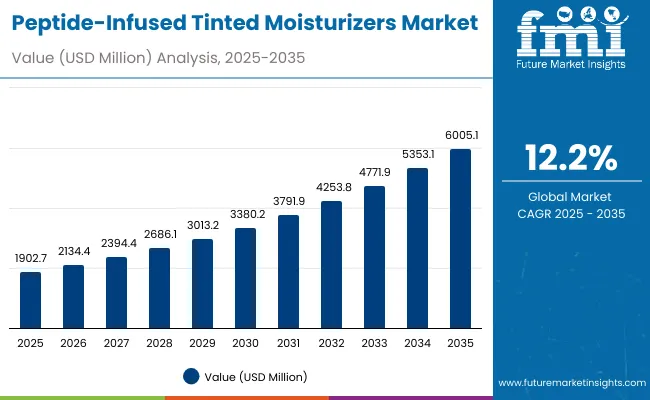

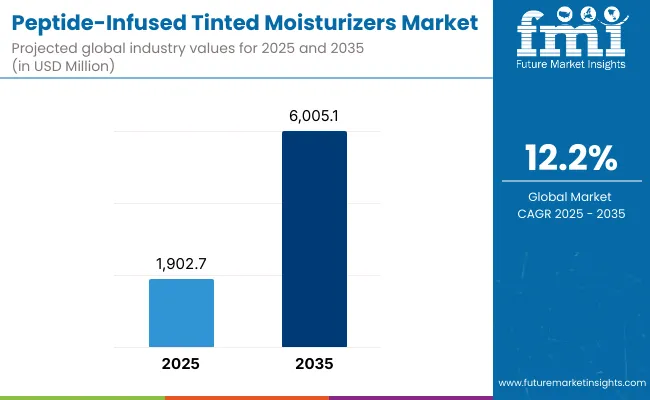

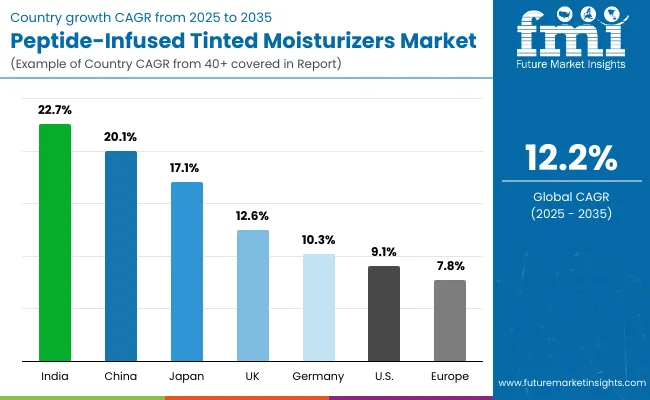

The market for peptide-infused tinted moisturizers is set to reach USD 1,902.7 Million in 2025 and expand to USD 6,005.1 Million by 2035, reflecting an addition of more than USD 4,100 Million in value. This surge represents a 193% increase in market size over the decade, supported by a 12.2% CAGR.

Peptide-Infused Tinted Moisturizers Market Key Takeaways

| Metric | Value |

|---|---|

| Peptide-Infused Tinted Moisturizers Market Estimated Value in (2025E) | USD 1,902.7 Million |

| Peptide-Infused Tinted Moisturizers Market Forecast Value in (2035F) | USD 6,005.1 Million |

| Forecast CAGR (2025 to 2035) | 12.2% |

The initial growth phase between 2025 and 2030 will see the market increase from USD 1,902.7 Million to USD 3,380.2 Million, accounting for nearly half of the total decade expansion. Growth in this stage will be supported by a rising shift toward daily-use multifunctional skincare, increased adoption of hybrid makeup formats, and the growing role of peptides in barrier protection.

The second half of the forecast period, from 2030 to 2035, is expected to deliver accelerated momentum, with the market rising from USD 3,380.2 Million to USD 6,005.1 Million. This segment alone will contribute 44% of the decade’s total gains, indicating that adoption will deepen across both premium and mass channels as SPF literacy advances and shade-inclusive innovation scales globally.

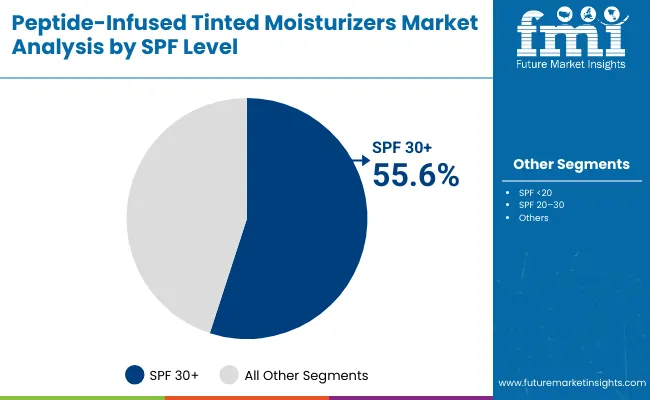

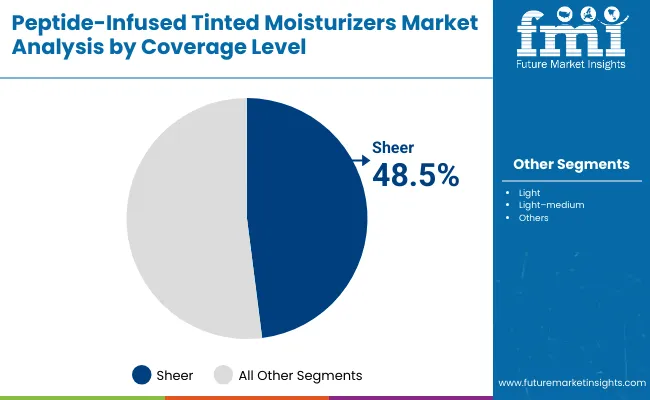

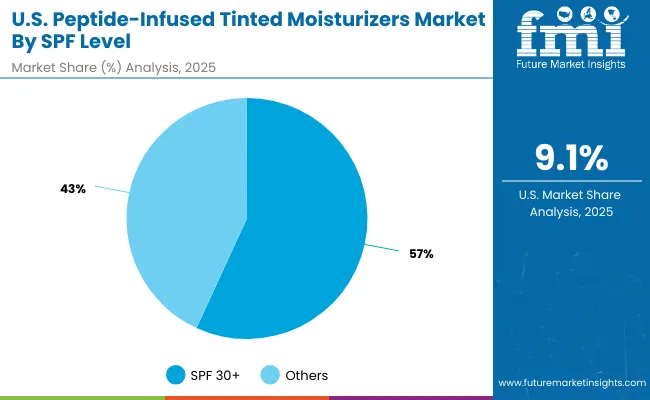

Within the segmentation landscape, SPF 30+ is projected to dominate with a 55.6% share in 2025, supported by dermatology-led endorsements and consumer awareness of high-protection daily wear. Sheer coverage is expected to lead coverage levels with a 48.5% share, reflecting a preference for breathable, natural-finish products.

The combination of peptide efficacy, tone-evening attributes, and daily SPF protection is expected to anchor sustained adoption, positioning this category as a central growth driver in the hybrid beauty-skincare segment through 2035.

Between 2025 and 2035, the market is expected to advance by over USD 4,100 Million, indicating a 193% expansion. Growth will be anchored by increasing consumer adoption of hybrid beauty formats, wider penetration of SPF 30+ products, and strong momentum in Asia-Pacific, where China and India are projected to record the highest growth rates. The United States is expected to retain significant market value, while Japan and Germany will provide steady contributions.

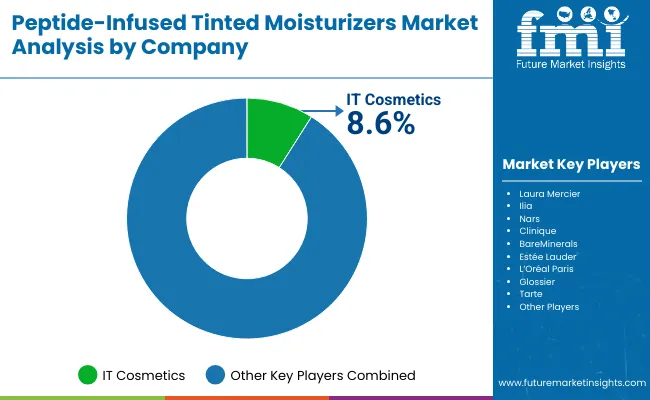

The competitive landscape in 2025 is expected to be highly fragmented, with IT Cosmetics leading at 8.6% share and the remainder dispersed among emerging and established beauty houses. Competition is anticipated to shift toward advanced formulations with credible peptide efficacy, inclusive shade innovation, and premium SPF integration. Distribution is likely to evolve with greater reliance on e-commerce, pharmacies, and premium beauty retail.

Future differentiation is expected to move beyond coverage and hydration toward skin-health outcomes and evidence-backed performance, allowing peptide-infused tinted moisturizers to emerge as a key driver of hybrid skincare adoption globally.

Growth in the peptide-infused tinted moisturizers market is being driven by rising consumer preference for hybrid formulations that merge skincare efficacy with cosmetic coverage. Advances in peptide technology have been positioned as key enablers of skin barrier support, firmness, and hydration, encouraging adoption among consumers seeking long-term skin health benefits. The expansion of SPF literacy has also accelerated usage, as high-protection daily wear is being prioritized in preventive skincare routines.

Market traction is being further reinforced by the trend toward routine simplification, where consumers favor multifunctional products that reduce application steps while maintaining performance. The growing focus on inclusivity and diverse skin tones has amplified demand for shade-flexible solutions, particularly in emerging markets.

Additionally, credibility from dermatology endorsements and social media amplification is expected to solidify consumer trust. With these drivers converging, the market is anticipated to achieve sustained double-digit growth through 2035, with innovation and accessibility positioned as the central accelerators.

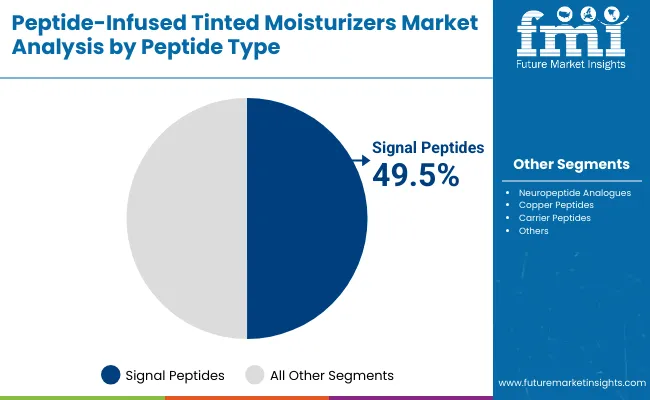

The peptide-infused tinted moisturizers market has been segmented across SPF level, peptide type, and coverage level, reflecting the diverse factors influencing adoption and consumer preference. SPF level plays a critical role, as growing awareness of daily sun protection is shaping purchase decisions, with higher protection products being prioritized.

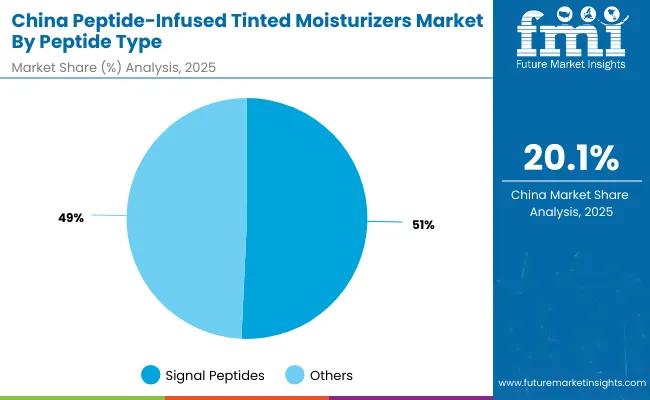

Peptide type segmentation highlights the balance between signal peptides and other formulations, showcasing how varying peptide functions are driving product innovation and skin-health claims. Coverage level segmentation underscores the demand for breathable, natural finishes alongside options providing greater coverage, aligning with evolving beauty standards.

Each of these segments contributes uniquely to the overall market performance and demonstrates how innovation, inclusivity, and skincare efficacy are converging to accelerate long-term growth.

| Segment | Market Value Share, 2025 |

|---|---|

| SPF 30+ | 55.6% |

| Others | 44.4% |

The SPF 30+ segment is projected to dominate the market in 2025 with a 55.6% share, supported by increasing consumer recognition of the importance of broad-spectrum protection in everyday skincare routines. Growth in this category is being fueled by dermatologist advocacy and regulatory emphasis on preventive care. Consumers are showing higher willingness to invest in multifunctional products that combine cosmetic appeal with clinically relevant SPF benefits.

Market momentum is further reinforced by the rising prevalence of digital platforms that highlight UV-related skin concerns. As a result, SPF 30+ is anticipated to remain the leading category, supported by product launches offering lightweight textures and advanced filter systems that encourage repeat usage across different consumer groups.

| Segment | Market Value Share, 2025 |

|---|---|

| Signal peptides | 49.5% |

| Others | 50.5% |

The peptide type segment in 2025 reflects a nearly balanced share, with signal peptides accounting for 49.5% and others slightly ahead at 50.5%. Signal peptides are being highlighted for their ability to stimulate collagen synthesis and promote firmer skin, driving their inclusion in advanced tinted moisturizers.

Other peptide types, including copper and neuropeptide analogues, are also gaining traction as they address hydration, repair, and barrier-strengthening benefits. Market growth is expected to be supported by increasing consumer trust in peptide-based skincare as a safe and effective alternative to stronger actives. Both categories are anticipated to maintain strong demand, but differentiation will depend on clinical validation and marketing strategies that emphasize visible improvements in skin quality over time.

| Segment | Market Value Share, 2025 |

|---|---|

| Sheer | 48.5% |

| Others | 51.5% |

The coverage level segment reveals a competitive landscape, with sheer finishes commanding 48.5% share in 2025. Demand for sheer products is being supported by the global shift toward natural, breathable looks that align with minimalist beauty routines. Consumers are prioritizing skin-first aesthetics, making sheer coverage a preferred option for daily wear.

At the same time, the category representing higher coverage is sustaining slightly larger share, reflecting continued relevance among users seeking multifunctional products that conceal imperfections while delivering skincare benefits. The overall balance between sheer and higher coverage options demonstrates the versatility of this market, where inclusivity in formulation and adaptability across different consumer groups will determine long-term success.

Growing momentum in the peptide-infused tinted moisturizers market is shaped by evolving consumer preferences, technological innovation in formulations, and regulatory considerations. Two critical factors are highlighted below to capture the forward-looking landscape of this industry.

Integration of Dermatology-Led Formulation Standards

Market expansion is being supported by the integration of dermatologist-endorsed formulation practices, where SPF standards and clinically validated peptide complexes are emphasized. Products are being positioned not only as cosmetic enhancers but also as daily-use therapeutic solutions. This convergence of beauty and dermatology is expected to elevate consumer trust while differentiating premium products in crowded markets.

Additionally, as consumer literacy regarding skin biology improves, a shift toward ingredient transparency and peer-reviewed efficacy claims is anticipated. This driver is likely to accelerate brand credibility and broaden acceptance in both established and emerging economies.

Inclusive Shade Development Aligned with Regional Skin Tones

A defining trend is the prioritization of inclusive shade ranges that adapt to regional undertones and climate-driven needs. Rather than offering limited shade palettes, brands are innovating with pigment technologies that remain stable across diverse skin tones without oxidization. Shade inclusivity is increasingly seen as an equity-driven commitment, reinforced by digital try-on tools and AI-based personalization engines.

This approach is expected to shift competitive advantage toward players capable of delivering both cultural sensitivity and technical consistency, ensuring that coverage aligns seamlessly with the diversity of global consumers.

| Country | CAGR |

|---|---|

| China | 20.1% |

| USA | 9.1% |

| India | 22.7% |

| UK | 12.6% |

| Germany | 10.3% |

| Japan | 17.1% |

The global peptide-infused tinted moisturizers market demonstrates differentiated growth trajectories across major economies, influenced by cultural beauty preferences, regulatory landscapes, and consumer awareness of multifunctional skincare. Asia is positioned as the primary growth hub, supported by rapid lifestyle shifts and expanding premium skincare adoption.

India is projected to record the highest CAGR of 22.7% between 2025 and 2035, with market momentum being shaped by rising disposable incomes, urban skincare adoption, and heightened interest in inclusive shade ranges tailored to diverse skin tones.

China follows closely with a CAGR of 20.1%, supported by strong demand for dermocosmetic products, heightened SPF awareness, and the prominence of e-commerce ecosystems that accelerate adoption across both urban and tier-2 cities. Japan, at 17.1% CAGR, reflects a preference for lightweight, barrier-friendly formulations aligned with local beauty rituals and high dermatological standards.

Europe maintains steady progression, with the UK at 12.6% and Germany at 10.3%. Growth in these markets is being driven by high consumer trust in clinically validated products, demand for sustainable packaging, and alignment with evolving EU cosmetic regulations. The United States, while expanding at a slower CAGR of 9.1%, is expected to retain a strong value position, underpinned by mature retail infrastructure and dermatologist-led endorsements.

Together, these key markets illustrate a balanced outlook where Asia dominates growth momentum while Europe and North America sustain structural stability and premiumization trends.

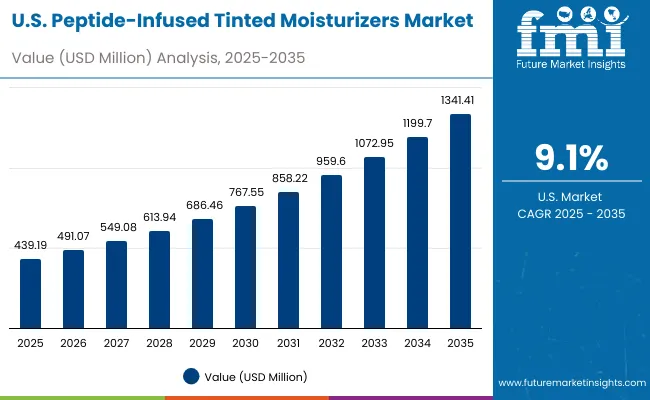

| Year | USA Peptide-Infused Tinted Moisturizers Market (USD Million) |

|---|---|

| 2025 | 439.19 |

| 2026 | 491.07 |

| 2027 | 549.08 |

| 2028 | 613.94 |

| 2029 | 686.46 |

| 2030 | 767.55 |

| 2031 | 858.22 |

| 2032 | 959.60 |

| 2033 | 1,072.95 |

| 2034 | 1,199.70 |

| 2035 | 1,341.41 |

The peptide-infused tinted moisturizers market in the United States is projected to grow at a CAGR of 11.6% between 2025 and 2035, reaching USD 1,341.41 Million by the end of the forecast period. Growth is being anchored by consumer movement toward multifunctional products that combine hydration, coverage, and advanced sun protection. Daily skincare routines are being simplified as SPF 30+ tinted moisturizers gain traction, reflecting the shift toward preventive skin health solutions endorsed by dermatologists.

Premium beauty retail and pharmacy-linked dermocosmetic channels are expected to accelerate distribution, while digital-first platforms and virtual shade-matching technologies will continue to transform consumer engagement and conversion.

The peptide-infused tinted moisturizers market in the United Kingdom is projected to expand at a CAGR of 12.6% from 2025 to 2035, reflecting steady consumer adoption shaped by evolving beauty standards and regulatory frameworks. Market demand is expected to be driven by the growing emphasis on hybrid products that combine aesthetic benefits with clinically supported skin health outcomes.

Dermatologist endorsements and compliance with stringent EU cosmetic safety regulations are strengthening consumer confidence, particularly in premium and masstige channels. Distribution through pharmacies, premium retailers, and digital platforms is anticipated to broaden reach, while inclusivity in shade development aligns with diverse consumer demographics.

The peptide-infused tinted moisturizers market in India is forecasted to grow at the highest CAGR of 22.7% between 2025 and 2035, fueled by urbanization, rising disposable incomes, and rapid adoption of multifunctional skincare. Increased consumer focus on hydration, SPF protection, and lightweight coverage is expected to elevate demand across both premium and mass segments.

E-commerce ecosystems and social commerce platforms are serving as critical discovery channels, while localized shade palettes are anticipated to strengthen acceptance across diverse skin tones. Growth will also be accelerated by rising skincare awareness in tier-2 and tier-3 cities, where aspirational consumers are engaging more with hybrid formulations.

The peptide-infused tinted moisturizers market in China is projected to advance at a CAGR of 20.1% during 2025 to 2035, supported by rising SPF literacy, strong e-commerce penetration, and increased consumer preference for dermocosmetic solutions. Hybrid formulations are being positioned as essentials in daily routines, aligning with the widespread culture of skin-first beauty.

Regulatory oversight is encouraging transparency and safety, pushing brands to emphasize clinically validated peptides and broad-spectrum SPF claims. Cross-border social commerce and influencer-led engagement are further shaping rapid adoption, especially among younger consumers seeking multifunctional beauty solutions.

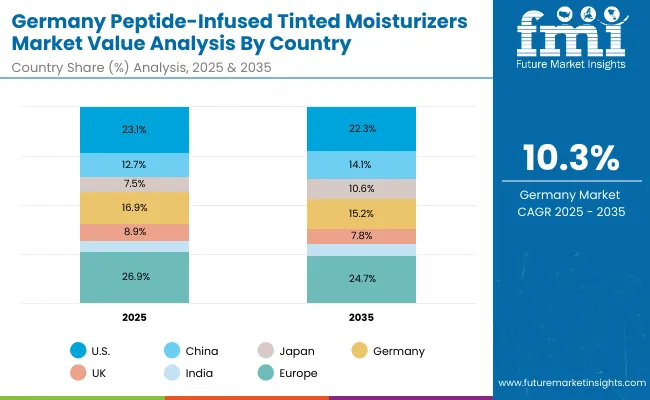

| Country | 2025 |

|---|---|

| USA | 23.1% |

| China | 12.7% |

| Japan | 7.5% |

| Germany | 16.9% |

| UK | 8.9% |

| India | 5.6% |

| Country | 2035 |

|---|---|

| USA | 22.3% |

| China | 14.1% |

| Japan | 10.6% |

| Germany | 15.2% |

| UK | 7.8% |

| India | 6.4% |

The peptide-infused tinted moisturizers market in Germany is expected to expand at a CAGR of 10.3% from 2025 to 2035, reflecting steady but measured growth across a mature beauty landscape. Strong consumer trust in dermatologically tested formulations is expected to reinforce market expansion, particularly in pharmacy and dermocosmetic channels.

Premium positioning will continue to resonate, but sustainable packaging and ethical ingredient sourcing are anticipated to become key purchase drivers in alignment with evolving EU regulations. Shade diversity remains a developing area, with inclusive innovations offering opportunities for stronger market penetration. Digital retail platforms and specialist stores are projected to drive future engagement, supported by increased consumer demand for ingredient transparency.

Growth Outlook For PEPTIDE-INFUSED TINTED MOISTURIZERS Market in USA

| Segment | Market Value Share, 2025 |

|---|---|

| SPF 30+ | 56.9% |

| Others | 43.1% |

The peptide-infused tinted moisturizers market in the United States is projected at USD 439.19 million in 2025. SPF 30+ contributes 56.9%, while other SPF variants account for 43.1%, indicating a decisive consumer preference for higher-protection formats.

This dominance stems from growing dermatology-led advocacy, increased awareness of sun-induced skin damage, and the shift toward daily preventive skincare. Consumers are showing stronger affinity for lightweight formulations that combine broad-spectrum SPF with peptide efficacy, making SPF 30+ the benchmark in product positioning.

The preference is also being shaped by the rise of hybrid beauty routines, where multifunctional products reduce application steps without compromising efficacy. E-commerce platforms and pharmacy-linked dermocosmetic retailers are reinforcing this adoption by emphasizing skin-health education and personalized discovery. As SPF awareness matures further, brands offering breathable, shade-inclusive, high-protection options are expected to sustain long-term leadership.

| Segment | Market Value Share, 2025 |

|---|---|

| Signal peptides | 50.5% |

| Others | 49.5% |

The peptide-infused tinted moisturizers market in China is projected at USD 242.56 million in 2025. Signal peptides contribute 50.5%, while other peptide formulations account for 49.5%, reflecting a nearly balanced split between the two categories. The slight lead of signal peptides indicates their stronger positioning in promoting collagen stimulation, firmness, and visible skin rejuvenation-attributes that resonate well with Chinese consumers focused on anti-aging and barrier-strengthening solutions.

Market traction is being shaped by a surge in dermocosmetic awareness, driven by urban professionals and younger consumers adopting hybrid skincare-makeup routines. E-commerce ecosystems and cross-border social platforms are amplifying product discovery, while regulatory emphasis on safety and transparency is reinforcing trust in peptide-based formulations. As clinical validation and consumer education expand, demand for signal peptides is expected to strengthen further, while other peptide blends remain competitive due to their hydration and repair benefits.

| Comapany | Global Value Share 2025 |

|---|---|

| IT Cosmetics | 8.6% |

| Others | 91.4% |

The peptide-infused tinted moisturizers market is moderately fragmented, with global leaders, established beauty brands, and emerging innovators competing to capture consumer demand across multiple regions. IT Cosmetics currently holds the largest global value share at 8.6% in 2025, positioning itself as the category leader due to its dermatologist-backed credibility, strong retail presence, and shade-inclusive product portfolio. This dominance is expected to have been established in 2024 as well, where IT Cosmetics accounted for around 8.3% share globally, reflecting steady leadership momentum.

Other leading players in this market include Laura Mercier, Nars, Clinique, BareMinerals, Estée Lauder, L’Oréal Paris, Glossier, Ilia, and Tarte. These companies are correct for this market as they represent both heritage beauty houses and fast-growing clean beauty innovators actively engaged in hybrid skincare-makeup development. Their strategies are increasingly focused on integrating SPF 30+ formulations, clinically validated peptide complexes, and texture innovations designed for breathable, natural finishes.

Mid-sized innovators are targeting niche spaces by promoting vegan, cruelty-free, and refillable tinted moisturizers, appealing to eco-conscious and ingredient-savvy consumers. Meanwhile, emerging players are experimenting with AI-enabled shade matching and social commerce-driven engagement, ensuring deeper personalization.

Competitive differentiation is shifting from traditional makeup branding toward evidence-based skincare positioning, inclusive shade strategies, and sustainable value propositions. As consumer trust continues to be shaped by dermatology-led claims and transparent marketing, brand loyalty is expected to consolidate around companies capable of merging skincare efficacy with proven cosmetic appeal.

Key Developments in Peptide-Infused Tinted Moisturizers Market

| Item | Value |

|---|---|

| Market size (2025) | USD 1,902.7 Million |

| Market size (2035) | USD 6,005.1 Million |

| CAGR (2025 to 2035) | 12.2% |

| Incremental growth (2025 to 2035) | USD 4,102.4 Million |

| Dominant segment by SPF level (2025) | SPF 30+ at 55.6% (USD 1,055.6 Million) |

| Other SPF share (2025) | 44.4% (USD 845.64 Million) |

| Peptide type split (2025) | Signal peptides 49.5% (USD 902.0 Million); Others 50.5% (USD 961.34 Million) |

| Coverage level split (2025) | Sheer 48.5% (USD 921.2 Million); Others 51.5% (USD 980.18 Million) |

| United States market value (2025) | USD 439.19 Million |

| China market value (2025) | USD 242.56 Million |

| United States SPF 30+ share (2025) | 56.9% (USD 249.7 Million) |

| China signal peptides share (2025) | 50.5% (USD 122.4 Million) |

| Growth-leading countries by CAGR (2025 to 2035) | India 22.7%; China 20.1%; Japan 17.1%; UK 12.6%; Germany 10.3%; USA 9.1% |

| Sales channels covered | E-commerce; Pharmacies; Premium beauty retail; Mass retail |

| Segmentation covered | SPF level; Peptide type; Coverage level |

| Regions covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries covered | United States; China; India; Japan; United Kingdom; Germany |

| Key companies profiled | IT Cosmetics; Laura Mercier; Ilia; Nars; Clinique; BareMinerals; Estée Lauder; L’Oréal Paris; Glossier; Tarte |

| Competitive snapshot (2025) | IT Cosmetics global value share 8.6%; Others 91.4% |

| Additional attributes | Daily-wear SPF adoption; dermatologist-endorsed peptide claims; inclusive shade expansion; lightweight, breathable textures; strong social/e-commerce discovery; compliance with regional SPF and labeling rules |

The global peptide-infused tinted moisturizers market is estimated to be valued at USD 1,902.7 million in 2025, driven by demand for multifunctional skincare products combining hydration, coverage, and sun protection.

The market size for peptide-infused tinted moisturizers is projected to reach USD 6,005.1 million by 2035, reflecting sustained adoption across premium, masstige, and mass channels.

The market is expected to grow at a CAGR of 12.2% between 2025 and 2035, representing a 193% increase in value over the decade.

Key segments include SPF level (SPF 30+ and others), peptide type (signal peptides and others), and coverage level (sheer and others), with SPF 30+ emerging as the leading category in 2025.

The SPF 30+ segment is projected to command 55.6% share in 2025, amounting to USD 1,055.6 million, supported by dermatologist recommendations and growing awareness of preventive skincare.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tinted Moisturizer Cream Market Size and Share Forecast Outlook 2025 to 2035

Tinted Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Tinted Sunscreen Market Size and Share Forecast Outlook 2025 to 2035

Tinted Glass Market Growth - Trends & Forecast 2025 to 2035

SPF Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Argan Oil Moisturizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hemp Seed Oil Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ceramide-Infused Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA