The Latin America food stabilizers market is set to grow from an estimated USD 225.6 million in 2025 to USD 410.1 million by 2035, with a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 225.6 million |

| Projected Latin America Value (2035F) | USD 410.1 million |

| Value-based CAGR (2025 to 2035) | 6.2% |

The Latin American frozen food sector, having ice creams, frozen desserts, and ready-meals among its products, is experiencing a fast-paced growth due to the consumers increasing preference for easy-to-cook and long-lasting food items.

Food stabilizers are the basic part of the food industry because they prevent the primary disturbance of crystallization, and keep the texture, and also the mouthfeel of the product, by adding food stabilizers during the storage and distribution stages.

Similarly, the bakery sector is also dependent on stabilizers like guar gum, pectin, and modified starches to keep the dough consistent, prolong shelf life, and retain moisture in order to ensure the quality and freshness of breads, pastries, and cakes.

The governments of Mexico, Brazil, and Chile are the ones that are augmenting the food processing capabilities and this leads to a consequent rise in the demand for stabilizers that are the key to enhancing product stability and export readiness. As Latin America expands its international food exports, particularly in dairy, sauces, and processed meats, the stabilizers are a must to preserve the texture, standardization, and longer shelf life.

This benefit of international quality standards achieved with the help of these stabilizers, spoilage reduction during transport, and increased appeal for the product in foreign markets contributes to the increased competitiveness of the region in the global food trade.

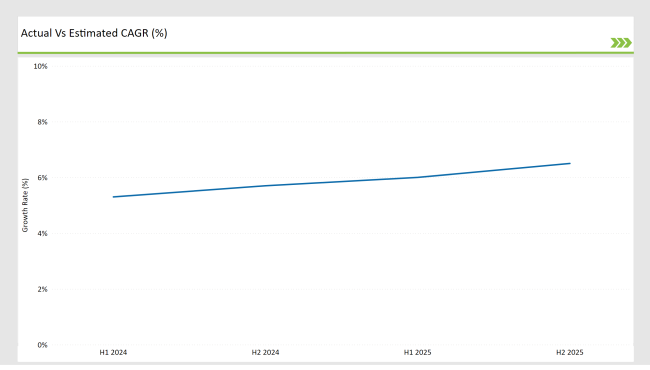

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America food stabilizers market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America food stabilizers market, the is predicted to grow at a CAGR of 5.3% during the first half of 2024, with an increase to 5.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 6.0% in H1 and is expected to rise to 6.5% in H2.

This pattern reveals a decrease of 12 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 22 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| November 2024 | Tate & Lyle completed its acquisition of CP Kelco, a leading provider of hydrocolloids and stabilizers. This strategic move aims to enhance Tate & Lyle's portfolio in natural food ingredients and strengthen its presence in the Latin American market. |

Expansion of the Bakery & Confectionery Industry in Latin America

The Latin American bakery market, especially in Brazil, Mexico, and Argentina, bursts with growth due to the consumer demand for breads, pastries, and baked snacks that just keeps on growing. Effectively driving this expansion are pectin and guar gum, which make it possible to improve dough stability, moisture content, and texture consistency in bakery products.

Stabilizers are the ingredients that allow baked products to stay soft and have a long shelf life which makes guarantees of these attributes essential in industrial-scale production and frozen bakery items. The same can be said for confectionery, which is now seeing a rising number of gummies, jellies, and soft candies, thus usage of gelatin for texture and elasticity enhancement has spiked too.

Natural stabilizers are being included by food manufacturers in order to achieve the desired chewiness and mouthfeel in healthier candy formulations and thus sustain the consumer trend of functional and sugar-free confectionery.

Growth in Dairy & Alternative Dairy Products in Latin America

The Latin American dairy industry is witnessing a mushrooming of demand for stabilizers in the form of carrageenan and pectin, which are the very significant ones in keeping the thickness, consistency, and creaminess in products such as yogurts, dairy desserts, and flavored milk.

At the same time that consumers are seeking longer shelf life, better texture products, are manufacturers using these substances to avoid separation, increase viscosity, and thus, improve the quality of the whole product?

Besides, the plant-based dairy segment is also developing as the answer to the lactose intolerances, vegan diets, and health trends mainly due to oat, almond, and soy milk alternatives, needing natural stabilizers to come as close to the creamy mouthfeel of traditional milk as they can. Meanwhile, as brands seek for innovation with sugar-free and protein-enriched plant-based dairy products, the stabilizers that achieve the desired texture and stability are thus more used.

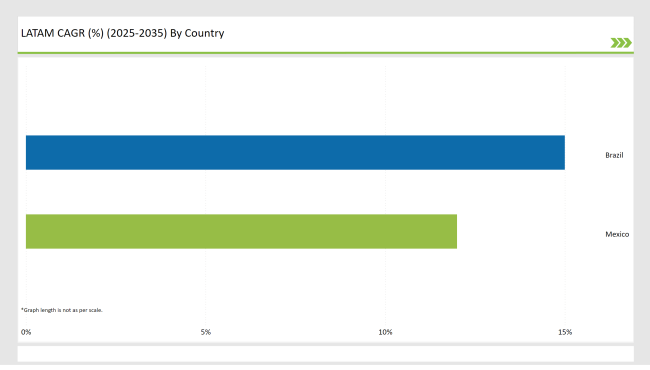

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Brazil's frozen and processed food sector is expanding due to increasing demand for ready-to-eat meals, ice creams, and processed meats, particularly in urban areas where convenience is a priority. Food stabilizers like xanthan gum, guar gum, and carrageenan play a crucial role in these products by preventing ingredient separation, improving viscosity, and extending shelf life.

Additionally, the rapid growth of fast food and convenience food chains has driven the use of stabilizers in sauces, dressings, and processed food formulations, ensuring consistency, texture, and better product stability to meet evolving consumer expectations in Brazil’s competitive food industry.

Mexico’s meat processing industry is expanding rapidly due to rising domestic consumption and export demand. To improve moisture retention, texture, and shelf life, manufacturers are using stabilizers like carrageenan and phosphates in sausages, cold cuts, and frozen meats.

Additionally, with the growing preference for clean-label and additive-free meat products, companies are shifting toward natural stabilizers, replacing synthetic binders and emulsifiers to meet regulatory and consumer health standards. Simultaneously, Mexico’s functional and nutritional food market is expanding, with health-conscious consumers demanding protein-enriched, low-sugar, and fortified foods.

Functional beverages, sports drinks, and probiotic yogurts now incorporate natural stabilizers like guar gum and pectin to maintain consistency, prevent separation, and enhance mouthfeel. This trend reflects the increasing focus on healthier, fortified food choices in Mexico’s food industry.

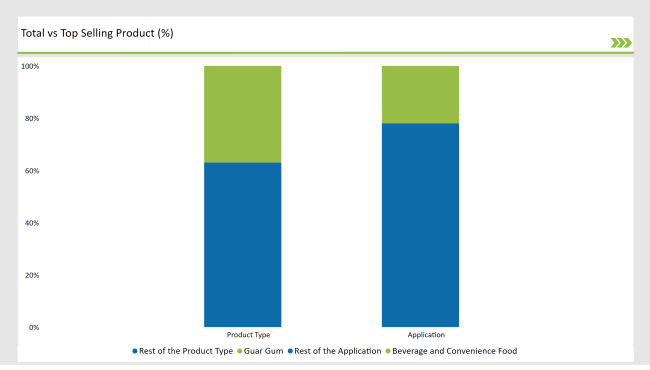

% share of Individual categories by Product Type and Application in 2025

Guar gum is emerging as a natural stabilizer in Latin America because it is cheaper and more eco-friendly than synthetic alternatives like CMC (Carboxymethyl Cellulose). Furthermore, it can bind water well and properties of emulsification which allows producers to lower the cost of formulation while the product quality is kept.

On the other hand, guaranteed customer interest in plant-based, and clean-label ingredients, along with the offering of guar gum are the main reasons it is an ideal thickening and stabilizing agent for many products such as dairy, sauces, and processed foods. guar gum is more used in functional and low-caloric beverages, For instance for sports drinks, flavored waters, and nutritional beverages.

Guar gum helps in the prevention of ingredient separation, which enhances the viscosity and gives a good mouthfeel, all making it an ideal ingredient for dietary and fiber-enriched drinks. With customers moving instead towards low-calorie and sugar-free formulations, guar gum's low glycemic index and high solubility make it a desirable ingredient in weight management and also functional beverages.

Latin America's raise in urbanization and the growing of on-the-go lifestyles have led to a monstrous rise in the demand for RTD (Ready-to-Drink) beverages such as iced teas, flavored waters, meal replacement shakes, and RTD coffee. These products call for stabilizers like carrageenan and modified starches to maintain a smooth texture, prevent sedimentation, and increase shelf life.

The RTD brands which have set out to diversify their portfolio, see stabilizers as the drive force behind quality standards and the needed sensory attraction of these must-have products. One the one hand, the need for plant-based and dairy-free drinks is increasing because of the continuously growing vegan population and secondly, the lactose intolerance rates in Latin America are rising.

The pectin and carrageenan that is used in the almond, soy, and oat milk industries come in quite handy in the enhancement of the creaminess and viscosity of these drinks, hence giving them and the traditional dairy products the same mouthfeel.

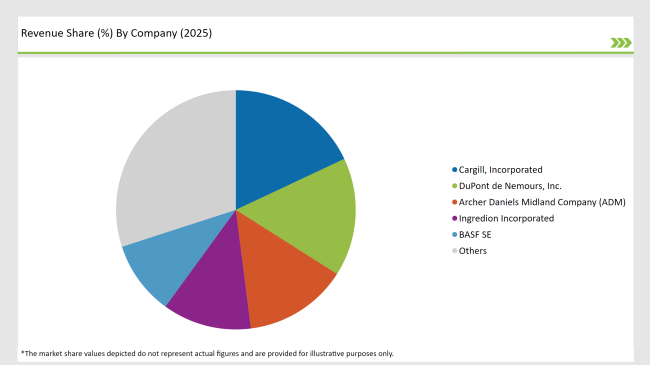

2025 Market share of Latin America Food Stabilizers Manufacturers

Note: above chart is indicative in nature

The Latin American food stabilizers market is moderately concentrated with Cargill, DuPont, and BASF, who control an important share of the market due to their vast equipment for research and development, strong networks for distribution, and their credibility.

These industry giants take advantage of their global presence and their innovative products to keep on being dominant in the region. However, the regional players like Ingredion, Kerry Group, and Palsgaard are the ones that thrive on tailor-made solutions for doing a booming business by dealing with the demand for clean-label and functional foodstuffs.

The strategic plan that they have is to be always near to people by being innovative and that is why these companies deal with the special needs of Latin American food manufacturers.

As per Product Type, the industry has been categorized into Pectin, Gelatin, Carrageenan, Xanthan Gum, Guar Gum, and Others

As per Function, the industry has been categorized into Stability, Texture, and Moisture Retention.

As per Application, the industry has been categorized into Bakery, Confectionery, Dairy Product, Sauce and Dressing, Beverage and Convenience Food, and Meat and Poultry Products.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America food stabilizers market is projected to grow at a CAGR of 6.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 410.1 million.

Mexico and Brazil are key regions with high consumption rates in the Latin America food stabilizers market.

Leading manufacturers include Cargill, Incorporated, DuPont de Nemours, Inc., Archer Daniels Midland Company (ADM), Ingredion Incorporated, and BASF SE.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA