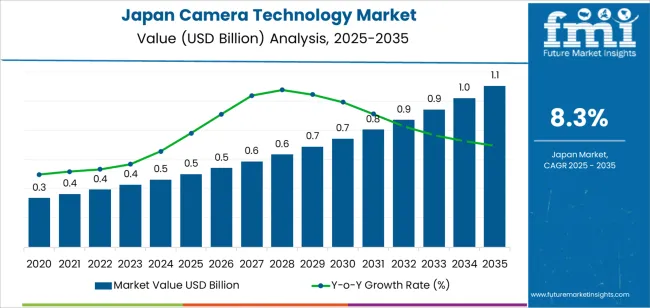

The Japan camera technology demand is valued at USD 0.5 billion in 2025 and is expected to reach USD 1.1 billion by 2035, reflecting a CAGR of 8.3%. Growth is driven by expanding utilization of imaging systems across consumer electronics, industrial automation, surveillance networks, robotics, and medical diagnostics. Increased adoption of high-resolution sensors, advancements in optical components, and integration of AI-enabled imaging functions support sustained demand. Broader deployment of automated inspection systems and smart-city surveillance frameworks adds further momentum.

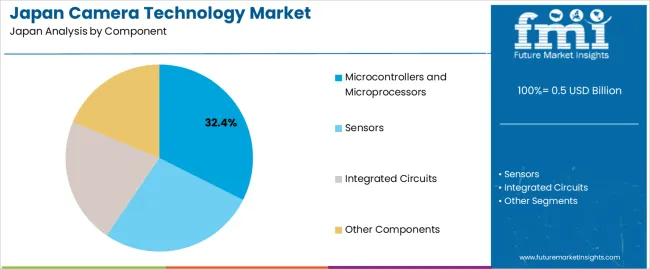

Microcontrollers and microprocessors lead the component landscape. These units are selected for their role in image processing, device control, autofocus management, and power optimization within advanced imaging platforms. Improved computational efficiency, miniaturization, and integration with embedded vision systems continue to influence component preference among device manufacturers and industrial system integrators.

Kyushu & Okinawa, Kanto, and Kinki record the highest utilization levels due to their concentration of electronics manufacturers, semiconductor fabrication facilities, and technology-driven industrial clusters. These regions also benefit from established R&D ecosystems and strong supply-chain networks that support imaging component development and device assembly. Key suppliers include Sony Corporation, Nikon Corporation, FLIR Systems Inc., and Bosch Security Systems. These companies supply imaging sensors, thermal-imaging modules, optical systems, and integrated camera platforms used in consumer devices, industrial equipment, surveillance solutions, and specialized imaging applications.

Growth-rate volatility in Japan’s camera-technology segment remains limited through the forecast horizon, reflecting a stable expansion pattern supported by steady product cycles and predictable adoption across consumer and industrial users. Early-period growth shows consistent movement as upgrades in imaging sensors, lens systems, and compact devices drive regular replacement activity. Demand across photography, mobile imaging, and security applications contributes to a uniform rise, minimizing abrupt year-to-year shifts.

Mid-period volatility stays contained because purchasing behavior aligns with structured refresh intervals in professional media, manufacturing, and robotics applications. Integration of advanced optics into automation and inspection processes supports a sustained baseline, creating steady annual gains rather than sharp accelerations. Variability remains low as industrial users prioritize reliability and long-term planning when adopting new imaging systems.

In the later period, the growth curve remains stable even as adoption deepens in medical imaging, autonomous systems, and precision measurement. These sectors expand gradually, contributing to predictable incremental increases. The overall volatility index remains low, with growth characterized by evenly paced demand, mature product lifecycles, and controlled adoption of advanced imaging technologies across Japanese industries.

| Metric | Value |

|---|---|

| Japan Camera Technology Sales Value (2025) | USD 0.5 billion |

| Japan Camera Technology Forecast Value (2035) | USD 1.1 billion |

| Japan Camera Technology Forecast CAGR (2025-2035) | 8.3% |

Demand for camera technology in Japan is increasing as consumers, businesses and industrial users seek higher precision imaging for photography, surveillance, automation and content creation. Japanese consumers continue to support premium mirrorless and compact digital cameras because of strong interest in travel, hobby photography and high-quality imaging. Manufacturers release models with improved sensors, faster autofocus and better low-light performance, which aligns with expectations in the domestic industry.

Commercial sectors such as retail, transportation and public facilities expand surveillance and monitoring systems that rely on advanced cameras with analytics, facial recognition and network integration. Industrial users in electronics, automotive and robotics employ machine-vision cameras for inspection, alignment and process control, contributing to steady equipment demand. Constraints include competition from smartphones, which reduces entry-level camera purchases, and high cost of specialized lenses and bodies that may limit upgrades for casual users. Some industries delay adoption of advanced vision systems until integration costs and technical support are well established.

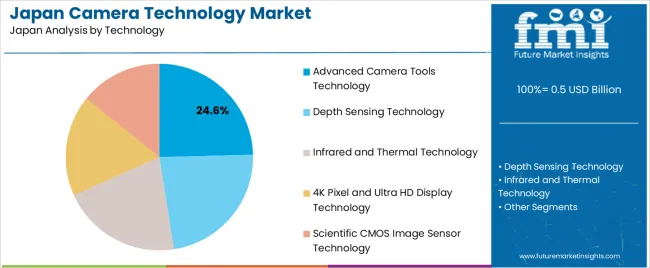

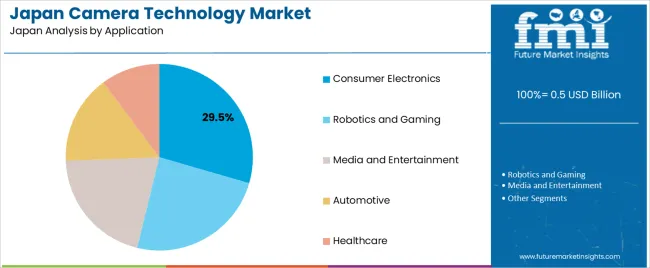

Demand for camera technology in Japan reflects the integration of imaging components into electronics, robotics, mobility systems, and healthcare devices. Component selection varies according to processing requirements, image clarity, device architecture, and compatibility with advanced imaging workflows. Technology preferences indicate Japan’s focus on depth sensing, thermal imaging, high-resolution capture, and scientific imaging applications. Application patterns show how camera systems support consumer devices, automation platforms, and media-related tasks across Japanese industries.

Microcontrollers and microprocessors hold 32.4% of national demand and represent the leading component category in Japan. These units support core processing, system control, and rapid data handling required for imaging across smartphones, industrial robots, and embedded devices. Sensors account for 27.1%, providing image capture, illumination response, and colour accuracy. Integrated circuits represent 21.8%, offering signal processing stability and component coordination. Other components hold 18.7%, covering lenses, housings, connectors, and supporting hardware widely used across Japanese electronics production. Component selection reflects Japan’s emphasis on advanced device engineering, performance consistency, and imaging reliability.

Key drivers and attributes:

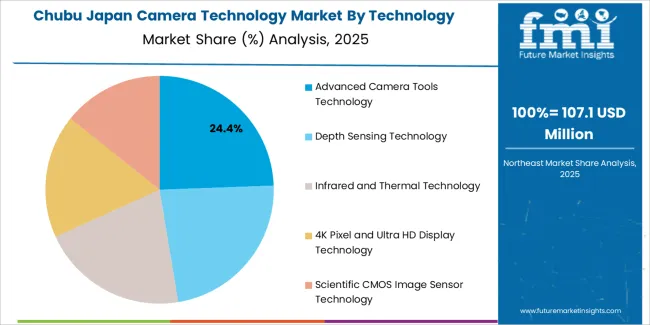

Advanced camera tools technology holds 24.6% of national demand and serves as the leading imaging technology in Japan. These tools support image modifications, automated adjustments, and enhanced processing precision across professional and consumer devices. Depth sensing technology accounts for 22.9%, widely applied in robotics, automation systems, and spatial positioning tasks. Infrared and thermal technology represents 20.8%, supporting low-light imaging, equipment monitoring, and industrial diagnostics. 4K pixel and ultra-HD technology holds 17.5%, contributing to display clarity and high-resolution capture. Scientific CMOS image sensor technology accounts for 14.2%, enabling sensitive imaging in laboratory and research settings.

Key drivers and attributes:

Consumer electronics hold 29.5% of national demand and represent the largest application category in Japan. Cameras support smartphone imaging, laptop webcams, smart-home devices, and compact digital systems used widely across households and workplaces. Robotics and gaming account for 24.3%, using camera systems for machine vision, gesture detection, and interactive applications. Media and entertainment represent 20.6%, supporting broadcasting, digital content production, and studio-based imaging. Automotive applications hold 15.4%, including driver-assistance cameras and monitoring systems used by Japanese automakers. Healthcare accounts for 10.2%, applying imaging for diagnostics, telemedicine, and surgical assistance.

Key drivers and attributes:

In Japan, demand for camera technology increases as short-video platforms and livestreaming gain popularity among younger users, especially in urban regions such as Tokyo and Osaka. Domestic broadcasters and film studios continue to invest in high-resolution cameras to support 4K and 8K production, reflecting Japan’s long-standing leadership in advanced imaging standards. Manufacturing clusters in Kansai, Chubu and Kyushu rely on machine-vision cameras for inspection, robotics and semiconductor production, which strengthens demand for compact industrial imaging systems. Retailers and transportation operators also expand use of surveillance cameras for safety and operational monitoring, contributing to wider adoption across sectors.

Japanese consumers frequently rely on high-quality smartphone cameras for daily photography, which reduces the need for standalone compact cameras. Smaller production companies and regional broadcasters may delay equipment upgrades because professional cameras require significant investment and integration with existing editing systems. In industrial settings, adoption of advanced camera-based automation can be slowed by limited availability of technicians trained in calibration, vision-system setup and sensor optimization. These factors moderate the pace of growth despite broad interest in imaging technology.

Mirrorless cameras continue to gain share in Japan due to compact designs, quiet operation and improved autofocus performance suited for street photography, documentary filming and travel content. AI-driven features such as automated subject tracking, noise reduction and real-time exposure optimization are being incorporated into both consumer and professional systems to simplify operation. Automotive suppliers and robotics developers in Japan increasingly integrate compact camera modules into driver-assist platforms, warehouse robots and delivery drones. These trends reinforce Japan’s role as a mature and innovation-driven industry for camera technology.

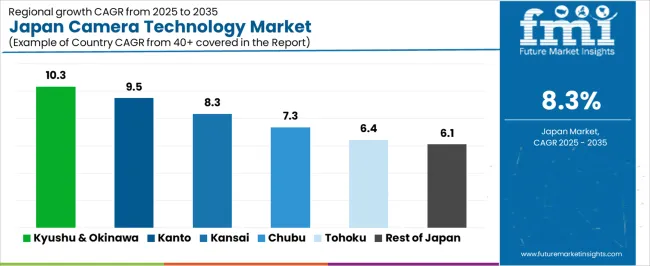

Demand for camera technology in Japan is rising through 2035 as consumers, media creators, industrial operators, and institutional users adopt imaging devices for photography, videography, surveillance, inspection, and scientific applications. Japanese demand reflects strong interest in mirrorless systems, action cameras, professional video equipment, optical components, and AI-supported imaging tools. Growth varies by region due to differences in population density, creator communities, manufacturing hubs, and educational institutions. Kyushu & Okinawa leads at 10.3%, followed by Kanto (9.5%), Kinki (8.3%), Chubu (7.3%), Tohoku (6.4%), and Rest of Japan (6.1%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 10.3% |

| Kanto | 9.5% |

| Kinki | 8.3% |

| Chubu | 7.3% |

| Tohoku | 6.4% |

| Rest of Japan | 6.1% |

Kyushu & Okinawa grows at 10.3% CAGR, supported by active creator communities, tourism-based imaging needs, and expanding industrial applications across Fukuoka, Kumamoto, Nagasaki, Kagoshima, and Okinawa. Regional photographers rely on mirrorless cameras for travel, documentary, and landscape content. Tourism-centered areas in Okinawa generate consistent demand for compact systems, underwater housings, and action cameras. Universities in Fukuoka invest in imaging equipment for research, robotics, and scientific documentation.

Manufacturing hubs require industrial cameras for inspection, automation, and quality monitoring. Local media businesses adopt advanced video tools for regional broadcasting. Retail stores in Fukuoka supply diverse camera systems, lenses, and accessories to meet rising consumer activity.

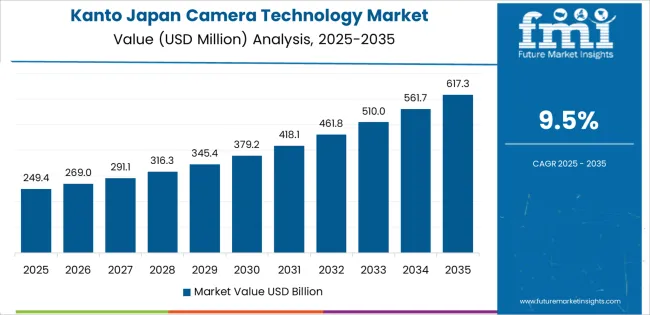

Kanto grows at 9.5% CAGR, influenced by dense creator populations, major broadcasting centers, corporate imaging requirements, and strong retail ecosystems across Tokyo, Kanagawa, Chiba, Saitama, and Ibaraki. Tokyo hosts active photography and videography communities using mirrorless systems, cinema cameras, and studio equipment. Media companies rely on advanced imaging for production, news gathering, and digital content creation. Retail hubs supply extensive lens selections and imaging accessories.

Surveillance system upgrades create steady institutional demand for high-resolution cameras. Universities and research institutes integrate imaging tools for robotics, biomedical work, and AI-based image processing. Corporate environments use cameras for remote communication, training, and product documentation.

Kinki grows at 8.3% CAGR, supported by regional content creation, industrial imaging adoption, and strong cultural and tourism photography activity across Osaka, Kyoto, Hyogo, Nara, Wakayama, and Shiga. Osaka’s media businesses adopt advanced cameras for commercial production. Kyoto’s cultural districts and tourism routes attract hobbyists and professionals who purchase mirrorless systems and specialty lenses. Industrial facilities in Hyogo and Osaka adopt machine-vision cameras for inspection, robotics, and manufacturing automation. Universities in Kyoto and Osaka expand imaging use for engineering and digital-media programs. Retail outlets maintain steady sales of interchangeable-lens systems, action cameras, and accessories.

Chubu grows at 7.3% CAGR, shaped by industrial imaging needs, tourism-driven photography, and steady consumer-device adoption across Aichi, Shizuoka, Gifu, Mie, and Nagano. Manufacturing centers in Aichi use industrial cameras for robotics, inspection, and automation. Tourism areas in Nagano and Gifu generate consistent demand for mirrorless systems and outdoor imaging equipment. Local universities incorporate imaging tools in engineering and environmental research programs. Retailers supply entry-level and mid-range cameras to support consumer needs. Regional businesses adopt high-resolution imaging for documentation, product development, and training.

Tohoku grows at 6.4% CAGR, driven by scenic-region tourism, documentary photography, and increasing adoption of surveillance and industrial imaging across Miyagi, Aomori, Fukushima, Akita, Iwate, and Yamagata. Photographers capture natural landscapes and seasonal events using mirrorless and DSLR systems. Regional tourism routes create strong demand for travel-focused imaging devices and accessories. Factories in Miyagi and Fukushima use industrial cameras for inspection and automation. Public institutions expand surveillance networks using high-resolution cameras for facility monitoring. Universities use imaging tools for environmental science and agricultural research.

Rest of Japan grows at 6.1% CAGR, supported by local tourism, community-level photography interest, small industrial clusters, and institutional imaging needs across prefectures outside major metropolitan areas. Households purchase compact cameras and entry-level mirrorless systems for travel and family use. Small manufacturers adopt vision systems for inspection tasks. Local tourism boards promote scenic routes that raise photography engagement. Clinics and public facilities expand use of cameras for documentation and monitoring. Educational institutions integrate imaging tools for student projects and scientific work.

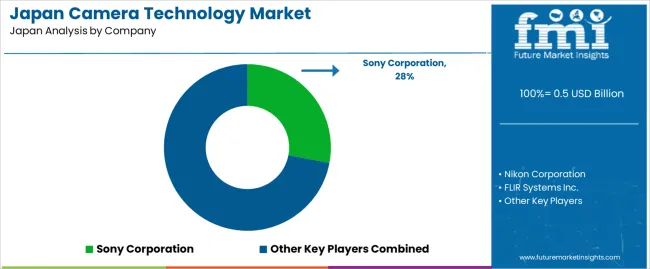

Demand for camera technology in Japan is shaped by imaging manufacturers and security-system suppliers with established domestic operations, distribution networks, and long-term engagement with consumer and industrial users. Sony Corporation holds an estimated 28.0% share, supported by controlled sensor fabrication, consistent image-processing capability, and strong adoption of its mirrorless systems across Japan’s consumer, professional, and broadcast sectors. Its position is reinforced by reliable low-light performance and deep integration with domestic electronics channels.

Nikon Corporation maintains significant presence through interchangeable-lens cameras manufactured and developed within Japan, offering stable autofocus behaviour, dependable colour accuracy, and verified optical performance for hobbyists, professionals, and corporate users. Nikon’s sustained service footprint and alignment with Japanese photographic culture support steady demand. Teledyne FLIR, operating in Japan through authorised industrial-vision and thermal-imaging partners, contributes thermal and infrared systems used in infrastructure monitoring, defence applications, factory automation, and environmental inspection. Its cameras are selected for controlled thermal sensitivity and stable mechanical durability in industrial environments.

Bosch Security Systems supports domestic demand across commercial buildings, transportation hubs, and public-area monitoring. Its networked-security cameras offer consistent imaging stability, verified integration with Japanese security integrators, and reliable operation across varied lighting conditions. Competition in Japan centres on sensor performance, processing accuracy, low-light reliability, network interoperability, ruggedness for industrial use, and nationwide service availability. Demand remains steady as Japanese consumers and enterprises adopt advanced imaging, thermal-inspection systems, and high-reliability security cameras for personal, commercial, and infrastructure applications.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Component | Microcontrollers and Microprocessors, Sensors, Integrated Circuits, Other Components |

| Technology | Advanced Camera Tools Technology, Depth Sensing Technology, Infrared and Thermal Technology, 4K Pixel and Ultra HD Display Technology, Scientific CMOS Image Sensor Technology |

| Application | Consumer Electronics, Robotics and Gaming, Media and Entertainment, Automotive, Healthcare |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Sony Corporation, Nikon Corporation, FLIR Systems Inc., Bosch Security Systems |

| Additional Attributes | Dollar sales by camera component type, imaging technology category, and application segment; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of imaging device manufacturers and vision-technology suppliers; developments in CMOS sensors, thermal imaging, depth-sensing modules, and ultra-high-resolution camera systems; integration with consumer electronics, autonomous vehicle platforms, robotics, healthcare diagnostics, and entertainment-grade imaging systems in Japan. |

The demand for camera technology in japan is estimated to be valued at USD 0.5 billion in 2025.

The market size for the camera technology in japan is projected to reach USD 1.1 billion by 2035.

The demand for camera technology in japan is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in camera technology in japan are microcontrollers and microprocessors, sensors, integrated circuits and other components.

In terms of technology, advanced camera tools technology segment is expected to command 24.6% share in the camera technology in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Japan Blow Fill Seal Technology Market Insights – Growth & Forecast 2023-2033

Demand for Distance Health Technology in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Smart Home Security Camera in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA