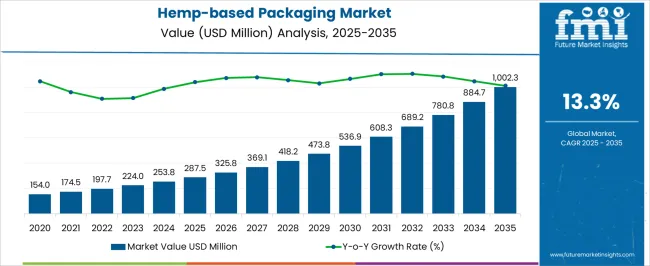

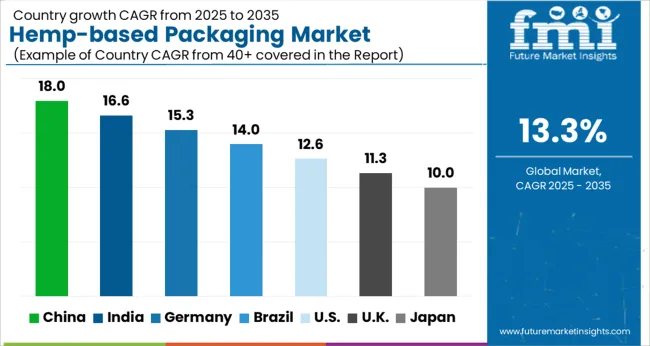

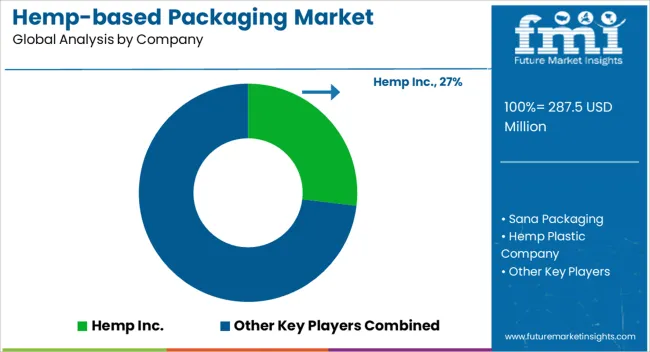

The Hemp-based Packaging Market is estimated to be valued at USD 287.5 million in 2025 and is projected to reach USD 1002.3 million by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

| Metric | Value |

|---|---|

| Hemp-based Packaging Market Estimated Value in (2025 E) | USD 287.5 million |

| Hemp-based Packaging Market Forecast Value in (2035 F) | USD 1002.3 million |

| Forecast CAGR (2025 to 2035) | 13.3% |

The hemp based packaging market is experiencing strong growth as sustainability becomes a central driver of packaging innovation. Rising restrictions on single use plastics and growing consumer demand for biodegradable and recyclable alternatives have accelerated adoption of hemp based solutions.

The material’s durability, lightweight structure, and compostable nature make it attractive for multiple industries. Investments in processing technologies and scalable supply chains are further supporting its integration into mainstream packaging applications.

In addition, global brands are aligning hemp packaging with their environmental, social, and governance goals, ensuring a wider scope of adoption in regulated markets. With increasing innovation in hemp based films, bags, and rigid packaging formats, the market outlook is favorable as it positions itself at the intersection of sustainability, functionality, and regulatory compliance.

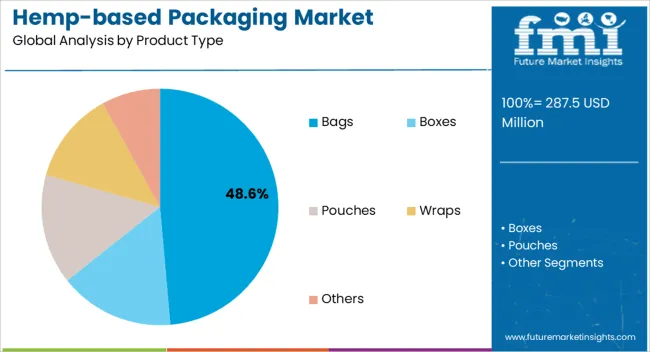

The bags segment is projected to account for 48.60% of total market revenue by 2025 within the product type category, making it the leading subsegment. This dominance is attributed to the rising need for sustainable alternatives to plastic bags in retail, grocery, and consumer goods packaging.

Hemp based bags provide durability, biodegradability, and reusability, aligning with consumer expectations and retailer commitments to eco friendly packaging. Their ability to support branding and customization has further reinforced demand across multiple sectors.

As sustainability regulations intensify and retailers prioritize eco friendly solutions, hemp based bags have emerged as the most widely adopted product type in this market.

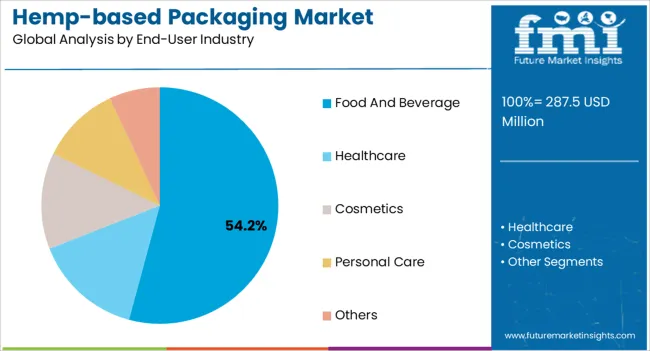

The food and beverage industry is expected to represent 54.20% of total market revenue by 2025, positioning it as the largest end user segment. This is being driven by the sector’s high volume packaging needs and growing consumer demand for sustainable food grade solutions.

Hemp based packaging offers the ability to preserve freshness while meeting recyclability and compostability standards. Global food brands are increasingly incorporating hemp packaging into their supply chains to meet sustainability targets and consumer preference for green alternatives.

The segment’s scale and regulatory alignment continue to establish food and beverage as the dominant end user industry.

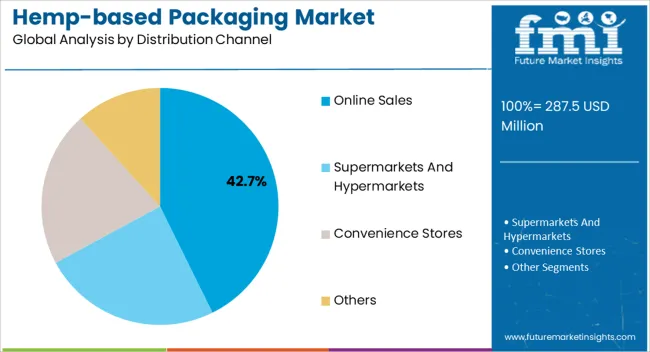

The online sales channel is projected to contribute 42.70% of total market revenue by 2025 within the distribution category, positioning it as the leading channel. Growth is being driven by the rapid expansion of e commerce and the parallel demand for sustainable packaging in shipping and delivery applications.

Hemp based packaging has gained preference in online retail due to its lightweight nature, strength, and environmentally friendly attributes. Consumer awareness of sustainable practices has also influenced online retailers to highlight eco friendly packaging as a differentiating factor.

As digital commerce continues to expand globally, the online sales channel remains the fastest growing and most impactful distribution pathway for hemp based packaging adoption.

It has the potential to revolutionize the packaging industry by offering an environmentally friendly and sustainable alternative to traditional methods.

Given the rising demand for sustainable packaging solutions and growing environmental concerns, the sector is likely to grow tremendously. As more people become conscious of the environmental impact of traditional packaging materials. There has been a substantial shift towards eco-friendly and biodegradable packaging options.

The increasing legalization of cannabis and hemp farming in various nations is likely to propel the hemp-based packaging market forward. Hemp can be cultivated without the use of pesticides or herbicides. Making it a more environmentally friendly and sustainable alternative to other plant-based materials used in packaging.

Technological breakthroughs in hemp-based packaging are projected to drive market expansion. Such as improvements in production processes and the development of new hemp-based materials. The usage of hemp fibers and shiv for packaging is likely to grow since these materials have a high strength-to-weight ratio. Making them excellent for a wide range of packaging applications.

Overall, the hemp-based packaging industry is predicted to increase significantly in the future years. Due to the rising demand for sustainable packaging solutions and hemp's growing appeal as a raw material.

Considering the above-mentioned factors FMI opines that the hemp-based packaging market is likely to witness a transformative growth rate of 13.3% in comparison to 10.97% from 2020 to 2025.

Hemp bags have various advantages over regular bags, including being biodegradable, long-lasting, and tear-resistant. Hemp fibers have a high strength-to-weight ratio, making them perfect for a variety of packaging applications.

The food and beverage industry is a key end-user of hemp-based bags, especially for packaging snacks, coffee, tea, and other food items. Hemp bags are also increasingly being utilized to package products such as supplements, vitamins, and cosmetics in the healthcare and personal care industries. The growing popularity of e-commerce and online retail is also predicted to boost the segment growth.

The food and beverage industry is one of the prominent consumers of packaging materials. There is a growing demand in this industry for sustainable and environmentally friendly packaging solutions. Furthermore, hemp-based packaging is appropriate for packing both dry food and liquids. Hemp-based packaging offers great barrier characteristics, which aid in the preservation of the product's freshness and quality. Ensuring that it is delivered to the consumer in optimal condition.

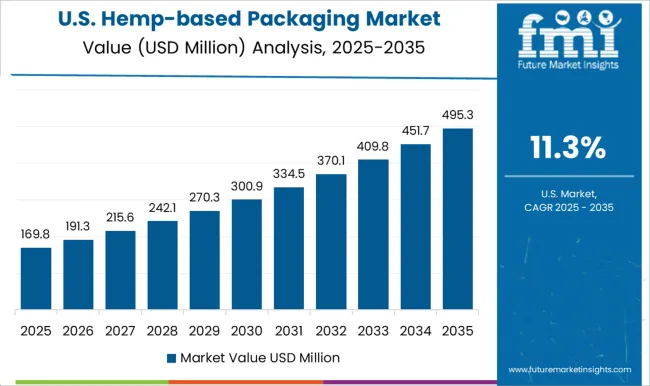

The growing need for eco-friendly packaging solutions, combined with favorable government regulations, is propelling the market in North America.

The adoption of the 2020 Farm Bill in the United States legalized the growth and sale of industrial hemp, resulting in a rise in the manufacturing of hemp-based products, including packaging.

Canada is another key market in North America for the hemp-based packaging business. The Canadian government has launched various measures to encourage sustainable packaging alternatives, including the creation of a national zero-waste policy. These initiatives have opened opportunities for Canadian enterprises involved in the hemp-based packaging market.

Several European countries have established severe rules to reduce the use of single-use plastic, offering the potential for hemp-based packaging industries. The European Union's Single-use Plastic Directive, which prohibits the use of some single-use plastic items, is likely to raise demand for sustainable packaging.

Germany is one of Europe's leading markets for hemp-based packaging, owing to the country's strong emphasis on sustainability and eco-friendliness.

To lessen their environmental impact, online businesses are increasingly embracing eco-friendly packaging options, and hemp-based packaging is seen as an excellent choice.

China is one of Asia Pacific's key markets for hemp-based packaging. Owing to the country's growing emphasis on sustainability and the development of the green economy. The Chinese government has launched many measures to promote sustainable packaging solutions, offering the potential for hemp-based packaging enterprises.

The market is highly competitive and fragmented, with competitors competing on product innovation, pricing strategies, and distribution networks.

Hemp Inc., Sana Packaging, Hemp Plastic Company, International Paper Company, Elevate Packaging, Inc., and others are among the leading companies in the market. To fulfill the growing demand for eco-friendly packaging options, these firms are focused on product innovation. Similarly, on the development of sustainable packaging solutions.

Hemp Plastic business, for example, teamed with Canadian packaging business Plastique in 2024. To expand its production capacity and fulfill the growing demand for hemp-based packaging solutions.

Manufacturers and Service Providers in the Sector can Expand in a Variety of Ways, including:

Product Innovation: By developing innovative and sustainable packaging solutions, manufacturers can differentiate their products and attract more customers.

Strategic Alliances: Companies can develop alliances with other value chain participants. Such as suppliers, distributors, and retailers, to broaden their reach and boost their market share.

Geographic Expansion: By establishing a presence in new regions or nations, businesses can access new markets and grow their consumer base.

Marketing and Branding: Strong branding and marketing initiatives can assist businesses in differentiating themselves from competitors and increasing their market presence.

Customer Engagement: Engaging with customers and understanding their wants can assist businesses in developing products. To satisfy their demands and build brand loyalty.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 13.3% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Product Type, By End-User Industry, By Distribution Channel, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Hemp Inc.; Sana Packaging; Hemp Plastic Company; International Paper Company; Elevate Packaging, Inc. |

| Customization & Pricing | Available upon Request |

The global hemp-based packaging market is estimated to be valued at USD 287.5 million in 2025.

The market size for the hemp-based packaging market is projected to reach USD 1,002.3 million by 2035.

The hemp-based packaging market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in hemp-based packaging market are bags, boxes, pouches, wraps and others.

In terms of end-user industry, food and beverage segment to command 54.2% share in the hemp-based packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA