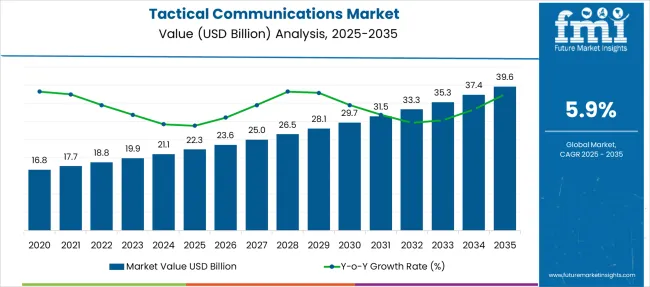

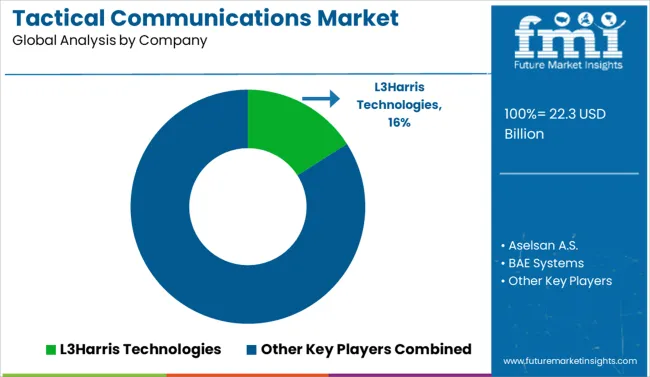

The Tactical Communications Market is estimated to be valued at USD 22.3 billion in 2025 and is projected to reach USD 39.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. The first half of the forecast window from 2025 to 2030 contributes approximately USD 7.4 billion, while the latter half from 2030 to 2035 adds nearly USD 9.9 billion. This shift indicates a front-loaded investment trend early in the decade, followed by intensified modernization of battlefield connectivity systems post-2030. Incremental yearly additions grow from USD 1.3 billion in 2026 to over USD 2.2 billion in 2035, which marks a 70% expansion in annual contribution toward market size.

This pattern suggests the market is gradually transitioning into a capital-intensive phase, driven by demand for IP-based radio networks, low-latency mesh communications, and secure frequency hopping technologies. Increased defense spending by Poland, Australia, and Saudi Arabia has reinforced short-term momentum, while longer-term deployments of satellite-integrated tactical systems by the United States Department of Defense and Japan Self-Defense Forces are likely to sustain post-2030 acceleration. Firms such as L3Harris Technologies and Rohde & Schwarz have been expanding software-defined radio portfolios and forming joint ventures to deliver battlefield-proven tactical links, further shaping the absolute growth curve across regions.

The tactical communications market is shaped by five principal parent markets. Around 30% of its value stems from the military and defense communications sector, where secure, ruggedized systems support command, control, and battlefield coordination. The law enforcement and public safety communications market contributes about 25%, serving police, fire, and emergency medical services with mission‑critical voice and data networks. Approximately 20% of the telecommunications equipment market is linked to tactical radios, mesh systems, and field deployable networks. The industrial and mining communications segment represents nearly 15%, using reliable links in isolated or hazardous environments. The remaining 10% is tied to humanitarian, disaster response, and offshore operations where temporary deployable networks support remote coordination and situational awareness.

The market is advancing with growing reliance on mobile command systems, intelligent networking, and resilient communication tools in field operations. Portable mesh-based radios are being deployed to maintain uninterrupted signal exchange across units without centralized infrastructure. Software-defined platforms are replacing analog systems, allowing real-time signal adjustments and bandwidth optimization during high-interference missions. Compact head-mounted and vest-integrated devices now combine encrypted audio, positioning, and short-range data relay for seamless tactical coordination. Ground units increasingly depend on hybrid communication kits capable of switching between terrestrial and satellite links to ensure coverage in isolated or obstructed zones. These advancements are redefining combat communication standards.

| Metric | Value |

|---|---|

| Tactical Communications Market Estimated Value in (2025E) | USD 22.3 billion |

| Tactical Communications Market Forecast Value in (2035F) | USD 39.6 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The tactical communications market is undergoing significant transformation, driven by modernization initiatives across defense forces, rising demand for secure battlefield communication, and the rapid incorporation of software-defined technologies. Evolving warfare scenarios, including hybrid threats and network-centric operations, are reshaping communication infrastructure requirements across armed forces globally.

Defense ministries are allocating higher budgets toward resilient and interoperable systems that ensure seamless real-time connectivity across land, air, and sea platforms. The need for encrypted, jamming-resistant, and high-throughput communication is encouraging adoption of IP-based networks, satellite links, and next-gen radios.

Focus on indigenous technology development and public-private partnerships is accelerating innovation in secure tactical systems. With the increasing complexity of joint operations and cross-border coordination, the market is expected to experience sustained demand, particularly for modular, scalable, and upgradable solutions that reduce deployment time and enhance mission effectiveness..

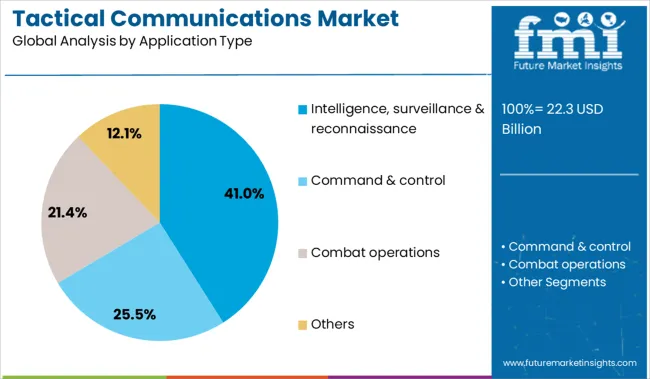

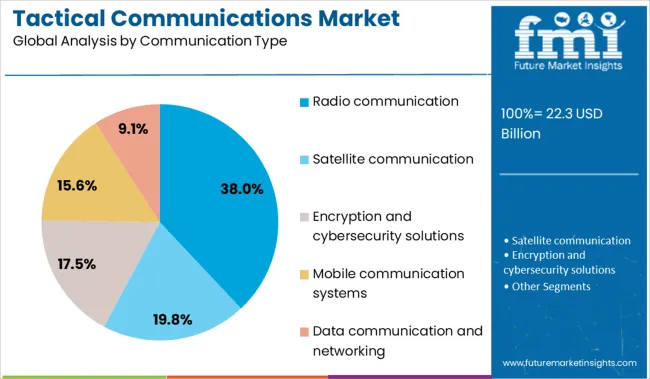

The market is segmented by platform type, application type, communication type, component type, point of sale type, frequency type, and region. By platform type, it includes ground, airborne, and naval systems, addressing diverse operational environments. In terms of application type, the segmentation comprises intelligence, surveillance and reconnaissance, command and control, combat operations, and others, reflecting the broad defense communication requirements. Based on communication type, the market includes radio communication, satellite communication, encryption and cybersecurity solutions, mobile communication systems, and data communication and networking. By component type, it is divided into hardware and software. Point of sale type segmentation covers new installations and upgrades, while frequency type includes single and multiple frequency systems. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The ground platform segment is projected to lead the tactical communications market with a 49.0% revenue share in 2025. This leadership is being driven by continued investments in land-based military modernization programs focused on enhancing infantry mobility, situational awareness, and combat readiness.

Ground forces require constant, encrypted communication in dynamic terrains, which has accelerated the deployment of vehicle-mounted and soldier-carried systems. The adoption of multi-band radios, mesh networks, and integrated command systems has been prioritized to support coordinated movements and real-time decision-making during missions.

Compatibility with legacy equipment, ruggedized design for field conditions, and interoperability with UAV and satellite feeds have further reinforced ground platform demand. As land-based deployments remain central to most military strategies, ground tactical communication systems are expected to retain long-term dominance..

The intelligence, surveillance, and reconnaissance (ISR) segment is anticipated to account for 41.0% of the market share in 2025, positioning it as the leading application area. This growth is attributed to the increasing reliance on integrated sensors, AI-enabled analytics, and high-bandwidth communication to deliver actionable intelligence from various operational theaters.

Tactical communications are essential in transmitting real-time data captured from ground units, drones, and satellites to command centers, allowing timely threat assessments and strategic decisions. Emphasis on persistent surveillance, border security, and target acquisition is driving defense agencies to prioritize ISR capabilities.

Secure and low-latency communications serve as the backbone for enabling distributed situational awareness across joint missions. As military strategies continue shifting toward data-centric warfare, the ISR segment will remain at the core of tactical communication innovation and investment..

Radio communication is expected to dominate the market with a 38.0% revenue share in 2025, marking it as the leading communication type. This segment's continued strength is driven by the reliability, portability, and spectrum efficiency of tactical radios in mission-critical scenarios.

Modern military operations demand secure voice and data transmission, even in GPS-denied or jamming-heavy environments, where radio technologies such as frequency hopping and encryption protocols play a critical role. Advances in software-defined radio (SDR), cognitive radio systems, and MANETs (Mobile Ad-hoc Networks) have further improved adaptability and range in contested areas.

Integration with battlefield management systems and real-time geolocation tools has enhanced radio utility across units. As armed forces invest in multi-domain operations and inter-force collaboration, radio communication remains the tactical core for both legacy and next-generation combat networks.

Increasing demand from defense forces, emergency services, and public safety agencies is driving growth. Expansion opportunities include integration with rugged mesh networks, secure smartphone apps, and situational data services.

Adoption of tactical communications systems is increasing among military units, law enforcement, and disaster response agencies that require uninterrupted and secure communication in complex environments. Features such as frequency hopping, encrypted channels, and ruggedized hardware ensure reliability under extreme conditions. Agencies are also investing in broadband push-to-talk systems operating over LTE or satellite to maintain coverage beyond radio limits. Standardized tactical platforms improve inter-agency interoperability for coordinated missions. The need for encrypted voice, live mapping, and real-time coordination reinforces tactical communication as a vital capability in defense and public safety operations.

Significant growth potential exists in mesh-based ad-hoc networks that create self-sustaining communication channels during field operations without central infrastructure. The integration of secure tactical apps on rugged smartphones provides teams with live mission updates, geo-tagged intelligence, and real-time data access. Advanced platforms that merge voice, video, and IoT sensor inputs with AR-driven overlays are improving situational awareness for first responders and tactical units. Flexible subscription models, including device-as-a-service, allow agencies to scale efficiently. Strategic partnerships with satellite operators, analytics firms, and emergency management providers ensure connectivity in rural or infrastructure-limited regions, enabling truly interoperable and resilient communications.

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

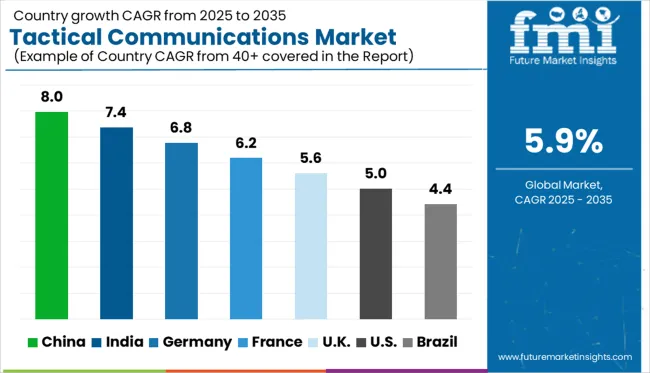

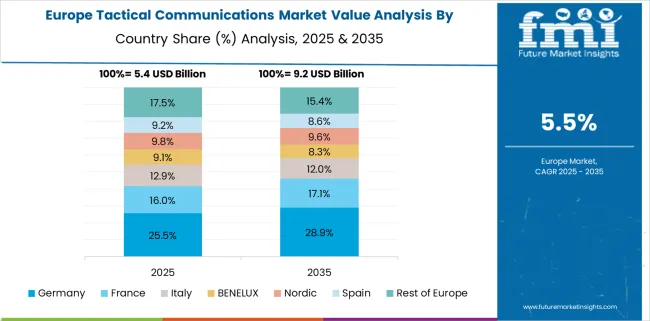

The global tactical communications sector is projected to expand at a CAGR of 5.9% between 2025 and 2035, driven by rising defense modernization, mission-critical connectivity, and digital transformation in battlefield systems. BRICS nations are showing stronger momentum, with China leading at 8.0% due to heavy military-tech investments and AI-driven communications. India follows at 7.4%, supported by indigenous programs under the “Make in India” initiative. Among OECD economies, Germany is set to grow at 6.8%, influenced by NATO-compliant upgrades and encrypted system adoption. The UK (5.6%) sees steady integration of joint force capabilities, while the US (5.0%) focuses on modernizing legacy systems and enhancing cyber resilience.

The United States tactical communications market is expanding at a steady 5.0% CAGR, reflecting measured growth shaped by structured procurement strategies and inter-service standardization. Rather than pursuing rapid fleet expansion, defense priorities focus on strengthening interoperability across Army, Navy, and Air Force units. Budget allocations are directed toward replacing legacy systems with secure, field-tested solutions that meet evolving mission-critical requirements.

The United Kingdom tactical communications market is set to grow at a CAGR of 5.6%, showing steady modernization focused on mobility for force structures. Year-over-year progress is modest as efforts prioritize operational flexibility over deep battlefield digitization. Procurement strategies concentrate on compact communication kits designed for expeditionary units operating under constrained logistics. Lightweight systems that ensure reliable performance during rapid deployment and short missions are receiving preference instead of complex, long-range platforms.

Germany is expanding its tactical communications sector through structured modernization programs, registering a CAGR of 6.8% with consistent year-over-year growth. Defense planners prioritize scalable multi-environment radio systems capable of operating effectively across armored and dismounted missions. Procurement remains linked to federal approvals, resulting in concentrated investment phases instead of continuous flows.

In India, growing deployment footprint along difficult terrain zones is pushing the tactical communications market forward at a 7.4% CAGR, with noticeable YoY lifts during seasonal troop rotations. The market is uniquely defined by the need for rugged, energy-efficient systems that work without infrastructure. Border activity and altitude challenges are shaping a new generation of encrypted devices tailored for extreme conditions. Domestic suppliers, backed by Make-in-India initiatives, are beginning to meet these specialized demands.

Tactical communications landscape in China is undergoing rapid internal restructuring, expanding at an aggressive 8.0% CAGR. Year-over-year gains are being driven by an increased tempo of brigade-level exercises and realignment of communication hierarchies. Field-level independence is becoming a tactical priority, prompting the adoption of radio systems with direct connectivity and minimal relay dependence. Procurement flows are synchronized with regimental training and integrated drills across military regions.

The tactical communications market is moderately consolidated, with a mix of global defense giants and specialized military communication providers shaping the competitive landscape. L3Harris Technologies leads the market, recognized for its robust portfolio of secure voice and data transmission systems designed for land, sea, air, and space operations. Major defense contractors like BAE Systems, Thales Group, Elbit Systems, and Northrop Grumman maintain strong positions through integrated communication networks and extensive defense contracts. Collins Aerospace, General Dynamics, and Lockheed Martin leverage their broader military technology expertise to deliver interoperable communication platforms. Specialists such as Barrett Communications, Cobham Advanced Electronic Solutions, and Rohde & Schwarz cater to niche military and government users, focusing on high-frequency radios, encryption, and mobile communications. Companies like Aselsan, Bharat Electronics Ltd., and Rolta India represent growing regional players, especially in Asia-Pacific markets.

On July 18, 2024, L3Harris Technologies announced a collaboration with Epirus to integrate its tactical radios with Epirus’s intelligent power-management electronics. The initiative aims to enhance field radios by expanding operational range, extending battery life, and improving heat management, addressing critical needs in modern combat environments

| Item | Value |

|---|---|

| Quantitative Units | USD 22.3 Billion |

| Platform Type | Ground, Airborne, and Naval |

| Application Type | Intelligence, surveillance & reconnaissance, Command & control, Combat operations, and Others |

| Communication Type | Radio communication, Satellite communication, Encryption and cybersecurity solutions, Mobile communication systems, and Data communication and networking |

| Component Type | Hardware and Software |

| Point of Sale Type | New and Upgrade |

| Frequency Type | Single and Multiple |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L3Harris Technologies, Aselsan A.S., BAE Systems, Barrett Communications, Bharat Electronics Ltd., Cobham Advanced Electronic Solutions Inc., Collins Aerospace, Curtiss-Wright Corporation, Data Link Solutions, Elbit Systems Ltd., General Dynamics Corporation, Honeywell International Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Rafael Advanced Defense Systems Ltd., Rohde & Schwarz, Rolta India Limited, Saab AB, Thales Group, Ultra, and Viasat Inc. |

| Additional Attributes | Dollar sales by communication type, platform, and end-user group; regional demand driven by defense modernization, border security, and joint operations; innovation in secure mesh networks, software-defined radios, and satellite integration; cost dynamics shaped by procurement cycles, interoperability standards, and encryption technologies; environmental impact of ruggedized equipment and energy consumption; and emerging use cases in disaster response, special operations, and unmanned system coordination. |

The global tactical communications market is estimated to be valued at USD 22.3 billion in 2025.

The market size for the tactical communications market is projected to reach USD 39.6 billion by 2035.

The tactical communications market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in tactical communications market are ground, airborne and naval.

In terms of application type, intelligence, surveillance & reconnaissance segment to command 41.0% share in the tactical communications market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tactical Data Link Market Size and Share Forecast Outlook 2025 to 2035

Tactical Boots Market Analysis - Growth & Industry Forecast to 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Micro Tactical Ground Robot Market Size and Share Forecast Outlook 2025 to 2035

Communications Platform as a Service (CPaaS) Market in Korea Growth – Trends & Forecast 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Japan Communications Platform as a Service Market Growth - Trends & Forecast 2025 to 2035

Unified Communications and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Customer Communications Management Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Military Communications Market Analysis by Component, Application, End User & Region from 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Military Communications Market Size and Share Forecast Outlook 2025 to 2035

Semiconductors for Wireless Communications Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA