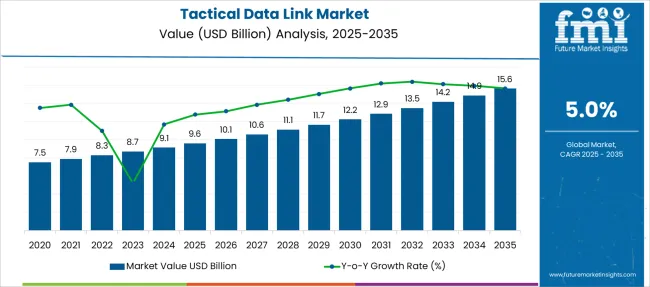

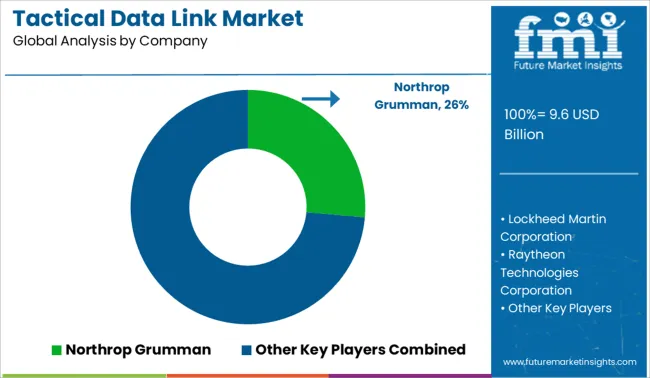

The Tactical Data Link Market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 15.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Tactical Data Link Market Estimated Value in (2025 E) | USD 9.6 billion |

| Tactical Data Link Market Forecast Value in (2035 F) | USD 15.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The tactical data link market is expanding steadily, driven by the increasing need for secure and reliable communication in defense and aerospace sectors. Enhanced situational awareness and faster decision-making have become critical in modern military operations, boosting the adoption of advanced data link systems.

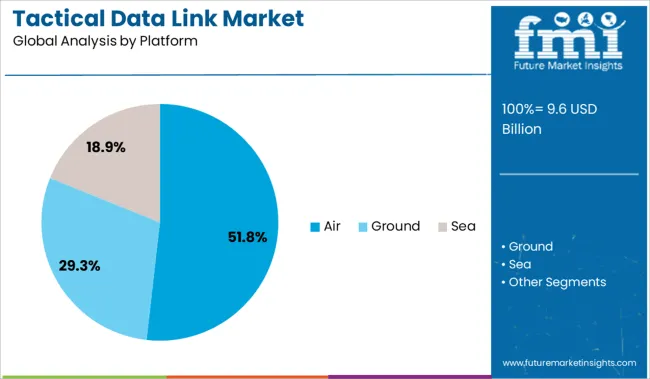

The demand for seamless interoperability between air, land, and sea platforms is rising as defense agencies modernize their communication networks. Improvements in hardware components, such as transceivers and antennas, have improved system performance and resilience.

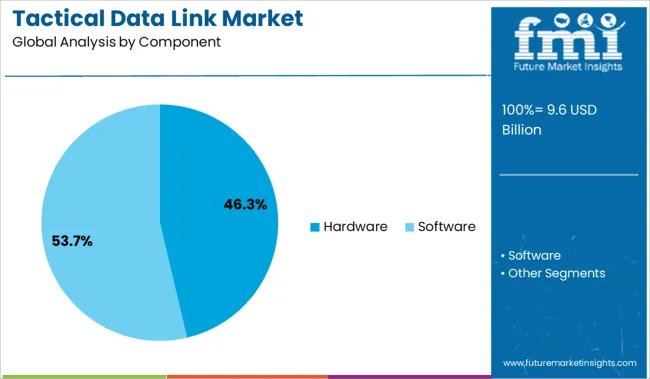

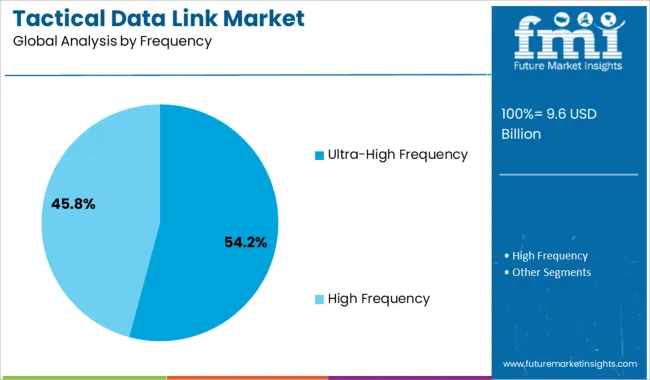

Moreover, growing investments in next-generation defense technologies and network-centric warfare strategies are accelerating market growth. The focus on real-time data exchange and secure communications is expected to continue shaping the market. Segmental growth is projected to be led by hardware components, air platforms, and ultra-high frequency bands which offer high bandwidth and resistance to interference.

The market is segmented by Component, Platform, Frequency, Data Link Type, Military Standard, and Application and region. By Component, the market is divided into Hardware, Terminals, Radio Sets, Modems, Routers, Controllers, Transceivers, Monitors, Others, and Software.

In terms of Platform, the market is classified into Air, Ground, and Sea. Based on Frequency, the market is segmented into Ultra-High Frequency and High Frequency. By Data Link Type, the market is divided into Link 16, Link 11, Link 22, and Others. By Military Standard, the market is segmented into MIL STD 6016, MIL STD 6011, MIL STD 6017, MIL STD 6020, and MIL STD 3011. By Application, the market is segmented into Command & Control, Intelligence, Surveillance & Reconnaissance, Electronic Warfare, and Radio Communications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is expected to contribute 46.3% of the tactical data link market revenue in 2025, retaining its leadership position. This segment's growth has been driven by the essential role of hardware components in ensuring the reliability and security of data transmission. Hardware such as transceivers, modems, and antennas are critical for establishing and maintaining communication links under diverse operational conditions.

Continuous technological advancements have enhanced hardware durability and miniaturization, making them suitable for various platforms. The increasing deployment of these components across multiple defense communication systems supports this segment's steady expansion.

The air platform segment is projected to hold 51.8% of the market revenue in 2025, maintaining its dominance. The extensive use of tactical data links in airborne systems is fueled by the necessity for real-time communication during reconnaissance, surveillance, and combat missions.

Airborne platforms require high-speed, secure, and reliable data links to coordinate complex operations. The evolution of unmanned aerial vehicles and advanced fighter jets has further increased demand. Airborne tactical data links facilitate effective coordination among allied forces and improve mission outcomes, making this segment a major contributor to market growth.

The ultra-high frequency (UHF) segment is anticipated to capture 54.2% of the tactical data link market revenue in 2025, leading the frequency band categories. UHF frequencies are preferred due to their ability to support high bandwidth communication and better penetration through obstacles and atmospheric conditions.

The reliability of UHF in maintaining secure and interference-resistant communication makes it ideal for tactical military applications.

Furthermore, advancements in UHF technology have enhanced spectral efficiency and range, addressing the demands of modern defense communication systems. As defense operations increasingly rely on uninterrupted data exchange, the UHF frequency segment is poised for continued growth.

The tactical data link market is growing as militaries prioritize real-time data sharing for enhanced mission coordination. Interoperability across platforms, sensor fusion, and digitized battlefields have become crucial for modern defense operations. The push for resilient communications under contested environments has elevated demand for multi-domain link solutions. Leading defense OEMs are aligning offerings with integrated C4ISR requirements, supported by rising defense budgets.

The demand for integrated operations across air, land, sea, and cyber domains has intensified the deployment of tactical data links. Multi-domain operations require secure and simultaneous communication between various platforms, often operating in hostile environments. Tactical data links provide this essential capability by enabling real-time data sharing, situational awareness, and command decision-making. As network-centric warfare continues to gain traction, modern militaries are investing in solutions that can seamlessly integrate unmanned platforms, satellite-based communications, and advanced ISR assets. Vendors are focusing on open-architecture designs and software-defined radios to support interoperability and ease of upgrade across allied forces.

Legacy defense platforms are being upgraded with advanced C4ISR capabilities, offering a significant opportunity for tactical data link vendors. Many aging fleets in NATO and Asia-Pacific countries are not equipped to handle modern data-intensive operations, prompting modernization programs. Rather than procuring entirely new systems, defense agencies are focusing on integrating tactical data link systems into existing airframes, naval vessels, and ground vehicles. This retrofit strategy ensures operational readiness at lower cost and with faster deployment timelines. Suppliers offering modular, scalable, and SWaP-optimized solutions are better positioned to capture this expanding segment, especially in mid-tier economies seeking cost efficiency.

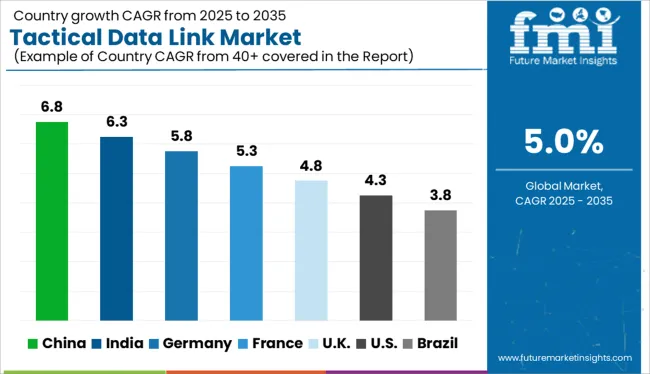

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

Global tactical data link market demand is rising at a CAGR of 5.0% through 2035, with national growth rates reflecting variations in defense procurement cycles, localization mandates, and interoperability strategies. China leads at 6.8%, exceeding the global benchmark by 1.8 percentage points. Expansion is driven by indigenous tactical communication suites, digital battlefield upgrades, and naval systems integration supported by state-led defense modernization. India follows at 6.3%, where programs under Make-in-India are scaling secure data link adoption across air and ground command systems. Germany records 5.8%, ahead of the global average, reflecting structured NATO-aligned procurement and sustained integration into joint operations platforms. France posts 5.3%, with strong momentum in airborne ISR platforms and tactical data link retrofits across legacy fleets. The United Kingdom, at 4.8%, lags slightly due to post-Brexit supply chain recalibrations and delayed program renewals in legacy comms infrastructure. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

China is witnessing a robust 6.8% CAGR through 2035 in tactical data link deployment, outperforming most OECD nations. Its military modernization initiatives and command-control digitization are supporting growth in integrated battlefield communication systems. With mass procurement led by the People’s Liberation Army and domestic satellite uplink infrastructure expansion, China’s network-centric warfare capacity is being significantly elevated. Homegrown defense OEMs like CETC and Norinco Group further strengthen tactical communication supply chains. Compared to India and France, China demonstrates deeper integration across airborne and naval platforms.

India is expected to grow at a 6.3% CAGR, benefitting from combined public–private defense modernization. DRDO-backed indigenous programs and Make in India initiatives are pushing localized TDL hardware development for air, land, and naval platforms. India’s strategic push for battlefield transparency through encrypted real-time feeds and secure UAV links has intensified post-Galwan and with Quad cooperation. Export potential remains low compared to China, but domestic programs continue to mature across army and IAF assets.

Demand for tactical data link in Germany is advancing at a 5.8% CAGR, driven by NATO modernization standards and EU defense coordination efforts. Emphasis has shifted toward interoperability with joint forces, especially within Eurofighter and Panavia Tornado fleets. Germany’s emphasis on encrypted satellite relay systems and real-time threat detection has fostered demand for advanced waveform compatibility and cross-platform deployment. Unlike France’s naval-led demand, Germany’s core application areas lie in air and joint land-air coordination.

Sales of tactical data link in France is expanding at a 5.3% CAGR through 2035, primarily influenced by Rafale fleet upgrades and blue-water naval communication systems. Naval-centric platforms like FREMM and Barracuda-class submarines rely on secure, long-range communication, stimulating tactical link updates. While not as export-intensive as the USA, France’s Thales Group anchors much of its domestic TDL ecosystem. The French defense command focuses more on robust maritime C2 applications compared to Germany’s air-led growth.

Tactical data link systems in the United Kingdom are growing at a modest 4.8% CAGR, trailing other major NATO players. The UK’s focus remains tied to legacy Link 16 modernization and integration into Type 26 frigates, Tempest fighter programs, and joint NATO operations. The Ministry of Defence has prioritized TDL enhancements in overseas deployments and cybersecurity safeguards across multi-domain ops. Compared to Germany’s broader deployment, UK growth is more compartmentalized and conservative in scope.

The tactical data link market is shaped by defense contractors specializing in secure communications, real-time situational awareness, and battlefield interoperability. Northrop Grumman, Raytheon Technologies, and Lockheed Martin dominate the landscape with integrated systems that align with NATO standards and multi-domain operations. These firms provide critical link-16, MADL, and SATCOM-enabled solutions for air, naval, and ground forces. L3Harris Technologies and General Dynamics UK offer modular data link architectures, emphasizing rapid deployment and secure mesh networking for coalition operations. BAE Systems focuses on software-defined radios and tactical integration across next-gen combat platforms. Thales Group, with strong European defense affiliations, continues to deliver encrypted, scalable communication protocols for allied forces. The market remains innovation-centric, driven by defense modernization programs, electronic warfare readiness, and seamless interoperability across joint forces.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.6 Billion |

| Component | Hardware, Terminals, Radio Sets, Modems, Routers, Controllers, Transceivers, Monitors, Others, and Software |

| Platform | Air, Ground, and Sea |

| Frequency | Ultra-High Frequency and High Frequency |

| Data Link Type | Link 16, Link 11, Link 22, and Others |

| Military Standard | MIL STD 6016, MIL STD 6011, MIL STD 6017, MIL STD 6020, and MIL STD 3011 |

| Application | Command & Control, Intelligence, Surveillance & Reconnaissance, Electronic Warfare, and Radio Communications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Northrop Grumman, Lockheed Martin Corporation, Raytheon Technologies Corporation, L3Harris Technologies, Inc., BAE Systems, Thales Group, and General Dynamics UK Limited |

| Additional Attributes | Dollar sales by protocol type and military platform, adoption of Link 16 and SADL in joint operations, integration of tactical data links in UAV and ISR platforms, modernization of naval communication suites with encrypted link standards, rising demand for BLOS connectivity in contested environments, upgrades driven by defense coalition interoperability mandates |

The global tactical data link market is estimated to be valued at USD 9.6 billion in 2025.

The market size for the tactical data link market is projected to reach USD 15.6 billion by 2035.

The tactical data link market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in tactical data link market are hardware, terminals, radio sets, modems, routers, controllers, transceivers, monitors, others and software.

In terms of platform, air segment to command 51.8% share in the tactical data link market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tactical Communications Market Size and Share Forecast Outlook 2025 to 2035

Tactical Boots Market Analysis - Growth & Industry Forecast to 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Micro Tactical Ground Robot Market Size and Share Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA