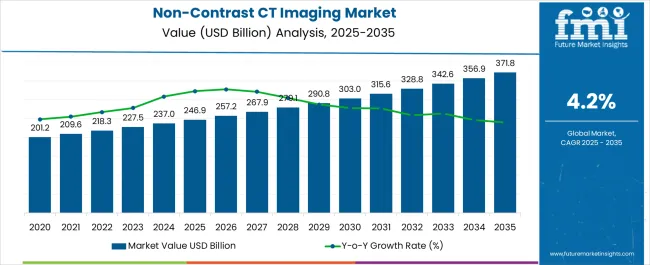

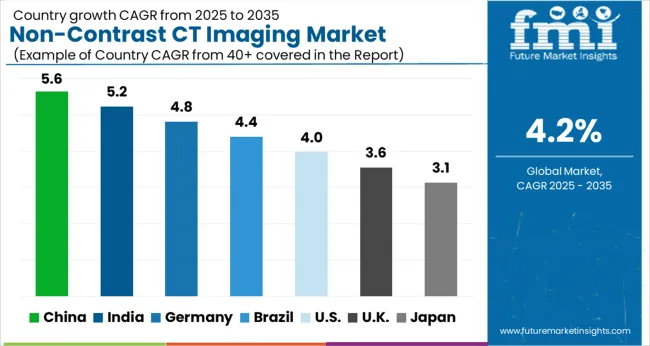

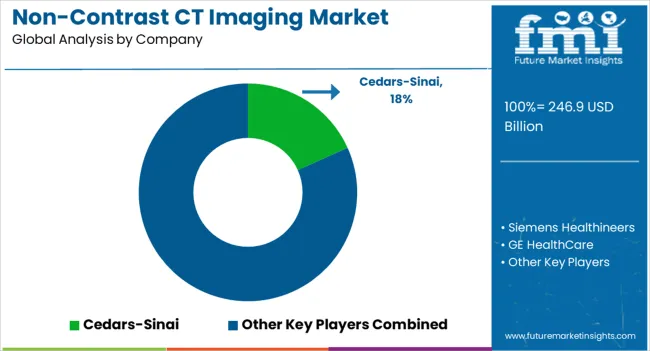

The Non-Contrast CT Imaging Market is estimated to be valued at USD 246.9 billion in 2025 and is projected to reach USD 371.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Non-Contrast CT Imaging Market Estimated Value in (2025 E) | USD 246.9 billion |

| Non-Contrast CT Imaging Market Forecast Value in (2035 F) | USD 371.8 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The non contrast CT imaging market is experiencing consistent growth driven by the rising prevalence of cardiovascular diseases, neurological disorders, and trauma related cases that require quick and precise imaging. The ability of non contrast CT scans to deliver accurate diagnostic outcomes without the risks associated with contrast agents is a major factor influencing adoption.

Increasing demand for cost effective diagnostic solutions, coupled with advancements in imaging technology that improve resolution and reduce scan times, are supporting broader clinical integration. Hospitals and diagnostic centers are increasingly adopting these systems for emergency and routine applications, further reinforced by government initiatives for improving healthcare infrastructure.

The market outlook remains positive as patient safety, accessibility, and rapid diagnostic turnaround continue to shape procurement strategies and future investment in CT imaging technologies.

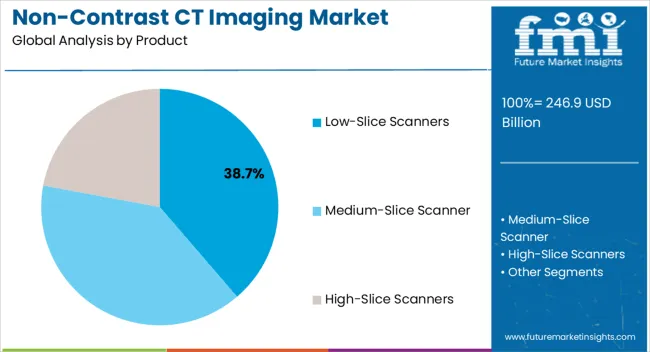

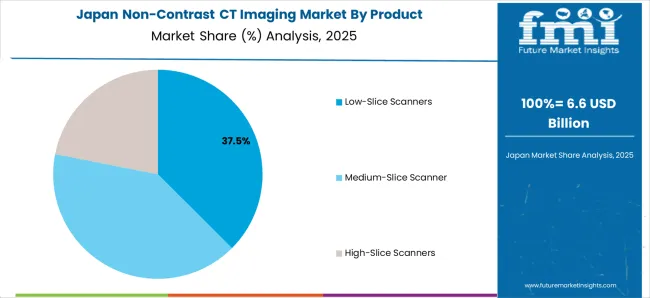

The low slice scanners segment is projected to account for 38.70% of total market revenue by 2025 within the product category, making it the leading segment. Growth has been influenced by their affordability, compact size, and suitability for routine diagnostic applications across a wide range of clinical settings.

Low slice systems provide adequate imaging quality for common procedures while ensuring lower operational costs compared to high end systems. Their reliability in handling basic imaging needs, particularly in resource constrained environments and smaller healthcare facilities, has accelerated adoption.

As healthcare providers prioritize cost efficiency along with patient throughput, low slice scanners continue to hold a dominant share in the product category.

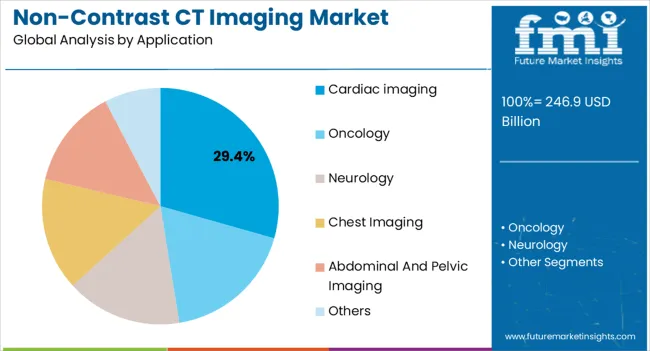

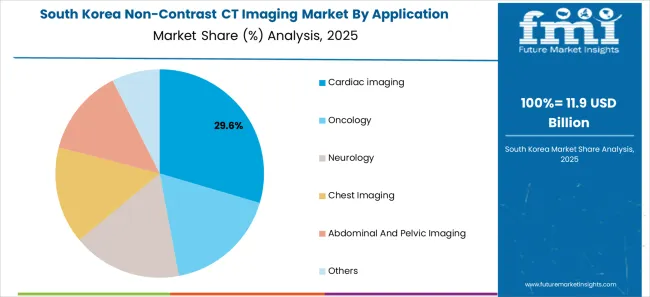

The cardiac imaging segment is expected to capture 29.40% of total market revenue by 2025 within the application category. This growth is being driven by the rising global burden of cardiovascular diseases and the need for rapid, accurate, and non invasive diagnostic tools.

Non contrast CT imaging is increasingly being preferred in cardiac diagnostics due to its ability to identify coronary calcium scores and structural abnormalities without the risk of contrast induced complications. Widespread use in preventive health checkups, early disease detection, and monitoring of at risk populations has strengthened its market position.

As the focus on cardiovascular health intensifies, adoption in this application segment is expected to remain robust.

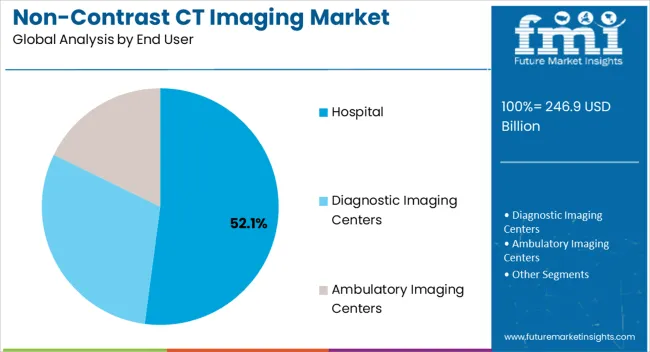

The hospital segment is projected to contribute 52.10% of total revenue by 2025 within the end user category, making it the most dominant segment. Hospitals remain primary adopters due to their capacity to handle high patient volumes, access to advanced imaging infrastructure, and the presence of trained professionals.

The integration of non contrast CT systems in emergency departments and specialized units such as neurology and cardiology has further reinforced their utilization. Additionally, hospitals benefit from reimbursement frameworks and government funding programs that support the procurement of imaging technologies.

These factors have positioned hospitals as the leading end user segment, driving consistent adoption of non contrast CT imaging solutions.

From 2020 to 2025, the global non-contrast CT imaging market experienced a CAGR of 2.9%, reaching a market size of USD 246.9 million in 2025.

From 2020 to 2025, the demand for non-contrast CT imaging has been driven by several factors, including the increasing prevalence of various medical conditions, advancements in imaging technology, and the need for quick and accurate diagnostic procedures. Non-contrast CT imaging is considered safe, cost-effective, and relatively quick compared to other imaging modalities, making it a popular choice in many clinical settings.

Future Forecast for Non-Contrast CT Imaging Industry:

Looking ahead, the global non-contrast CT imaging industry is expected to rise at a CAGR of 4.4% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 371.8 million by 2035.

Non-contrast CT imaging refers to computed tomography scans performed without the use of contrast agents or dyes. It is commonly used in various medical applications, including the evaluation of brain, abdomen, pelvis, and renal conditions. Non-contrast CT imaging provides valuable diagnostic information and helps in the detection of abnormalities, such as tumors, kidney stones, and vascular diseases.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 371.8 million |

| CAGR % 2025 to End of Forecast (2035) | 6.8% |

The non-contrast CT imaging industry in the United States is expected to reach a market size of USD 371.8 million by 2035, expanding at a CAGR of 6.8%. Non-contrast CT imaging is considered a cost-effective and efficient diagnostic tool for certain indications. It allows for quick imaging and evaluation of structures without the need for contrast agents, reducing procedure time and associated costs. This cost-effectiveness, along with the ease of use and widespread availability of CT scanners, has contributed to the growth of the non-contrast CT imaging market.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 23.2 million |

| CAGR % 2025 to End of Forecast (2035) | 5.1% |

The non-contrast CT imaging industry in the United Kingdom is expected to reach a market value of USD 23.2 million, expanding at a CAGR of 5.1% during the forecast period. The UK's National Health Service (NHS) plays a crucial role in driving the adoption and growth of medical imaging technologies. The NHS's focus on providing quality healthcare services and timely diagnostics has led to investments in advanced imaging technologies, including non-contrast CT. Funding and support from the NHS facilitate the availability and accessibility of non-contrast CT imaging services across the country.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 43.8 million |

| CAGR % 2025 to End of Forecast (2035) | 7.6% |

The non-contrast CT imaging industry in China is anticipated to reach a market size of USD 43.8 million, moving at a CAGR of 7.6% during the forecast period. China's rapid urbanization and the development of healthcare infrastructure in tier-2 and tier-3 cities have improved access to medical services, including non-contrast CT imaging. The expansion of healthcare facilities, including hospitals and imaging centers, in these areas has contributed to the growth of the market.

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 21.0 million |

| CAGR % 2025 to End of Forecast (2035) | 5.6% |

The non-contrast CT imaging industry in Japan is estimated to reach a market size of USD 21.0 million by 2035, thriving at a CAGR of 5.6%. Collaboration between academia, industry stakeholders, and healthcare providers in Japan has played a crucial role in the development and adoption of non-contrast CT imaging. Research institutions and medical facilities collaborate with industry partners to drive technological advancements, conduct clinical trials, and develop best practices. This collaboration promotes the growth of the non-contrast CT imaging market.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 9.0 million |

| CAGR % 2025 to End of Forecast (2035) | 5.6% |

The non-contrast CT imaging industry in South Korea is expected to reach a market size of USD 9.0 million, expanding at a CAGR of 5.6% during the forecast period. South Korea has become a popular destination for medical tourism, attracting patients from both domestic and international markets. The availability of advanced medical technologies, including non-contrast CT imaging, plays a significant role in attracting medical tourists. The growth of medical tourism has further stimulated the demand for non-contrast CT imaging services in South Korea.

Medium-Slice Scanner is expected to dominate the non-contrast CT imaging industry with a CAGR of 3.3% from 2025 to 2035. Medium-slice scanners provide better spatial resolution and image quality. Better anatomical structure visualization is made possible by this advancement, which also improves the precision of diagnostic interpretation-especially in non-contrast CT imaging. Medium-slice scanners are generally faster than older-generation scanners, allowing for quicker scan times. This is beneficial for both patients and healthcare providers, as it reduces the time required for image acquisition, enhancing patient comfort and increasing departmental efficiency.

The chest imaging segments are expected to dominate the non-contrast CT imaging industry with a CAGR of 2.8% from 2025 to 2035. Chest imaging, particularly non-contrast CT scans, is commonly used to evaluate and diagnose various respiratory conditions such as pulmonary embolism, pneumonia, lung nodules, interstitial lung diseases, and lung cancer. The demand for accurate and detailed chest imaging is driving the growth of non-contrast CT imaging.

The hospital segment is expected to dominate the non-contrast CT imaging industry with a CAGR of 3.3% from 2025 to 2035. Hospitals are the main sources of healthcare and frequently have departments for sophisticated imaging with non-contrast CT scanners. The use of non-contrast CT imaging has grown as a result of their wide distribution and accessibility to a sizable patient population. Non-contrast CT scans are conveniently accessible to patients through hospitals, facilitating rapid diagnosis and treatment.

The market for non-contrast CT imaging is highly competitive, with numerous vendors vying for supremacy. Important players must use cunning tactics in such a situation to stay ahead of the opposition.

Key Strategies Used by the Participants

To produce creative products that improve effectiveness, which is reliability, and cost-effectiveness, businesses make significant investments in research and development. Product innovation enables companies to stand out from the competition while also meeting the shifting needs of their customers.

Strategic partnerships and alliances with other businesses are regularly formed by Key players in an industry to take advantage of each other's advantages and expand their market reach. Through such partnerships, companies may also obtain access to new technologies and markets.

The market for non-contrast CT imaging devices is growing quickly in emerging economies like China and India. To increase their presence in these regions, major companies are expanding their distribution networks and building regional manufacturing sites.

Mergers and acquisitions are frequently used by key players in the non-contrast CT imaging business to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the Non-Contrast CT Imaging Market:

The global non-contrast CT imaging market is estimated to be valued at USD 246.9 billion in 2025.

The market size for the non-contrast CT imaging market is projected to reach USD 371.8 billion by 2035.

The non-contrast CT imaging market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in non-contrast CT imaging market are low-slice scanners, medium-slice scanner and high-slice scanners.

In terms of application, cardiac imaging segment to command 29.4% share in the non-contrast CT imaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CT Guided Intervention Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Global CTNG Testing Market Analysis – Trends, Size & Forecast 2024-2034

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Actinic Keratosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Octadecanedioic Acid Market Size and Share Forecast Outlook 2025 to 2035

MCT Oil Market Size and Share Forecast Outlook 2025 to 2035

Activated Cake Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Octreotide Market Size and Share Forecast Outlook 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Bags Market Size and Share Forecast Outlook 2025 to 2035

Active & Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ectoin-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Activated Carbon Filter Market Growth - Trends & Forecast 2025 to 2035

Analysis of the Action Figures Market by Material, Type, End-user, and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA