The Automotive Fuel Gauge Sending Unit Market is set to witness gradual growth from 2025 until 2035. Since the automotive sector will continue emphasizing fuel efficiency and modern technologies, demand for fuel gauge sending units will increase.

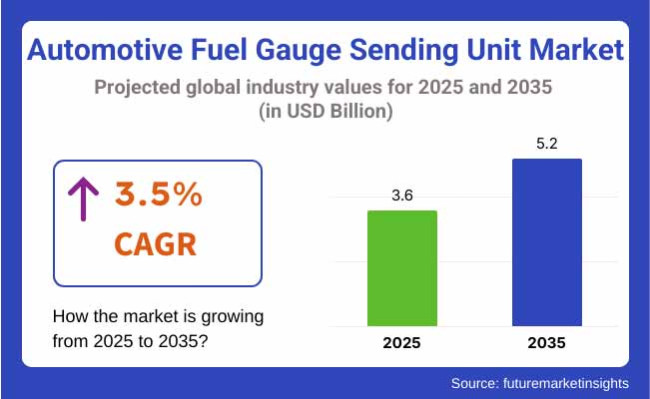

Through a compound annual growth rate (CAGR) of 3.5% between 2025 and 2035, the market will continue experiencing upgrades in fuel monitoring system accuracy and reliability.

Technological innovations in automotive electronics will propel progress, increasing the performance of fuel gauge units. The rising need for electric vehicles (EVs) will see fuel gauge systems incorporated into hybrid cars, and improvement in EV infrastructure will facilitate this. Manufacturers will potentially partner with OEMs to meet the changing demands of electric and hybrid cars.

The market will be around USD 3.6 billion by 2025, retaining its growth trajectory. The market will grow to around USD 5.2 billion by 2035, buoyed by ongoing technology developments and rising demand for fuel-efficient and electric vehicles.

The Automotive Fuel Gauge Sending Unit Market is set for steady growth, driven by increasing demand for fuel-efficient and electric vehicles. Technological advancements in automotive electronics and the shift toward hybrid and electric vehicle integration will be key drivers of this growth. Manufacturers focused on innovation and strategic partnerships with OEMs will benefit, while those slow to adapt to new technologies and the rise of electric vehicles may face challenges.

Demand for multiple fuel gauge sending unit technologies will keep increasing from 2025 to 2035, fueled by technological advancements in vehicle systems and the growth of more fuel-efficient and electric vehicles. Resistive fuel gauge sending unit will still be in demand because it is simple, inexpensive, and reliable in conventional vehicles.

Capacitive fuel gauge senders will grow in the high-end and hybrid vehicles as they provide enhanced precision and longer lifetimes. Ultrasonic fuel gauge senders will experience increased adoption as their contactless technology provides higher reliability and less mechanical failure. Hall effect fuel gauge senders will increase in use with their ability to provide extremely accurate measurements, particularly in the case of advanced fuel systems.

Optical fuel gauge sending units will serve specialty applications in high-performance, high-technology vehicles because of their high-end technologies and accuracy. Manufacturers will emphasize making these technologies a part of new models to satisfy changing consumer demands.

The in-tank versus external fuel gauge sending units choice will primarily be a function of the vehicle's fuel system design and functionality in the forecast period. In-tank fuel gauge sending units will remain the dominant choice as they can give more precise readings while being protected from external conditions.

This alignment minimizes the risk of wear or contamination and is suitable for most vehicles, including electric and conventional vehicles.

Remote fuel gauge sending units, although less frequent, will have use in certain vehicle designs, i.e., heavier trucks or specialty vehicles, where accessibility or space in the vehicle are top concerns and the fuel tank is not accessible.

The shift towards electric and hybrid vehicles will push some manufacturers to seek alternative tank placement options, but in-tank designs will continue to be the most favored option, considering their ruggedness and compatibility with contemporary automotive designs.

The automotive fuel gauge sending unit market will experience a sustained demand for gasoline and diesel-powered vehicles between 2025 and 2035. Gasoline vehicles will continue to be a major driver of market growth, with sustained demand from conventional passenger cars and light commercial vehicles.

The requirement for efficient and economical fuel gauge systems in gasoline vehicles will make the segment continue to grow consistently. Diesel cars, which find maximum usage in commercial and heavy-duty applications, will also push market growth, particularly in geographies where diesel is the choice of fuel. With the rest of the world shifting towards greener options, the "others" category, such as electric and hydrogen vehicles, will also become more noticeable, although it will be relatively smaller than that of gasoline and diesel.

As electric vehicle adoption continues to grow, fuel gauge sending units will be redesigned to address the specific requirements of these alternative fuel vehicles to provide for their seamless integration into upcoming vehicle models.

Passenger cars will maintain leadership in the automotive fuel gauge sending unit market from 2025 to 2035 based on the steady need for conventional and electric cars. The shift toward electric vehicles will generate new demand for fuel gauge technologies tailored specifically to electric vehicle models. When hybrid and complete electric cars increase their usage base, fuel gauge systems must adopt alternative energy storage and consumption paradigms.

Light commercial vehicles will also continue to witness growth in demand for fuel gauge sending units, as fleet operators prioritize greater fuel efficiency and cost minimization. Heavy commercial vehicles, trucks, and buses will have consistent demand for robust and reliable fuel gauge units, especially in high-logistics and transportation demand markets.

As automobile technology improves and the market moves toward more environmentally friendly choices, manufacturers will keep pushing the limits to address the varied demands of all types of automobiles, providing accuracy, dependability, and efficiency in their fuel monitoring systems.

Invest in Advanced Fuel Gauge Technologies

Executives should prioritize investments in next-generation fuel gauge technologies such as capacitive, ultrasonic, and optical sensors to enhance accuracy and reliability. As consumer preferences shift towards electric and hybrid vehicles, these advanced technologies will be crucial in maintaining competitive advantage. Stakeholders should also allocate resources to R&D for integrating these systems into future vehicle models, ensuring they align with emerging trends in automotive electronics.

Align with EV and Hybrid Market Shifts

With the automotive industry’s pivot toward electric and hybrid vehicles, stakeholders must align their product offerings to cater to this evolving market. Executives should focus on developing fuel gauge systems designed for electric vehicle energy storage solutions, ensuring that their products meet the needs of modern powertrains. Building partnerships with OEMs who specialize in hybrid and electric vehicles will position stakeholders to benefit from the accelerating adoption of these vehicles.

Focus on Strategic Partnerships and Acquisitions

To stay ahead of market trends, stakeholders should focus on forming strategic partnerships with key OEMs, tech innovators, and system integrators. Collaborating on joint ventures or acquisitions will provide the necessary technological resources and market presence to compete effectively. Additionally, investing in R&D for fuel gauge systems that support future vehicle types, including electric and hydrogen-powered vehicles, will offer long-term growth opportunities.

| Risk | Probability-Impact |

|---|---|

| Technological Obsolescence | High-High |

| Slow Adoption of Electric Vehicles | Medium-High |

| Supply Chain Disruptions | Medium-Medium |

1-Year Executive Watchlist

| Priority Item | Immediate Action |

|---|---|

| Invest in Next-Gen Fuel Gauge Tech | Run feasibility study for capacitive and ultrasonic sensors development |

| Align with EV Trends | Initiate partnerships with EV manufacturers for co-development of fuel gauge systems |

| Explore M&A Opportunities | Evaluate acquisition targets in EV and hybrid vehicle components |

The automotive fuel gauge sending unit industry stands at the cusp of change as the adoption of electric and hybrid cars gains momentum. Management should replot their approach to focus more on high-tech fuel gauge technology that corresponds with such developments.

Forming strategic partnerships with hybrid and electric vehicle players, coupled with investments in next-generation sensor technology, will ensure the business for sustainable growth and market differentiation. Furthermore, investigating possible acquisitions or joint ventures will improve technological advancement and market presence, guaranteeing leadership in a fast-growing market.

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, OEMs, and automotive industry experts, across the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance

Convergent and Divergent Perspectives on ROI

69% of USA stakeholders view advanced sensor technologies as "worth the investment" for long-term fuel management benefits, whereas 41% in Japan still rely on basic systems.

Consensus

Steel: Chosen by 60% of stakeholders due to its durability, especially for high-performance vehicles and trucks.

Variance

Shared Challenges

82% cited rising costs of raw materials (steel up 30%, aluminum up 18%) as a key challenge for price-sensitive vehicle segments.

Regional Differences

Manufacturers

Distributors

End-Users (OEMs and Automotive Manufacturers)

Alignment

70% of global manufacturers plan to invest in advanced sensor R&D to cater to evolving electric vehicle demands.

Divergence

USA

66% of stakeholders believe stricter emissions and fuel economy regulations (e.g., CAFE standards) will drive demand for more efficient and reliable fuel gauge systems.

Western Europe

79% view the EU’s tighter emissions standards as a driver for technological innovation in fuel systems, which includes the development of more precise fuel monitoring systems.

Japan/South Korea

42% report that government regulations have influenced their purchasing decisions, particularly concerning compliance with fuel economy standards and vehicle safety requirements.

High Consensus

Global stakeholders agree on the importance of durability, accuracy, and compliance with emerging regulatory standards as essential drivers in the automotive fuel gauge sending unit market.

Key Variances

Strategic Insight

A "one-size-fits-all" approach is not suitable for this market. Stakeholders must adapt their product offerings to regional preferences, whether focusing on advanced technologies in the USA, sustainability in Europe, or cost-effective designs in Asia.

| Countries | Impact of Policies and Regulations |

|---|---|

| United States | Tighter fuel economy and emissions standards (e.g., CAFE regulations) are increasing demand for improved and precise fuel gauge systems. State vehicle safety legislation (e.g., California's CARB standards) is also impacting product design. OEMs are having to incorporate sophisticated sensor technologies in fuel systems to achieve efficiency objectives more and more. |

| Western Europe | EU legislation to reduce carbon emissions (e.g., EU 2023 to 2027 Animal Welfare and Green Deal Regulations) push manufacturers toward environmentally friendly materials and technologies. EU fuel economy regulation and EV introduction are pushing fuel gauge system innovation. EU vehicle regulation compliance certification (CE marking, REACH) is mandatory for market access. |

| Japan | Japan has implemented measures to enhance fuel efficiency and cut emissions, particularly for hybrid and electric cars, impacting fuel gauge technology development. Policies that support the use of clean technologies in vehicles, such as the target of 2030 zero-emission vehicles, compel OEMs to implement correct and sophisticated fuel monitoring systems. Japan's regulators demand certifications like JIS (Japanese Industrial Standards) for auto parts. |

| South Korea | South Korea is focusing on promoting electric vehicle adoption and improving energy efficiency, which influences the demand for fuel gauge sending units capable of working in EVs. The government's "Green New Deal" includes provisions for clean energy technologies in the automotive sector. South Korea also requires compliance with K-Mark certification for automotive products and safety standards for component approval. |

| China | China’s policies to cut emissions and improve vehicle fuel efficiency are pushing for more accurate and efficient fuel gauge systems. With the rapid growth in electric vehicles, regulations are driving the adoption of specialized fuel monitoring technologies. Mandatory certifications like CCC (China Compulsory Certification) are required for components, including fuel gauge systems, before they can be sold in the market. |

| India | India’s push toward reducing carbon emissions, especially with the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, impacts the demand for fuel gauge units in electric and hybrid vehicles. Regulatory requirements also push manufacturers to ensure high fuel efficiency in vehicles. The BIS (Bureau of Indian Standards) certification is necessary for automotive components to meet national safety and quality standards. |

| Company Name | Market Share (%) |

|---|---|

| Honeywell International Inc. | 27% |

| Bosch Mobility Solutions | 22% |

| Magneti Marelli S.p.A. | 17% |

| Denso Corporation | 13% |

| Continental AG | 10% |

| Delphi Technologies | 8% |

| ZF Friedrichshafen AG | 3% |

Key Developments (Mergers, Acquisitions, Partnerships) in 2024

The USA automotive fuel gauge sending unit market is anticipated to record a compound annual growth rate (CAGR) of 4.5% during the period of 2025 to 2035. This, however, is largely influenced by the rising need for sophisticated fuel management systems, particularly with electric vehicles (EVs) and hybrid cars increasingly gaining traction in the automobile industry.

Being one of the world's largest automotive markets, the USA is experiencing a fast shift towards connected cars, where sophisticated sensors are emerging as a key element. Moreover, the drive towards sustainability and increasing government regulations on fuel efficiency and emissions is prompting automakers to incorporate more precise fuel gauge systems.

The relentless progress in IoT and sensor technology also adds to the growth of the market. With the expanding market for EVs, demand for fuel gauge sending units with the ability to read battery level and energy consumption in real-time will keep rising, providing consistent demand for novel solutions.

The UK automotive fuel gauge sending unit market is expected to grow at a CAGR of 3.8% between 2025 and 2035. The UK automotive sector is undergoing a change, with higher usage of hybrid and electric vehicles, which is being largely influenced by the government policies that focus on reducing carbon emissions.

The government initiative for electrification, in the form of the Road to Zero strategy, is assisting in defining the market for fuel gauge systems as OEMs transition to more stringent environmental regulations.

Furthermore, the emphasis of UK automobile industry's emphasis on ensuring better vehicle safety features is nudging the implementation of more developed sensor technologies into fuel gauge send-out units.

With improvements in the accuracy and real-time status of sensors making greater impacts in everyday life, manufacturers in the UK are setting sights on combining such technologies within their vehicles. With consumer orientations gravitating in favor of electric cars, more novel fuel management systems with efficient battery and fuel status reading accuracy will propel market demand further ahead.

In France, the automotive fuel gauge sending unit market is anticipated to expand at a CAGR of 4.0% during the period 2025 to 2035. France is among the top European countries with a strong automotive production industry, especially in electric vehicle manufacturing. With the European Union's ambitious carbon-reduction goals and France's focus on green technologies, the market is witnessing growing demand for advanced fuel gauge systems that support electric and hybrid vehicles.

As part of its European Green Deal, France also pledged to add more zero-emission vehicles on the road by 2035, which is driving innovation in the automotive fuel gauge market. French manufacturers are investing in advanced sensor technologies next generation that will work seamlessly with battery management systems in electric cars. This movement, coupled with growing consumer demand for more precise fuel and energy measurements, is driving the country's market expansion.

Germany's automotive fuel gauge sending unit market will grow at a CAGR of 4.2% during the period 2025 to 2035. Being the largest automobile producer in Europe, Germany is a key driver of the global automotive industry. The focus of the country on high-tech technologies, especially in electric and hybrid cars, is fueling the need for sophisticated fuel gauge technologies.

With German car behemoths like Volkswagen, BMW, and Daimler placing greater emphasis on sustainability and electric mobility, demand is on the rise for sophisticated fuel gauge sending units that can measure fuel as well as battery levels accurately. In addition, Germany's efforts to achieve European Union emissions reduction goals are driving the market towards efficient fuel monitoring solutions.

The adoption of IoT-based solutions and real-time monitoring for fuel and electric power consumption is projected to be one of the main drivers of growth over the next few years, making Germany a prime industry player in the worldwide fuel gauge market.

Italy's automotive fuel gauge sending unit market is expected to register a CAGR of 3.6% during the period from 2025 to 2035. The automotive industry in the country, renowned for its design and innovation, is witnessing massive investments in electric vehicle technologies, thereby boosting the demand for more sophisticated fuel management systems.

As Italy is concentrating on lowering carbon emissions and promoting the use of hybrid and electric cars, the demand for precise and effective fuel gauge sending units is becoming increasingly important. Italian automobile makers are especially interested in adopting fuel and energy management systems that can enable the operation of electric powertrains within EVs.

Additionally, Italy's continued emphasis on EU standards on sustainability and fuel efficiency is stimulating the adoption and development of intelligent fuel gauge systems. Consequently, the market will see continuous growth with accelerating technology adoption, particularly in hybrid and electric car applications.

The automotive fuel gauge sending unit market in New Zealand is expected to grow at a CAGR of 3.0% from 2025 to 2035. As a smaller automotive market compared to other countries, New Zealand’s growth is primarily driven by the gradual adoption of electric vehicles, spurred by government incentives and environmental initiatives.

New Zealand’s commitment to reducing carbon emissions aligns with the global push for more sustainable transportation solutions, which is accelerating the demand for advanced fuel gauge systems that can monitor both fuel and battery usage in electric vehicles.

Although the adoption rate of electric vehicles in New Zealand is currently lower compared to other markets, it is anticipated to rise significantly in the coming years as infrastructure for EVs improves. Additionally, New Zealand’s automotive sector is increasingly focusing on integrating technologies that support real-time fuel monitoring and efficient energy management in vehicles, which will further drive the market for fuel gauge sending units.

The South Korean automotive fuel gauge sending unit market is expected to expand at a CAGR of 4.3% between 2025 and 2035. South Korea is one of the world's most significant players in the automotive industry, with leading automakers such as Hyundai and Kia spearheading the production of electric and hybrid vehicles.

South Korean vehicle manufacturers are concentrating on adding leading-edge sensor technologies to their cars in order to meet enhanced environment regulations and customer demands for accuracy and reliability. In addition, the emphasis of the government on clean energy and lowering carbon emission levels is propelling the adoption of electric vehicles, which in turn is boosting demand for next-generation fuel gauge technologies. This drive towards electric mobility is a leading reason for South Korea's strong market growth in this industry.

Japan’s automotive fuel gauge sending unit market is expected to grow at a CAGR of 3.5% from 2025 to 2035. Japan’s automotive sector is dominated by technological innovation, with companies such as Toyota and Honda leading the way in hybrid and electric vehicle production. The country is pushing for more eco-friendly transportation solutions, including the adoption of fuel-efficient technologies and electric vehicles, which is driving demand for advanced fuel gauge systems.

Japan’s focus on developing hydrogen-powered vehicles and increasing the market share of hybrid cars also emphasizes the need for accurate fuel monitoring systems. However, Japan’s automotive market is also characterized by slower adoption of advanced technologies compared to some Western countries, with a preference for cost-effective solutions.

Nonetheless, the growing adoption of electric and hybrid vehicles, coupled with government incentives for green technologies, is expected to drive steady growth in the automotive fuel gauge sending unit market in Japan.

China's automotive fuel gauge sending unit market will increase at a rate of 5.0% CAGR during 2025 to 2035, the highest among significant markets. Being the world's largest automotive market, China is spearheading the global shift towards electric vehicles (EVs), and the government strongly supports this with subsidies, tax relief, and infrastructure development. China's focus on carbon reductions and fuel efficiency is driving demand for more advanced fuel gauge technologies capable of supporting EV and hybrid vehicle manufacturing.

The nation's quick adoption of electric mobility, especially in urban regions, is triggering a massive market for fuel gauge sending units that are specifically for battery management as well as real-time monitoring of energy. China's automotive companies also heavily invest in R&D to create fuel gauge systems that will cater to the demands of both traditional and electric powertrains, triggering immense growth in the market.

The automotive fuel gauge sending unit industry in Australia is set to expand at a CAGR of 3.4% during 2025 to 2035. The automobile market in Australia is transforming, with an increasing emphasis on sustainability and a slow transition towards electric vehicles.

Although the uptake of electric vehicles is slower in Australia than other nations, government incentives and infrastructure spending are predicted to drive EV adoption over the next few years, supporting demand growth for sophisticated fuel monitoring systems. Australia's automotive industry is also concerned with fuel efficiency and compliance with tight emissions standards, driving demand for more precise fuel gauge systems.

The convergence of IoT-based solutions and real-time monitoring in fuel gauge systems is likely to be a key driver in this market, as Australian manufacturers look to improve the performance and reliability of their vehicles. With increasing environmental consciousness, the fuel gauge sending unit market is likely to see steady growth over the next decade.

Resistive Fuel Gauge Sending Unit, Capacitive Fuel Gauge Sending Unit, Ultrasonic Fuel Gauge Sending Unit, Hall Effect Fuel Gauge Sending Unit, Optical Fuel Gauge Sending Unit

In-Tank Fuel Gauge Sending Unit, External Fuel Gauge Sending Unit

Gasoline, Diesel, Others

Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, The Middle East & Africa

Automotive fuel gauge sending units utilize various technologies, including resistive, capacitive, ultrasonic, Hall Effect, and optical systems. These technologies allow for precise and reliable fuel level monitoring, ensuring that the vehicle operates efficiently and safely.

Automotive fuel gauge sending units are used in a wide range of vehicles, including passenger cars, light commercial vehicles, and heavy commercial vehicles. As electric and hybrid vehicles become more common, these units are also adapting to monitor both fuel and battery levels in EVs.

Advanced fuel gauge sending units provide improved accuracy in fuel level readings, help optimize fuel usage and ensure better vehicle performance. With newer technologies like ultrasonic and Hall Effect systems, these units offer more precise data, contributing to better fuel efficiency and enhanced user experience.

The automotive fuel gauge sending unit contributes to vehicle safety by providing real-time data on fuel levels, preventing unexpected fuel shortages. It ensures drivers can monitor their fuel usage accurately, preventing issues related to running out of fuel unexpectedly or inefficient fuel management.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 & 2032

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2017 & 2032

Table 4: Global Market Volume (Tons) Forecast by Technology, 2017 & 2032

Table 5: Global Market Value (US$ Million) Forecast by Fuel Tank Position, 2017 & 2032

Table 6: Global Market Volume (Tons) Forecast by Fuel Tank Position, 2017 & 2032

Table 7: Global Market Value (US$ Million) Forecast by Fuel Type, 2017 & 2032

Table 8: Global Market Volume (Tons) Forecast by Fuel Type, 2017 & 2032

Table 9: Global Market Value (US$ Million) Forecast by Vehicle Type, 2017 & 2032

Table 10: Global Market Volume (Tons) Forecast by Vehicle Type, 2017 & 2032

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 12: North America Market Volume (Tons) Forecast by Country, 2017 & 2032

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2017 & 2032

Table 14: North America Market Volume (Tons) Forecast by Technology, 2017 & 2032

Table 15: North America Market Value (US$ Million) Forecast by Fuel Tank Position, 2017 & 2032

Table 16: North America Market Volume (Tons) Forecast by Fuel Tank Position, 2017 & 2032

Table 17: North America Market Value (US$ Million) Forecast by Fuel Type, 2017 & 2032

Table 18: North America Market Volume (Tons) Forecast by Fuel Type, 2017 & 2032

Table 19: North America Market Value (US$ Million) Forecast by Vehicle Type, 2017 & 2032

Table 20: North America Market Volume (Tons) Forecast by Vehicle Type, 2017 & 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2017 & 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Technology, 2017 & 2032

Table 24: Latin America Market Volume (Tons) Forecast by Technology, 2017 & 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Fuel Tank Position, 2017 & 2032

Table 26: Latin America Market Volume (Tons) Forecast by Fuel Tank Position, 2017 & 2032

Table 27: Latin America Market Value (US$ Million) Forecast by Fuel Type, 2017 & 2032

Table 28: Latin America Market Volume (Tons) Forecast by Fuel Type, 2017 & 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2017 & 2032

Table 30: Latin America Market Volume (Tons) Forecast by Vehicle Type, 2017 & 2032

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2017 & 2032

Table 33: Western Europe Market Value (US$ Million) Forecast by Technology, 2017 & 2032

Table 34: Western Europe Market Volume (Tons) Forecast by Technology, 2017 & 2032

Table 35: Western Europe Market Value (US$ Million) Forecast by Fuel Tank Position, 2017 & 2032

Table 36: Western Europe Market Volume (Tons) Forecast by Fuel Tank Position, 2017 & 2032

Table 37: Western Europe Market Value (US$ Million) Forecast by Fuel Type, 2017 & 2032

Table 38: Western Europe Market Volume (Tons) Forecast by Fuel Type, 2017 & 2032

Table 39: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2017 & 2032

Table 40: Western Europe Market Volume (Tons) Forecast by Vehicle Type, 2017 & 2032

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2017 & 2032

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2017 & 2032

Table 44: Eastern Europe Market Volume (Tons) Forecast by Technology, 2017 & 2032

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Fuel Tank Position, 2017 & 2032

Table 46: Eastern Europe Market Volume (Tons) Forecast by Fuel Tank Position, 2017 & 2032

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Fuel Type, 2017 & 2032

Table 48: Eastern Europe Market Volume (Tons) Forecast by Fuel Type, 2017 & 2032

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2017 & 2032

Table 50: Eastern Europe Market Volume (Tons) Forecast by Vehicle Type, 2017 & 2032

Table 51: East Asia Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 52: East Asia Market Volume (Tons) Forecast by Country, 2017 & 2032

Table 53: East Asia Market Value (US$ Million) Forecast by Technology, 2017 & 2032

Table 54: East Asia Market Volume (Tons) Forecast by Technology, 2017 & 2032

Table 55: East Asia Market Value (US$ Million) Forecast by Fuel Tank Position, 2017 & 2032

Table 56: East Asia Market Volume (Tons) Forecast by Fuel Tank Position, 2017 & 2032

Table 57: East Asia Market Value (US$ Million) Forecast by Fuel Type, 2017 & 2032

Table 58: East Asia Market Volume (Tons) Forecast by Fuel Type, 2017 & 2032

Table 59: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2017 & 2032

Table 60: East Asia Market Volume (Tons) Forecast by Vehicle Type, 2017 & 2032

Table 61: South Asia Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 62: South Asia Market Volume (Tons) Forecast by Country, 2017 & 2032

Table 63: South Asia Market Value (US$ Million) Forecast by Technology, 2017 & 2032

Table 64: South Asia Market Volume (Tons) Forecast by Technology, 2017 & 2032

Table 65: South Asia Market Value (US$ Million) Forecast by Fuel Tank Position, 2017 & 2032

Table 66: South Asia Market Volume (Tons) Forecast by Fuel Tank Position, 2017 & 2032

Table 67: South Asia Market Value (US$ Million) Forecast by Fuel Type, 2017 & 2032

Table 68: South Asia Market Volume (Tons) Forecast by Fuel Type, 2017 & 2032

Table 69: South Asia Market Value (US$ Million) Forecast by Vehicle Type, 2017 & 2032

Table 70: South Asia Market Volume (Tons) Forecast by Vehicle Type, 2017 & 2032

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 72: MEA Market Volume (Tons) Forecast by Country, 2017 & 2032

Table 73: MEA Market Value (US$ Million) Forecast by Technology, 2017 & 2032

Table 74: MEA Market Volume (Tons) Forecast by Technology, 2017 & 2032

Table 75: MEA Market Value (US$ Million) Forecast by Fuel Tank Position, 2017 & 2032

Table 76: MEA Market Volume (Tons) Forecast by Fuel Tank Position, 2017 & 2032

Table 77: MEA Market Value (US$ Million) Forecast by Fuel Type, 2017 & 2032

Table 78: MEA Market Volume (Tons) Forecast by Fuel Type, 2017 & 2032

Table 79: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2017 & 2032

Table 80: MEA Market Volume (Tons) Forecast by Vehicle Type, 2017 & 2032

Figure 1: Global Market Value (US$ Million) by Technology, 2022 & 2032

Figure 2: Global Market Value (US$ Million) by Fuel Tank Position, 2022 & 2032

Figure 3: Global Market Value (US$ Million) by Fuel Type, 2022 & 2032

Figure 4: Global Market Value (US$ Million) by Vehicle Type, 2022 & 2032

Figure 5: Global Market Value (US$ Million) by Region, 2022 & 2032

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 7: Global Market Volume (Tons) Analysis by Region, 2017 & 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 10: Global Market Value (US$ Million) Analysis by Technology, 2017 & 2032

Figure 11: Global Market Volume (Tons) Analysis by Technology, 2017 & 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology, 2022 & 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis by Fuel Tank Position, 2017 & 2032

Figure 15: Global Market Volume (Tons) Analysis by Fuel Tank Position, 2017 & 2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Fuel Tank Position, 2022 & 2032

Figure 17: Global Market Y-o-Y Growth (%) Projections by Fuel Tank Position, 2022 to 2032

Figure 18: Global Market Value (US$ Million) Analysis by Fuel Type, 2017 & 2032

Figure 19: Global Market Volume (Tons) Analysis by Fuel Type, 2017 & 2032

Figure 20: Global Market Value Share (%) and BPS Analysis by Fuel Type, 2022 & 2032

Figure 21: Global Market Y-o-Y Growth (%) Projections by Fuel Type, 2022 to 2032

Figure 22: Global Market Value (US$ Million) Analysis by Vehicle Type, 2017 & 2032

Figure 23: Global Market Volume (Tons) Analysis by Vehicle Type, 2017 & 2032

Figure 24: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 & 2032

Figure 25: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 26: Global Market Attractiveness by Technology, 2022 to 2032

Figure 27: Global Market Attractiveness by Fuel Tank Position, 2022 to 2032

Figure 28: Global Market Attractiveness by Fuel Type, 2022 to 2032

Figure 29: Global Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 30: Global Market Attractiveness by Region, 2022 to 2032

Figure 31: North America Market Value (US$ Million) by Technology, 2022 & 2032

Figure 32: North America Market Value (US$ Million) by Fuel Tank Position, 2022 & 2032

Figure 33: North America Market Value (US$ Million) by Fuel Type, 2022 & 2032

Figure 34: North America Market Value (US$ Million) by Vehicle Type, 2022 & 2032

Figure 35: North America Market Value (US$ Million) by Country, 2022 & 2032

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 37: North America Market Volume (Tons) Analysis by Country, 2017 & 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 40: North America Market Value (US$ Million) Analysis by Technology, 2017 & 2032

Figure 41: North America Market Volume (Tons) Analysis by Technology, 2017 & 2032

Figure 42: North America Market Value Share (%) and BPS Analysis by Technology, 2022 & 2032

Figure 43: North America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 44: North America Market Value (US$ Million) Analysis by Fuel Tank Position, 2017 & 2032

Figure 45: North America Market Volume (Tons) Analysis by Fuel Tank Position, 2017 & 2032

Figure 46: North America Market Value Share (%) and BPS Analysis by Fuel Tank Position, 2022 & 2032

Figure 47: North America Market Y-o-Y Growth (%) Projections by Fuel Tank Position, 2022 to 2032

Figure 48: North America Market Value (US$ Million) Analysis by Fuel Type, 2017 & 2032

Figure 49: North America Market Volume (Tons) Analysis by Fuel Type, 2017 & 2032

Figure 50: North America Market Value Share (%) and BPS Analysis by Fuel Type, 2022 & 2032

Figure 51: North America Market Y-o-Y Growth (%) Projections by Fuel Type, 2022 to 2032

Figure 52: North America Market Value (US$ Million) Analysis by Vehicle Type, 2017 & 2032

Figure 53: North America Market Volume (Tons) Analysis by Vehicle Type, 2017 & 2032

Figure 54: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 & 2032

Figure 55: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 56: North America Market Attractiveness by Technology, 2022 to 2032

Figure 57: North America Market Attractiveness by Fuel Tank Position, 2022 to 2032

Figure 58: North America Market Attractiveness by Fuel Type, 2022 to 2032

Figure 59: North America Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 60: North America Market Attractiveness by Country, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) by Technology, 2022 & 2032

Figure 62: Latin America Market Value (US$ Million) by Fuel Tank Position, 2022 & 2032

Figure 63: Latin America Market Value (US$ Million) by Fuel Type, 2022 & 2032

Figure 64: Latin America Market Value (US$ Million) by Vehicle Type, 2022 & 2032

Figure 65: Latin America Market Value (US$ Million) by Country, 2022 & 2032

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2017 & 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 70: Latin America Market Value (US$ Million) Analysis by Technology, 2017 & 2032

Figure 71: Latin America Market Volume (Tons) Analysis by Technology, 2017 & 2032

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Technology, 2022 & 2032

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) Analysis by Fuel Tank Position, 2017 & 2032

Figure 75: Latin America Market Volume (Tons) Analysis by Fuel Tank Position, 2017 & 2032

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Fuel Tank Position, 2022 & 2032

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Fuel Tank Position, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) Analysis by Fuel Type, 2017 & 2032

Figure 79: Latin America Market Volume (Tons) Analysis by Fuel Type, 2017 & 2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Fuel Type, 2022 & 2032

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Fuel Type, 2022 to 2032

Figure 82: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2017 & 2032

Figure 83: Latin America Market Volume (Tons) Analysis by Vehicle Type, 2017 & 2032

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 & 2032

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 86: Latin America Market Attractiveness by Technology, 2022 to 2032

Figure 87: Latin America Market Attractiveness by Fuel Tank Position, 2022 to 2032

Figure 88: Latin America Market Attractiveness by Fuel Type, 2022 to 2032

Figure 89: Latin America Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 90: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 91: Western Europe Market Value (US$ Million) by Technology, 2022 & 2032

Figure 92: Western Europe Market Value (US$ Million) by Fuel Tank Position, 2022 & 2032

Figure 93: Western Europe Market Value (US$ Million) by Fuel Type, 2022 & 2032

Figure 94: Western Europe Market Value (US$ Million) by Vehicle Type, 2022 & 2032

Figure 95: Western Europe Market Value (US$ Million) by Country, 2022 & 2032

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2017 & 2032

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 100: Western Europe Market Value (US$ Million) Analysis by Technology, 2017 & 2032

Figure 101: Western Europe Market Volume (Tons) Analysis by Technology, 2017 & 2032

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2022 & 2032

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 104: Western Europe Market Value (US$ Million) Analysis by Fuel Tank Position, 2017 & 2032

Figure 105: Western Europe Market Volume (Tons) Analysis by Fuel Tank Position, 2017 & 2032

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Fuel Tank Position, 2022 & 2032

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Fuel Tank Position, 2022 to 2032

Figure 108: Western Europe Market Value (US$ Million) Analysis by Fuel Type, 2017 & 2032

Figure 109: Western Europe Market Volume (Tons) Analysis by Fuel Type, 2017 & 2032

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Fuel Type, 2022 & 2032

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Fuel Type, 2022 to 2032

Figure 112: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2017 & 2032

Figure 113: Western Europe Market Volume (Tons) Analysis by Vehicle Type, 2017 & 2032

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 & 2032

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 116: Western Europe Market Attractiveness by Technology, 2022 to 2032

Figure 117: Western Europe Market Attractiveness by Fuel Tank Position, 2022 to 2032

Figure 118: Western Europe Market Attractiveness by Fuel Type, 2022 to 2032

Figure 119: Western Europe Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 120: Western Europe Market Attractiveness by Country, 2022 to 2032

Figure 121: Eastern Europe Market Value (US$ Million) by Technology, 2022 & 2032

Figure 122: Eastern Europe Market Value (US$ Million) by Fuel Tank Position, 2022 & 2032

Figure 123: Eastern Europe Market Value (US$ Million) by Fuel Type, 2022 & 2032

Figure 124: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2022 & 2032

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2022 & 2032

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2017 & 2032

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2017 & 2032

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Technology, 2017 & 2032

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2022 & 2032

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Fuel Tank Position, 2017 & 2032

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Fuel Tank Position, 2017 & 2032

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Fuel Tank Position, 2022 & 2032

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Fuel Tank Position, 2022 to 2032

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Fuel Type, 2017 & 2032

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Fuel Type, 2017 & 2032

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Fuel Type, 2022 & 2032

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Fuel Type, 2022 to 2032

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2017 & 2032

Figure 143: Eastern Europe Market Volume (Tons) Analysis by Vehicle Type, 2017 & 2032

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 & 2032

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 146: Eastern Europe Market Attractiveness by Technology, 2022 to 2032

Figure 147: Eastern Europe Market Attractiveness by Fuel Tank Position, 2022 to 2032

Figure 148: Eastern Europe Market Attractiveness by Fuel Type, 2022 to 2032

Figure 149: Eastern Europe Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 150: Eastern Europe Market Attractiveness by Country, 2022 to 2032

Figure 151: East Asia Market Value (US$ Million) by Technology, 2022 & 2032

Figure 152: East Asia Market Value (US$ Million) by Fuel Tank Position, 2022 & 2032

Figure 153: East Asia Market Value (US$ Million) by Fuel Type, 2022 & 2032

Figure 154: East Asia Market Value (US$ Million) by Vehicle Type, 2022 & 2032

Figure 155: East Asia Market Value (US$ Million) by Country, 2022 & 2032

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 157: East Asia Market Volume (Tons) Analysis by Country, 2017 & 2032

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 160: East Asia Market Value (US$ Million) Analysis by Technology, 2017 & 2032

Figure 161: East Asia Market Volume (Tons) Analysis by Technology, 2017 & 2032

Figure 162: East Asia Market Value Share (%) and BPS Analysis by Technology, 2022 & 2032

Figure 163: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 164: East Asia Market Value (US$ Million) Analysis by Fuel Tank Position, 2017 & 2032

Figure 165: East Asia Market Volume (Tons) Analysis by Fuel Tank Position, 2017 & 2032

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Fuel Tank Position, 2022 & 2032

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Fuel Tank Position, 2022 to 2032

Figure 168: East Asia Market Value (US$ Million) Analysis by Fuel Type, 2017 & 2032

Figure 169: East Asia Market Volume (Tons) Analysis by Fuel Type, 2017 & 2032

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Fuel Type, 2022 & 2032

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Fuel Type, 2022 to 2032

Figure 172: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2017 & 2032

Figure 173: East Asia Market Volume (Tons) Analysis by Vehicle Type, 2017 & 2032

Figure 174: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 & 2032

Figure 175: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 176: East Asia Market Attractiveness by Technology, 2022 to 2032

Figure 177: East Asia Market Attractiveness by Fuel Tank Position, 2022 to 2032

Figure 178: East Asia Market Attractiveness by Fuel Type, 2022 to 2032

Figure 179: East Asia Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 180: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 181: South Asia Market Value (US$ Million) by Technology, 2022 & 2032

Figure 182: South Asia Market Value (US$ Million) by Fuel Tank Position, 2022 & 2032

Figure 183: South Asia Market Value (US$ Million) by Fuel Type, 2022 & 2032

Figure 184: South Asia Market Value (US$ Million) by Vehicle Type, 2022 & 2032

Figure 185: South Asia Market Value (US$ Million) by Country, 2022 & 2032

Figure 186: South Asia Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 187: South Asia Market Volume (Tons) Analysis by Country, 2017 & 2032

Figure 188: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 189: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 190: South Asia Market Value (US$ Million) Analysis by Technology, 2017 & 2032

Figure 191: South Asia Market Volume (Tons) Analysis by Technology, 2017 & 2032

Figure 192: South Asia Market Value Share (%) and BPS Analysis by Technology, 2022 & 2032

Figure 193: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 194: South Asia Market Value (US$ Million) Analysis by Fuel Tank Position, 2017 & 2032

Figure 195: South Asia Market Volume (Tons) Analysis by Fuel Tank Position, 2017 & 2032

Figure 196: South Asia Market Value Share (%) and BPS Analysis by Fuel Tank Position, 2022 & 2032

Figure 197: South Asia Market Y-o-Y Growth (%) Projections by Fuel Tank Position, 2022 to 2032

Figure 198: South Asia Market Value (US$ Million) Analysis by Fuel Type, 2017 & 2032

Figure 199: South Asia Market Volume (Tons) Analysis by Fuel Type, 2017 & 2032

Figure 200: South Asia Market Value Share (%) and BPS Analysis by Fuel Type, 2022 & 2032

Figure 201: South Asia Market Y-o-Y Growth (%) Projections by Fuel Type, 2022 to 2032

Figure 202: South Asia Market Value (US$ Million) Analysis by Vehicle Type, 2017 & 2032

Figure 203: South Asia Market Volume (Tons) Analysis by Vehicle Type, 2017 & 2032

Figure 204: South Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 & 2032

Figure 205: South Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 206: South Asia Market Attractiveness by Technology, 2022 to 2032

Figure 207: South Asia Market Attractiveness by Fuel Tank Position, 2022 to 2032

Figure 208: South Asia Market Attractiveness by Fuel Type, 2022 to 2032

Figure 209: South Asia Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 210: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 211: MEA Market Value (US$ Million) by Technology, 2022 & 2032

Figure 212: MEA Market Value (US$ Million) by Fuel Tank Position, 2022 & 2032

Figure 213: MEA Market Value (US$ Million) by Fuel Type, 2022 & 2032

Figure 214: MEA Market Value (US$ Million) by Vehicle Type, 2022 & 2032

Figure 215: MEA Market Value (US$ Million) by Country, 2022 & 2032

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 217: MEA Market Volume (Tons) Analysis by Country, 2017 & 2032

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 220: MEA Market Value (US$ Million) Analysis by Technology, 2017 & 2032

Figure 221: MEA Market Volume (Tons) Analysis by Technology, 2017 & 2032

Figure 222: MEA Market Value Share (%) and BPS Analysis by Technology, 2022 & 2032

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 224: MEA Market Value (US$ Million) Analysis by Fuel Tank Position, 2017 & 2032

Figure 225: MEA Market Volume (Tons) Analysis by Fuel Tank Position, 2017 & 2032

Figure 226: MEA Market Value Share (%) and BPS Analysis by Fuel Tank Position, 2022 & 2032

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Fuel Tank Position, 2022 to 2032

Figure 228: MEA Market Value (US$ Million) Analysis by Fuel Type, 2017 & 2032

Figure 229: MEA Market Volume (Tons) Analysis by Fuel Type, 2017 & 2032

Figure 230: MEA Market Value Share (%) and BPS Analysis by Fuel Type, 2022 & 2032

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Fuel Type, 2022 to 2032

Figure 232: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2017 & 2032

Figure 233: MEA Market Volume (Tons) Analysis by Vehicle Type, 2017 & 2032

Figure 234: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2022 & 2032

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022 to 2032

Figure 236: MEA Market Attractiveness by Technology, 2022 to 2032

Figure 237: MEA Market Attractiveness by Fuel Tank Position, 2022 to 2032

Figure 238: MEA Market Attractiveness by Fuel Type, 2022 to 2032

Figure 239: MEA Market Attractiveness by Vehicle Type, 2022 to 2032

Figure 240: MEA Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Fuel Gauge Market: Trends, Technologies, and Growth Outlook

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Injector Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Pulsation Damper Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Pressure Regulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Transfer Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Delivery System Market Trends - Growth & Forecast 2025 to 2035

Automotive Fuel Return Line Market Insights - Trends, Demand & Growth 2025 to 2035

Automotive Fuel Cock Market

Automotive Fuel Rail Market

Automotive E-Fuel Market Size and Share Forecast Outlook 2025 to 2035

United States Automotive Turbocharger Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

Automotive Display Units Market Growth - Trends & Forecast 2025 to 2035

Port Fuel Injection Units Market Size and Share Forecast Outlook 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Automotive Sunroof Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbag Controller Unit Market Size and Share Forecast Outlook 2025 to 2035

Automotive Battery Disconnect Unit (BDU) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA