The demand for medical terahertz technology in USA is valued at USD 78.1 million in 2025 and is projected to reach USD 351.7 million by 2035, reflecting a compound annual growth rate of 16.2%. Growth is shaped by wider interest in high-frequency systems used for noninvasive imaging, tissue characterization and early identification of structural changes. Terahertz platforms provide detailed surface and subsurface analysis without ionizing radiation, which encourages their gradual use across research hospitals and specialized diagnostic units. As clinical teams investigate their suitability for dermatology, oncology and margin assessment, procurement increases in line with new feasibility studies. These developments support rising adoption across advanced diagnostic environments that are exploring clearer visualization methods for complex assessments.

The growth curve shows a pronounced upward slope beginning at USD 36.8 million in earlier years and advancing to USD 78.1 million in 2025 before progressing toward USD 351.7 million by 2035. Annual increments widen steadily, with values moving from USD 90.7 million in 2026 to USD 105.5 million in 2027 and continuing through larger gains in later periods. The pattern reflects strong momentum driven by heightened research activity, extended evaluation across clinical workflows and the search for more refined imaging approaches. As institutions expand diagnostic capabilities and explore next-generation modalities, terahertz platforms gain attention for specialized applications. This results in a rapidly advancing demand trajectory shaped by consistent development, broader clinical exploration and increased investment across USA’s medical technology landscape.

Demand in USA for medical terahertz technology is projected to rise from USD 78.1 million in 2025 to USD 351.7 million by 2035, representing a compound annual growth rate (CAGR) of approximately 16.2%. Beginning at USD 36.8 million in 2020, the value climbs steadily USD 67.2 million in 2024, USD 78.1 million in 2025 and continues upward through USD 165.7 million by 2030 and ultimately USD 351.7 million by 2035. Growth is driven by an increasing focus on non-invasive diagnostic tools, the rising incidence of chronic and oncologic diseases, and the push for advanced imaging modalities (such as terahertz imaging and spectroscopy) that enable early detection and precision diagnostics.

This significant expansion underscores both volume growth more facilities adopting terahertz systems and applying them across more procedures and escalating value per deployment, as device capabilities advance and adoption broadens. Early years of the forecast see initial uptake as clinical trials and pilot installations pave the way. In the latter half, value growth gains prominence: systems integrating higher resolution, deeper penetration, AI enabled analysis and hybrid modalities generate higher average revenue per installation. As healthcare providers invest in advanced diagnostic infrastructure, the combination of growing procedure volumes and premium equipment positions the sector for strong growth toward USD 351.7 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 78.1 million |

| Forecast Value (2035) | USD 351.7 million |

| Forecast CAGR (2025 to 2035) | 16.2% |

The demand for medical terahertz (THz) technology in USA is rising as healthcare stakeholders seek non-ionising diagnostic tools that support early detection and precision care. THz imaging and spectroscopy can distinguish between healthy and abnormal tissues by detecting differences in water content and molecular structure, which appeals particularly in oncology, dermatology and dental imaging. Research institutions and specialized clinics in USA are initiating pilot studies of THz systems to support surgical margin assessment, non-invasive skin cancer screening and molecular diagnostics. The strong biomedical research infrastructure in USA ensures access to new technologies, which helps accelerate uptake of THz-based devices.

Another factor supporting demand is the broader shift toward minimally invasive diagnostics and personalised medicine. Clinics and ambulatory surgical centres are acquiring equipment that enables tissue characterisation without ionising radiation, which aligns with patient safety and outpatient care trends. Equipment manufacturers are developing portable THz systems suitable for point-of-care settings and integrating real-time data analysis applications. Cost of devices, limited penetration depth of current systems and regulatory approvals remain obstacles, yet the convergence of clinical need, technology readiness and research momentum suggests growing demand for medical terahertz technology in USA.

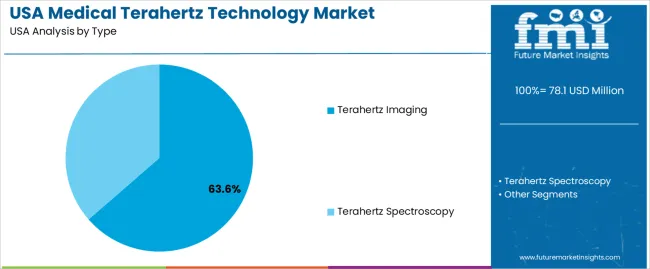

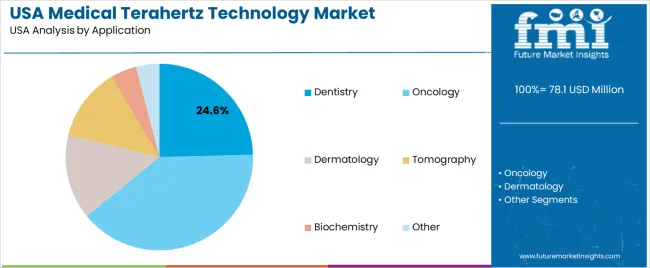

The demand for medical terahertz technology in USA is shaped by the two primary technology types and the wide range of clinical applications that rely on non-invasive diagnostic tools. Terahertz imaging and terahertz spectroscopy support different diagnostic aims, with imaging focused on structural visualization and spectroscopy used for analyzing tissue composition. Applications span dentistry, oncology, dermatology, tomography, biochemistry and other fields that require precise detection of surface and subsurface features. As medical teams look for alternatives that provide detailed information without ionizing effects, the combination of imaging capabilities and varied clinical uses influences overall adoption across USA’s healthcare settings.

Terahertz imaging accounts for 64% of total demand for medical terahertz technology in USA. Its leading position reflects strong interest in high-resolution, non-invasive imaging suited to identifying surface-level and shallow subsurface tissue characteristics. Many clinical workflows adopt terahertz imaging when conventional tools provide limited clarity for early-stage structural changes. Providers value the ability to examine tissues without radiation exposure, supporting repeated use when monitoring progression. The technique’s capacity to assist in visualizing lesions and differentiating tissue types strengthens its application across diagnostic routines. These advantages guide steady adoption in clinical environments seeking detailed imaging without extensive procedural requirements.

Demand for terahertz imaging continues to rise as facilities explore its suitability for tasks requiring fine structural assessment. The technology assists providers when evaluating irregular tissue patterns and supports more precise decision-making in multidisciplinary settings. Its alignment with emerging diagnostic pathways that emphasize early detection and minimal patient burden contributes to routine use. As healthcare teams incorporate tools that help refine diagnostic accuracy, terahertz imaging maintains its role as the dominant type within USA’s terahertz technology landscape.

Dentistry accounts for 24.6% of total demand for medical terahertz technology in USA. This leading share reflects the usefulness of terahertz systems in identifying early-stage dental issues, examining enamel conditions and assessing microstructural changes that may not appear clearly on conventional radiographs. Dentists rely on the technology’s ability to evaluate lesions and detect decay without exposing patients to ionizing radiation. Its non-invasive operation supports frequent monitoring, which is valuable for preventive care and long-term dental management. These characteristics make terahertz tools suitable for routine clinical assessments across a broad patient base.

Demand for terahertz technology in dentistry grows as practices adopt tools that enhance diagnostic sensitivity. The technology provides detailed visualization of tooth surfaces and subsurface features, assisting clinicians in refining treatment plans. Its straightforward operation and potential for real-time feedback support efficient patient interactions. Facilities also value its compatibility with preventive care strategies that emphasize early detection. As dental practices continue seeking reliable imaging methods that improve diagnostic outcomes, dentistry remains the primary application shaping demand for medical terahertz technology in USA.

Demand for medical terahertz (THz) technology in the USA is growing as healthcare providers seek non-ionizing imaging and spectroscopy tools that afford early diagnosis, tissue differentiation and minimally-invasive assessment. Growth is supported by rising cancer incidence, emphasis on early detection and technological advances in THz sources and detectors. However, barriers include high equipment cost, limited clinical validation of many applications and regulatory/reimbursement gaps for novel imaging modalities. Together these forces influence the speed and scale at which THz medical systems are adopted across USA hospitals and diagnostic centres.

In the USA, clinical demand for safe, high-contrast imaging-especially for skin, breast or superficial cancers, dental applications and wound assessment-aligns with THz system capabilities, which offer potential advantages over X-ray or MRI in certain superficial tissue contexts. At the same time USA research institutes and medical device manufacturers are advancing compact THz sources, improved detectors, AI-enhanced image processing and integration with existing workflows. These innovation efforts support growing interest in THz platforms among USA healthcare buyers, although practical deployment remains emergent.

Growth opportunities in the USA lie in outpatient dermatology clinics, dental practices, wound-care centres, and hospital imaging departments focused on early detection or intraoperative guidance. Because of rising demand for precision diagnostics and minimally invasive assessments, THz systems that provide high surface-oriented resolution may find niche applications. Suppliers offering user-friendly, compact and cost-effective THz devices that can integrate with existing imaging suites or diagnostics labs are well positioned to capture this emerging demand in the United States.

Despite promising potential, several challenges restrict broader uptake in the USA THz technology remains relatively new in clinical practice, requiring more long-term outcome data and standardised protocols. The high capital cost of systems, the need for operator training, and limited reimbursement for novel imaging tests deter many facilities. Integration with hospital IT systems and regulatory approvals also add complexity. Additionally, competition with established imaging modalities like MRI, CT and ultrasound means THz systems must demonstrate clear value-proposition to gain scale.

| Region | CAGR (%) |

|---|---|

| West | 18.7% |

| South | 16.7% |

| Northeast | 14.9% |

| Midwest | 13.0% |

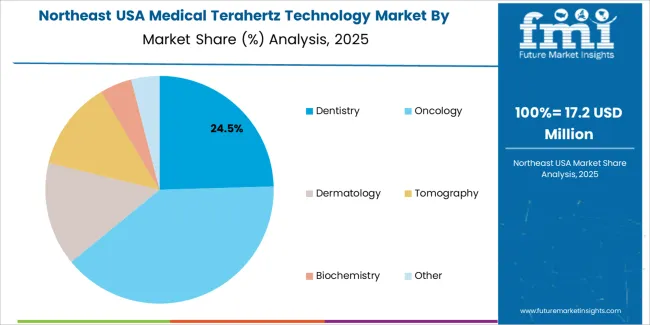

Demand for medical terahertz technology in the USA is rising quickly across regions, with the West leading at 18.7%. Growth in this region reflects strong engagement from research institutions and hospitals exploring terahertz imaging for non-invasive diagnostic use. The South follows at 16.7%, supported by expanding medical centers and steady interest in emerging diagnostic platforms. The Northeast records 14.9%, shaped by its concentration of academic hospitals and ongoing evaluation of terahertz systems in clinical research settings. The Midwest grows at 13.0%, where regional facilities adopt early-stage terahertz tools for investigative work. These trends show broad national movement toward advanced imaging technologies applied in research and specialized diagnostics.

West USA is projected to grow at a CAGR of 18.7% through 2035 in demand for medical terahertz technology. California and neighboring states are increasingly adopting terahertz imaging and spectroscopy for non-invasive diagnostics, early disease detection, and advanced cancer imaging. Rising demand for precision diagnostics, personalized treatment, and non-invasive procedures drives adoption. Manufacturers provide high-resolution, clinically compatible terahertz systems suitable for hospitals and research centers. Distributors ensure availability across urban medical facilities. Healthcare infrastructure expansion, research initiatives, and rising demand for advanced imaging technologies support steady adoption of medical terahertz technology across West USA.

South USA is projected to grow at a CAGR of 16.7% through 2035 in demand for medical terahertz technology. Texas, Florida, and Georgia are increasingly using terahertz imaging and spectroscopy in hospitals and research centers for early cancer detection, molecular imaging, and non-invasive diagnostics. Rising need for precision diagnostics, clinical accuracy, and personalized treatments drives adoption. Manufacturers supply high-resolution, portable terahertz systems for hospital and research workflows. Distributors expand access across urban and suburban medical facilities. Medical infrastructure investment, research center expansion, and advanced diagnostic technology adoption support steady growth across South USA.

Northeast USA is projected to grow at a CAGR of 14.9% through 2035 in demand for medical terahertz technology. New York, Boston, and Philadelphia are adopting terahertz imaging solutions in hospitals and research centers for early disease detection, molecular imaging, and non-invasive diagnostics. Rising demand for precision, faster diagnostics, and clinical accuracy drives adoption. Manufacturers provide high-resolution, multi-modality terahertz systems suitable for clinical and research applications. Distributors ensure availability across urban medical and research facilities. Healthcare infrastructure development, hospital expansion, and diagnostic technology adoption support steady growth in Northeast USA.

Midwest USA is projected to grow at a CAGR of 13.0% through 2035 in demand for medical terahertz technology. Chicago, Detroit, and Minneapolis hospitals and research centers are gradually adopting terahertz imaging and spectroscopy for non-invasive diagnostics and early disease detection. Rising demand for advanced imaging technology, precision diagnostics, and personalized treatment drives adoption. Manufacturers supply high-resolution, clinically compatible terahertz systems suitable for hospital and research applications. Distributors expand access across urban and semi-urban medical facilities. Hospital modernization, medical research expansion, and diagnostic technology adoption support steady growth of medical terahertz technology in Midwest USA.

The demand for medical terahertz (THz) technology in the USA is being driven by growing emphasis on non-invasive diagnostics, early detection of disease, and advanced imaging for clinical and research applications. THz imaging and spectroscopy offer the ability to differentiate tissues based on water content and structural characteristics, making them potentially useful for early cancer detection, burn assessment, and dermatological monitoring. The strong base of clinical research institutions in the United States, combined with increasing regulatory attention to imaging technologies, supports uptake of THz systems. At the same time, the shift toward precision medicine and minimally invasive procedures encourages adoption of advanced imaging tools that complement conventional modalities.

Key companies active in the USA medical terahertz technology sector include Acal Bfi Limited, Advantest Corporation, Teraview Limited, Luna Innovations Inc., and Insight Product Company. These companies provide terahertz sources, imaging modules, spectroscopy instruments and integrated systems tailored for medical and life-science applications. Their product portfolios address research-lab as well as clinical-trial environments, offering flexibility, sensitivity and compatibility with USA regulatory standards. Through collaboration with healthcare providers and research institutions, and by developing systems suited to USA workflows, these firms play a significant role in shaping the commercial availability, adoption and evolution of medical terahertz technology across the United States.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Terahertz Imaging, Terahertz Spectroscopy |

| Application | Dentistry, Oncology, Dermatology, Tomography, Biochemistry, Other |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Acal BFI Limited, Advantest Corporation, Teraview Limited, Luna Innovations Inc., Insight Product Company |

| Additional Attributes | Dollar by sales by type and application; regional CAGR and adoption trends; usage across research hospitals, specialized clinics, and outpatient centers; non-ionizing imaging applications in dermatology, oncology, dentistry and biochemistry; clinical and research adoption patterns; integration with AI-enabled analysis and hybrid imaging modalities; portable and point-of-care system adoption; regulatory and reimbursement considerations; ongoing product innovation including higher resolution, improved penetration, and workflow integration; projected value uplift and volume growth across the forecast period. |

The demand for medical terahertz technology in usa is estimated to be valued at USD 78.1 million in 2025.

The market size for the medical terahertz technology in usa is projected to reach USD 351.7 million by 2035.

The demand for medical terahertz technology in usa is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in medical terahertz technology in usa are terahertz imaging and terahertz spectroscopy.

In terms of application, dentistry segment is expected to command 24.6% share in the medical terahertz technology in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Terahertz Technology Market Trends - Growth & Forecast 2025 to 2035

Demand for Medical Terahertz Technology in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Tourism Market Analysis – Size, Share & Forecast 2025-2035

Terahertz Technology Market

Medical Device Technology Market Size and Share Forecast Outlook 2025 to 2035

Demand for Homecare Medical Devices in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Distance Health Technology in USA Size and Share Forecast Outlook 2025 to 2035

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA