The ASEAN Food Stabilizers market is set to grow from an estimated USD 39.4 million in 2025 to USD 72.4 million by 2035, with a compound annual growth rate (CAGR) of 6.3% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 39.4 million |

| Projected ASEAN Value (2035F) | USD 72.4 million |

| Value-based CAGR (2025 to 2035) | 6.3% |

The ASEAN (Association of Southeast Asian Nations) Food Stabilizers Market is growing remarkably and this growth is caused mainly by the higher demand for processed and convenience foods. As people tend to eat more healthily and go for convenient food, food stabilizers become a must-have product. These kinds of food additives are important because they improve the food products' texture, stability, and shelf-life, thus, they are needed in the food manufacturing process.

The ASEAN region, which includes ten member countries, is seen as an interesting field for business, as it has a diverse market and different consumer preferences, regulatory environments, and economic conditions.

For instance, countries such as Indonesia, Thailand, and Malaysia are experiencing fast urbanization and a rise in disposable income, which is one of the main causes of changing dietary habits. This, in turn, is linked to the increasing level of information regarding food safety and quality, which is the reason why food manufacturers have to add food stabilizers to meet the expectations of consumers.

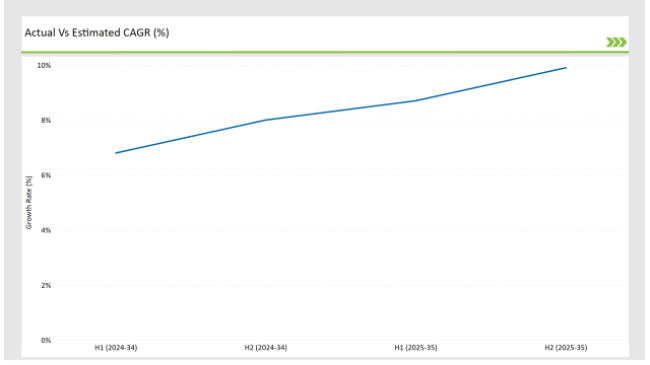

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Food Stabilizers market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Food Stabilizers market, the sector is predicted to grow at a CAGR of 6.8% during the first half of 2024, increasing to 8.0% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.7% in H1 but is expected to rise to 9.9% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | DuPont Nutrition & Biosciences: Launched a new line of natural stabilizers derived from plant sources to meet the growing demand for clean label products. |

| 2024 | Kerry Group: Acquired a leading natural food stabilizer manufacturer to expand its product portfolio and enhance its market presence in the ASEAN region. |

| 2025 | Cargill: Introduced a new range of pectin-based stabilizers designed for dairy applications, focusing on improving texture and shelf-life while meeting consumer demand for natural ingredients. |

| 2025 | Ingredion Incorporated: Announced the development of a new extraction process for guar gum, enhancing its purity and functionality for use in various food applications. |

Shift towards Natural and Clean Label Ingredients

The food sector is undergoing a paradigm shift as more and more natural and clean-label ingredients are being preferred; this development is largely propelled by the consumers' persuasion for healthier and more genuinely reflected food products.

This trend is especially visible in the ASEAN region, where customers' health awareness is gaining momentum, and they are looking for products that do not contain any artificial additives and preservatives. For this reason, food companies are now substituting their formulations with plant-sourced natural stabilizers such as pectin, agar, and carrageenan instead of the ones that contain synthetic substances.

The natural stabilizers are not just in conformity with the customer’s choice of preference but are also in agreement with local laws in many ASEAN countries that are protective of the use of safe and natural ingredients in food products.

Technological Advancements in Feed Additives

The Food Stabilizers Market, especially in the ASEAN area, is being greatly influenced by technological growth. Introducing new food processing technologies, including encapsulation and microencapsulation, enables manufacturers to increase the performance and efficacy of food stabilizers.

The technologies lead to the modified stabilizers that, instead of being added to the food all at once, are gradually absorbed and reincorporated into the food, which is beneficial for the stabilizers in various food applications. The increased extraction and purification methods are the causes of the production of more powerful and high-quality natural stabilizers with new functional properties.

For example, the extraction of pectin from citrus peels and apple pomace is more effective now and therefore results in higher yields and better products. It is, thus, a way to meet the demand for more natural ingredients, and additionally, it contributes to sustainability through the use of food waste.

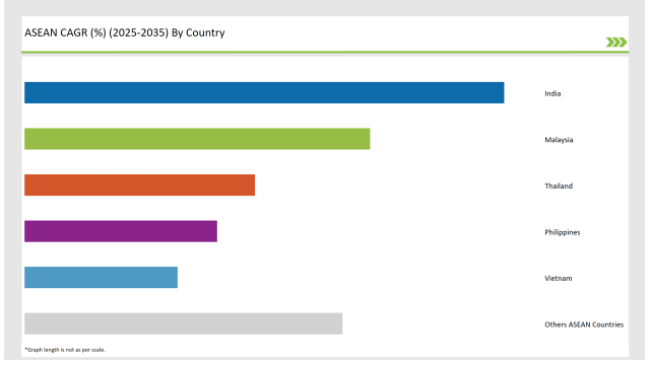

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The progress of India's Food Stabilizers Market is solid and is due to the help of several prominent factors. The quick rise in the country's population along with the higher urbanization has resulted in an increased requirement of processed and convenience foods. In this regard, esterification's basic need of the products which eases the preparation and storage of food items.

This situation derivatives from the fact that consumer spending on disposable products is increasing due to the higher disposable incomes. The increasing number of people's health and fitness awareness is also affecting the market, as there is a growing tendency to use natural and clean-label ingredients.

This situation has led food producers to reform their processes by using natural stabilizers instead of artificial ones such as pectin and guar gum, which are used to bring about health to the more thoughtful clients consumer group.

The Malaysian food stabilizers market is on the verge of a surge, as it is being driven by the food and beverage industry's robust growth. Besides that, the manufacturers of food stabilizers are being buoyed by the increasing urbanization and, consequently, the changing lifestyles that bring about more demand for processed food.

Since people are looking for not only convenience but also quality in their food choices, the requirement for stabilizers that can enhance the texture, stability, and shelf life is more noticeable. Malaysia's rich variety of food culture offers a special chance for food stabilizers because the manufacturers are looking to make local products according to the tastes and preferences of the consumers.

The increasing fascination with health and wellness is also a major driver in the market with consumers looking out for more natural and clean label products. The kind of change that these processes bring very often will lead manufacturers to the research and development departments with new and advanced stabilizers that will be the advantages over their competitors.

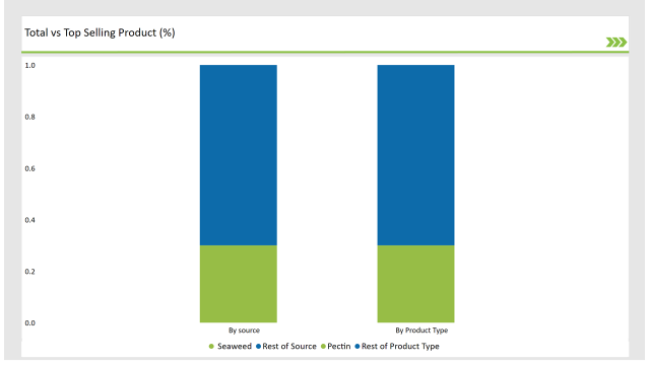

Pectin is among the most common food stabilizers and the one with the highest market share in ASEAN countries. It is a natural food stabilizer derived mainly from citrus fruits and apples. The main reason why pectin is a gelling agent, a thickener, and a stabilizer is that it forms hydrogen bonds with water and other substances.

As a result, it is used in a wide variety of food products, including jams, jellies, and dairy products. The increased awareness of the need for green and clean-label ingredients has significantly affected the rate of popularity of pectin, as people are far more interested in items that do not contain artificial additives nowadays. Due to the adaptability of pectin, the ingredient can be added to various food products.

For example, fruit-based applications, bakery items, and dairy products are some of the examples. It is its capability to gel and the stability of emulsions that makes pectin so important in the production of jams and jellies, where it gives the desired texture and the right consistency. Pectin is also commonly added to yogurt and other dairy items for the sake of enhancing the mouthfeel and avoidance of syneresis (the separation of liquid from a gel).

Seaweed-based stabilizers are experiencing substantial growth in the Food Stabilizers Market, specifically in the ASEAN region, where they hold a considerable market share. Coming from different varieties of seaweed, for example; agar, carrageenan, and alginate, are some of the stabilizers that have these types of attributes.

The increasing demand for plant-based and natural ingredients has been one of the main reasons for the growth of these seaweed-based stabilizers; as manufacturers promote themselves as being chemical-free, consumers are gradually avoiding synthetic additives.

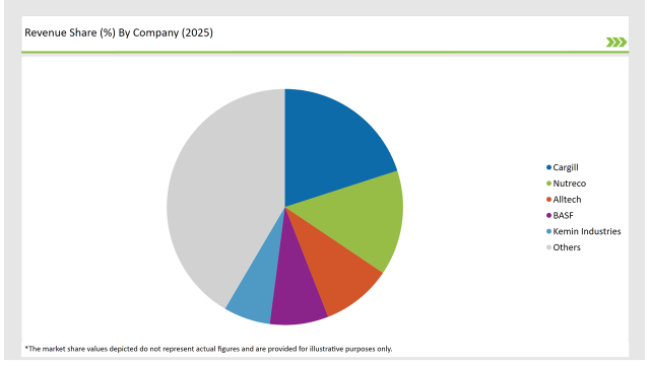

2025 Market Share of ASEAN Food Stabilizers Manufacturers

Note: The above chart is indicative

The Food Stabilizers Market is marked by strong competition as it has a lot of players fighting for market shares in various segments and sectors. The major participants in the market consist of international companies such as DuPont Nutrition & Biosciences, Kerry Group, Cargill, Ingredion Incorporated, and Tate & Lyle, etc.

Product Type: Pectin, Agar, Gelatin, Xanthan Gum, Carrageenan, Guar Gum and Others

Source: Seaweed, Plant, Microbial, Synthetic, Animal, and Others

Application by Bakery Products, Dairy and Desserts, Confectionery Items, Sauces and Dressings, Meat and Poultry Products, Convenience Foods, Beverages and Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Food Stabilizers market is projected to grow at a CAGR of 6.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 72.4 million.

India are key Country with high consumption rates in the ASEAN Food Stabilizers market.

Leading manufacturers include Cargill, Nutreco, Alltech, and BASF key players in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Food Stabilizers Market Share & Provider Insights

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

UK Food Stabilizers Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Superfood Powder Market Report - Growth, Demand & Forecast 2025 to 2035

USA Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Frozen Food Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

Europe Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Allergen Free Food Market Outlook – Size, Share & Innovations 2025–2035

ASEAN Postbiotic Pet Food Market Analysis – Demand, Growth & Forecast 2025-2035

ASEAN Plant-Based Pet Food Market Insights – Demand, Size & Industry Trends 2025-2035

Latin America Food Stabilizers Market Trends – Growth, Demand & Forecast 2025–2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA