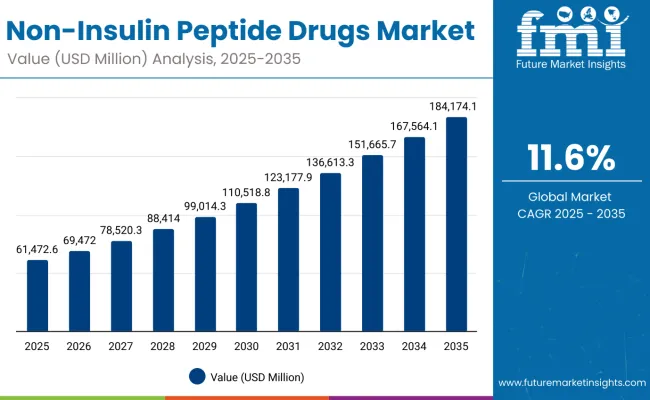

The non-insulin peptide drugs market is projected to grow from USD 61,472.6 million in 2025 to approximately USD 184,174.1 million by 2035, recording an absolute increase of USD 122,701.6 million over the forecast period. This translates into a total growth of 199.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 11.6% between 2025 and 2035. The overall market size is expected to grow by approximately 3.0X during the same period, supported by increasing prevalence of diabetes and obesity, growing adoption of innovative peptide therapies, and rising demand for targeted therapeutic solutions across global healthcare systems.

Non-Insulin Peptide Drugs Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 61,472.6 million |

| Forecast Value in (2035F) | USD 184,174.1 million |

| Forecast CAGR (2025 to 2035) | 11.60% |

Between 2025 and 2030, the non-insulin peptide drugs market is projected to expand from USD 61,472.6 million to USD 106,414.9 million, resulting in a value increase of USD 44,942.3 million, which represents 36.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of GLP-1 receptor agonists, rising prevalence of metabolic disorders, and growing utilization in diabetes and obesity management. Pharmaceutical manufacturers and biotechnology companies are expanding their product portfolios to address the growing demand for innovative peptide-based therapeutics in metabolic disease treatment.

From 2030 to 2035, the market is forecast to grow from USD 106,414.9 million to USD 184,174.1 million, adding another USD 77,759.3 million, which constitutes 63.4% of the overall ten-year expansion. This period is expected to be characterized by the advancement of dual-action peptide therapies, the integration of long-acting formulations, and the development of specialized treatments for rare metabolic disorders. The growing emphasis on personalized medicine and precision therapeutics will drive demand for advanced non-insulin peptide drugs with enhanced efficacy profiles and improved patient outcomes.

Between 2020 and 2024, the non-insulin peptide drugs market experienced robust growth, driven by breakthrough approvals of GLP-1 receptor agonists for obesity treatment and growing recognition of peptide therapies' effectiveness in treating metabolic disorders across hospital and outpatient applications. The market developed as healthcare providers recognized the potential for non-insulin peptide drugs to address unmet medical needs while meeting modern healthcare requirements for chronic disease management. Technological advancement in peptide synthesis and drug delivery began emphasizing the critical importance of maintaining therapeutic efficacy while extending duration of action and improving patient compliance.

The non-insulin peptide drugs market represents a transformative therapeutic opportunity at the intersection of metabolic medicine, biotechnology innovation, and precision healthcare, with the market projected to expand from USD 61,472.6 million in 2025 to USD 184,174.1 million by 2035 at a robust 11.6% CAGR a 3.0X growth driven by increasing diabetes and obesity prevalence, breakthrough peptide innovations, and the integration of advanced therapeutic modalities into mainstream medical practice.

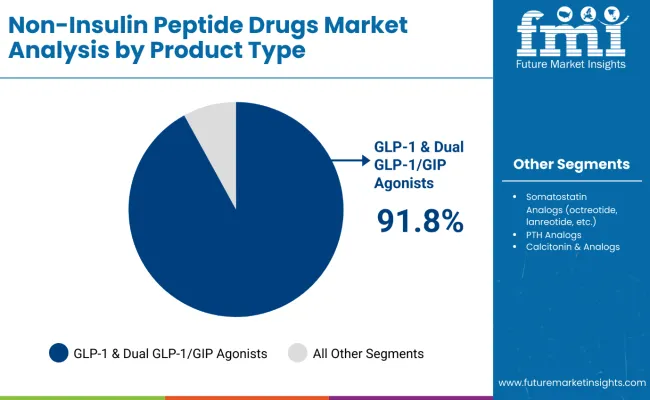

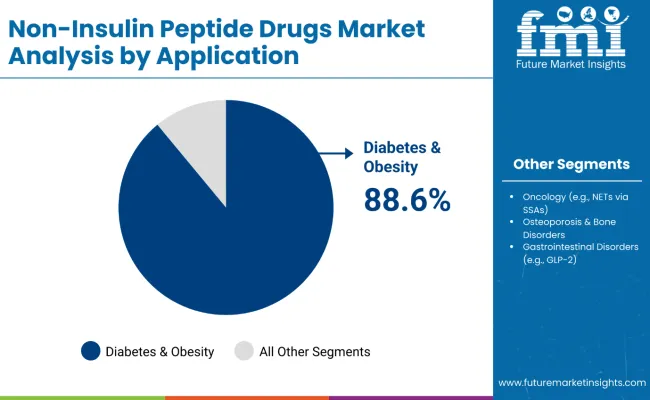

This convergence opportunity leverages the growing emphasis on metabolic disease management, advances in peptide engineering, and the increasing availability of specialized therapeutic solutions to create treatments that offer superior glycemic control and weight management. GLP-1 & Dual GLP-1/GIP Agonists lead with 91.8% market share due to their exceptional efficacy in diabetes and obesity treatment, while retail & specialty pharmacies dominate distribution with 69.5% share as specialized dispensing becomes increasingly important for high-value peptide therapeutics. Geographic growth is strongest in India (14.5% CAGR) and China (14.2% CAGR), where expanding healthcare infrastructure and growing metabolic disease prevalence create favorable market conditions.

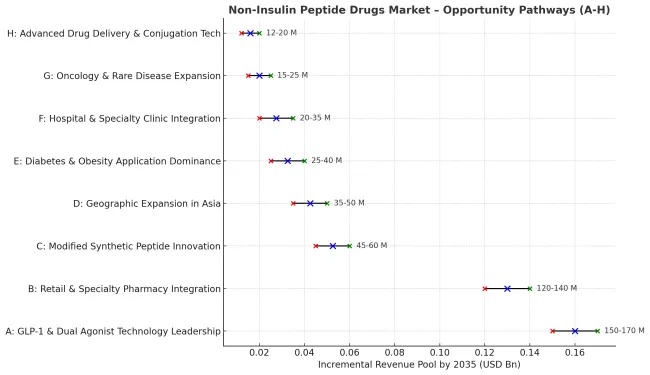

Pathway A - GLP-1 & Dual Agonist Technology Leadership. The dominant product category offers superior metabolic outcomes, weight management benefits, and cardiovascular protection essential for comprehensive diabetes and obesity care. Companies developing next-generation GLP-1 receptor agonists with enhanced dual mechanisms, improved dosing convenience, and expanded therapeutic indications will capture the leading technology segment. Expected revenue pool: USD 150-170 million.

Pathway B - Retail & Specialty Pharmacy Integration. The largest distribution segment benefits from growing demand for specialized dispensing services and comprehensive patient support programs. Providers developing advanced pharmacy networks with specialized peptide handling, patient education programs, and clinical outcome monitoring will dominate this primary distribution channel. Opportunity: USD 120-140 million.

Pathway C - Modified Synthetic Peptide Innovation. Advanced peptide therapeutics require sophisticated manufacturing processes capable of producing long-acting formulations, enhanced stability, and improved bioavailability. Companies investing in depot formulations, sustained-release technologies, and peptide modification platforms will create competitive differentiation and premium positioning. Revenue uplift: USD 45-60 million.

Pathway D - Geographic Expansion in High-Growth Asian Markets. India and China's expanding healthcare infrastructure and growing metabolic disease burden create substantial opportunities. Local partnerships, regulatory expertise, and culturally adapted treatment approaches enable market penetration in these high-growth regions. Pool: USD 35-50 million.

Pathway E - Diabetes & Obesity Application Dominance. Modern patients and healthcare providers prioritize comprehensive metabolic management and sustainable weight loss solutions. Developing therapies that address multiple metabolic parameters, provide cardiovascular benefits, and improve quality of life addresses growing demand for holistic treatment approaches. Expected upside: USD 25-40 million.

Pathway F - Hospital & Specialty Clinic Integration. Specialized healthcare facilities represent growing opportunities for comprehensive metabolic disease management and integrated treatment protocols. Systems offering seamless integration with clinical workflows, outcome tracking, and patient management create enhanced value propositions. USD 20-35 million.

Pathway G - Oncology and Rare Disease Expansion. Emerging therapeutic applications require specialized peptide formulations for neuroendocrine tumors, gastrointestinal disorders, and rare genetic conditions. Developing niche applications with somatostatin analogs and GLP-2 agonists expands treatment options and appeals to specialized medical centers. Pool: USD 15-25 million.

Pathway H - Advanced Drug Delivery and Conjugation Technologies. Premium market segments demand innovative delivery systems, peptide-drug conjugates, and next-generation formulations. Companies developing cutting-edge delivery platforms with improved patient convenience, reduced injection frequency, and enhanced therapeutic outcomes will capture premium pricing opportunities. Expected revenue: USD 12-20 million.

Market expansion is being supported by the increasing global prevalence of diabetes and obesity and the corresponding shift toward innovative peptide-based therapeutics that can provide superior metabolic outcomes while meeting healthcare requirements for comprehensive chronic disease management. Modern healthcare providers are increasingly focused on incorporating advanced non-insulin peptide therapies to enhance treatment success rates while satisfying demands for personalized medicine approaches and specialized endocrinology care capabilities. Non-insulin peptide drugs' proven ability to deliver effective glycemic control, weight management, and cardiovascular protection makes them essential treatments for metabolic disease programs and specialized diabetes care centers.

The growing emphasis on precision medicine and metabolic syndrome management is driving demand for high-quality non-insulin peptide therapies that can support distinctive patient outcomes and comprehensive treatment positioning across hospital, outpatient, and specialty pharmacy categories. Healthcare provider preference for treatments that combine therapeutic excellence with advanced mechanism-of-action profiles is creating opportunities for innovative peptide implementations in both traditional diabetes care and emerging obesity treatment applications. The rising influence of value-based healthcare initiatives and patient outcome optimization is also contributing to increased adoption of specialized non-insulin peptide therapies that can provide authentic therapeutic differentiation characteristics.

The market is segmented by product type, application, technology, sales channel, and region. By product type, the market is divided into GLP-1 & Dual GLP-1/GIP Agonists, Somatostatin Analogs, PTH Analogs, Calcitonin & Analogs, Vasopressin/Oxytocin Analogs, GLP-2 & GI Peptides, and other emerging non-insulin peptides. Based on application, the market is categorized into diabetes & obesity, oncology, osteoporosis & bone disorders, gastrointestinal disorders, rare & genetic disorders, and cardiovascular & renal disorders.

By technology, the market includes modified/synthetic peptides, recombinant peptides, and peptide-drug conjugates & other modalities. Based on sales channel, the market covers retail & specialty pharmacies, hospitals & specialty clinics, and research & academic institutes. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The GLP-1 & Dual GLP-1/GIP Agonists segment is projected to account for 91.8% of the non-insulin peptide drugs market in 2025, reaffirming its position as the dominant product type category. Pharmaceutical companies and healthcare providers increasingly utilize GLP-1 receptor agonists for their superior glycemic control capabilities, significant weight loss benefits, and cardiovascular protection in diabetes and obesity management across diverse therapeutic applications. GLP-1 & Dual GLP-1/GIP Agonists' proven clinical efficacy and comprehensive metabolic benefits directly address the clinical requirements for effective diabetes management and sustainable weight reduction in metabolic disease treatment.

This product segment forms the foundation of modern metabolic disease therapy, as it represents the technology with the greatest therapeutic potential and established efficacy across multiple patient populations. Manufacturer investments in GLP-1 optimization and dual-mechanism development continue to strengthen adoption among pharmaceutical companies. With healthcare providers prioritizing metabolic outcomes and patient quality of life, GLP-1 & Dual GLP-1/GIP Agonists align with both clinical effectiveness objectives and safety requirements, making them the central component of comprehensive diabetes and obesity treatment strategies.

Diabetes & Obesity applications are projected to represent 88.6% of the non-insulin peptide drugs market in 2025, underscoring their critical role as the primary therapeutic application for comprehensive metabolic disease management and chronic care solutions. Healthcare providers and patients prefer diabetes & obesity treatments for their proven effectiveness in achieving glycemic targets, substantial weight reduction, and cardiovascular risk mitigation while supporting long-term disease management requirements. Positioned as essential therapies for metabolic health, diabetes & obesity applications offer both clinical effectiveness and patient satisfaction advantages.

The segment is supported by continuous advancement in peptide therapeutic technology and the growing recognition of integrated approaches to metabolic disease management that enable comprehensive patient care and improved clinical outcomes. Additionally, healthcare systems are investing in diabetes & obesity prevention and treatment programs to support population health improvement and healthcare cost reduction. As metabolic disease prevalence continues to expand and healthcare providers seek comprehensive treatment solutions, diabetes & obesity applications will continue to dominate the therapeutic landscape while supporting clinical advancement and patient outcome optimization strategies.

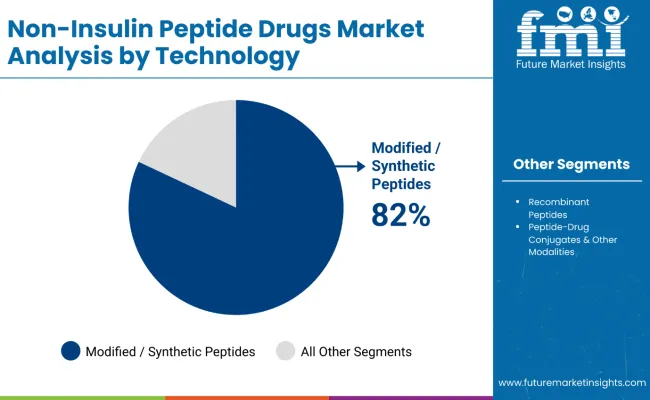

Modified/Synthetic Peptides are projected to represent 82.0% of the non-insulin peptide drugs market in 2025, underscoring their critical role as the primary technology platform for advanced therapeutic development and enhanced drug performance applications. Pharmaceutical manufacturers and researchers prefer modified/synthetic peptides for their superior stability characteristics, extended duration of action, and ability to provide optimized pharmacokinetic profiles while supporting advanced therapeutic requirements during complex treatment protocols. Positioned as essential technologies for high-performance peptide therapeutics, modified/synthetic peptides offer both manufacturing efficiency and clinical effectiveness advantages.

The segment is supported by continuous advancement in peptide modification techniques and the growing availability of specialized manufacturing capabilities that enable enhanced therapeutic properties and improved patient convenience. Additionally, pharmaceutical companies are investing in synthetic peptide platforms to support product differentiation and competitive positioning. As peptide technology continues to advance and healthcare providers seek superior therapeutic solutions, modified/synthetic peptides will continue to dominate the technology landscape while supporting innovation and therapeutic optimization strategies.

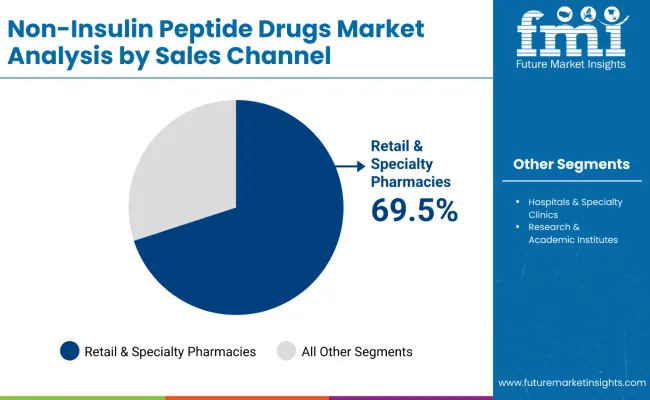

Retail & Specialty Pharmacies are projected to represent 69.5% of the non-insulin peptide drugs market in 2025, underscoring their critical role as the primary distribution channel for specialized therapeutic dispensing and comprehensive patient support applications. Healthcare systems and patients prefer retail & specialty pharmacy services for their specialized handling capabilities, comprehensive patient education programs, and ability to provide ongoing support while meeting complex dispensing requirements during chronic therapy management. Positioned as essential infrastructure for high-value therapeutics, retail & specialty pharmacies offer both accessibility and specialized service advantages.

The segment is supported by continuous investment in specialty pharmacy capabilities and the growing establishment of specialized dispensing programs that enable comprehensive patient care and optimized therapeutic outcomes. Additionally, pharmacy networks are expanding their specialty services to support market differentiation and comprehensive chronic disease management positioning. As peptide therapeutics continue to advance and patients require specialized support services, retail & specialty pharmacies will continue to dominate the distribution landscape while supporting patient adherence and comprehensive care strategies.

The non-insulin peptide drugs market is advancing rapidly due to increasing diabetes and obesity prevalence and growing demand for innovative therapeutic solutions that emphasize superior metabolic outcomes across hospital and outpatient applications. However, the market faces challenges, including high treatment costs compared to conventional diabetes medications, limited insurance coverage for obesity indications, and supply chain constraints for specialized peptide manufacturing. Innovation in peptide engineering and drug delivery continues to influence market development and expansion patterns.

Expansion of Advanced Peptide Technology Applications

The growing adoption of non-insulin peptide drugs in comprehensive metabolic disease programs and specialized obesity treatment applications is enabling pharmaceutical companies to develop products that provide distinctive therapeutic capabilities while commanding premium positioning and enhanced clinical outcome characteristics. Advanced applications provide superior efficacy while allowing more sophisticated treatment development across various therapeutic categories and specialty segments. Manufacturers are increasingly recognizing the competitive advantages of peptide technology positioning for premium product development and metabolic medicine market penetration.

Integration of Personalized Medicine Programs

Modern peptide therapy providers are incorporating advanced patient stratification systems, biomarker-guided treatment protocols, and outcome tracking technologies to enhance therapeutic success rates, improve metabolic outcomes, and meet healthcare demands for precision medicine solutions. These programs improve treatment effectiveness while enabling new applications, including personalized dosing strategies and integrated disease management systems. Advanced personalization integration also allows providers to support premium market positioning and clinical excellence leadership beyond traditional therapeutic approaches.

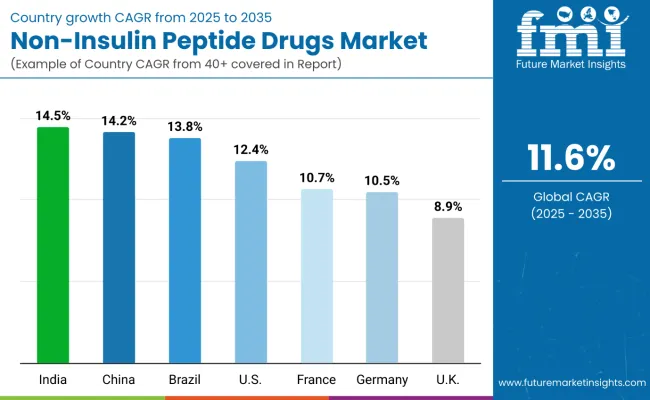

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 14.50% |

| China | 14.20% |

| Brazil | 13.80% |

| USA | 12.40% |

| France | 10.70% |

| Germany | 10.50% |

| UK | 8.90% |

The non-insulin peptide drugs market is experiencing robust growth globally, with India leading at a 14.5% CAGR through 2035, driven by rapidly expanding diabetes prevalence, growing healthcare infrastructure, and increasing adoption of innovative therapeutic solutions. China follows at 14.2%, supported by massive healthcare investments, rising middle-class healthcare spending, and government initiatives promoting advanced diabetes care. Brazil shows strong growth at 13.8%, emphasizing expanding healthcare access and growing metabolic disease awareness.

The USA records 12.4%, focusing on breakthrough therapy approvals and comprehensive insurance coverage expansion. France demonstrates 10.7% growth, prioritizing advanced endocrinology care and innovative treatment integration. Germany exhibits 10.5% growth, supported by robust healthcare systems and specialized diabetes centers. The UK shows 8.9% growth, emphasizing NHS modernization and private healthcare expansion while maintaining established clinical excellence in metabolic medicine.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from non-insulin peptide drugs in the United States is projected to grow at a CAGR of 12.4% through 2035, supported by breakthrough therapy approvals, expanding insurance coverage for obesity treatments, and strong adoption of innovative therapeutic technologies across established healthcare systems. The country's advanced pharmaceutical ecosystem, coupled with rising awareness of metabolic disease management, is driving robust expansion. Leading pharmaceutical manufacturers and endocrinology specialists continue to invest in innovation, offering cutting-edge peptide therapeutics within a supportive regulatory environment.

Revenue from non-insulin peptide drugs in China is projected to exhibit strong growth with a CAGR of 14.2% through 2035, driven by rapidly expanding healthcare infrastructure, massive government healthcare investments, and growing prevalence of diabetes and obesity across major urban centers. The country's rising middle-class healthcare spending and increasing acceptance of innovative therapeutic solutions are creating substantial demand for advanced peptide therapies in both public and private healthcare settings. Major pharmaceutical companies are establishing comprehensive manufacturing and distribution capabilities to serve both domestic consumption and regional markets.

Revenue from non-insulin peptide drugs in India is expanding at a CAGR of 14.5%, supported by rapidly rising diabetes prevalence, expanding healthcare infrastructure, and growing middle-class healthcare spending. The country's developing pharmaceutical manufacturing capabilities and increasing acceptance of innovative therapeutic solutions are driving demand for advanced peptide therapies across both urban and rural healthcare applications. International pharmaceutical companies and domestic manufacturers are establishing comprehensive service networks to address growing market demand for metabolic disease management solutions.

Revenue from non-insulin peptide drugs in Brazil is projected to grow at a CAGR of 13.8% through 2035, driven by expanding healthcare infrastructure, growing diabetes prevalence, and increasing government support for chronic disease management. Brazil's developing pharmaceutical sector and strong focus on metabolic health are creating steady demand for both innovative and established peptide therapeutic varieties. Leading pharmaceutical companies are establishing comprehensive distribution strategies to serve both domestic markets and growing regional demand.

Revenue from non-insulin peptide drugs in France is projected to grow at a CAGR of 10.7% through 2035, supported by the country's advanced healthcare system, comprehensive diabetes care programs, and leadership in innovative therapeutic adoption. France's sophisticated medical culture and strong support for endocrinology services are creating steady demand for both standard and advanced peptide therapeutic varieties. Leading medical centers and endocrinology specialists are establishing comprehensive treatment strategies to serve both European markets and growing international demand.

Revenue from non-insulin peptide drugs in Germany is projected to grow at a CAGR of 10.5% through 2035, supported by the country's advanced pharmaceutical sector, specialized diabetes centers, and established expertise in metabolic medicine requiring innovative peptide therapeutic solutions. German healthcare providers consistently seek cutting-edge treatments that enhance patient outcomes for both public and private healthcare applications. The country's position as a European healthcare leader continues to drive innovation in therapeutic applications and treatment standards.

Revenue from non-insulin peptide drugs in the United Kingdom is projected to grow at a CAGR of 8.9% through 2035, supported by NHS modernization initiatives, expanding private healthcare sector, and established expertise in metabolic medicine. British healthcare providers prioritize evidence-based treatments and comprehensive diabetes care, making non-insulin peptide drugs essential therapies for both NHS and private healthcare applications. The country's comprehensive healthcare development and clinical excellence patterns support continued market expansion.

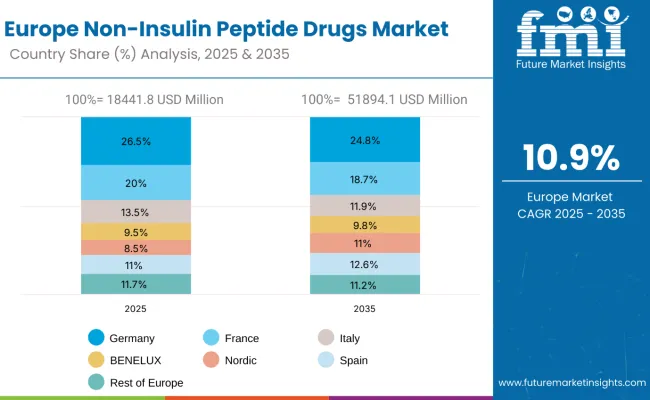

The Europe non-insulin peptide drugs market is projected to grow from USD 18,441.8 million in 2025 to USD 51,894.1 million by 2035, recording a CAGR of 10.9% over the forecast period. Germany leads with a 26.5% share in 2025, decreasing slightly to 24.8% by 2035, supported by advanced healthcare infrastructure and strong pharmaceutical adoption. France follows with 20.0% in 2025, moderating to 18.7% by 2035, driven by comprehensive diabetes care programs and innovative treatment integration. Italy accounts for 13.5% in 2025, declining to 11.9% by 2035, reflecting moderate growth patterns.

Spain contributes 11.0% in 2025, expanding to 12.6% by 2035, supported by increasing healthcare investments. The Nordic countries grow from 8.5% in 2025 to 11.0% in 2035, supported by high per-capita healthcare spending and advanced medical technology adoption. BENELUX holds 9.5% in 2025, rising to 9.8% by 2035, reflecting steady demand growth. The Rest of Europe moderates from 11.7% in 2025 to 11.2% in 2035, reflecting varied growth patterns across smaller healthcare markets.

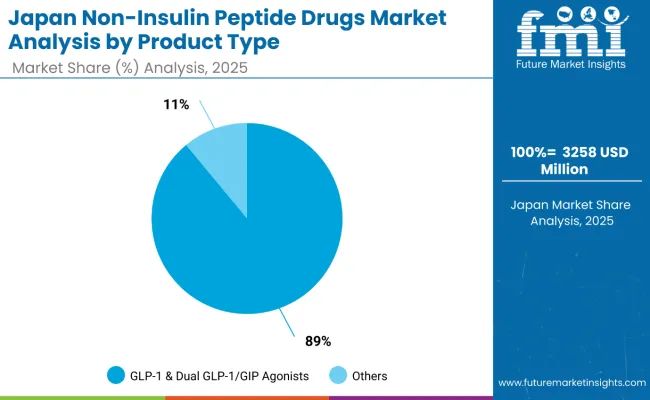

The Japan non-insulin peptide drugs market is valued at USD 3,258.0 million in 2025, with GLP-1 & Dual GLP-1/GIP Agonists holding the dominant position at 89% share, supported by strong adoption in diabetes and obesity management. Somatostatin Analogs follow with 5.0%, driven by established oncology applications and neuroendocrine tumor treatments. PTH Analogs account for 2.0%, supported by osteoporosis treatment applications but facing competitive pressure from newer therapeutic options.

Calcitonin & Analogs command 1.1%, showing stable but limited growth potential. Vasopressin/Oxytocin Analogs represent 1.2%, reflecting niche applications in specialized therapeutic areas. GLP-2 & GI Peptides hold 1.0%, with emerging applications in gastrointestinal disorders. Other Emerging Non-Insulin Peptides account for 1.2%, representing innovative therapeutic developments and pipeline opportunities.

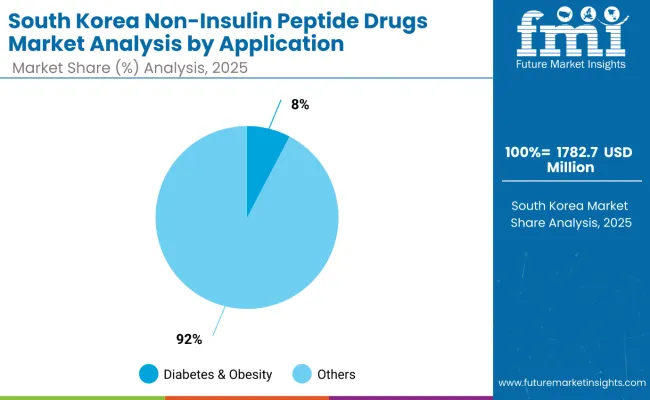

The South Korea non-insulin peptide drugs market is valued at USD 1,782.7 million in 2025, dominated by diabetes & obesity at 92% share, supported by rising metabolic disease prevalence and strong healthcare system adoption. Oncology applications hold 4.0%, driven by neuroendocrine tumor treatments and specialized cancer care centers. Osteoporosis & Bone Disorders account for 2.0%, reflecting aging population demographics and established treatment protocols.

Gastrointestinal Disorders represent 2.5%, supported by growing recognition of GLP-2 applications and inflammatory bowel disease treatments. Rare & Genetic Disorders hold 0.7%, representing specialized applications with limited market volume. Cardiovascular & Renal Disorders account for 0.6%, reflecting emerging applications and expanding therapeutic indications. The concentrated distribution highlights South Korea's focus on metabolic disease management and established clinical protocols.

The non-insulin peptide drugs market is characterized by intense competition among leading pharmaceutical companies, specialized biotechnology firms, and integrated therapeutic solution providers. Companies are investing in advanced peptide engineering technologies, novel drug delivery systems, indication-specific product development, and comprehensive clinical research capabilities to deliver consistent, high-performance, and effective therapeutic solutions. Innovation in mechanism-of-action enhancement, patient outcome optimization, and personalized medicine compatibility is central to strengthening market position and clinical adoption.

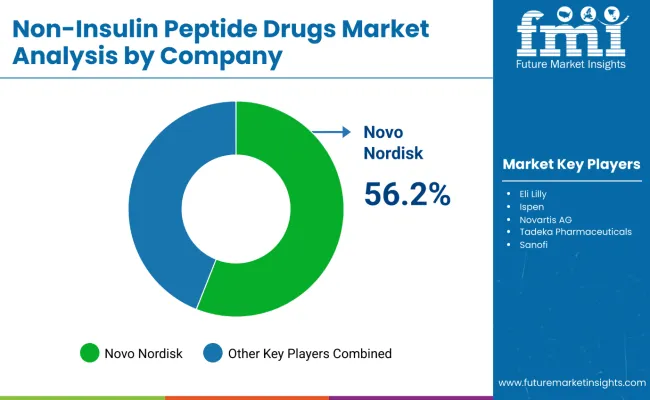

Novo Nordisk leads the market with a commanding 56.2% market share, focusing on GLP-1 receptor agonist innovation and comprehensive diabetes and obesity care solutions, offering advanced therapeutic platforms with emphasis on clinical effectiveness and patient convenience. Eli Lilly provides comprehensive metabolic disease solutions with a focus on dual-mechanism therapies and global distribution networks. Ipsen delivers specialized peptide therapeutics with a focus on oncology and rare disease applications.

Novartis AG offers integrated pharmaceutical platforms with advanced technology integration and clinical research excellence. Takeda Pharmaceuticals focuses on gastrointestinal and specialty therapeutic areas. Sanofi emphasizes comprehensive diabetes care solutions, while Ferring Pharmaceuticals and Rhythm Pharmaceuticals specialize in niche therapeutic applications with targeted patient populations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 61,472.6 Million |

| Product Type | GLP-1 & Dual GLP-1/GIP Agonists, Somatostatin Analogs, PTH Analogs, Calcitonin & Analogs, Vasopressin/Oxytocin Analogs, GLP-2 & GI Peptides, Other Emerging Non-Insulin Peptides |

| Application | Diabetes & Obesity, Oncology, Osteoporosis & Bone Disorders, Gastrointestinal Disorders, Rare & Genetic Disorders, Cardiovascular & Renal Disorders |

| Technology | Modified/Synthetic Peptides, Recombinant Peptides, Peptide-Drug Conjugates & Other Modalities |

| Sales Channel | Retail & Specialty Pharmacies, Hospitals & Specialty Clinics, Research & Academic Institutes |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Novo Nordisk, Eli Lilly, Ipsen, Novartis AG, Takeda Pharmaceuticals, Sanofi, Ferring Pharmaceuticals, and Rhythm Pharmaceuticals |

| Additional Attributes | Dollar sales by product type, application, technology, and sales channel; regional demand trends, competitive landscape, technological advancements in peptide engineering, therapeutic innovation initiatives, clinical outcome optimization programs, and metabolic disease management enhancement strategies |

By North America

By Europe

By East Asia

By South Asia & Pacific

By Latin America

By Middle East & Africa

The global non-insulin peptide drugs market is estimated to be valued at USD 61,472.6 million in 2025.

The non-insulin peptide drugs market is projected to reach USD 184,174.1 million by 2035.

The non-insulin peptide drugs market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in the non-insulin peptide drugs market are GLP-1 & Dual GLP-1/GIP Agonists, Somatostatin Analogs, PTH Analogs, Calcitonin & Analogs, Vasopressin/Oxytocin Analogs, GLP-2 & GI Peptides, and other emerging non-insulin peptides.

In terms of sales channels, retail & specialty pharmacies are anticipated to command 69.5% share of the non-insulin peptide drugs market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peptide-Infused Anti-Aging Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Based Nanomaterials Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Tinted Moisturizers Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Enhanced Firming Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Peptide-based Sweetener Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peptide Receptor Radionuclide Therapy (PRRT) Market Trends and Forecast 2025 to 2035

Peptide Synthesis Market Analysis – Trends, Share & Growth 2025 to 2035

Key Players & Market Share in the Peptide Microarray Sector

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Peptide Antibiotics Market

Peptide Microarrays Market

Tuna Peptides Market – Growth, Demand & Functional Benefits

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Tetra-Peptide Anti-Wrinkle Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Marine Peptide Market Size and Share Forecast Outlook 2025 to 2035

Lupine Peptides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA