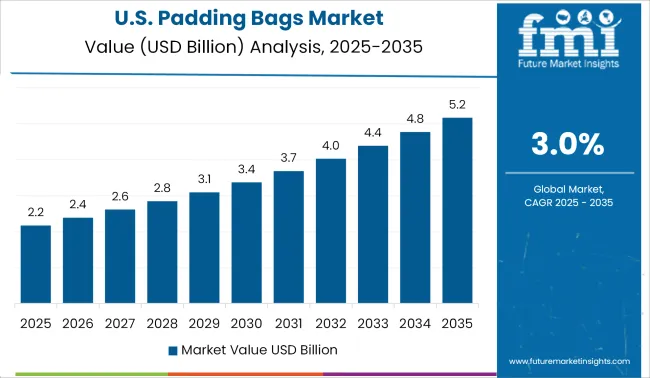

The Padding Bags Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

The padding bags market is witnessing accelerated adoption, driven by rising demand for protective packaging solutions across e-commerce, logistics, and retail ecosystems. The surge in online purchases, combined with the need for efficient last-mile delivery, has intensified the requirement for lightweight, durable, and sustainable packaging options.

Manufacturers are investing in advanced material combinations and closure technologies to enhance product security while aligning with environmental compliance norms. Regulatory emphasis on waste reduction and recyclability is also influencing purchasing behavior, favoring biodegradable and recyclable alternatives.

Evolving consumer expectations for damage-free delivery and brand sustainability commitments are further reinforcing the demand for high-performance padded packaging. The outlook remains optimistic as market players continue to focus on functional design, eco-conscious innovation, and operational cost-efficiency, positioning padding bags as an essential component in modern packaging infrastructure.

It has been noted that the fiber-based material segment is anticipated to hold 36.50% of total market revenue by 2025, establishing itself as the leading sub-category under material. This dominance is attributed to its recyclable, biodegradable, and compostable nature, aligning well with global sustainability trends and packaging mandates.

Regulatory initiatives targeting single-use plastics have led enterprises to prioritize fiber-based solutions that offer similar performance in cushioning and protection. Additionally, fiber materials provide superior printability, allowing for enhanced branding opportunities.

The shift toward environmentally responsible sourcing and closed-loop supply chains has further strengthened the fiber-based segment’s position, making it the preferred material for companies seeking to meet both functional and ESG criteria.

The self-seal closure type is projected to account for 58.70% of market revenue, signifying its role as the dominant segment within closure types. This growth is driven by its ease of use, tamper-resistance, and time-saving advantages in high-volume packaging operations.

The self-seal mechanism eliminates the need for additional adhesives or manual taping, improving packaging speed and reducing labor costs. Its reliability in securely sealing parcels makes it a preferred choice in industries with high throughput demands such as e-commerce and logistics.

Moreover, it supports consumer convenience during returns and exchanges, which has become an essential requirement in omnichannel retail models. These functional and operational benefits have solidified its leading share within the closure segment.

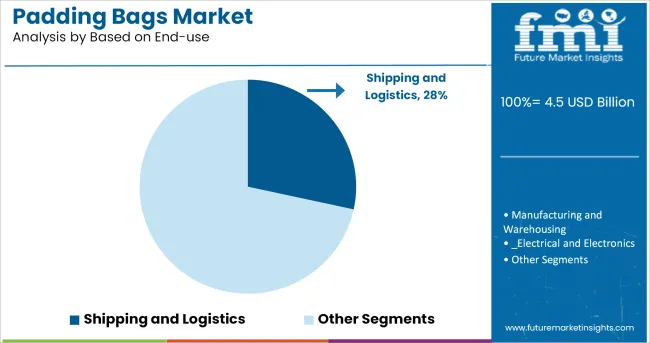

The shipping and logistics sector is projected to represent 28.40% of market revenue under the end-use category, placing it at the forefront of industry application. This prominence is driven by the explosive growth in global e-commerce, coupled with the need for damage-resistant, lightweight packaging for diverse shipment types.

Padding bags offer essential shock absorption and surface protection during transit, minimizing return rates and enhancing customer satisfaction. Logistic providers and fulfillment centers are increasingly opting for these solutions to streamline packaging operations and reduce shipping weights, leading to cost efficiencies.

The compatibility of padded bags with automated packaging systems and sustainability benchmarks has also contributed to their preference. As the volume of global shipments continues to climb, the demand for protective, scalable, and sustainable packaging solutions in the logistics sector remains a primary force shaping market growth.

With increasing stringent government regulations and changing environmental stresses, manufacturers are steering the policies toward leveraged innovative plastic technologies to improve sustainable and recyclable solutions, including definite properties such as easy-tear propagation and chemical resistance.

Moreover, significant areas for manufacturers comprise the improvement of substitute bioplastics solutions such as bio polypropylene and polybutylene succinate, along with the price and removal of bioplastics, which needs to be examined to safeguard successful usage.

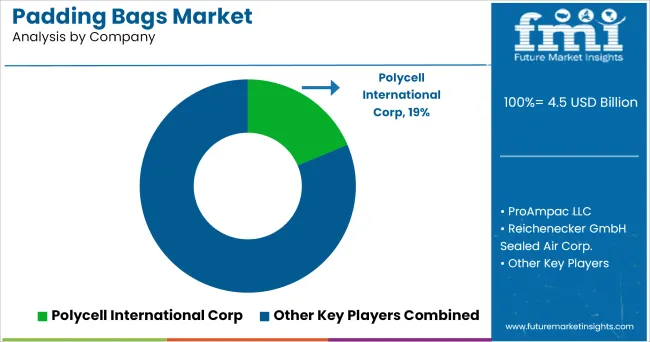

Prominent players have cited the requirement for a cost-effective and sustainable solution to stay ahead and lead the competition in the padding bags market. Moreover, fast-moving consumer goods products have committed to the consumers for providing more sustainable packaging by adopting circular strategies of waste reduction.

In addition, various start-ups are entering the padding bags market and are helping to create cutting-edge solutions which are helping prominent leaders in partnering with these organizations. Moreover, having a competitive advantage is incredibly important for a sector that has a growing demand for sustainable products and has numerous competitors.

In terms of sales, the North American market is projected to take the lead in the global target market. With rising demand for delicate electronic products, alternative materials other than plastic is helping the padding bags market to grow, hence reducing regulatory concerns regarding plastics.

Moreover, prominent players are opting for recyclable materials that are a mixture of polyethylene resins and Oxo-biodegradable additives. Hence, it is the key factor for the development of the padding bags market.

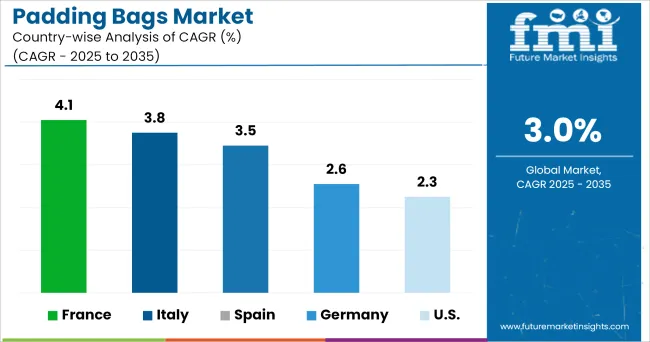

The European padding bags market is estimated to grow at a promising rate. Manufacturers are aiming at linear low-density polyethylene, the demand of the consumers; hence, padding bags companies are making swift progress concerning evolving innovative packaging options.

The market for padding bags is estimated to see swift growth through the projection period driven by huge investments done by market players in increasing warehousing of pharmaceutical products and automotive equipment.

Some of the key players manufacturing padding bags are as follows

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global padding bags market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the padding bags market is projected to reach USD 6.0 billion by 2035.

The padding bags market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in padding bags market are fiber-based, polyethylene, ldpe/lldpe and hdpe.

In terms of based on closure:, self-seal segment to command 58.7% share in the padding bags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Silo bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Competitive Breakdown of Silo Bag Manufacturers

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Market Share Breakdown of Craft Bags Manufacturers

Competitive Breakdown of Paper Bags Providers

Market Share Analysis of Jumbo Bags & Key Players

Grout Bags Market Demand & Construction Industry Trends 2024 to 2034

Sugar Bags Market

Cotton Bags Market Size and Share Forecast Outlook 2025 to 2035

Refuse Bags Market Size and Share Forecast Outlook 2025 to 2035

Emesis Bags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA