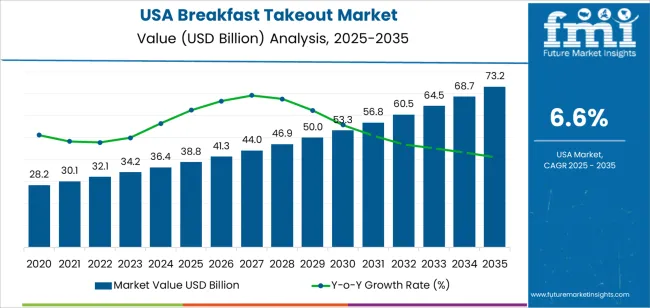

The demand for breakfast takeout in the USA is projected to grow from USD 38.8 billion in 2025 to USD 73.2 billion by 2035, reflecting a CAGR of 6.6%. Breakfast takeout refers to the growing consumer preference for convenient, on-the-go meal options during the morning rush. This trend is largely driven by busy lifestyles, increased demand for convenience, and the rise of online food delivery platforms that make it easier for consumers to access quick breakfast options. Popular items such as coffee, sandwiches, smoothies, and breakfast bowls are increasingly being offered by both traditional fast food chains and new entrants in the food delivery market.

The demand for breakfast takeout is also fueled by changes in consumer behavior and the expansion of digital ordering platforms, which allow for increased accessibility and convenience. As more people seek healthier, high-protein, or customizable breakfast options, food establishments are innovating to meet these needs. The growing emphasis on personalization and nutritional value in takeout options will further contribute to market expansion as breakfast takeout becomes an integral part of daily consumer habits.

From 2025 to 2030, the demand for breakfast takeout in the USA will grow from USD 38.8 billion to USD 53.3 billion, contributing USD 14.5 billion in value. During this early phase, the market will experience moderate volatility, driven by increased adoption of delivery platforms and the expansion of breakfast options in quick-service restaurants (QSRs) and fast casual eateries. The growth will be fueled by the continued shift towards convenience, as consumers increasingly choose takeout options due to busy work schedules and changing eating habits. Competition among restaurants and market trends such as the growing demand for healthy breakfast alternatives will influence market performance during this period.

From 2030 to 2035, the market will grow from USD 53.3 billion to USD 73.2 billion, adding USD 19.9 billion in value. The market will see reduced volatility in this phase, as the demand for breakfast takeout stabilizes and matures, becoming a mainstream offering in food service. However, growth will continue, driven by technological advancements in food delivery systems, personalized menu options, and the growing focus on nutritional value. As the market becomes more established, the growth rate will moderate, with price competition and consumer loyalty becoming key drivers of market expansion.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 38.8 billion |

| Industry Forecast Value (2035) | USD 73.2 billion |

| Industry Forecast CAGR (2025-2035) | 6.6% |

Demand for breakfast takeout in the USA is growing as consumers seek convenient, ready to eat morning meals amid busy lifestyles and increasing dependency on coffee shops, fast food outlets and delivery services. The breakfast takeout sector was valued at roughly USD 109.6 billion in 2025 and is projected to reach about USD 213.7 billion by 2035, indicating a compound annual growth rate (CAGR) near 6.9 %. This growth reflects heightened demand for mobile ordering, app based pickup, and expanded breakfast menu hours.

Another factor supporting this growth is the shift in consumer preferences toward healthier, protein rich, plant based and portable breakfast options tailored to time pressured professionals and urban households. In addition, innovations in packaging, delivery infrastructure and menu variety (such as breakfast bowls, sandwich wraps and smoothie options) enhance accessibility and impulse purchase appeal. At the same time, challenges include ingredient cost inflation, labour shortages in foodservice operations and competition from at home breakfast consumption. Despite these constraints, the structural trend of increasing takeout demand in morning meal occasions suggests continued robust growth in the breakfast takeout market in the USA.

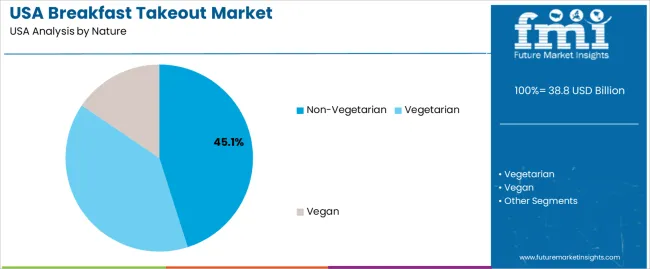

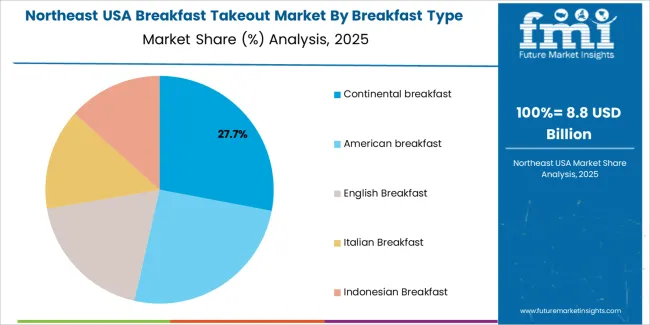

The demand for breakfast takeout in the USA is driven by nature and breakfast type. The leading nature of breakfast takeout is non-vegetarian, accounting for 45% of the market share, while continental breakfast leads in the breakfast type category, capturing 28.7% of the demand. As consumer preferences for convenience and variety continue to rise, breakfast takeout has become a popular option for busy mornings, with diverse offerings to cater to different dietary preferences.

Non-vegetarian breakfasts lead the demand for breakfast takeout in the USA, holding 45% of the market share. Non-vegetarian options such as breakfast sandwiches, egg dishes with bacon or sausage, and breakfast burritos are among the most popular choices for takeout. These dishes offer a combination of protein-rich ingredients that are appealing to a broad customer base, particularly those seeking filling and energizing morning meals.

The demand for non-vegetarian breakfast takeout is driven by the widespread popularity of traditional American breakfast foods, which often include meat-based items. Additionally, non-vegetarian breakfasts tend to have higher levels of consumer satisfaction in terms of taste and variety, making them a top choice for busy individuals who want a satisfying meal on the go. As convenience and speed remain top priorities, non-vegetarian breakfast options are expected to continue to lead in the takeout segment.

Continental breakfast is the leading breakfast type for takeout in the USA, capturing 28.7% of the demand. Continental breakfasts typically consist of lighter fare such as pastries, breads, fruits, yogurt, and coffee, offering a quick and convenient option for those seeking a lighter start to their day. This type of breakfast is particularly popular in urban areas, where consumers may prefer quick, easy-to-eat options while commuting or running errands.

The demand for continental breakfasts is driven by the growing trend of healthier, lighter meal choices and the increasing preference for quick, easy-to-prepare options that do not require extensive preparation. Continental breakfast takeout appeals to those who want a more balanced and less heavy meal in the morning, especially in contrast to heavier, protein-rich options. With the ongoing focus on health and convenience, continental breakfasts are expected to maintain their popularity in the breakfast takeout market.

Demand for breakfast take out in the USA is shaped by busy morning routines, increased engagement with digital ordering and the growth of quick service restaurants offering portable breakfast meals. Consumers increasingly seek convenience in early hours, driving take out and delivery options. At the same time, inflationary pressures, higher input costs in ingredients and evolving food service competition moderate growth. These contrasting forces together define how the market for breakfast take out evolves by value and volume.

Multiple factors support growth. First, rising participation of mobile ordering and food delivery platforms makes breakfast items more accessible on the go. Second, both full service and quick service chains are expanding breakfast menus and promotional campaigns to capture morning occasions. Third, changing workplace patterns and commuter behaviours elevate demand for ready to eat breakfast meals as consumers start their days outside the home. Fourth, menu innovation such as protein rich bowls, plant based breakfast items and specialty coffees helps broaden appeal beyond traditional breakfast categories.

Despite encouraging growth, certain constraints apply. Rising food inputs and labour costs reduce margins for breakfast take out providers, which may lead to higher prices or constrained offerings. Consumer hesitation in spending on discretionary meals in the morning may reduce frequency of take out breakfast consumption especially during economic softness. Some households revert to home based breakfast when budgets tighten or time allows, limiting take out growth. Additionally, competition from in store dining, grocery breakfast purchases and meal prep services may reduce incremental uptake of take out meals.

Key trends include stronger integration of technology such as mobile apps and AI based recommendations that improve ordering efficiency for breakfast take out. Drive thru, curb side pickup and delivery focused models are gaining significance for early day meals. Sustainability and health driven menu offerings lower sugar, plant based proteins and recycled packaging are influencing breakfast take out formats. Meanwhile, "day part expansion" strategies by food service operators aim to energise breakfast traffic during slower hours and differentiate via speciality formats and limited time offers.

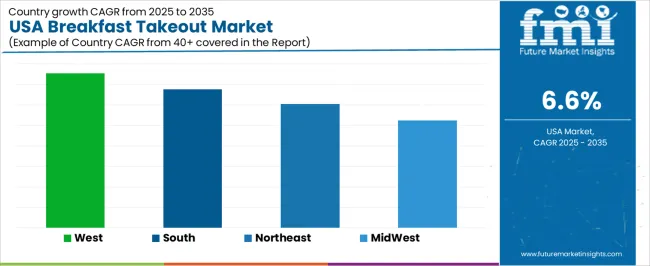

The demand for breakfast takeout in the USA is experiencing steady growth across all regions, with the West leading at a CAGR of 7.5%. The South follows closely with a 6.8% CAGR, driven by an active lifestyle and growing consumer preference for convenient meal options. The Northeast shows moderate growth at 6.0%, supported by its bustling urban centers and demand for on-the-go meals. The Midwest exhibits the slowest growth at 5.2%, reflecting more traditional meal patterns but still showing a steady increase in demand. Overall, the growing trend of convenience, healthier breakfast options, and the evolving foodservice landscape is driving growth in the breakfast takeout market.

| Region | CAGR (2025-2035) |

|---|---|

| West | 7.5% |

| South | 6.8% |

| Northeast | 6% |

| Midwest | 5.2% |

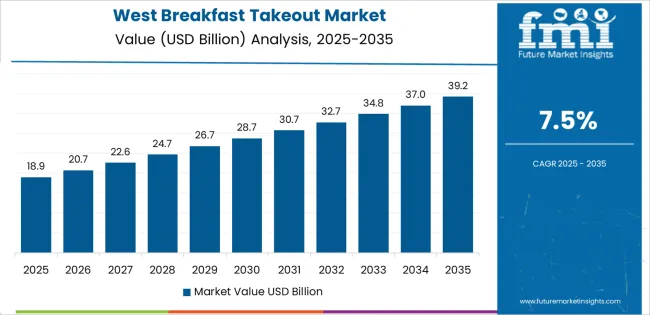

The demand for breakfast takeout in the West is projected to grow at a CAGR of 7.5%, fueled by the region’s fast-paced lifestyle and high consumer demand for convenience. The West, particularly in states like California, is known for its strong foodservice industry, with a growing number of restaurants and cafes offering quick breakfast options for on-the-go consumers. The increasing preference for healthier, quick breakfast choices, such as smoothies, bowls, and protein-packed options, also contributes to the rising demand.

Additionally, the West’s population, which often prioritizes work-life balance and convenience, has embraced breakfast takeout as an essential part of their daily routines. As mobile ordering and delivery platforms continue to rise in popularity, more consumers are opting for breakfast takeout, contributing to the strong growth in this sector.

In the South, the demand for breakfast takeout is expected to grow at a CAGR of 6.8%, driven by changing consumer habits and the region’s growing focus on convenience and healthier meal options. The South’s rapidly expanding urban population and the increasing number of professionals who seek quick and easy breakfast options on their way to work are key drivers of this demand. Additionally, the region’s culinary traditions, which often include hearty breakfasts, are evolving to include more modern, takeout-friendly choices like wraps, sandwiches, and bowls.

The convenience of having breakfast on-the-go, paired with the growing number of foodservice establishments offering takeout options, is contributing to the region’s rising demand for breakfast takeout. The South’s relatively younger, more diverse population is also influencing the growing trend of breakfast takeout, as consumers seek a variety of fast, healthy, and flavorful options.

In the Northeast, the demand for breakfast takeout is projected to grow at a CAGR of 6.0%, supported by the region’s high population density and fast-paced urban lifestyle. Cities like New York, Boston, and Philadelphia are major hubs for breakfast takeout, where busy professionals and commuters seek convenient meal options that fit into their hectic schedules. The demand for quick, healthy, and portable breakfast choices, such as oatmeal, smoothies, and breakfast burritos, is rising as consumers become more health-conscious and time-conscious.

Furthermore, the Northeast’s established coffee culture, which often pairs with breakfast items, further drives demand for takeout options. As foodservice providers increasingly cater to the busy lifestyles of the Northeast’s population, the market for breakfast takeout is expected to continue growing, particularly as demand for healthier, more varied choices increases.

The demand for breakfast takeout in the Midwest is expected to grow at a CAGR of 5.2%, reflecting more gradual, but steady, adoption of convenience-based meal options. The Midwest has traditionally placed a stronger emphasis on home-cooked meals and sit-down breakfast options, which results in slower growth compared to other regions. However, as the region’s urban centers continue to expand and consumer habits evolve, breakfast takeout is becoming more popular, particularly in larger cities like Chicago and Minneapolis.

The rising demand for healthier, portable breakfast options is also contributing to the growing market, as more consumers look for convenient and nutritious choices on their way to work or school. Additionally, the increased availability of food delivery services and mobile ordering platforms in the Midwest is helping to drive demand for breakfast takeout. While growth remains moderate, the trend is steadily gaining momentum in the region.

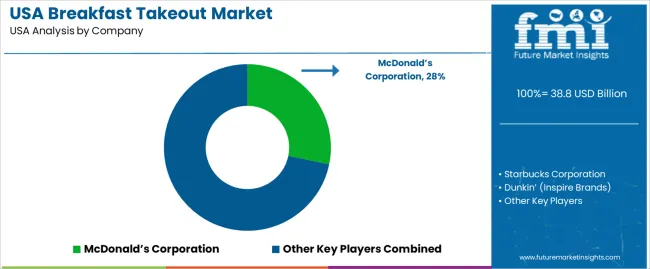

Demand for breakfast takeout in the United States is rising, driven by consumer preference for convenience and mobile ordering. The market is expected to grow with a compound annual growth rate (CAGR) of around 5% or more through the coming years. Leading companies in this segment include McDonald’s Corporation (holding about 28.2% market share), Starbucks Corporation, Dunkin’ (Inspire Brands), Tim Hortons (Restaurant Brands International), and Subway. These firms operate large quick-service restaurant (QSR) networks and digital ordering platforms, which enable them to capture a significant portion of the breakfast takeout market.

Competition among these companies is driven by menu innovation, service convenience, and digital integration. Firms are expanding breakfast menus to include sandwiches, burritos, bowls, and beverages tailored for on-the-go consumption. Features such as smartphone ordering, drive-thru lanes, and early opening hours are key differentiators. Additionally, value pricing and combo offers help attract price-sensitive consumers. Breakfast remains a key growth period for many chains, and companies that align their offerings with convenience, digital access, and competitive pricing aim to maintain or expand their market share in the USA breakfast takeout industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Nature | Vegetarian, Non-Vegetarian, Vegan |

| Breakfast Type | Continental Breakfast, American Breakfast, English Breakfast, Italian Breakfast, Indonesian Breakfast |

| Purchase Model | Chained Foodservice, Independent Foodservice |

| Payment Type | Cash, Debit Cards, Credit Cards, Digital Wallets, Electronic Bank Transfers |

| Business Type | Direct-to-consumer, Platform-to-consumer |

| Key Companies Profiled | McDonald’s Corporation, Starbucks Corporation, Dunkin’ (Inspire Brands), Tim Hortons (Restaurant Brands International), Subway |

| Additional Attributes | The market analysis includes dollar sales by nature, breakfast type, purchase model, payment type, business type, and company categories. It also covers regional demand trends in the USA, driven by the growing popularity of breakfast takeout in both chained and independent foodservice establishments. The competitive landscape highlights key companies focusing on innovations in breakfast menu offerings, convenience, and digital ordering platforms. Trends in the increasing adoption of digital wallets, contactless payments, and the shift towards healthier breakfast options such as vegan and vegetarian menus are explored, along with consumer preferences for diverse breakfast types. |

The demand for breakfast takeout in usa is estimated to be valued at USD 38.8 billion in 2025.

The market size for the breakfast takeout in usa is projected to reach USD 73.2 billion by 2035.

The demand for breakfast takeout in usa is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in breakfast takeout in usa are non-vegetarian, vegetarian and vegan.

In terms of breakfast type, continental breakfast segment is expected to command 28.7% share in the breakfast takeout in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Demand for Breakfast Takeout in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Breakfast Cereal in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Breakfast Drinks Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA