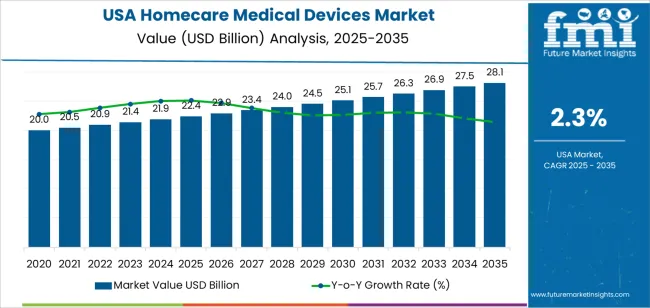

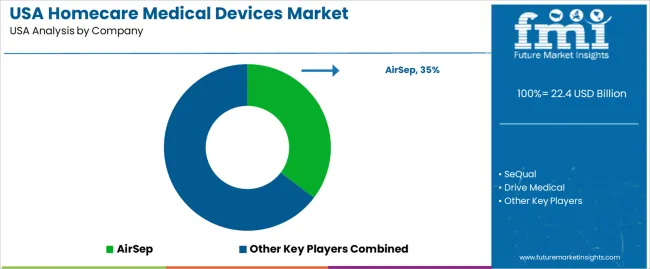

The USA homecare medical devices demand is valued at USD 22.4 billion in 2025 and is estimated to reach USD 28.2 billion by 2035, supported by a CAGR of 2.3%. Demand is shaped by broader adoption of in-home therapeutic equipment, mobility assistance devices, and respiratory-care systems as healthcare delivery models continue shifting toward outpatient and home-based management. An ageing population, rising prevalence of chronic respiratory conditions, and increased emphasis on patient autonomy contribute to stable long-term consumption of home-use devices. Growth also reflects steady procurement by home-health agencies and durable medical equipment providers that supply mobility aids, oxygen concentrators, and rehabilitation equipment.

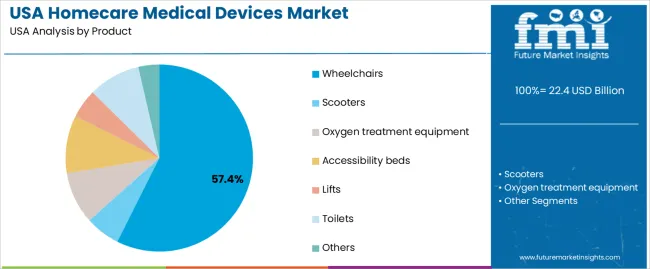

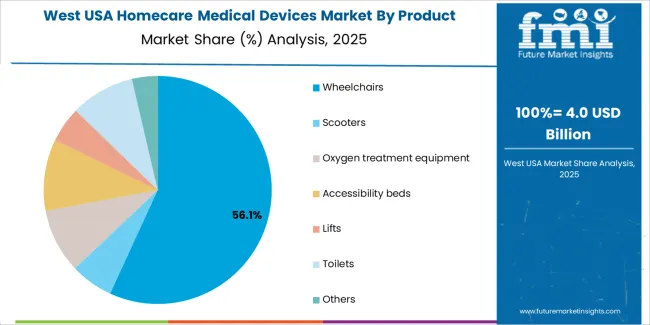

Wheelchairs represent the leading product category, driven by continued reliance on manual and powered mobility solutions across rehabilitation, postoperative recovery, and elderly care. Their consistent use in long-term physical-support needs maintains a strong baseline for annual device replacement and service cycles within both institutional and home environments.

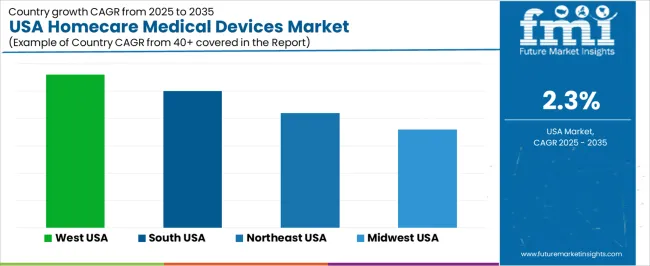

The West, South, and Northeast record the highest demand due to their large ageing populations, extensive home-healthcare networks, and established medical-equipment distribution channels. These regions also host major healthcare facilities and service providers that support continuous device deployment, maintenance, and patient-training programmes. AirSep, SeQual, Drive Medical, Graham-Field, Inogen, and Invacare are the principal suppliers. Their portfolios include oxygen concentrators, mobility aids, home-ventilation equipment, and daily-living assistive tools that support respiratory stability, movement assistance, and long-term rehabilitative needs.

Peak-to-trough analysis indicates a stable but lightly cyclical pattern shaped by demographic demand, reimbursement conditions, and procurement behavior across home-care providers. From 2025 to 2028, the segment is likely to reach an early peak as ageing-related needs support steady use of mobility aids, respiratory devices, home-monitoring tools, and chronic-care equipment. Expanded use of home-based therapy, along with consistent discharge-planning practices in hospitals, reinforces this initial rise.

A mild trough may appear between 2029 and 2031 as reimbursement updates, supply-chain adjustments, and slower equipment-replacement cycles temporarily soften annual purchasing. These fluctuations remain limited because long-term care needs for chronic respiratory conditions, mobility impairments, and cardiovascular monitoring maintain a stable baseline. Following 2031, the segment is expected to regain momentum as device updates focus on improved sensor accuracy, lighter materials, and greater integration with remote-monitoring platforms. The peak-to-trough pattern reflects a mature, necessity-driven segment characterised by demographic stability, consistent home-care utilisation, and predictable equipment lifecycles across USA households and home-care networks.

| Metric | Value |

|---|---|

| USA Homecare Medical Devices Sales Value (2025) | USD 22.4 billion |

| USA Homecare Medical Devices Forecast Value (2035) | USD 28.2 billion |

| USA Homecare Medical Devices Forecast CAGR (2025 to 2035) | 2.3% |

Demand for homecare medical devices in the USA is increasing because of the ageing population, rising prevalence of chronic diseases and the shift toward outpatient and home-based care. Devices that enable monitoring, therapy or rehabilitation at home, such as infusion pumps, respiratory devices, glucose monitors, and tele-health connected equipment are increasingly adopted by patients and caregivers. Health-care providers and payers promote home-care solutions to reduce hospital stays, lower costs and improve patient outcomes.

Technological advancements such as compact design, connectivity and remote-monitoring capabilities make home-care devices more accessible and reliable. Increased recognition of value-based care models and reimbursement schemes for home-based treatment reinforce industry growth. Constraints include higher device cost, reimbursement complexity, integration challenges with patient data systems and user training requirements. Some home-care users may face barriers in equipment installation, connectivity or caregiver support, which may slow adoption in certain segments.

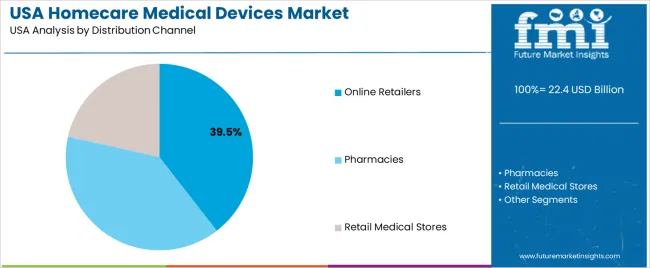

Demand for homecare medical devices in the United States reflects needs associated with ageing populations, chronic illness management, mobility support, and in-home therapeutic care. Product distribution follows functional requirements ranging from mobility assistance to respiratory support and accessibility equipment. Distribution-channel patterns show how users purchase devices through online and local retail options that support insurance-linked fulfilment and direct consumer access.

Wheelchairs hold 57.4% of national demand and represent the leading product category. Their use spans mobility impairment, rehabilitation, long-term disability, and age-related conditions that restrict independent movement. Oxygen-treatment equipment accounts for 9.0%, supporting chronic respiratory disorders requiring controlled oxygen delivery at home. Toilets also represent 9.0%, serving individuals with limited mobility who require enhanced bathroom accessibility. Accessibility beds hold 10.0%, supporting post-surgical recovery and chronic-care positioning needs. Scooters represent 6.0%, used by individuals requiring indoor and outdoor mobility assistance. Lifts account for 5.0%, assisting transfers in home-care environments. The remaining 3.6% includes supportive devices for routine daily-living functions. Product distribution reflects mobility prevalence, home-care complexity, and long-term support needs.

Key drivers and attributes:

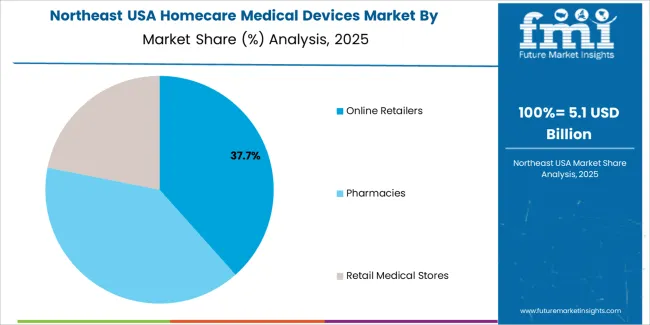

Online retailers hold 39.5% of national demand and form the largest distribution channel. Their broad product availability, transparent pricing, and delivery convenience support device acquisition for households managing long-term medical needs. Pharmacies represent 39.0%, serving users who require guidance on device suitability, accessory coordination, or insurance-linked purchases. Retail medical stores account for 21.5%, offering in-person fitting, demonstration, and after-sales support for wheelchairs, scooters, lifts, and accessibility solutions. Distribution-channel patterns reflect differing user preferences for professional assistance, product comparison, and access to specialised equipment across homecare settings. Channel selection depends on clinical recommendations, device complexity, and insurance-related fulfilment processes.

Key drivers and attributes:

Growing chronic disease prevalence, aging population, and shift to home-based care are driving demand.

In the United States, demand for medical devices designed for the homecare environment is rising as more people live longer and manage conditions such as diabetes, respiratory disease, cardiovascular disorders and mobility impairment at home. The cost pressures on hospitals and the push for patient-centred care have encouraged earlier discharge and expanded home-use device installation. Advances in portable monitoring, connectivity, and easy-to-use therapeutic equipment support this trend by enabling patients to receive treatment, monitoring and rehabilitation in their own residences.

Reimbursement complexity, device cost and usability challenges moderate growth.

Some homecare medical devices remain expensive to purchase or lease, which may limit access for patients or smaller providers. Reimbursement policies vary by payer and state, and navigating those rules for new home-use equipment can delay adoption. Usability remains a concern: patients or caregivers may require training or technical support for effective device use, which can slow deployment in home environments. Device reliability and maintenance requirements also affect user experience and provider willingness to recommend homecare solutions.

Integration of remote monitoring and telehealth, growth in smart connected devices and expansion of home rehabilitation and mobility aids define industry trends.

Manufacturers are increasingly offering homecare medical devices with built-in connectivity, allowing clinicians to monitor patients remotely, receive alerts and adjust care plans without a clinic visit. Smart devices such as connected respiratory units, home dialysis systems and mobility aids with sensor feedback are in higher demand. Mobility devices like powered wheelchairs, electric lifts and adjustable beds are also growing rapidly as many users age in place and seek independence at home. These developments support sustained expansion of the homecare medical-device industry in the USA as care delivery continues to shift away from hospitals and into residential settings.

Demand for homecare medical devices in the USA is rising through 2035 as aging populations, chronic disease prevalence, and increased use of remote monitoring drive adoption across households and home-health networks. Devices such as blood-pressure monitors, glucose meters, pulse oximeters, respiratory-support equipment, digital thermometers, and mobility aids support long-term management of cardiovascular diseases, diabetes, respiratory disorders, and age-related functional limitations.

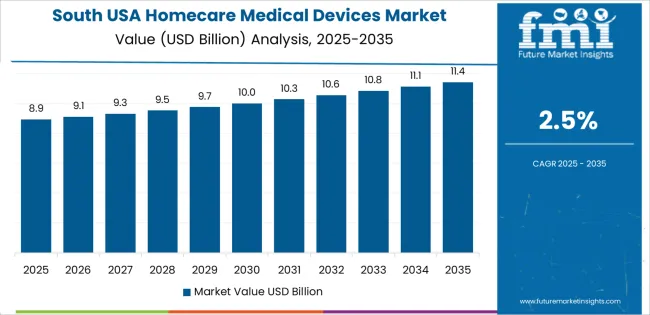

Homebound patients and caregivers rely on easy-to-use, clinically validated devices supported by telehealth systems and pharmacy-based distribution. Adoption varies by region based on healthcare-service availability, chronic-care demand, and local insurance utilization. The West grows at 2.8%, the South at 2.5%, the Northeast at 2.1%, and the Midwest at 1.8%.

| Region | CAGR (2025-2035) |

|---|---|

| West | 2.8% |

| South | 2.5% |

| Northeast | 2.1% |

| Midwest | 1.8% |

The West grows at 2.8% CAGR, supported by strong adoption of home-monitoring tools, respiratory-support devices, and chronic-care equipment across California, Washington, and Oregon. Healthcare networks expand home-care services that incorporate blood-pressure monitors, glucose meters, digital thermometers, and pulse oximeters into routine follow-up programs. Telehealth platforms encourage the use of remote-monitoring devices for chronic cardiac and respiratory conditions. Households adopt mobility aids, home nebulizers, and portable suction units for long-term care of elderly family members. Pharmacy chains and medical-supply distributors maintain wide inventories of home-use devices across metropolitan areas. Growing acceptance of self-monitoring and strong insurance participation reinforce steady regional demand.

The South grows at 2.5% CAGR, supported by rising chronic-disease prevalence, expanding home-health networks, and widespread caregiver usage across Texas, Florida, Georgia, and the Carolinas. Households use home-monitoring devices for diabetes, hypertension, and respiratory concerns. Home-health agencies rely on portable diagnostic tools, pulse oximeters, and respiratory-support equipment for routine patient visits. Medical-supply distributors provide steady access to mobility devices, wound-care equipment, and basic therapeutic tools. Older adults using in-home assistance programs adopt devices that support daily monitoring and chronic-condition management. Although adoption varies across rural areas, steady clinical demand maintains consistent use of homecare devices.

The Northeast grows at 2.1% CAGR, supported by structured chronic-care programs, dense hospital networks, and reliable distribution channels across New York, Massachusetts, Pennsylvania, and neighboring states. Home-monitoring devices are widely used for hypertension, diabetes, and postoperative recovery. Respiratory-support tools, including nebulizers and portable oxygen concentrators, support patients with chronic lung conditions. Telehealth programs in metropolitan areas integrate home devices into remote-care workflows, improving follow-up and adherence. Pharmacies and medical-supply stores maintain steady inventories of clinically validated home-use devices. Although some care shifts to outpatient centers, household demand remains stable due to strong chronic-disease management needs.

The Midwest grows at 1.8% CAGR, supported by essential chronic-care needs, home-health utilization, and aging-population services across Illinois, Ohio, Michigan, Wisconsin, and Minnesota. Households adopt blood-pressure monitors, glucose meters, and mobility aids for long-term care. Home-health agencies use portable monitoring devices, thermometers, and pulse oximeters during routine visits. Rural communities depend on homecare devices due to longer travel distances to healthcare facilities, increasing reliance on self-monitoring. Pharmacy networks support distribution of basic home-care equipment, although specialized devices remain more limited. While growth is slower, stable chronic-care requirements maintain continuous demand.

Demand for home-care medical devices in the USA is shaped by a concentrated group of respiratory-care and mobility-equipment suppliers supporting chronic-disease management, home-oxygen therapy, and long-term rehabilitation. AirSep holds the leading position with an estimated 35.3% share, supported by established oxygen-concentrator platforms, controlled purity-delivery performance, and long-standing use in home-based respiratory programmes. Its position is reinforced by dependable compressor durability and consistent adherence to USA respiratory-care standards.

SeQual and Drive Medical follow as significant participants. SeQual provides high-capacity portable oxygen units suited to patients requiring continuous or pulse-dose delivery, supported by stable oxygen output and predictable battery performance. Drive Medical maintains a wide presence through mobility aids, respiratory devices, and home-care equipment distributed across national durable-medical-equipment channels, emphasizing reliable construction and consistent day-to-day use.

Graham-Field contributes capability with home-care rehabilitation devices and respiratory-support equipment used in long-term-care and community-care settings. Inogen remains a key participant through lightweight portable oxygen concentrators designed for enhanced mobility, characterised by predictable flow performance and strong adoption in outpatient respiratory programmes. Invacare supports additional demand through home-care mobility and respiratory products known for stable engineering and broad compatibility with USA reimbursement pathways.

Competition across this segment centers on oxygen-delivery stability, device reliability, battery endurance, mobility support, noise performance, and ease of maintenance. Demand remains strong as USA patients increasingly shift toward home-based respiratory and mobility management, driven by chronic-disease prevalence, ageing demographics, and preference for dependable, patient-operated medical devices.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product | Wheelchairs, Scooters, Oxygen Treatment Equipment, Accessibility Beds, Lifts, Toilets, Others |

| Distribution Channel | Online Retailers, Pharmacies, Retail Medical Stores |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | AirSep, SeQual, Drive Medical, Graham-Field, Inogen, Invacare |

| Additional Attributes | Dollar sales by product category and distribution channel; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of homecare medical device manufacturers; advancements in portable oxygen concentrators, powered mobility aids, lift systems, and home accessibility equipment; integration with home-based care programs, chronic disease management, and aging-in-place support across the USA. |

The global demand for homecare medical devices in USA is estimated to be valued at USD 22.4 billion in 2025.

The market size for the demand for homecare medical devices in USA is projected to reach USD 28.1 billion by 2035.

The demand for homecare medical devices in USA is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in demand for homecare medical devices in USA are wheelchairs, scooters, oxygen treatment equipment, accessibility beds, lifts, toilets and others.

In terms of distribution channel, online retailers segment to command 39.5% share in the demand for homecare medical devices in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Tourism Market Analysis – Size, Share & Forecast 2025-2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Medical Cleaning Devices Market Overview - Trends & Forecast 2025 to 2035

Portable Medical Devices Market Analysis - Growth & Forecast 2025 to 2035

AI-enabled Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Medical Devices Market is segmented by drug type, treatment and distribution channel from 2025 to 2035

Reprocessed Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Homecare Dermatology Energy-based Devices Market Growth – Trends & Forecast 2018-2028

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Reprocessed Medical Devices Market Growth – Trends & Forecast 2025 to 2035

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA