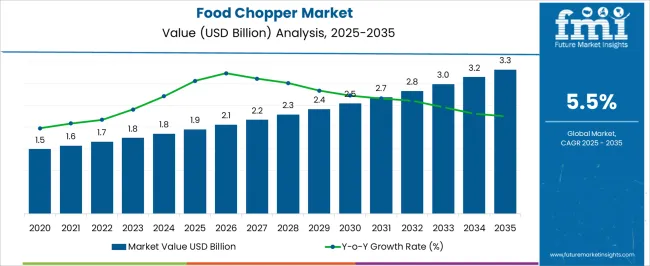

The food chopper market is projected to grow steadily from USD 1.9 billion in 2025 to approximately USD 3.3 billion by 2035, expanding at a CAGR of 5.5% during the forecast period. Between 2025 and 2029, the market expands from USD 1.9 billion to USD 2.4 billion, driven by increasing consumer demand for convenient kitchen appliances that save preparation time and enhance cooking efficiency.

This phase benefits from the growing popularity of home cooking, rising adoption of compact and multifunctional appliances, and product innovations that incorporate advanced blade technology and ergonomic designs. From 2030 to 2034, the market advances from USD 2.5 billion to USD 3.0 billion, supported by expanding online retail channels, rising disposable incomes in emerging markets, and product diversification into electric and battery-powered models catering to varied consumer needs.

Enhanced safety features, durability improvements, and the integration of smart controls further strengthen market adoption during this period. By 2035, the market reaches USD 3.3 billion, fueled by sustained interest in premium and professional-grade food choppers, increased penetration in small commercial kitchens, and ongoing product upgrades. Overall, the food chopper market is set for consistent growth, underpinned by lifestyle changes, innovation in design and functionality, and the steady expansion of distribution networks worldwide.

| Metric | Value |

|---|---|

| Food Chopper Market Estimated Value in (2025 E) | USD 1.9 billion |

| Food Chopper Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The food chopper market is witnessing strong momentum, fueled by shifting consumer lifestyles, rising demand for convenience-based cooking tools, and increased focus on kitchen automation. Urbanization and dual-income households have elevated the need for compact, efficient appliances that reduce food prep time without compromising performance.

Continued innovation in blade design, motor efficiency, and multi-functionality is enhancing user satisfaction and extending product lifespans. Manufacturers are also introducing safety-first features and ergonomically designed choppers to align with family usage patterns.

The growing influence of digital retail platforms and home cooking trends accelerated by health consciousness and social media exposure are expanding consumer access and product visibility. As sustainability and recyclability become central to purchase decisions, brands are increasingly investing in material innovation and modular designs, strengthening long-term market adoption across both residential and commercial kitchens.

The food chopper market is segmented by product type, material, capacity, distribution channel, and region. By product type, the market is divided into electric food choppers and manual food choppers. In terms of material, it is classified into plastic, stainless steel, and glass. Based on capacity, the market is segmented into small, medium, and large. By distribution channel, it is divided into offline and online sales. Regionally, the food chopper industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

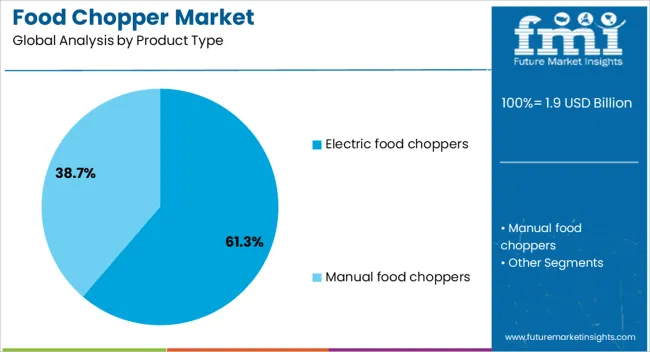

Electric food choppers are expected to account for 61.30% of the total revenue in 2025, establishing them as the dominant product type. Their widespread use is being attributed to efficiency in handling repetitive chopping tasks, compact design suited for small kitchens, and growing affordability across emerging economies.

These devices reduce manual effort and are often equipped with safety locks, interchangeable blades, and multi-speed settings features that enhance their utility in everyday cooking. The rise in home-cooked meal preparation, especially in health-conscious demographics, is further increasing adoption.

Additionally, advancements in cordless and rechargeable variants are driving preference among younger, tech-savvy consumers looking for portable yet powerful food processing tools.

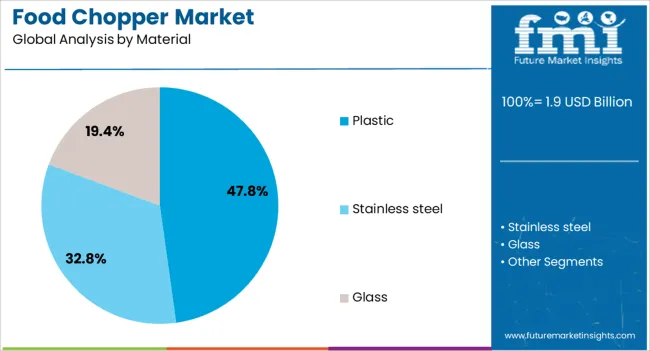

Plastic is projected to hold 47.80% of the market share by 2025, making it the most widely used material in food chopper construction. This leadership is driven by its lightweight nature, ease of molding into diverse designs, and cost-efficiency during mass production.

BPA-free and food-grade plastic options are addressing consumer safety concerns while maintaining visual appeal through transparent or tinted finishes. Plastic housings and bowls are also shatter-resistant and dishwasher-safe, supporting the modern kitchen’s demand for practicality and convenience.

Its compatibility with electric motor systems and ability to integrate non-slip bases make it an ideal choice for manufacturers aiming to balance durability with affordability.

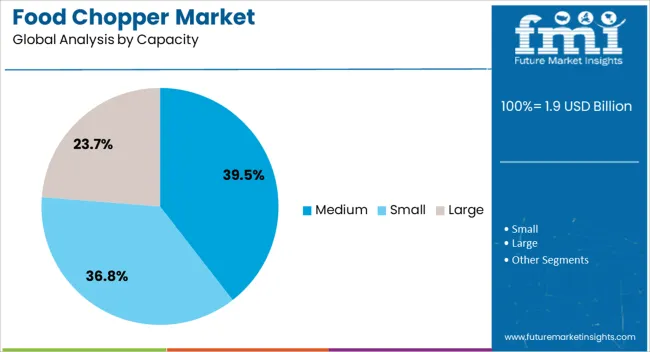

Medium-capacity food choppers are expected to capture 39.50% of market revenue in 2025, making them the preferred size segment among consumers. Their popularity stems from their versatility in handling everyday portions suited for small to medium families.

This segment effectively bridges the gap between low-capacity units used for herbs or spices and large, space-consuming appliances meant for batch cooking. Medium choppers provide the optimal balance between size, storage ease, and food volume handled, making them ideal for regular household meal prep.

Consumers are increasingly opting for compact units that do not compromise on motor power or blade performance, supporting the continued demand for mid-range capacity appliances across global markets.

The food chopper segment is being shaped by multi-functionality, changing cooking habits, digital retail expansion, and user-centric product design. These factors collectively drive both consumer engagement and competitive differentiation.

The increasing preference for appliances that combine multiple functions such as chopping, slicing, and grinding is influencing product development in the food chopper segment. Consumers in both residential and commercial kitchens are seeking compact solutions that save space and reduce preparation time. This demand is prompting manufacturers to integrate detachable components, multiple blade types, and variable speed settings in their designs. The segment is also benefiting from the shift toward easy-to-clean appliances with dishwasher-safe parts. Enhanced safety mechanisms, including non-slip bases and lockable lids, are also gaining traction. Multi-functionality is expected to remain a central factor in purchasing decisions, particularly in urban households and small-scale food service establishments.

Changing meal preparation habits, influenced by busy lifestyles and interest in home cooking, are driving the adoption of food choppers. As consumers look to prepare fresh ingredients quickly, compact electric and manual models are finding increasing acceptance. Growth in home-based food businesses is also contributing to higher sales volumes. Marketing strategies highlighting convenience, time-saving benefits, and healthy cooking preparation are resonating strongly with buyers. Manufacturers are capitalizing on these trends by offering targeted product ranges that appeal to different user groups, from entry-level manual choppers to high-capacity electric models. This shift in consumer preferences is reshaping the competitive dynamics within the kitchen appliance category.

E-commerce platforms are playing a significant role in the food chopper market, enabling wider distribution and exposure for both established brands and emerging players. Consumers are increasingly relying on online reviews, product videos, and detailed specifications to make informed purchases. Competitive pricing strategies and exclusive online offers are boosting sales volumes. Cross-border e-commerce is also allowing regional brands to enter international markets without significant infrastructure investments. Subscription-based purchase options and bundled deals with complementary kitchen tools are expanding customer engagement. This growing digital channel is expected to outpace traditional retail in sales growth, driven by convenience, price competitiveness, and extensive product variety.

Design improvements that enhance ease of use and ergonomics are becoming major differentiators in the food chopper category. Lightweight construction, reduced noise levels, and intuitive controls are increasingly valued by end users. Manufacturers are investing in research to develop sharper, longer-lasting blades that maintain performance over extended use. Innovations in storage-friendly designs, such as collapsible or stackable units, are addressing consumer needs for space efficiency. The introduction of attractive color options and modern finishes is also influencing purchasing decisions, particularly among younger consumers. As kitchen aesthetics become a consideration in appliance purchases, design-driven innovation is expected to gain even greater prominence.

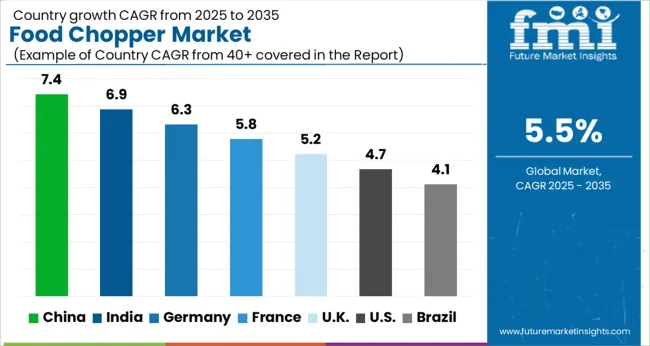

The food chopper market is projected to grow at a global CAGR of 5.5% between 2025 and 2035, driven by evolving consumer lifestyles, rising demand for convenient food preparation tools, and continuous product innovations in both manual and electric segments. China leads with a CAGR of 7.4%, fueled by the rapid growth of domestic appliance manufacturing, expansion of e-commerce channels, and increasing penetration of multifunctional kitchen devices. India follows at 6.9%, supported by rising middle-class consumption, kitchen modernization trends, and growth in organized retail.

France records 5.8%, shaped by demand for premium kitchen appliances, culinary culture, and compact electric solutions. The United Kingdom achieves 5.2%, benefiting from a growing inclination toward quick meal preparation and adoption of smart kitchen appliances, while the United States posts 4.7%, influenced by mature market dynamics, steady household replacement cycles, and high competition among domestic and global brands. This analysis incorporates insights from multiple regions, highlighting how these countries define key benchmarks for product design, distribution models, and competitive strategies that are expected to influence the food chopper industry’s long-term expansion.

Between 2020 and 2024, the CAGR for the China food chopper market averaged around 6.1%, supported by gradual lifestyle shifts and steady uptake of multifunctional appliances. From 2025 to 2035, the growth rate rises to 7.4%, reflecting broader e-commerce penetration, product upgrades with compact designs, and increasing adoption among smaller households. The faster pace in the latter period is attributed to a rising middle-income base and competitive local manufacturing driving down retail prices. Domestic brands have leveraged direct-to-consumer models, improving reach across tier-2 and tier-3 cities, while partnerships with online grocery platforms have expanded usage beyond urban hubs.

The India food chopper market posted a CAGR of roughly 5.8% during 2020–2024, driven by rising kitchen appliance adoption in metro cities and steady rural penetration through low-cost models. In the 2025–2035 period, the CAGR climbs to 6.9%, reflecting rapid modernization in household kitchens, expansion of organized retail, and increasing brand competition. This acceleration is strongly linked to aggressive discounting during festive seasons, improved after-sales service, and growth in the working population seeking quick meal preparation tools. Domestic and international brands are expanding their presence in tier-2 cities with affordable, high-durability models.

France recorded a CAGR of about 4.6% between 2020 and 2024, influenced by stable consumer demand in the premium kitchen appliance category. For 2025–2035, the growth rate advances to 5.8%, driven by an appetite for compact and multifunctional devices among urban consumers. This jump is backed by increased marketing of mid-range electric choppers and a growing preference for products with energy efficiency features. Consumer demand is also shaped by cooking culture, driving consistent replacement cycles for high-quality appliances. Retail expansion and online availability of international brands have improved accessibility across regions.

The UK food chopper market registered a CAGR of around 4.3% during 2020–2024, primarily driven by steady replacement demand and limited category innovation. This rate is projected to increase to 5.2% from 2025–2035, factoring in the global CAGR of 5.5% and growing consumer inclination toward time-saving kitchen tools. The improvement is linked to an expanding base of single-person households, the influence of cooking shows on appliance adoption, and stronger e-commerce discount campaigns. Brand strategies have shifted toward smart and multifunctional choppers catering to compact kitchens, with better warranty coverage boosting consumer trust.

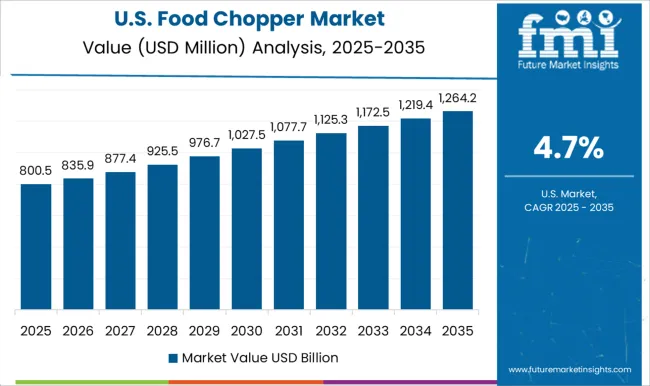

The USA food chopper market achieved a CAGR of approximately 3.9% from 2020 to 2024, reflecting maturity in the category with slow replacement cycles. Between 2025 and 2035, the CAGR rises to 4.7%, supported by shifts toward compact, multifunctional, and design-oriented models. Growth is aided by niche segments such as health-focused meal prep tools, rising popularity of subscription meal kits, and the influence of influencer-driven product recommendations. Premium brands are focusing on stainless steel durability and low-noise performance, while mass-market players are adopting bundled kitchen appliance packages.

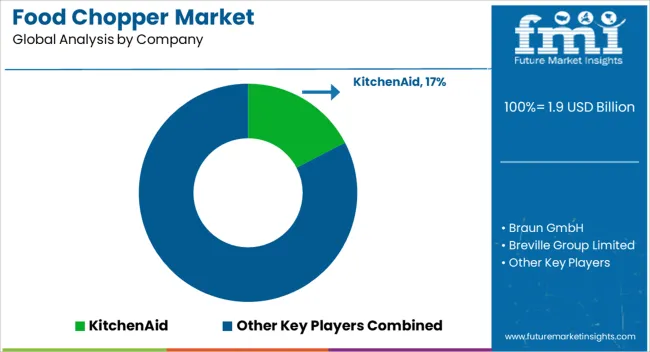

The food chopper market features intense competition among global kitchen appliance brands and specialized manufacturers focusing on convenience, functionality, and design innovation. KitchenAid maintains strong brand loyalty through premium multifunctional choppers catering to both home and professional kitchens. Braun GmbH emphasizes ergonomic designs and high-performance blades to capture health-conscious consumers seeking efficiency. Breville Group Limited targets the premium segment with technologically advanced and durable products.

Cuisinart leverages a broad product portfolio and competitive pricing to strengthen its market reach. Groupe SEB (Moulinex) capitalizes on its international distribution network to expand in emerging and developed markets. Hamilton Beach Brands, Inc. appeals to value-driven customers with versatile and affordable options, while Koninklijke Philips N.V. integrates energy efficiency and safety features into its designs. Magimix commands a premium positioning with French-engineered quality and robust build.

OXO International Ltd. focuses on user-friendly designs and compact form factors for space-conscious buyers. Preethi Kitchen Appliances Pvt Ltd leads in the Indian market by blending local culinary needs with modern performance. Proctor Silex Co., Inc. targets budget-conscious households with reliable, entry-level models. SharkNinja Operating LLC gains traction with multifunctional systems combining chopping, blending, and food processing capabilities. Stanley Black & Decker, Inc. benefits from its brand strength and retail presence across multiple regions.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product Type | Electric food choppers and Manual food choppers |

| Material | Plastic, Stainless steel, and Glass |

| Capacity | Medium, Small, and Large |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | KitchenAid, Braun GmbH, Breville Group Limited, Cuisinart, Groupe SEB (Moulinex), Hamilton Beach Brands, Inc., Koninklijke Philips N.V., Magimix, OXO International Ltd., Preethi Kitchen Appliances Pvt Ltd, Proctor Silex Co., Inc., SharkNinja Operating LLC, Stanley Black & Decker, Inc., Tupperware Brands Corporation, and Zyliss USA |

| Additional Attributes | Dollar sales, share, competitive landscape, growth rate by region, product segmentation trends, consumer demographics, pricing benchmarks, channel performance, innovation pipeline, regulatory changes, import-export data, investment opportunities, and key risks. |

The global food chopper market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the food chopper market is projected to reach USD 3.3 billion by 2035.

The food chopper market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in food chopper market are electric food choppers and manual food choppers.

In terms of material, plastic segment to command 47.8% share in the food chopper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA