The wound wash market is advancing steadily, driven by the growing demand for safe, efficient, and cost-effective wound irrigation solutions across healthcare and home care environments. Industry reports and clinical updates have emphasized the critical role of wound cleansing in infection prevention, especially in acute and surgical wound management. Rising incidences of trauma injuries, burns, and diabetic wounds have accelerated the need for effective wound irrigation products.

Healthcare institutions are increasingly prioritizing products that ensure aseptic delivery, user convenience, and broad antimicrobial compatibility. Product innovations such as non-cytotoxic formulations, pH-balanced solutions, and preservative-free washes have improved treatment outcomes and user compliance.

Moreover, the shift toward outpatient wound care, home-based treatment, and sports injury management has widened the application scope. Looking forward, advancements in packaging design for single-handed use, coupled with regulatory emphasis on infection control, are expected to drive sustained market growth. Segmental expansion is being led by Bulk Solution as the preferred product format, Dispensing Cap Bottle as the leading packaging solution, and Acute Wounds as the primary wound category driving product utilization.

| Metric | Value |

|---|---|

| Wound Wash Market Estimated Value in (2025 E) | USD 208.1 million |

| Wound Wash Market Forecast Value in (2035 F) | USD 305.1 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

The market is segmented by Product, Packaging, Wound, and End User and region. By Product, the market is divided into Bulk Solution and Single Use Saline. In terms of Packaging, the market is classified into Dispensing Cap Bottle, Trigger Spray Bottle, Finger Spray Bottle, and Single Use Bottle. Based on Wound, the market is segmented into Acute Wounds and Chronic Wounds. By End User, the market is divided into Hospitals, Ambulatory Surgical Centers, Clinics, Long Term Care Centers, Home Care Settings, and Wound Care Center. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

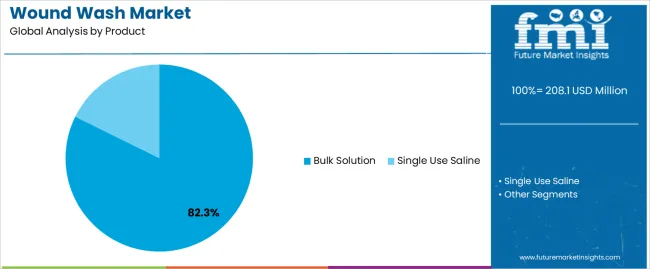

The Bulk Solution segment is projected to capture 82.3% of the wound wash market revenue in 2025, making it the dominant product format. This growth has been attributed to the high demand for cost-effective, large-volume wound irrigation solutions in hospitals, clinics, and emergency departments.

Healthcare providers have favored bulk formats due to their suitability for treating multiple patients, performing surgical site irrigation, and managing chronic wound beds that require repeated cleansing. The segment’s growth has also been supported by procurement strategies that prioritize volume-based purchasing to control per-use costs in high-throughput healthcare settings.

Manufacturers have responded by offering bulk containers in varying volumes, often with sterilized contents that meet infection control standards. As institutional care providers focus on reducing wound-related complications and standardizing treatment protocols, the Bulk Solution segment is expected to maintain its leading position across clinical environments.

The Dispensing Cap Bottle segment is expected to account for 41.8% of the wound wash market revenue in 2025, leading the packaging category. Its growth has been supported by the segment’s ease of use, targeted fluid application, and ability to maintain sterility during repeated use.

Clinicians and caregivers have favored this packaging format for its ergonomic design, which supports controlled flow during irrigation while reducing waste. The growing emphasis on patient comfort, home care accessibility, and single-handed operation has contributed to wider adoption across outpatient and self-care environments.

Additionally, packaging innovations have enhanced user safety by reducing the risk of cross-contamination, especially during minor procedures and first-aid scenarios. As patient populations grow more reliant on portable and self-directed wound care solutions, the Dispensing Cap Bottle segment is poised to remain a preferred choice due to its practicality and infection control advantages.

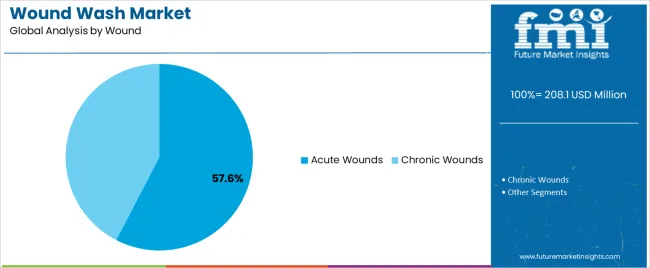

The Acute Wounds segment is projected to hold 57.6% of the wound wash market revenue in 2025, positioning it as the leading wound type in product application. Growth in this segment has been driven by the high prevalence of surgical incisions, traumatic injuries, abrasions, and superficial lacerations that require immediate and thorough cleansing to prevent infection.

Clinical protocols have emphasized the importance of timely irrigation to reduce microbial load and promote optimal healing in acute wound cases. Emergency care departments, surgical centers, and urgent care clinics have consistently relied on wound wash solutions for pre- and post-operative cleansing and trauma management.

Furthermore, acute wounds tend to be treated in high volumes across both institutional and home settings, contributing to strong segment demand. The increasing availability of non-irritating, isotonic wash formulations suitable for acute wound use has further strengthened market penetration. As public health initiatives continue to promote first-aid readiness and trauma response, the Acute Wounds segment is expected to maintain its leading market share.

Increasing Surgical and Trauma Cases Worldwide Fostering Industry Growth

According to the data from National Library of Medicine, more than 310 million surgeries are performed globally. Out of which 40 to 50 million are performed in United States and 20 million in Europe. The data also show that trauma is the leading cause of death worldwide accounting for more than 5 million lives.

More than 1 billion people per year need medical care for trauma injuries. Within the age group of 5 to 45 years, trauma is the major cause of disability. This increasing surgical and trauma cases have increased the adoption of wash product by healthcare professional to deliver effective wound care.

The growth of ambulatory surgical center (ASC), have increased the demand for wound care products. Ambulatory surgical center are cost effective, and convenient for patient. As strong focus is being put on preventing hospital-acquired infection ASCs must adhere to infection prevention protocols. Wound wash product serves important in this context. Due to the combination of above factors the industry for such wash is increasing.

Demand for Specialized Wound Care Products Provides an Opportunity for Market Players

Emerging countries have large population and increasing incidences of surgical procedure. The healthcare infrastructure across all the developing countries is also being developed and there is rise in awareness about the importance of wound care. There is huge gap in the industry for the specialized wound care products.

This present an opportunity for the market player to improved patient outcomes and reduce burden of wound infections. Companies can partner with local distributor to do so. Industry players need to conduct research and develop strategies to tackle challenges of regulation and economic factor.

Presence of Alternative Product Challenging the Industry Expansion

Healthcare experts generally opt for wound wash mostly that involves the usage of the saline solution (NaCl 0.9%). The main application of this product is to clean the wound free from debris and unwanted exudate.

There are alternative product in the industry that are more viable for this application and also offers additional advantages. Specialized wound cleanser in the market are antimicrobial, film forming, property and have surfactant in it. This provide more efficient cleaning of the wound. The availability of this alternative product is hampering the industry growth for wound wash.

Global sales increased at a CAGR of 3.1% from 2020 to 2025. For the next ten years, projections are that expenditure on wound wash will rise at 3.9% CAGR

Post pandemic, there have been shift in the mentality of consumer and healthcare professional. There have been greater focus on preventive healthcare. The growing awareness about the repercussion of poor wound management among healthcare professional and general population have fuelled the adoption of such products. Such products play a critical role in preventing infection and promoting wound healing.

Wound cleaning is the most fundamental step in any similar treatment. The availability of wound wash with antimicrobial agent and proper PH balanced has allowed healthcare professionals to improve patient outcomes.

The educational initiatives, public awareness campaigns and training programs for medical staff and general public can help in bridging the knowledge gap and drive the adoption of such solutions. Healthcare professional, when informed about the benefits of using the right wash product, can lead to more utilization of the wound cleaning products and overall industry growth.

The following table shows the estimated growth rates of the top five markets. China and the United Kingdom are set to exhibit high wound wash consumption, recording CAGRs of 6.8% and 4.0%, respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| The United States | 2.3% |

| Germany | 3.1% |

| France | 3.7% |

| The United Kingdom | 4.0% |

| China | 6.8% |

The industry for wound wash in the United States is projected to exhibit a CAGR of 2.3% during the assessment period. By 2035, revenue from the sales of wound wash in the country is expected to reach USD 71.9 million.

The United States dominated the industry due large of volume of surgical procedure performed. According to National Library of Medicine, there are around 64 million surgical procedure performed. As the surgical procedure require the wound care product such as wound wash to prevent infection and promote healing, the demand for such products is increasing in the United States. On top of that, the United States has well established healthcare infrastructure and growing geriatric population both which indirectly contributes to the demand for such products. The combination of above factors has led to the dominance of the United States in the global wound wash market.

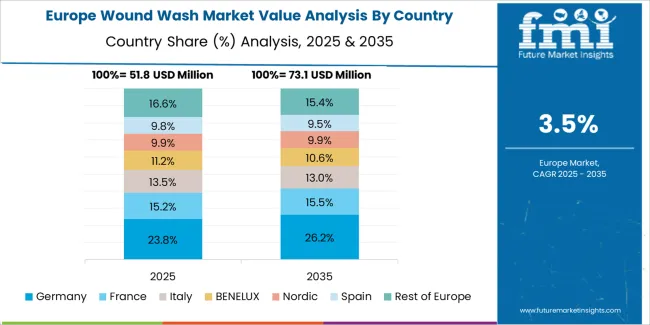

Demand in Germany is calculated to rise at a value CAGR of 3.1 % during the forecast period (2025 to 2035). By 2035, Germany is expected to account for 6.6% of sales on a global scale.

Germany have been encountering demographic shift with rise in geriatric population, which are more susceptible to chronic disease such as diabetes. This chronic disease has shown to lead to chronic wound which require wound care product for proper treatment. According to recent study, the wound care burden has increase post the Covid-19 due to multiple factor. This resulted in surge in the sale of wound care product to address the increase in wound care burden. Due to the aforementioned factors, the Germany industry is growing.

Consumption of wound wash in France is projected to increase at a value CAGR of 3.7% over the next ten years. By 2035, the industry size is forecasted to reach USD 15.5 million, with France expected to account for a share of 5.3% in global industry.

France along with other European countries has reported an increase in hospitalization for wound treatment cases. Such instances have led to increase demand for wound care products. The prevalence of chronic disorder in France has also been contributing to the demand for wound wash product. Chronic wound such as diabetes related ulcers and pressure ulcers, requires advance wound care product including wound wash solution to effectively manage these conditions. France also has robust healthcare infrastructure contributing to the increase of the industry.

| Segment | Bulk Solution (Product) |

|---|---|

| Value Share (2025) | 82.3% |

Single use Saline have high cost due to the increase cost of packaging per unit. Large healthcare institutions prefer bulk wound wash solution due to its cost effectiveness. The wound cleaning requires sufficient quantity of solution to remove debris and exudate.

Single use saline has small quantity of solution suitable for minor wound cleaning only. This limits their application for small acute wound management only. This factor results in the dominance of bulk solution segment in wound wash market.

| Segment | Hospitals (End User) |

|---|---|

| Value Share (2025) | 46.5 % |

Rapidly growing adoption of such products in hospital is attributed to large number of wound treatment cases addresses in hospital setting. The hospital segment is anticipated to advance at 2.1% CAGR during the projection period.

Such solution is effective in promoting wound healing and decreasing the risk of infection. It removes debris, contaminants and unwanted exudate from the wound bed, which is important for healing process. As hospital serves as the primary treatment center across the globe, the need for wound wash solution is high in hospitals. According to WHO there are 421 million hospitalization cases in the world annually. There is emergence of specialty wound care centers but that is limited to developed economies. The universal nature of hospital has led to its dominance in the wound wash market.

The wound wash market is characterized by presence of large established players such as McKesson, Mölnlycke Health Care, 3M, and Cardinal Health.

These market players are deploying different strategy to secure large industry share and increase their revenue. Popular strategies adopted by the key manufacturers are product launch and partnership. Companies are investing in developing more innovative product and establishing partnership with various stakeholder such as distributors, healthcare professional etc.

For instance:

As per product, the market has been categorized into single use saline and bulk solution.

This segment is further categorized into dispensing cap bottle, trigger spray bottle, finger spray bottle, and single use bottle.

This wound type segment is bifurcated into acute wounds (surgical wounds, traumatic wounds, and burns) and chronic wounds (venous ulcers, pressure ulcers, diabetic foot ulcers, and others).

Different end user includes hospitals, ambulatory surgical centers, clinics, long term care centers, home care settings, and wound care center.

Industry analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

The global wound wash market is estimated to be valued at USD 208.1 million in 2025.

The market size for the wound wash market is projected to reach USD 305.1 million by 2035.

The wound wash market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in wound wash market are bulk solution and single use saline.

In terms of packaging, dispensing cap bottle segment to command 41.8% share in the wound wash market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wound Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Wound Evacuators Market Size and Share Forecast Outlook 2025 to 2035

Wound Skin Care Market - Demand & Forecast 2025 to 2035

Wound Stimulation Therapy Market Insights – Demand and Growth Forecast 2025 to 2035

Wound Care Surfactant Market Insights – Demand and Growth Forecast 2025 to 2035

Analysis and Growth Projections for Wound Healing Nutrition Market

Wound Irrigation Systems Market Growth - Trends & Forecast 2025 to 2035

Wound Debridement Products Market Analysis - Growth & Forecast 2025 to 2035

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Wound Measurement Devices Market

Wound Irrigation Devices Market

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Spiral Wound Membrane Market

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Digital Wound Measurement Devices Market is segmented by Diabetic Ulcer, Chronic Wounds, Burns from 2025 to 2035

Advance Wound Care Market Analysis by Advance Wound Dressings, NPWT Devices and Others through 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA