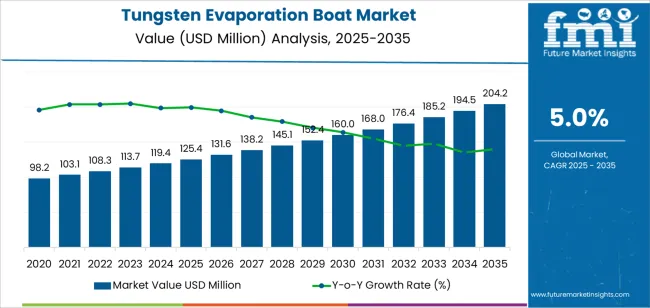

The global tungsten evaporation boat market is projected to reach USD 204.2 million by 2035, reflecting an absolute increase of USD 78.8 million over the forecast period. The market is valued at USD 125.4 million in 2025 and is expected to grow at a CAGR of 5.0%. Growth is driven by increasing demand for tungsten evaporation boats across industries such as electronics, optics, and materials science, where high-performance thin-film deposition is crucial. Tungsten evaporation boats are widely used in physical vapor deposition (PVD) processes to create thin metallic films on substrates, which are essential for applications such as semiconductor manufacturing, solar panels, and optical coatings.

Tungsten evaporation boats are highly valued for their ability to withstand high temperatures and corrosive environments, making them ideal for depositing materials such as gold, silver, and other metals used in the electronics and semiconductor industries. As the demand for miniaturized electronic components continues to rise, the need for precise thin-film coatings increases, further driving demand for tungsten evaporation boats. Additionally, the growing adoption of renewable energy technologies, such as photovoltaic solar panels, where tungsten-based coatings are used, contributes to market expansion.

The market for tungsten evaporation boats is also supported by technological advancements in deposition techniques and the expansion of manufacturing processes that require ultra-thin films. The aerospace and automotive industries are increasingly utilizing thin-film technologies for applications such as coating engine parts, components, and optical elements. Furthermore, tungsten’s properties, such as its high melting point and excellent thermal conductivity, make it a preferred material for many high-performance applications, which bolsters its demand in the evaporation boat market.

Between 2025 and 2030, the tungsten evaporation boat market is projected to grow from USD 125.4 million to approximately USD 155.7 million, adding USD 30.3 million, which accounts for about 38.4% of the total forecast growth for the decade. This period will be characterized by increased demand for thin-film coatings in semiconductor manufacturing and the growing use of tungsten in advanced material science applications.

From 2030 to 2035, the market is expected to expand from approximately USD 155.7 million to USD 204.2 million, adding USD 48.5 million, which constitutes about 61.6% of the overall growth. This phase will be marked by further technological advancements in PVD processes, expansion of renewable energy technologies such as solar panels, and the continued need for high-performance coatings in aerospace and automotive sectors, driving further adoption of tungsten evaporation boats.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 125.4 million |

| Market Forecast Value (2035) | USD 204.2 million |

| Forecast CAGR (2025-2035) | 5.0% |

The tungsten evaporation boat market is growing due to the increasing demand for high-quality thin films and coatings in industries such as electronics, optics, and aerospace. Tungsten evaporation boats are essential in vacuum deposition processes, where tungsten is used to evaporate and deposit metal coatings on various substrates. These coatings are critical in the production of semiconductors, solar panels, and other advanced technological products, which require precise and durable materials to function efficiently.

The expansion of the electronics industry, particularly in the production of semiconductor devices and displays, is a major driver of market growth. Tungsten evaporation boats provide a stable and efficient means of depositing thin films of materials such as gold, silver, and aluminum, which are commonly used in electronic components. As the demand for smaller, more powerful electronic devices continues to rise, the need for advanced deposition techniques and high-performance materials like tungsten is increasing.

Advancements in solar energy technologies are contributing to the market's expansion. Tungsten boats are used in the manufacturing of thin-film solar cells, where precise material deposition is crucial for optimal efficiency. However, challenges such as the high cost of tungsten and the technical expertise required for the evaporation process may limit adoption in some industries or regions with less mature manufacturing capabilities.

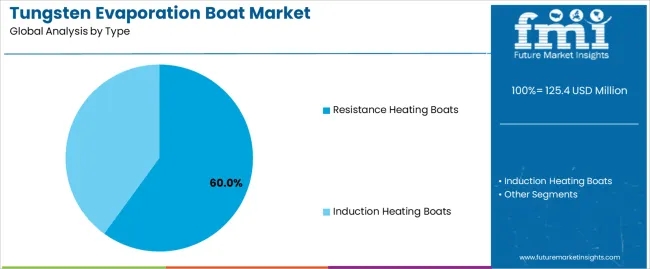

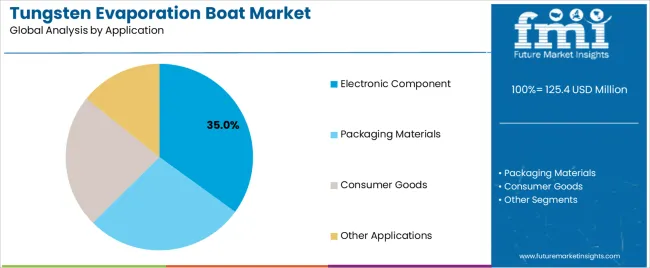

The market is segmented by type, application, and region. By type, the market is divided into resistance heating boats and induction heating boats. Based on application, the market is categorized into electronic component, packaging materials, consumer goods, and other applications. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

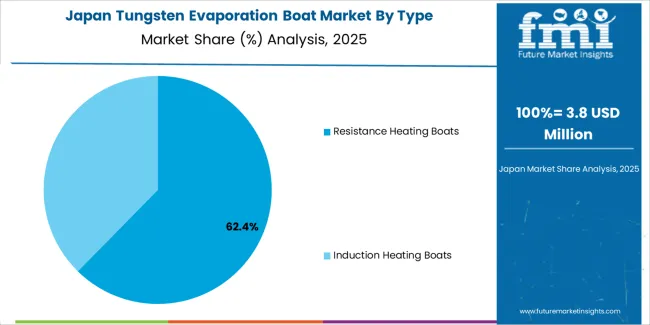

The resistance heating boats segment leads the tungsten evaporation boat market, capturing 60.0% of the total market share. Resistance heating boats are widely used in various industrial applications due to their ability to withstand high temperatures and provide efficient heating. These boats are highly preferred in vacuum deposition processes, where tungsten is used for thin-film coatings, particularly in semiconductor and electronics industries. Their durability and performance in high-temperature environments make them the go-to choice for many applications.

On the other hand, induction heating boats account for a smaller share of the market. Though they offer benefits such as faster heating times and more precise control over temperature distribution, they are more expensive and require more complex equipment. These boats are used in more specialized applications where precise control and energy efficiency are critical. However, the resistance heating boats remain the dominant choice due to their lower cost and reliability in mass production environments.

The electronic component application dominates the tungsten evaporation boat market, holding approximately 35.0% of the total market share. Tungsten evaporation boats are integral in the manufacturing of various electronic components, especially in processes like thin-film deposition used for semiconductors, sensors, and other electronic devices. The increasing demand for electronic products, coupled with advancements in technology, drives the demand for efficient and reliable tungsten boats in the electronics sector.

Other segments such as packaging materials, consumer goods, and other applications also contribute to the market, but they hold a smaller share compared to electronic components. Packaging materials require specialized coatings, which drive some demand for tungsten boats, while the consumer goods segment benefits from their use in high-performance coatings for various products. Despite these contributions, the electronic component application remains the largest driver of growth in the tungsten evaporation boat market.

The market is growing as manufacturers increasingly demand high‑purity evaporation boats made of tungsten for thin‑film deposition in electronics, optics and semiconductor sectors. These components offer features like exceptional thermal stability, high melting point and uniform evaporation performance. Key drivers include rising semiconductor fabrication, optical coating applications and advanced display manufacturing, while restraints stem from high material and fabrication costs and technical integration challenges.

Why Are Tungsten Evaporation Boats Gaining Popularity?

Tungsten evaporation boats are gaining popularity because they provide superior durability and performance in high‑temperature vacuum environments, which are common in semiconductor and thin‑film manufacturing. Their high melting point and excellent thermal conductivity allow for stable evaporation of materials without contamination or distortion. As device manufacturers push for smaller geometries, more uniform films and higher throughput, the reliability of tungsten boats becomes critical. Industries such as solar, aerospace and flexible electronics are adopting advanced coating technologies that require tungsten’s material properties. With the surge in demand for precision deposition and high‑purity components, tungsten evaporation boats have emerged as a preferred solution for high‑end applications.

How Are Material and Process Innovations Driving Growth in This Sector?

Material and process innovations are driving growth in the tungsten evaporation boat sector by improving design, fabrication and lifecycle performance. Advances in manufacturing methods such as precision machining of tungsten, enhanced metallurgical treatments, improved surface finishes and optimized geometry are allowing boats to operate at higher power, with greater uniformity and longer service life. Process enhancements in vacuum systems and coating lines also enable tungsten boats to integrate with automated deposition workflows and high‑volume manufacturing. In parallel, the rise of thin‑film applications in semiconductors, display panels and optical coatings expands the demand for tungsten boats capable of handling rigorous process cycles. These innovations expand application reach and enhance operational value, thus supporting market growth.

What Are the Key Challenges Impacting the Adoption of Tungsten Evaporation Boats?

Several challenges are limiting the broader adoption of tungsten evaporation boats. A significant barrier is the high cost of tungsten material and the complex fabrication required to produce boats with precise geometry and defect‑free surfaces. These costs raise the investment threshold for manufacturers, particularly in smaller or emerging fabrication facilities. Quality control is another issue ensuring the boats perform reliably under repeated high‑temperature cycles demands stringent production standards and inspection. Integrating tungsten boats into existing vacuum deposition systems may require process re‑qualification, which slows adoption. Supply‑chain vulnerabilities for tungsten and related alloys can also cause material price fluctuations and manufacturing delays. These factors collectively hinder rapid expansion in some segments of the market.

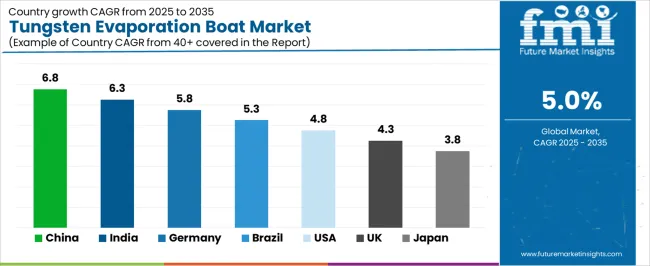

| Country | CAGR (%) |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

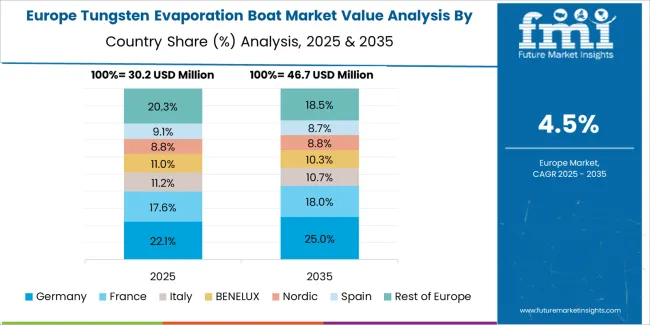

The global tungsten evaporation boat market is expanding with China in the lead at a 6.8% CAGR, driven by increasing demand for high‑performance materials in electronic, display and solar industries. India follows at 6.3%, supported by growing manufacturing and thin‑film processes. Germany grows at 5.8%, backed by precision engineering and additive manufacturing segments. Brazil advances at 5.3%, through rising infrastructure and industrial processing needs. The USA records 4.8%, influenced by semiconductor, aerospace and coating sectors. The UK and Japan grow at 4.3% and 3.8% respectively, reflecting mature markets focusing on high‑value manufacturing and advanced materials. Demand for tungsten boats remains strong as thermal stability and high‑temperature evaporation requirements rise.

Why is China Leading the Tungsten Evaporation Boat Market?

China is driving the growth of the tungsten evaporation boat market with a 6.8% CAGR. The country’s expansive manufacturing sector, particularly in electronics, solar panel production, and vacuum deposition, creates strong demand for these high-performance components. Tungsten evaporation boats are essential for thermal evaporation processes in physical vapor deposition (PVD) systems, where their high melting point and excellent thermal conductivity make them ideal for high-temperature applications. As China continues to expand its domestic production of displays, solar panels, and coatings, the need for reliable and durable evaporation boats rises.

China’s rapid industrialization and its push toward renewable energy sources like solar and wind power contribute significantly to the demand. As the demand for thin-film technologies in electronics and solar power generation increases, so too does the need for tungsten evaporation boats to support these processes. Moreover, China’s growing manufacturing base, along with its local supply chain and investment in automation, further strengthens its position in the global market. As the country remains focused on enhancing its capabilities in high-tech industries, the demand for tungsten evaporation boats will continue to grow, ensuring China maintains its leadership in this sector.

What Factors are Driving Growth in India’s Tungsten Evaporation Boat Market?

India is witnessing a 6.3% CAGR in the tungsten evaporation boat market, driven by expanding industries in electronics, solar, and manufacturing. The country's growing focus on high-tech manufacturing and renewable energy sources like solar power significantly boosts the demand for evaporation boats. As India continues to ramp up its solar module production and thin-film deposition technologies, the need for reliable and efficient evaporation systems has increased.

Tungsten evaporation boats are crucial for high-temperature applications, where they are used in vacuum deposition systems for coating and thin-film technology. India’s focus on domestic manufacturing, including initiatives like “Make in India,” is pushing for greater investment in modern infrastructure and high-quality production equipment. As more industries adopt vacuum coating and evaporation processes, demand for tungsten boats will rise steadily. As the country increases its renewable energy capacity, particularly in solar power, the integration of these energy sources requires efficient deposition systems that rely on high-performance components such as tungsten boats. India’s continued industrialization, combined with growing research and development in thin-film technologies, positions the country for continued growth in the tungsten evaporation boat market.

How is Germany Contributing to the Tungsten Evaporation Boat Market?

Germany is experiencing steady growth in the tungsten evaporation boat market, with a 5.8% CAGR, driven by its robust industrial base and advanced manufacturing sectors. The country’s automotive, aerospace, and electronics industries require high-performance materials for precision manufacturing, and tungsten evaporation boats play a crucial role in high-temperature deposition processes. Germany’s strong engineering capabilities and emphasis on sustainable, energy-efficient technologies make it a key player in the market. As Germany continues to lead in industrial automation, additive manufacturing, and high-precision engineering, the demand for reliable and efficient deposition systems grows.

Tungsten evaporation boats are used in physical vapor deposition (PVD) applications for thin-film coatings, ensuring the durability and performance of components in demanding environments. Germany’s commitment to renewable energy integration, especially in wind and solar power, contributes to the increasing use of thin-film technologies, which require tungsten-based evaporation boats. The country’s ongoing focus on clean energy solutions and advanced materials science further fuels the demand for high-quality, durable components used in vacuum coating systems. With its strong industrial heritage and commitment to innovation, Germany is well-positioned for continued growth in the tungsten evaporation boat market.

What is Driving Demand for Tungsten Evaporation Boats in Brazil?

Brazil is seeing moderate growth in the tungsten evaporation boat market, with a 5.3% CAGR, driven by the expansion of its industrial base and increasing demand for renewable energy solutions. Brazil’s key industries, such as oil and gas, mining, and automotive, require efficient cooling and deposition systems, where tungsten evaporation boats are critical components. The country's increasing focus on solar power and wind energy has created new opportunities for thin-film technologies, which rely on high-performance deposition systems. As Brazil invests in renewable energy, the demand for tungsten evaporation boats in solar module manufacturing and wind turbine components grows.

Brazil’s expanding industrial sector, including the automotive and electronics industries, drives the need for advanced materials and reliable manufacturing systems. Tungsten evaporation boats are used in the vacuum deposition processes for coatings and surface treatments, where their high thermal stability and durability are essential. With Brazil’s push for infrastructure development and growth in high-tech industries, the demand for tungsten evaporation boats will continue to rise. The country’s adoption of energy-efficient technologies and the expansion of its renewable energy projects will further accelerate market growth, solidifying Brazil’s position as a growing market for tungsten evaporation boats.

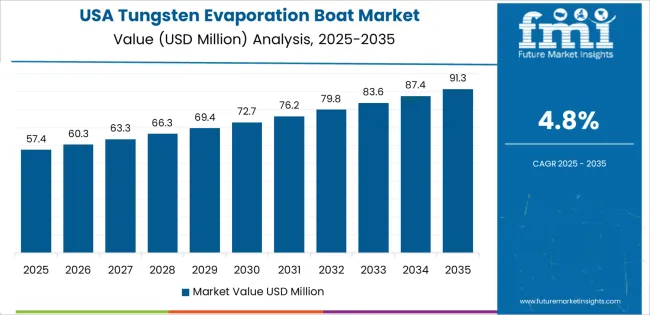

How is the USA Contributing to the Tungsten Evaporation Boat Market?

The USA is experiencing steady growth in the tungsten evaporation boat market, with a 4.8% CAGR, driven by its strong presence in the electronics, aerospace, and semiconductor industries. These sectors require advanced deposition systems for thin-film technologies, where tungsten evaporation boats play a vital role. As the USA continues to invest in cutting-edge manufacturing and research, the demand for high-quality evaporation components remains strong. Tungsten boats are widely used in vacuum deposition systems for coating various components, from sensors to semiconductor devices.

With the ongoing shift toward renewable energy and sustainable technology, especially in the solar power sector, the need for thin-film deposition equipment that uses tungsten evaporation boats has increased. The USA’s aerospace industry, which is a key consumer of high-temperature deposition systems, further supports the demand for these advanced components. The country’s focus on innovation and high-tech manufacturing, combined with a growing renewable energy market, drives the need for reliable, high-performance evaporation boats. As industries continue to prioritize energy efficiency and advanced materials, the USA’s tungsten evaporation boat market will continue to experience steady growth, supported by its technological advancements and demand for sustainable production processes.

What Factors are Influencing Growth in the UK’s Tungsten Evaporation Boat Market?

The UK is experiencing moderate growth in the tungsten evaporation boat market, with a 4.3% CAGR, driven by its focus on advanced manufacturing, research, and renewable energy. As the UK continues to prioritize sustainability and clean energy, the demand for thin-film deposition technologies in solar energy and electronic devices has increased. Tungsten evaporation boats are essential in vacuum deposition processes used for thin-film coatings in these sectors. The UK’s growing research and development capabilities in materials science and nanotechnology also contribute to the rising demand for tungsten boats.

The systems for precision manufacturing, further driving the use of tungsten evaporation boats. The UK’s commitment to achieving carbon reduction goals and embracing clean energy solutions supports the demand for renewable energy technologies that rely on thin-film technologies. The country’s industrial infrastructure, coupled with its focus on innovation, ensures a steady market for tungsten evaporation boats. As the UK continues to modernize its industrial processes and adopt energy-efficient technologies, the demand for reliable, high-performance materials like tungsten evaporation boats will continue to grow.

Why is Japan Seeing Steady Growth in the Tungsten Evaporation Boat Market?

Japan is witnessing steady growth in the tungsten evaporation boat market, with a 3.8% CAGR, driven by its strong manufacturing sectors, including automotive, electronics, and precision instruments. Japan’s industries rely heavily on thin-film deposition processes for components such as semiconductors, displays, and sensors, where tungsten evaporation boats are essential. The country’s advanced materials science and engineering capabilities support the use of tungsten boats in vacuum deposition systems, which are critical for producing high-performance components.

Japan’s growing focus on renewable energy, particularly solar and wind power, also contributes to the demand for tungsten evaporation boats, as thin-film technologies are increasingly used in solar panel manufacturing. Despite slower growth compared to other regions, Japan’s mature market continues to demand high-quality, durable evaporation components for research and industrial applications. The country’s emphasis on precision, innovation, and sustainability further supports steady market growth. As Japan continues to lead in advanced manufacturing and renewable energy development, the demand for tungsten evaporation boats will remain stable, ensuring their ongoing use in various high-tech applications.

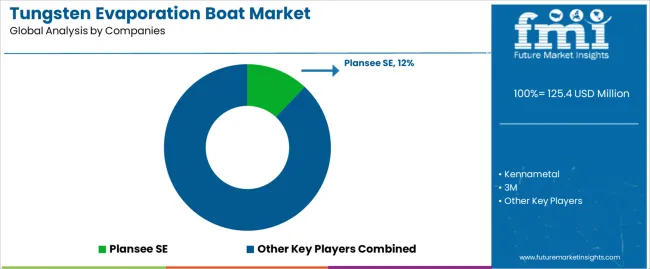

The tungsten evaporation boat market is competitive, with a range of key players providing high-quality products used in various industries, including electronics, coatings, and thin film deposition. Plansee SE leads the market with a 12% share, known for its expertise in the production of tungsten-based products. Plansee’s strong reputation for high-performance materials, precision manufacturing, and advanced technology makes it a leading supplier in the evaporation boat market.

Other prominent players include Kennametal, 3M, and PENSC, which are well-established in the materials and coatings sectors. Kennametal offers a range of tungsten-based products for various industrial applications, focusing on precision and durability. 3M, known for its innovation across multiple industries, also offers tungsten evaporation boats as part of its advanced materials portfolio. PENSC competes by providing tungsten boats tailored for specific coating and deposition processes, emphasizing quality and customer-specific solutions.

Regional players such as Orient Special Ceramics, Zibo Peida, and Qingzhou Dongshan also contribute to the market, focusing on cost-effective and reliable tungsten products. Companies like Achemetal, Jonye Ceramics, and ATTL provide specialized products for niche applications, offering competitive pricing and custom solutions. The market competition is driven by factors such as product quality, customization capabilities, and the increasing demand for advanced materials used in coating, electronics, and semiconductor industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Resistance Heating Boats, Induction Heating Boats |

| Application | Electronic Component, Packaging Materials, Consumer Goods, Other Applications |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Plansee SE, Kennametal, 3M, PENSC, Orient Special Ceramics, Zibo Peida, Qingzhou Dongshan, Achemetal, Jonye Ceramics, ATTL |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in tungsten evaporation boat technology, integration with semiconductor and electronic manufacturing. |

The global tungsten evaporation boat market is estimated to be valued at USD 125.4 million in 2025.

The market size for the tungsten evaporation boat market is projected to reach USD 204.2 million by 2035.

The tungsten evaporation boat market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in tungsten evaporation boat market are resistance heating boats and induction heating boats.

In terms of application, electronic component segment to command 35.0% share in the tungsten evaporation boat market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tungsten Metal Powder Market

Tungsten Disulphide Nanoparticles Market

Tungsten Carbide Market

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Boat Wiring Harness Market Size and Share Forecast Outlook 2025 to 2035

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Boat Trolling Motor Market Size and Share Forecast Outlook 2025 to 2035

Boat Control Lever Market Growth - Trends & Forecast 2025 to 2035

Boat Rental Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Boat Hook Market Growth - Trends & Forecast 2024 to 2034

Boat Console Market

Airboats Market

Sailboat Market Size and Share Forecast Outlook 2025 to 2035

Crew boats (Standby Crew Vessels) Market

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Korea Boat Trailer Market Growth – Trends & Forecast 2024-2034

Japan Boat Trailer Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA