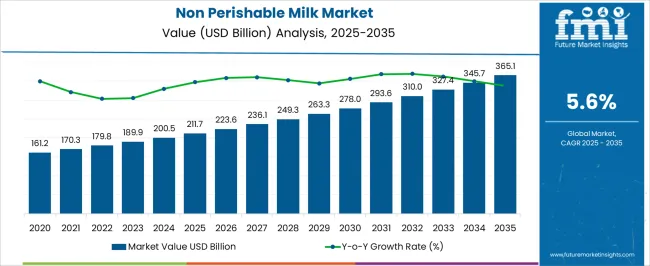

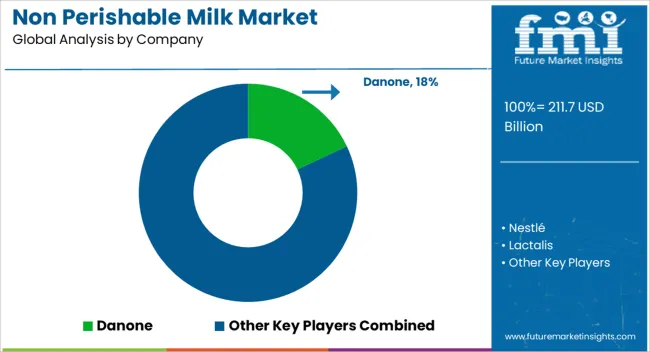

The non perishable milk market is estimated to be valued at USD 211.7 billion in 2025 and is projected to reach USD 365.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

Food safety standards, including pasteurization requirements, microbiological limits, and shelf-life specifications, are central to market stability. Regulatory bodies in major consuming regions enforce compliance with these standards, ensuring product safety and consistency, which directly affects manufacturer costs and operational processes. Labeling regulations related to nutritional content, fortification, and allergen disclosure also play a critical role, as adherence determines market access across different countries. Noncompliance can result in recalls, fines, or restricted distribution, which can impact market growth trajectories. The import-export regulations, tariffs, and regional quality certifications influence cross-border trade, with stricter frameworks in regions such as Europe and North America potentially limiting rapid market expansion compared to more flexible regulatory environments in parts of Asia-Pacific and Latin America.

Environmental and packaging-related regulations, including restrictions on single-use plastics and requirements for sustainable materials, further affect cost structures along the supply chain. These regulatory pressures require producers to invest in compliant packaging solutions, quality assurance systems, and monitoring processes. The regulatory landscape serves both as a safeguard for consumers and as a determinant of market dynamics, shaping investment strategies, production planning, and distribution approaches across regions.

| Metric | Value |

|---|---|

| Non Perishable Milk Market Estimated Value in (2025 E) | USD 211.7 billion |

| Non Perishable Milk Market Forecast Value in (2035 F) | USD 365.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The non-perishable milk market is regarded as a strategic and steadily growing segment across the dairy and packaged beverage industries. It is estimated to hold 7.6% of the overall dairy and milk products market, reflecting demand for shelf stable, ready-to-consume milk. Within packaged beverages, a 5.2% share is assessed, supported by convenience and portability. Retail grocery and supermarket channels contribute 4.1%, highlighting distribution penetration. In infant and nutritional milk products, the share is 3.5%, driven by long shelf life and storage efficiency. The long shelf life food and beverage sector accounts for 6.3%, underpinned by demand in remote regions and emergency supplies.

Recent industry trends have been shaped by technological advances in ultra-high temperature processing, aseptic packaging, and extended shelf life solutions. Groundbreaking developments include plant-based long life milk alternatives, fortified variants with vitamins and minerals, and eco-friendly packaging. Key players are adopting strategies involving direct-to-consumer supply chains, collaboration with retailers for brand visibility, and innovations in packaging sustainability. Regional growth is led by Asia-Pacific and North America due to growing consumption, urban penetration, and lifestyle convenience. Automation in processing, enhanced sterilization, and value added formulations continue to drive adoption across multiple dairy and beverage applications.

The market is experiencing sustained growth, driven by evolving consumer lifestyles and the increasing demand for long shelf life dairy products. Extended storage capabilities without refrigeration have made non perishable milk an essential choice for households, food service providers, and remote supply chains. Advancements in processing technologies, particularly UHT treatment, have enhanced product safety and nutritional retention, encouraging broader adoption across global markets.

The growing prevalence of e-commerce grocery channels has further supported accessibility, while changing dietary patterns in emerging economies are boosting consumption. Increasing urbanization, coupled with rising disposable incomes, is strengthening demand for premium and fortified non perishable milk varieties.

Regulatory support for food safety and quality standards has encouraged manufacturers to invest in product innovation and packaging improvements As global supply chains seek stable and transport-friendly dairy solutions, non perishable milk is positioned to maintain a strong trajectory of growth, with demand spanning retail, institutional, and export markets.

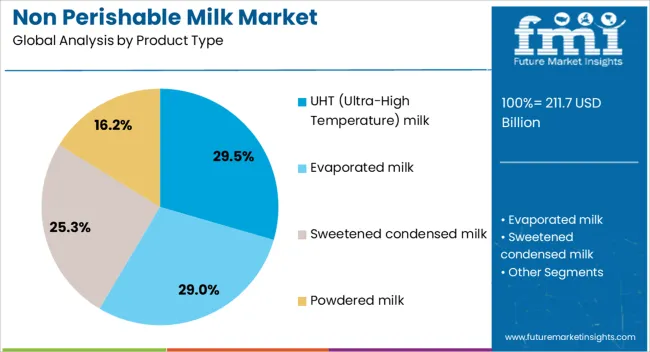

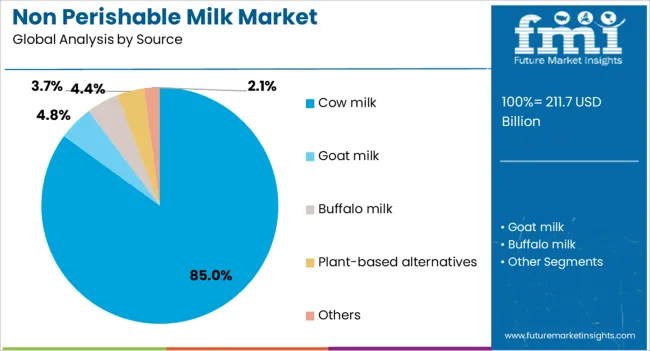

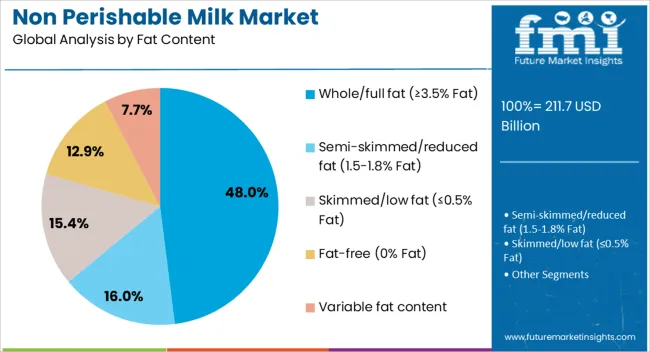

The non perishable milk market is segmented by product type, source, fat content, packaging type, distribution channel, end use, and geographic regions. By product type, non perishable milk market is divided into UHT (Ultra-High Temperature) milk, evaporated milk, sweetened condensed milk, powdered milk, and others. In terms of source, non perishable milk market is classified into cow milk, goat milk, buffalo milk, plant-based alternatives, and others. Based on fat content, non perishable milk market is segmented into whole/full fat (≥3.5% Fat), semi-skimmed/reduced fat (1.5-1.8% Fat), skimmed/low fat (≤0.5% Fat), fat-free (0% Fat), and variable fat content. By packaging type, non perishable milk market is segmented into tetra packs/aseptic cartons, cans, bottles, pouches, bag-in-box, tins & sachets (for powdered milk), and others. By distribution channel, non perishable milk market is segmented into supermarkets & hypermarkets, specialty stores, convenience stores, online retail, foodservice, direct sales (B2B), and others. By end use, non perishable milk market is segmented into direct consumption, food processing, beverage industry, food service industry, nutritional supplements, and others. Regionally, the non perishable milk industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The UHT milk product type is projected to account for 29.50% of the non perishable milk market revenue share in 2025, making it the leading product type. This dominance has been driven by its ability to maintain product safety and quality for extended periods without refrigeration. The application of ultra-high temperature processing eliminates harmful microorganisms while preserving taste and nutritional content, meeting both health and convenience expectations. Its compatibility with diverse packaging formats enhances portability and storage efficiency, making it suitable for a wide range of distribution channels. Demand has been further supported by the increasing need for shelf stable dairy products in regions with limited cold chain infrastructure. The suitability of UHT milk for export markets and emergency food supply programs has reinforced its position in the market Its consistent performance in maintaining flavor and freshness over long durations has ensured sustained consumer preference, establishing UHT milk as a key growth driver within the product type category.

The cow milk source segment is expected to hold 85% of the market revenue share in 2025, solidifying its position as the dominant source type. This leadership has been supported by its abundant availability, established production infrastructure, and high consumer acceptance across global markets. Cow milk offers a well-balanced nutritional profile, making it suitable for both direct consumption and processing into value-added dairy products. The adaptability of cow milk to advanced processing methods such as UHT treatment has further strengthened its role in the non perishable segment. The broad reach of dairy cooperatives and commercial farms ensures steady supply, while strong brand recognition associated with cow milk products supports consumer trust. Its cost competitiveness compared to alternative milk sources has also contributed to its sustained demand The combination of quality consistency, scalability, and compatibility with evolving processing technologies continues to drive the dominant share of cow milk in the overall market.

The whole or full fat category, defined as containing 3.5% fat or higher, is projected to capture 48% of the market revenue share in 2025, making it the leading fat content segment. This preference has been shaped by consumer demand for richer flavor, creamier texture, and enhanced nutritional benefits associated with higher fat content. Whole or full fat milk is valued for its role in delivering essential fatty acids and fat-soluble vitamins, contributing to a balanced diet. Its use in culinary applications and premium beverage formulations has further supported its popularity. In non perishable formats, the preservation of natural taste and mouthfeel through advanced processing techniques has strengthened consumer loyalty. The segment has also benefited from shifting dietary trends that embrace natural and less processed dairy products Its strong presence in both retail and food service channels ensures that whole or full fat milk continues to be a primary driver of revenue growth in the non perishable milk market.

The market has grown substantially due to its extended shelf life, convenience, and nutritional retention compared to fresh milk. Products such as UHT (ultra high temperature) milk, powdered milk, and sterilized liquid milk have been widely adopted in households, foodservice, and industrial applications. Growth has been driven by increasing global consumption, rising demand in regions with limited cold chain infrastructure, and evolving consumer lifestyles favoring ready to use dairy products. Manufacturers have focused on maintaining taste, nutrient content, and microbial safety while expanding distribution through retail, online, and institutional channels.

Non-perishable milk products have been favored for their ability to remain stable without refrigeration, particularly in regions with limited cold chain infrastructure. UHT milk, sterilized liquid milk, and powdered milk have allowed consumers to store dairy products for weeks or months without quality degradation. This stability has supported distribution to remote and rural areas, schools, and emergency relief programs. Packaging innovations including tetra packs, aseptic cartons, and vacuum sealed pouches have enhanced protection against contamination and spoilage. Extended shelf life has allowed retailers to reduce inventory loss, while consumers have benefited from convenience, consistent quality, and uninterrupted access to dairy nutrients.

Advancements in processing technology have preserved the protein, calcium, vitamins, and taste profile of non-perishable milk products. Fortification with minerals, vitamins, and functional ingredients has addressed specific dietary needs and health conscious consumer segments. Powdered milk has been used in infant nutrition, sports nutrition, and cooking applications due to its versatility and nutrient retention. Flavor variations such as chocolate, vanilla, and lactose free formulations have been introduced to widen consumer acceptance. Innovations in homogenization, spray drying, and aseptic filling have allowed manufacturers to maintain sensory and nutritional qualities comparable to fresh milk, increasing confidence and adoption among diverse demographics.

The market has been reinforced by the expansion of supermarkets, convenience stores, and e commerce platforms offering ready to consume dairy solutions. Shelf stable products enable retailers to stock large volumes without refrigeration, reducing operational costs and spoilage. Single serve packs and portion controlled options have been designed for on the go consumption and household flexibility. Institutional buyers including hotels, restaurants, and cafes rely on these products to ensure uninterrupted supply without refrigeration constraints. The combination of accessibility, convenience, and reliable quality has significantly contributed to consistent market demand across global regions.

Nonperishable milk has been widely used in bakery, confectionery, dairy products, and beverage formulations in industrial and foodservice sectors. Powdered and UHT milk provide reliable raw material for yogurt, cheese, ice cream, and flavored drinks, offering consistent composition and microbial safety. The extended shelf life reduces dependency on cold chain logistics for large scale production and catering operations. Emerging foodservice chains and quick service restaurants have increasingly relied on non-perishable milk for menu standardization and operational efficiency. Integration into industrial and institutional applications has provided steady consumption volumes, further supporting market growth and manufacturer investment in processing and packaging technologies.

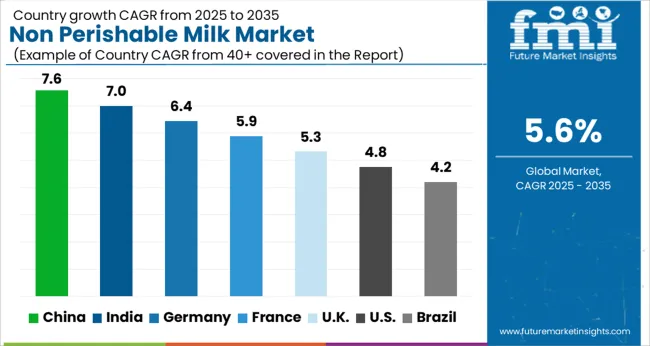

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

China maintained the leading growth in the non-perishable milk market with a forecast CAGR of 7.6%, driven by rising urban consumption, expanding dairy processing infrastructure, and increasing demand for long shelf-life products. India followed at 7.0%, supported by government initiatives in dairy modernization and growing retail distribution networks. Germany grew at 6.4%, leveraging advanced processing technologies and strong consumer preference for packaged milk. The United Kingdom recorded 5.3%, driven by product diversification and increased demand in the retail sector. The United States registered 4.8%, where large-scale production and widespread adoption of UHT milk sustained market growth. These countries collectively reflect the global dynamics of production, innovation, and market adoption in non-perishable milk. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.6% in the market, driven by increasing urbanization, changing lifestyles, and a preference for convenient dairy products. The rising awareness of nutritional benefits, coupled with growing middle-class incomes, encourages consumption across households. Modern retail formats and e-commerce channels are expanding access to long-life milk products. Domestic and international manufacturers are focusing on product diversification, including flavored, fortified, and shelf-stable milk variants. Government regulations ensuring safety and quality standards reinforce consumer trust. China presents significant growth potential in non-perishable milk consumption, supported by convenience-driven lifestyles, expanding retail infrastructure, and increasing health-conscious demand.

India is expected to expand at a CAGR of 7.0% in the market, supported by increasing demand for safe, convenient, and nutritious dairy products. Rising awareness about protein intake and fortified foods encourages adoption among urban and semi-urban populations. Local and multinational companies are introducing innovative flavors and packaging to cater to evolving consumer needs. Modern retail chains, supermarkets, and e-commerce platforms play a crucial role in distribution. Government initiatives promoting dairy safety, fortification programs, and quality standards further stimulate market growth. India exhibits steady growth prospects in the market, driven by health-conscious consumer behavior and an expanding organized retail ecosystem.

Germany is experiencing a CAGR of 6.4% in the market, supported by growing demand for long-life, fortified, and organic dairy products. Consumers increasingly seek convenient options with nutritional benefits that align with active lifestyles. Supermarkets, specialty stores, and online platforms expand the reach of shelf-stable milk products. Manufacturers emphasize quality, hygiene, and sustainable packaging to meet consumer expectations. Regulatory standards ensure product safety, reinforcing trust and adoption. Germany represents a mature market for non-perishable milk, where health-conscious consumption trends, convenience, and premium product offerings drive growth.

The United Kingdom is growing at a CAGR of 5.3% in the market, driven by demand for long-life, functional, and fortified dairy products. Changing lifestyles and convenience-oriented consumption patterns encourage household adoption. Retail chains, health stores, and online grocery platforms enhance product accessibility. Companies focus on packaging innovations, extended shelf-life solutions, and fortified variants to cater to urban consumers. Government regulations regarding nutritional labeling and food safety ensure product quality. The UK market exhibits steady growth opportunities, shaped by consumer awareness, convenience preferences, and continuous product innovations in non-perishable milk.

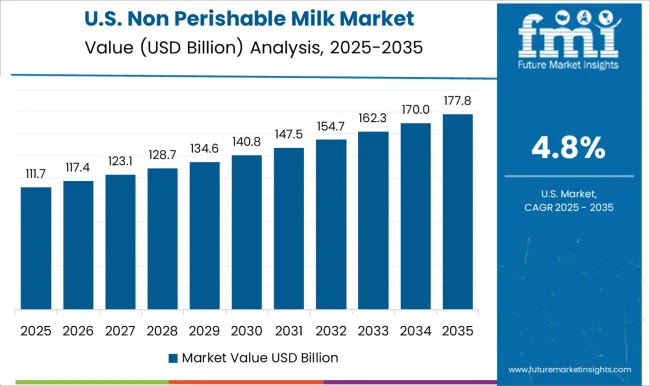

The United States is expanding at a CAGR of 4.8% in the market, supported by consumer preference for convenient, fortified, and long-life dairy products. Health-conscious trends encourage adoption of protein-rich and functional milk varieties. Retail stores and e-commerce platforms enhance product accessibility across urban and suburban regions. Companies focus on innovative packaging, flavors, and shelf-stable variants to cater to busy lifestyles. Regulatory standards ensure safety and quality, fostering consumer confidence. The US market presents steady growth potential in non-perishable milk consumption, driven by convenience, health trends, and organized retail distribution networks.

The market is witnessing steady growth as consumers increasingly seek convenient, long-shelf-life dairy options. Danone remains a key player with a broad portfolio of UHT and aseptically packaged milk, catering to international markets while emphasizing quality and safety. Nestlé contributes significantly through its extensive range of shelf-stable milk products, including fortified variants designed for diverse consumer needs, from children to adults. Lactalis leverages its global network to provide a variety of long-life milk products, maintaining consistency in taste, nutritional content, and regulatory compliance across regions. Fonterra focuses on producing UHT and powdered milk for both retail and industrial applications, emphasizing innovation in processing technologies that extend shelf life without compromising flavor or nutritional value.

FrieslandCampina (Friesland) offers a mix of consumer-focused non-perishable milk products, emphasizing sustainability and high-quality dairy sourcing. Arla Foods provides an extensive selection of long-life milk variants, combining natural ingredients with modern aseptic packaging techniques. In addition, numerous local and regional cooperatives play a critical role in supplying niche markets, offering traditional flavors and catering to regional tastes. Collectively, these providers support market growth by ensuring availability, quality, and convenience for a diverse global consumer base.

| Item | Value |

|---|---|

| Quantitative Units | USD 211.7 billion |

| Product Type | UHT (Ultra-High Temperature) milk, Evaporated milk, Sweetened condensed milk, Powdered milk, and Others |

| Source | Cow milk, Goat milk, Buffalo milk, Plant-based alternatives, and Others |

| Fat Content | Whole/full fat (≥3.5% Fat), Semi-skimmed/reduced fat (1.5-1.8% Fat), Skimmed/low fat (≤0.5% Fat), Fat-free (0% Fat), and Variable fat content |

| Packaging Type | Tetra packs/aseptic cartons, Cans, Bottles, Pouches, Bag-in-box, Tins & sachets (for Powdered Milk), and Others |

| Distribution Channel | Supermarkets & hypermarkets, Specialty stores, Convenience stores, Online retail, Foodservice, Direct sales (B2B), and Others |

| End Use | Direct consumption, Food processing, Beverage industry, Food service industry, Nutritional supplements, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Danone, Nestlé, Lactalis, Fonterra, FrieslandCampina (Friesland), Arla Foods, Local / regional cooperatives, and Others |

| Additional Attributes | Dollar sales by milk type and distribution channel, demand dynamics across retail, foodservice, and institutional segments, regional trends in long-life milk adoption, innovation in fortification, shelf-life extension, and packaging, environmental impact of production and packaging waste, and emerging use cases in convenience products and nutritional supplementation. |

The global non perishable milk market is estimated to be valued at USD 211.7 billion in 2025.

The market size for the non perishable milk market is projected to reach USD 365.1 billion by 2035.

The non perishable milk market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in non perishable milk market are uht (ultra-high temperature) milk, _whole uht milk, _semi-skimmed uht milk, _skimmed uht milk, _flavored uht milk, evaporated milk, _whole evaporated milk, _skimmed evaporated milk, _others, sweetened condensed milk, _regular sweetened condensed milk, _flavored sweetened condensed milk, _others, powdered milk, _whole milk powder, _skimmed milk powder, _fat-filled milk powder, _infant formula, _others and others.

In terms of source, cow milk segment to command 85.0% share in the non perishable milk market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Non-Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Non Destructive Testers (NDT) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nonaisoprenol Market Size and Share Forecast Outlook 2025 to 2035

Non Lethal Projectiles Market Size and Share Forecast Outlook 2025 to 2035

Nonmetallic Mineral Product Market Size and Share Forecast Outlook 2025 to 2035

Non-Magnetic Connectors Market Size and Share Forecast Outlook 2025 to 2035

Non-Selective Broadleaf Herbicides Market Size and Share Forecast Outlook 2025 to 2035

Non-Insulin Peptide Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nonylphenol Ethoxylates Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Non-Contrast CT Imaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Non-Powered Air Purifying Respirator Market Size and Share Forecast Outlook 2025 to 2035

Non-Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Non-Sterile Liquids Suspensions Market Size and Share Forecast Outlook 2025 to 2035

Non-Polarized Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Non-Dairy Yogurt Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA