The USA Microbial Seed Treatment Market is forecasted to reach USD 359.6 million in 2025, with strong momentum driving it to USD 1,194.0 million by 2035. This growth represents a forecasted CAGR of 12.8% from 2025 to 2035, fueled by the rising adoption of sustainable agricultural practices, advancements in microbial formulations, and increasing demand for bio-based seed treatments.

Farmers are increasingly turning to microbial seed treatments as an eco-friendly alternative to synthetic chemicals, improving crop resilience, soil health, and nutrient absorption.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 359.6 million |

| Industry Value (2035F) | USD 1,194.0 million |

| CAGR (2025 to 2035) | 12.8% |

The USA Microbial Seed Treatment Market is witnessing rapid growth due to the increasing adoption of biological seed treatment solutions by farmers that are in need of protection of their crops, increasing soil biodiversity, and enhanced plant growth. Demand for bacteria- and fungi-based seed treatment is high due to resistance to soil-borne diseases, nutrient solubilization, and root development enhancements.

The industry in microbial formulations is highly competitive, with Bayer AG, BASF SE, and Syngenta AG leading the way in innovative formulations. All these companies are spending money on research with agricultural universities and biotechnology firms to enhance strain efficacy, shelf stability, and compatibility with conventional seed coatings.

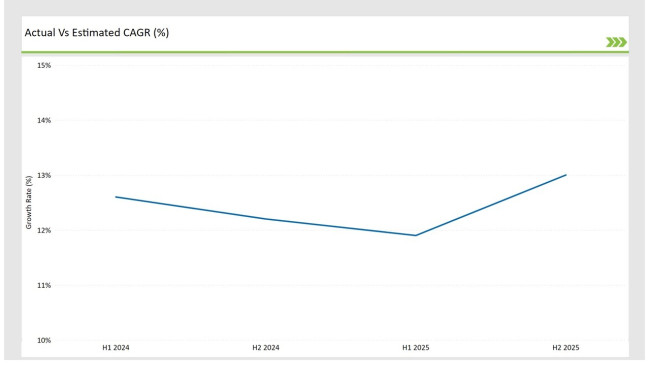

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Microbial Seed Treatment market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 12.6% |

| H2 Growth Rate (%) | 12.2% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 11.9% |

| H2 Growth Rate (%) | 13.0% |

For the USA market, the Microbial Seed Treatment sector is projected to grow at a CAGR of 12.6% during the first half of 2024, with an increase to 12.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 11.9% in H1 and reach 13.0% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Novozymes introduced a cold-tolerant microbial seed coating for early season planting. The treatment maintains efficacy at soil temperatures as low as 8°C. |

| Oct-2024 | Corteva Agriscience launched a broad-spectrum biological seed treatment platform. The system combines multiple beneficial microorganisms for enhanced crop protection. |

| Aug-2024 | BASF acquired BioTreat Solutions, a specialist in microbial seed enhancement. The acquisition adds proprietary bacterial strains to BASF's biological portfolio. |

| Jun-2024 | Syngenta developed new encapsulation technology for extended microbial viability. The innovation extends shelf life of treated seeds to 24 months at ambient conditions. |

| Apr-2024 | UPL Limited introduced drought-resistant microbial seed coating for arid regions. The treatment improves water use efficiency and early seedling establishment. |

Bacteria-Based Microbial Seed Treatments Gain Momentum for Root Health and Disease Resistance

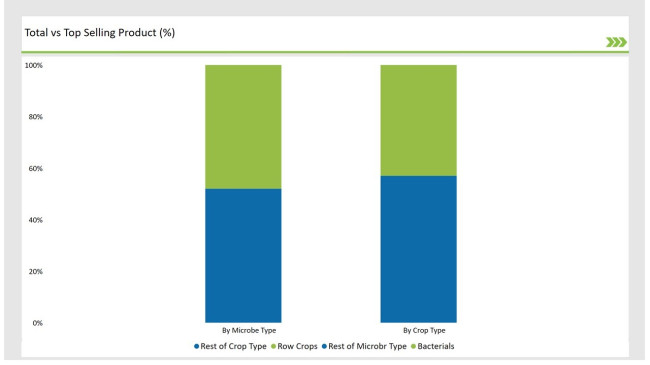

Bacterial seed treatments have the highest market share (48.3%) within the microbial category, mainly because they improve root development, nitrogen fixation, and pathogen resistance. Rhizobacteria and Bacillus species are applied extensively in row crops and cereal farming for drought tolerance, soil structure, and vigor in plants.

Novozymes A/S and Corteva Agriscience have been working on the development of novel bacterial strains with higher resilience against environmental stressors, so these strains could work better under a variety of soil types and climatic conditions.

Liquid Formulations Dominate the Market Due to Superior Seed Adhesion and Stability

Liquid microbial seed treatment has an area share of 56.4%, the high absorption efficiency of which helps increase the rate of microbial viability along with application flexibility. They coat seeds homogenously that's why their popularity is quite on the list. Powder and granular types remain relevant for only 43.6%.

Their usage goes towards dry seed treatments to make sure the formulations possess longer shelf lives and thus accommodate large mechanized farming systems. BASF SE and Koppert Biological Systems will continue broadening the portfolio of liquid formulations for bio-fungicidal and bio-stimulant applications.

| By Microbe Type | Market Share |

|---|---|

| Bacterials | 48.3% |

| Remaining Segments | 51.7% |

Bacteria-Based Seed Treatments Drive Market Growth Due to Enhanced Nutrient Solubilization

Bacterial seed treatments are the most famous, with a 48.3% share, as they have multiple agronomic benefits, such as phosphate solubilization, nitrogen fixation, and pathogen suppression. They are especially helpful to corn, soybean, and wheat.

These seed treatments make crop yields more consistent and increase soil microbial diversity. Though market demand for fungal seed treatments is increasing, bacteria-based solutions are still dominating because of their colonization rate in seeds and compatibility with a wide range of crops.

| By Crop Type | Market Share |

|---|---|

| Row Crops | 42.7% |

| Remaining Segments | 57.3% |

Row Crops Lead Microbial Seed Treatment Adoption Due to Large-Scale Cultivation Needs

Row crops, such as corn, soybeans, and cotton, comprise the largest share with 42.7% because MBST enhances the seed germination performance, initial seedling vigor, and resistance to soil pathogens.

Bio-stimulants, in particular, can be effective in these products because a strong root support system and efficiency in nutrient uptake are required. In cereals & grains (27.4%) and fruits & vegetables (19.8%), adoption is also strong, mainly because the approach advocates for organic and precision farming, whose bases are the biological inputs rather than synthetic applications.

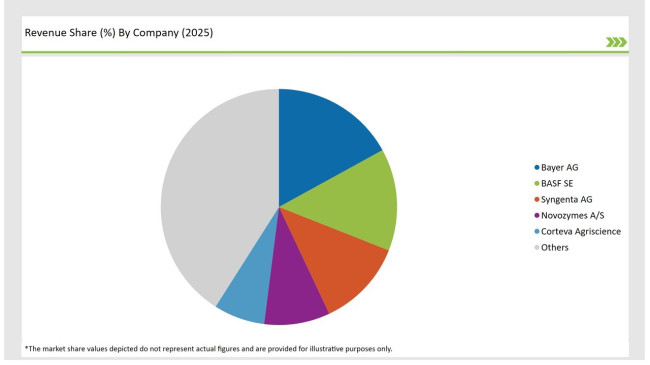

The USA Microbial Seed Treatment Market is relatively fragmented with key agricultural biotechnology companies and chemical majors competing for market share. Bayer AG, BASF SE, and Syngenta AG are dominant with strong R&D capabilities and large-scale networks of distribution.

Valent BioSciences and Marrone Bio Innovations are emerging players focusing on innovative formulations of bio-stimulants and niche seed treatment solutions.

Companies are investing into fermentation technologies as well as to research on microbial consortia aimed at developing a multi-functional seed treatment with excellent performance across multiple soil conditions.

| Company | Market Share |

|---|---|

| Bayer AG | 16.8% |

| BASF SE | 14.2% |

| Syngenta AG | 11.5% |

| Novozymes A/S | 9.3% |

| Corteva Agriscience | 7.1% |

| Other Players | 41.1% |

Top players are heading towards strain enhancements of microbes, diversification of product portfolios, and expansion in the supply chain. Bayer AG and BASF SE both have innovation centers for seed treatment in the Midwest that ensure localized R&D focused on USA crop varieties.

Novozymes and Syngenta AG are associating with academic research institutions and startups to accelerate bio-fermentation advancements and multi-strain formulations of microbes. Companies are also strengthening their outreach programs with farmers, selling bio-based seed treatments as an alternative to chemical fungicides and insecticides.

Bacterials, Fungals, Others

Row Crops, Cereals & Grains, Fruits & Vegetables, Oil Seeds

Seed Protection, Seed Enhancement, Bio-fertilizers

Liquid, Powder/Granules

By 2025, the USA Microbial Seed Treatment Market is expected to grow at a CAGR of 12.8%, supported by the increasing demand for sustainable agricultural practices, higher crop productivity needs, and regulatory shifts favoring bio-based inputs.

By 2035, the USA Microbial Seed Treatment Market is projected to reach USD 1,194.0 million, fueled by increased adoption in row crops, cereals, and organic farming systems.

The key growth drivers include rising demand for chemical-free farming solutions, advancements in bio-stimulant technologies, improved microbial seed coating techniques, and increasing government support for sustainable agriculture.

Major manufacturers in the USA Microbial Seed Treatment Market include Bayer AG, BASF SE, Syngenta AG, Novozymes A/S, and Corteva Agriscience, alongside emerging biotech firms specializing in microbial consortia for crop enhancement.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA