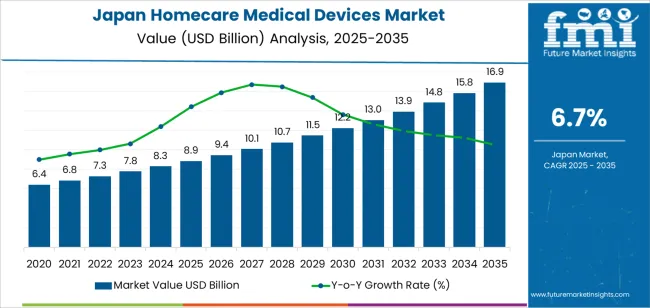

The demand for homecare medical devices in Japan is expected to grow from USD 8.9 billion in 2025 to USD 16.9 billion by 2035, reflecting a CAGR of 6.7%. Homecare medical devices, including blood pressure monitors, glucometers, CPAP machines, and mobility aids, are increasingly essential as the aging population in Japan requires more personalized healthcare solutions. With an increasing focus on aging in place and patient-centric care, demand for devices that enable people to manage their health at home is expected to rise. The Japanese government's healthcare initiatives and efforts to reduce hospital admissions will also drive growth in this sector, encouraging the use of home care solutions as part of a broader push toward efficient healthcare delivery.

The adoption of telemedicine and remote patient monitoring systems will further bolster the demand for homecare medical devices. As these devices become more integrated with digital health platforms, they will offer real-time data sharing with healthcare providers, enhancing patient management and chronic disease control. As the technology improves and becomes more cost-effective, home care devices will increasingly replace traditional in-hospital treatments for non-emergency care, expanding the market for these products.

From 2025 to 2030, the demand for homecare medical devices in Japan will grow from USD 8.9 billion to USD 12.2 billion, contributing an increase of USD 3.3 billion in value. During this phase, the market will experience strong acceleration due to the rising prevalence of chronic conditions, the growing elderly population, and government incentives for home-based healthcare solutions. Technological advancements in homecare devices, such as smart blood pressure monitors, glucose testing devices, and oxygen therapy units, will also drive significant adoption. The rising preference for independent living and the increasing affordability of homecare devices will lead to rapid market expansion. Additionally, the adoption of remote monitoring technologies will encourage healthcare professionals to recommend homecare devices as part of ongoing patient management.

From 2030 to 2035, the market will grow from USD 12.2 billion to USD 16.9 billion, adding USD 4.7 billion in value. This phase will reflect more mature market growth, with steady demand driven by the increasing integration of homecare devices into health management ecosystems. Although the market growth rate will slow slightly due to saturation in some segments, the demand for advanced monitoring systems and specialized care devices will continue to rise. Moreover, the expanding need for at-home care solutions for the aging population will ensure a consistent increase in market value. The growth will also be bolstered by the ongoing evolution of healthcare models that prioritize patient autonomy and cost-effective treatment at home.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 8.9 billion |

| Industry Forecast Value (2035) | USD 16.9 billion |

| Industry Forecast CAGR (2025-2035) | 6.7% |

Demand for homecare medical devices in Japan is growing due to the country’s rapidly ageing population and its high prevalence of chronic diseases. Older adults often require ongoing monitoring or therapeutic equipment such as oxygen concentrators, mobility aids, and pressure-relief mattresses at home instead of in institutional settings. Healthcare providers, insurers, and device manufacturers are responding by expanding offerings that support long-term care in domestic environments and reduce hospital bed usage.

Technological innovation and shifts in healthcare delivery models are also supporting the market. Connected devices, remote monitoring platforms, and telehealth services enable users and caregivers to track vital signs, adjust therapy parameters, and receive alerts outside hospital settings. Distribution is increasingly moving toward online retailers and home-care providers, improving accessibility. At the same time, reimbursement and regulatory frameworks vary among devices, and high upfront costs can limit adoption among some users. Despite these challenges, the alignment of demographic trends, caregiving needs, and technical capabilities means that demand for homecare medical devices in Japan is expected to increase.

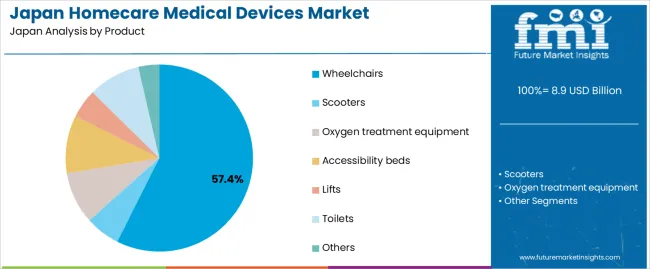

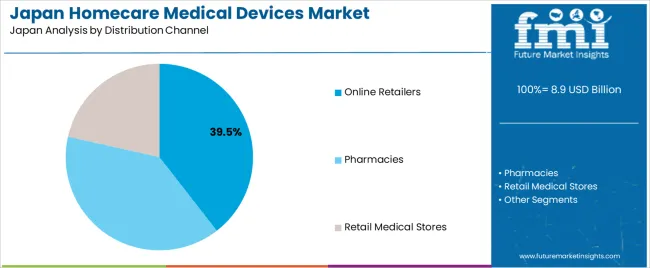

The demand for homecare medical devices in Japan is primarily driven by product type and distribution channel. The leading product type is wheelchairs, accounting for 57% of the market share, while online retailers dominate the distribution channel, capturing 39.5% of the demand. Homecare medical devices, which include equipment that helps individuals with mobility, respiratory, and accessibility needs, are increasingly sought after as Japan’s aging population grows.

Wheelchairs lead the demand for homecare medical devices in Japan, holding 57% of the market share. Wheelchairs are essential for individuals with mobility impairments, offering increased independence and comfort. Both manual and powered wheelchairs are widely used in homes, healthcare facilities, and long-term care settings, where mobility support is crucial for daily activities.

The demand for wheelchairs is driven by Japan’s aging population and the increasing prevalence of mobility-related conditions, such as arthritis and neurological disorders. With the ongoing focus on improving quality of life for elderly and disabled individuals, wheelchairs remain the dominant product in the homecare medical device market. As technology improves, the demand for more advanced, ergonomic, and customizable wheelchairs is expected to continue to rise.

Online retailers are the leading distribution channel for homecare medical devices in Japan, capturing 39.5% of the demand. The rise of e-commerce has made it easier for consumers to access medical devices from the comfort of their homes, particularly for those seeking specialized equipment such as wheelchairs, scooters, and oxygen treatment devices.

The demand for online sales is driven by convenience, product variety, and competitive pricing, with consumers increasingly turning to online platforms to purchase homecare medical devices. Online retailers provide easy access to detailed product information, reviews, and comparisons, helping consumers make informed purchasing decisions. As the trend of online shopping continues to grow, particularly among Japan’s tech-savvy population, online retailers are expected to maintain their dominant role in the homecare medical device market.

Demand for homecare medical devices in Japan is driven by the country’s rapidly ageing population, rising incidence of chronic diseases and a healthcare system that encourages care outside of hospitals. Devices for home use such as respiratory equipment, mobility aids and monitoring systems support independence and ease strain on institutions. At the same time, cost containment in healthcare, regulatory approval processes and infrastructure limitations moderate how fast homecare devices are adopted. These factors shape how the homecare-device segment develops in Japan.

Several drivers underpin growth. First, Japan’s population aged 65 years or older accounts for nearly one-third of the total population, generating heightened demand for long-term care devices and home-based monitoring. Second, prevalence of chronic conditions such as cardiovascular disease, diabetes and respiratory disorders requires solutions that enable monitoring, rehabilitation or therapy at home. Third, government policies and reimbursement schemes are increasingly favouring homecare and remote-care settings, which benefit device adoption outside hospitals. Fourth, technological advances such as connectivity, tele-monitoring and compact device design improve usability and suitability for home deployment.

Despite supportive conditions, several challenges remain. The cost of advanced homecare devices, along with ongoing expenses for maintenance or consumables, may deter households or smaller care-providers. Integrating devices into home environments requires user-friendly design, service support and training, which increases burden for manufacturers and users alike. Regulatory processes for device approval and reimbursement in Japan can be lengthy and may delay market entry. Finally, some rural or regional areas still lack sufficient infrastructure-such as reliable connectivity or home-care services-which limits full reach of home-based device solutions.

Important trends include rising deployment of remote-monitoring and telehealth-enabled devices that support chronic-disease management and reduce hospital visits. There is increasing focus on user-centric design, portability and simplicity of operation to match home-care settings rather than clinical environments. Devices with multi-function capabilities (for example mobility aids with embedded sensors, or respiratory devices with digital feedback) are gaining popularity. Additionally, there is growth in direct-to-consumer distribution and rental or subscription models for homecare devices, which expand access and reduce upfront costs for users.

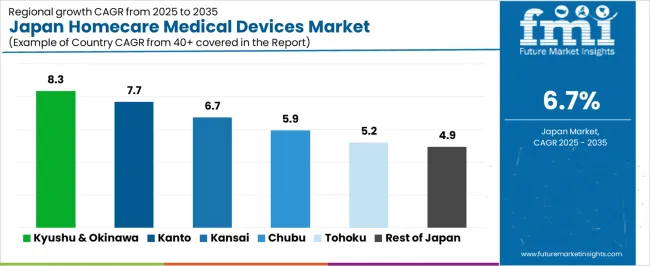

The demand for homecare medical devices in Japan is driven by several factors, including the country’s aging population, the growing preference for in-home healthcare, and the rise in chronic diseases that require ongoing management. Homecare medical devices, such as blood pressure monitors, glucose meters, oxygen concentrators, and mobility aids, enable patients to manage their health conditions independently and reduce the need for frequent hospital visits. With Japan's healthcare system increasingly focused on cost-effective solutions, homecare medical devices offer a way to enhance patient outcomes while reducing overall healthcare costs.

Additionally, the advancement of telemedicine and remote patient monitoring technologies has further fueled the demand for these devices, allowing for real-time health data transmission between patients and healthcare providers. Regional demand for homecare medical devices is influenced by factors such as local healthcare infrastructure, the prevalence of chronic conditions, and the level of awareness surrounding in-home care solutions.

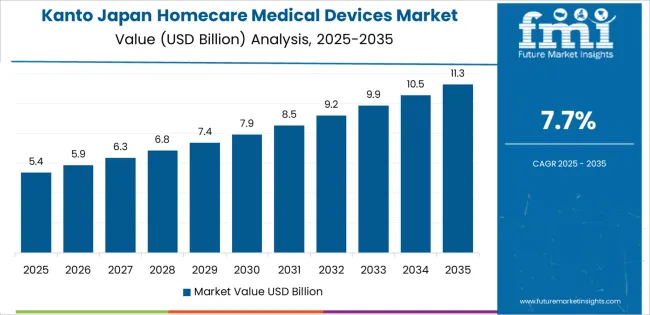

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 8.3 |

| Kanto | 7.7 |

| Kinki | 6.7 |

| Chubu | 5.9 |

| Tohoku | 5.2 |

| Rest of Japan | 4.9 |

Kyushu & Okinawa leads the demand for homecare medical devices in Japan with a CAGR of 8.3%. The region’s growing elderly population, particularly in Okinawa, which has one of the highest life expectancies in the world, significantly contributes to this demand. The preference for aging in place, combined with Japan’s focus on community-based healthcare, has made homecare medical devices essential for managing chronic health conditions and maintaining independence at home.

Additionally, the increasing availability of government and insurance support for home healthcare services has further promoted the adoption of these devices. The growing number of local healthcare initiatives aimed at improving the quality of life for elderly residents in Kyushu & Okinawa is expected to sustain this strong demand for homecare medical devices.

Kanto shows strong demand for homecare medical devices with a CAGR of 7.7%. The region, which includes Tokyo, is home to a large and diverse population, including a significant proportion of elderly individuals who are increasingly managing chronic conditions such as diabetes, hypertension, and respiratory diseases. With Japan’s healthcare system shifting towards more home-based care solutions to reduce hospital burdens, Kanto's well-established healthcare infrastructure is well-positioned to meet this growing need.

The adoption of remote patient monitoring technologies and telemedicine in Kanto further supports the market for homecare medical devices, allowing healthcare providers to track patients' conditions in real-time. The region’s strong focus on technological innovation and healthcare accessibility ensures continued growth in the demand for homecare medical devices.

Kinki, with a CAGR of 6.7%, shows steady demand for homecare medical devices. The region, which includes Osaka, is an important hub for healthcare innovation and has a large population that includes a growing number of elderly individuals who require ongoing medical care. The demand is driven by Kinki's emphasis on improving healthcare services for the aging population, as well as the rise in chronic diseases that require continuous management.

Although the growth rate is slightly lower compared to Kyushu & Okinawa and Kanto, Kinki’s steady demand reflects the region's significant investment in healthcare infrastructure and its adoption of technology-driven solutions to enhance home-based care. As more people in Kinki seek to manage their health at home, the market for homecare medical devices is expected to remain strong.

Chubu shows moderate growth in the demand for homecare medical devices with a CAGR of 5.9%. The region’s industrial base, particularly in manufacturing and automotive, is seeing an increasing need for devices to monitor and manage employee health, especially in light of growing concerns over occupational diseases and an aging workforce. Chubu’s aging population, along with a rise in chronic health conditions like diabetes and cardiovascular diseases, has driven the demand for homecare medical devices that offer convenience, affordability, and effective disease management.

As healthcare providers in Chubu continue to invest in home healthcare solutions, the demand for homecare medical devices is expected to grow steadily. Additionally, the region's expanding focus on elder care and preventive healthcare will contribute to the market’s growth in the coming years.

Tohoku, with a CAGR of 5.2%, and the Rest of Japan, with a CAGR of 4.9%, show slower growth in the demand for homecare medical devices compared to more industrialized regions like Kyushu & Okinawa and Kanto. These areas are typically less urbanized, and while the aging population is growing, the demand for homecare medical devices has been slower to develop due to the lower concentration of healthcare facilities and technology-driven services.

However, as the overall healthcare system in Japan continues to evolve toward more home-based care solutions and the demand for elderly care services increases, both Tohoku and the Rest of Japan will see gradual increases in the adoption of homecare medical devices. Regional investments in healthcare infrastructure and awareness of the benefits of home healthcare solutions will support future growth in these areas.

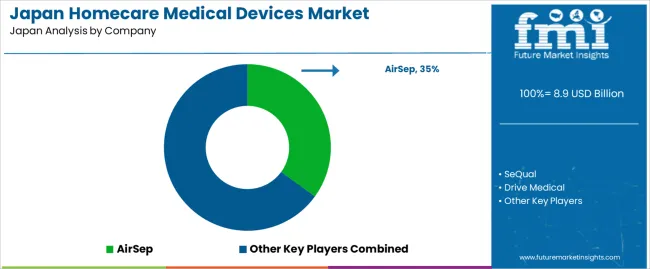

The homecare medical devices market in Japan is expanding as the ageing population and rise in chronic conditions increase demand for devices that support care outside clinical settings. Industry data show the broader home healthcare market reached around USD 27.2 billion in 2024 and is expected to grow with a compound annual growth rate (CAGR) of about 8.1 % through 2033. Key firms in this segment include AirSep (approximate 35% share), SeQual, Drive Medical, Graham Field, Inogen and Invacare. These companies serve mobility support, respiratory care and other device categories tailored for home settings.

Competition in Japan’s homecare medical device industry focuses on device usability, after sales service and regulatory support. Providers invest in portable and user friendly designs, such as compact oxygen concentrators or lightweight mobility aids, to match home use needs. In addition to product design, service models matter: companies offering rentals, maintenance plans and remote monitoring support gain advantage in Japan’s market where home based care is valued. Compliance with Japanese medical device regulations and reimbursement practices is another critical factor. Marketing and technical documentation typically emphasise portability, ease of setup, quiet operation (for home use) and compatibility with Japanese home environments. Firms that align their offerings with patient preferences for independence, caregiver convenience and streamlined home administration look to strengthen their position in Japan’s homecare medical devices industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Product | Wheelchairs, Scooters, Oxygen Treatment Equipment, Accessibility Beds, Lifts, Toilets, Others |

| Distribution Channel | Online Retailers, Pharmacies, Retail Medical Stores |

| Key Companies Profiled | AirSep, SeQual, Drive Medical, Graham-Field, Inogen, Invacare |

| Additional Attributes | The market analysis includes dollar sales by product, distribution channel, and company categories. It also covers regional demand trends in Japan, particularly driven by the increasing adoption of homecare medical devices in elderly care and for individuals with mobility challenges. The competitive landscape highlights key manufacturers focusing on innovations in mobility solutions, oxygen treatment, and home healthcare equipment. Trends in the growing demand for online sales channels and homecare medical devices are explored, along with advancements in product performance, accessibility, and ease of use. |

The demand for homecare medical devices in japan is estimated to be valued at USD 8.9 billion in 2025.

The market size for the homecare medical devices in japan is projected to reach USD 16.9 billion by 2035.

The demand for homecare medical devices in japan is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in homecare medical devices in japan are wheelchairs, scooters, oxygen treatment equipment, accessibility beds, lifts, toilets and others.

In terms of distribution channel, online retailers segment is expected to command 39.5% share in the homecare medical devices in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Demand for Homecare Medical Devices in USA Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Medical Cleaning Devices Market Overview - Trends & Forecast 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Medical Devices Market Analysis - Growth & Forecast 2025 to 2035

AI-enabled Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Medical Devices Market is segmented by drug type, treatment and distribution channel from 2025 to 2035

Reprocessed Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Homecare Dermatology Energy-based Devices Market Growth – Trends & Forecast 2018-2028

Demand for Medical Tourism in Japan Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Demand for Medical Terahertz Technology in Japan Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Reprocessed Medical Devices Market Growth – Trends & Forecast 2025 to 2035

Demand for Blood Collection Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA