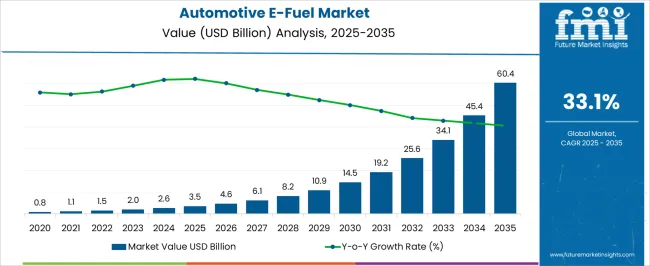

The Automotive E-Fuel Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 60.4 billion by 2035, registering a compound annual growth rate (CAGR) of 33.1% over the forecast period. The YoY analysis in the chart below clearly shows exponential growth after 2028, with adoption accelerating as regulatory frameworks and technological advancements mature. Early progress remains modest, with values under USD 10 billion until 2028, but rapid scaling occurs from 2029 onward. By 2031, the market crosses USD 19.2 billion, and by 2033 it surpasses USD 34.1 billion, eventually doubling in just two years to reach USD 60.4 billion by 2035.

The YoY growth rate shows an early peak around 2025–2026, followed by a gradual decline as the base value expands, though absolute market size continues to soar. Key growth drivers include strict decarbonization mandates, rising interest in carbon-neutral liquid fuels for existing internal combustion fleets, and partnerships between automakers and energy providers. The ability of e-fuels to complement battery electric vehicles by decarbonizing hard-to-electrify transport segments like heavy-duty trucks and long-haul cars enhances their appeal. Despite high production costs, scaling of renewable hydrogen and carbon capture technologies is expected to push commercial viability across multiple regions.

| Metric | Value |

|---|---|

| Automotive E-Fuel Market Estimated Value in (2025 E) | USD 3.5 billion |

| Automotive E-Fuel Market Forecast Value in (2035 F) | USD 60.4 billion |

| Forecast CAGR (2025 to 2035) | 33.1% |

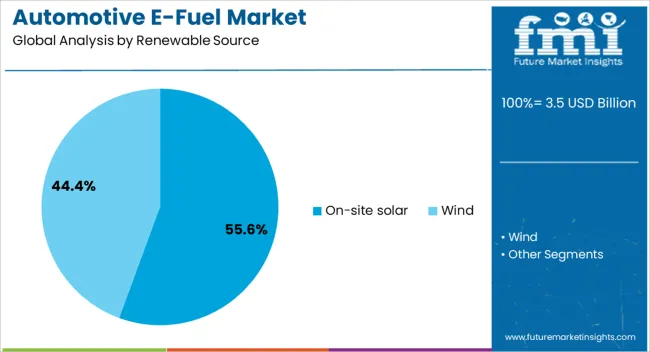

The automotive e-fuel market is expanding rapidly as the transportation sector seeks cleaner and more sustainable fuel alternatives. Industry developments have underscored the rising importance of renewable energy sources to reduce carbon emissions and meet global climate goals. On-site solar energy production has become a key driver by providing a reliable and green power source for e-fuel synthesis, reducing the overall carbon footprint of fuel production.

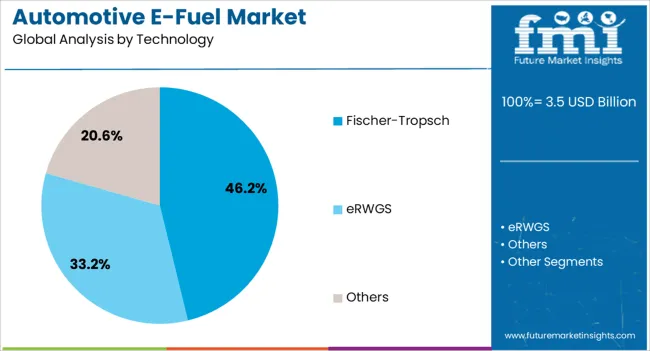

Advances in technology have played a crucial role, with Fischer-Tropsch processes gaining traction for their ability to convert renewable feedstocks into liquid fuels compatible with existing vehicle engines. The growing emphasis on decarbonizing road transport, supported by policy incentives and increasing consumer environmental awareness, has accelerated market growth.

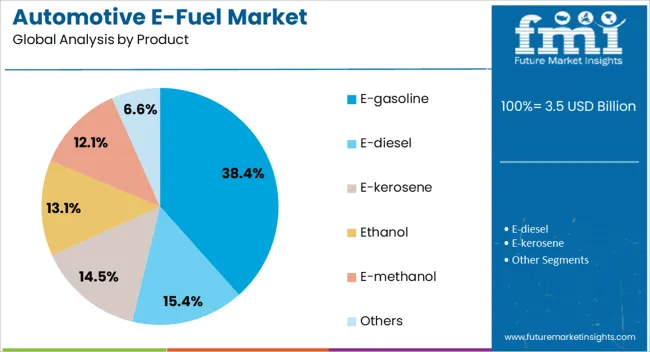

The integration of e-gasoline as a drop-in fuel solution has expanded product offerings, appealing to both consumers and manufacturers aiming to reduce lifecycle emissions. Market growth is expected to be fueled by continued improvements in renewable energy integration, catalytic processes, and supportive regulatory frameworks.

The automotive e-fuel market is segmented by renewable source, technology, product, and geographic regions. By renewable source, the automotive e-fuel market is divided into On-site solar and Wind. In terms of technology, the automotive e-fuel market is classified into Fischer-Tropsch, eRWGS, and Others.

Based on product, the automotive e-fuel market is segmented into E-gasoline, E-diesel, E-kerosene, Ethanol, E-methanol, and Others. Regionally, the automotive e-fuel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The On-site Solar segment is projected to contribute 55.6% of the automotive e-fuel market revenue in 2025, solidifying its position as the leading renewable source. This segment’s growth has been driven by the decreasing costs of solar photovoltaic systems and their increasing deployment at e-fuel production sites.

On-site solar generation enables direct utilization of clean energy, minimizing transmission losses and enhancing the sustainability of e-fuel production. Operators have favored solar power for its scalability and ability to provide consistent energy in sun-rich regions.

The integration of solar with energy storage solutions has further improved reliability, supporting continuous fuel synthesis operations. As renewable energy adoption accelerates globally, on-site solar is expected to remain a preferred choice for powering e-fuel production facilities.

The Fischer-Tropsch technology segment is expected to hold 46.2% of the automotive e-fuel market revenue in 2025, leading the technology category. This growth has been attributed to the process’s ability to produce high-quality synthetic fuels from a variety of renewable feedstocks, including biomass and captured CO2.

The Fischer-Tropsch process is favored for its compatibility with existing fuel infrastructure and engines, allowing for seamless integration into current automotive fuel systems. Advances in catalyst development and process optimization have enhanced conversion efficiencies, making Fischer-Tropsch more economically viable.

Additionally, growing investments in pilot and commercial-scale plants have increased confidence in this technology. With continued research and development, Fischer-Tropsch technology is poised to drive a significant portion of the e-fuel market’s expansion.

The E-gasoline segment is projected to account for 38.4% of the automotive e-fuel market revenue in 2025, establishing itself as the leading product type. Demand for e-gasoline has grown due to its compatibility with existing internal combustion engines and fuel distribution networks, providing a practical pathway for emissions reduction without major vehicle modifications.

The product has gained traction as a renewable alternative that can be blended with conventional gasoline or used as a standalone fuel. Consumer acceptance has been supported by performance parity with traditional fuels and the promise of lower lifecycle greenhouse gas emissions.

Policy frameworks encouraging low-carbon fuels have further supported the market penetration of e-gasoline. As automakers and fuel producers look for transitional solutions toward full electrification, e-gasoline is expected to remain a key product segment within the e-fuel market.

The automotive e-fuel market is supported by OEM partnerships, regulatory backing, cost optimization efforts, and industry collaborations. It is emerging as a complementary pathway alongside electrification in the transport sector.

The automotive e-fuel market has been gaining traction due to increasing partnerships between car manufacturers and energy companies. OEMs are investing in pilot projects with e-fuel producers to secure long-term supply for premium and performance vehicles. These collaborations highlight e-fuels as a solution for reducing lifecycle emissions without the need for major redesigns of combustion engines. Luxury brands and high-performance automakers see e-fuels as a way to preserve driving dynamics while meeting stricter regulations. Strategic agreements are also extending to fleet operators who prefer fuel compatibility with existing infrastructure. Such partnerships ensure visibility, early adoption, and gradual scaling of production capacity across regions.

Government regulations have become a strong driver for the automotive e-fuel market, particularly in Europe where zero- and low-carbon fuel initiatives are advancing. Regulatory frameworks allow e-fuels to count toward emission reduction targets, giving automakers flexibility in compliance strategies. Countries such as Germany and Japan are supporting pilot projects and incentivizing investments in synthetic fuel plants. Tax benefits, credits, and allowances for using low-carbon fuels are also reinforcing adoption. These measures have created a favorable policy landscape for e-fuels to scale. By reducing dependence on conventional fossil fuels, e-fuels are being recognized as an essential tool for reaching emission targets across transportation

Despite growing support, production challenges remain a key concern in the automotive e-fuel market. High capital investment, reliance on renewable hydrogen, and costly carbon capture technologies limit large-scale affordability. Current production costs make e-fuels more expensive than conventional fuels or even biofuels, restricting adoption beyond pilot-scale projects. However, ongoing research into improving conversion efficiency and scaling up synthetic fuel plants is expected to bring costs down gradually. Market competitiveness will rely on reducing reliance on subsidies and achieving parity with conventional fuels. Addressing these bottlenecks is critical to ensuring long-term viability and broader adoption across global automotive markets.

The future of automotive e-fuels is being shaped by international collaborations, large-scale demonstration projects, and expanding industrial partnerships. Oil majors, renewable energy firms, and automakers are forming consortia to build integrated production plants with export potential. E-fuels are expected to complement EV adoption, providing an alternative for heavy-duty vehicles, legacy fleets, and performance cars where electrification faces barriers. Global momentum will be influenced by the success of initial projects and the ability to scale production in regions with abundant renewable energy resources. These collaborations not only secure future supply but also increase confidence among stakeholders in the viability of e-fuels.

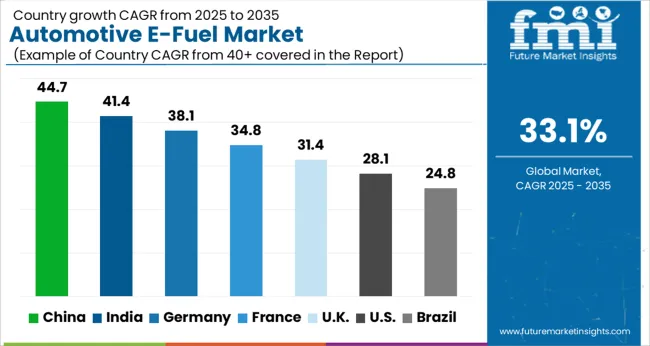

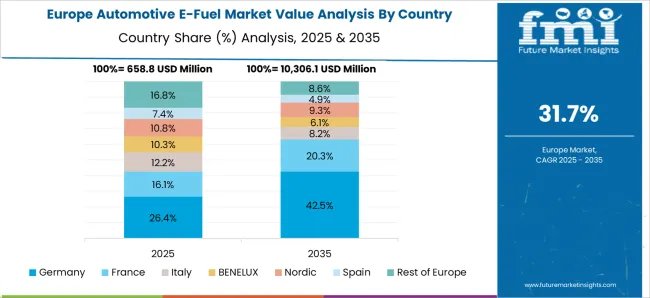

The automotive e-fuel market is projected to grow globally at a CAGR of 33.1% between 2025 and 2035, supported by regulatory backing, OEM partnerships, and increasing pilot-scale production plants across multiple regions. China leads with a CAGR of 44.7%, driven by heavy government investment in alternative fuels, rapid industrial scale-up, and interest from premium automakers to complement electrification. India follows at 41.4%, supported by public-private partnerships, favorable policy measures, and efforts to decarbonize road transport without replacing existing engine infrastructure. France records 34.8%, benefitting from carbon neutrality goals, new refinery projects, and interest from luxury car brands. The United Kingdom grows at 31.4%, aided by demonstration plants, R&D collaborations, and demand from performance vehicle manufacturers, while the United States records 28.1%, shaped by commercial fleet adoption, pilot projects, and niche applications in motorsports and aviation. The analysis spans over 40 countries, with these five acting as capacity planning, long-term OEM agreements, and investment priorities across the global automotive e-fuel industry.

China is projected to record a CAGR of 44.7% during 2025–2035, well above the global baseline of 33.1%. In the earlier period of 2020–2024, the CAGR was 29.5%, reflecting limited pilot plants and constrained supply infrastructure. Growth momentum strengthened after 2025 as major state refiners and automotive OEMs scaled up investment into large e-fuel projects. Government-backed incentives promoting decarbonization in transport and energy security goals also amplified demand. Expansion of CO₂ capture systems and renewable hydrogen imports supported commercial readiness, while premium automakers accelerated adoption in performance vehicles. Strategic partnerships with technology suppliers created a competitive edge that allowed China to build capacity faster than global peers.

India is expected to post a CAGR of 41.4% during 2025–2035, higher than the global average. During 2020–2024, CAGR was 30.8%, reflecting smaller-scale adoption limited to refinery experiments and trial corridors. Growth accelerated post-2025 due to stronger state-level directives encouraging synthetic fuels in logistics, aviation, and premium vehicles. Domestic refiners collaborated with global developers to establish local capacity, reducing dependency on imports and enabling cost competitiveness. Dedicated corridors for freight and long-haul trucking created anchor demand, driving higher uptake in the transport ecosystem. The integration of renewable energy resources into production also enhanced commercial scalability, making India a fast-rising hub for e-fuels.

France is projected to record a CAGR of 34.8% during 2025–2035, above the global benchmark. From 2020–2024, CAGR was 26.9%, reflecting limited adoption during early pilot projects. Growth rose significantly post-2025 as the government strengthened carbon neutrality frameworks and supported investment in refinery-scale e-fuel plants. Automotive majors partnered with refiners to create predictable offtake agreements, ensuring consistent demand pipelines. Aviation adoption also played a crucial role, as airlines explored synthetic fuels to meet EU emissions mandates. France benefited from a strong export-oriented luxury car segment, further accelerating uptake across high-value mobility solutions.

The United Kingdom is expected to post a CAGR of 31.4% during 2025–2035, slightly below the global average of 33.1%. For the earlier 2020–2024 period, CAGR was 24.7%, reflecting modest progress due to reliance on EU-driven projects. Growth improved post-2025 as policy clarity emerged around carbon-neutral fuels for aviation, motorsports, and high-performance vehicles. Domestic demonstration plants supported production readiness, while collaboration with EU partners enabled knowledge transfer and reduced cost barriers. Investor confidence increased as e-fuels became more integrated into net-zero transition policies. Though still lagging behind China and India, the UK demonstrated stronger uptake compared to its 2020–2024 phase.

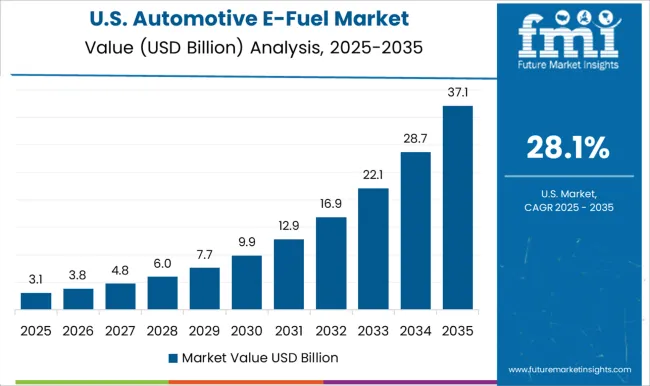

The United States is forecast to record a CAGR of 28.1% during 2025–2035, which is below the global benchmark. For 2020–2024, CAGR was 21.5%, as fragmented federal policies and reliance on niche use cases limited acceleration. Post-2025, growth strengthened as federal pilot programs and defense applications created structured demand. Partnerships with refiners and automakers added momentum, particularly in motorsports and commercial trucking. Although expansion was slower than in Asia and Europe, blending mandates and rising interest from aviation players supported moderate growth. Focus on energy independence and selective large-scale deployments kept the USA trajectory steady though below faster-growing economies.

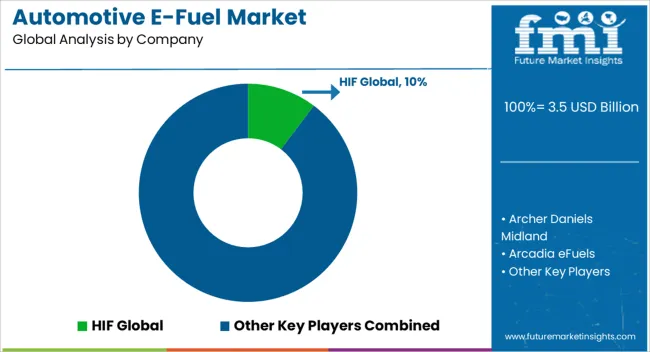

The automotive e-fuel market consists of global energy companies, specialized e-fuel developers, technology providers, and automotive OEM collaborators building synthetic fuel ecosystems. HIF Global leads with large-scale e-fuel production plants in South America and expanding projects in the USA and Europe. Archer Daniels Midland focuses on bio-based fuel integration, bridging agricultural feedstocks with synthetic fuel pathways. Arcadia eFuels advances modular e-fuel production units tailored for distributed deployment, targeting aviation and automotive sectors. Ballard Power Systems and Ceres Power Holding contribute through fuel cell and electrolysis innovations that enhance e-fuel conversion efficiency. Clean Fuels Alliance America plays a pivotal role in advocacy and standardization, while Climeworks provides carbon capture technology critical for scaling synthetic fuel projects. eFuel Pacific and Electrochaea emphasize renewable hydrogen and biological methanation, strengthening regional supply chains. ExxonMobil leverages its refining infrastructure and global partnerships to test large-scale blending with conventional fuels. FuelCell Energy contributes to integrated power-to-fuel systems supporting automotive and aviation adoption. INFRA Synthetic Fuels and LanzaJet expand production bases with advanced catalytic and alcohol-to-jet technologies, aligning with long-haul and freight mobility requirements.

Liquid Wind focuses on renewable methanol plants across Europe, while MAN Energy Solutions delivers critical electrolysis and carbon capture equipment. Norsk e-Fuel, supported by strong European consortia, accelerates the commercialization of CO₂-to-fuel facilities in Norway. Porsche drives high-visibility adoption by integrating e-fuels into motorsports and performance vehicles, strengthening consumer confidence. Sunfire advances high-temperature electrolysis to reduce production costs, enabling scale efficiencies for the sector. Competitive strategies revolve around scaling industrial plants, advancing CO₂ capture integration, securing long-term automotive and aviation partnerships, and diversifying regional production bases. Key focus areas include commercial viability, policy-backed adoption, and expansion of synthetic fuel supply chains across premium automotive, heavy-duty trucking, and aviation applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Renewable Source | On-site solar and Wind |

| Technology | Fischer-Tropsch, eRWGS, and Others |

| Product | E-gasoline, E-diesel, E-kerosene, Ethanol, E-methanol, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HIF Global, Archer Daniels Midland, Arcadia eFuels, Ballard Power Systems, Ceres Power Holding, Clean Fuels Alliance America, Climeworks, eFuel Pacific, Electrochaea, ExxonMobil, FuelCell Energy, INFRA Synthetic Fuels, LanzaJet, Liquid Wind, MAN Energy Solutions, Norsk e-Fuel, Porsche, and Sunfire |

| Additional Attributes | Dollar sales, regional share, cost competitiveness versus EVs, policy incentives, refinery integration opportunities, end-user adoption, and partnership landscapes. |

The global automotive e-fuel market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the automotive e-fuel market is projected to reach USD 60.4 billion by 2035.

The automotive e-fuel market is expected to grow at a 33.1% CAGR between 2025 and 2035.

The key product types in automotive e-fuel market are on-site solar and wind.

In terms of technology, fischer-tropsch segment to command 46.2% share in the automotive e-fuel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA