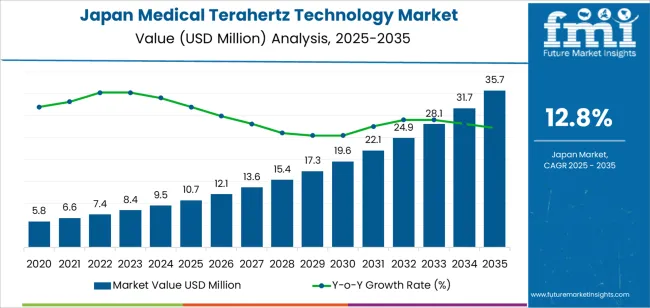

The demand for medical terahertz technology in Japan is valued at USD 10.7 million in 2025 and is projected to reach USD 35.7 million by 2035, reflecting a compound annual growth rate of 12.8%. Growth is shaped by wider interest in high-frequency imaging and sensing systems used for noninvasive diagnostics, tissue characterization and early disease detection. Terahertz platforms support detailed analysis without ionizing radiation, which encourages gradual adoption across research hospitals and advanced diagnostic centers. As medical teams explore applications in dermatology, oncology and surgical margin assessment, equipment procurement increases in step with expanding clinical trials and feasibility studies. These factors contribute to rising use across specialized settings that seek clearer structural information and improved diagnostic precision.

The growth curve shows a pronounced upward slope, beginning at USD 5.8 million in earlier years and rising to USD 10.7 million in 2025 before advancing to USD 35.7 million by 2035. Annual increments widen steadily, with values moving from USD 12.1 million in 2026 to USD 13.6 million in 2027 and continuing through larger increases as demand reaches USD 24.9 million in 2032 and USD 31.7 million in 2034. This acceleration reflects growing research activity and expanding interest in terahertz-based diagnostic exploration. As clinical environments adopt more sophisticated imaging pathways and invest in next-generation diagnostic tools, the demand curve maintains strong upward momentum, marking a rapidly maturing but still emerging segment across Japan’s medical technology landscape.

Demand in Japan for medical terahertz technology is projected to grow from USD 10.7 million in 2025 to USD 35.7 million by 2035, reflecting an approximate compound annual growth rate (CAGR) of 12.8%. Beginning at USD 5.8 million in 2020, demand rises each year USD 9.5 million in 2024, USD 10.7 million in 2025 and continues its upward trajectory toward USD 15.4 million in 2028, USD 22.1 million in 2031, and ultimately USD 35.7 million in 2035. Growth is driven by increasing applications of terahertz imaging and spectroscopy in non-invasive diagnostics, oncology screening, and pharmaceutical research.

Over the forecast period the total value uplift is USD 25.0 million (from USD 10.7 million in 2025 to USD 35.7 million in 2035). In the early stage of the period volume growth is dominant more hospitals and diagnostic centres adopt terahertz systems as awareness and regulatory acceptance increase. In the latter half of the decade value growth becomes more significant: devices integrate advanced features such as higher resolution, enhanced penetration, portability and AI-enabled image analysis, raising average system value per deployment. Stakeholders focusing on both broader adoption and higher-value system innovation are best placed to capture the opportunity across Japan.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 10.7 million |

| Forecast Value (2035) | USD 35.7 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

The demand for medical terahertz (THz) technology in Japan is being shaped by growing focus on non invasive diagnostics and early disease detection. Facilities in Japan are exploring THz imaging systems for applications such as distinguishing between healthy and cancerous tissue, real time surgical margin analysis, and dental diagnostic procedures. THz radiation’s ability to penetrate soft tissue without ionizing radiation aligns with safety priorities in Japanese medical settings. Strong research activity in imaging modalities and interest in high precision diagnostics among aging populations support uptake of terahertz based equipment.

In addition, Japan’s advanced healthcare infrastructure and increasing use of outpatient and minimally invasive treatments contribute to demand for terahertz systems. Clinics and hospitals in Japan are looking for diagnostic tools that offer faster results, better spatial resolution and reduced patient trauma compared with some traditional methods. These requirements drive interest in THz enabled spectroscopic and imaging solutions. Device cost and the need for clinical validation remain constraints, yet overall interest and investment suggest steady growth in demand for medical terahertz technology in Japan.

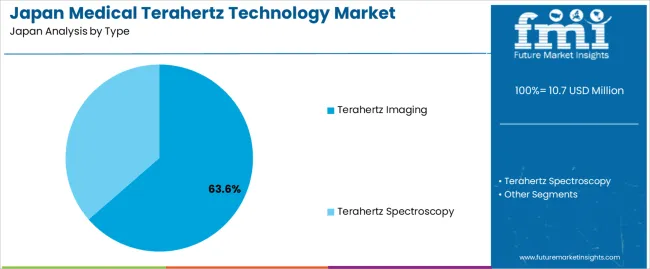

The demand for medical terahertz technology in Japan is shaped by the different types of technology used and the wide range of applications within healthcare. The two primary types of terahertz technology are terahertz imaging and terahertz spectroscopy, each offering distinct diagnostic capabilities in terms of non-invasive imaging and material analysis. Applications of this technology span dentistry, oncology, dermatology, tomography, biochemistry, and other specialized fields. As medical professionals continue to prioritize early detection, precise diagnostics, and non-invasive techniques, the combination of terahertz technology and its diverse applications drives its growing adoption in Japan's healthcare sector.

Terahertz imaging accounts for 64% of total demand for medical terahertz technology in Japan. This dominant share reflects its growing role in non-invasive imaging, particularly in identifying tissue abnormalities and tumors. Terahertz imaging offers high resolution with minimal penetration, making it ideal for diagnosing soft tissue conditions in a variety of medical fields. Its ability to provide real-time, non-destructive images allows for faster and more accurate diagnosis compared to conventional imaging methods. Healthcare providers favor it for its potential to reveal detailed anatomical structures without the need for radiation, which increases patient safety and comfort.

Demand for terahertz imaging continues to rise as medical teams explore its versatility across specialties. Its application in dermatology, oncology, and biochemistry supports diagnosis and treatment planning, while its non-invasive nature contributes to reduced patient recovery times and lower healthcare costs. With increased investment in research and the advancement of imaging techniques, terahertz imaging is expected to expand its role in medical diagnostics, offering a promising alternative to traditional methods.

Dentistry accounts for 24.6% of total demand for medical terahertz technology in Japan. This strong demand reflects the increasing use of terahertz imaging for early detection of dental issues, such as cavities and tooth decay, without the need for invasive procedures. Terahertz technology provides detailed imaging of tooth structure, enabling dentists to detect problems before they become visible on traditional X-rays. Its non-invasive nature and the ability to examine soft tissues and hard materials within the dental anatomy make it a valuable tool in preventive care and diagnosis.

The adoption of terahertz technology in dentistry is also driven by its ability to improve the accuracy of diagnosis and treatment planning. Dentists can use it to monitor the progression of dental conditions over time, enhancing the ability to track treatment efficacy. As Japanese dental practices continue to prioritize patient comfort and the use of cutting-edge technology, terahertz imaging plays a growing role in offering safer, more efficient diagnostic options, driving its continued demand in the dental field.

Demand in Japan for medical terahertz (THz) technology is growing as clinicians and researchers explore non-ionizing imaging and spectroscopy methods that can support early diagnosis, tissue differentiation and minimally invasive assessment. The country’s strong investment in advanced medical devices and ageing population add impetus. At the same time, broad commercial deployment is constrained by high equipment cost, limited clinical validation in many applications and the need for regulatory and reimbursement frameworks. These factors together shape how quickly medical THz technology moves from research into routine clinical use in Japan.

Japanese healthcare settings increasingly require imaging tools that detect subtle tissue changes, support dermatology or oncology applications and integrate with advanced diagnostics. Terahertz systems show promise for non destructive imaging of skin, dental and superficial tissue lesions, aligning with the focus on early intervention and less invasive methods. Meanwhile, Japanese technology firms and research institutes are advancing compact THz sources and detectors, which improves feasibility in hospitals. These combined clinical and innovation dynamics drive interest in THz equipment among Japanese medical device buyers.

Key opportunities lie in dermatology clinics, dental practices, outpatient imaging centres and hospital departments focusing on early cancer detection, skin disease or wound assessment. Because Japan has a large elder care segment and increasing use of home based or ambulatory diagnostics, portable or lower cost THz systems may find traction. Also, device makers offering modular, upgradable THz platforms that can complement MRI/CT or optical imaging might capture interest from Japanese healthcare providers looking to differentiate. These segments offer clear paths for growth.

Despite the potential, adoption in Japan is moderated by several barriers. Clinical evidence and long term outcome data for THz imaging remain less comprehensive than established modalities, which can delay hospital procurement decisions. The high upfront cost of THz imaging equipment and required infrastructure integration pose hurdles, especially for smaller clinics. Regulatory pathways, reimbursement codes and staff training for new imaging methods in Japan also add complexity. These constraints mean that THz technology is moving forward gradually rather than seeing rapid rotation into standard diagnostic workflows.

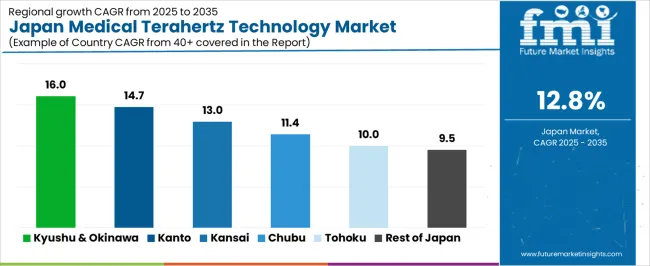

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 16.0% |

| Kanto | 14.7% |

| Kinki | 13.0% |

| Chubu | 11.4% |

| Tohoku | 10.0% |

| Rest of Japan | 9.5% |

Demand for medical terahertz technology in Japan is growing rapidly across regions, with Kyushu and Okinawa leading at 16.0%. This growth is driven by the increasing application of terahertz imaging in medical diagnostics, particularly for non-invasive scans. Kanto follows at 14.7%, supported by high adoption in medical research centers and hospitals leveraging cutting-edge diagnostic tools. Kinki records 13.0%, shaped by steady demand from healthcare institutions and universities. Chubu grows at 11.4%, with increasing interest in terahertz technology among regional medical facilities. Tohoku reaches 10.0%, with steady adoption across public health and research initiatives. The rest of Japan posts 9.5%, reflecting broader interest in advanced diagnostic technologies across smaller markets.

Kyushu & Okinawa is projected to grow at a CAGR of 16.0% through 2035 in demand for medical terahertz technology. Hospitals, medical research centers, and diagnostic facilities in Fukuoka are adopting terahertz imaging and spectroscopy for early disease detection, cancer diagnosis, and non-invasive medical imaging. Rising demand for precision diagnostics, non-invasive procedures, and enhanced medical imaging techniques drives adoption. Manufacturers provide advanced, high-resolution terahertz imaging systems suitable for clinical and research applications. Investment in healthcare infrastructure, research initiatives, and medical technology innovation supports steady growth in the adoption of terahertz technology across Kyushu & Okinawa.

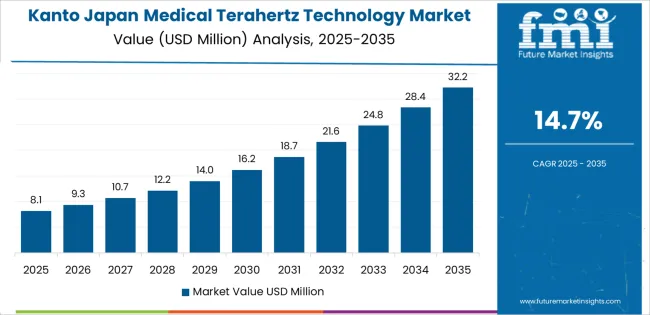

Kanto is projected to grow at a CAGR of 14.7% through 2035 in demand for medical terahertz technology. Tokyo and surrounding urban centers are increasingly adopting terahertz imaging and spectroscopy for early cancer detection, molecular imaging, and non-invasive diagnostics. Rising demand for precision medical technologies, early disease detection, and personalized treatment drives adoption. Manufacturers provide advanced imaging solutions compatible with clinical and research workflows. The region’s strong research infrastructure, investment in medical technology, and growing healthcare needs support steady adoption of terahertz technology across Kanto.

Kinki is projected to grow at a CAGR of 13.0% through 2035 in demand for medical terahertz technology. Osaka and Kyoto are increasingly adopting terahertz imaging systems in hospitals and research institutions for early disease detection and advanced medical imaging. Rising demand for non-invasive diagnostic tools and precision medicine drives adoption. Manufacturers offer high-resolution terahertz devices suitable for both clinical and research applications. Retailers and distributors ensure access across urban medical facilities. Industrial and healthcare infrastructure growth, along with medical research advancements, supports steady adoption of terahertz technology in Kinki.

Chubu is projected to grow at a CAGR of 11.4% through 2035 in demand for medical terahertz technology. Nagoya and other urban centers are adopting terahertz imaging solutions in hospitals, research institutes, and diagnostic centers for non-invasive disease diagnosis and molecular imaging. Rising interest in precision medicine, early cancer detection, and advanced medical technologies drives adoption. Manufacturers supply high-resolution terahertz systems compatible with clinical workflows. Healthcare infrastructure development, regional medical research initiatives, and technology adoption support steady demand growth for terahertz technology across Chubu.

Tohoku is projected to grow at a CAGR of 10.0% through 2035 in demand for medical terahertz technology. Hospitals, research centers, and medical institutions in Sendai are adopting terahertz imaging and spectroscopy for non-invasive diagnostic applications, especially in oncology and dermatology. Rising demand for advanced, precision medical imaging drives adoption. Manufacturers provide high-performance terahertz systems for clinical and research purposes. Investment in medical technology infrastructure, along with growing healthcare needs in the region, ensures steady demand for terahertz technology adoption across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 9.5% through 2035 in demand for medical terahertz technology. Smaller towns and rural medical facilities are gradually adopting terahertz imaging solutions for disease detection and molecular diagnostics. Rising awareness of advanced medical technologies and non-invasive diagnostic techniques drives adoption. Manufacturers provide cost-effective, portable terahertz devices for smaller healthcare settings. Distributors ensure access across semi-urban and rural regions. Gradual adoption in smaller healthcare facilities, along with growing interest in precision medicine, supports steady demand for terahertz technology across the Rest of Japan.

The demand for medical terahertz (THz) technology in Japan is driven by the rising need for non-invasive diagnostic and imaging solutions. Japan’s aging population and increasing incidence of diseases such as skin cancer, oral cancer and other conditions that benefit from early detection encourage adoption of THz imaging and spectroscopy systems. These systems function without ionising radiation and can provide high-resolution imaging of tissues, which supports screening, treatment monitoring and research. The broader focus on healthcare innovation, precision diagnostics and integration of advanced modality workflows within Japanese hospitals and medical research facilities further boosts demand for THz-based medical technologies.

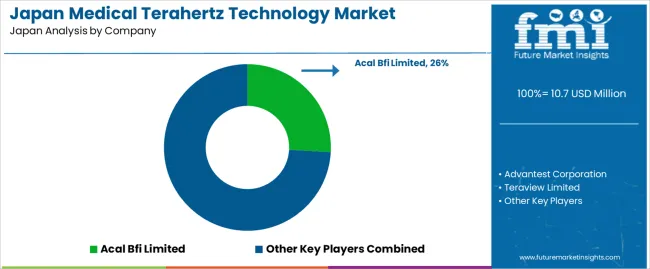

Key companies active in Japan’s medical terahertz technology segment include Acal Bfi Limited, Advantest Corporation, Teraview Limited, Luna Innovations Inc. and Insight Product Company. These firms supply terahertz sources, imaging systems, detectors and analysis platforms designed for medical and life-science applications. Their technical capabilities include high-frequency THz generation, compact instrumentation and integration of imaging modalities suited for Japanese clinical standards. Through partnerships with Japanese research institutes and healthcare providers, they are influencing system adoption, clinical validation and deployment of THz technology within Japan’s healthcare infrastructure.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Terahertz Imaging, Terahertz Spectroscopy |

| Application | Dentistry, Oncology, Dermatology, Tomography, Biochemistry, Other |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Acal BFI Limited, Advantest Corporation, Teraview Limited, Luna Innovations Inc., Insight Product Company |

| Additional Attributes | Dollar by sales by application and type; regional CAGR and growth trends; adoption across healthcare settings such as research hospitals, outpatient centers, and dental clinics; integration with advanced diagnostic workflows; clinical trial involvement; growth of non-invasive diagnostics; shift towards precision medicine; rising incidence of diseases like skin and oral cancer; cost-sensitive equipment adoption; demand for high-resolution, portable THz systems; regulatory approval processes and clinical validation; supplier partnerships with hospitals and research institutes for system integration and clinical deployment. |

The demand for medical terahertz technology in japan is estimated to be valued at USD 10.7 million in 2025.

The market size for the medical terahertz technology in japan is projected to reach USD 35.7 million by 2035.

The demand for medical terahertz technology in japan is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in medical terahertz technology in japan are terahertz imaging and terahertz spectroscopy.

In terms of application, dentistry segment is expected to command 24.6% share in the medical terahertz technology in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Terahertz Technology Market Trends - Growth & Forecast 2025 to 2035

Demand for Medical Terahertz Technology in USA Size and Share Forecast Outlook 2025 to 2035

Terahertz Technology Market

Medical Device Technology Market Size and Share Forecast Outlook 2025 to 2035

Demand for Medical Tourism in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Camera Technology in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Homecare Medical Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Blow Fill Seal Technology Market Insights – Growth & Forecast 2023-2033

Demand for Distance Health Technology in Japan Size and Share Forecast Outlook 2025 to 2035

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA