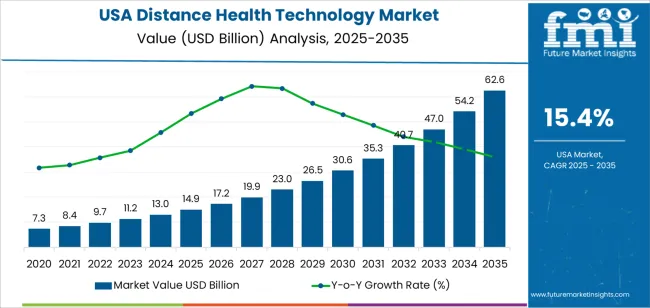

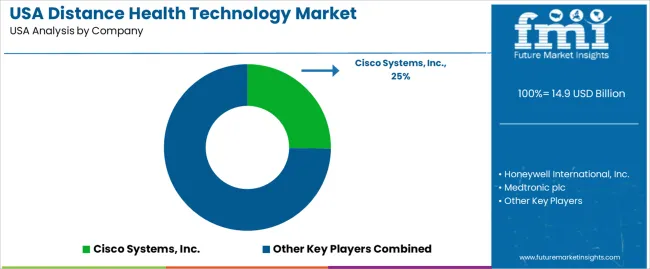

The demand for distance health technology in the USA is valued at USD 14.9 billion in 2025 and is projected to reach USD 62.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of 15.4%. The growth is driven by increasing adoption of telehealth services, remote monitoring tools, and virtual healthcare consultations, particularly accelerated by the ongoing digital transformation of healthcare and the COVID-19 pandemic. These technologies enable patients to access healthcare from the comfort of their homes, improving access to care, especially in rural areas. With growing patient demand for convenience, cost-effectiveness, and improved healthcare outcomes, the distance health technology sector is poised for substantial growth over the next decade.

The demand for distance health technology is projected to grow rapidly over the forecast period, moving from USD 7.3 billion in earlier years to USD 14.9 billion in 2025, and further rising to USD 62.6 billion by 2035. The growth momentum is robust, with annual increments showing significant expansion, such as from USD 14.9 billion in 2025 to USD 17.2 billion in 2026, and continuing on an upward trajectory through the forecast period. This consistent growth reflects the increasing reliance on digital health solutions by both healthcare providers and patients, fueled by innovations in technology and the growing recognition of the benefits of distance health solutions.

Demand in USA for distance health technology is projected to increase from USD 14.9 billion in 2025 to USD 62.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 15.4%. Beginning at USD 7.3 billion in 2020, demand rises to USD 14.9 billion in 2025 and continues to expand through annual values of USD 17.2 billion (2026), USD 23.0 billion (2028), USD 30.6 billion (2030), and USD 54.2 billion (2034). These gains reflect increased adoption of remote patient monitoring, teleconsultations, virtual care platforms, and digital health solutions across both consumer and clinical settings. Key drivers include rising chronic disease incidence, growing patient preference for convenient care, and enhanced connectivity infrastructure.

Over the forecast period, technology innovation and ecosystem expansion will further reinforce demand. Improvements in artificial intelligence analytics, wearable sensors, and interoperability of remote health platforms will elevate value per application and broaden service scope. The shift toward value based care models and away from episodic in person treatment supports sustained uptake of distance health solutions. As service delivery models evolve, healthcare providers and payors will increasingly invest in remote technologies, helping drive the projected ramp to USD 62.6 billion by 2035.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 14.9 billion |

| Forecast Value (2035) | USD 62.6 billion |

| Forecast CAGR (2025–2035) | 15.4% |

The demand for distance health technology in USA is propelled by growing needs for accessible healthcare and efficiency. Remote consultations, virtual monitoring, and digital health platforms enable delivery of care beyond traditional clinic settings. Healthcare providers face pressure to serve larger patient volumes while managing resource constraints. Consumers expect convenient, technology enabled experiences and tools to manage health from home. Advances in connectivity, cloud computing, sensors, and artificial intelligence enhance the capabilities of distance health technologies and support wider adoption.

Another key driver is the rise in chronic disease prevalence and ageing populations in USA. Continuous monitoring and early intervention via remote platforms help manage long term conditions, reduce readmissions, and lower costs for both providers and patients. Regulatory and reimbursement changes have become more supportive of virtual care, encouraging investment and deployment of distance health solutions. Data interoperability and cybersecurity still pose challenges. Overall the demand for distance health technology in USA remains on an upward trajectory as healthcare delivery models evolve.

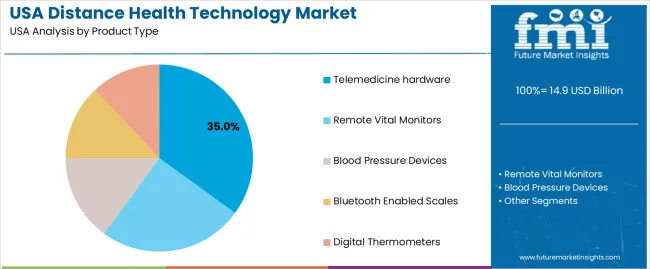

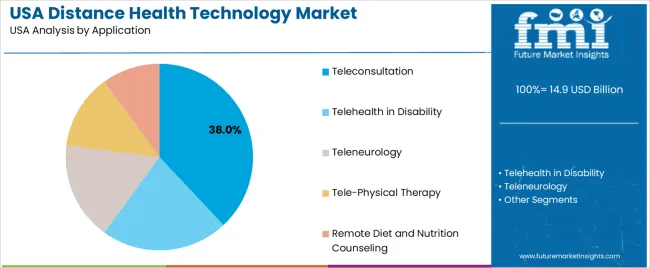

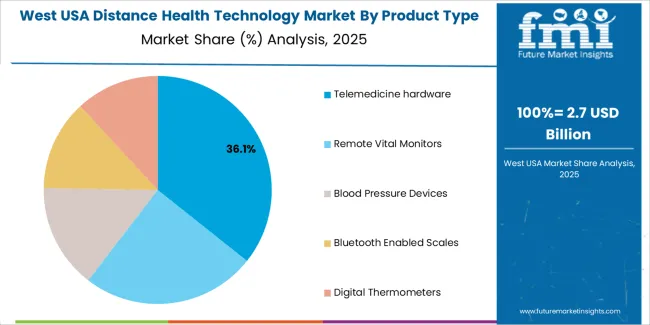

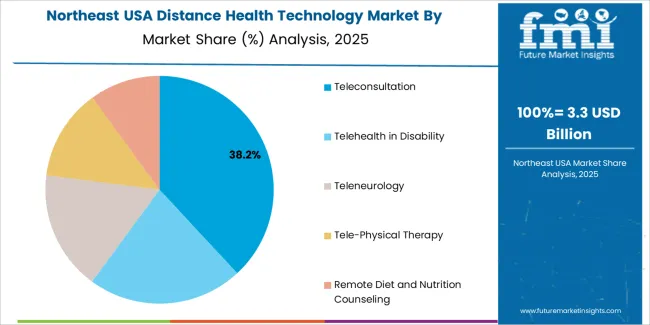

The demand for distance health technology in the USA is shaped by the product types and applications within the healthcare sector. The product types include telemedicine hardware, remote vital monitors, blood pressure devices, Bluetooth-enabled scales, and digital thermometers. Applications of these technologies span across teleconsultation, telehealth in disability, teleneurology, tele-physical therapy, and remote diet and nutrition counseling. These segments reflect the growing adoption of telehealth solutions, which enable healthcare providers to offer services remotely, improving access to care while meeting the needs of various patient groups.

Telemedicine hardware accounts for 35% of the total demand for distance health technology in the USA. This product type is in high demand as it serves as the foundation for remote consultations, enabling healthcare providers and patients to connect via video, audio, and data sharing. Telemedicine hardware, such as cameras, microphones, and specialized equipment, facilitates a seamless remote consultation experience for both patients and doctors. As the healthcare industry increasingly shifts toward virtual care, telemedicine hardware continues to be crucial in making telehealth accessible and effective.

The growth in telemedicine hardware demand is also driven by the ongoing expansion of virtual healthcare services and the increasing recognition of their benefits. This includes greater convenience, cost-effectiveness, and accessibility, particularly for patients in rural or underserved areas. As healthcare providers continue to integrate telemedicine into their service offerings, the demand for reliable, high-quality telemedicine hardware is expected to increase, ensuring consistent and effective patient care.

Teleconsultation represents 38.0% of the total demand for distance health technology in the USA. This application is one of the most widely adopted telehealth services, offering patients the ability to consult with healthcare providers remotely for a variety of health concerns. The demand for teleconsultation is primarily driven by the need for accessible healthcare, particularly during situations like the COVID-19 pandemic, which highlighted the importance of virtual consultations for maintaining social distancing while continuing to provide care.

The growing demand for teleconsultation is further fueled by advancements in technology that improve the quality and reliability of virtual appointments. Teleconsultation helps reduce wait times, lowers healthcare costs, and increases access for individuals who face geographical, mobility, or financial barriers to in-person care. As both patients and healthcare providers embrace the convenience of teleconsultation, its demand is expected to continue to rise, becoming a permanent fixture in healthcare delivery across the USA.

The demand for distance health technology in the USA is expanding as healthcare providers and patients increasingly adopt remote care solutions, virtual consultations, and digital monitoring tools. Broad internet access and growing awareness of convenience and accessibility support this growth. Yet challenges remain, including inconsistent availability of virtual services across regions and concerns about data security. Understanding the interplay of technological advancement, regulatory support, patient expectations and adoption barriers is essential for anticipating how remote health technology will evolve in the United States.

How is virtual first care reshaping the demand for Distance Health Technology in USA?

Virtual first care models where patients initiate care via digital channels rather than in person are transforming how remote health technology is used in the United States. These models prioritize online consultations, smartphone based health apps and connected device monitoring, enabling patients to receive care from home. As more health systems adopt these models, demand for software platforms, secure video visit infrastructure and integrated remote monitoring grows. This shift supports remote health technology expansion by placing digital care channels at the core of healthcare delivery and patient engagement.

Why is the drive for improved healthcare access increasing demand for Distance Health Technology in USA?

Efforts to improve access to healthcare, especially in underserved rural areas and among populations with limited mobility, are enhancing the appeal of remote health technology in the United States. Distance health tools allow patients to connect with specialists, receive follow up care and monitor chronic conditions from home, reducing travel burdens and wait times. In turn, healthcare providers and payers invest in platforms that support remote visits and monitoring to lower costs and expand reach. This push for broader access underpins the growing demand for remote health technology solutions.

Which barriers are slowing the broader adoption of Distance Health Technology in USA?

One major barrier to wider adoption of remote health technology in the United States is the uneven availability of reliable digital infrastructure and virtual care offerings. A recent survey found that while many consumers are willing to use virtual visits, only a minority report providers offering them consistently. Access to broadband, familiarity with digital tools and provider organisational readiness vary significantly across regions. These shortcomings reduce adoption potential and challenge the scaling of remote health technology solutions across all segments of the US population.

| Region | CAGR (%) |

|---|---|

| West | 17.7% |

| South | 15.9% |

| Northeast | 14.2% |

| Midwest | 12.3% |

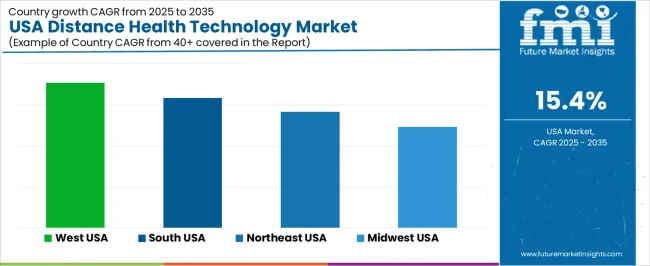

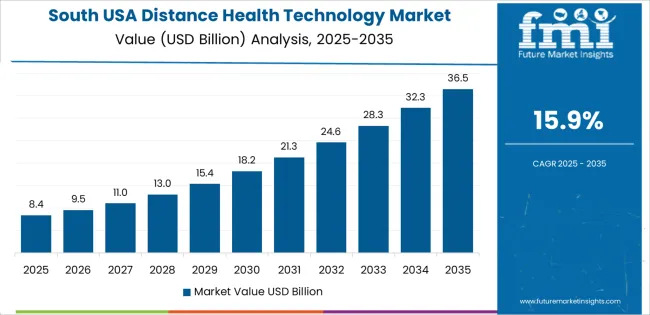

The demand for distance health technology in the USA is growing rapidly across all regions, with the West leading at a 17.7% CAGR. This growth is fueled by the region's strong healthcare infrastructure, high adoption of telemedicine solutions, and the technological focus of healthcare providers. The South follows with a 15.9% growth, driven by increasing healthcare access in rural areas and the adoption of remote monitoring solutions. The Northeast experiences a 14.2% growth, supported by urban centers and a robust healthcare system that integrates telemedicine into standard care. The Midwest, with a 12.3% CAGR, shows steady demand, driven by both urban and rural healthcare providers adopting distance health technologies to improve access and efficiency.

The West region of the USA is projected to grow at a CAGR of 17.7% through 2035 in demand for distance health technology. The region’s advanced healthcare infrastructure, combined with a large tech-driven market, accelerates the adoption of telemedicine and remote health monitoring solutions. States like California and Washington, with their robust healthcare systems and tech industries, drive this growth. The increasing focus on accessible healthcare, coupled with the growing number of health-conscious consumers, leads to increased demand for innovative distance health technologies to improve patient outcomes and convenience.

The South region of the USA is projected to grow at a CAGR of 15.9% through 2035 in demand for distance health technology. The region’s large and diverse population, combined with the expansion of telehealth services, drives the adoption of remote health technologies. States like Texas and Florida, with their rapidly growing healthcare facilities, are leading the way in providing virtual health consultations and monitoring systems. The increasing focus on healthcare accessibility, particularly in rural areas, further contributes to the rising demand for distance health technology across the South.

The Northeast region of the USA is projected to grow at a CAGR of 14.2% through 2035 in demand for distance health technology. With its dense population and well-established healthcare networks, the Northeast remains a major adopter of telemedicine and remote patient monitoring solutions. States like New York and Massachusetts are key drivers of growth, leveraging their advanced medical institutions and technology infrastructure. The region’s healthcare providers are increasingly turning to distance health technologies to offer efficient, cost-effective care while improving patient accessibility and outcomes.

The Midwest region of the USA is projected to grow at a CAGR of 12.3% through 2035 in demand for distance health technology. The region’s focus on expanding rural healthcare access and enhancing healthcare delivery through technology contributes to steady growth. States like Illinois and Ohio are leading the charge in implementing telehealth services and remote monitoring solutions. The rise in chronic diseases and the growing need for healthcare efficiency further support the adoption of distance health technologies to improve patient care while reducing healthcare costs.

The demand for distance health technology in USA is fueled by the growing need to deliver healthcare remotely, monitor chronic conditions, and reduce burdens on clinical staff. Aging population demographics alongside the prevalence of chronic diseases increase demand for remote monitoring, virtual consultations, and mobile health apps. Healthcare providers seek tools that improve operational efficiency and patient outcomes while reducing administrative tasks. Advances in connected devices, data analytics, and artificial intelligence enhance capability of distance health solutions. Moreover, favourable reimbursement policies for telehealth services support adoption across care settings.

Major firms active in the USA distance health technology industry include Cisco Systems, Inc., Honeywell International, Inc., Medtronic plc, Koninklijke Philips N.V., and Teladoc Health, Inc. These companies provide platforms, devices, software and services that enable telemedicine, remote patient monitoring, health system connectivity and virtual care. Cisco offers networking and collaboration infrastructure that supports healthcare environments; Honeywell delivers remote monitoring and environmental control technologies; Medtronic supplies connected medical devices and solutions for chronic care; Philips delivers integrated health technology platforms and telehealth services; Teladoc specialises in virtual care and digital health services. The competitive focus lies in interoperability, device integration, data security and scalable care models.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Telemedicine Hardware, Remote Vital Monitors, Blood Pressure Devices, Bluetooth Enabled Scales, Digital Thermometers |

| Application | Teleconsultation, Telehealth in Disability, Teleneurology, Tele-Physical Therapy, Remote Diet and Nutrition Counseling |

| End User | Hospitals, Clinics, Long Term Care Centres, Specialty Centers, Clinical Pharmacy Services |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Cisco Systems, Inc., Honeywell International, Inc., Medtronic plc, Koninklijke Philips N.V., Teladoc Health, Inc. |

| Additional Attributes | Dollar by sales by product type and application; regional CAGR and adoption trends; use in telemedicine, remote monitoring, and virtual healthcare; technology adoption for chronic care and rural access; growth of teleconsultation, teleneurology, and tele-physical therapy; expansion of remote patient monitoring platforms; integration with AI and connected devices; interoperability and data security considerations; value-based care adoption; patient preference trends for virtual care; vendor offerings including hardware, software, services and platform integration; reimbursement and regulatory influences; infrastructure and broadband availability impacts. |

The global demand for distance health technology in USA is estimated to be valued at USD 14.9 billion in 2025.

The market size for the demand for distance health technology in USA is projected to reach USD 62.6 billion by 2035.

The demand for distance health technology in USA is expected to grow at a 15.4% CAGR between 2025 and 2035.

The key product types in demand for distance health technology in USA are telemedicine hardware, remote vital monitors, blood pressure devices, bluetooth enabled scales and digital thermometers.

In terms of application, teleconsultation segment to command 38.0% share in the demand for distance health technology in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Distance Health Technology in Japan Size and Share Forecast Outlook 2025 to 2035

Distance Health Technologies Market is segmented by Product, Application and End User

Healthcare Technology Management Market Insights – Growth & Forecast 2024-2034

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

Demand for Animal Healthcare in USA Size and Share Forecast Outlook 2025 to 2035

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Health and Fitness Club Market Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Distance Measurement Image Sensor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA