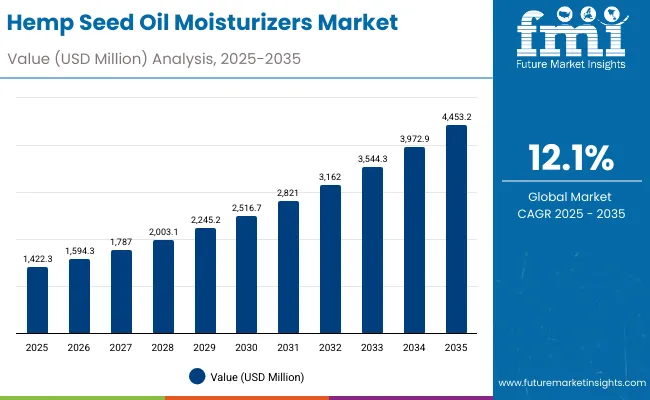

The Hemp Seed Oil Moisturizers Market is expected to record a valuation of USD 1,422.3 million in 2025 and USD 4,453.2 million in 2035, with an increase of USD 3,030.9 million, which equals a growth of more than 213% over the decade. The overall expansion represents a CAGR of 12.1% and more than a 3X increase in market size.

Quick Stats for Hemp Seed Oil Moisturizers Market

Hemp Seed Oil Moisturizers Market Key Takeaways

| Metric | Value |

|---|---|

| Hemp Seed Oil Moisturizers Market Estimated Value in (2025E) | USD 1,422.3 million |

| Hemp Seed Oil Moisturizers Market Forecast Value in (2035F) | USD 4,453.2 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,422.3 million to USD 2,516.7 million, adding USD 1,094.4 million, which accounts for 36% of the total decade growth. This phase records steady adoption in skincare categories as hydration-focused and barrier-repair moisturizers gain strong consumer traction. Cold-pressed organic grade oils become the premium choice for natural beauty buyers, while creams and lotions dominate mainstream retail channels with nearly half of the sales share. E-commerce/D2C emerges as a strong distribution driver in this phase, with USA and European markets adopting hemp seed oil-based moisturizers in mass retail and pharmacy channels.

The second half from 2030 to 2035 contributes USD 1,936.5 million, equal to 64% of total growth, as the market jumps from USD 2,516.7 million to USD 4,453.2 million. This acceleration is powered by widespread adoption of clean-label, vegan, and fragrance-free claims that resonate with sensitive-skin consumers globally. Long-term demand is reinforced by high growth in India (18.5% CAGR) and China (16.4% CAGR), where younger demographics adopt hemp moisturizers as part of natural beauty regimens. By the end of the decade, face oils and gel creams take a larger share in Asia-Pacific markets, while non-comedogenic claims dominate dermatology-driven demand in Western regions. Digital-first distribution models and dermatologist-endorsed launches expand recurring sales, while mass retailers integrate organic hemp seed oil SKUs into private-label portfolios.

From 2020 to 2024, the Hemp Seed Oil Moisturizers Market grew steadily, driven by hardware-equivalent factors such as cold-pressed oil adoption, organic formulations, and expanding retail placement. During this period, the competitive landscape was dominated by global cosmetic houses and natural beauty pioneers, with leaders such as The Body Shop and Kiehl’s controlling a significant share of revenue. Competitive differentiation relied on natural authenticity, premium ingredient sourcing, and consumer perception of clean-label trustworthiness. Service-led and subscription-driven models had minimal traction, contributing less than 10% of the total market value, as mass-market adoption was still in its early phase.

Demand for hemp seed oil moisturizers will expand to USD 1,422.3 million in 2025, and the revenue mix will shift as vegan, fragrance-free, and dermatologist-recommended positioning grows to over 40% share by 2030. Traditional natural beauty leaders face rising competition from digital-first and D2C players offering AI-driven skincare personalization, skin-type matching, and subscription-based models. Major heritage brands are pivoting to hybrid distribution, integrating e-commerce personalization and private-label collaborations with large retailers to retain relevance. Emerging entrants specializing in hemp-squalane blends, hybrid formats like gel creams, and clinical-dermatology positioning are gaining share. The competitive advantage is moving away from branding heritage alone to ecosystem strength, dermatology credibility, scalability across regions, and recurring revenue from subscription-driven channels.

Advances in natural skincare formulations have significantly improved the functionality of hemp seed oil moisturizers, allowing them to address hydration, barrier repair, and anti-redness needs in one application. Hydration & barrier repair functions have gained popularity due to their ability to strengthen the skin’s natural defenses and lock in long-term moisture. The rise of cold-pressed organic grade oils has contributed to enhanced nutrient preservation, ensuring higher omega fatty acid content and stronger consumer preference in premium ranges. Markets such as the USA, Germany, and the UK are driving demand for hemp seed oil moisturizers that can integrate seamlessly into established clean-beauty and sensitive-skin routines.

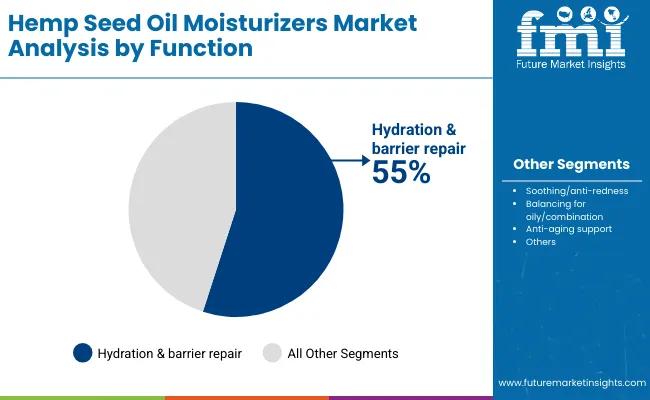

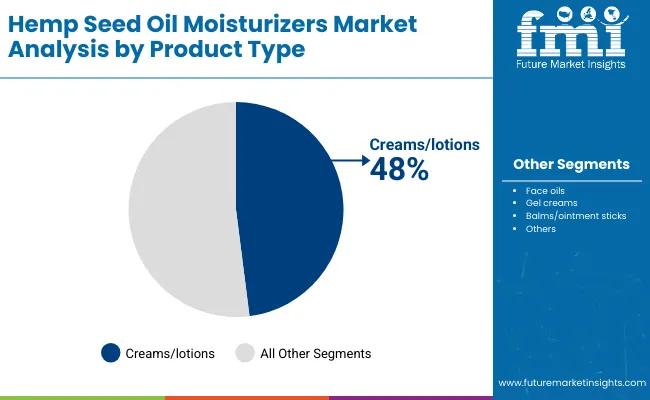

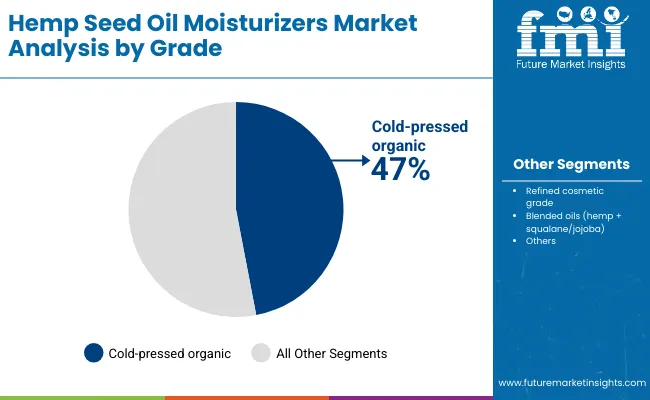

Expansion of e-commerce/D2C and dermatologist-backed endorsements has fueled market growth. Innovations in hybrid formats like gel creams and hemp face oils, combined with the increasing demand for fragrance-free and hypoallergenic options, are opening new application areas. Segment growth is expected to be led by hydration & barrier repair in function categories, creams/lotions in product types, and cold-pressed organic oils in grades due to their precision in targeting multiple consumer skin needs and adaptability across skin types.

The market is segmented by function, product type, grade, channel, claim, and geography. Functions include hydration & barrier repair, soothing/anti-redness, balancing for oily/combination, and anti-aging support, highlighting the role of hemp moisturizers in multifunctional skincare. Product type classification covers creams/lotions, face oils, gel creams, and balm/ointment sticks to serve varied consumer textures and preferences.

Based on grade, segmentation includes cold-pressed organic, refined cosmetic grade, and blended oils (hemp + squalane/jojoba). In terms of channel, categories encompass e-commerce/D2C, pharmacies/drugstores, natural/organic stores, and mass retail. Claim-based segmentation includes vegan, clean-label, fragrance-free/hypoallergenic, and non-comedogenic. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with countries such as the USA, China, India, Japan, UK, and Germany leading growth momentum.

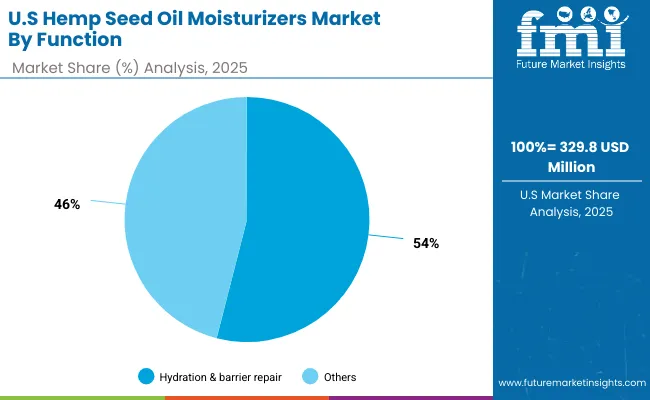

| Function | Value Share% 2025 |

|---|---|

| Hydration & barrier repair | 55% |

| Others | 45.0% |

The hydration & barrier repair segment is projected to contribute 55% of the Hemp Seed Oil Moisturizers Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by increasing consumer focus on skin barrier health, hydration, and prevention of environmental damage. Consumers across both mature and emerging markets are investing in moisturizers enriched with hemp seed oil to strengthen skin resilience, reduce dryness, and provide long-lasting protection.

The segment’s growth is also supported by strong adoption among sensitive-skin users who prioritize moisturizers that repair and maintain the skin’s natural defense. As claims like “fragrance-free,” “hypoallergenic,” and “vegan” gain momentum, hydration-focused products are becoming central to mainstream and premium product portfolios. With dermatologists and clean-beauty advocates emphasizing barrier protection as essential to overall skin wellness, hydration & barrier repair is expected to remain the backbone of the Hemp Seed Oil Moisturizers Market.

| Product Type | Value Share% 2025 |

|---|---|

| Creams/lotions | 48% |

| Others | 52.0% |

The creams/lotions segment is forecasted to hold 48% of the market share in 2025, led by its accessibility and widespread acceptance as the most familiar moisturizer format. Creams and lotions are favored for their versatility, ease of application, and suitability across multiple skin types, making them the first choice for both mass-market and premium consumers. Their balanced texture allows brands to incorporate hemp seed oil effectively without overwhelming oily or combination skin types, further broadening their appeal.

Growth in this segment is reinforced by the integration of hemp seed oil into dermatologist-endorsed hydration creams and daily-use body lotions positioned as clean-label and natural. Additionally, mass retailers and private labels are expanding their hemp-infused cream offerings, ensuring wide consumer access at various price points. As consumers increasingly seek multifunctional moisturizers that combine hydration, barrier repair, and anti-redness benefits, creams and lotions are expected to continue leading the product landscape throughout the forecast period.

| Grade | Value Share% 2025 |

|---|---|

| Cold-pressed organic | 47% |

| Others | 53.0% |

The cold-pressed organic grade segment is projected to account for 47% of the Hemp Seed Oil Moisturizers Market revenue in 2025, establishing it as a leading grade preference among consumers. This dominance stems from the perception of cold-pressed oils as more natural and nutrient-rich, retaining essential fatty acids and antioxidants critical for skin hydration and repair. Clean-beauty and organic product certifications further elevate the demand for cold-pressed hemp oils, particularly in Europe and North America, where consumers are highly ingredient-conscious.

The segment’s growth is also supported by premium beauty brands highlighting cold-pressed sourcing in their marketing narratives to differentiate themselves from refined cosmetic-grade products. As sustainability and traceability gain importance, cold-pressed organic hemp oils appeal strongly to eco-conscious buyers. With rising disposable incomes in Asia-Pacific and growing consumer awareness about the benefits of minimally processed skincare ingredients, cold-pressed organic is expected to maintain its position as a cornerstone of innovation and premiumization in the Hemp Seed Oil Moisturizers Market.

Rising Dermatology-Led Adoption of Hemp Seed Oil for Barrier Repair

One of the strongest drivers is the dermatology-backed positioning of hemp seed oil as a clinically relevant moisturizing ingredient. Hemp seed oil is naturally rich in omega-3 and omega-6 fatty acids, which are highly effective in repairing the skin barrier and reducing transepidermal water loss. Dermatologists in markets like the USA and Europe increasingly recommend fragrance-free hemp seed oil moisturizers for patients with eczema, dermatitis, and sensitive skin, giving the category credibility in clinical skincare. This professional endorsement not only boosts pharmacy and drugstore sales but also enables premiumization, as consumers are willing to pay higher prices for dermatologist-approved formulations. By 2025, hydration & barrier repair already holds 55% of global functional share, highlighting the strength of this driver.

Accelerated Penetration in Asia-Pacific through E-Commerce and Social Platforms

The second major driver is Asia-Pacific’s rapid adoption of hemp seed oil moisturizers through digital-first retail ecosystems. China and India, with CAGR growth rates of 16.4% and 18.5% respectively, are transforming into powerhouse regions where e-commerce platforms like Tmall, Flipkart, and Nykaa amplify brand reach. In China, influencer-led “shoppertainment” formats are normalizing hemp seed oil moisturizers as mainstream skincare. In India, Ayurveda-inspired narratives are creating consumer affinity for cold-pressed organic hemp oils, while Tier 2 and Tier 3 cities are accessing hemp moisturizers primarily through digital marketplaces. These channels lower entry barriers for emerging brands, making Asia-Pacific not just a demand center but also a hub for competitive brand expansion.

Regulatory Ambiguity Around Hemp-Derived Cosmetics

A key restraint is the patchy and inconsistent regulatory stance toward hemp-based cosmetics across global markets. While hemp seed oil is non-psychoactive and legally permitted in cosmetics in most regions, the continued association with cannabis creates compliance hurdles. For example, in parts of Asia and the Middle East, authorities scrutinize labeling, marketing, and cross-border imports, slowing product approvals and limiting retail distribution. This leads to delays for multinational players and restricts brand messaging freedom. In contrast, Western markets have clearer regulatory frameworks, putting emerging Asian and Middle Eastern markets at a relative disadvantage. This inconsistent landscape increases compliance costs and slows global harmonization.

Price Sensitivity and Private-Label Competition in Mature Markets

Another restraint comes from growing price sensitivity and the rise of private-label hemp moisturizers in the USA and Europe. Mass retailers and pharmacy chains are increasingly introducing their own hemp-based skincare lines at lower price points, eroding margins for established premium brands. While consumers appreciate clean-label and organic credentials, many are unwilling to pay premium prices for hemp seed oil moisturizers when cheaper private-label options offer similar claims. This commoditization risk is particularly evident in the creams/lotions segment, which holds nearly 48% global share, making it vulnerable to price wars. Premium brands are forced to differentiate through packaging, added actives (like hyaluronic acid), or sustainability certifications to justify higher price points.

Blending Hemp with High-Performance Botanicals and Actives

A defining trend is the blending of hemp seed oil with trending actives such as squalane, niacinamide, and hyaluronic acid. This hybrid formulation strategy is enabling brands to shift hemp moisturizers from niche natural skincare into the mainstream premium segment. For example, cold-pressed organic hemp oil blended with squalane is positioned as both deeply hydrating and anti-aging, appealing to consumers who demand multi-functionality. Such blends are especially successful in Asia-Pacific and Europe, where consumers expect visible results alongside clean-label positioning.

Clean-Label and Vegan Claims Driving Loyalty in Premium Segments

Clean-label, vegan, and cruelty-free positioning is no longer just a differentiator but a central purchase driver in the hemp seed oil moisturizers category. Brands such as The Ordinary, Herbivore Botanicals, and Paula’s Choice are building loyal consumer bases by emphasizing transparency, vegan sourcing, and eco-friendly packaging. Vegan claims resonate strongly in Western markets, while “Ayurveda + vegan” narratives are gaining traction in India. This trend is also reshaping competitive dynamics: players unable to secure vegan certifications or sustainable packaging are at risk of losing share in premium categories where consumers equate hemp-based skincare with ethical consumption.

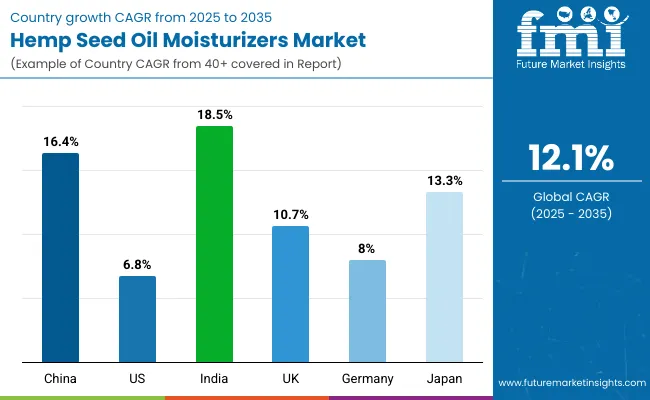

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.4% |

| USA | 6.8% |

| India | 18.5% |

| UK | 10.7% |

| Germany | 8.0% |

| Japan | 13.3% |

Between 2025 and 2035, the Hemp Seed Oil Moisturizers Market will see India (18.5% CAGR) and China (16.4% CAGR) emerge as the fastest-growing countries. In India, rapid urbanization, a young consumer base, and a strong cultural acceptance of plant-based remedies are fueling demand for hemp-infused moisturizers. Consumers are shifting toward clean-label, vegan, and non-comedogenic skincare, with e-commerce and D2C platforms driving accessibility across Tier 1 and Tier 2 cities.

China is witnessing a surge in premium beauty spending, supported by digital-first retail ecosystems such as Tmall and JD.com. Chinese consumers are increasingly drawn to hemp seed oil moisturizers marketed for soothing and anti-aging benefits, with international and domestic brands leveraging influencer marketing to deepen adoption. Both markets are central to the global growth trajectory, together contributing a significant portion of the incremental revenue during the forecast decade.

Meanwhile, mature beauty markets like the USA (6.8% CAGR), UK (10.7% CAGR), Germany (8.0% CAGR), and Japan (13.3% CAGR) will experience steady but more measured expansion. The USA market remains sizable, supported by dermatology-led positioning of hemp moisturizers and strong retail penetration across pharmacies and mass retail chains. In Europe, the UK’s growth is accelerated by clean-beauty adoption and regulatory support for hemp-derived cosmetics, while Germany sustains growth through organic and pharmacy-driven sales.

Japan, with a 13.3% CAGR, reflects a growing preference for lightweight gel creams and multifunctional skincare formats, especially in anti-aging. Collectively, these regions balance the global market between high-growth Asian economies and steady-performing Western countries, ensuring both volume expansion and premiumization opportunities for key players.

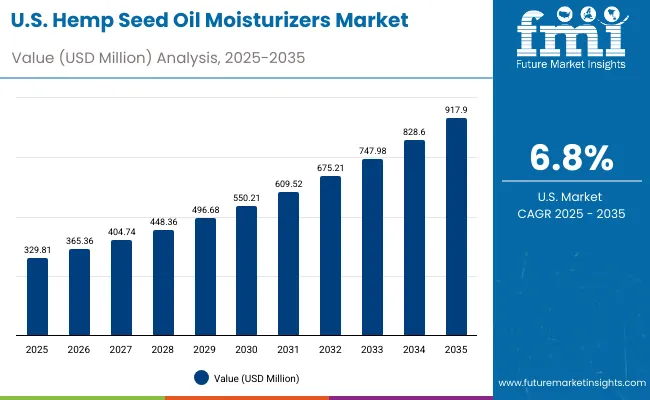

| Year | USA Hemp Seed Oil Moisturizers Market (USD Million) |

|---|---|

| 2025 | 329.81 |

| 2026 | 365.36 |

| 2027 | 404.74 |

| 2028 | 448.36 |

| 2029 | 496.68 |

| 2030 | 550.21 |

| 2031 | 609.52 |

| 2032 | 675.21 |

| 2033 | 747.98 |

| 2034 | 828.60 |

| 2035 | 917.90 |

The Hemp Seed Oil Moisturizers Market in the United States is projected to grow at a CAGR of 6.8%, supported by strong adoption in dermatology-driven skincare and mass-market moisturizers. Hydration & barrier repair leads demand with over half of USA market share, reflecting consumer focus on strengthening the skin barrier and preventing dryness. Retail pharmacy chains and drugstores continue to drive sales, while clean-label and fragrance-free claims resonate strongly with sensitive-skin buyers. Premium players like Kiehl’s and The Body Shop are expanding product lines in face oils and creams, while private-label hemp moisturizers are increasingly visible in supermarkets.

The Hemp Seed Oil Moisturizers Market in the United Kingdom is expected to grow at a CAGR of 10.7%, supported by a growing clean-beauty movement and consumer awareness of hemp as a natural, sustainable ingredient. The UK skincare industry has embraced hemp seed oil for its vegan and non-comedogenic properties, with brands highlighting its role in balancing oily/combination skin. E-commerce/D2C is accelerating product penetration, particularly through social media-led awareness campaigns. The market also benefits from increasing organic certifications and regulatory clarity around hemp-based cosmetics.

India is witnessing rapid growth in the Hemp Seed Oil Moisturizers Market, forecast to expand at a CAGR of 18.5% through 2035, making it the fastest-growing market globally. Rising disposable incomes and urban millennial demand are fueling adoption, while Tier 2 and Tier 3 cities are seeing increased product access via online channels. Indian consumers are shifting toward natural beauty solutions, with hemp seed oil moisturizers positioned as vegan, Ayurvedic-inspired, and multi-functional. Domestic brands are actively launching cold-pressed organic hemp moisturizers, while global players are localizing formats like lightweight gel creams for hot and humid climates.

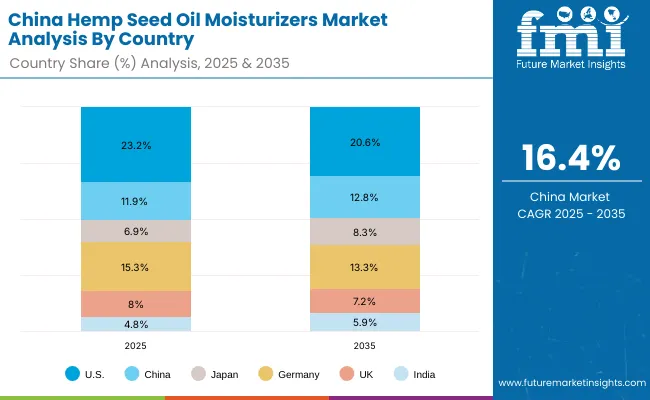

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.0% |

| India | 4.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 8.3% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

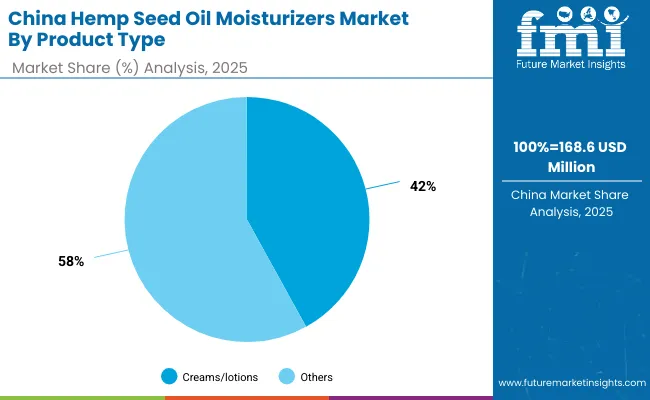

The Hemp Seed Oil Moisturizers Market in China is expected to grow at a CAGR of 16.4%, the highest among leading economies after India. Growth is driven by premium beauty spending, rapid e-commerce expansion, and strong consumer interest in natural and herbal ingredients. Hemp seed oil moisturizers are increasingly positioned for anti-aging and soothing benefits, with creams/lotions holding 42% market share in 2025. Domestic Chinese brands are leveraging competitive pricing and influencer-driven campaigns to expand reach, while international brands focus on premium formulations targeting middle-class urban consumers.

| USA By function | Value Share% 2025 |

|---|---|

| Hydration & barrier repair | 54% |

| Others | 46.0% |

The Hemp Seed Oil Moisturizers Market in the United States is projected at USD 329.8 million in 2025, rising to USD 917.9 million in 2035, reflecting a CAGR of 6.8%. Hydration & barrier repair contributes 54%, while other functions hold 46%, underscoring the strong emphasis on skin barrier protection among USA consumers. This functional dominance stems from increasing dermatological endorsements of hemp seed oil for hydration and barrier recovery, especially for sensitive and dry skin conditions. The clinical positioning of hemp seed oil moisturizers is further reinforced through pharmacies and drugstore distribution, where consumers perceive added trust and safety.

Growing demand for fragrance-free and hypoallergenic hemp moisturizers is a major catalyst, aligning with USA consumer preference for “clean” and dermatologist-tested skincare. Additionally, USA brands are integrating hemp seed oil into multifunctional daily creams and serums that combine hydration with anti-aging or redness reduction. The e-commerce/D2C boom adds a recurring revenue stream, supported by subscription models and influencer-led marketing. As innovation deepens, hybrid claims such as “vegan + dermatologist-approved” are expected to push the category further into the mainstream.

| China By Product Type | Value Share% 2025 |

|---|---|

| Creams/lotions | 42% |

| Others | 58.0% |

The Hemp Seed Oil Moisturizers Market in China is valued at USD 168.6 million in 2025, with creams/lotions leading at 42%, followed by face oils, gel creams, and balms at 58%. The dominance of creams/lotions reflects Chinese consumer preference for familiar, easy-to-use product formats, especially in urban skincare routines. At the same time, the rapid rise of gel creams and lightweight oils highlights strong alignment with younger consumers seeking multifunctional products suitable for humid climates and acne-prone skin.

This advantage positions hemp seed oil moisturizers as an essential product within China’s booming natural and herbal skincare market. Premium and imported brands emphasize anti-aging and soothing claims, while local companies leverage competitive pricing and digital-first distribution to capture mass consumers. As cross-border e-commerce grows, hemp seed oil moisturizers are gaining visibility across major platforms like Tmall and JD.com. With rising middle-class incomes and heightened demand for plant-based, clean-label beauty, China is expected to outpace most global peers, expanding its share to 12.8% by 2035.

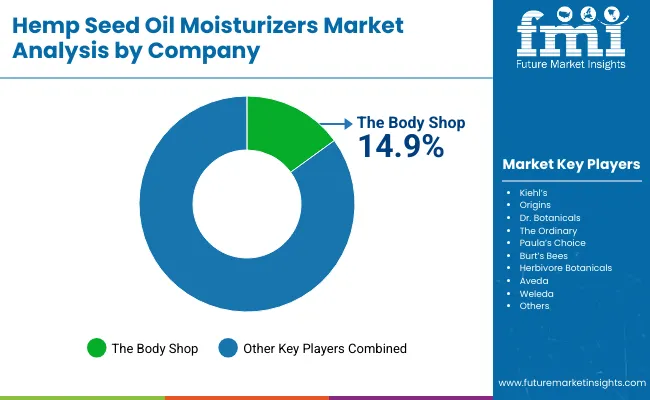

The Hemp Seed Oil Moisturizers Market is moderately fragmented, with global heritage beauty houses, niche clean-label innovators, and emerging D2C players competing across functions and product types. Market leader The Body Shop commands a 14.9% share in 2025, driven by its established hemp skincare range and strong retail presence across North America and Europe. Its portfolio leverages clean-label positioning and vegan credentials, aligning with mainstream consumer values.

Established mid-sized players such as Kiehl’s, Origins, and Dr. Botanicals cater to premium demand, with formulations emphasizing hydration, soothing, and barrier repair. These brands are accelerating adoption by blending hemp seed oil with trending actives like squalane, hyaluronic acid, and ceramides, ensuring appeal across diverse consumer segments. Meanwhile, digital-first brands such as The Ordinary, Herbivore Botanicals, and Paula’s Choice thrive through e-commerce-led distribution, transparent ingredient storytelling, and dermatologist-driven marketing.

Natural and sustainability-driven companies including Weleda, Aveda, and Burt’s Bees focus on clean-label, cruelty-free, and eco-conscious packaging strategies, making them highly relevant in Europe and North America. Competitive differentiation is shifting away from ingredient novelty toward ecosystem strength, including sustainability certifications, omnichannel distribution, and subscription-based loyalty programs. With Asia-Pacific growth accelerating, regional brands in China and India are expected to challenge incumbents by 2030 with competitively priced hemp-based moisturizers designed for local climate and skin needs.

Key Developments in Hemp Seed Oil Moisturizers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,422.3 Million |

| Function | Hydration & barrier repair, Soothing/anti-redness, Balancing for oily/combination, Anti-aging support |

| Product Type | Creams/lotions, Face oils, Gel creams, Balms/ointment sticks |

| Grade | Cold-pressed organic, Refined cosmetic grade, Blended oils (hemp + squalane /jojoba) |

| Channel | E-commerce/D2C, Pharmacies/drugstores, Natural/organic stores, Mass retail |

| Claim | Vegan, Clean-label, Fragrance-free/hypoallergenic, Non- comedogenic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Body Shop, Kiehl’s, Origins, Dr. Botanicals, The Ordinary, Paula’s Choice, Burt’s Bees, Herbivore Botanicals, Aveda, Weleda |

| Additional Attributes | Dollar sales by function and product type, adoption trends in hydration & barrier repair, rising demand for vegan and fragrance-free claims, sector-specific growth in dermatology and pharmacy channels, software-driven e-commerce personalization, integration with AI-based skin analysis and digital-first retail models, regional growth led by India, China, and Japan, and innovations in cold-pressed organic oils and blended hemp- squalane formulations. |

The Hemp Seed Oil Moisturizers Market is estimated to be valued at USD 1,422.3 million in 2025.

The market size for the Hemp Seed Oil Moisturizers Market is projected to reach USD 4,453.2 million by 2035.

The Hemp Seed Oil Moisturizers Market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in the Hemp Seed Oil Moisturizers Market are creams/lotions, face oils, gel creams, and balms/ointment sticks.

In terms of function, the hydration & barrier repair segment will command a 55% share in the Hemp Seed Oil Moisturizers Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hemp-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hemp Protein Skincare Market Size and Share Forecast Outlook 2025 to 2035

Hemp Animal Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hemp Milk Market Analysis by Variant, Type, End Use, and Sales Channel Through 2035

Industry Share Analysis for Hemp Fiber Producers

Hemp Protein Powder Market – Growth, Demand & Health Benefits

Hemp Paper Bag Market Trends & Industry Growth Forecast 2024-2034

Hemp Oil Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Hempseed Milk Business

Hemp Seed Oil Market Trends - Growth, Demand & Forecast 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Industrial Hemp Market

Demand for Hemp Seed Oil in EU Size and Share Forecast Outlook 2025 to 2035

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA