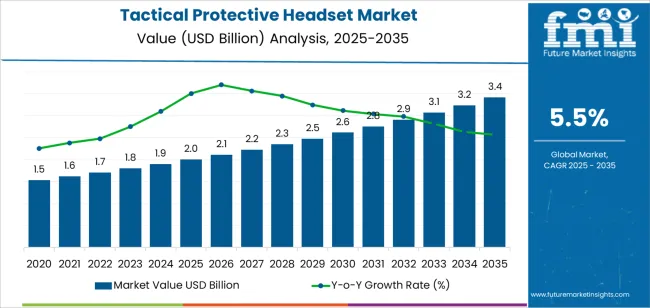

The tactical protective headset market is valued at USD 2.0 billion in 2025 and is projected to reach USD 3.4 billion by 2035, at a 5.5% CAGR, as defense forces, law enforcement agencies, and security organizations prioritize clear communication and auditory protection for field personnel. Demand strengthens through rising defence modernisation, the wider use of radio-integrated systems, and increased awareness of hearing loss risks during high-noise operations. Tactical headsets support clear voice transmission, situational awareness, impulse noise control, and interoperability with radios and soldier gear used in land, air, and marine environments.

IP67-rated models lead global adoption due to reliable protection against dust and short-term water exposure, combined with active noise reduction, ambient listening, and directional sound processing. Manufacturers enhance product value through lighter frames, improved battery efficiency, wireless options, and acoustic elements tailored for long-duration missions. Asia Pacific records the fastest expansion, driven by higher defence procurement in China, India, and South Korea, while North America and Europe maintain consistent demand, supported by established acquisition programs and advanced research in signal processing. Growth extends into civil sectors such as police, emergency response, aviation support, and private security, where communication safety standards are steadily rising. High equipment cost, complex system integration, and certification requirements shape procurement decisions, along with the need for compatibility with legacy radios.

Asia Pacific is the fastest-growing regional market, supported by increased defense spending in China, India, and South Korea. Europe and North America remain major markets driven by established defense procurement frameworks and continuous technological innovation. Prominent players include 3M, Opsmen, Setcom, Howard Leight, Recon Brothers, Sordin, Safariland, OTTO, Gentex, and TEA, focusing on rugged design, communication clarity, and multi-platform compatibility.

The growth contribution index highlights that defense modernization programs will represent the largest share of market expansion during the initial phase from 2025 to 2029. Increased procurement of advanced communication and hearing protection systems by armed forces will account for over half of total market growth within this period. The integration of situational awareness and active noise reduction technologies will further enhance demand in military and law enforcement applications.

From 2030 to 2035, commercial and industrial segments will contribute more strongly to the growth index as adoption widens among private security, construction, and aviation personnel. This shift will be supported by improved product affordability, ergonomic design enhancements, and compliance with occupational safety standards. Regional contributions will remain led by North America and Europe, with Asia-Pacific showing a rising share through local manufacturing and defense procurement expansion. The growth contribution index reflects a balanced long-term trend driven by sustained defense investments, diversification of end-use applications, and ongoing improvements in communication and hearing protection technologies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.0 billion |

| Market Forecast Value (2035) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The tactical protective headset market is expanding as demand increases for communication and hearing protection equipment in military, law-enforcement, and security operations. Users in high-noise and high-risk environments require headsets that combine situational awareness, noise suppression, and secure communication channels to maintain safety and effectiveness.

Advanced audio technology, active noise cancellation, ergonomic design, and compatibility with communication systems enhance the performance of protective headsets in challenging conditions. Governments worldwide continue to allocate funds for defense modernisation and upgrade of tactical gear, which supports procurement of specialised headsets. The growth of asymmetrical warfare, counter-terrorism initiatives, and expanded special operations units also drives adoption.

Manufacturers are innovating products with multimodal communication features, modular accessories, lightweight materials, and digital integration to meet evolving tactical requirements. Rising civilian demand for advanced personal protective systems and private security applications adds to the addressable market. Constraints include high unit cost due to sophisticated components, rigorous certification and performance testing requirements, and compatibility issues among legacy systems and new technologies.

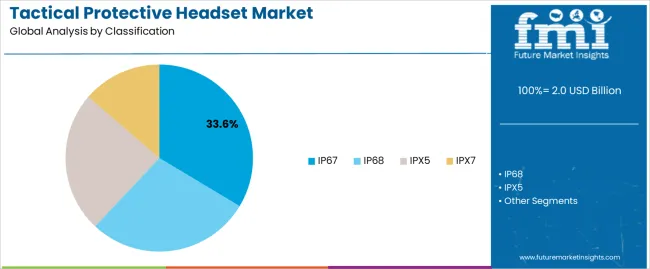

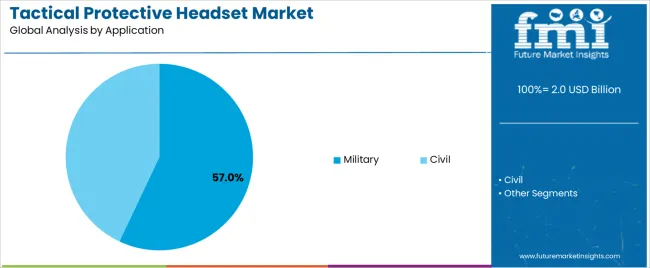

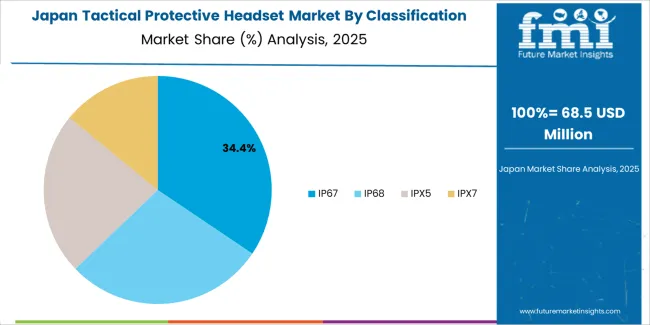

The tactical protective headset market is segmented by classification and application. By classification, the market is divided into IP67, IP68, IPX5, and IPX7 protection levels. Based on application, it is categorized into military and civil use. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The IP67 segment holds the leading position in the tactical protective headset market, representing approximately 33.6% of the total share in 2025. IP67-rated headsets are engineered to resist dust ingress and withstand temporary immersion in water, providing dependable performance in demanding field environments. These features make IP67 models the preferred choice in tactical, defense, and law enforcement operations where environmental durability and consistent communication are essential.

This classification supports active noise reduction (ANR), ambient sound awareness, and integration with tactical communication networks. The segment’s leadership reflects its balance between cost efficiency, ruggedness, and operational reliability across land, air, and marine defense applications. The IP68 segment, offering greater immersion resistance, is growing in niche defense operations and special mission units. The IPX5 and IPX7 categories are primarily used in civil, security, and industrial sectors where water resistance and basic noise reduction are sufficient for operational needs.

Key factors supporting the IP67 segment include:

The military segment accounts for approximately 57.0% of the tactical protective headset market in 2025. This dominance is attributed to the widespread use of tactical headsets by armed forces for communication, hearing protection, and situational awareness in high-noise and high-risk environments. These headsets are integrated with radio systems, helmets, and command communication devices to enable coordinated field operations and reduce auditory fatigue.

Growing investment in soldier modernization programs and the rising need for advanced communication technologies in combat and training scenarios continue to drive this segment’s expansion. The civil segment includes law enforcement, emergency response, and industrial safety applications where similar communication and noise reduction features are required, albeit under less severe conditions.

Primary dynamics driving demand from the military segment include:

Rising defense expenditure, demand for integrated communication, and increased focus on hearing protection are driving market growth.

The Tactical Protective Headset Market is expanding due to higher defense and security budgets across developed and developing nations. Modern military operations require communication systems that protect hearing while maintaining clear situational awareness in high-noise environments. Law enforcement and paramilitary forces are increasingly adopting tactical headsets designed for mission-critical communication, providing protection against impulse noise from firearms and machinery. Advancements in materials, ergonomics, and acoustic engineering are improving comfort, clarity, and durability. The integration of headsets with radios, sensors, and helmets is enhancing interoperability, supporting efficient coordination in field operations.

High procurement cost, compatibility issues, and maintenance complexity are restraining market expansion.

Tactical protective headsets are high-value equipment due to specialized electronics, noise-canceling circuits, and secure communication modules, which raise unit cost and limit accessibility for small agencies. Compatibility challenges between modern digital communication systems and older radio networks complicate large-scale adoption. Maintenance and calibration requirements for hearing protection and communication systems increase lifecycle costs. Limited technical expertise in operating and servicing advanced headsets can delay procurement and reduce utilization efficiency, particularly in regions with constrained defense infrastructure.

Shift toward wireless modular systems, smart communication integration, and regional defense modernization define market trends.

Manufacturers are focusing on developing wireless and modular headset designs that reduce cable dependency and enhance mobility during tactical missions. The integration of smart communication features such as adaptive noise filtering, voice-activated transmission, and real-time situational feedback is improving performance in combat and rescue operations. Expanding defense modernization programs in Asia-Pacific, the Middle East, and Eastern Europe are generating significant opportunities for suppliers. The market is evolving toward lighter, durable, and digitally integrated protective headsets that combine hearing safety with communication efficiency.

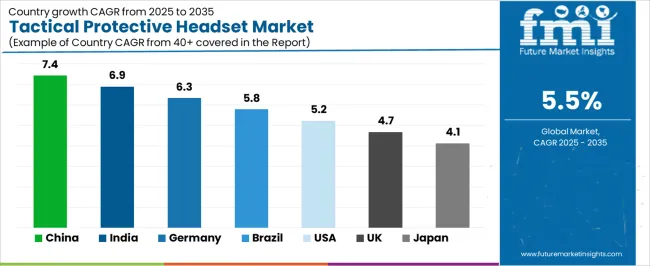

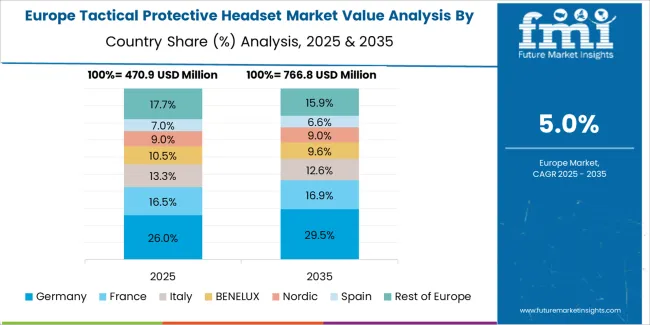

The global tactical protective headset market is expanding steadily through 2035, supported by advancements in military communication technology, soldier modernization programs, and growing demand for hearing protection in defense and law enforcement operations. China leads with a 7.4% CAGR, followed by India at 6.9%, driven by rising defense budgets and localized production. Germany grows at 6.3%, reflecting innovation in acoustic technology and integrated communication systems. Brazil’s 5.8% growth is linked to security modernization and law enforcement adoption. The United States records 5.2%, maintained by ongoing defense R&D. The United Kingdom (4.7%) and Japan (4.1%) maintain stable expansion through high-spec headset design and defense equipment upgrades.

| Country | CAGR (%) |

|---|---|

| China | 7.4 |

| India | 6.9 |

| Germany | 6.3 |

| Brazil | 5.8 |

| USA | 5.2 |

| UK | 4.7 |

| Japan | 4.1 |

China’s tactical protective headset market grows at 7.4% CAGR, supported by rapid defense equipment modernization, technological self-reliance, and increasing demand for integrated communication systems. Domestic manufacturers are producing headsets with active noise reduction, voice recognition, and ballistic compatibility features. The government’s military upgrade initiatives under the People’s Liberation Army (PLA) Modernization Plan emphasize digital communication and situational awareness. Collaboration between electronics and defense equipment firms supports innovation in ruggedized headset systems for use in field operations. Civil defense and law enforcement agencies also contribute to rising demand for tactical hearing protection devices.

Key Market Factors:

India’s market grows at 6.9% CAGR, driven by defense procurement reforms, indigenous manufacturing, and modernization of communication infrastructure for armed and paramilitary forces. The Make in India initiative is enabling domestic firms to produce tactical headsets with active-passive hybrid protection and clear communication capabilities. Partnerships with global defense technology providers are facilitating local assembly of noise-canceling and wireless systems. Growing operational requirements from the Indian Army, Air Force, and Central Armed Police Forces (CAPF) enhance market penetration. The focus on soldier comfort and endurance in combat environments continues to drive design innovation.

Market Development Factors:

Germany’s market grows at 6.3% CAGR, supported by technological innovation, precision engineering, and continuous defense modernization. Domestic manufacturers are developing digital headsets with environmental listening modes and adaptive signal processing. The Bundeswehr’s modernization programs include procurement of next-generation soldier systems integrating communication and protection technologies. Acoustic engineering research supports enhanced speech intelligibility and electronic noise filtering. Strong collaboration between defense electronics companies and government R&D institutions is improving battery efficiency and miniaturization. Demand also extends to aviation, police, and industrial protection sectors.

Key Market Characteristics:

Brazil’s market grows at 5.8% CAGR, supported by government investment in defense modernization, internal security operations, and peacekeeping participation. Local defense manufacturers are assembling cost-effective headsets using imported acoustic components. The Brazilian Army’s modernization initiatives are enhancing demand for durable, multi-channel headsets compatible with tactical radios. Law enforcement agencies are also increasing adoption for urban security operations. Partnerships with international suppliers are facilitating training and localization of production. The market benefits from expanding military exercises and infrastructure improvements in communication networks.

Market Development Factors:

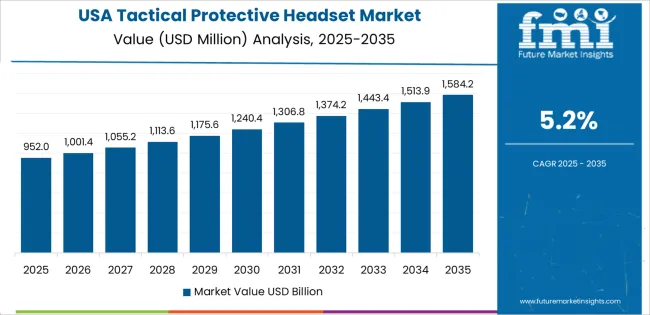

The United States grows at 5.2% CAGR, supported by leadership in defense electronics, innovation in acoustic technology, and extensive military R&D. The Department of Defense (DoD) continues to invest in next-generation tactical headsets designed for real-time communication, directional awareness, and hearing protection. Leading manufacturers are developing AI-integrated and bone conduction systems that reduce latency and improve clarity in high-noise environments. The U.S. Army’s Integrated Visual Augmentation System (IVAS) project drives integration of headsets with visual and audio situational awareness systems. Law enforcement agencies and defense contractors also represent significant demand segments.

Key Market Factors:

The United Kingdom’s market grows at 4.7% CAGR, supported by defense technology modernization and expanding procurement programs. British manufacturers and defense contractors are producing advanced noise-canceling headsets compatible with communication and situational awareness platforms. The Future Soldier Programme and Ministry of Defence initiatives prioritize integration of lightweight, durable hearing protection systems. Collaboration with European and U.S. technology suppliers strengthens local product innovation. Increasing use in homeland security, aviation, and training operations also contributes to market growth. Rigorous quality testing ensures compliance with NATO and British defense standards.

Market Development Factors:

Japan’s market grows at 4.1% CAGR, supported by defense modernization, industrial technology strength, and focus on acoustic engineering. Domestic firms are producing compact, high-fidelity headsets for the Self-Defense Forces and law enforcement agencies. Research on miniaturized microphone arrays and noise-filtering circuitry enhances communication efficiency in demanding environments. The National Security Strategy emphasizes investment in soldier system integration, including tactical hearing protection and communication interoperability. Collaboration with global suppliers facilitates the incorporation of lightweight, durable components suitable for marine and aerial operations.

Key Market Characteristics:

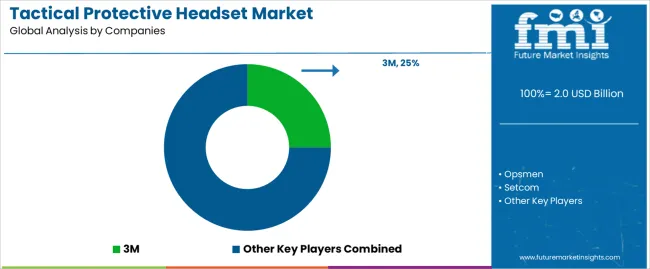

The tactical protective headset market is moderately consolidated, with approximately ten major manufacturers serving defense, security, and law enforcement applications globally. 3M leads the market with an estimated 25% global share, driven by its established PELTOR product line and proven expertise in integrating hearing protection with tactical communication systems.

The company’s leadership is reinforced by broad product certification, ergonomic design optimization, and compliance with NATO and ANSI standards. Opsmen, Howard Leight, and Sordin follow as key competitors, offering tactical headsets designed for situational awareness, environmental noise suppression, and compatibility with modern communication platforms. Their products emphasize comfort, modularity, and adaptive noise control suited to prolonged field operations. Safariland and OTTO maintain strong positions through defense contracts and system-level integration with protective gear and radio systems used by armed forces and first responders.

Gentex and TEA specialize in high-performance headsets for aviation and ground combat, providing advanced acoustic clarity and voice transmission in high-decibel environments. Setcom and Recon Brothers cater to niche defense, law enforcement, and civilian tactical markets, focusing on reliability, affordability, and compact system design. Competition in this market centers on audio clarity, hearing protection efficiency, and interoperability with communication devices. Product differentiation depends on weight reduction, power efficiency, and ruggedization standards. Growth is driven by modernization of tactical communication systems and the increasing focus on operator safety and mission-ready equipment across global defense sectors.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | IP67, IP68, IPX5, IPX7 |

| Application | Military, Civil |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | 3M, Opsmen, Setcom, Howard Leight, Recon Brothers, Sordin, Safariland, OTTO, Gentex, TEA |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of tactical communication and protective headset manufacturers; advancements in active noise cancellation and IP-rated protection technologies; integration with defense communication, field operations, and law enforcement systems. |

The global tactical protective headset market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the tactical protective headset market is projected to reach USD 3.4 billion by 2035.

The tactical protective headset market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in tactical protective headset market are ip67, ip68, ipx5 and ipx7.

In terms of application, military segment to command 57.0% share in the tactical protective headset market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tactical Data Link Market Size and Share Forecast Outlook 2025 to 2035

Tactical Communications Market Size and Share Forecast Outlook 2025 to 2035

Tactical Boots Market Analysis - Growth & Industry Forecast to 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Micro Tactical Ground Robot Market Size and Share Forecast Outlook 2025 to 2035

Dual-Channel Tactical Communication Headset Market Size and Share Forecast Outlook 2025 to 2035

Noise Reduction Tactical Headset Market Size and Share Forecast Outlook 2025 to 2035

Protective Glove Market Forecast Outlook 2025 to 2035

Protective Film Market Size and Share Forecast Outlook 2025 to 2035

Protective Earth Resistance Meter Market Size and Share Forecast Outlook 2025 to 2035

Protective Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Protective Wrapping Paper Market Size and Share Forecast Outlook 2025 to 2035

Protective Mask Market Size and Share Forecast Outlook 2025 to 2035

Protective Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

Protective Clothing Market - Trends, Growth & Forecast 2025 to 2035

Protective Eyewear Market Trends – Industry Growth & Forecast 2025 to 2035

Market Share Distribution Among Protective Packaging Manufacturers

Market Share Insights of Leading Protective Textiles Providers

Protective Relay Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA