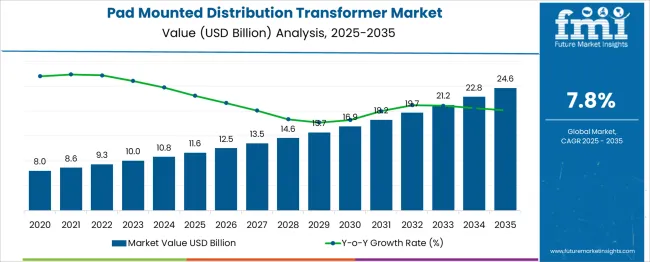

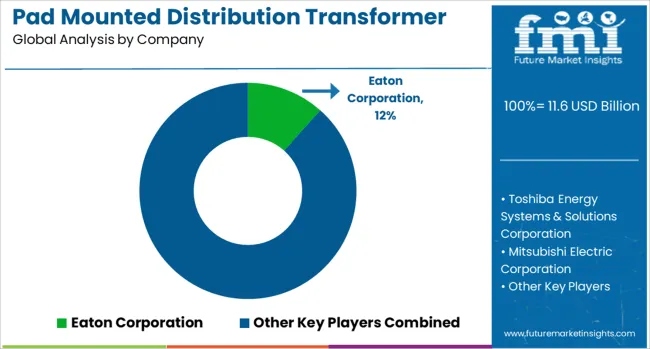

The Pad Mounted Distribution Transformer Market is estimated to be valued at USD 11.6 billion in 2025 and is projected to reach USD 24.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Pad Mounted Distribution Transformer Market Estimated Value in (2025 E) | USD 11.6 billion |

| Pad Mounted Distribution Transformer Market Forecast Value in (2035 F) | USD 24.6 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The pad mounted distribution transformer market is expanding steadily, driven by rising demand for reliable and compact power distribution systems across residential, commercial, and industrial applications. Urbanization and the development of smart grid infrastructure have increased the need for efficient, space-saving transformer solutions that can be installed safely in accessible locations.

Governments and utility providers are investing heavily in upgrading aging grid infrastructure and enhancing rural electrification, further accelerating market demand. Advancements in transformer technology, including improved cooling methods, enhanced safety features, and environmental compliance, are shaping product development and adoption trends.

Looking ahead, sustained growth is expected as renewable energy integration, electric vehicle infrastructure, and distributed power generation continue to evolve. The market’s ability to support high-load density areas while offering aesthetic and operational advantages will remain central to its expansion in both developed and emerging economies.

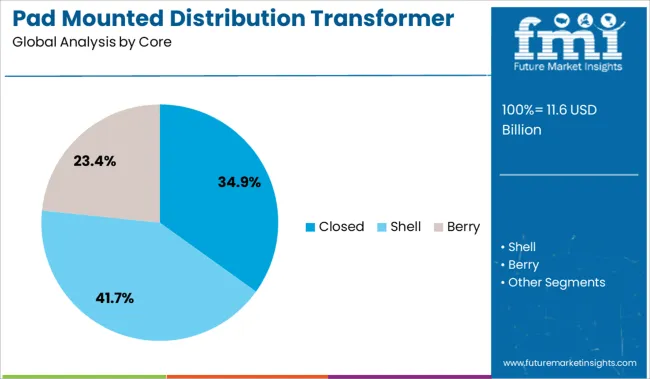

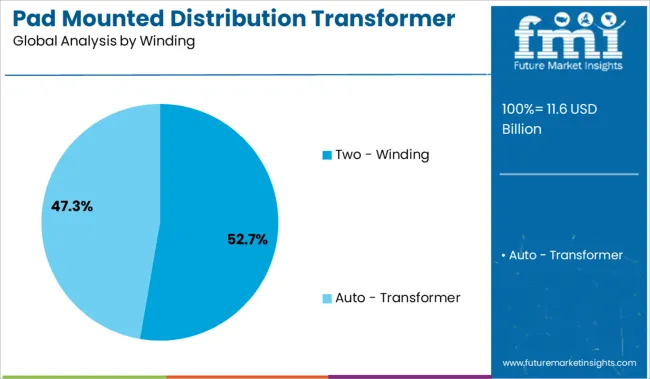

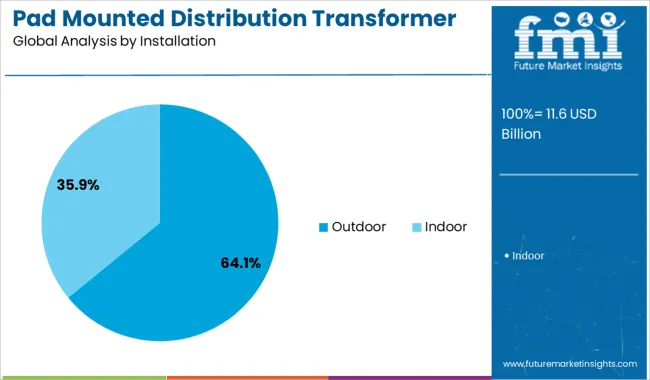

The pad-mounted distribution transformer market is segmented by core, winding, installation, cooling, and gas and geographic regions. The core of the pad-mounted distribution transformer market is divided into Closed, Shell, and Berry. In terms of winding of the pad-mounted distribution transformer, the market is classified into two-winding and auto-transformer. Based on the installation of the pad-mounted distribution transformer, the market is segmented into Outdoor and Indoor. The cooling of the pad-mounted distribution transformer market is segmented into Dry Type, Oil Immersed, and Insulation. The pad-mounted distribution transformer market is segmented by type into Oil, Solid, Air, Others, and Phase. Regionally, the pad-mounted distribution transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The closed core segment accounted for 34.9% of the market within the core category, reflecting its widespread usage due to compact design, magnetic efficiency, and lower leakage flux. This configuration ensures better containment of magnetic fields and reduces energy loss, making it suitable for applications requiring consistent voltage output in space-constrained environments.

Closed core transformers are widely preferred in urban and suburban settings where pad-mounted units must be installed near public access areas. The design also enhances mechanical stability and noise reduction, which are crucial for installations in residential zones and commercial establishments.

As demand for durable and low-maintenance power distribution equipment grows, the closed core design remains a favorable choice due to its long service life and cost-efficiency. Continued improvements in insulation and magnetic material technologies are expected to reinforce the market position of this segment in upcoming years.

The two-winding segment leads the winding category with a commanding 52.7% share, highlighting its foundational role in traditional transformer design. This configuration involves separate primary and secondary windings, ensuring isolation between circuits and facilitating safe energy transfer.

It is widely used across distribution networks due to its reliability, simplicity, and suitability for diverse voltage levels. Two-winding transformers are particularly favored in regions with established grid infrastructure, where standardized voltage conversion and safety compliance are priorities.

This segment benefits from lower initial costs and straightforward maintenance compared to advanced alternatives like autotransformers. As utilities and private sector developers continue grid modernization efforts, the two-winding configuration is expected to retain its dominance due to compatibility with legacy systems and ease of integration into existing distribution networks.

The outdoor installation segment holds the highest market share at 64.1%, driven by the requirement for robust, weather-resistant transformer solutions capable of functioning efficiently in exposed environments. Outdoor pad mounted transformers are essential for power distribution in residential neighborhoods, commercial complexes, and industrial facilities, where underground wiring and secure external equipment placement are necessary.

These units are designed to endure environmental stressors such as temperature fluctuations, moisture, and physical damage, often featuring tamper-proof enclosures and corrosion-resistant materials. Their widespread adoption is supported by utility regulations emphasizing safety, accessibility, and minimal maintenance.

The segment continues to benefit from infrastructure expansion in urban and remote locations alike, where reliable and space-efficient outdoor installations are critical to power delivery. Growth is expected to persist as decentralized energy systems and smart grids drive the need for versatile and resilient transformer setups.

Pad mounted distribution transformers are being deployed in residential, commercial and industrial power networks to facilitate efficient voltage step-down and reliable service delivery. Their enclosed, ground-level design has enabled safer installations without oil pits and elevated platforms. Units with advanced cooling, remote monitoring, and tamper-resistant enclosures have been selected for suburban feeders, solar farm interconnections, and microgrid extensions. Demand has been supported by grid reinforcement requirements, safety regulations and load balancing needs across pole-to-pedestal distribution systems.

Pad mounted transformers have been installed to replace aging pole-mounted and underground units, addressing public safety and operational flexibility. Their fully enclosed design allows placement at ground level without requiring fencing or oil remediation infrastructure. Cooling methods such as natural convection and ester-filled insulation have been applied to manage thermal performance under fluctuating load conditions. Remote sensing and telemetry modules have been added to monitor temperature, oil levels and load patterns in real time. Feeder automation and sectionalizing schemes have leveraged these transformers as control nodes to reduce outage durations and improve power quality. Municipal utilities and independent distribution operators have prioritized units certified to ANSI and IEC standards to support feeder reinforcement and demand growth. As new housing developments, commercial parks and renewable interconnects have been built, pad mounted transformer volumes have been increased in state and regional budgets.

Deployment of pad mounted transformers has been challenged by higher initial procurement costs compared to less protected pole-mounted units. Ground-level placement necessitates site preparation such as pad construction, drainage systems and vandal-resistant placement, which raises CAPEX. Compliance with fire safety, noise, and oil containment regulations requires additional engineering studies and certifications. Accessibility standards for visually impaired and mobility-limited areas require raised platforms and public safety clearances. Oil-filled units are subject to environmental permits and spill prevention regulations in several jurisdictions. Integration with smart grid projects has required retrofit of older fleets with sensors and communication units, creating compatibility and capital planning challenges. Smaller utilities have expressed difficulty in managing these costs alongside aging infrastructure renewal priorities and limited financing options.

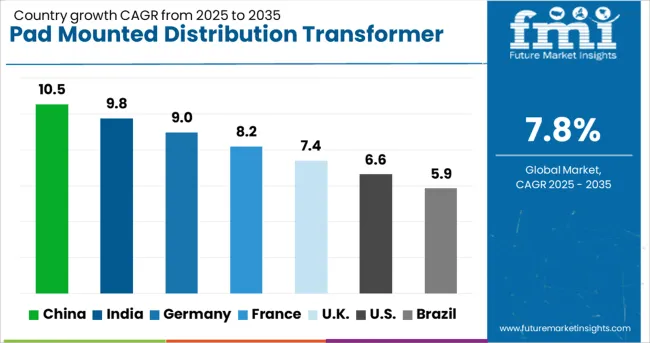

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

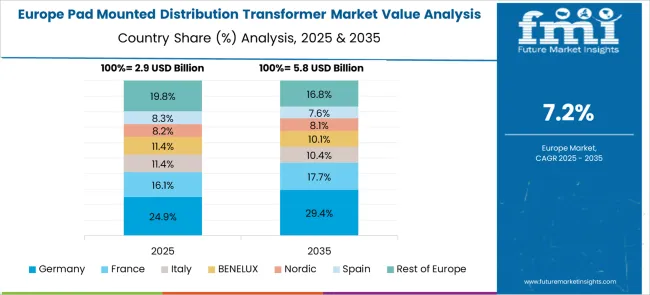

The global pad mounted distribution transformer market is projected to grow at a 7.8% CAGR from 2025 to 2035, fueled by rising demand for grid modernization, renewable energy integration, and underground distribution networks. BRICS markets lead, with China at 10.5% and India at 9.8%, driven by large-scale urban infrastructure projects and rural electrification programs. In OECD regions, Germany grows at 9.0%, emphasizing grid resilience and smart transformer upgrades, while France at 8.2% prioritizes modernization of aging networks. The United Kingdom, at 7.4%, focuses on decentralized power distribution and compliance with energy efficiency regulations. The report includes analysis of over 40 countries, with five profiled below for reference.

China is expected to grow at a 10.5% CAGR, supported by large-scale infrastructure expansion and investments in smart grid modernization. Pad mounted distribution transformers are widely adopted in residential complexes, commercial hubs, and renewable energy projects requiring underground distribution networks. The rapid deployment of solar and wind energy plants is fueling demand for energy-efficient pad-mounted transformers with advanced monitoring systems. Local manufacturers are introducing eco-friendly insulation oils and compact designs to comply with environmental guidelines. Strategic partnerships with state-owned utilities ensure accelerated deployment in urban and semi-urban areas. Automation integration in transformers is enhancing grid reliability and reducing downtime during peak demand.

India is projected to grow at a 9.8% CAGR, driven by electrification programs, industrial expansion, and integration of distributed energy resources. Government initiatives such as Deen Dayal Upadhyaya Gram Jyoti Yojana and IPDS support pad-mounted transformer installations in rural and semi-urban regions. Increasing demand from metro rail projects, data centers, and EV charging infrastructure accelerates adoption of energy-efficient distribution transformers. Domestic manufacturers are focusing on producing low-loss transformers that meet Bureau of Energy Efficiency (BEE) standards. Strategic collaborations with renewable developers ensure application in hybrid solar-wind projects. Utilities are adopting pad-mounted units for enhanced safety and reliability in high-density areas.

Germany is forecast to grow at a 9.0% CAGR, supported by energy transition initiatives and smart grid upgrades. Pad mounted distribution transformers are being deployed in underground networks to enhance safety and optimize space utilization in urban areas. Growing adoption of digital monitoring systems supports predictive maintenance and grid efficiency. Manufacturers are developing eco-friendly dry-type transformers and using ester-based insulation fluids to comply with EU environmental norms. Increasing investments in EV charging infrastructure and renewable energy integration boost demand for pad-mounted units in distributed power networks. Public-private partnerships under the German Energy Transition Plan are accelerating infrastructure modernization.

France is projected to grow at an 8.2% CAGR, driven by aging grid replacement programs and renewable energy integration mandates. Pad mounted distribution transformers are increasingly preferred for urban and rural grid modernization projects to enhance operational safety and efficiency. Utilities are focusing on compact, low-maintenance designs for underground networks in densely populated regions. Adoption of fire-retardant ester oil-based transformers is rising to meet stringent EU safety norms. Deployment in wind and solar farms is expanding to support France’s clean energy targets under its long-term decarbonization roadmap. Local suppliers are investing in digital-ready transformers for smart grid applications.

The United Kingdom is forecast to grow at a 7.4% CAGR, driven by grid decentralization and renewable energy expansion. Pad mounted distribution transformers are extensively used in residential neighborhoods, retail complexes, and industrial estates with underground cabling systems. Adoption of digital-ready transformers with load monitoring features is increasing to support dynamic power distribution in EV charging stations and distributed solar networks. Manufacturers are developing units with optimized thermal performance and energy efficiency to comply with UK energy regulations. Strategic utility partnerships ensure large-scale procurement of eco-friendly transformer units for green infrastructure projects.

Eaton Corporation leads the pad-mounted distribution transformer market with a significant share, supported by robust designs and a strong global distribution network. Toshiba Energy Systems & Solutions, Mitsubishi Electric, Siemens, and General Electric compete by delivering advanced oil-immersed and dry-type solutions for urban and industrial applications. Regional specialists such as Celme S.r.l, ORMAZABAL, IMEFY Group, Voltamp, and CG Power offer cost-effective, customized units for markets in Europe, Asia, and Latin America. Hitachi Energy, HYOSUNG Heavy Industries, Schneider Electric, ABB, ERMCO, and Elsewedy Electric strengthen their positions with smart-grid compatible designs and extensive service capabilities. Competition is driven by product reliability, energy efficiency, mounting flexibility, and lifecycle support for expanding utility and urban distribution networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.6 Billion |

| Core | Closed, Shell, and Berry |

| Winding | Two - Winding and Auto - Transformer |

| Installation | Outdoor and Indoor |

| Cooling | Dry Type, Oil Immersed, and Insulation |

| Gas | Oil, Solid, Air, Others, and Phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eaton Corporation, Toshiba Energy Systems & Solutions Corporation, Mitsubishi Electric Corporation, Celme S.r.l., ORMAZABAL, Siemens, IMEFY GROUP, Hitachi Energy Ltd., Voltamp, General Electric, HYOSUNG HEAVY INDUSTRIES, Schneider Electric, CG Power & Industrial Solutions Ltd., ABB, ERMCO, and Elsewedy Electric |

| Additional Attributes | Dollar sales in the pad mounted transformer market are segmented by power rating, with the >1 MVA segment leading due to its application in industrial and commercial sectors. Demand is rising for eco-friendly, dry-type transformers, driven by urbanization and renewable energy integration. Adoption is strongest in North America and Europe, supported by infrastructure modernization and sustainability initiatives. |

The global pad mounted distribution transformer market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the pad mounted distribution transformer market is projected to reach USD 24.6 billion by 2035.

The pad mounted distribution transformer market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in pad mounted distribution transformer market are closed, shell and berry.

In terms of winding, two - winding segment to command 52.7% share in the pad mounted distribution transformer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pad Mounted Switchgear Market Growth – Trends & Forecast 2024-2034

Distribution Transformers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Pressure Redistribution Pads Market

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Transformer Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

Transformer Valve Market Size and Share Forecast Outlook 2025 to 2035

Distribution Board Market Forecast Outlook 2025 to 2035

Transformer Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Padded Mailers Market Size and Share Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Distribution Automation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Insulation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Component Market Size and Share Forecast Outlook 2025 to 2035

Distribution Lines And Poles Market Size and Share Forecast Outlook 2025 to 2035

Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA