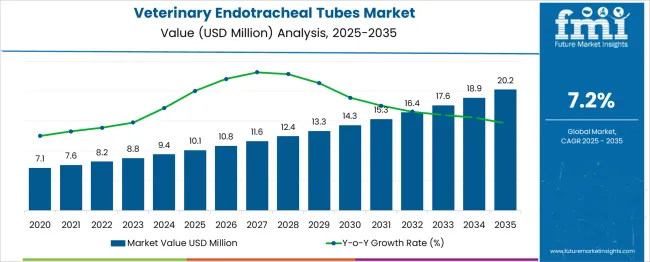

The Veterinary Endotracheal Tubes Market is estimated to be valued at USD 10.1 million in 2025 and is projected to reach USD 20.2 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

Analyzing year-over-year growth trends from 2020 to 2035 reveals a relatively consistent and healthy upward trajectory. Between 2020 and 2025, annual growth fluctuated between 6.5% to 7.4%, with 2021 and 2023 witnessing moderate accelerations. The market grew from USD 7.1 million in 2020 to USD 10.1 million in 2025, a 42.3% rise over five years. From 2026 onward, the pace stabilizes around 7.0% to 7.5% YoY, suggesting sustained demand supported by growth in animal healthcare infrastructure, pet ownership, and surgical interventions in veterinary settings. Key milestones include the market surpassing USD 15 million by 2031 and USD 18 million by 2034, with absolute year-on-year increases growing incrementally from USD 0.7 million in 2026 to USD 1.3 million by 2035. This steady YoY expansion underlines a maturing market with minimal volatility. The absence of sharp peaks or troughs indicates predictable procurement cycles and broader adoption of endotracheal intubation procedures in both companion and livestock animal care.

| Metric | Value |

|---|---|

| Veterinary Endotracheal Tubes Market Estimated Value in (2025 E) | USD 10.1 million |

| Veterinary Endotracheal Tubes Market Forecast Value in (2035 F) | USD 20.2 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The Veterinary Endotracheal Tubes Market operates within the broader Veterinary Medical Devices Market, which has seen sustained expansion due to increasing global expenditure on animal healthcare and advanced surgical practices. Veterinary endotracheal tubes, accounting for approximately 6%–8% of the total veterinary surgical devices segment, are critical tools used during anesthesia and emergency procedures for airway management in both small and large animals.

The parent Veterinary Medical Devices Market is valued at over USD 2.5 billion in 2025, with projections exceeding USD 5.0 billion by 2035, growing at a CAGR of roughly 7.5%. Within this, surgical and diagnostic tools continue to gain traction, particularly in developed regions where pet ownership is high and veterinary care is becoming more specialized. The increasing incidence of respiratory diseases, rising awareness about animal surgical safety, and growth in veterinary hospitals and clinics are collectively fueling demand. The integration of minimally invasive techniques and demand for precise, single-use airway devices is accelerating innovation within this niche. Veterinary endotracheal tubes, though a relatively small segment, play a pivotal role in the surgical preparedness ecosystem, indicating their steady growth will continue to mirror the overall expansion of veterinary surgical infrastructure globally.

The veterinary endotracheal tubes market is expanding steadily, driven by rising awareness around animal healthcare, increasing veterinary surgical procedures, and improved access to companion animal services globally. The growth of pet ownership and the corresponding rise in demand for anesthesia and airway management equipment have contributed significantly to the market’s adoption.

Additionally, the advancement in tube materials, better cuff inflation systems, and species-specific product innovations have enabled more effective, safe, and controlled intubation practices. As veterinary practices modernize, the need for consistent, low-risk respiratory support across preoperative and emergency procedures has fueled the uptake of advanced endotracheal tubes.

Furthermore, the market is supported by growing regulatory emphasis on surgical care standards and the increasing availability of training for veterinary professionals.

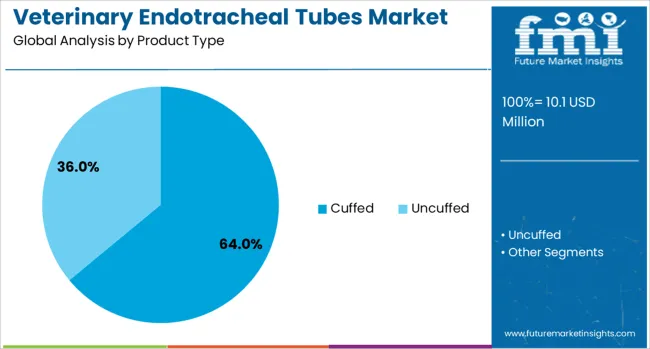

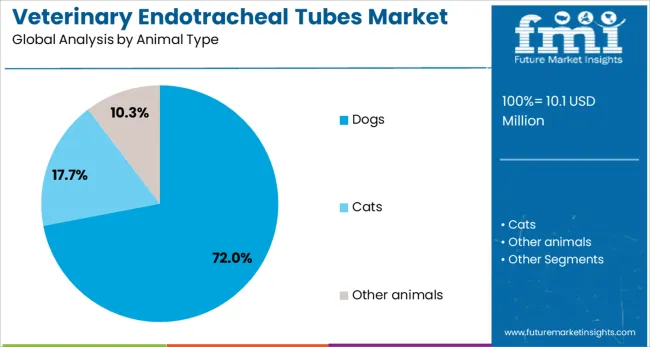

The veterinary endotracheal tubes market is segmented by product type, animal type, material, application, end-use, and geographic regions. The veterinary endotracheal tubes market is divided by product type into Cuffed and Uncuffed. In terms of animal type, the veterinary endotracheal tubes market is classified into Dogs, Cats, and Other animals.

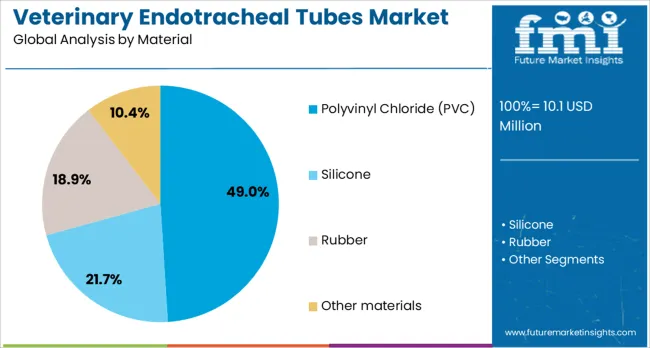

The veterinary endotracheal tubes market is segmented into Polyvinyl Chloride (PVC), Silicone, Rubber, and Other materials. The veterinary endotracheal tubes market is segmented by material into Polyvinyl Chloride (PVC), Silicone, Rubber, and Other materials. The veterinary endotracheal tubes market is segmented into Surgery, General Anaesthesia, and Other applications. By end-use of the veterinary endotracheal tubes market is segmented into Veterinary hospitals & clinics and Academic & research institutes. Regionally, the veterinary endotracheal tubes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cuffed endotracheal tubes are projected to dominate the market with a 64.0% revenue share in 2025. This leadership stems from their superior sealing capability, which minimizes the risk of aspiration and ensures effective ventilation during procedures.

Cuffed tubes are especially favored in prolonged surgeries or emergency situations where airway protection is critical. They also provide better control of anesthetic gases, reducing leakage and environmental contamination.

As veterinary clinics standardize surgical protocols and adopt more advanced monitoring systems, cuffed tubes are being preferred for their enhanced safety profile and adaptability across diverse animal sizes and breeds.

By animal type, dogs are expected to account for 72.0% of the veterinary endotracheal tubes market revenue by 2025, making them the dominant end-user species. This high share reflects the significant global dog ownership population and their frequent presentation in veterinary hospitals for procedures requiring airway management.

Dogs are also more likely to undergo dental surgeries, tumor removals, and orthopedic operations many of which require general anesthesia.

The high demand for canine-specific endotracheal tubes has led to innovations in tube sizing, curvature, and cuffing methods that enhance intubation success rates and postoperative recovery.

Polyvinyl Chloride (PVC) is forecast to hold 49.0% of the market share by 2025, making it the leading material type in veterinary endotracheal tubes. PVC’s popularity is driven by its flexibility, biocompatibility, and affordability.

It allows for transparent tube construction, which aids in visibility of blockages or fluid accumulation during use. The material's ability to maintain shape while still being soft enough for safe insertion makes it ideal for small and medium-sized animals.

Additionally, PVC can be sterilized effectively and supports disposable formats, which align with infection control standards increasingly adopted by modern veterinary clinics.

The veterinary endotracheal tubes market is growing steadily due to increasing pet ownership, rising veterinary surgical procedures, and a stronger focus on companion animal health. These devices are critical in maintaining airway patency during anesthesia and emergency care in animals. Growing awareness among veterinarians and improved access to animal healthcare services support demand. The market includes a range of tube types designed for different species and procedures. Veterinary clinics, animal hospitals, and academic institutions remain the primary end users of these products.

The increasing number of surgical interventions in animals, particularly in pets, is a major factor driving demand for veterinary endotracheal tubes. These tubes are essential for ensuring airway management during anesthesia, which is frequently required in procedures ranging from dental cleanings to major surgeries. With more households treating pets as family members, the willingness to invest in surgical care has grown. Veterinary professionals are also becoming more skilled in handling complex cases, leading to broader application of anesthesia-supported procedures. Additionally, large animal and livestock surgeries in farms and rural clinics are contributing to adoption. Hospitals and clinics are upgrading their anesthesia equipment, often bundling endotracheal tubes with monitoring and ventilation systems. With increasing access to veterinary education and professional certification programs, there is a broader understanding of the need for proper airway tools. This growing professionalization of veterinary care continues to fuel the market’s expansion across both companion and livestock segments.

One of the main challenges in the veterinary endotracheal tubes market is the anatomical variability across species, which complicates product standardization. Unlike human patients, animals vary widely in airway size and structure based on species, breed, and age. A tube that fits a small dog may be entirely unsuitable for a cat or a large breed canine. This diversity requires a broad range of tube sizes, designs, and materials to accommodate various animal types, from exotic pets to large farm animals. Manufacturers must account for these differences while maintaining safety and efficacy. This need for customization increases production complexity and inventory demands for veterinary clinics. Moreover, the lack of universal sizing guidelines or clear standards across regions may result in incorrect tube selection, potentially leading to complications during procedures. These sizing inconsistencies and anatomical differences make training, stocking, and equipment standardization difficult, particularly for smaller or rural veterinary practices.

Expanding veterinary services in developing regions creates strong growth opportunities for suppliers of endotracheal tubes. As more countries invest in animal healthcare infrastructure, particularly in livestock and poultry sectors, demand for reliable airway management tools rises. Government initiatives to improve animal welfare, disease control, and food safety are driving more structured veterinary practices, especially for herd-level management. Additionally, mobile clinics and outreach programs in rural areas are increasing surgical access for animals, often under field conditions. Manufacturers offering affordable, robust tubes suitable for variable conditions can address this emerging segment. Beyond livestock, rising interest in exotic pets and wildlife rescue centers in these regions also requires specialized airway devices. Suppliers who partner with training institutions, veterinary schools, and distributors in these areas can expand their reach and build long-term presence. As awareness and spending grow in these markets, providers with diverse and adaptive product portfolios stand to benefit significantly.

Despite growing awareness, the market faces restraints due to limited veterinary infrastructure in many parts of the world. In rural or underserved areas, clinics often lack basic surgical or anesthesia equipment, making procedures involving endotracheal tubes rare or impractical. The availability of trained veterinary anesthetists or technicians is also a constraint, as proper intubation requires skill and familiarity with animal anatomy. Incorrect placement can result in complications or poor patient outcomes, which discourages adoption among less-experienced practitioners. Budget constraints in small clinics further limit the ability to stock a variety of tube types and sizes. Even in more advanced regions, some clinics prioritize cost-saving measures over stocking comprehensive airway tools. These structural limitations hinder wider deployment of endotracheal tubes, especially outside urban centers or major hospitals. Until there is broader access to training, funding, and infrastructure for veterinary procedures, the market will face challenges in achieving consistent growth across all regions.

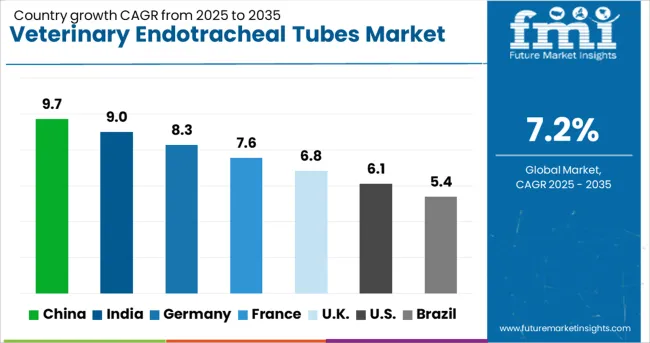

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global veterinary endotracheal tubes market is projected to grow at a CAGR of 7.2% through 2035, supported by rising companion animal surgeries, improvements in veterinary care infrastructure, and regulatory emphasis on animal health. Among BRICS nations, China leads with a 9.7% growth rate, driven by the expansion of veterinary hospitals, increased pet ownership, and in-country production of medical-grade devices. India follows at 9.0%, supported by veterinary training programs, rural animal health initiatives, and a growing base of private animal clinics. Within the OECD region, Germany reports 8.3% growth, driven by strict animal safety regulations and demand for precision veterinary equipment. The United Kingdom, growing at 6.8%, emphasizes anesthetic safety in small animal practices and advanced surgical protocols. The United States, at 6.1%, remains a mature market shaped by FDA veterinary device standards and innovation in small animal surgery. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The veterinary endotracheal tubes market in China is advancing at a CAGR of 9.7%, driven by a rise in animal hospitals with advanced surgical capabilities. Multi-specialty veterinary centers in cities such as Beijing, Shanghai, and Guangzhou are performing a growing number of surgeries on companion animals, leading to higher usage of airway management devices. Clinics are expanding the number of operating rooms and introducing high-flow oxygen systems, both of which require precise tube sizes and materials. Domestic manufacturers have begun producing cost-effective tubes with softer materials that reduce trauma during intubation. Livestock facilities in provinces like Shandong and Henan are also employing endotracheal tubes during sedation or respiratory treatments for high-value cattle and pigs. With increased awareness of animal anesthesia protocols, training institutions are now integrating hands-on endotracheal tube placement into veterinary programs.

In India, the veterinary endotracheal tubes market is growing at a CAGR of 9.0%, supported by a rise in pet ownership and improved access to veterinary surgical care. Clinics in Delhi, Bengaluru, and Mumbai are expanding their surgical capacity, performing procedures such as mass removals, orthopedics, and dental extractions where airway support is critical. Demand is increasing for tubes with adjustable cuffs and clear markings to suit various animal sizes. Veterinary teaching hospitals are equipping their surgery wings with standardized intubation sets and suction systems. Several manufacturers are offering disposable tubes at reduced costs to improve hygiene standards in budget-constrained clinics. Additionally, rural mobile vet units treating cattle and buffalo during respiratory infections or transport recovery are using endotracheal tubes for oxygen administration.

The veterinary endotracheal tubes market in Germany is expanding at a CAGR of 8.3%, with demand centered on high-standard veterinary practices and animal hospitals. Clinics in Munich, Berlin, and Stuttgart are equipped with surgical wings that follow strict anesthetic protocols, requiring precision airway control. Surgeons increasingly prefer tubes with low-pressure cuffs and transparent tubing for better visibility during procedures. Manufacturers are supplying silicone and reinforced variants suitable for long-duration surgeries. Equine hospitals and zoos have also adopted specialty endotracheal equipment for exotic species requiring anesthesia. Clinics have begun integrating capnography and oxygen monitoring systems, which rely on well-fitted tubes for accurate results. The growing use of advanced dental cleaning under anesthesia for dogs and cats has also added to recurring demand for different tube sizes.

The veterinary endotracheal tubes market in United Kingdom is growing at a CAGR of 6.8%, led by clinics performing airway and dental procedures on small animals. Urban pet care centers across London, Manchester, and Edinburgh are reporting an uptick in surgeries where general anesthesia is needed, requiring safe intubation practices. Practices are shifting toward cuffed tubes with pressure indicators to prevent tracheal injuries. Emergency clinics have adopted color-coded intubation sets to reduce prep time and ensure faster response during critical care. Veterinary nurses are receiving certification in airway management, enhancing proper placement and post-operative monitoring. Manufacturers are also introducing shorter tube lengths optimized for brachycephalic breeds like bulldogs and pugs, who require special consideration during intubation.

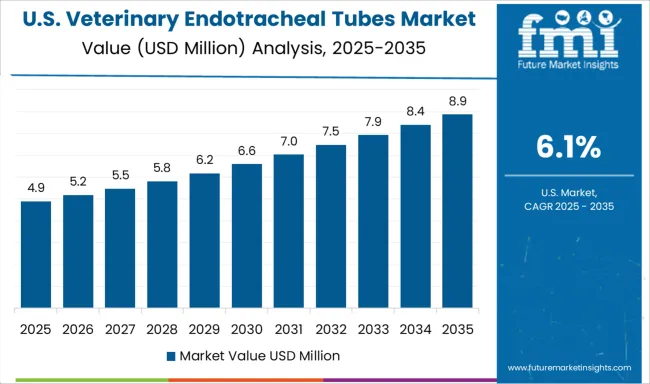

In United States, the veterinary endotracheal tubes market is growing at a CAGR of 6.1%, with growth spread across both companion animal and livestock care facilities. Veterinary hospitals in Texas, Florida, and California are expanding operating theaters and incorporating dual-use anesthetic machines. Mixed animal practices are now performing a higher volume of surgical procedures, including soft tissue and orthopedic surgeries in dogs, cats, and farm animals. Manufacturers are offering tubes with integrated connectors for oxygen and suction systems, allowing for efficient surgical preparation. Mobile surgery units in rural areas have increased usage of compact intubation kits for field operations. Additionally, tubes made with thermosensitive materials are being used in teaching hospitals to reduce patient trauma and facilitate training.

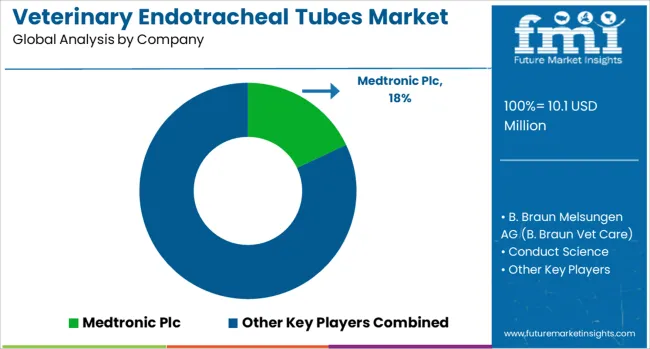

The veterinary endotracheal tubes market is composed of a mix of established medical device manufacturers and specialized veterinary care firms. Medtronic Plc leads the market with its advanced product lines designed for both human and animal applications, benefiting from a global supply chain and trusted clinical performance. Similarly, B. Braun Melsungen AG, through its Vet Care division, offers a comprehensive catalog tailored to the needs of veterinary professionals, combining clinical-grade materials with ergonomic designs to support reliable airway management in a variety of species. Mid-tier players like Conduct Science, Harvard Apparatus, and RWD Life Science are actively growing their footprint by focusing on precision-engineered products suited for both research labs and private practices. These companies benefit from working closely with universities, animal health researchers, and veterinary clinics, giving them insight into changing user needs. Their product development strategies often emphasize customization and adaptability across different animal sizes and procedures, a key differentiator in this niche yet technically demanding field. Veterinary-focused firms such as Jorgensen Laboratories, Supera Anesthesia Innovations, Vetamac, and Vetland Medical operate with strong regional distribution networks and a tight focus on field-ready solutions. Their success hinges on customer trust and long-term service support, especially in clinics where standardization of tools is crucial. These companies are increasingly adopting direct veterinarian feedback loops to refine product design, giving them a responsiveness edge in a market that values both reliability and adaptability during critical procedures.

Recent DevelopmentAs announced by Vetamac in March 2025, the company launched a new range of micro‑sized silicone endotracheal tubes tailored for rodents and small laboratory animals. These tubes enable safer, precise airway management in preclinical and academic research settings requiring miniature instrumentation.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.1 Million |

| Product Type | Cuffed and Uncuffed |

| Animal Type | Dogs, Cats, and Other animals |

| Material | Polyvinyl Chloride (PVC), Silicone, Rubber, and Other materials |

| Material | Polyvinyl Chloride (PVC), Silicone, Rubber, and Other materials |

| Application | Surgery, General Anaesthesia, and Other applications |

| End-use | Veterinary hospitals & clinics and Academic & research institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Medtronic Plc, B. Braun Melsungen AG (B. Braun Vet Care), Conduct Science, Harvard Apparatus, Intriquip Instruments, Inc., Jorgensen Laboratories, RWD Life Science Co, Ltd., Supera Anesthesia Innovations, Vetamac, Inc., and Vetland Medical Sales & Services, LLC |

| Additional Attributes | Dollar sales vary by tube type and end-use, with cuffed tubes dominating value, while uncuffed tubes in clinics grow fastest. North America leads revenue , as Asia‑Pacific shows highest. Pricing fluctuates with raw material and silicone costs. Growth accelerates via species-specific designs, trauma‑minimizing cuffs, and expanded clinic adoption under pet-care expansion trends. |

The global veterinary endotracheal tubes market is estimated to be valued at USD 10.1 million in 2025.

The market size for the veterinary endotracheal tubes market is projected to reach USD 20.2 million by 2035.

The veterinary endotracheal tubes market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in veterinary endotracheal tubes market are cuffed and uncuffed.

In terms of animal type, dogs segment to command 72.0% share in the veterinary endotracheal tubes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA