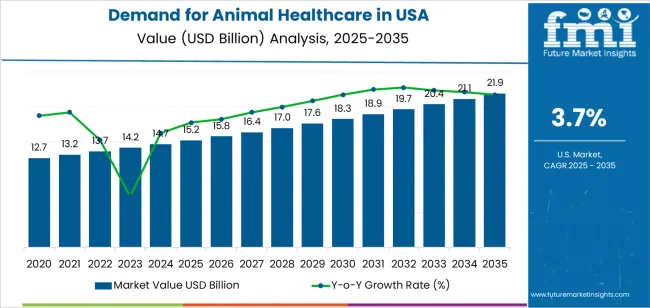

The demand for animal healthcare in the USA is valued at USD 15.2 billion in 2025 and is projected to reach USD 21.9 billion by 2035, reflecting a CAGR of 3.7%. Early growth is driven by increasing pet ownership, rising awareness of animal health, and the growing demand for preventive healthcare for companion animals, livestock, and wildlife. Veterinary care, including vaccinations, treatments for chronic conditions, and wellness plans, is becoming more essential as pet owners seek to ensure their animals live longer, healthier lives. Additionally, advancements in veterinary technologies and pharmaceuticals contribute to the growing demand for animal healthcare products and services across various species.

As the market progresses toward 2035, demand continues to grow steadily, influenced by expanding pet populations, veterinary care innovations, and the rising importance of livestock health in agricultural industries. The later years of the forecast period may see slightly slower growth as the market matures, with pet healthcare becoming more standardized and routine. However, demand remains strong due to ongoing research into animal diseases, genetic treatments, and advancements in animal nutrition and wellness, ensuring continued market stability and growth through 2035.

In the initial years (2020-2025), volume growth is the primary driver of demand, as more animals are being treated due to the rise in pet ownership and the growing need for routine veterinary services. As pets are increasingly viewed as family members, more frequent visits to vets and spending on animal healthcare products contribute to the demand. During this period, price growth is modest as basic care services remain affordable and accessible.

From 2025 onward, price growth begins to play a larger role in demand expansion. As the animal healthcare sector evolves, more advanced treatments, specialty care, and high-quality pet products are introduced, leading to higher prices. The increased use of cutting-edge diagnostic tools, specialized medications, and advanced surgical procedures will drive up costs per visit and treatment. By 2035, while volume continues to increase, price growth will become a more significant contributor to the overall demand, reflecting the trend toward premium and specialized animal healthcare services.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 15.2 billion |

| Forecast Value (2035) | USD 21.9 billion |

| Forecast CAGR (2025–2035) | 3.7% |

The demand for animal healthcare services in the USA is increasing as pet ownership continues to rise and companion animals are increasingly treated as family members rather than property. Pet owners show heightened willingness to invest in preventative care, specialty treatments, and advanced diagnostics for their animals. Clinics and hospitals expand offerings such as imaging services, orthopedic surgery, oncology care, and tele veterinary consultations. These capabilities align with growing human health parallels and expand veterinary service scope across the companion animal segment. Services adapt with cloud based record systems, mobile appointment scheduling, and integrated wellness plans tailored to breeds and life stages.

Growth is also supported by the expansion of pet insurance plans, rising average spending per veterinary visit, and increasing awareness of zoonotic disease risks. Livestock and equine sectors similarly invest in biosecurity, reproductive technologies, and herd health programmes to maintain productivity and animal welfare. Lifecycle extensions for companion animals and regulated frameworks for food animal safety increase demand for diagnostics, preventive medication, and procedural interventions. Although staffing shortages and regional access gaps remain challenges in veterinary care, continued prioritisation of animal well being and enhanced service delivery ensure sustained growth in the USA animal healthcare sector.

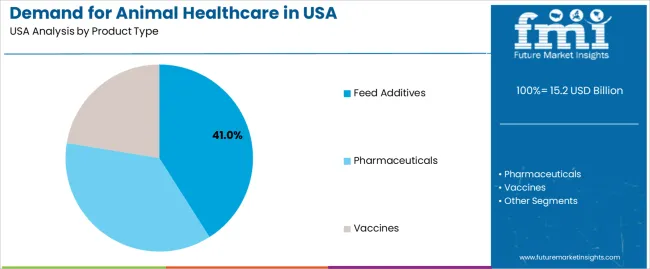

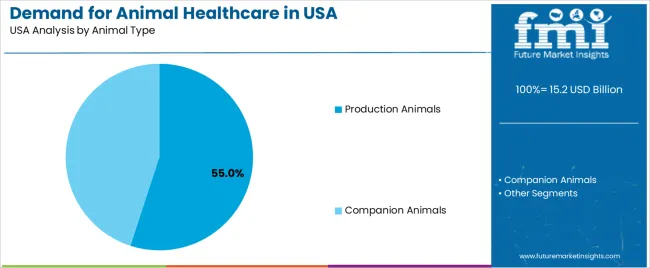

The demand for animal healthcare in the USA is segmented by product type and animal type. By product type, the demand is divided into feed additives and others. Based on animal type, it is categorized into production animals and companion animals. These segments reflect varying healthcare needs across different animal types and the types of products used to maintain their health and well-being.

The feed additives segment accounts for approximately 41% of the total demand for animal healthcare in the USA in 2025, making it the leading product type category. This position is supported by the critical role that feed additives play in enhancing the nutrition and health of livestock, particularly in production animals. Feed additives such as vitamins, minerals, enzymes, and probiotics are used to improve the quality of animal feed, boost immunity, promote growth, and prevent diseases in animals.

The growth of the feed additives segment is driven by the increasing focus on animal health, productivity, and disease prevention in the livestock sector. Feed additives are particularly essential for ensuring the optimal health of cattle, poultry, and swine, which are critical components of the production animal sector. The adoption of feed additives is particularly high in North America, where the livestock industry is well-established and focused on maintaining the health and efficiency of large-scale production systems. The segment maintains its lead due to its integral role in enhancing the productivity and health of animals in the agricultural sector.

The production animals segment represents about 55.0% of the total demand for animal healthcare in the USA in 2025, making it the dominant animal type category. This position reflects the large-scale commercial production of livestock, such as cattle, poultry, and swine, which require extensive healthcare products and services to ensure optimal health, growth, and disease prevention. The need for animal healthcare in production animals is driven by the demand for high-quality meat, dairy, and eggs to meet the dietary needs of a growing population.

Adoption is particularly strong in the agricultural regions of the USA, where large-scale farms and production facilities are located. Production animals require ongoing healthcare management, including vaccinations, disease monitoring, and nutritional support, which increases the demand for related products like feed additives, vaccines, and health supplements. The segment maintains its leading share because production animals represent a significant portion of the USA’s agricultural output, and maintaining their health is essential to meet market demands and ensure the efficiency of the production process.

The demand for animal healthcare services in USA is steadily increasing as pet ownership rises, expenditure on pet wellness grows and livestock management becomes more intensive. Companion animals are increasingly seen as family members, which drives spending on diagnostics, therapeutics and preventive care. In parallel, food animal health receives greater attention due to food safety and regulatory concerns. However, the sector faces constraints such as shortages of qualified veterinarians, high service costs and variability in access across rural and underserved regions. Providers are enhancing telemedicine, technology enabled diagnostics and preventive care models to keep pace with demand.

Pet owners in the USA are spending more on diagnostics, advanced treatments and preventive care for dogs, cats and horses as they regard animals as part of the family. Simultaneously, livestock producers are increasing investment in veterinary services to ensure herd health, comply with bio security regulations and avert zoonotic disease risk. These shifts across companion and food animal sectors are boosting overall demand for veterinary professionals, diagnostics, therapeutics and wellness programmes in the national animal healthcare ecosystem.

The growth of animal healthcare services is restrained by a shortage of veterinarians relative to rising demand, with projections indicating a significant shortfall in companion animal practitioners by 2030. High cost of advanced care for animals discourages some owners from seeking treatments. Geographic disparities mean rural or remote areas often lack veterinary services, impacting access and continuity of care. These structural and economic barriers slow the pace of service expansion in certain segments of the animal healthcare field.

Emerging trends include the adoption of tele veterinary consultations and mobile veterinary units to improve access in underserved areas. Diagnostic technologies such as point of care testing and imaging for pets are advancing, enabling more comprehensive care. Preventive health programmes and pet insurance uptake is increasing as owners seek to reduce long term costs. In the livestock sector, integration of digital monitoring, precision medicine and bio surveillance systems are growing to support herd health and food safety compliance. These developments are transforming service delivery and expanding care models in the USA animal healthcare landscape.

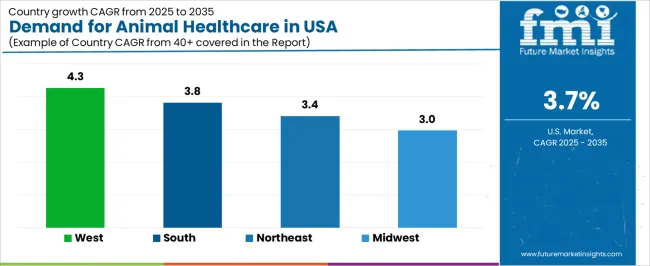

| Region | CAGR (%) |

|---|---|

| West | 4.3% |

| South | 3.8% |

| Northeast | 3.4% |

| Midwest | 3.0% |

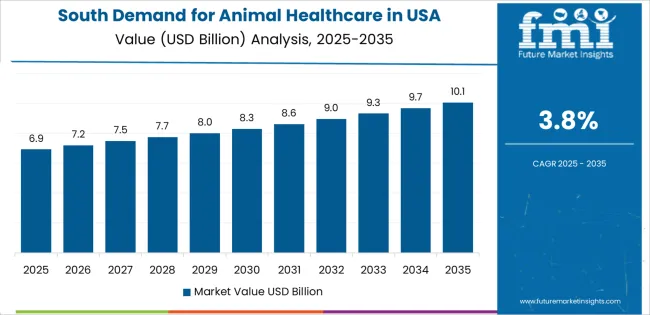

The demand for animal healthcare in USA is growing steadily across regions, with the West leading at a 4.3% CAGR through 2035, driven by a large pet population, strong veterinary infrastructure, and a focus on advanced healthcare services for pets and livestock. The South follows at 3.8%, supported by rising pet ownership, increased awareness of animal welfare, and strong agricultural sectors that require animal health services. The Northeast records 3.4%, with demand driven by urban pet ownership, high spending on pet care, and increasing veterinary services in the region. The Midwest grows at 3.0%, supported by agricultural industries, farming operations, and rising awareness of the importance of animal health management.

The West region of the USA is projected to grow at a CAGR of 4.3% through 2035 in demand for animal healthcare. The region’s strong pet ownership culture, combined with high disposable incomes, fuels the demand for advanced animal healthcare services. Veterinary practices in states like California and Oregon provide a wide range of services, from routine check-ups to specialized treatments, for pets and livestock. The growth of pet insurance and wellness trends also contributes to market demand. Additionally, the increasing focus on preventive healthcare and long-term pet care boosts the need for animal healthcare services.

The South region of the USA is projected to grow at a CAGR of 3.8% through 2035 in demand for animal healthcare. The region’s large rural population and agricultural base create a significant need for livestock health services, alongside growing pet healthcare needs. Veterinarians in the South provide essential services for both pets and farm animals, including vaccinations, disease prevention, and treatment of common conditions. As the region’s pet ownership continues to rise, demand for routine veterinary care and specialty treatments increases. The expansion of animal healthcare services in rural areas also supports market growth.

The Northeast region of the USA is projected to grow at a CAGR of 3.4% through 2035 in demand for animal healthcare. High pet ownership rates in urban areas like New York and Boston contribute to the rising demand for pet healthcare services. The increasing awareness of animal wellness, preventive care, and specialized treatments boosts the need for veterinary care. The region’s affluent population, which is increasingly willing to spend on pet healthcare, also supports the market. Additionally, the Northeast’s established network of animal hospitals and clinics caters to a broad spectrum of animal health needs.

The Midwest region of the USA is projected to grow at a CAGR of 3% through 2035 in demand for animal healthcare. The region’s focus on agriculture and livestock farming creates a substantial need for animal healthcare services, including vaccinations, disease management, and emergency care for farm animals. In urban areas, rising pet ownership and an increasing focus on pet health drive demand for veterinary services. The Midwest’s strong agricultural sector also encourages advancements in livestock health management. The growing importance of animal wellness and preventive care continues to contribute to the region’s expanding healthcare needs.

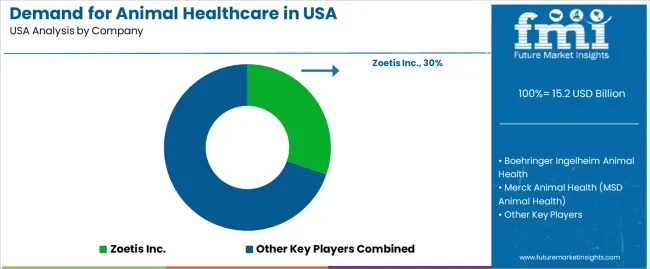

The demand for animal healthcare in USA is expanding due to increasing pet ownership, growing livestock production, and rising awareness of animal health and wellness. Zoetis Inc. leads the market with a broad portfolio of vaccines, diagnostics, and therapeutic solutions for both companion animals and livestock, addressing the evolving needs of pet owners and farmers. Boehringer Ingelheim Animal Health follows closely, offering advanced treatments, including vaccines and parasiticides, designed to improve animal health and productivity. Merck Animal Health (MSD Animal Health) strengthens the market with its comprehensive range of veterinary solutions, from antibiotics to vaccines, and its strong focus on animal welfare. Elanco Animal Health Incorporated contributes by providing innovative products and solutions for the care of both pets and farm animals, with a focus on improving animal health and food safety. Ceva Santé Animale expands the competitive landscape with its specialized focus on vaccines and treatments for livestock and pets, offering solutions for both large and small animal care.

Key factors driving the growth of animal healthcare in the USA include the rise in companion animal ownership, increased demand for sustainable and efficient livestock production, and advancements in veterinary care and technology. As consumers become more concerned about the health and well-being of their pets, and as the agricultural sector seeks to enhance productivity and disease prevention, the demand for effective and preventative healthcare solutions for animals continues to rise. Competition in this space is driven by product innovation, regulatory compliance, and the ability to offer comprehensive care solutions. Companies that prioritize advanced treatments, preventative care, and sustainability in both pet and livestock sectors are well-positioned to lead the market in the coming years.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Feed Additives, Pharmaceuticals, Vaccines |

| Animal Type | Production Animals, Companion Animals |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Zoetis Inc., Boehringer Ingelheim Animal Health, Merck Animal Health (MSD Animal Health), Elanco Animal Health Incorporated, Ceva Santé Animale |

| Additional Attributes | Dollar sales by product type, regional demand trends, segmentation by animal type, veterinary care advancements, livestock health management, innovations in pharmaceuticals and vaccines, increasing pet healthcare services. |

The global demand for animal healthcare in USA is estimated to be valued at USD 15.2 billion in 2025.

The market size for the demand for animal healthcare in USA is projected to reach USD 21.9 billion by 2035.

The demand for animal healthcare in USA is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in demand for animal healthcare in USA are feed additives, pharmaceuticals and vaccines.

In terms of animal type, production animals segment to command 55.0% share in the demand for animal healthcare in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA