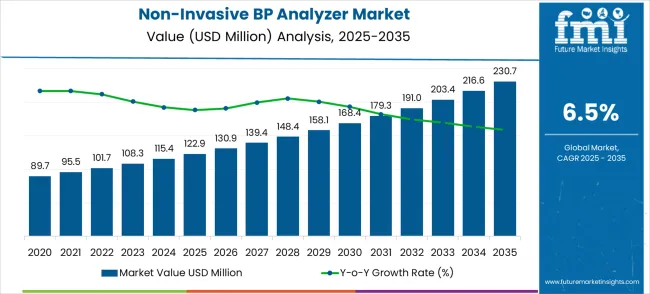

The non-invasive blood pressure analyzer market is set to increase from USD 122.9 million in 2025 to USD 230.7 million by 2035, with a CAGR of 6.5%, reflecting steady market expansion throughout the forecast period. From 2021 to 2025, the market sees consistent growth, rising from USD 89.7 million in 2021 to USD 122.9 million in 2025. This growth is driven by the increasing demand for non-invasive diagnostic solutions in healthcare environments. Companies that lead in technological advancements, patient-centered solutions, and adapting to healthcare needs are likely to see a strong and steady increase in their market share.

Between 2025 and 2035, the market is expected to experience gradual growth, moving from USD 122.9 million to USD 230.7 million. This indicates that companies innovating in device functionality such as improving accuracy, enhancing wireless connectivity, and integrating with electronic health records (EHR)—are positioned to capture a larger share of the market. On the other hand, companies that do not prioritize innovation or lag behind in regulatory compliance may face a decline in their market share. The increasing demand for advanced, non-invasive solutions will favor companies that adapt quickly to market trends, potentially leading to a redistribution of market share in favor of more progressive players.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 122.9 million |

| Forecast Value in (2035F) | USD 230.7 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The medical diagnostics market is the primary driver, accounting for approximately 40–45% of the market share. Non-invasive blood pressure analyzers are essential in medical diagnostics, where they are widely used in hospitals, clinics, and healthcare centers for routine blood pressure monitoring. The healthcare equipment market plays a significant role, contributing about 25–30%, as NIBP analyzers are part of a broader range of diagnostic and monitoring devices used by healthcare professionals to assess patient health.

The home healthcare market is an emerging segment, contributing roughly 15–18%, as patients increasingly use non-invasive blood pressure analyzers for home monitoring, particularly for chronic conditions such as hypertension. The fitness and wellness market influences the demand as well, with about 5–8% of the market share, as more consumers are interested in personal health monitoring devices for fitness tracking, which includes blood pressure monitoring as part of overall health management. The telemedicine and remote patient monitoring market, contributing around 5–8%, drives the adoption of NIBP analyzers as part of remote diagnostics and telehealth services, enabling healthcare providers to monitor patients' blood pressure from a distance.

Market expansion is being supported by the increasing focus on animal welfare in biomedical research and the corresponding demand for non-invasive measurement technologies that minimize stress and provide accurate cardiovascular data. Modern research protocols require precise blood pressure monitoring that can be performed repeatedly without causing physiological stress or requiring anesthesia that might interfere with experimental results. Advanced non-invasive analyzers provide the measurement accuracy and reliability needed for cardiovascular research while maintaining research subject welfare and data quality standards.

The growing complexity of cardiovascular disease research and drug development programs is driving demand for sophisticated monitoring systems that can provide comprehensive hemodynamic data for diverse research applications. Regulatory requirements and ethical guidelines for animal research are creating opportunities for non-invasive technologies that support both scientific rigor and animal welfare compliance. The rising adoption of translational research approaches and personalized medicine development is also contributing to increased demand for monitoring systems that can provide detailed cardiovascular phenotyping data across different research models and applications.

The market is segmented by device type, end-use application, measurement technology, channel configuration, data output, and region. By device type, the market is divided into single channel and multi-channel systems. Based on end-use application, the market is categorized into disease model research, drug development, hypertension research, and others. In terms of measurement technology, the market is segmented into tail-cuff method, volume pressure recording, and oscillometric measurement. By channel configuration, the market is classified into 1-channel, 4-channel, 8-channel, and 16-channel systems. By data output, the market is divided into analog output, digital output, and network connectivity. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

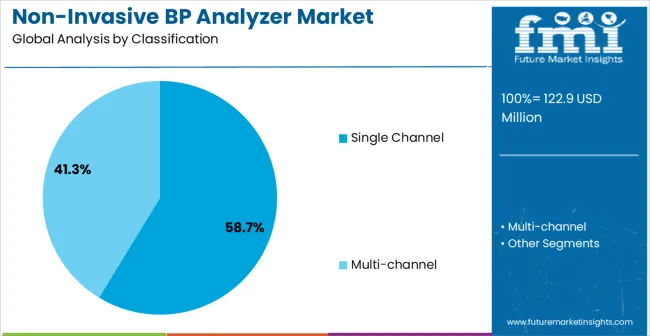

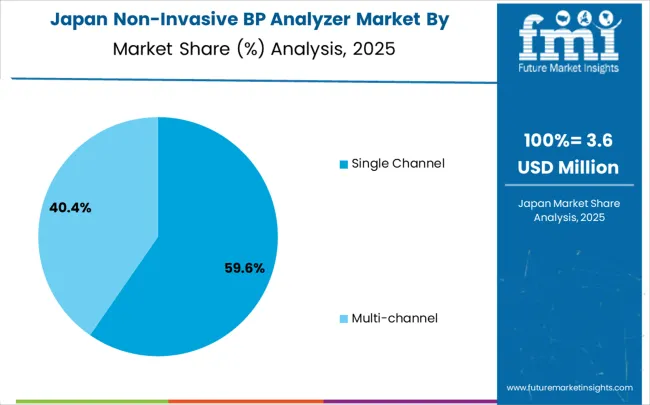

The single channel device segment is projected to capture 58.7% of the non-invasive blood pressure analyzer market in 2025, reinforcing its dominant position. This device type is favored for its cost-effectiveness, reliability, and ease of use in standard cardiovascular research applications. Single channel analyzers are essential for routine hemodynamic monitoring, drug efficacy studies, and disease model characterization. Their proven ability to provide accurate blood pressure measurements while simplifying operation makes them the go-to solution for researchers seeking dependable monitoring equipment. Single channel systems provide the perfect balance between performance and affordability, ensuring widespread adoption in research settings.

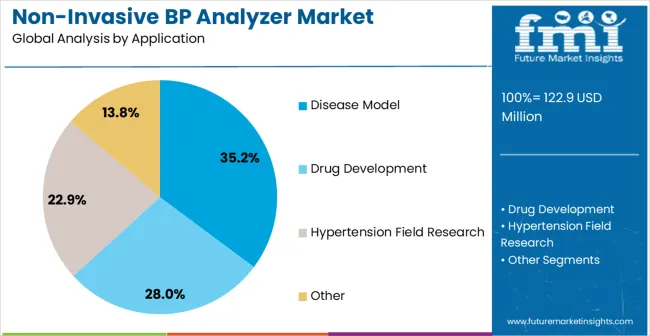

The disease model research application is projected to represent 35.2% of non-invasive blood pressure analyzer demand in 2025, underscoring its role as the largest application category for cardiovascular monitoring equipment. Research institutions consistently focus on disease model applications for their fundamental importance in understanding cardiovascular pathophysiology, developing therapeutic interventions, and validating treatment efficacy. Positioned as essential research tools, disease model blood pressure analyzers offer both scientific benefits, such as detailed hemodynamic characterization and longitudinal monitoring capabilities, and research advantages, including reproducible data collection and standardized measurement protocols.

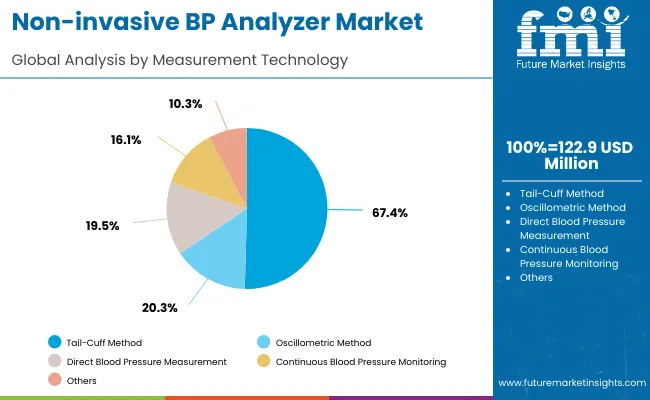

The tail-cuff method technology is forecasted to contribute 67.4% of the non-invasive blood pressure analyzer market in 2025, reflecting the widespread adoption of this established measurement technique in small animal research applications. Researchers consistently prefer tail-cuff methodology for its proven accuracy in rodent studies, non-invasive measurement approach, and compatibility with conscious animal monitoring protocols. This measurement technology aligns with the requirements of most cardiovascular research applications while providing standardized measurement procedures that enable data comparison across different studies and research institutions.

The non-invasive blood pressure analyzer market is advancing steadily due to increasing focus on animal welfare in biomedical research and growing demand for stress-free measurement technologies that provide accurate cardiovascular data without compromising research subject well-being. , The market faces challenges including measurement accuracy limitations in certain experimental conditions, complex data interpretation requirements, and competition from alternative monitoring technologies. Innovation in sensor technologies and data analysis software continue to influence measurement performance and market expansion patterns.

The growing adoption of multi-channel blood pressure monitoring systems is enabling enhanced research productivity through simultaneous measurement of multiple research subjects and comprehensive hemodynamic data collection. Advanced multi-channel analyzers equipped with automated data management and statistical analysis capabilities provide superior research efficiency while maintaining measurement accuracy and animal welfare standards. These technologies offer exceptional throughput and data quality, particularly beneficial for large-scale drug development studies and population-based cardiovascular research requiring extensive data collection and analysis.

Modern non-invasive blood pressure analyzer manufacturers are incorporating wireless data transmission and automated data management technologies to improve research workflow efficiency and data quality assurance. Advanced software platforms enable real-time data monitoring, automated analysis protocols, and comprehensive data documentation that support regulatory compliance and research quality standards. These technologies enhance research productivity while providing the data management capabilities necessary for complex cardiovascular studies and multi-site research collaborations.

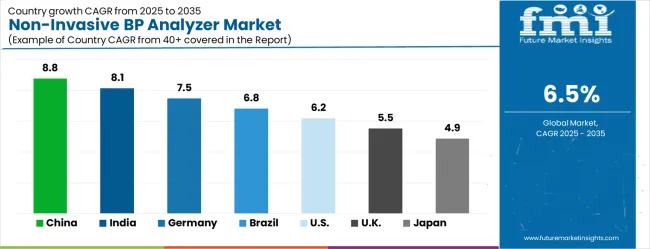

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| United States | 6.2% |

| United Kingdom | 5.5% |

| Japan | 4.9% |

The non-invasive blood pressure analyzer market is experiencing robust growth globally, with China leading at 8.8% CAGR through 2035, driven by rapid expansion of biomedical research infrastructure, increasing investment in cardiovascular disease research, and growing adoption of advanced research instrumentation. India follows at 8.1%, supported by expanding pharmaceutical industry, increasing research and development investment, and growing focus on preclinical research capabilities. Germany shows strong growth at 7.5%, emphasizing precision engineering excellence and advanced biomedical research technology development. Brazil records 6.8%, focusing on research infrastructure modernization and cardiovascular health research expansion. The United States demonstrates 6.2% growth, prioritizing biomedical research innovation and advanced instrumentation capabilities. The United Kingdom shows 5.5% expansion, supported by pharmaceutical research excellence and preclinical research development programs. Japan maintains 4.9% growth, leveraging precision manufacturing expertise and advanced biomedical instrumentation technology capabilities.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

The non-invasive blood pressure analyzer market in China is expected to grow at a CAGR of 8.8% from 2025 to 2035, driven by the rising prevalence of hypertension, an aging population, and increasing health awareness. Healthcare providers are increasingly adopting advanced diagnostic tools that offer accurate, non-invasive measurements, reducing the need for cumbersome traditional procedures. The Chinese government’s initiatives to modernize healthcare facilities, especially in tier-2 and tier-3 cities, are further propelling the adoption of non-invasive blood pressure analyzers. The growing trend of home healthcare is creating demand for portable devices. Chinese manufacturers are focusing on R&D to improve device accuracy, portability, and integration with telemedicine platforms, contributing to market growth.

The non-Invasive blood pressure analyzer market is projected to grow at an 8.1% CAGR from 2025 to 2035, fueled by a significant rise in lifestyle-related diseases, including hypertension and diabetes, among the population. The increased focus on primary healthcare and chronic disease management is driving the adoption of non-invasive blood pressure analyzers. Urbanization and the expanding middle class are making healthcare technologies more accessible, with an focus on portable and user-friendly devices for home use. Moreover, the Indian government healthcare initiatives, including the National Health Mission, are contributing to the growth of diagnostic equipment across the country. Manufacturers are capitalizing on cost-effective solutions tailored to the Indian market, helping drive adoption.

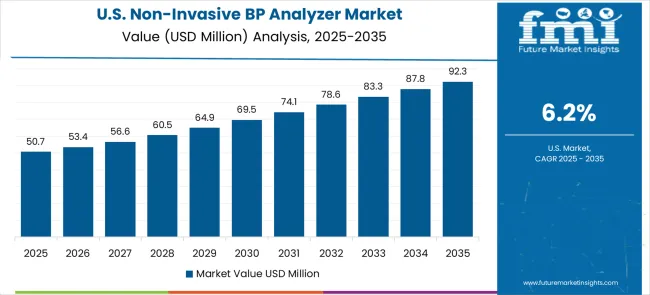

The USA market is projected to grow at a CAGR of 6.2% from 2025 to 2035, fueled by increasing awareness about hypertension management and the need for non-invasive diagnostic solutions. As the prevalence of cardiovascular diseases continues to rise, healthcare professionals and consumers are turning to advanced, easy-to-use, and accurate blood pressure measurement tools. The growing trend of remote patient monitoring and telemedicine is also driving demand for portable and connected devices. The USA government’s healthcare policies and reimbursement programs are facilitating the adoption of modern diagnostic technologies in hospitals and outpatient clinics.

Demand for non-invasive blood pressure analyzer in Germany is expanding at a CAGR of 7.5% from 2025 to 2035, driven by the country’s robust healthcare infrastructure and growing demand for advanced medical diagnostics. Germany’s aging population is a major factor contributing to the increased prevalence of cardiovascular diseases, including hypertension. The government’s commitment to providing quality healthcare services has led to increased investment in medical technologies, including blood pressure analyzers. Germany is home to several key players in the healthcare device market, which are continuously innovating to develop more accurate, user-friendly devices. Integration with digital health platforms is also a key trend.

The non-invasive blood pressure analyzer market in Brazil is expected to expand at a CAGR of 6.8% from 2025 to 2035, driven by the country's large healthcare market and a growing middle class. The increasing incidence of hypertension and other cardiovascular diseases is contributing to higher demand for non-invasive diagnostic tools. With a focus on improving healthcare accessibility, Brazil is investing in expanding its healthcare infrastructure, particularly in rural and underserved areas. The government is pushing for the inclusion of advanced diagnostic devices in public health centers, which is expected to boost market demand. There is a growing trend towards the adoption of portable blood pressure analyzers for home use.

The UK market is expected to grow at a CAGR of 5.5% from 2025 to 2035, driven by the aging population and an increasing burden of chronic diseases such as hypertension. The National Health Service (NHS) continues to invest in advanced diagnostic tools, including non-invasive blood pressure analyzers, to improve patient care and monitoring. With growing awareness of the importance of cardiovascular health, there is an increasing preference for home monitoring devices. The rise in telehealth services has accelerated the adoption of connected and portable devices, allowing patients to monitor their health remotely.

Demand for non-invasive blood pressure analyzer in Japan is anticipated to rise at a CAGR of 4.9% from 2025 to 2035, driven by the country’s rapidly aging population and the associated rise in cardiovascular diseases. The demand for non-invasive blood pressure analyzers is growing, particularly in hospitals, clinics, and home healthcare settings. Japan's healthcare system is advanced, and there is a high focus on preventative care, which includes regular blood pressure monitoring. Government initiatives to improve the accessibility of healthcare services, particularly in rural regions, are further propelling market growth. The popularity of wearable and portable medical devices is also rising.

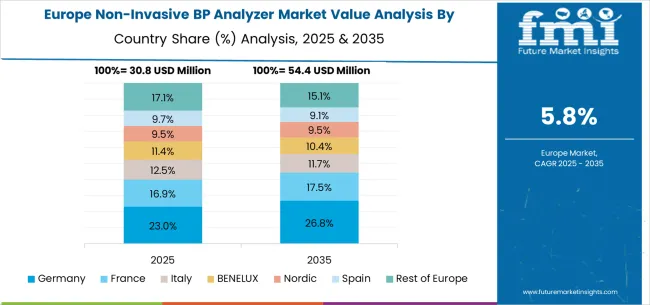

The non-invasive blood pressure analyzer market in Europe is projected to grow from USD 30.8 million in 2025 to USD 54.4 million by 2035, registering a CAGR of 5.8% over the forecast period. Germany will remain the largest market, expanding from 23.0% in 2025 to 26.8% by 2035, supported by its biomedical research infrastructure, cardiovascular research programs, and strong medtech industry base. France will hold 16.9% in 2025, rising to 17.5% by 2035, reflecting steady demand across clinical research institutions and cardiovascular diagnostics. Italy is expected to contribute 12.5% in 2025, declining slightly to 11.7% by 2035, reflecting moderate adoption in healthcare systems.

The BENELUX region will account for 11.4% in 2025, softening to 10.4% by 2035, reflecting consolidation in specialized medtech clusters. The Nordic countries will represent 9.5% in 2025, falling slightly to 9.1% by 2035, supported by cardiovascular disease research but facing slower incremental growth. Spain will hold 9.7% in 2025, softening to 9.1% by 2035, reflecting limited expansion despite steady adoption. Meanwhile, the Rest of Europe will decline from 17.1% in 2025 to 15.1% by 2035, as adoption in smaller Eastern European markets lags behind Western medtech hubs.

The non-invasive blood pressure analyzer market is characterized by competition among specialized biomedical instrumentation manufacturers, research equipment providers, and laboratory technology companies focusing on high-quality monitoring solutions for cardiovascular research applications. Companies are investing in advanced sensor technologies, comprehensive software platforms, regulatory compliance capabilities, and technical support services to deliver reliable, accurate, and user-friendly monitoring systems for demanding research environments. Technology innovation, measurement precision, and research application expertise are central to strengthening product portfolios and market positioning in this specialized research instrumentation sector.

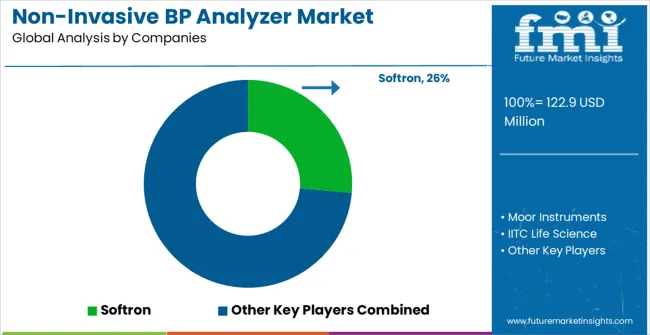

Softron, Japan-based, provides comprehensive non-invasive blood pressure monitoring solutions with focus on tail-cuff methodology, multi-channel capabilities, and advanced data analysis software for cardiovascular research applications. Moor Instruments, UK, delivers sophisticated physiological monitoring systems with focus on laser Doppler technology integration and comprehensive research applications. IITC Life Science offers specialized animal research instrumentation with focus on cardiovascular monitoring, behavioral assessment, and comprehensive research support services. Visitech Systems provides advanced monitoring equipment with focus on non-invasive measurement technologies and laboratory automation integration.

Kent Scientific delivers precision research instrumentation with focus on animal welfare compliance and comprehensive measurement capabilities. Muromachi Kikai, Japan, offers specialized biomedical equipment with focus on precision manufacturing and quality assurance for research applications. Nanjing Calvin Biotech, Beijing Zhishu Duobao Biotech, Alaska Technology, Anhui Yaokun Biotech, Hangzhou Jianke Life Science, and Shanghai Yuyan Scientific Instruments provide comprehensive research instrumentation solutions across diverse biomedical applications, maintaining focus on measurement accuracy, regulatory compliance, and cost-effective solutions for academic and industrial research environments.

Non-invasive blood pressure analyzers represent essential tools for cardiovascular research and drug development, with the global market valued at $122.9 million in 2023 and projected to reach $230.7 million by 2030, growing at a 6.5% CAGR. These specialized instruments enable continuous, automated blood pressure monitoring in laboratory animals and human subjects without surgical intervention, supporting hypertension research, pharmaceutical development, and cardiovascular disease studies. Market growth is driven by increasing cardiovascular disease prevalence, expanding preclinical research activities, regulatory requirements for safety testing, and technological advances in sensor miniaturization and data analytics. However, scaling requires coordinated efforts across regulatory compliance, technology standardization, clinical validation, and specialized training programs.

Biomedical Research Facility Investment: Establish national centers of excellence for cardiovascular research equipped with state-of-the-art non-invasive monitoring systems. Provide grants for universities and research institutes upgrading their preclinical research capabilities with advanced blood pressure analysis equipment.

Regulatory Framework Development: Create streamlined approval pathways for innovative blood pressure monitoring technologies while maintaining rigorous safety and accuracy standards. Develop harmonized guidelines for non-invasive blood pressure measurement in both animal research and clinical applications.

Research Funding Programs: Fund large-scale cardiovascular research initiatives requiring sophisticated blood pressure monitoring capabilities. Support translational research projects bridging preclinical animal studies with human clinical trials using compatible monitoring technologies.

Technology Transfer Initiatives: Facilitate collaboration between academic research institutions and commercial manufacturers to accelerate development of next-generation blood pressure analysis systems. Provide funding for proof-of-concept studies validating new sensor technologies and analysis algorithms.

International Research Collaboration: Establish bilateral research agreements enabling sharing of cardiovascular research data and standardization of blood pressure measurement protocols across different research institutions and regulatory jurisdictions.

Measurement Accuracy Standards: Develop comprehensive validation protocols for non-invasive blood pressure measurement accuracy across different species, age groups, and disease models. Create standardized calibration procedures ensuring measurement consistency between different analyzer systems and research facilities.

Data Integration Guidelines: Establish protocols for integrating blood pressure data with other physiological parameters including heart rate variability, cardiac output, and vascular resistance measurements. Develop standardized data formats enabling cross-platform analysis and multi-site research collaboration.

Animal Welfare Best Practices: Create comprehensive guidelines for humane non-invasive blood pressure monitoring minimizing animal stress while maintaining measurement accuracy. Develop training protocols for research personnel on proper restraint techniques and equipment operation.

Clinical Translation Frameworks: Establish validation pathways for translating preclinical blood pressure findings to human clinical applications. Develop comparative analysis methodologies correlating animal model results with human cardiovascular responses.

Quality Assurance Programs: Implement certification programs for blood pressure analyzer manufacturers ensuring equipment reliability, measurement accuracy, and compliance with research quality standards.

Advanced Sensor Technologies: Develop next-generation pressure sensors with improved sensitivity, reduced noise characteristics, and enhanced stability for long-term monitoring applications. Invest in MEMS-based sensor systems enabling miniaturization while maintaining accuracy.

Multi-Parameter Integration: Create integrated monitoring platforms combining blood pressure measurement with ECG, temperature, activity monitoring, and respiratory analysis. Develop wireless sensor systems enabling unrestrained monitoring in freely moving subjects.

Artificial Intelligence Integration: Implement machine learning algorithms for automated artifact detection, signal quality assessment, and predictive analysis of cardiovascular events. Develop AI-driven analysis systems capable of identifying subtle changes in blood pressure patterns indicating disease progression.

User-Friendly Interface Design: Create intuitive software platforms enabling researchers with varying technical expertise to operate sophisticated blood pressure analysis systems effectively. Develop automated report generation capabilities and statistical analysis tools.

Miniaturization and Portability: Advance portable blood pressure analysis systems for field research applications and point-of-care testing. Develop battery-powered systems with extended operation capabilities for longitudinal studies.

Protocol Standardization: Develop standardized operating procedures for non-invasive blood pressure measurement across different research applications including hypertension studies, drug safety testing, and cardiovascular disease modeling.

Training and Competency Programs: Establish comprehensive training programs for research personnel covering equipment operation, data interpretation, troubleshooting procedures, and quality control measures. Create certification systems ensuring consistent measurement practices across different operators.

Research Collaboration Networks: Form consortiums sharing best practices, validation data, and research protocols for non-invasive blood pressure analysis. Develop multi-site studies validating measurement consistency across different institutions and equipment platforms.

Data Management Systems: Implement robust data management platforms ensuring secure storage, backup, and analysis of blood pressure research data. Develop database systems supporting longitudinal studies and cross-study comparisons.

Clinical Translation Strategies: Develop systematic approaches for translating preclinical blood pressure research findings into clinical applications. Create validation protocols demonstrating correlation between animal model results and human clinical outcomes.

Research Infrastructure Development: Finance construction of specialized cardiovascular research facilities incorporating advanced blood pressure monitoring capabilities. Structure investments supporting both academic research institutions and commercial contract research organizations.

Technology Innovation Funding: Back startups and established companies developing breakthrough technologies including wireless monitoring systems, AI-driven analysis platforms, and novel sensor technologies. Support joint ventures between medical device manufacturers and software companies.

Market Expansion Investment: Fund expansion into emerging markets where cardiovascular research infrastructure is developing rapidly. Support establishment of regional service centers providing technical support, training, and equipment maintenance.

Clinical Validation Studies: Finance large-scale validation studies demonstrating clinical utility and regulatory compliance of advanced blood pressure analysis systems. Support post-market surveillance studies tracking long-term performance and reliability.

Digital Health Integration: Invest in companies developing integrated platforms connecting preclinical blood pressure research with clinical trial management systems and electronic health records. Support development of cloud-based analysis platforms enabling remote monitoring and data sharing.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 122.9 million |

| Device Type | Single Channel, Multi-channel |

| End-Use | Disease Model Research, Drug Development, Hypertension Research, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Softron, Moor Instruments, IITC Life Science, Visitech Systems, Kent Scientific, Muromachi Kikai, Nanjing Calvin Biotech, Beijing Zhishu Duobao Biotech, Alaska Technology, Anhui Yaokun Biotech, Hangzhou Jianke Life Science, Shanghai Yuyan Scientific Instruments |

| Additional Attributes | Dollar sales by device type and measurement technology, regional adoption trends across biomedical research markets, competitive landscape analysis with established instrumentation manufacturers and emerging research technology providers, researcher preferences for single-channel versus multi-channel monitoring systems, integration with laboratory information management systems and automated research workflows |

The global non-invasive blood pressure analyzer market is estimated to be valued at USD 122.9 million in 2025.

The market size for the non-invasive blood pressure analyzer market is projected to reach USD 230.7 million by 2035.

The non-invasive blood pressure analyzer market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in non-invasive blood pressure analyzer market are single channel and multi-channel.

In terms of application, disease model segment to command 35.2% share in the non-invasive blood pressure analyzer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Blood Cancer Treatment Market Growth – Trends & Forecast 2025 to 2035

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Key Players & Market Share in the Blood-Based Biomarker Industry

Competitive Landscape of Blood Temperature Indicator Providers

Blood Meal Market Analysis – Applications, Demand & Growth

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA