tech and domestic production scale gives it an edge in the stabilizer systems market.

The CAGR for food stabilizer systems market in India is forecasted at 4.6% between 2025 and 2035. The food stabilizer systems market in India is witnessing rapid growth due to increased demand for packaged food, dairy, and bakery products, particularly in Tier II and Tier III cities. Manufacturers are opting for cost-effective stabilizer solutions that cater to a value-driven consumer base.

Stabilizers are commonly used in products like paneer, yogurt, cakes, and sauces to improve shelf life, texture, and visual appeal. The domestic food processing industry is focusing on developing clean-label products while maintaining affordability. Local producers are increasingly collaborating with international suppliers for formulation expertise and ingredient access.

Regulatory efforts promoting food safety and manufacturing best practices are supporting market formalization. The rise in plant-based dairy and regional snack innovations is boosting the requirement for flexible stabilizer systems. Growth is further enhanced by young demographics, urban migration, and increased nutritional awareness.

The CAGR for food stabilizer systems market in Germany is projected at 3.2% from 2025 to 2035. As a key player in Europe’s food processing sector, Germany maintains strong demand for high-quality stabilizer systems used in premium bakery, dairy, and convenience foods. Clean-label reformulation trends are prompting food brands to replace synthetic additives with plant-based emulsifiers and gums.

Stabilizers like xanthan gum, locust bean gum, and natural starches are commonly integrated into yogurt, sauces, and frozen desserts to improve consistency and shelf life. German manufacturers emphasize functional ingredients that meet stringent EU regulations and satisfy eco-conscious consumer preferences. Innovative product lines, including organic and allergen-free foods, are gaining traction.

Leading companies are investing in R&D and sustainable sourcing to remain competitive. With its focus on food safety, traceability, and health, Germany offers a favorable environment for stabilizer system adoption. The country’s export-oriented food sector also encourages use of globally compliant stabilizer formulations.

As per an Ingredion press release, the company has expanded its range of plant-derived stabilizers, including NOVATION® Indulge 2940, a clean-label starch designed for dairy and savory applications to enhance mouthfeel and gelling properties.

According to a Tate & Lyle announcement, the company completed the acquisition of CP Kelco in November 2024, strengthening its portfolio with natural texturants such as pectin, gellan gum, and carrageenan-enhancing its footprint in the beverages and bakery space.

As mentioned on Cargill.com, Cargill has continued expanding its SimPure® line of starches, including SimPure™ 99600 for plant-based meats and SimPure™ 99900 for soups and sauces-both tailored for high-performance texture and water retention.

According to Kerry Group’s product catalog, the company is focusing on custom stabilizer systems to serve global B2B markets, particularly for clean-label processed food solutions.

As per Ashland’s website, the firm is advancing fermentation-derived hydrocolloids used in dairy and beverage formulations to improve viscosity and shelf stability.

CP Kelco, now under Tate & Lyle, continues to lead in natural hydrocolloids, supporting clean-label transitions in various applications. As per ADM, the company offers a growing portfolio of natural emulsifiers and stabilizers, including lecithins and xanthan gum, aligning with sustainability trends.

According to a BASF press release, the company introduced Emulgade® Verde 10 OL, a cold-processable emulsifier aimed at reducing energy use in food and personal care formulations. Hydrosol, as highlighted on its website, is providing modular stabilizer systems tailored for the dairy, meat, and plant-based sectors to improve texture and product consistency. Palsgaard, as per its official platform, is delivering emulsifier-stabilizer blends for plant-based yogurts, drinks, and desserts, supporting texture and shelf-life demands.

| Report Attributes | Details |

|---|---|

| Current Market Size (2025) | USD 2.5 billion |

| Projected Market Size (2035) | USD 3.8 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Product Types Analyzed | Pectin, Gelatin, Carrageenan, Xanthan Gum, Guar Gum, Others |

| Functions Analyzed | Stability, Texture, Moisture Retention |

| Applications Analyzed | Bakery, Confectionery, Dairy Product, Sauce and Dressing, Beverage and Convenience Food, Meat and Poultry Products |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa (MEA) |

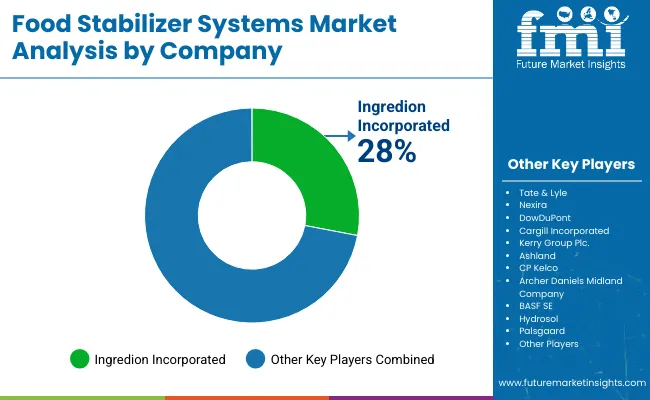

| Key Companies Profiled | Ingredion Incorporated, Tate & Lyle, Nexira, DowDuPont, Cargill Incorporated, Kerry Group Plc, Ashland, CP Kelco, ADM, BASF SE, Hydrosol, Palsgaard |

| Additional Attributes | Pricing Trends, Regulatory Framework, Supply Chain Overview, Innovation Landscape, Consumer Behavior Analysis |

By product type, the market is categorized into Pectin, Gelatin, Carrageenan, Xanthan Gum, Guar Gum, and Others.

By function, the market is categorized into Texturizing, Stabilizing, Moisture Retention, and Others.

By application, the market is categorized into Bakery, Dairy, Beverages, Sauces & Dressings, Confectionery, and Processed Food.

By region, the market is geographically segmented into North America, Latin America, Europe, East Asia, South Asia & Oceania, and Middle East & Africa.

The market is projected to reach USD 2.5 billion in 2025.

The food stabilizer systems market is expected to reach USD 3.8 billion by 2035.

The bakery segment dominates the market in terms of application.

The USA, UK, China, India, and Germany are the top countries driving market demand.

Ingredion, Tate & Lyle, Nexira, DowDuPont, Cargill, Kerry Group, Ashland, CP Kelco, Archer Daniels Midland Company, BASF SE, Hydrosol, and Palsgaard are among the leading players in this space.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Functions, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Functions, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast By Applications, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast By Applications, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Functions, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Functions, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast By Applications, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast By Applications, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Functions, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Functions, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast By Applications, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast By Applications, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Functions, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Functions, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast By Applications, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast By Applications, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Functions, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Functions, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast By Applications, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast By Applications, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Functions, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Functions, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast By Applications, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast By Applications, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Functions, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Functions, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast By Applications, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast By Applications, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Functions, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Functions, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast By Applications, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast By Applications, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Functions, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by By Applications, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Functions, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Functions, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Functions, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Functions, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by By Applications, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by By Applications, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by By Applications, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by By Applications, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Functions, 2023 to 2033

Figure 23: Global Market Attractiveness by By Applications, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Functions, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by By Applications, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Functions, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Functions, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Functions, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Functions, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by By Applications, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by By Applications, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by By Applications, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by By Applications, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Functions, 2023 to 2033

Figure 47: North America Market Attractiveness by By Applications, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Functions, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by By Applications, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Functions, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Functions, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Functions, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Functions, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by By Applications, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by By Applications, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by By Applications, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by By Applications, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Functions, 2023 to 2033

Figure 71: Latin America Market Attractiveness by By Applications, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Functions, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by By Applications, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Functions, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Functions, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Functions, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Functions, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by By Applications, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by By Applications, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by By Applications, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by By Applications, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Functions, 2023 to 2033

Figure 95: Europe Market Attractiveness by By Applications, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Functions, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by By Applications, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Functions, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Functions, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Functions, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Functions, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by By Applications, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by By Applications, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by By Applications, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by By Applications, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Functions, 2023 to 2033

Figure 119: East Asia Market Attractiveness by By Applications, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Functions, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by By Applications, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Functions, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Functions, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Functions, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Functions, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by By Applications, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by By Applications, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by By Applications, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by By Applications, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Functions, 2023 to 2033

Figure 143: South Asia Market Attractiveness by By Applications, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Functions, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by By Applications, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Functions, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Functions, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Functions, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Functions, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by By Applications, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by By Applications, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by By Applications, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by By Applications, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Functions, 2023 to 2033

Figure 167: Oceania Market Attractiveness by By Applications, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Functions, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by By Applications, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Functions, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Functions, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Functions, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Functions, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by By Applications, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by By Applications, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by By Applications, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by By Applications, 2023 to 2033

Figure 189: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Functions, 2023 to 2033

Figure 191: MEA Market Attractiveness by By Applications, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA