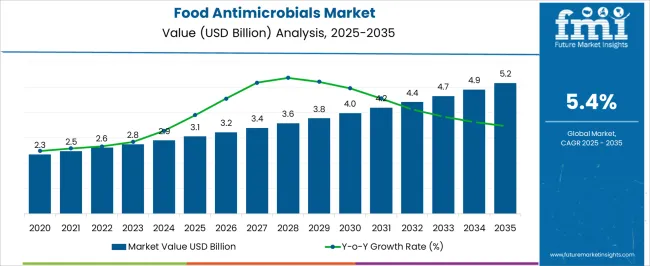

The Food Antimicrobials Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. The initial phase, from 2020 to 2025, shows the market increasing from USD 2.3 billion to USD 2.9 billion, driven by heightened consumer focus on food safety, demand for extended shelf life, and a shift toward natural preservation solutions. This period reflects growing awareness of foodborne pathogens, stricter regulatory mandates on food quality, and wider application of both natural and synthetic antimicrobials across food processing and packaging sectors.

The preference for clean-label products with minimal synthetic additives further supports market expansion. Between 2026 and 2030, the market gains momentum, advancing from USD 3.1 billion to USD 3.8 billion. This phase benefits from innovations in antimicrobial formulations that enhance efficacy and broaden application in dairy, meat, beverages, and processed foods. Increasing adoption of plant-based and bio-preservatives aligns with rising consumer interest in health and wellness, while advancements in delivery and controlled release technologies improve performance and acceptance.

Emerging economies contribute substantially to growth due to rising incomes and urbanization. From 2031 to 2035, the market surges from USD 4.0 billion to USD 5.2 billion, reflecting integration with active packaging and smart preservation systems. Technological progress, regulatory harmonization, and collaboration between food manufacturers and biotech firms stimulate expansion. Overall, the food antimicrobials market is poised for sustained growth, propelled by evolving consumer preferences, regulatory support, and continuous innovation in food safety.

| Metric | Value |

|---|---|

| Food Antimicrobials Market Estimated Value in (2025 E) | USD 3.1 billion |

| Food Antimicrobials Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The food antimicrobials market is expanding steadily, driven by heightened awareness around food safety, clean-label trends, and the need to extend shelf life without synthetic preservatives. Increasing global concerns over foodborne illnesses and spoilage have led manufacturers to seek effective, compliant antimicrobial solutions across multiple categories.

Regulatory bodies are reinforcing safer food handling practices and promoting natural additive alternatives, encouraging innovation in both formulation and delivery. Additionally, advancements in bio-based ingredients and the integration of antimicrobial systems in packaging technologies have elevated the relevance of these solutions in modern food supply chains.

Future market momentum is expected to be supported by the convergence of consumer preferences for minimally processed foods and the food industry’s pursuit of efficiency, transparency, and product longevity.

The food antimicrobials market is segmented by form, type, application, and geographic regions. The food antimicrobials market is divided into Liquid, Powder, and Others. In terms of the type of food, the antimicrobials market is classified into Natural, nature-identical, and Synthetic. Based on the application, the food antimicrobials market is segmented into Meat and poultry, Bakery and confectionery, Dairy and frozen desserts, Beverages, Snacks, and Others. Regionally, the food antimicrobials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

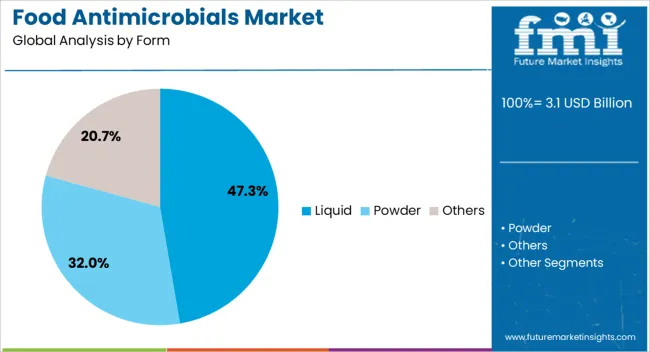

Liquid antimicrobials are projected to account for 47.30% of the total market revenue in 2025, positioning them as the dominant form segment. This leadership is attributed to their ease of integration into processing lines and superior dispersion capabilities in food matrices.

Liquid formats have demonstrated consistent efficacy in coating, dipping, and spraying applications, making them suitable for perishable food categories. Their adaptability in automated systems and compatibility with multi-phase formulations have encouraged widespread adoption across meat, dairy, and beverage sectors.

Moreover, liquid antimicrobials often require fewer processing steps during production, resulting in reduced operational complexity and cost. These advantages have led food manufacturers to favor liquid solutions for real-time, scalable antimicrobial interventions.

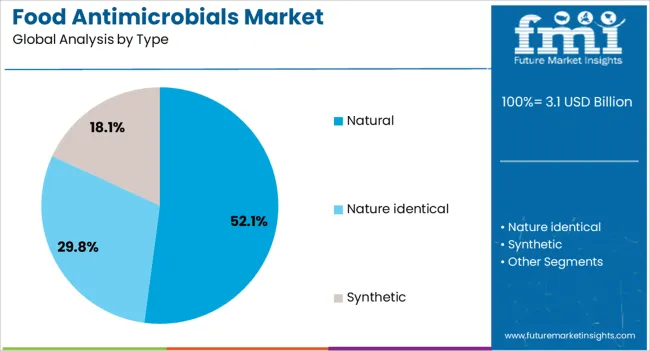

Natural antimicrobials are expected to represent 52.10% of market revenues in 2025, making them the leading segment by type. This growth is being driven by rising consumer skepticism around synthetic preservatives and increasing demand for transparent, clean-label ingredient declarations.

Plant-based extracts, essential oils, and microbial-derived compounds have gained regulatory acceptance and industry trust for their safety and effectiveness. Natural antimicrobials align with the growing popularity of organic and minimally processed foods, reinforcing their inclusion in reformulated product lines.

Additionally, as food brands aim to differentiate through health-driven messaging, natural preservatives are being adopted as a competitive advantage. Their strong perception among health-conscious consumers continues to support their growing share in both mainstream and specialty food categories.

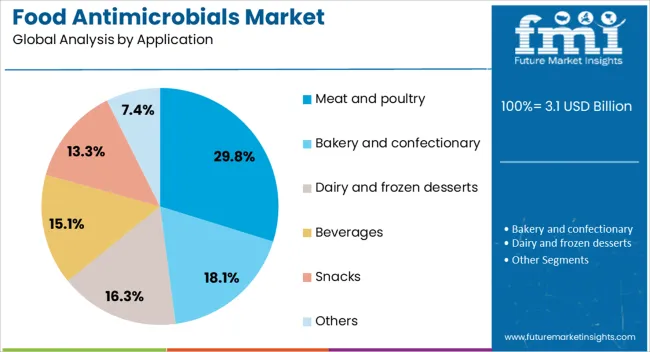

Meat and poultry applications are projected to account for 29.80% of the food antimicrobials market by 2025, making this the top application area. This leadership is a result of the high perishability and microbial sensitivity of meat-based products, which necessitate effective microbial control throughout processing and distribution.

Antimicrobials are used to reduce spoilage organisms and pathogens, extending shelf life while complying with strict food safety regulations. Increased global consumption of ready-to-eat and processed meat products has further amplified the need for reliable antimicrobial systems.

Integration of antimicrobials into marinades, surface treatments, and packaging films has also contributed to their widespread adoption in this segment. As demand for protein-rich diets rises, ensuring microbiological safety in meat and poultry continues to be a top priority for processors and regulators alike.

Food antimicrobials are driven by the need for shelf life extension, clean-label adoption, regulatory compliance, and improved application technologies. These factors are shaping market strategies and expanding their role in global food processing.

The need to maintain product quality over longer storage and distribution periods is a primary driver for the food antimicrobials market. Growing trade in perishable products and the expansion of modern retail networks require solutions that delay spoilage without altering taste or texture. Food antimicrobials play a key role in preserving freshness in meat, dairy, bakery, and beverage products, which are most susceptible to microbial contamination. This demand is reinforced by evolving consumer preferences for convenience-oriented products that remain safe for consumption over extended timelines. As a result, manufacturers are increasingly integrating antimicrobials into both conventional and premium product lines to ensure consistent quality and reduce waste during transportation and retail display.

The market is witnessing a strong shift toward natural and plant-based antimicrobial ingredients, driven by rising consumer scrutiny of synthetic additives. Extracts from herbs, spices, and fermentation processes are gaining acceptance for their functional benefits and market appeal. Clean-label positioning has become a critical factor for manufacturers looking to differentiate in competitive retail environments. This shift has encouraged investment in ingredient research to develop formulations that combine efficacy with minimal sensory impact. Natural antimicrobials are increasingly applied in premium and health-oriented product segments, helping brands target consumers who prioritize ingredient transparency alongside food safety. The trend is reshaping formulation strategies across multiple product categories.

Strict food safety regulations across global markets are influencing the adoption of antimicrobials as part of standardized quality control systems. Compliance with standards such as HACCP, Codex Alimentarius, and regional legislation requires proven solutions to control microbial risks. Food processors are investing in validated antimicrobial systems that meet both safety and labeling requirements. Regulatory oversight is particularly strong in meat, seafood, and dairy processing facilities, where contamination risks are highest. This has led to greater emphasis on documentation, testing, and traceability in antimicrobial application. Companies that can align their offerings with evolving legal frameworks stand to strengthen customer relationships and secure access to export-oriented markets.

Advancements in antimicrobial delivery methods are improving their efficiency and compatibility with diverse food products. Encapsulation technologies, active packaging, and controlled-release systems are enabling more precise application, reducing dosage requirements while maintaining efficacy. These methods are particularly valuable in products with complex compositions, where direct addition of antimicrobials might affect flavor or texture. Tailored application systems also support multi-functional benefits, such as moisture control or antioxidant effects, alongside microbial inhibition. As production processes evolve, suppliers are developing adaptable solutions that integrate seamlessly into existing manufacturing lines. This focus on application efficiency is helping manufacturers improve operational consistency and product performance in competitive markets.

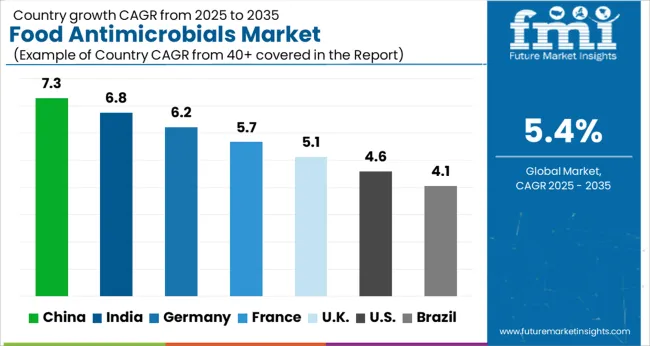

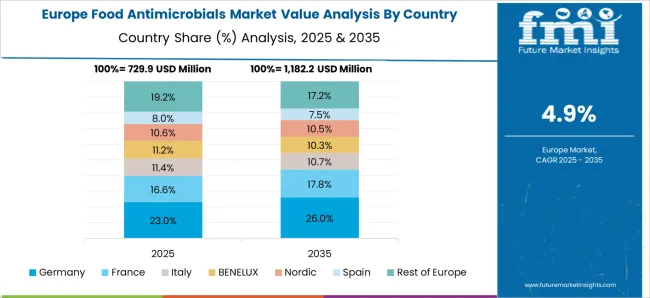

The food antimicrobials market is projected to grow at a global CAGR of 5.4% from 2025 to 2035, driven by increasing demand for food safety, longer shelf life, and rising consumer preference for natural preservatives. China leads with a CAGR of 7.3%, driven by rapid urbanization, increased food production, and growing concerns over foodborne illnesses. India follows at 6.8%, fueled by the expanding food processing sector, rising awareness about food safety, and government regulations promoting food quality standards. France grows at 5.7%, influenced by the increasing adoption of natural food preservatives in line with health-conscious consumer trends. The United Kingdom achieves 5.1%, supported by strong demand for antimicrobial solutions in meat, dairy, and beverage sectors. The United States records 4.6%, shaped by regulatory compliance in food safety standards and the growing trend toward clean-label and organic products. This analysis highlights the significant role of regulatory frameworks, consumer preferences, and technological advancements in driving the global growth of food antimicrobials.

The CAGR for the food antimicrobials market in the United Kingdom was around 4.1% during 2020–2024 and is projected to rise to 5.1% during 2025–2035. The initial growth during 2020–2024 was relatively slower due to moderate adoption of food safety solutions and regulatory challenges. However, the upward trend in the next decade is supported by increasing demand for longer shelf life, higher awareness of food safety among consumers, and the growing use of natural antimicrobials in clean-label products. The strong growth is further reinforced by rising consumer preference for organic and minimally processed foods. Additionally, stricter regulations regarding food safety and quality standards are expected to drive the adoption of food antimicrobials, making it a more mainstream solution in food processing.

China is expected to experience a CAGR of 7.3% during 2025–2035, significantly surpassing the global average of 5.4%. The market grew at a CAGR of 6.2% during 2020–2024, driven by rapid industrialization, expansion in the food processing sector, and growing concerns over foodborne illnesses. The acceleration in growth for the coming decade is attributed to China's expanding food safety regulations, increased urbanization, and rising middle-class demand for safe, high-quality food. Investments in the food supply chain, alongside the integration of natural preservatives and antimicrobial agents in packaging, will significantly contribute to the market’s growth.

India’s food antimicrobials market is projected to grow at a CAGR of 6.8% from 2025 to 2035, above the global average of 5.4%. The market grew at 5.2% during 2020–2024, driven by increasing food safety awareness, growth in the food processing industry, and rising demand for preservatives in packaged foods. The anticipated acceleration is linked to greater emphasis on food quality and safety, especially in the rapidly expanding retail and food service industries. Government initiatives for food safety and hygiene, coupled with an increasing inclination toward natural food preservatives, will further boost demand for food antimicrobials.

France’s food antimicrobials market is expected to achieve a CAGR of 5.7% during 2025–2035. The market grew at 4.9% during 2020–2024, driven by the shift toward natural preservatives and increasing concerns regarding food safety and sustainability. France’s focus on clean-label products, along with consumer preference for organic and minimally processed foods, is fueling the demand for antimicrobial solutions. The rising popularity of organic foods, alongside stricter food safety regulations in Europe, is expected to enhance the use of antimicrobials in food products, especially in meats, dairy, and beverages.

The USA food antimicrobials market is projected to grow at a CAGR of 4.6% during 2025-2035. The market grew at a CAGR of 4.0% during 2020–2024, driven by steady demand for food safety solutions and preservatives. In the next decade, the adoption of food antimicrobials is expected to accelerate due to increasing consumer demand for longer shelf life, greater food safety awareness, and the growing trend toward natural, clean-label products. The USA regulatory environment, which mandates strict food safety standards, will continue to promote the use of antimicrobials in food preservation, especially in packaged and perishable goods.

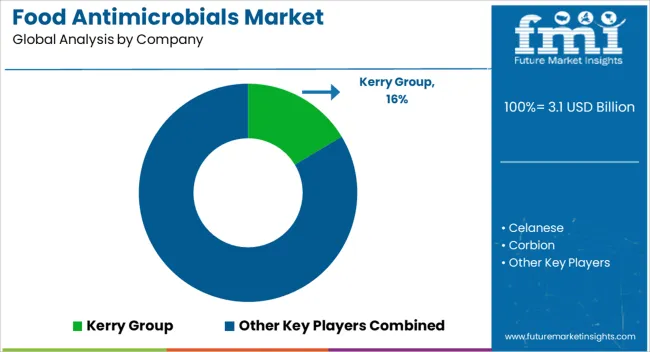

The food antimicrobials market is highly competitive, with global ingredient manufacturers and specialized solution providers addressing preservation, safety, and shelf-life extension needs across diverse food categories. Kerry Group leverages its extensive food science expertise to deliver natural and clean-label antimicrobial systems for bakery, dairy, and ready-to-eat products. Celanese focuses on engineered antimicrobial ingredients that integrate seamlessly into large-scale food processing.

Corbion stands out for its lactic acid-based solutions, catering to meat, poultry, and plant-based product safety. DSM-Firmenich combines biotechnology and flavor expertise to create multifunctional antimicrobials with sensory compatibility. Eastman develops functional ingredients and delivery systems that enhance preservation efficiency. Galactic specializes in organic acid-based antimicrobials targeting meat and beverage applications. International Flavors & Fragrances (IFF) integrates preservation with flavor systems for synergistic product performance. Jungbunzlauer delivers bio-based antimicrobials derived from fermentation, appealing to clean-label demands. Kalsec emphasizes spice- and herb-based solutions for natural preservation. Mitsubishi Chemical provides high-purity chemical preservatives for global industrial food production. Novonesis focuses on microbial control through enzyme and fermentation technologies, serving dairy and fermentation-driven foods. Competitive strategies center on clean-label innovation, targeted applications, regional compliance alignment, and partnerships with food processors to optimize preservation performance while meeting evolving consumer and regulatory expectations.

DSM, a global leader in food ingredients, has been focusing on developing natural antimicrobial solutions for the food industry, particularly in the form of plant-based preservatives. The company offers a range of products for the dairy, meat, and beverage industries, leveraging its expertise in enzymes, nutraceuticals, and bio-based chemicals.

Ecolab provides antimicrobial solutions primarily focused on food safety, sanitation, and disinfection in the food processing and foodservice sectors. Their offerings include antimicrobial washes, surface sanitizers, and water treatment chemicals that help prevent foodborne pathogens from contaminating products during processing.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Form | Liquid, Powder, and Others |

| Type | Natural, Nature identical, and Synthetic |

| Application | Meat and poultry, Bakery and confectionary, Dairy and frozen desserts, Beverages, Snacks, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kerry Group, Celanese, Corbion, Dsm-firmenich, Eastman, Galactic, International Flavors & Fragrances, Jungbunzlauer, Kalsec, Mitsubishi Chemical, and Novonesis |

| Additional Attributes | Dollar sales, share, regional demand trends, regulatory landscape, competitive benchmarking, ingredient innovation pipeline, end-use sector growth, pricing analysis, distribution channels, customer preferences, emerging clean-label opportunities. |

The global food antimicrobials market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the food antimicrobials market is projected to reach USD 5.2 billion by 2035.

The food antimicrobials market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in food antimicrobials market are liquid, powder and others.

In terms of type, natural segment to command 52.1% share in the food antimicrobials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA