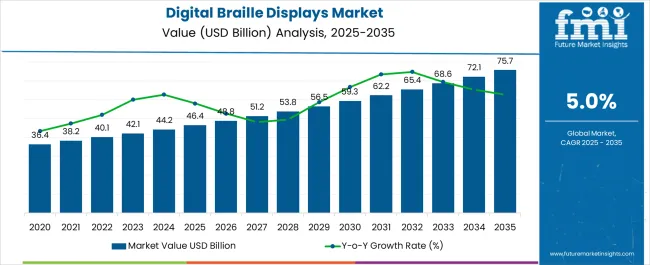

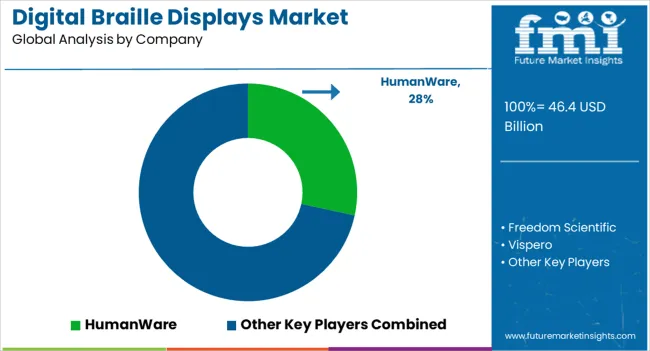

The Digital Braille Displays Market is estimated to be valued at USD 46.4 billion in 2025 and is projected to reach USD 75.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Digital Braille Displays Market Estimated Value in (2025 E) | USD 46.4 billion |

| Digital Braille Displays Market Forecast Value in (2035 F) | USD 75.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The digital braille displays market is witnessing steady advancement driven by the increasing global focus on inclusive technology and accessibility for visually impaired individuals. Rising investments in assistive technologies, coupled with supportive government policies and funding programs, are fueling the adoption of braille displays across educational institutions, workplaces, and public services.

Advancements in tactile feedback mechanisms, ergonomic designs, and refreshable braille cells have significantly enhanced user experience and device usability. The growing integration of digital braille devices with smartphones, tablets, and computers is further promoting widespread adoption.

Demand is particularly strong in regions with well-established accessibility frameworks, while emerging economies are gradually embracing digital inclusion. As innovation continues to reduce costs and improve performance, the outlook for digital braille displays remains optimistic across professional, educational, and personal use scenarios.

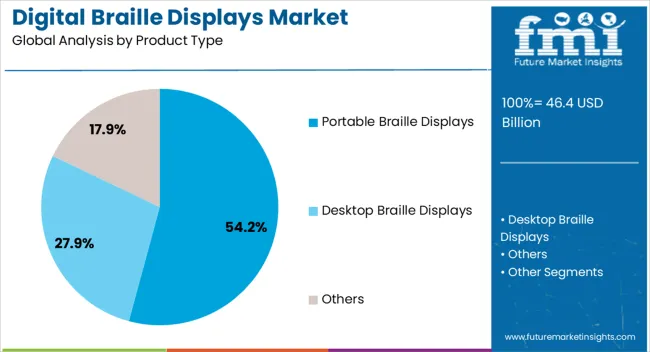

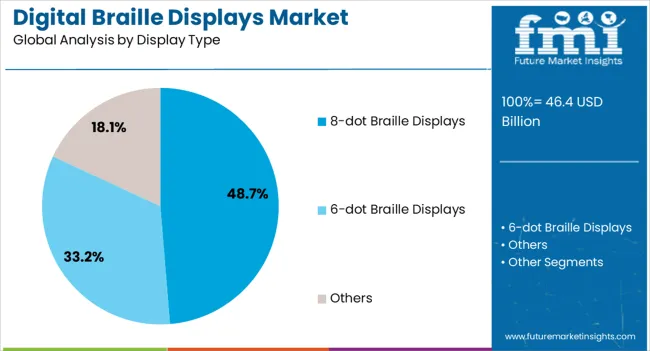

The digital braille displays market is segmented by product type, display type, connectivity, end-user, distribution channel, technology, and geographic regions. By product type, the digital braille displays market is divided into Portable Braille Displays, Desktop Braille Displays, and Others. In terms of display type, the digital braille displays market is classified into 8-dot Braille Displays, 6-dot Braille Displays, and Others.

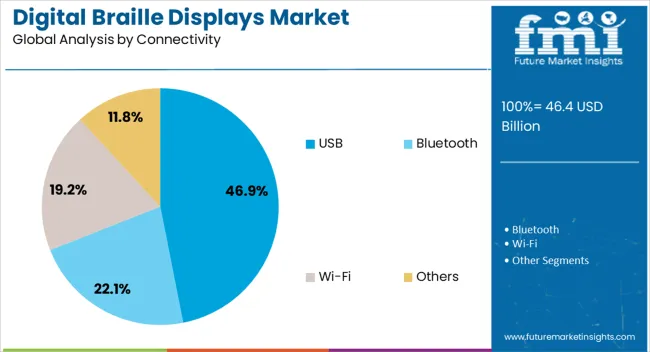

Based on connectivity, the digital braille displays market is segmented into USB, Bluetooth, Wi-Fi, and Others. By end-user, the digital braille displays market is segmented into Blind and Visually Impaired Individuals, Educational Institutions, Enterprises and Workplaces, Government Organizations, Non-Profit Organizations, and Others. By distribution channel, the digital braille displays market is segmented into Online Retail, Offline Retail, Direct Sales, Third-Party Distributors, and Others.

By technology, the digital braille displays market is segmented into Piezoelectric Braille Cells, Electroactive Polymer Braille Cells, and Others. Regionally, the digital braille displays industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The portable braille displays segment is projected to hold 54.20% of total market revenue by 2025 within the product type category, making it the most dominant segment. This leadership position is attributed to the increasing demand for mobile and on-the-go accessibility tools among visually impaired users. The lightweight design, rechargeable operation, and compatibility with multiple digital platforms make portable displays highly convenient for students, professionals, and daily commuters. Their growing integration with screen readers and mainstream operating systems enhances usability across devices. As accessibility solutions evolve toward compact and travel-friendly formats, portable braille displays have emerged as the preferred choice, reinforcing their dominance in the product landscape.

The 8-dot Braille display segment is expected to account for 48.70% of total market revenue by 2025 within the display type category. This growth is driven by their ability to represent a broader range of characters, including capital letters and symbols, which enhances reading efficiency and digital interaction. Their utility in coding, data entry, and language learning applications makes them especially relevant in academic and professional environments. As digital content becomes more complex and interactive, the demand for displays capable of accommodating expanded character sets has increased. This has resulted in the growing preference for 8-dot configurations, positioning them as the leading display type in the market.

The USB connectivity segment is anticipated to contribute 46.90% of total market revenue by 2025 within the connectivity category. This is due to the widespread compatibility of USB with computers, tablets, and assistive devices, enabling stable and reliable data transfer. USB-connected braille displays offer plug-and-play functionality, low latency, and a consistent power supply, which are essential in both professional and educational settings. Despite the emergence of wireless alternatives, USB continues to be the preferred mode for users seeking security, speed, and uninterrupted operation. These factors have cemented USB’s status as the leading connectivity option within the digital braille displays market.

The market has been expanding due to the rising adoption of assistive technologies for visually impaired individuals across education, workplaces, and personal use. These devices, which convert digital text into tactile braille output, have enabled improved accessibility, literacy, and information independence. Manufacturers have focused on reducing device size, improving refresh speed, and enhancing connectivity with computers and mobile devices. The market has been influenced by technological innovation, government accessibility mandates, and growing awareness of inclusive education, making digital braille displays a critical tool in bridging communication and information gaps for visually impaired populations globally.

The market has been significantly driven by educational institutions and workplace initiatives that support visually impaired individuals. These devices have been utilized in schools, colleges, and vocational training centers to provide real-time access to digital textbooks, learning modules, and examination materials. In professional environments, braille displays have been integrated with computers and mobile devices to facilitate email reading, document editing, and data entry tasks. Government and institutional programs have often subsidized device acquisition to ensure compliance with accessibility regulations. Adoption has been reinforced by awareness campaigns promoting inclusive education and employment practices. As digital literacy becomes a standard requirement, visually impaired students and professionals have increasingly relied on braille displays to participate effectively in academic and workplace settings, making these devices a core element of accessibility solutions across multiple regions.

Technological innovation has played a central role in shaping the digital braille displays market. Refreshable braille cells, compact device design, and improved tactile sensitivity have enhanced reading accuracy and user comfort. Bluetooth and USB connectivity have enabled seamless integration with computers, smartphones, and screen readers, increasing device versatility. Battery performance and portability improvements have supported mobile and on-the-go usage, expanding application scenarios beyond stationary setups. Advanced software algorithms have allowed faster braille translation and real-time content rendering. Manufacturers have also developed multi-line and multi-lingual displays to accommodate diverse user requirements. These technological advancements have increased adoption by providing visually impaired individuals with practical, reliable, and user-friendly solutions for accessing digital content efficiently. Integration with mainstream digital platforms has further strengthened market growth and functionality.

The market has been influenced by governmental policies and international standards promoting accessibility for visually impaired populations. Regulations such as disability inclusion mandates, accessibility standards for educational and workplace technologies, and assistive technology funding programs have driven device adoption. Governments and NGOs have often partnered with technology providers to supply braille displays in schools, public offices, and libraries. Tax incentives, grants, and procurement programs have encouraged manufacturers to develop affordable and compliant devices. Additionally, global accessibility initiatives have promoted awareness and inclusion, creating a favorable ecosystem for braille display deployment. Regulatory frameworks have ensured that manufacturers prioritize compliance, device usability, and integration with accessible software, thereby reinforcing market expansion while addressing educational, occupational, and social accessibility needs for visually impaired individuals worldwide.

Aftermarket services and device customization have further strengthened the market. Devices have been adapted to support specific languages, multi-line outputs, and personalized tactile feedback settings. Accessories such as protective cases, portable stands, and device connectors have enhanced user convenience and portability. Technical support and software updates have enabled long-term usability, extending device lifecycle and user satisfaction. Customization has allowed integration with personal computers, smartphones, and tablets, making braille displays compatible with both mainstream and specialized applications. The combination of aftermarket services, personalization, and device interoperability has encouraged adoption among visually impaired users of varying age groups, professional backgrounds, and educational levels. Such market expansion has reinforced the overall accessibility ecosystem and positioned digital braille displays as essential assistive technologies globally.

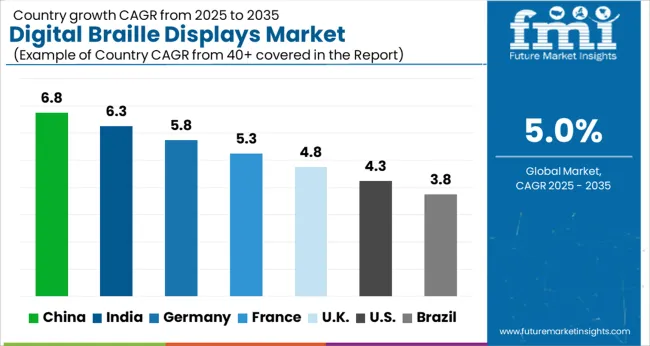

The market is set to grow at a CAGR of 5.0% from 2025 to 2035, fueled by rising adoption of assistive technologies, advancements in tactile display devices, and increasing focus on accessibility solutions for visually impaired individuals. China leads with a 6.8% CAGR, expanding through large-scale manufacturing of affordable braille devices and growing awareness initiatives. India follows at 6.3%, supported by government programs promoting inclusive education and technology adoption. Germany, at 5.8%, benefits from high-quality engineering and innovation in assistive electronics. The UK, growing at 4.8%, focuses on accessibility-driven R&D and educational support systems. The USA, at 4.3%, experiences steady growth due to established assistive technology markets and integration in educational and workplace settings. This report covers 40+ countries, with the top markets highlighted here for reference.

The market in China is projected to expand at a CAGR of 6.8%, driven by increasing adoption of assistive technologies in education, workplaces, and public services. Rising government initiatives to enhance accessibility for visually impaired individuals are fueling demand. Leading manufacturers are investing in compact, lightweight, and energy-efficient braille displays with high durability and compatibility with multiple devices. Collaboration between tech firms and educational institutions is expanding market reach. The demand from private consumers and rehabilitation centers is also growing, driven by rising awareness of digital accessibility solutions. Continuous innovation in tactile display technology is expected to shape the market over the next decade.

India is forecasted to grow at a CAGR of 6.3%, driven by increasing focus on inclusive education and workplace accessibility. Rising initiatives to promote technology for visually impaired individuals, combined with expanding awareness of assistive devices, is driving sales. Manufacturers are focusing on portable and durable braille display models compatible with smartphones, tablets, and computers. Market penetration is supported by partnerships between local tech companies and NGOs. Demand is also increasing from specialized learning centers and private users seeking advanced tactile technology solutions. R&D investments in enhancing tactile feedback and device reliability are shaping the competitive landscape.

The market in Germany is projected to grow at a CAGR of 5.8%, driven by strong emphasis on accessibility and smart assistive technologies. Consumer preference for high-quality, durable, and portable braille displays is rising, particularly in educational and professional environments. Manufacturers are investing in advanced tactile interface technology and energy-efficient devices. Strategic partnerships with disability-focused organizations are enhancing outreach and sales. Market growth is supported by increasing government and institutional programs aimed at integrating assistive technologies in everyday life. Technological innovation and rising consumer awareness are expected to drive consistent growth over the forecast period.

The United Kingdom market is expected to grow at a CAGR of 4.8%, driven by rising demand from educational institutes, rehabilitation centers, and individual users. Government and private initiatives are supporting technology adoption for visually impaired individuals. Manufacturers are focusing on portable, lightweight, and energy-efficient solutions that are compatible with a range of devices. Collaborative projects with educational and vocational institutions are increasing market penetration. R&D efforts are directed towards improving tactile feedback, connectivity, and device reliability. Growing awareness among users and stakeholders about the benefits of digital braille technology is positively influencing market growth.

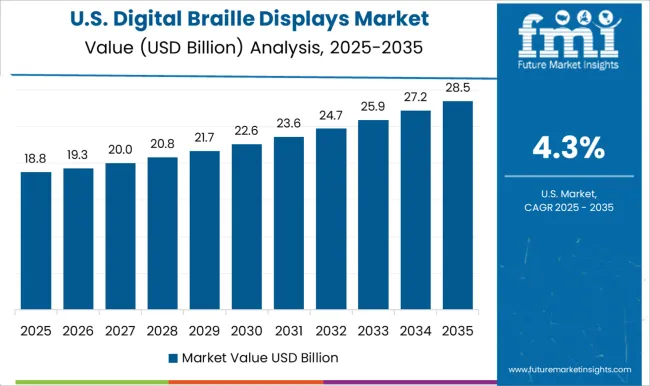

The United States market is forecasted to grow at a CAGR of 4.3%, supported by increasing investments in assistive technology for visually impaired consumers. Growing adoption in educational settings, workplaces, and rehabilitation centers is driving demand. Manufacturers are enhancing product durability, portability, and device compatibility. Partnerships with advocacy groups and educational institutions are expanding market access. Consumer interest in high-quality, energy-efficient digital braille solutions is boosting sales in private and institutional sectors. Continuous innovation in tactile interface technology and smart connectivity solutions is expected to strengthen competitive positioning and market growth over the coming decade.

The market is primarily led by HumanWare, Freedom Scientific, and Vispero, offering innovative assistive technologies that enable visually impaired users to access digital content efficiently. HumanWare focuses on compact, portable displays with high refresh rates and ergonomic designs, providing seamless integration with computers, tablets, and smartphones. Freedom Scientific delivers robust solutions featuring customizable braille input and output functionalities suitable for educational, professional, and personal use, emphasizing accessibility and ease of use.

Vispero enhances market reach with advanced connectivity options, multi-language support, and compatibility with mainstream operating systems, strengthening user experience across diverse environments. Other significant players, such as Papenmeier and Handy Tech Elektronik GmbH, contribute specialized solutions for both portable and desktop applications. Papenmeier emphasizes precision engineering and reliability, offering durable displays designed for extended daily use, while Handy Tech Elektronik GmbH focuses on high-quality tactile feedback and integration with assistive software. The market is increasingly shaped by technological advancements, including wireless connectivity, compact designs, and real-time braille translation, allowing visually impaired users to engage with digital content efficiently. Strategic collaborations with educational institutions, government programs, and technology providers are further expanding adoption, making innovation, reliability, and accessibility the key differentiators among leading Digital Braille Display providers.

| Item | Value |

|---|---|

| Quantitative Units | USD 46.4 Billion |

| Product Type | Portable Braille Displays, Desktop Braille Displays, and Others |

| Display Type | 8-dot Braille Displays, 6-dot Braille Displays, and Others |

| Connectivity | USB, Bluetooth, Wi-Fi, and Others |

| End-User | Blind and Visually Impaired Individuals, Educational Institutions, Enterprises and Workplaces, Government Organizations, Non-Profit Organizations, and Others |

| Distribution Channel | Online Retail, Offline Retail, Direct Sales, Third-Party Distributors, and Others |

| Technology | Piezoelectric Braille Cells, Electroactive Polymer Braille Cells, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HumanWare, Freedom Scientific, Vispero, Papenmeier, and Handy Tech Elektronik GmbH |

| Additional Attributes | Dollar sales by display type and end user, demand dynamics across education and assistive technology sectors, regional trends in accessibility adoption, innovation in tactile feedback and connectivity, environmental impact of electronic waste, and emerging use cases in inclusive learning and workplace solutions. |

The global digital braille displays market is estimated to be valued at USD 46.4 billion in 2025.

The market size for the digital braille displays market is projected to reach USD 75.7 billion by 2035.

The digital braille displays market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in digital braille displays market are portable braille displays, desktop braille displays and others.

In terms of display type, 8-dot braille displays segment to command 48.7% share in the digital braille displays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA