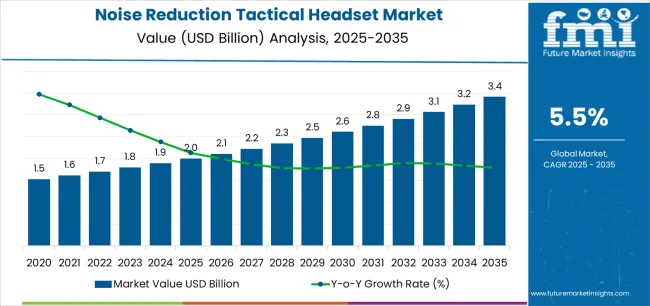

The noise reduction tactical headset market is valued at USD 2.0 billion in 2025 and is projected to reach USD 3.4 billion by 2035, growing at a CAGR of 5.5%. Market expansion is driven by increasing defense modernization programs, heightened focus on soldier communication systems, and rising adoption of advanced hearing protection technologies across military, law enforcement, and security applications. The growing use of digital communication networks and integrated battlefield systems has elevated demand for durable, high-performance headsets that balance situational awareness with acoustic safety.

IP67-rated headsets account for the leading market share due to their resistance to dust, water, and impact, ensuring reliable performance in extreme operational environments. These models combine electronic noise suppression with directional sound amplification, enabling users to maintain awareness while protecting hearing against impulse noises such as gunfire or explosions. Advances in wireless connectivity, lightweight materials, and battery efficiency continue to enhance comfort and field usability.

Asia Pacific leads growth, supported by defense procurement initiatives and rising homeland security budgets. Europe and North America remain key markets due to established defense technology ecosystems and continuous product innovation. Major companies include 3M, Opsmen, Setcom, Howard Leight, and Recon Brothers, emphasizing rugged design, acoustic clarity, and integration compatibility with tactical communication platforms.

Year-on-year (YoY) growth analysis indicates a consistent expansion pattern supported by rising defense modernization programs and improved tactical communication technologies. From 2025 to 2028, annual growth rates are expected to remain between 5.2% and 5.6%, driven by procurement of advanced headsets by military and law enforcement agencies seeking better situational awareness and hearing protection.

Between 2029 and 2032, YoY growth may experience minor fluctuations due to cyclical defense budgets and procurement cycles across major economies. Despite these variations, steady demand from private security firms and training applications will maintain market momentum. From 2033 to 2035, the YoY rate is likely to stabilize around 5.4%, reflecting market maturity and widespread product adoption. Continuous advancements in noise-cancellation, wireless connectivity, and lightweight materials will ensure steady volume growth during this period. The overall YoY trend demonstrates predictable expansion with limited volatility, driven by consistent defense investments, enhanced communication requirements, and technological integration in tactical and industrial noise-protection environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.0 billion |

| Market Forecast Value (2035) | USD 3.4 billion |

| Forecast CAGR (2025-2035) | 5.5% |

The noise reduction tactical headset market is expanding as military, law-enforcement, and industrial users demand headsets that both suppress hazardous ambient noise and provide clear communication in intense environments. Rising defense and security budgets worldwide support procurement of advanced hearing-protection headsets equipped with active noise reduction (ANR), ballistic or explosion-resistant materials, and integrated communications systems.

Technological innovations, such as wireless connectivity, Bluetooth push-to-talk, adaptive noise-cancellation algorithms, and compatibility with tactical radios and helmets, further drive adoption. Heightened regulation around occupational noise exposure and hearing conservation programs also push procurement in industrial applications, while growth in training, simulation and tactical-gear markets broadens the application base. Growth is limited by higher unit costs of premium tactical headsets, integration and compatibility complexities with existing systems, and competition from simpler hearing-protection earmuffs in lower-budget segments.

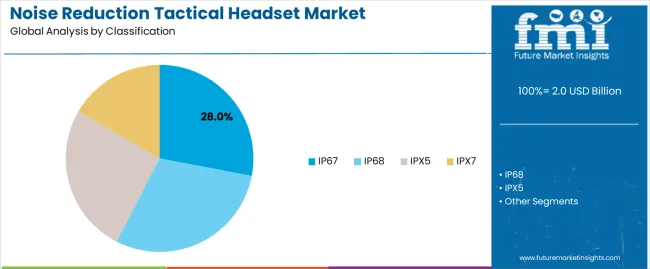

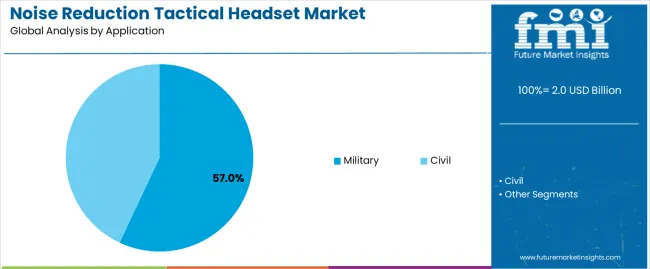

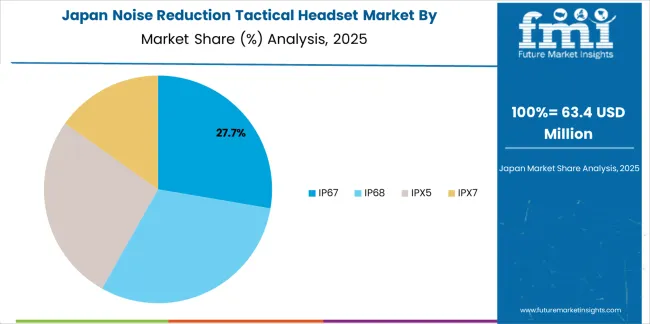

The noise reduction tactical headset market is segmented by classification and application. By classification, the market is divided into IP67, IP68, IPX5, and IPX7 protection levels. Based on application, it is categorized into military and civil use. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The IP67 segment holds the leading position in the noise reduction tactical headset market, representing approximately 28.0% of the total share in 2025. IP67-rated headsets are designed to provide complete protection against dust ingress and temporary immersion in water, ensuring operational reliability in demanding field environments. Their dominance is supported by extensive adoption in military and tactical communication systems, where durability, acoustic clarity, and resistance to environmental stressors are essential for mission performance.

These headsets typically integrate active noise reduction (ANR) and ambient sound awareness technologies, enabling clear communication in high-noise scenarios such as combat operations, training exercises, and rescue missions. The IP68 category represents higher resistance to water immersion and is increasingly applied in special operations or marine-based defense units. IPX5 and IPX7-rated headsets cater to civil, law enforcement, and light industrial users, offering varying levels of moisture and dust protection for less extreme conditions.

Key factors supporting the IP67 segment include:

The military segment accounts for approximately 57.0% of the noise reduction tactical headset market in 2025. This segment’s dominance arises from sustained defense investments in advanced communication systems designed to enhance soldier coordination, hearing protection, and operational efficiency in dynamic environments. Tactical headsets in this category are engineered for interoperability with radio networks, helmets, and body-worn communication systems while maintaining high acoustic protection levels.

Military demand is further driven by modernization initiatives focusing on next-generation soldier systems that incorporate integrated hearing protection and voice transmission technologies. The civil segment includes applications in law enforcement, aviation, and industrial sectors where noise control and reliable communication remain critical but operational demands are less extreme.

Primary dynamics driving demand from the military segment include:

Rising defence and law-enforcement budgets, increasing operational noise hazards, and advanced smart helmet integration are accelerating adoption.

The noise reduction tactical headset market is driven by increasing global defence and public-safety expenditures, which fuel procurement of advanced personal protective equipment for personnel operating in high-noise environments such as combat zones, urban operations and tactical vehicle mounted platforms. Growing recognition of hearing protection coupled with mission-critical communication needs motivates adoption of headsets with active noise reduction (ANR), hearing protection and integrated radio/communication systems. The trend toward smart helmets and sensor-equipped tactical gear enhances demand for headsets that seamlessly integrate with devices and support real-time situational awareness, communications and noise suppression.

High product cost, technology integration complexity and limited non-military scale inhibit broader market reach.

These tactical headsets often involve premium components including ruggedized construction, ANR circuitry, encrypted communication links and certified hearing protection levels; such cost structures reduce accessibility for smaller buyers or budget-constrained agencies. Integration with existing communication networks and tactical gear remains complex, requiring compatibility with legacy radio systems, helmet mounts and sensor arrays, which slows deployment. The market’s primary end-users remain military and law-enforcement sectors; relatively limited commercial application scales reduce economies of scale and slow cost-decline, thereby restraining broader adoption.

Shift toward wireless and modular designs, expansion in Asia-Pacific security forces, and convergence with augmented-reality communication systems define future outlook.

Key trends include development of wireless tactical noise-reduction headsets that permit mobile, untethered operation in field conditions and support inter-team mesh communications. The Asia-Pacific region is emerging as a growth hot-spot, driven by expanding internal security budgets, modernisation of armed forces and increasing private-security demand. Headset manufacturers are designing modular systems that integrate noise suppression, voice-activated communication, biometric sensing and augmented-reality overlays, moving from pure hearing protection toward multifunction tactical platforms.

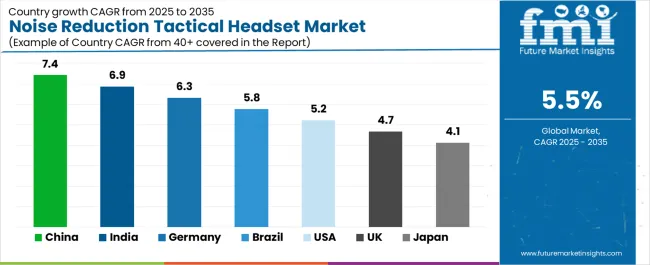

The global noise reduction tactical headset market is expanding steadily through 2035, driven by advancements in defense communication systems, soldier modernization programs, and industrial safety applications. China leads with a 7.4% CAGR, followed by India at 6.9%, supported by defense equipment localization and security infrastructure expansion. Germany grows at 6.3%, reflecting innovation in acoustic technology and precision engineering. Brazil’s 5.8% growth stems from defense modernization and law enforcement equipment upgrades. The United States records 5.2%, sustained by innovation in communication integration. The United Kingdom (4.7%) and Japan (4.1%) maintain gradual growth through high-spec defense procurement and specialized headset design.

| Country | CAGR (%) |

|---|---|

| China | 7.4 |

| India | 6.9 |

| Germany | 6.3 |

| Brazil | 5.8 |

| U.S. | 5.2 |

| U.K. | 4.7 |

| Japan | 4.1 |

China’s market grows at 7.4% CAGR, driven by increased military spending, defense modernization, and domestic manufacturing of tactical communication systems. The country’s focus on enhancing soldier situational awareness supports widespread adoption of active noise reduction (ANR) headsets. Domestic electronics firms are investing in microelectronic signal processing and durable communication modules. Defense research centers are partnering with industrial suppliers to improve headset ergonomics, durability, and compatibility with integrated radio systems. The civilian and paramilitary sectors also contribute to demand through expanded use in law enforcement and aviation training programs.

Key Market Factors:

India’s market grows at 6.9% CAGR, supported by rising defense procurement and indigenization of tactical communication equipment. The Make in India defense initiative has increased local production of advanced hearing protection and communication systems. Indian firms are collaborating with global defense manufacturers to introduce digital noise-canceling headsets for military, law enforcement, and emergency response forces. Demand from border security agencies and tactical training units continues to expand. The adoption of ruggedized, lightweight headset models enhances operational performance in varied climatic conditions. Ongoing R&D in active-passive hybrid systems ensures improved communication clarity and hearing safety.

Market Development Factors:

Germany’s market grows at 6.3% CAGR, supported by innovation in acoustic engineering, signal processing, and defense technology. Leading manufacturers are integrating digital noise filtering, bone-conduction microphones, and environmental awareness systems in headset designs. The Bundeswehr’s modernization programs emphasize soldier protection and communication clarity, driving steady product demand. Research institutions collaborate with defense contractors to develop energy-efficient circuitry and low-latency communication modules. The market benefits from strong defense funding and industrial emphasis on performance-certified tactical equipment. Industrial and aviation sectors further contribute to growth through adoption of certified protective communication systems.

Key Market Characteristics:

Brazil’s market grows at 5.8% CAGR, supported by defense modernization, public security investments, and manufacturing expansion. The government’s efforts to upgrade military and police communication systems have increased adoption of tactical headsets with integrated noise control. Domestic electronics assemblers are producing cost-effective models for national defense agencies. Partnerships with international equipment providers are transferring technology for advanced hearing protection and environmental awareness systems. The growth of regional law enforcement units and participation in peacekeeping operations are further promoting headset deployment. Industrial safety and aviation maintenance sectors also contribute to steady demand.

Market Development Factors:

The United States grows at 5.2% CAGR, driven by ongoing defense innovation, strong R&D funding, and the presence of global tactical headset manufacturers. The Department of Defense prioritizes enhanced hearing protection and multi-channel communication integration for combat operations. Major suppliers are developing modular headset systems compatible with next-generation soldier communication platforms. Increased application in law enforcement and homeland security further supports market stability. The integration of AI-based sound recognition and adaptive noise suppression technology is improving situational awareness and communication efficiency across defense and industrial applications.

Key Market Factors:

The United Kingdom’s market grows at 4.7% CAGR, supported by defense procurement initiatives and expansion of digital communication infrastructure. British manufacturers are introducing lightweight, ergonomic headset designs for armed forces and special operations. The Ministry of Defence’s modernization programs promote adoption of integrated hearing protection technologies. Collaborations between local defense contractors and European electronics firms enhance system interoperability and design quality. Adoption in aviation and defense training facilities contributes to steady growth. Stringent quality and performance standards under the Defence Equipment and Support (DE&S) framework drive consistent technological upgrades.

Market Development Factors:

Japan’s market grows at 4.1% CAGR, supported by advancements in microelectronics and defense modernization under the National Security Strategy. Domestic firms are developing precision-engineered headsets optimized for clear communication and long-term comfort. Research in signal modulation and digital acoustic filtering is improving headset durability and reliability. The Self-Defense Forces’ modernization programs promote deployment of tactical communication systems across air, naval, and ground divisions. Partnerships with global defense electronics companies enhance local technology capabilities. Japan’s focus on precision manufacturing ensures steady growth in performance-oriented and export-ready tactical communication equipment.

Key Market Characteristics:

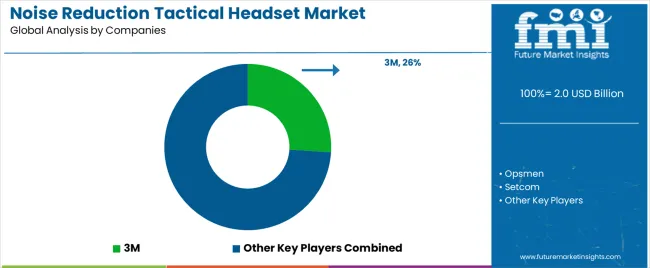

The noise reduction tactical headset market is moderately concentrated, comprising around ten specialized manufacturers serving defense, law enforcement, and industrial safety applications. 3M leads the market with an estimated 26.0% global share, supported by its extensive product portfolio under the PELTOR brand and its consistent integration of active hearing protection technologies with advanced communication systems. Its global distribution network and compliance with military and industrial standards reinforce its market dominance.

Opsmen, Howard Leight, and Sordin follow as prominent mid-tier competitors, offering tactical headsets designed for field communication, situational awareness, and environmental noise suppression. Their competitive strength lies in ergonomic design, customizable fit, and adaptive sound control technologies that enhance user comfort during extended operational periods. Safariland and OTTO maintain established positions through partnerships with defense agencies and integration of tactical communication systems into modular protective gear.

Gentex, TEA, and Setcom focus on advanced signal clarity and headset compatibility with multi-band radio systems, catering to high-intensity mission requirements. Recon Brothers operates in the niche segment of training and simulation equipment, offering specialized designs for civilian tactical markets.

Competition centers on durability, audio clarity, and interoperability, with technology innovation focused on reducing weight and improving battery efficiency. As military modernization and tactical safety standards expand, demand increasingly favors manufacturers capable of combining acoustic protection, seamless communication, and ergonomic resilience within rugged operational environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | IP67, IP68, IPX5, IPX7 |

| Application | Military, Civil |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | 3M, Opsmen, Setcom, Howard Leight, Recon Brothers, Sordin, Safariland, OTTO, Gentex, TEA |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of tactical communication and hearing protection device manufacturers; advancements in active noise cancellation and IP-rated headset technologies; integration with military communication systems and field operation gear. |

The global noise reduction tactical headset market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the noise reduction tactical headset market is projected to reach USD 3.4 billion by 2035.

The noise reduction tactical headset market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in noise reduction tactical headset market are ip67, ip68, ipx5 and ipx7.

In terms of application, military segment to command 57.0% share in the noise reduction tactical headset market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Noise And Vibration Coatings Market Size and Share Forecast Outlook 2025 to 2035

Noise Insulation Jackets Market Size and Share Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Noise Control System Market Analysis - Size, Share, and Demand Forecast Outlook 2025 to 2035

Noise-muffling Infant Hat Market

Noise Vibration Harshness (NVH) Testing Market

Noise Control Enclosures Packaging Market

Pass By Noise Testing Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Noise Barrier Market

Industrial Noise Control Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Sodium Reduction Ingredient Business

Methane Reduction Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Kickback Reduction Tool Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Pathogen Reduction Systems Market

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Salt Content Reduction Ingredients Market Size & Trends 2035

Non-Surgical Fat Reduction Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Enzymatic Acrylamide-Reduction Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Selective Catalytic Reduction Systems Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA