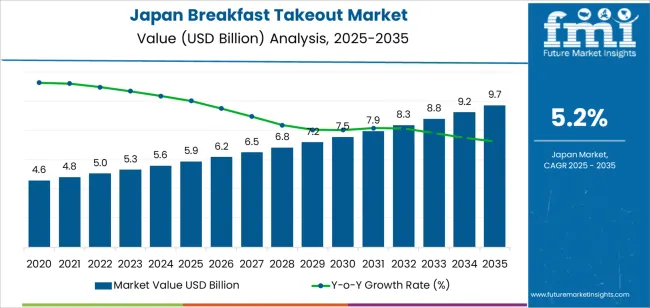

The demand for breakfast takeout in Japan is projected to grow from USD 5.9 billion in 2025 to USD 9.7 billion by 2035, reflecting a CAGR of 5.2%. The increasing preference for convenient breakfast options is largely driven by busy, time-conscious consumers seeking quick, ready-to-eat meals during their hectic mornings. With the rise of urbanization and workplace cultures that prioritize productivity, takeout options have become essential for many, especially in the foodservice industry. Breakfast takeout options, including coffee, sandwiches, smoothies, and bento boxes, are in high demand due to their convenience and customizability, catering to a wide range of dietary preferences and lifestyles.

The growth of digital food delivery platforms and e-commerce services is expected to further contribute to the rise in demand. As these platforms become more integrated into daily routines, the availability and accessibility of breakfast takeout will expand. Additionally, consumer interest in health-conscious and premium breakfast items, such as organic smoothies or protein-rich bowls, will encourage the development of innovative offerings. With Japan’s evolving food culture and a growing emphasis on health and convenience, breakfast takeout is set to remain a strong growth area in the coming decade.

From 2025 to 2030, the demand for breakfast takeout in Japan will grow from USD 5.9 billion to USD 7.5 billion, adding USD 1.6 billion in value. This phase will represent the initial growth period, marked by rapid adoption of breakfast takeout services driven by the increasing demand for convenience and time-saving solutions. As delivery services and mobile app-based orders become more widespread, the market will experience accelerated expansion. However, despite the steady increase in demand, the growth rate will start to moderate towards the end of this period as the market begins to approach its early stages of saturation in urban areas.

From 2030 to 2035, the market will grow from USD 7.5 billion to USD 9.7 billion, contributing USD 2.2 billion in value. While growth continues, the rate will slow slightly as the market reaches a maturity phase and nears its saturation point. During this phase, competition between food delivery services and food chains will intensify, with innovation and brand loyalty becoming key factors to retain customer interest. The market will likely stabilize as more standardized offerings become the norm, and the introduction of new services or healthier alternatives may become essential to maintain growth momentum. As the demand reaches near saturation, focus will shift towards product diversification and personalization to continue attracting customers in a more competitive environment.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 5.9 billion |

| Industry Forecast Value (2035) | USD 9.7 billion |

| Industry Forecast CAGR (2025-2035) | 5.2% |

Demand for breakfast takeout in Japan is increasing as urban professionals and commuters favor convenient morning meals that fit tight schedules. The market value for breakfast takeout is estimated at USD 5.9 billion and is projected to rise to USD 9.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of about 5.2%. Operators such as coffee chains, fast service cafés and convenience store outlets are expanding early morning menus and delivery friendly formats to capture demand.

Another factor contributing to growth is the expansion of digital ordering platforms and delivery services, which make grab and go breakfasts more accessible. Additionally, menu innovation such as breakfast bowls, on the go sandwiches and speciality coffee pairings meets consumer interest in variety and quality. At the same time, challenges such as labour shortages in the food service industry, rising food and operational costs and competition from home based breakfast options remain. Despite these constraints, the combination of urban lifestyle trends and convenient service models indicates that demand for breakfast takeout in Japan is positioned for steady expansion.

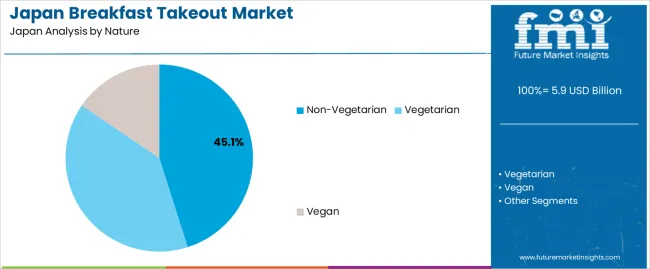

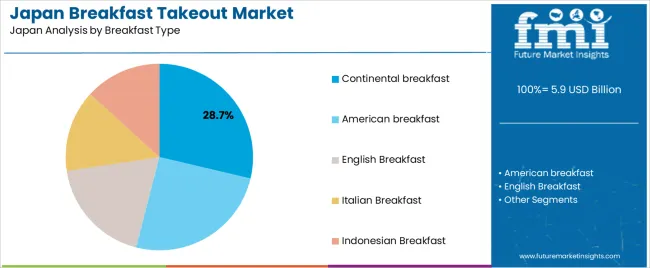

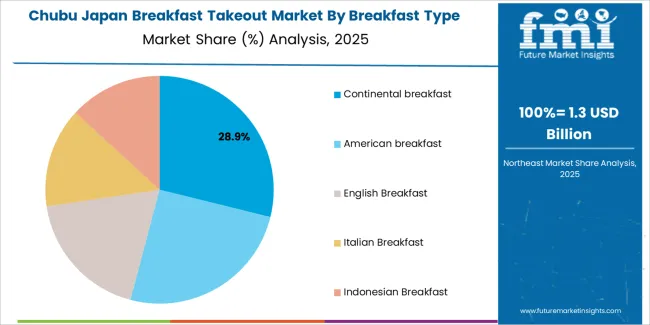

The demand for breakfast takeout in Japan is driven by nature and breakfast type. The leading nature is non-vegetarian, capturing 45% of the market share, while continental breakfast leads the breakfast type category, accounting for 28.7% of the demand. As convenience and variety continue to shape consumer preferences, breakfast takeout has become a popular choice, offering diverse and quick options for individuals on the go. This trend reflects a growing shift in dining habits, with consumers seeking satisfying, portable breakfast options.

Non-vegetarian breakfast takeout leads the market in Japan, holding 45% of the demand. Non-vegetarian options, such as breakfast sandwiches with eggs, bacon, sausage, or chicken, and savory breakfast burritos, are commonly chosen by consumers looking for a protein-rich start to their day. These options offer a filling and energizing meal that is ideal for individuals with busy lifestyles, making them a staple in the breakfast takeout market.

The demand for non-vegetarian breakfast takeout is driven by traditional breakfast preferences, which often include meat as a key ingredient. As convenience and portability become more important to consumers, non-vegetarian breakfast options are well-suited for those who prefer a quick, satisfying meal that provides the energy needed to start the day. Additionally, the growing popularity of breakfast fast-food chains and delivery services is contributing to the continued strength of non-vegetarian offerings in the market.

Continental breakfast is the leading breakfast type for takeout in Japan, capturing 28.7% of the demand. A continental breakfast typically consists of lighter fare, such as pastries, bread, yogurt, fruits, and coffee, offering a quick and convenient option for consumers who prefer a more balanced, less heavy start to the day. It is a particularly popular choice in urban areas, where individuals often seek easy, portable breakfast options that don’t require extensive preparation.

The growing demand for continental breakfasts in Japan is driven by the shift towards healthier, lighter meal options that cater to those looking for a quick breakfast without the heaviness of traditional cooked meals. As consumers become more health-conscious and busy, the popularity of continental breakfast takeout is expected to continue growing. This segment is favored for its versatility and ability to cater to a wide variety of dietary preferences, from fruit-based options to pastries and coffee, making it a staple in the breakfast takeout market.

Demand for breakfast take out in Japan is shaped by faster paced urban lifestyles, increasing dual income households and the growth of on the go morning meals that require minimal preparation or waiting. Convenience stores, quick service restaurants and delivery platforms are expanding breakfast offering lines to serve time pressed commuters and remote workers. At the same time, cost pressures, nutritional expectations and established home meal habits moderate growth. These factors together define how the breakfast take out market is developing in Japan.

Several factors support growth. First, the increase in morning commuting and workplace attendance creates demand for ready to eat breakfast menus at retail and food service outlets. Second, expansion of digital ordering, mobile apps and food delivery services makes breakfast take out more convenient and accessible across Japanese cities. Third, menu innovation such as protein rich bowls, western style sandwich meals and healthy smoothies broadens consumer appeal beyond traditional Japanese breakfast formats. Fourth, the rise of convenience store chains and vending solutions offering fresh breakfast items meets morning consumption occasions efficiently.

Despite favorable conditions, several constraints apply. High ingredient and labor costs affect margins for food service providers offering breakfast take out, which may limit promotional pricing or menu expansion. Some consumers continue to prefer home prepared breakfast for cost, tradition or dietary reasons, reducing shift toward take out. Nutritional and health considerations such as sugar content and portion size mean providers must adapt to strict consumer expectations, increasing complexity. Finally, delivery logistics for early morning hours can be less efficient and costlier, especially in regional or suburban Japanese markets.

Key trends include increasing availability of healthy and functional breakfast take out options, such as whole grain sandwiches, low sugar yogurt bowls and plant based smoothie meals. There is also growth in morning focused digital ordering and contactless pickup designed for commuters such as express lanes in convenience stores or mobile app pre orders. Retailers are improving packaging for on the go convenience and food safety assurance in morning formats. Additionally, breakfast take out is increasingly being integrated into workplace catering and subscription breakfast service models that serve offices, thereby expanding channel reach and service scope.

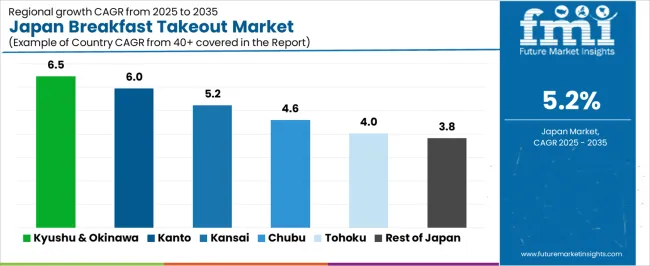

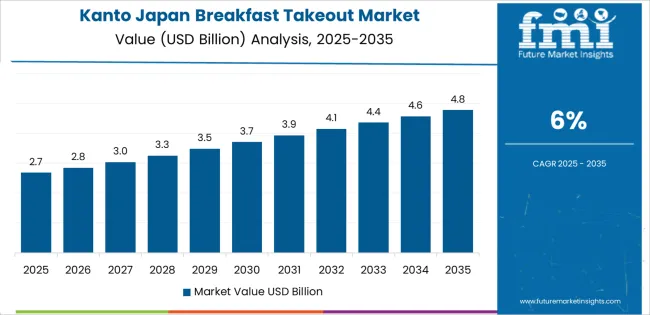

The demand for breakfast takeout in Japan shows steady growth across different regions, with Kyushu & Okinawa leading at a CAGR of 6.5%. Kanto follows closely with a 6.0% CAGR, driven by urbanization and a growing demand for convenient food options. The Kinki region exhibits a solid growth rate of 5.2%, while Chubu, Tohoku, and the Rest of Japan have more moderate growth, with respective CAGRs of 4.6%, 4.0%, and 3.8%. These regional differences reflect varying levels of consumer interest in convenience-based dining, regional economic activity, and the pace of lifestyle changes across Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.5% |

| Kanto | 6% |

| Kinki | 5.2% |

| Chubu | 4.6% |

| Tohoku | 4% |

| Rest of Japan | 3.8% |

The demand for breakfast takeout in Kyushu & Okinawa is projected to grow at a CAGR of 6.5%, supported by a combination of lifestyle changes and growing consumer demand for convenience. Kyushu & Okinawa, with their large urban and tourist populations, are increasingly adopting fast, on-the-go breakfast options. The rising popularity of healthier, quick breakfast choices, such as rice bowls, sandwiches, and wraps, is contributing to this trend.

The regions’ growing emphasis on tourism and hospitality, particularly in Okinawa, has created a greater need for food services catering to travelers and busy locals. Additionally, the relatively relaxed pace of life and emphasis on local, fresh food offerings also support the demand for breakfast takeout. As the region continues to develop its foodservice infrastructure, the convenience and accessibility of breakfast takeout are likely to become even more appealing to consumers.

In Kanto, the demand for breakfast takeout is expected to grow at a CAGR of 6.0%, driven by the fast-paced lifestyle and high population density, particularly in Tokyo. As one of Japan's busiest and most urbanized regions, Kanto has a large number of professionals, commuters, and students who increasingly rely on quick, convenient breakfast options to fit into their busy routines. The region’s diverse food culture also influences the rising popularity of breakfast takeout, with many consumers seeking a variety of nutritious and portable meal choices.

Furthermore, the growing availability of mobile ordering and delivery platforms in urban areas facilitates easy access to breakfast options. As Kanto continues to be a hub for innovation and convenience-driven services, the demand for breakfast takeout will continue to rise, particularly among younger, more tech-savvy consumers who value convenience.

The demand for breakfast takeout in the Kinki region is projected to grow at a CAGR of 5.2%, reflecting a moderate but steady increase. Kinki, which includes major cities such as Osaka and Kyoto, is known for its vibrant food culture, with both traditional and modern breakfast options gaining traction. The growing number of busy professionals and students in urban areas is contributing to the demand for quick, convenient meal options.

The rise in awareness of health-conscious eating habits also fuels the popularity of on-the-go breakfast choices, such as salads, smoothie bowls, and protein-packed wraps. Additionally, Kinki's tourism industry plays a role in driving demand for breakfast takeout, as travelers seek quick meals during their stay. As the demand for convenience-based dining continues to rise, Kinki’s dynamic urban landscape ensures steady growth in the breakfast takeout market.

The demand for breakfast takeout in Chubu is expected to grow at a CAGR of 4.6%, reflecting steady but slower adoption compared to other regions. Chubu, home to key industrial cities like Nagoya, has a large working population that increasingly relies on convenient meal options. However, the region tends to have a more traditional food culture, with many people still favoring sit-down breakfasts at home.

Despite this, the demand for breakfast takeout is gradually increasing, driven by the rise in working professionals, the younger population’s preference for convenience, and the increasing availability of foodservice outlets catering to busy consumers. Additionally, Chubu’s growing e-commerce and delivery services are making breakfast takeout more accessible to a broader range of consumers. The moderate growth rate reflects a balance between traditional meal patterns and the evolving demand for faster, on-the-go food options.

In Tohoku, the demand for breakfast takeout is projected to grow at a CAGR of 4.0%, reflecting a more gradual adoption of convenience-based dining options. Tohoku, known for its rural landscape and smaller urban centers, tends to have more traditional meal habits, with many consumers still opting for homemade or sit-down breakfasts. However, as younger generations and busy professionals become more prominent, there is a growing interest in breakfast takeout.

Additionally, the region’s tourism industry, particularly in cities like Sendai, is driving demand for convenient breakfast options for visitors. While the overall growth rate is slower compared to other regions, the increasing availability of mobile apps and delivery services in Tohoku is making breakfast takeout more accessible, and this is expected to drive gradual growth in demand in the coming years.

In the Rest of Japan, the demand for breakfast takeout is expected to grow at a CAGR of 3.8%, reflecting more conservative trends in food consumption compared to urban areas. This region includes rural areas where traditional breakfast habits, such as home-cooked rice and miso soup, are more prevalent. However, as the Japanese population becomes more urbanized and younger consumers seek more convenient, time-saving options, breakfast takeout is slowly gaining popularity.

The Rest of Japan’s more gradual adoption of these trends is influenced by slower infrastructure development and a preference for traditional meals. Nevertheless, with the growing presence of convenience stores offering ready-to-eat breakfast items and the expansion of food delivery services, the market for breakfast takeout in these regions is expected to experience steady growth, although at a slower pace.

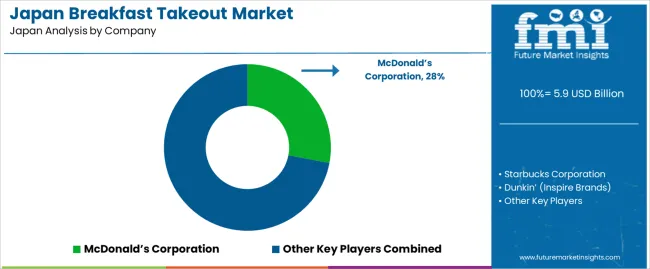

Demand for breakfast takeout in Japan is growing as more consumers adopt on the go eating habits and quick service restaurant chains expand their morning menus. Major companies in this space include McDonald’s Corporation (holding about 28.0% market share), Starbucks Corporation, Dunkin’ (Inspire Brands), Tim Hortons (Restaurant Brands International), and Subway. These chains widen availability of breakfast items such as sandwiches, bowls, coffees and breakfast sets, while using mobile ordering, early opening hours, and drive thru services to cater to busy commuters and breakfast time consumers.

Competition in the Japanese breakfast takeout market centres on menu innovation, speed of service, and localization of offerings. Companies develop breakfast menus that combine familiar global items with regional tastes to appeal to Japanese consumers. They prioritise easy to eat formats that suit morning routines, including coffee and toast sets or grab and go sandwiches. Another competitive factor is operational convenience: efficient store layout, mobile ordering apps, and loyalty programmes support frequent visits.

Pricing strategies and value menus also matter, given consumer sensitivity to cost. Marketing communications typically emphasise taste, convenience, menu variety and brand familiarity. By aligning their offerings with consumer demand for fast, familiar and accessible breakfast options, these companies aim to maintain and grow their presence in Japan’s breakfast takeout industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Nature | Vegetarian, Non-Vegetarian, Vegan |

| Breakfast Type | Continental Breakfast, American Breakfast, English Breakfast, Italian Breakfast, Indonesian Breakfast |

| Purchase Model | Chained Foodservice, Independent Foodservice |

| Payment Type | Cash, Debit Cards, Credit Cards, Digital Wallets, Electronic Bank Transfers |

| Business Type | Direct-to-consumer, Platform-to-consumer |

| Key Companies Profiled | McDonald’s Corporation, Starbucks Corporation, Dunkin’ (Inspire Brands), Tim Hortons (Restaurant Brands International), Subway |

| Additional Attributes | The market analysis includes dollar sales by nature, breakfast type, purchase model, payment type, business type, and company categories. It also covers regional demand trends in Japan, driven by the growing popularity of breakfast takeout in both chained and independent foodservice establishments. The competitive landscape highlights key companies focusing on innovations in breakfast menu offerings, convenience, and digital ordering platforms. Trends in the increasing adoption of digital wallets, contactless payments, and the shift towards healthier breakfast options such as vegan and vegetarian menus are explored, along with consumer preferences for diverse breakfast types. |

The demand for breakfast takeout in japan is estimated to be valued at USD 5.9 billion in 2025.

The market size for the breakfast takeout in japan is projected to reach USD 9.7 billion by 2035.

The demand for breakfast takeout in japan is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in breakfast takeout in japan are non-vegetarian, vegetarian and vegan.

In terms of breakfast type, continental breakfast segment is expected to command 28.7% share in the breakfast takeout in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Demand for Breakfast Cereal in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Breakfast Drinks Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Breakfast Cereal Market Trends – Healthy & Indulgent Options Driving Growth 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA