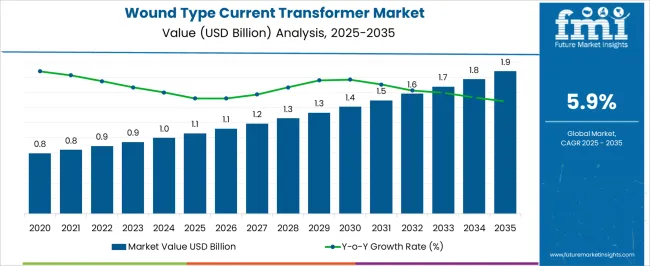

The wound type current transformer market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

Steady growth has been anticipated from 2025 onwards, with the market showing incremental increases from 0.8 USD billion in the initial years to 1.0 USD billion by 2025. The year-on-year growth reflects a gradual rise, with 2026 and 2027 observing slight increases to 1.1 USD billion, suggesting a stable adoption of wound type current transformers across industrial and utility applications. From 2028 to 2030, market expansion is expected to accelerate modestly, moving from 1.2 USD billion to 1.4 USD billion, driven by rising demand for precise current measurement in energy distribution networks and automation systems.

The period between 2031 and 2035 is anticipated to witness stronger growth, with the market scaling from 1.5 USD billion in 2031 to 1.9 USD billion by 2035, reflecting increased investments in smart grid infrastructure and industrial modernization initiatives. Incremental year-on-year gains indicate that manufacturers are progressively leveraging technological advancements, enhanced material efficiency, and improved transformer designs to capture a larger market share.

Market dynamics such as regulatory compliance, rising electricity consumption, and modernization of transmission and distribution systems are expected to underpin sustained growth throughout the forecast horizon. Overall, the wound type current transformer market demonstrates a consistent upward trajectory, with its expansion supported by evolving energy infrastructure requirements and rising demand for accurate power monitoring solutions.

The wound type current transformer (CT) market is shaped by several interrelated parent markets, each influencing its growth and adoption across power generation, transmission, and industrial applications. The largest contributor is the power distribution and transmission equipment market, which holds approximately 35% share. This prominence is attributed to the critical role wound type CTs play in monitoring current flow, protecting transformers, and ensuring accurate metering in high-voltage and medium-voltage networks.

The industrial automation and process control market contributes around 25%, reflecting the rising deployment of CTs in manufacturing plants, chemical processing units, and heavy machinery setups where precise current measurement is essential for operational efficiency and safety.

The smart grid and energy management systems market accounts for nearly 20% of the influence, driven by the integration of CTs in advanced monitoring systems that support real-time load management, fault detection, and predictive maintenance. The electrical metering and instrumentation market adds about 15%, fueled by the growing need for accurate energy measurement in commercial, residential, and industrial settings, where regulatory compliance and energy efficiency are increasingly prioritized.

Finally, the renewable energy sector contributes around 5%, as wound type CTs are increasingly applied in solar and wind energy installations to monitor variable currents and maintain grid stability. Collectively, these parent markets create a comprehensive ecosystem that drives the wound type current transformer market, ensuring its relevance across traditional and emerging electrical infrastructure while supporting adoption in technologically advanced power management solutions.

| Metric | Value |

|---|---|

| Wound Type Current Transformer Market Estimated Value in (2025 E) | USD 1.1 billion |

| Wound Type Current Transformer Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The wound type current transformer market is witnessing sustained growth driven by its critical role in accurate current measurement, protection, and monitoring across power transmission and distribution systems. Rising investments in grid modernization, coupled with expanding renewable energy integration, are creating consistent demand for reliable transformer solutions. The market is being supported by advancements in insulation, core materials, and manufacturing precision, enabling enhanced performance under varying load conditions.

Regional demand patterns are influenced by infrastructure development projects in emerging economies, while mature markets are focused on replacement and upgrade cycles to meet evolving safety and efficiency standards. Strategic collaborations between manufacturers and utility companies are fostering customized product designs suited to specific network requirements.

Additionally, supportive regulatory frameworks and mandatory compliance with international standards are ensuring product quality and interoperability Over the forecast period, the combination of expanding electricity consumption, urbanization, and technological upgrades in power networks is expected to sustain market momentum and create opportunities for innovation-driven differentiation.

The wound type current transformer market is segmented by cooling, rating, application, and geographic regions. By cooling, wound type current transformer market is divided into oil immersed and dry type. In terms of rating, wound type current transformer market is classified into ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV. Based on application, wound type current transformer market is segmented into power distribution, manufacturing, and others. Regionally, the wound type current transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

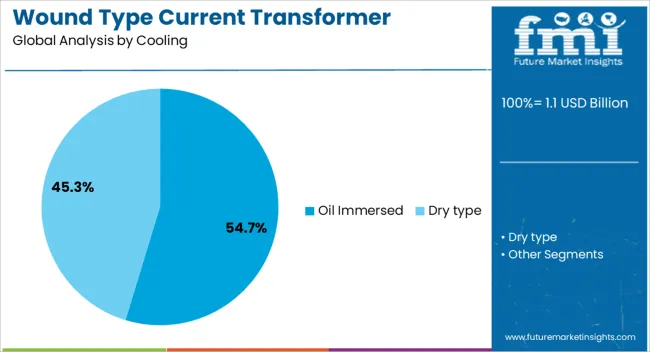

The oil immersed cooling category, with a 54.7% share, has maintained its dominance due to superior thermal management capabilities and proven reliability in high-load, continuous operation environments. Its adoption is reinforced by extended service life, low maintenance needs, and stable performance under varying environmental conditions.

Utility providers and industrial operators favor oil immersed units for their ability to handle higher insulation levels and operational stresses, making them suitable for critical power network components. Manufacturing improvements have enhanced oil sealing and insulation systems, minimizing leakage risks and improving operational safety.

Furthermore, their compatibility with diverse transformer configurations allows flexibility in deployment across both transmission and distribution networks The segment’s strong position is also supported by long-term cost efficiency and reduced lifecycle operational disruptions, which are critical considerations in power infrastructure projects, thereby ensuring continued preference in large-scale applications.

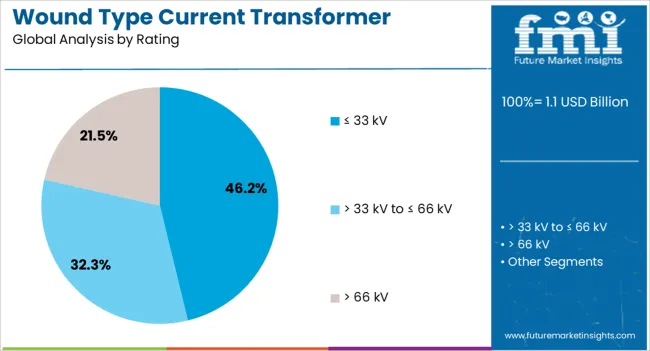

The ≤ 33 kV rating category, holding 46.2% of the market, leads due to its suitability for medium-voltage applications, particularly within regional and local distribution grids. This rating range aligns with the voltage requirements of most urban and rural distribution systems, making it a standard choice for utilities and industrial facilities.

The segment benefits from widespread use in secondary substations, manufacturing plants, and renewable energy projects, where compact size and operational efficiency are essential. Technical enhancements in winding design and insulation quality have improved performance stability, while standardization across regulatory jurisdictions ensures compatibility and ease of integration.

Lower installation and operational costs compared to higher-rated units further enhance its attractiveness, especially in cost-sensitive infrastructure development As electrification efforts accelerate in developing regions, the demand for ≤ 33 kV rated transformers is expected to remain robust.

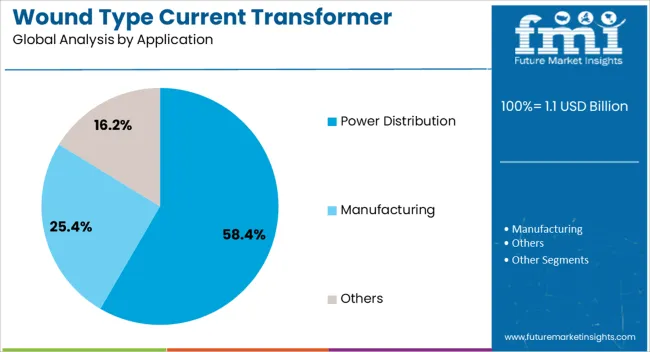

The power distribution application, representing 58.4% of the market, dominates due to the essential role of wound type current transformers in ensuring accurate current monitoring, fault detection, and network protection in distribution systems. This segment is supported by the continuous expansion of distribution networks to meet growing electricity demand in urban, semi-urban, and industrial areas.

The widespread use in both primary and secondary distribution substations reinforces its position, as accurate measurement is critical for efficiency, safety, and regulatory compliance. Technological developments in metering accuracy and integration with digital monitoring systems have further enhanced operational capabilities, enabling predictive maintenance and reducing downtime.

The segment’s growth is also fueled by government-led initiatives for rural electrification, grid strengthening, and renewable energy integration into distribution networks With increasing emphasis on energy efficiency, reliability, and advanced fault detection, the power distribution application is expected to maintain its leadership position throughout the forecast period.

The wound type current transformer market is primarily driven by power distribution needs, industrial automation, smart grids, and renewable energy applications. Increasing adoption across sectors ensures sustained growth and critical role in modern energy systems.

The wound type current transformer market is driven by increasing demand for reliable power distribution systems. Utilities are adopting CTs to accurately measure current flow and monitor load conditions in transmission and distribution networks. Rapid expansion of electrical infrastructure in developing regions has resulted in higher adoption of medium- and high-voltage CTs. Fault detection, overload protection, and grid monitoring remain critical drivers, as operators seek to prevent equipment failures and optimize energy delivery. Consistent replacement of aging transformers and upgrading existing substations has further fueled demand. Market growth is reinforced by the need for precise metering in industrial facilities and commercial buildings, where energy efficiency and operational safety are key priorities.

Industrial operations are increasingly leveraging wound type CTs for process control, motor protection, and predictive maintenance. CTs enable real-time monitoring of electrical currents in machinery, ensuring operational reliability and preventing downtime due to overloads. Adoption in manufacturing plants, chemical processing units, and heavy equipment installations has expanded as companies aim to improve efficiency and reduce maintenance costs. These transformers support advanced protection relays and intelligent monitoring systems, enhancing decision-making for plant operators. Growing industrial electricity consumption and regulatory requirements for accurate metering further contribute to market growth. The reliability offered by CTs makes them indispensable for safeguarding expensive equipment while maintaining uninterrupted operations.

The rise of smart grid initiatives and energy management systems has significantly impacted the wound type CT market. These transformers are applied in load monitoring, fault detection, and grid stability analysis, providing operators with actionable data for efficient energy distribution. Integration into intelligent metering systems allows utilities to track consumption patterns and implement demand-side management strategies. Increasing adoption of digital substation solutions and automated monitoring platforms strengthens market demand. Energy efficiency regulations and growing investment in digital infrastructure further support adoption. The use of CTs in grid modernization ensures enhanced safety, reduces downtime, and enables more reliable electricity delivery across industrial, commercial, and residential sectors, making them a key component of modern energy systems.

Wound type CTs are increasingly applied in renewable energy projects, such as solar and wind farms, to monitor variable current outputs and maintain grid stability. Their ability to accurately measure alternating currents in fluctuating conditions is crucial for system reliability. Power generation from distributed energy sources requires precise current measurement to optimize performance and protect inverters and transformers from overloads. Integration with monitoring systems allows operators to detect faults, prevent downtime, and maintain consistent energy flow. Rising investment in renewable energy infrastructure globally has expanded CT applications in off-grid and microgrid projects. These developments position wound type CTs as essential components in modern energy transition initiatives.

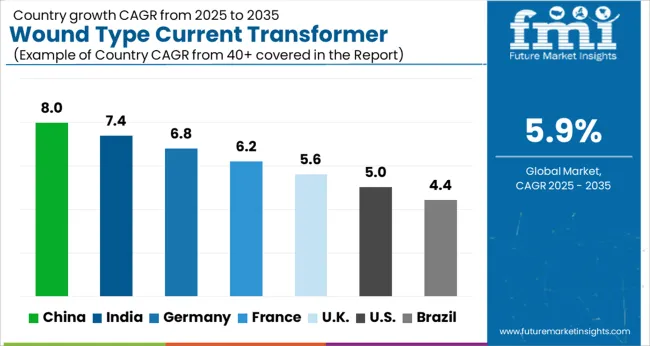

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

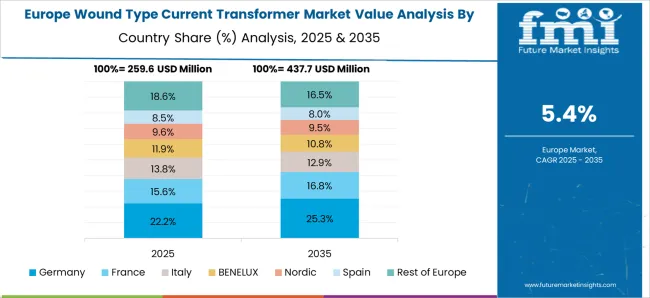

The global wound type current transformer market is expected to grow at a CAGR of 5.9% between 2025 and 2035. China leads with an 8.0% growth rate, followed by India at 7.4%, Germany at 6.8%, the United Kingdom at 5.6%, and the United States at 5.0%. Expansion is driven by rising electricity demand, modernization of transmission and distribution networks, and the increasing deployment of industrial automation systems requiring precise current measurement.

Developing economies such as China and India are supporting market growth through grid expansion, substation upgrades, and smart monitoring initiatives, while advanced economies like Germany, the UK, and the USA focus on integrating CTs into smart grid infrastructure and energy management systems. The analysis encompasses over 40 countries, highlighting the key contributors to global wound type current transformer adoption.

The wound type current transformer (CT) market in China is projected to grow at a CAGR of 8.0% from 2025 to 2035, driven by extensive investments in electricity transmission, distribution networks, and industrial automation systems. The country’s expanding urban infrastructure and rising power consumption have created strong demand for CTs in substations, manufacturing plants, and commercial facilities. Utilities are focusing on upgrading aging equipment, installing high-precision CTs to ensure grid stability, and integrating them with advanced energy monitoring systems.

Industrial facilities are deploying CTs for predictive maintenance, motor protection, and process control. Domestic manufacturers are scaling production capacities while partnering with global technology providers to meet increasing demand. Government programs targeting energy efficiency and smart grid modernization further strengthen the market outlook.

The wound type CT market in India is expected to grow at a CAGR of 7.4% from 2025 to 2035, propelled by expanding power generation capacity and modernization of transmission and distribution systems. Rapid industrial growth and rising electricity consumption are encouraging utilities and private operators to adopt precise measurement devices for load management and fault detection. CTs are increasingly deployed in large-scale manufacturing facilities, process industries, and infrastructure projects to ensure equipment protection and operational reliability. The country’s smart grid initiatives, coupled with government-backed programs for rural electrification, are also expanding the market. Local manufacturers are collaborating with international suppliers to deliver high-quality, cost-efficient transformers for both urban and semi-urban regions.

The wound type CT market in Germany is projected to grow at a CAGR of 6.8% from 2025 to 2035, fueled by modernization of the country’s electrical infrastructure and industrial automation systems. German utilities are focusing on integrating CTs into smart substations and energy management systems for precise current measurement and load monitoring. The manufacturing sector is leveraging CTs for motor protection, predictive maintenance, and operational efficiency. Strong regulatory frameworks mandating accurate metering and energy monitoring also support adoption.

Additionally, Germany’s push toward digital energy infrastructure and renewable integration is creating opportunities for CT applications in solar and wind energy installations. Local manufacturers are investing in advanced designs to meet both domestic and export demand.

The wound type CT market in the United Kingdom is expected to grow at a CAGR of 5.6% from 2025 to 2035, influenced by investments in grid modernization and industrial energy monitoring systems. CTs are increasingly deployed in transmission networks, distribution substations, and large commercial buildings for current measurement and overload protection.

Industrial facilities utilize CTs to safeguard electrical equipment and enable predictive maintenance programs. Adoption is further driven by renewable energy integration, including solar farms and offshore wind projects, requiring precise current monitoring for grid stability. Local suppliers are enhancing product quality while collaborating with utilities and industrial operators to ensure compatibility with intelligent metering and energy management systems.

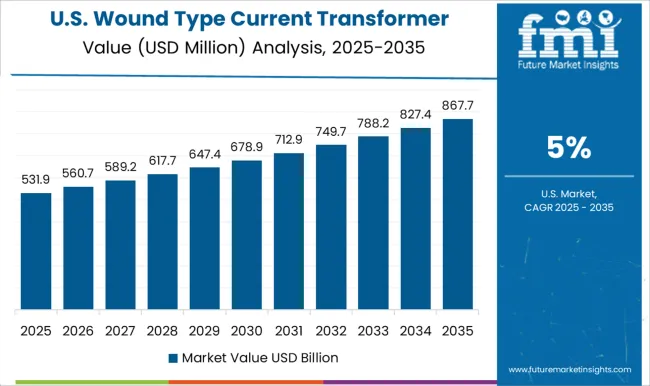

The wound type CT market in the United States is projected to grow at a CAGR of 5.0% from 2025 to 2035, supported by modernization of power transmission and distribution networks across residential, commercial, and industrial sectors. Utilities are deploying CTs to enhance grid reliability, enable real-time monitoring, and support automated fault detection systems.

The manufacturing and heavy industry sectors are leveraging CTs for motor protection, predictive maintenance, and energy optimization. Federal programs promoting energy efficiency and smart grid initiatives are creating additional market opportunities. Domestic manufacturers are focusing on advanced designs and reliable solutions, while partnerships with international technology providers help meet evolving market requirements and infrastructure upgrades.

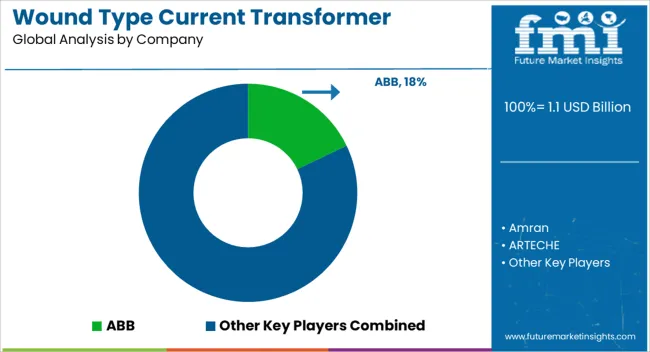

Competition in the wound type current transformer market is defined by accuracy, reliability, and integration with modern electrical systems. Leadership is held by ABB, leveraging its global presence, extensive product portfolio, and strong relationships with utilities and industrial operators. Siemens Energy and Hitachi Energy provide technologically advanced CT solutions, focusing on smart grid and industrial automation applications where precision and longevity are critical.

General Electric maintains a competitive edge through high-performance transformers designed for both conventional and renewable energy installations, while ARTECHE and Amran emphasize high-accuracy measurement devices and scalable solutions for medium- and high-voltage networks. Automatic Electric and Peak Demand target utility-focused deployments, offering products that integrate seamlessly with monitoring and protection systems.

Chinese manufacturers such as Dalian Huayi Electric Power Electric Appliances, Guangdong Sihui Instrument Transformer Works, Macroplast, TWB, and Wenzhou Unisun Electric are increasing market presence through cost-competitive designs, localized support, and participation in domestic grid modernization initiatives. Strategies in this sector revolve around product precision, thermal and electrical resilience, and compatibility with intelligent monitoring platforms.

Standard compliance with IEC and ANSI specifications is prioritized to ensure interoperability with protection relays and energy management systems. Companies differentiate through enhanced insulation designs, compact construction, low-loss cores, and integration with digital metering solutions.

Partnerships with utilities, industrial enterprises, and integrators enable customized solutions for urban grids, industrial plants, and renewable energy projects. Emphasis is placed on predictive maintenance support, modular designs for faster installation, and alignment with emerging smart grid architectures, ensuring that competitive positioning is maintained while meeting evolving energy infrastructure requirements globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 billion |

| Cooling | Oil Immersed and Dry type |

| Rating | ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV |

| Application | Power Distribution, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Amran, ARTECHE, Automatic Electric, Dalian Huayi Electric Power Electric Appliances, General Electric, Guangdong Sihui Instrument Transformer Works, Hitachi Energy, Instrument Transformers, Macroplast, Peak Demand, Siemens Energy, TWB, and Wenzhou Unisun Electric |

| Additional Attributes | Dollar sales, CAGR, regional and country-wise share, segment growth by voltage class, industrial vs utility adoption, competitive landscape, pricing trends, regulatory impact, and emerging applications. |

The global wound type current transformer market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the wound type current transformer market is projected to reach USD 1.9 billion by 2035.

The wound type current transformer market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in wound type current transformer market are oil immersed and dry type.

In terms of rating, ≤ 33 kv segment to command 46.2% share in the wound type current transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wound Wash Market Size and Share Forecast Outlook 2025 to 2035

Wound Evacuators Market Size and Share Forecast Outlook 2025 to 2035

Wound Skin Care Market - Demand & Forecast 2025 to 2035

Wound Stimulation Therapy Market Insights – Demand and Growth Forecast 2025 to 2035

Wound Care Surfactant Market Insights – Demand and Growth Forecast 2025 to 2035

Analysis and Growth Projections for Wound Healing Nutrition Market

Wound Irrigation Systems Market Growth - Trends & Forecast 2025 to 2035

Wound Debridement Products Market Analysis - Growth & Forecast 2025 to 2035

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Wound Measurement Devices Market

Wound Irrigation Devices Market

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Spiral Wound Membrane Market

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Digital Wound Measurement Devices Market is segmented by Diabetic Ulcer, Chronic Wounds, Burns from 2025 to 2035

Advance Wound Care Market Analysis by Advance Wound Dressings, NPWT Devices and Others through 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA