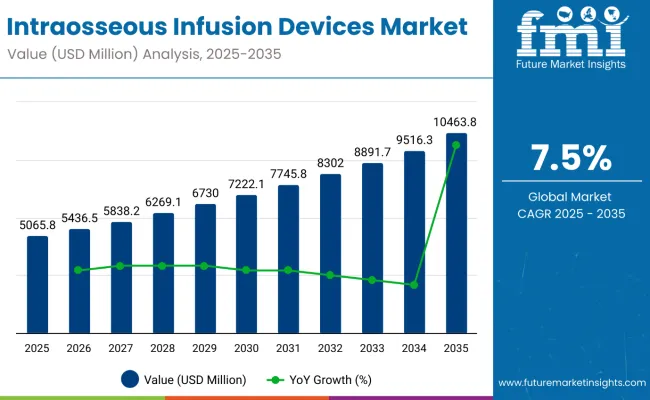

The global sales of intraosseous infusion devices are estimated to be worth USD 5,065.8 million in 2025 and anticipated to reach a value of USD 10,463.8 million by 2035. Sales are projected to rise at a CAGR of 7.5% over the forecast period between 2025 and 2035. The revenue generated by intraosseous infusion devices in 2024 was USD 4,725.6 million.

Intraosseous Infusion Devices which falls under vascular access device are the devices which are used at the time of emergency where rapid infusion of clinical treatment is done. The growth of intraosseous infusion devices (IO devices) is mainly attributed to their various benefits. IO Devices are designed to maximize efficiency, safety, eliminate unnecessary services and decrease treatment time.

A sedentary lifestyle has also determined the growth of the market as it causes various illnesses which incudes, last stage renal diseases, COPD, urological diseases, cardiovascular diseases, etc. Such chronic clinical conditions have brought demand in the vascular access devices in the forecast period.

Emergency medical care is considered as pre-hospital or ambulatory transportation aid for road accident victims and those who have sustained life-threatening injuries for which, immediate medical intervention is required. Lack of structural models in medical aid leads to ineffective medical care. These factors, along with the rising number of emergency cases globally is expected to raise demand for efficient emergency medical services and in turn, is underpinning the intraosseous infusion device market.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 4,725.6 million |

| Estimated Size, 2025 | USD 5,065.8 million |

| Projected Size, 2035 | USD 10,463.8 million |

| Value-based CAGR (2025 to 2035) | 7.5% |

According to American Heart Association report, with compiled data from the Centers for Disease Control and Prevention, the National Institutes of Health and other government sources, cardiovascular disease is a leading cause for death globally, associated with 17.3 Million deaths per year, which is further expected to increase to 23.6 Million by 2030 end.

Vascular access products fill an important void in emergency medical services and contribute significantly towards the annual revenue of various major medical devices manufacturers. The ease and immediate effect through vascular access have helped a major chunk of patients requiring immediate medication intervention.

According to an Elsevier/Journal of Emergency Medical Services (JEMS) editorial supplement sponsored by VidaCare, IO infusion supported vascular access of drugs positively and provided rapid vascular access in 250 patients with a success rate of 97%. The study supports the significance of the need for vascular access and is expected to favour the growth of the intraosseous infusion market shortly

The increase in medical emergencies that started a few years ago was allegedly due to the rise in demand from patients, doctors, and insurers. Rapid advancements in technology have made so many procedures possible with the help of vascular access devices; it can only be seen as positive for the gaining area.

The increasing number of emergency cases has been propelling the market growth. These cases include strokes, seizures, burns, sudden breathing difficulty etc., where the use of intraosseous infusion devices is of immense need, thereby boosting the market.

Intraosseous infusion devices come into practice when intravenous entry points are unavailable and so treatment is provided through an entry point on the bone marrow. Intraosseous infusion devices are easy to learn and administered which can avoid morbidity and mortality.

Intraosseous infusion devices are critical medical tools used for rapid vascular access in emergency and critical care situations. Ensuring their safety, effectiveness, and reliability is essential to protect patient health. Regulatory authorities worldwide enforce stringent guidelines and standards covering device design, manufacturing, biocompatibility, sterilization, and packaging. Compliance with these regulations helps manufacturers maintain high quality and safety levels while facilitating market access. These measures also ensure that the devices perform consistently in demanding clinical environments.

The intraosseous infusion device market is evolving with the integration of smart technologies aimed at improving clinical efficiency and patient safety. These innovations include real-time feedback systems, automated insertion mechanisms, and wireless data connectivity, which are particularly valuable in emergency and trauma care settings.

The below table presents the expected CAGR for the global intraosseous infusion devices market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 8.5%, followed by a slightly lower growth rate of 8.1% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 8.5% (2024 to 2034) |

| H2 | 8.1% (2024 to 2034) |

| H1 | 7.4% (2025 to 2035) |

| H2 | 7.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 7.4% in the first half and decrease moderately at 7.0% in the second half. In the first half (H1) the market witnessed a decrease of 110 BPS while in the second half (H2), the market witnessed a increase of 110 BPS.

Rising Number of Traumatic Surgeries Demanded in the Intraosseous Infusion Devices Markets

There are two components involved in community care, care during transportation and care in the healthcare facility. In emergency medical departments a patient can be brought in a sever life threatening conditions be it severe burns, road traffic accidents or cardiac arrest etc., where sometimes it is difficult to find for an IV point or it becomes difficult when the venous system is collapsed. This in turn demanded a significant need for intraosseous infusion devices in the market.

The American College of Surgeons Advanced Trauma Life Support Manual (ATLS) 1997, has suggested the use of intraosseous infusion in children up to 6 years of age during traumatic situations like a circulatory failure or after two failed attempts of intravenous access.

Also growing need for vascular access products fills an important void in emergency medical services and contributes significantly towards the annual revenue of various major medical devices manufacturers. The ease and immediate effect through vascular access has helped major chunk of patients requiring immediate medication intervention.

According to an Elsevier/Journal of Emergency Medical Services (JEMS) editorial supplement sponsored by VidaCare, IO infusion supported vascular access of drugs in a positive way and provided rapid vascular access in 250 patients with success rate of 97%. The study supports the significance for need of vascular access and is expected to favor growth of the intraosseous infusion market in near future.

Provision of Large and Rapid Administration of Infusion Volumes of Fluids in Case of Cardiac Arrest

Intravenous fluid and drug administration is a prime choice in normal medical procedure as they are comparatively economic and less painful than intraosseous infusion. However, demand for intraosseous infusion is expected to increase on the backdrop of rise in need of rapid and high volume infusions during emergency.

Vascular access is important for saving a critically affected patients suffering from conditions such as shock, cardiac arrest, drug overdose, dehydration, diabetic coma, renal failure and altered states of consciousness and sometimes it may be impossible to access the vein.

In such conditions intraosseous infusion is the viable resort for making the patient survive. The infusion volumes varies from 900 ml per hour to 5 liter per hour. Due to rise in conditions mentioned above the intraosseous infusion device market is expected to grow in near future.

Due to lifestyle changes cardiac arrest and cardiovascular surgery are getting common globally with an incidence rate of around 0.7 to 2.9%. Physiological deterioration being the prime initiator in these cases. However, cardiac arrest can be sudden with unseen physiological changes but there are causes associated with this condition such as hypovolemia, myocardial ischemia, and pacing failure.

Defibrillation being the primary resort for the cardiac arrest for resuscitation on failure of which titrated adrenaline is administered through sternum using intraosseous infusion device. The rising prevalence of cardiovascular disorder is expected to fuel growth of the IO infusion device market.

Greater Focus on Designing Automated Intraosseous Infusion Devices will Create Opportunities in the Market

Adoption of automated intraosseous infusion devices is increasing as they tend to consume lesser time than manual infusion devices. Further, automated infusion is considered to be safe for use for patients aged 6 years and below. Intraosseous access can be carried out by semi-skilled healthcare givers with minimal training as compared to IV access that required administration by skilled professionals.

Automated intraosseous access could prove largely useful in emergency settings in military and rescue scenarios, where rapid access may be crucial and peripheral venous access may be hard to obtain. Also, in remote locations, caregiving responders may have limited experience or technical capacity.

There is growing demand for intraosseous infusion in vascular resuscitation. While there exists vast scope in developing economies, developed economies such as the USA have already incorporated the same in their American Heart Association Guidelines for Cardiopulmonary Resuscitation.

Such an infusion route is known to cause minimal disruption of chest compressions. Newer devices with detailed product usage manuals are easy to use are known to offer easy venous access during an emergency resuscitation event. Early vascular access could prove to be life-saving with minimal or no disruptive CPR.

Possibility of Compartment Syndrome due to Gushing of Fluids and Drugs into Soft Tissues May Restrict the Market

Although there are many advantages in intraosseous infusion system, growth for this market is still hindered by some of the complication during the process. Extravasation is a complication, which can be common effect of IO infusion. The improper manual insertion of the needle may cause gushing of fluids and blood and their deposit into body tissue. Due to the recessive factor such as compartment syndrome and extravasation the intraosseous infusion system is expected to be affected.

According to fire engineering article, a study on 182 adult cardiac arrest patients, IO infusion through tibia was more successful as compared to IV route. Although there were complications reported to be minimal to less than one percent, problems such as fractures, compartment syndrome, osteomyelitis, and extravasation blood and fluids into the soft tissue. Cellulitis, osteomyelitis and fractures were the main reason for such problems.

The global intraosseous infusion devices industry recorded a CAGR of 7.1% during the historical period between 2020 and 2024. The growth of intraosseous infusion devices industry was positive as it reached a value of USD 4,725.6 million in 2024 from USD 3,347.4 million in 2020.

The demand for intraosseous devices is increasing in the given forecast period. For instance, air support for immediate medical emergency services is the new outlook in 911 services and has been appreciated by the other emergency health professionals and the local population. The upcoming air emergency medical service is to be equipped with a significant variety of emergency medical devices such as a ventilator, cardiac monitor, burn packs, IV pumps, cervical collars and obstetric kit along with intraosseous infusion devices.

The upcoming policy is expected to fuel the market for intraosseous infusion devices in near future. Infusion of drugs through the bone using intraosseous devices is more cost-effective and can be used with more efficiency as compared to intravenous catheters in hospital settings.

Furthermore, around five million intravenous infusions are performed per year in the USA at an average cost of USD 300 for around 15 minutes procedures. On the contrary by the intraosseous procedure of around 90 seconds at an average cost of USD 100 per insertion, saves time and cost of the procedure. The cost-effectiveness of the procedure is expected to raise the demand for intraosseous infusion soon.

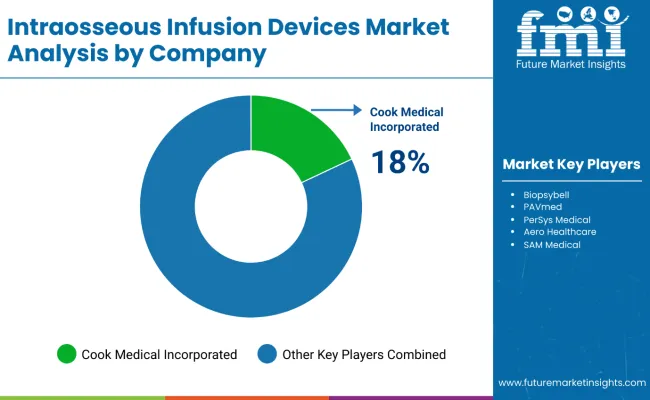

Manufacturers are investing in research and development activities to develop IO devices that can be used in hospital settings to initiate instant care to patients. Merger and acquisition together with extensive R&D for strengthening product portfolio is the key strategy adopted by companies to increase their revenue and expand their regional presence as well as product offerings and related benefits.

For Instance, On Dec 18, Cook Medical Incorporated announced the acquisition of Whitaker Park Development Authority Inc. that once manufactured cigarettes but henceforth will be manufacturing intraosseous infusion devices for better care of the patients.

The market is consolidated and is dominated by players such as include, Pyng medical Corp., Cook Medical Incorporated, PerSys Medical, Aero Healthcare, Teleflex, Inc., and Becton Dickinson and Co. The growth is attributed due to the rising number of research and development activities for innovative technology development and major companies which are actively participating in strategic planning and developments to expand their market presence and strengthen product portfolios.

Tier 1 Companies dominate the intraosseous infusion devices market, holding 26.1% of the global market share. They lead through significant R&D investments, strategic partnerships, and rigorous clinical trials to develop innovative solutions for emergency care. Key players include Teleflex, Becton Dickinson (BD), Cook Medical, and PerSys Medical.

Tier 2 Companies hold around 33.5% of the market share and have strong regional influence. They focus on partnerships with research institutions and cost-effective production methods to bring specialized solutions to market. Notable companies include SAM Medical, Pyng Medical, Aero Healthcare, and Cardinal Health.

Tier 3 Companies cater to niche markets, offering specialized intraosseous infusion devices. Companies like Biopsybell and PAVmed contribute by diversifying the market with unique products for specific applications.

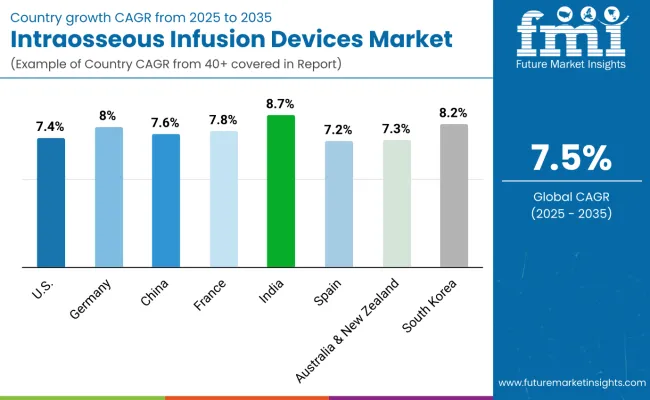

The section below covers the industry analysis for the intraosseous infusion devices market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and MEA, is provided. The United States is anticipated to remain at the forefront in North America, with higher market share through 2034. In Asia Pacific, India is projected to witness a CAGR of 8.7% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

| Germany | 8.0% |

| China | 7.6% |

| France | 7.8% |

| India | 8.7% |

| Spain | 7.2% |

| Australia & New Zealand | 7.3% |

| South Korea | 8.2% |

United States intraosseous infusion devices market is expected to grow at a CAGR of 7.4% between 2024 and 2034. Currently, it holds the highest share in the North American market, and the trend is expected to continue during the forecast period.

Intraosseous infusion devices are being recognized for supplying the fastest emergency management of acute medical cases within the United States. In trauma cases, cardiac arrests, and life-threatening emergencies, the need to deliver vascular access quickly is growing with patient demand.

Intraosseous infusion technologies offer fast, reliable, effective options for the administration of medicines, fluids, and blood products during critical times when IV access has been otherwise compromised. Also, the acceptance of newer technologies through emergency or critical care in the USA would further reach the growth levels within the market.

China’s intraosseous infusion devices market is poised to exhibit a CAGR of 7.6% between 2025 and 2035. Currently, it holds the highest share in the East Asia market, and the trend is expected to continue during the forecast period.

The demand for intraosseous infusion devices in China is growing very fast because of continuous technological advancements, the expansions taking place in health sector, and the need for safe and effective medical procedures. These devices are very reliable for emergency care or during critical scenarios. Besides, the market dynamics are influenced by domestic factors such as regulatory changes, government support, and increased funding of healthcare infrastructures.

These initiatives will not only increase accessibility but also provide a guideline on how the future market cares about change. With the government's continued push towards modernization in healthcare services, China has become a huge contributor to intraosseous infusion devices' world growth.

Germany intraosseous infusion devices market is poised to exhibit a CAGR of 8.0% between 2025 and 2035. Currently, it holds the highest share in the Western Europe market, and the trend is expected to continue during the forecast period.

Growth of the Germany intraosseous infusion devices market can be attributed to the increasing use of advanced medical technologies in emergencies and critical care. Other factors propelling demand for these devices include a growing focus on enhanced patient outcomes, requiring improvisation in emergencies, especially in cases of trauma and in cardiac arrest.

The strong healthcare setup in Germany has a considerable role to play in supporting the growth of this market because of investments in medical innovation. Supportive regulatory frameworks and training programs for medical professionals can further allow the intraosseous infusion devices to prosper in the market, which puts Germany as one of the key markets in Europe.

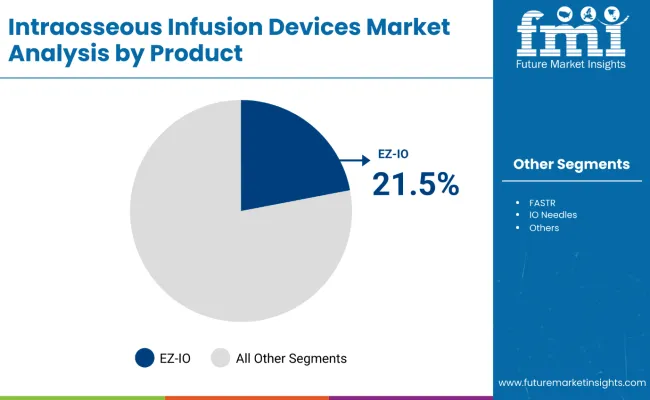

The section contains information about the leading segments in the industry. By product, the EZ-IO segment holds the highest market share of 21.5% in 2025.

| By Product | EZ-IO |

|---|---|

| Value Share (2025) | 21.5% |

The EZ-IO type of intraosseous infusion device accounted 21.5% of the market in 2025. The high growth of this product category is attributed to its rapid response and assured intraosseous access in less than 30 seconds, thus favored in critical and emergency medical conditions.

These devices are particularly valued due to their reliability to enable quick vascular access where conventional methods are unviable or take long to achieve. The growing traction of EZ-IO devices by healthcare professionals shows their significance in improving patient outcomes and thereby securing their continued leadership in the market globally for intraosseous infusion solutions.

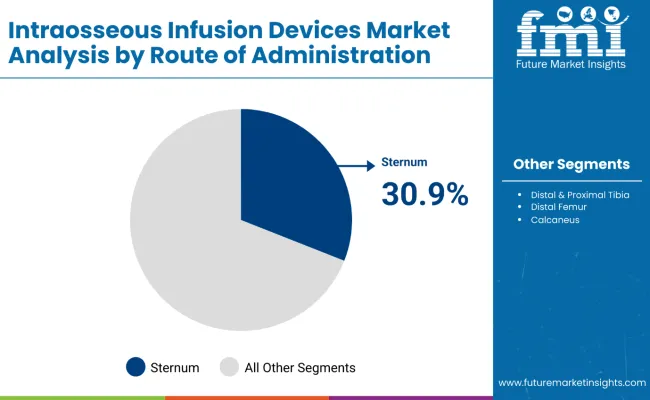

| By Route of Administration | Sternum |

|---|---|

| Value Share (2025) | 30.9% |

Sternum segment is anticipated to be the most lucrative route of administration in the intraosseous infusion devices market with a huge market share of 30.9% as per 2025. This enables the surge in growing preference for high-quality care and accuracy in determining the right intraprocedures to be adopted, especially in critical and emergency situations.

The sternum offers advantages in access and efficiency over distal and proximal tibia routes and therefore, a preferred route of healthcare professionals. Such trends are likely to constitute the factors driving the growth of the intraosseous infusion devices market in the near future due to the presence of this growing factor.

The expanding acceptance of technologically advanced music for intraosseous infusion practices to support better patient outcomes. The sternum's unique strategic anatomical position and rapid vascular access firmly make it a stronghold in the intraosseous infusion devices market.

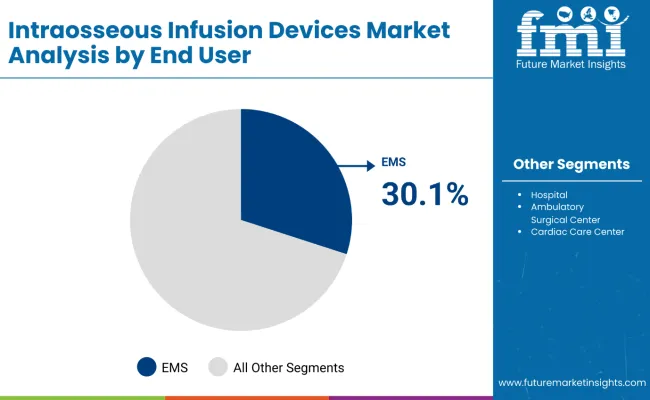

| By End User | EMS |

|---|---|

| Value Share (2025) | 30.1% |

The increased sophistication in demand for IO devices in emergency and critical care scenarios is the underpinnings of that leading market segment. Continual advances in technology, alongside the adoption of new scientific innovations, have enhanced the efficacy and dependability of these devices, thereby ensuring providers that the devices are indispensable. Growth continues to be propelled by an increased focus among health providers on bettering patient outcomes, assuring the market continued expansion.

Companies manufacturing intraosseous infusion devices are actively seeking to strengthen their position through various strategic planning such as collaborations, merger & acquisition partnerships, FDA approvals and agreements with established as well as emerging market players. These strategies helps manufacturers to capitalize on the market share and capture the significant share of the market. Some of the recent instances include.

In terms of product, the industry is divided into- B.I.G, FAST1, EZ-IO, FASTR, IO Needles and Others .

In terms of route of administration, the industry is segregated into sternum, distal & proximal tibia, distal femur, calcaneus and head of humerus

In terms of technology, the industry is segregated into- manual and automatic ( impact driven and power drill )

In terms of end user, the industry is segregated into EMS, hospitals, ambulatory surgical centers and cardiac care centers

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global intraosseous infusion devices market is projected to witness CAGR of 7.4% between 2024 and 2034.

The global intraosseous infusion devices industry stood at USD 4,408.2 million in 2023.

The global intraosseous infusion devices market is anticipated to reach USD 9,692.3 million by 2034 end.

India is set to record the highest CAGR of 8.7% in the assessment period.

The key players operating in the global intraosseous infusion devices market include Pyng Medical Corp., Biopsybell, Cook Medical Incorporated, PAVmed, PerSys Medical, Aero Healthcare, Teleflex, Inc., Becton Dickinson and Company, SAM Medical AND Cardinal Health, Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intraosseous Devices Market Analysis - Trends & Forecast 2025 to 2035

Intraosseous Infusion Kits Market Size and Share Forecast Outlook 2025 to 2035

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Infusion fluid holder Market Size and Share Forecast Outlook 2025 to 2035

Infusion Pharmacy Management Market

Infusion Chair Market

Infusion Rate Monitoring Market

IV Infusion Bottle Seals & Caps Market Size and Share Forecast Outlook 2025 to 2035

IV Infusion Gravity Bags Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in IV Infusion Bottle Seals & Caps

Home Infusion Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Advanced Infusion Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Pressure Infusion Cuffs Market Growth – Trends & Future Outlook 2024-2034

Marula Oil Infusions Market Size and Share Forecast Outlook 2025 to 2035

Jojoba Oil Infusions Market Size and Share Forecast Outlook 2025 to 2035

Implantable Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Infusion Pump Market

Rice Bran Oil Infusions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA