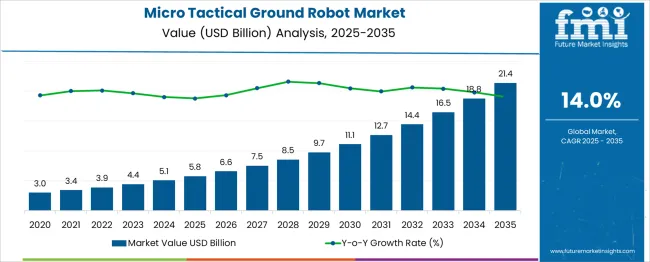

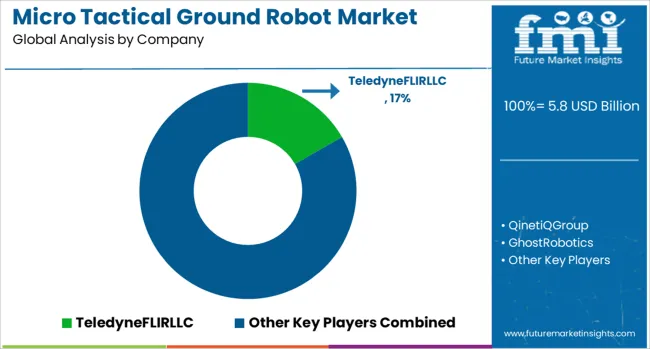

The Micro Tactical Ground Robot Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 21.4 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period. Between 2020 and 2025, the market expands from USD 3.0 billion to USD 5.8 billion, generating an absolute dollar opportunity of USD 2.8 billion. This rapid growth is fueled by increasing defense budgets, the rising need for unmanned ground vehicles in military and security operations, and advancements in AI and sensor technologies. Early-stage growth is supported by investments in robotics firms and government contracts, positioning the market for robust expansion. From 2025 to 2035, the market is expected to add an additional USD 15.6 billion in absolute dollar opportunity, driven by wider adoption across military and law enforcement agencies globally.

The introduction of innovative platforms by leading companies such as Teledyne FLIR, QinetiQ Group, Ghost Robotics, Roboteam, and Boston Dynamics is set to enhance operational capabilities and reliability. Midway through this phase, by 2030, the market is expected to surpass USD 11.1 billion, indicating accelerated uptake and integration of these systems. The combined absolute dollar opportunity for 2020–2035 totals USD 18.4 billion, offering significant potential for technology developers and defense contractors to capitalize on the growing demand for tactical robotics solutions.

| Metric | Value |

|---|---|

| Micro Tactical Ground Robot Market Estimated Value in (2025 E) | USD 5.8 billion |

| Micro Tactical Ground Robot Market Forecast Value in (2035 F) | USD 21.4 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The micro tactical ground robot market is gaining momentum due to growing deployment across defense, homeland security, and law enforcement operations where real-time intelligence and remote operability are mission-critical. These compact unmanned systems are increasingly being utilized for surveillance, explosive ordnance disposal, and reconnaissance in confined or hazardous environments. Rising geopolitical tensions, urban warfare scenarios, and the need to minimize human exposure in threat zones are accelerating investment in micro robotics.

Technological progress in lightweight materials, ruggedized sensors, and high-efficiency actuators is enabling better mobility, endurance, and data collection in dynamic terrains. The integration of AI-assisted navigation, thermal imaging, and encrypted communication protocols is further enhancing field utility and autonomy.

Procurement programs initiated by defense ministries and the rising participation of private manufacturers in unmanned ground vehicle innovation are also contributing to market expansion. In the coming years, the synergy between AI-driven command systems and next-gen robotic platforms is expected to shape the operational landscape for mobile tactical robotics globally.

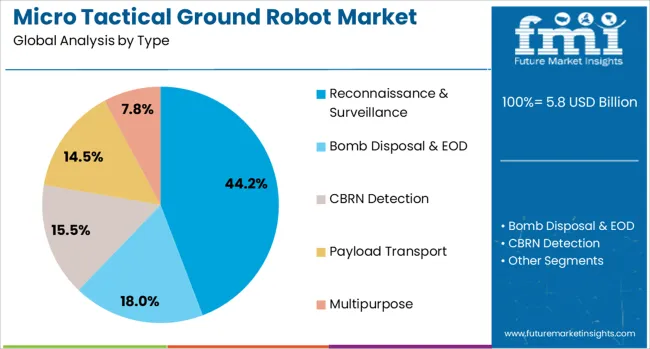

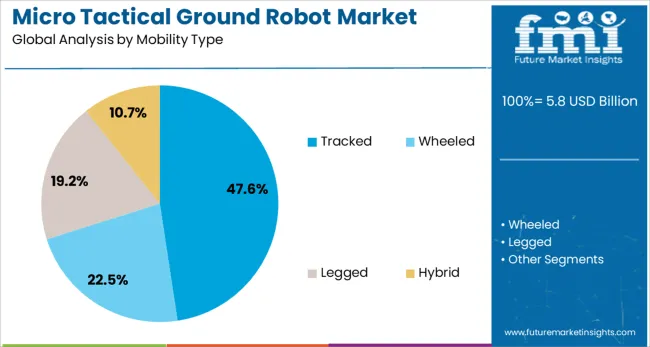

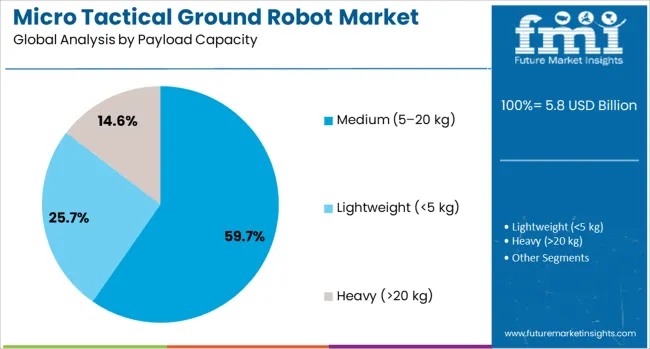

The micro tactical ground robot market is segmented by type, mobility type, payload capacity, operating environment, application, and geographic regions. By type, the micro tactical ground robot market is divided into Reconnaissance & Surveillance, Bomb Disposal & EOD, CBRN Detection, Payload Transport, and Multipurpose. In terms of mobility type, the micro tactical ground robot market is classified into Tracked, Wheeled, Legged, and Hybrid. The payload capacity of the micro tactical ground robot market is segmented into Medium (5–20 kg), Lightweight (<5 kg), and Heavy (>20 kg). The operating environment of the micro tactical ground robot market is segmented into Urban / Indoors, Confined Spaces, Rural / Open Terrain, Underground / Tunnel, and Amphibious. By application of the micro tactical ground robot market is segmented into Military & Defense, Law Enforcement, Industrial Inspection, Disaster ResponseSearch and Rescue. Regionally, the micro tactical ground robot industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reconnaissance and surveillance segment is expected to account for 44.2% of the total revenue share in the micro tactical ground robot market in 2025, making it the most prominent application segment. The high share is supported by increased demand for real-time visual intelligence in tactical missions and border patrol operations. Micro tactical robots equipped with visual sensors, night vision capabilities, and live-feed transmission systems are being relied upon to provide situational awareness in inaccessible or high-threat areas.

These platforms enable forces to assess environments without physical entry, thereby reducing personnel risk and enabling faster decision-making. As asymmetric warfare tactics and urban conflict zones become more common, demand for deployable surveillance units has risen significantly.

The modular architecture of these robots allows rapid configuration with advanced optics, microphones, and chemical sensors, further reinforcing their utility in intelligence gathering and perimeter monitoring. Their compact size, quiet operation, and improved maneuverability make them indispensable tools for modern surveillance tasks.

The tracked mobility type segment is projected to contribute 47.6% of the total revenue share in the micro tactical ground robot market in 2025, emerging as the leading mobility category. This dominance is driven by the superior traction and terrain adaptability offered by tracked designs, which allow robots to operate effectively across rubble, sand, mud, and inclines.

The stability and weight distribution inherent to tracked systems enhance payload handling, obstacle navigation, and shock resistance, making them ideal for unpredictable and rugged field conditions. In tactical scenarios where real-time deployment and obstacle negotiation are essential, tracked robots have shown consistent operational reliability.

Additionally, the compatibility of tracked platforms with a broad range of sensor modules and arm attachments enables greater versatility in surveillance, bomb disposal, and reconnaissance missions. The increasing adoption of tracked configurations in defense modernization programs and their proven performance in both training and live operations are contributing to their continued market leadership.

The medium payload capacity segment, defined as systems carrying between 5 and 20 kilograms, is forecast to hold 59.7% of the revenue share in the micro tactical ground robot market in 2025, positioning it as the most dominant capacity category. This segment’s leadership is being propelled by the optimal balance it offers between mobility, endurance, and functional capability.

Robots in this category are able to support advanced imaging equipment, manipulator arms, and communication systems without compromising agility or battery life. Their ability to perform complex tasks such as bomb detection, object retrieval, and multi-sensor surveillance has made them highly valuable in military and special operations units.

Medium payload robots provide sufficient power and surface area for modular payload integration while remaining portable enough for rapid field deployment. The growing preference for versatile systems that can be customized based on mission needs has driven procurement in this segment, solidifying its dominance in both urban and field operations.

The micro tactical ground robot market is growing steadily as defense and security agencies increasingly deploy small, agile robots for reconnaissance, surveillance, and explosive ordnance disposal (EOD). These compact robots, typically weighing under 20 kilograms, provide frontline troops with real-time intelligence and reduce human exposure to dangerous environments. Their use in urban combat, counterterrorism operations, and disaster response enhances operational efficiency and safety. Advances in sensor technology, wireless communication, and mobility improve their effectiveness in complex terrains. North America and Europe lead adoption due to advanced defense budgets, while emerging markets in Asia-Pacific are expanding investments in tactical robotics. The growing need for rapid deployment, remote operation, and multi-mission capabilities drives product development and integration with other battlefield technologies.

Micro tactical ground robots are designed for portability, maneuverability, and adaptability across varied environments. They feature modular payloads including cameras, chemical detectors, and manipulator arms for interaction with suspicious objects. Compact size allows deployment via backpacks or drones, enabling access to confined or hazardous areas. Battery life and communication range are key operational parameters, with manufacturers optimizing energy efficiency and signal resilience. Advanced locomotion systems, such as tracked or wheeled designs, enable navigation over rubble, stairs, and uneven terrain. Integration with command and control systems ensures real-time data sharing and coordinated mission planning. The ability to customize payloads according to mission needs enhances versatility for military, law enforcement, and emergency response users.

By providing remote surveillance and reconnaissance, micro tactical ground robots reduce risks to human personnel during hazardous missions. They allow early threat detection and situation assessment, enabling informed decision-making and rapid response. These robots are critical in detecting improvised explosive devices (IEDs) and hazardous materials, thus preventing casualties and mission failure. Their deployment enhances situational awareness, supports tactical planning, and facilitates communication between units in complex operations. Additionally, their presence can act as a force multiplier by enabling small teams to conduct missions that traditionally required larger numbers. As tactical environments become more unpredictable, these robots provide reliable, persistent support, improving operational safety and mission outcomes in urban warfare, counterterrorism, and disaster zones.

Micro tactical ground robots must comply with strict military standards regarding durability, electromagnetic compatibility, and cybersecurity. They need to withstand harsh environmental conditions, including extreme temperatures, dust, moisture, and shocks. Ensuring secure and interference-resistant communication links is critical to prevent hacking or signal jamming. Battery limitations pose operational challenges, restricting continuous use and necessitating efficient power management or quick battery swaps. Furthermore, operators require training to maximize robot capabilities and interpret gathered data effectively. Regulatory constraints on the export and use of military-grade robotics also influence market dynamics. Companies investing in ruggedization, cybersecurity solutions, and operator training programs strengthen market positioning by addressing these operational hurdles.

The micro tactical ground robot market is competitive, featuring established defense contractors and innovative startups offering diverse platforms. Success depends on the ability to deliver reliable, adaptable, and mission-ready robots with strong after-sales support. Supply chain stability for high-tech components such as sensors, processors, and communication modules is vital. Global semiconductor shortages and geopolitical tensions may affect component availability and production timelines. Many manufacturers pursue collaborations with military agencies for product customization and field testing to meet specific operational requirements. Building regional service centers and training facilities enhances customer satisfaction and trust. Companies offering integrated solutions combining robotics, data analytics, and command systems gain a competitive edge in an evolving defense market focused on force protection and technological superiority.

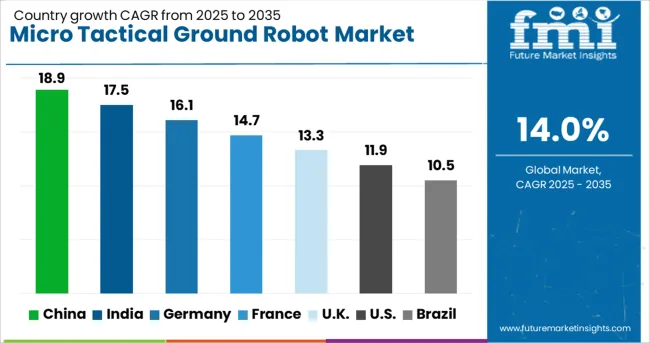

| Country | CAGR |

|---|---|

| China | 18.9% |

| India | 17.5% |

| Germany | 16.1% |

| France | 14.7% |

| UK | 13.3% |

| USA | 11.9% |

| Brazil | 10.5% |

The micro tactical ground robot market is advancing rapidly with a CAGR of 14.0%, driven by increased demand for unmanned systems in defense, surveillance, and emergency response. Among BRICS countries, China leads with an 18.9% growth rate, fueled by heavy investments in military robotics and automation technologies. India follows at 17.5%, supported by modernization efforts in defense and expanding research capabilities. Within the OECD region, Germany reports 16.1% growth, reflecting its advanced robotics industry and defense sector collaboration. The United Kingdom grows at 13.3%, driven by government-backed innovation programs and private sector developments. The United States, a mature market, exhibits 11.9% growth due to strong defense budgets and technological leadership in robotics. These countries shape the market landscape through their development, regulation, and operational deployment of micro tactical ground robots. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the micro tactical ground robot market with a rapid 18.9% growth rate. The country’s focus on modernizing defense capabilities and increasing investments in robotics technology drives this surge. Compared to India, China benefits from a well-established manufacturing base and government support for military technology development. Integration of artificial intelligence and sensor advancements enhances operational efficiency. The market also gains momentum from rising security and surveillance demands. Collaboration between defense contractors and research institutes fuels innovation.

Indian micro tactical ground robot market grows at 17.5%, propelled by increased defense spending and modernization initiatives. Compared to Germany, India focuses on cost-effective solutions tailored to regional security challenges. The government’s emphasis on “Make in India” encourages domestic production and technology transfer. Growing border tensions and internal security needs amplify demand for tactical ground robots. Collaborative programs with international defense firms support skill development and product refinement.

Germany shows steady growth of 16.1% in the micro tactical ground robot market. The country prioritizes precision engineering and quality standards for defense robotics. Compared to the United Kingdom, Germany invests heavily in research and development to improve robot autonomy and durability. The market is fueled by demand from military and law enforcement agencies for enhanced reconnaissance capabilities. Export opportunities within NATO countries strengthen market potential. Collaboration between academia and industry promotes continuous innovation.

The United Kingdom’s micro tactical ground robot market grows at 13.3%, supported by investments in defense technology upgrades. Compared to the United States, the UK places a greater emphasis on modular robot designs adaptable to diverse missions. Funding from government defense programs stimulates research in sensor technologies and mobility enhancements. The law enforcement sector increasingly adopts these robots for surveillance and tactical operations. Partnerships with technology firms accelerate product development.

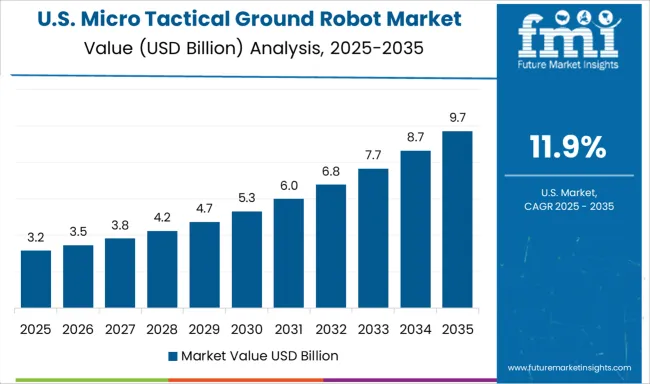

The United States expands the micro tactical ground robot market at 11.9%, driven by high defense budgets and technological leadership. Compared to China, the US focuses on advanced AI capabilities and battlefield integration. The market benefits from strong support from military branches for reconnaissance and combat applications. Private sector innovation accelerates the development of lightweight, durable robots. Ongoing investments in sensor technology and autonomy improve mission effectiveness. Collaboration with allied nations enhances technology exchange.

eledyne FLIR, through its Endeavor Robotics division, positions itself strongly with micro robots that integrate thermal imaging, autonomous navigation, and proven ruggedized platforms designed for hazardous reconnaissance and explosive ordnance disposal. QinetiQ leverages its defense heritage to offer adaptable robots optimized for situational awareness and troop protection, with a focus on modular payloads that can be rapidly deployed in complex terrains. Ghost Robotics brings innovation through legged robotic platforms that excel in mobility and endurance, providing unmatched agility across diverse battlefield environments where wheeled or tracked robots face limitations.

Roboteam and Recon Robotics emphasize modular, lightweight platforms with interchangeable payloads that allow seamless integration of cameras, sensors, and communications equipment, catering to tactical teams operating in urban and confined spaces. Northrop Grumman applies its broader unmanned systems expertise to deliver micro robots that integrate within networked defense ecosystems, enabling unified command and control across air, land, and sea domains. Boston Dynamics and Sarcos Robotics contribute advanced locomotion, dexterity, and human-machine interface capabilities, which, though not always developed exclusively for micro platforms, are being adapted for tactical ground robotics to improve mobility and usability. Milrem Robotics pursues hybrid approaches that combine micro tactical functions with larger unmanned ground vehicles, expanding operational flexibility and demonstrating scalability for different mission profiles.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.8 Billion |

| Type | Reconnaissance & Surveillance, Bomb Disposal & EOD, CBRN Detection, Payload Transport, and Multipurpose |

| Mobility Type | Tracked, Wheeled, Legged, and Hybrid |

| Payload Capacity | Medium (5–20 kg), Lightweight (<5 kg), and Heavy (>20 kg) |

| Operating Environment | Urban / Indoors, Confined Spaces, Rural / Open Terrain, Underground / Tunnel, and Amphibious |

| Application | Military & Defense, Law Enforcement, Industrial Inspection, Disaster Response, and Search and Rescue |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TeledyneFLIRLLC, QinetiQGroup, GhostRobotics, Roboteam, EndeavorRobotics(FLIRSystemssubsidiary), NorthropGrummanCorporation, ReconRoboticsInc., BostonDynamics, SarcosRobotics, and MilremRobotics |

| Additional Attributes | Dollar sales in the Micro Tactical Ground Robot Market vary by type including reconnaissance, surveillance, and bomb disposal robots, application across military, law enforcement, and emergency response, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising security concerns, technological advancements, and increasing defense spending. |

The global micro tactical ground robot market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the micro tactical ground robot market is projected to reach USD 21.4 billion by 2035.

The micro tactical ground robot market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in micro tactical ground robot market are reconnaissance & surveillance, bomb disposal & eod, cbrn detection, payload transport and multipurpose.

In terms of mobility type, tracked segment to command 47.6% share in the micro tactical ground robot market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micro Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robot Assisted Surgical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Micro-Vent Cap Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tactical Backpack Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Readers and Scanners Market Size and Share Forecast Outlook 2025 to 2035

Tactical Protective Headset Market Size and Share Forecast Outlook 2025 to 2035

Micron CBN Powder Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Robot Controller, Integrator and Software Market Size and Share Forecast Outlook 2025 to 2035

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Micro Hotel Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Micro-energy Harvesting System Market Size and Share Forecast Outlook 2025 to 2035

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Micro CHP Market Size and Share Forecast Outlook 2025 to 2035

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Micro Flute Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA